Market Overview

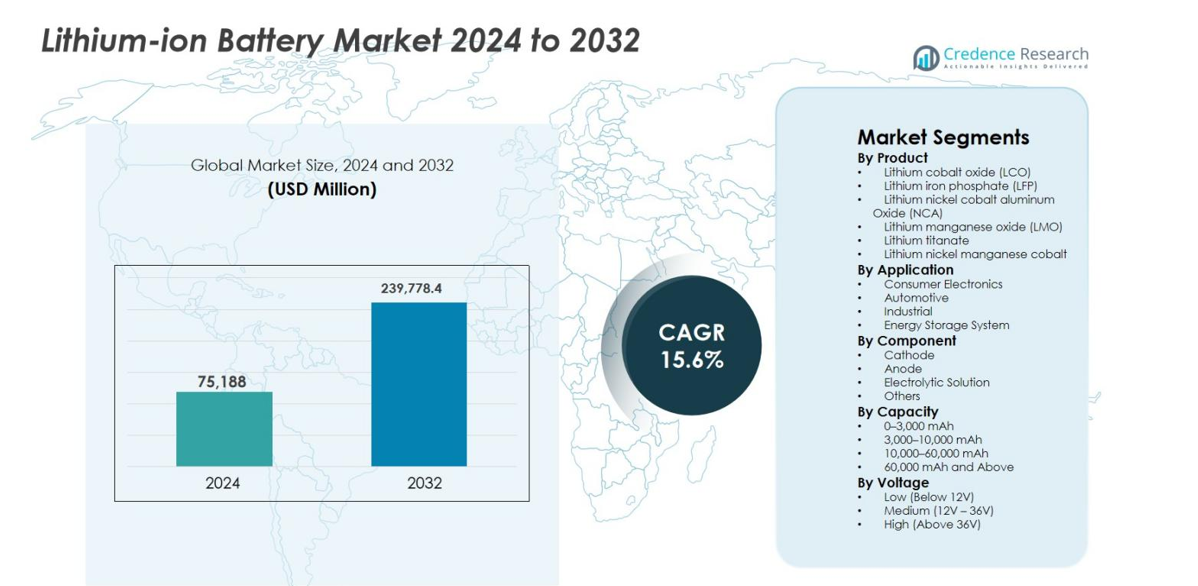

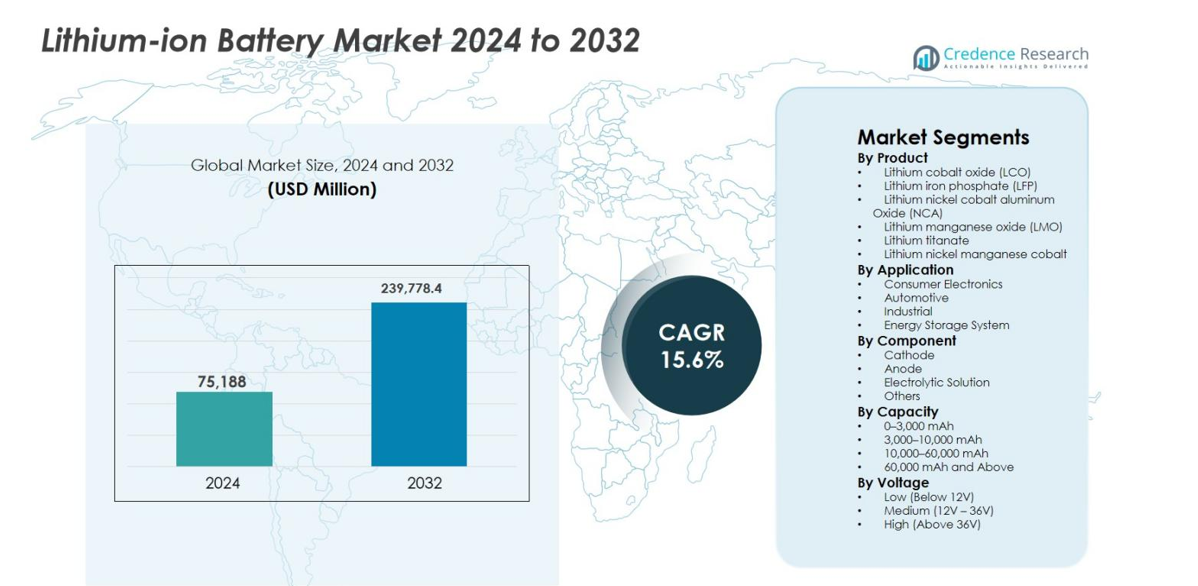

Lithium-ion Battery market size was valued at USD 75,188 Million in 2024 and is anticipated to reach USD 239,778.4 Million by 2032, at a CAGR of 15.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium-ion Battery Market Size 2024 |

USD 75,188 Million |

| Lithium-ion Battery Market, CAGR |

15.6% |

| Lithium-ion Battery Market Size 2032 |

USD 239,778.4 Million |

Lithium-ion Battery market is led by key players including Panasonic Corporation, BYD Company, Samsung SDI, LG Chem, Contemporary Amperex Technology Co. Ltd (CATL), Saft Group S.A., Toshiba Corporation, BAK Power, Automotive Energy Supply Corporation, and A123 Systems. These companies dominate through extensive manufacturing capacities, advanced R&D capabilities, and strategic partnerships, catering to growing demand across electric vehicles, consumer electronics, and energy storage systems. Asia-Pacific emerges as the leading region with a 32.5% market share in 2024, driven by China, Japan, and South Korea’s strong EV adoption and renewable energy deployment. North America and Europe follow with 28.4% and 26.7% shares, respectively, supported by government incentives, stringent emission regulations, and industrial energy storage projects. Market leaders focus on innovation in battery chemistry, capacity expansions, and regional collaborations to strengthen their competitive positioning and address evolving global demand efficiently.

Market Insights

- Lithium-ion Battery market size was valued at USD 75,188 Million in 2024 and is projected to reach USD 239,778.4 Million by 2032, growing at a CAGR of 15.6% during the forecast period.

- Growing adoption of electric vehicles and expansion of renewable energy projects are the primary drivers, boosting demand across automotive, industrial, and energy storage applications. High energy density, long cycle life, and improved safety of lithium-ion batteries further support market growth.

- Technological advancements in battery chemistries such as LFP, NMC, and LTO, along with innovations in cathode and anode materials, are shaping market trends, enabling faster charging, higher efficiency, and longer lifespan across applications.

- Key players include Panasonic, BYD, Samsung SDI, LG Chem, CATL, Saft Group, Toshiba, BAK Power, Automotive Energy Supply Corporation, and A123 Systems, focusing on R&D, capacity expansion, and strategic partnerships to strengthen market presence.

- Asia-Pacific leads with 32.5% share, followed by North America at 28.4% and Europe at 26.7%. LFP dominates the product segment with 38.7% share, while automotive applications account for 45.2% of the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Lithium-ion Battery market by product is led by Lithium Iron Phosphate (LFP), capturing 38.7% of the market in 2024. LFP batteries are preferred for their superior thermal stability, longer cycle life, and enhanced safety, making them highly suitable for electric vehicles (EVs) and energy storage applications. Lithium Nickel Cobalt Aluminum Oxide (NCA) and Lithium Cobalt Oxide (LCO) follow closely, driven by high energy density requirements in consumer electronics and premium EV models. Growing demand for EVs, renewable integration, and portable electronics continues to propel the adoption of high-performance lithium-ion chemistries.

- For instance, Tesla uses prismatic LFP cells supplied from CATL in standard‑range Model 3 and Model Y vehicles, highlighting the chemistry’s cost‑effective thermal stability and absence of cobalt or nickel in high‑volume passenger EVs.

By Application

Within applications, Automotive dominates the Lithium-ion Battery market with a 45.2% share in 2024. The rise of electric vehicles and hybrid models globally is a key driver, supported by government incentives, carbon emission regulations, and expanding EV infrastructure. Consumer Electronics accounts for the second-largest segment, fueled by smartphones, laptops, and wearables. Industrial applications and Energy Storage Systems (ESS) are witnessing rapid growth due to industrial automation and renewable energy integration. The shift toward electrification and sustainable energy storage is expected to maintain strong momentum across all applications during the forecast period.

- For instance, LG Energy Solution supplied large-scale LFP-based battery packs for Tesla’s Megapack projects, supporting renewable energy integration and grid stabilization.

By Component

The Cathode segment leads the Lithium-ion Battery market by component, holding 41.5% share in 2024. Cathode materials significantly influence battery performance, energy density, and lifespan, making them critical for EVs and large-scale ESS. The Anode segment, primarily using graphite and silicon-based materials, follows closely due to its role in charge efficiency and cycle stability. Electrolytic solutions and other components, including separators and binders, support safety and thermal management. Continuous material innovation, enhanced battery chemistry, and demand for high-energy-density batteries drive growth across all components in the market.

Key Growth Drivers

Rising Electric Vehicle Adoption

The rapid adoption of electric vehicles (EVs) is a primary growth driver for the Lithium-ion Battery market. Increasing environmental concerns, stringent emission regulations, and government incentives accelerate the shift from internal combustion engines to electric mobility. EV manufacturers prioritize high-energy-density and long-life lithium-ion batteries to enhance driving range and performance. Expanding EV infrastructure and consumer awareness of sustainable transportation further fuel demand. Continuous innovation in battery chemistries ensures optimal efficiency and safety, positioning EV adoption as a core catalyst for market expansion across automotive and related applications.

- For instance, China’s CATL, the world’s largest EV battery maker, announced plans to roll out 1,000 battery‑swap stations in 2025 (with a long‑term goal of 10,000), enabling drivers to exchange depleted packs in about 100 seconds, which can accelerate EV adoption by reducing charging time barriers.

Renewable Energy Integration

The integration of renewable energy sources, such as solar and wind, is driving demand for lithium-ion batteries in energy storage systems (ESS). These batteries store surplus energy and ensure grid stability, addressing the intermittent nature of renewables. Lithium-ion batteries offer high efficiency, long cycle life, and rapid charge-discharge capabilities, making them ideal for large-scale ESS deployment. Government policies promoting clean energy adoption and carbon neutrality targets further stimulate investments. Industrial, commercial, and residential sectors increasingly rely on these solutions, boosting overall Lithium-ion Battery market growth globally.

- For instance, Malaysia inaugurated a 100 MW / 400 MWh battery energy storage system (BESS) in Sabah, Borneo the largest of its kind in Southeast Asia to store solar generation and improve grid reliability amid increasing renewable integration.

Technological Advancements in Battery Chemistry

Continuous innovation in lithium-ion battery chemistry enhances performance, safety, and cost-efficiency. Chemistries like Lithium Iron Phosphate (LFP), Nickel Manganese Cobalt (NMC), and Lithium Titanate (LTO) offer higher energy density, faster charging, and longer lifespan. Improved thermal stability and safety features expand applications across EVs, consumer electronics, and energy storage. R&D investments reduce production costs while optimizing performance. Advances in cathode and anode materials, solid-state electrolytes, and manufacturing techniques drive adoption. Technological improvements strengthen market competitiveness and support rapid growth in global lithium-ion battery demand.

Key Trends & Opportunities

Expansion in Consumer Electronics Applications

Lithium-ion batteries are increasingly used in consumer electronics, creating growth opportunities beyond automotive and industrial applications. Smartphones, laptops, tablets, and wearable devices require compact, high-energy-density batteries for longer usage and improved performance. Miniaturization trends and demand for portable power solutions accelerate adoption. Integration with IoT devices and smart home solutions further boosts market potential. Rising consumption of personal electronics, combined with advancements in battery energy density and safety, presents a sustainable growth avenue and encourages innovation in lithium-ion battery design for next-generation electronic devices.

- For instance, Amperex Technology Limited (ATL) supplies compact lithium‑ion cells that are widely used in smartphones and laptops from major brands, enabling high energy density in slim device form factors.

Expansion of Energy Storage Systems

The growing deployment of energy storage systems (ESS) offers significant opportunities for lithium-ion batteries. ESS enables efficient grid management, peak shaving, and renewable energy integration, supporting smart grid initiatives worldwide. Residential, commercial, and utility-scale installations are increasing, driven by sustainability goals and cost savings. Lithium-ion batteries provide high efficiency, scalability, and reliability for ESS applications. Innovations in modular and hybrid storage solutions enhance flexibility and adoption. Government subsidies and policy incentives for renewable energy storage further accelerate market penetration, presenting a long-term opportunity for sustained Lithium-ion Battery market growth.

- For instance, South Korea’s SK On signed an agreement to supply up to 2 GWh of lithium‑ion LFP batteries to U.S.‑based Flatiron Energy Development for energy storage systems between 2026 and 2030, marking a major ESS supply expansion beyond EVs.

Key Challenges

Raw Material Supply Constraints

Limited availability and rising costs of key raw materials, including lithium, cobalt, and nickel, pose a major challenge for the lithium-ion battery market. Geopolitical risks, mining constraints, and export restrictions can disrupt supply chains, affecting production timelines and profitability. High dependence on a few resource-rich regions increases vulnerability to market fluctuations. Manufacturers are investing in recycling and alternative chemistries to mitigate risks, but securing stable material supply remains critical. Price volatility can increase battery costs and slow adoption, particularly in cost-sensitive sectors such as automotive and consumer electronics.

Safety and Environmental Concerns

Safety risks, including thermal runaway, fire hazards, and electrolyte leakage, challenge widespread adoption of lithium-ion batteries. Improper handling, manufacturing defects, or overcharging can lead to accidents, limiting consumer and industrial confidence. Environmental concerns regarding battery disposal, recycling, and hazardous material management are growing. Regulatory compliance and sustainable end-of-life solutions are essential to mitigate environmental impact. Manufacturers invest in safer chemistries, advanced separators, and solid-state technologies to enhance battery safety. Addressing these safety and environmental issues is crucial to maintain market credibility and support long-term growth.

Regional Analysis

North America

The North America Lithium-ion Battery market accounted for 28.4% share in 2024, driven primarily by strong electric vehicle adoption and industrial energy storage deployment. The United States leads the regional demand due to government incentives, stringent emission regulations, and rapid EV infrastructure expansion. Canada contributes through renewable energy integration and grid modernization projects. Consumer electronics adoption also supports market growth. The presence of key battery manufacturers and ongoing R&D initiatives for advanced chemistries, thermal management, and solid-state technologies further bolster regional growth. Continued policy support and rising clean energy investments are expected to sustain North America’s market dominance through 2032.

Europe

Europe held 26.7% share of the global Lithium-ion Battery market in 2024, propelled by aggressive EV adoption, stringent CO2 emission norms, and growing renewable energy integration. Germany, France, and the UK are leading contributors, supported by extensive EV infrastructure and industrial energy storage initiatives. The expansion of consumer electronics and smart home applications further drives regional demand. Government incentives, technological advancements in battery chemistries, and increased local manufacturing capacities strengthen Europe’s position. The region is witnessing strategic collaborations between automakers and battery manufacturers, ensuring robust supply chains and continued growth across the Lithium-ion Battery market during the forecast period.

Asia-Pacific

Asia-Pacific dominates the global Lithium-ion Battery market with a 32.5% share in 2024, led by China, Japan, and South Korea. High EV adoption, major consumer electronics production hubs, and large-scale renewable energy storage deployment drive regional demand. China is the largest contributor, supported by government subsidies, manufacturing capabilities, and battery material availability. Japan and South Korea lead in technological innovation and advanced battery chemistries. The presence of major market players like BYD, CATL, and Panasonic ensures robust regional growth. Strong infrastructure development, favorable regulations, and rising industrial and commercial energy storage applications are expected to sustain Asia-Pacific’s leadership in the market.

Latin America

Latin America captured 5.1% of the Lithium-ion Battery market in 2024, with Brazil, Mexico, and Chile leading regional adoption. EV penetration is gradually increasing, supported by government incentives and growing charging infrastructure. Renewable energy deployment, particularly solar and wind, drives demand for energy storage systems. Local automotive and industrial sectors are gradually incorporating lithium-ion solutions for electrification and efficiency improvements. Challenges include limited raw material processing capacity and uneven infrastructure development. However, strategic investments by global battery manufacturers and policy support for green energy transition are expected to propel market growth in Latin America during the forecast period.

Middle East & Africa

The Middle East & Africa accounted for 7.3% share of the Lithium-ion Battery market in 2024. Increasing investments in renewable energy projects, such as solar farms and industrial energy storage systems, are key growth drivers. Countries like the UAE, Saudi Arabia, and South Africa are investing heavily in electrification and smart grid infrastructure. EV adoption is still in early stages but growing steadily. Government incentives, combined with foreign investments in battery manufacturing and technology partnerships, enhance regional growth potential. Rising awareness of sustainable energy solutions and energy security initiatives are expected to drive continued adoption of lithium-ion batteries across the Middle East & Africa region.

Market Segmentations:

By Product

- Lithium cobalt oxide (LCO)

- Lithium iron phosphate (LFP)

- Lithium nickel cobalt aluminum Oxide (NCA)

- Lithium manganese oxide (LMO)

- Lithium titanate

- Lithium nickel manganese cobalt

By Application

- Consumer Electronics

- Automotive

- Industrial

- Energy Storage System

By Component

- Cathode

- Anode

- Electrolytic Solution

- Others

By Capacity

- 0–3,000 mAh

- 3,000–10,000 mAh

- 10,000–60,000 mAh

- 60,000 mAh and Above

By Voltage

- Low (Below 12V)

- Medium (12V – 36V)

- High (Above 36V)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Lithium-ion Battery market features a dynamic competitive landscape characterized by strong presence of global and regional manufacturers driving innovation, capacity expansion, and strategic partnerships. Key players such as Panasonic Corporation, BYD Company, Samsung SDI, LG Chem, Contemporary Amperex Technology Co. Ltd (CATL), Saft Group S.A., Toshiba Corporation, BAK Power, Automotive Energy Supply Corporation, and A123 Systems dominate the market with significant production capabilities and technological expertise. Companies focus on enhancing energy density, cycle life, and safety of battery chemistries to cater to growing demand from electric vehicles, consumer electronics, and energy storage systems. Strategic initiatives, including joint ventures, mergers and acquisitions, and capacity expansions, enable these players to strengthen regional footprints, optimize supply chains, and reduce costs. Continuous R&D investments and innovation in cathode, anode, and electrolyte technologies allow companies to maintain a competitive edge while addressing evolving market requirements, driving overall market growth and resilience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2025, Samsung SDI America secured a US$1.36 billion contract to supply prismatic lithium iron phosphate (LFP) batteries for energy storage systems with production beginning in 2027.

- In December 2025, Dragonfly Energy announced a new distribution partnership with National Railway Supply (NRS) to supply lithium battery products to North American rail customers.

- In November 2025, NEO Battery Materials Ltd. entered into a Joint Product Development Agreement with Nascent Materials Inc. to co‑develop high‑performance lithium‑ion batteries for defense drones and AI energy storage systems

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Component, Capacity, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Lithium-ion Battery market is expected to grow steadily due to rising electric vehicle adoption worldwide.

- Expansion of renewable energy installations will increase demand for large-scale energy storage systems.

- Continuous innovation in battery chemistries will improve energy density, charging speed, and lifespan.

- Growing consumer electronics adoption will sustain demand for compact, high-performance batteries.

- Governments will continue offering incentives and policies to support EV and clean energy adoption.

- Strategic collaborations and partnerships among battery manufacturers and automakers will enhance market penetration.

- Recycling and sustainable material initiatives will gain importance to address raw material constraints.

- Advanced manufacturing technologies will reduce production costs and improve battery performance.

- Asia-Pacific is expected to remain the leading region due to strong industrial and EV growth.

- Safety improvements and solid-state battery development will drive broader adoption across applications.