Market Overview:

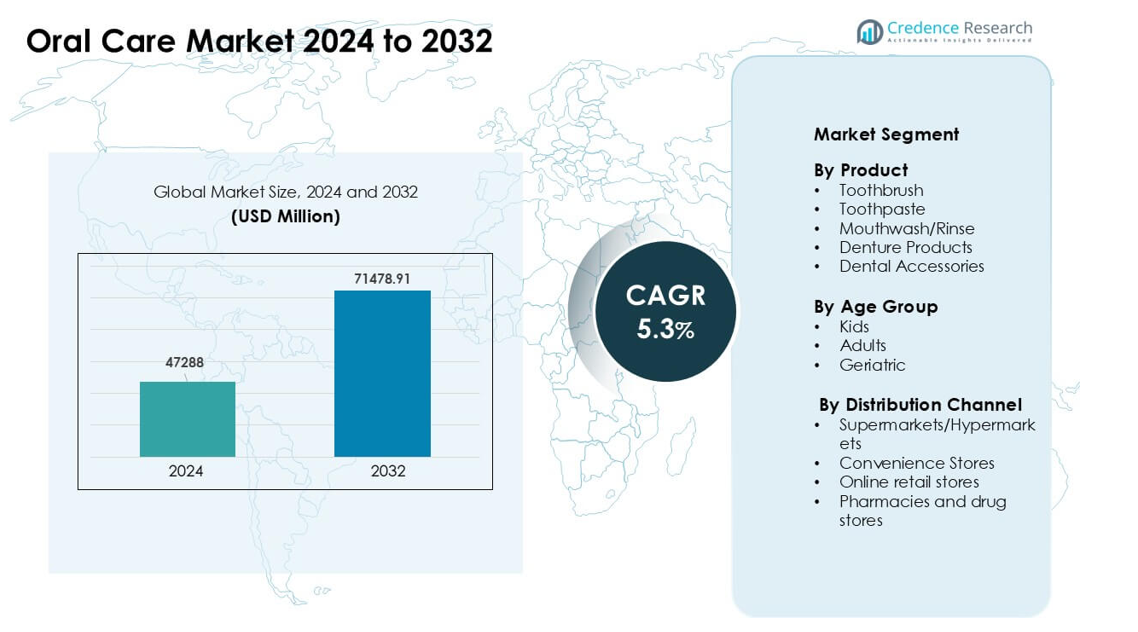

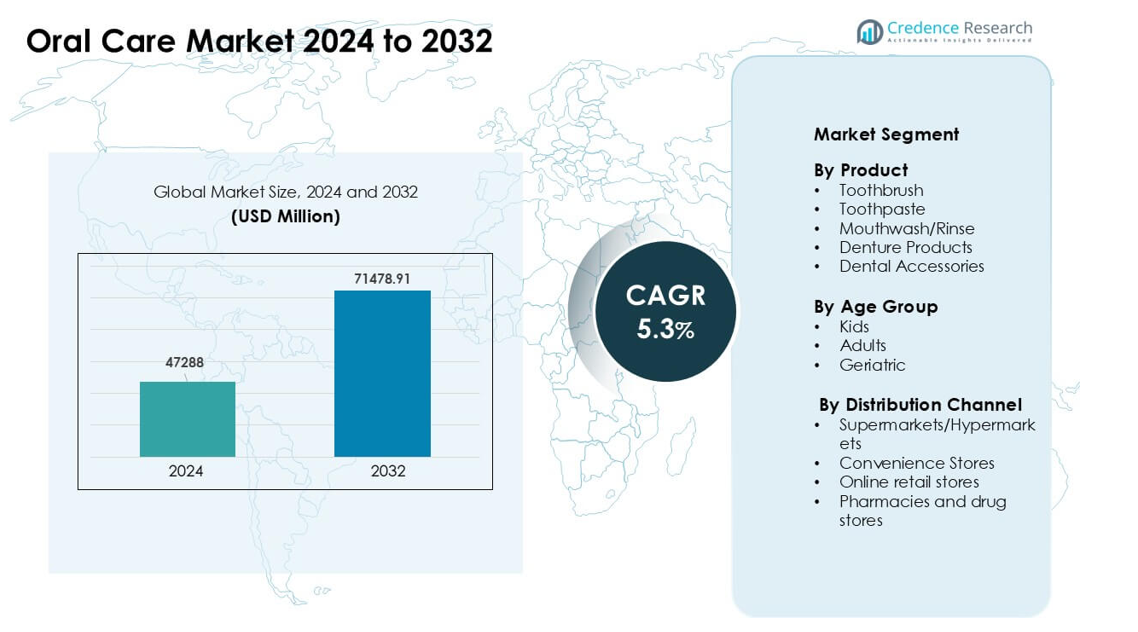

Oral Care Market was valued at USD 47288 million in 2024 and is anticipated to reach USD 71478.91 million by 2032, growing at a CAGR of 5.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oral Care Market Size 2024 |

USD 47288 million |

| Oral Care Market, CAGR |

5.3% |

| Oral Care Market Size 2032 |

USD 71478.91 million |

The Oral Care Market is shaped by major companies that lead global product innovation and distribution. Key players such as Colgate-Palmolive, Procter & Gamble, Unilever, GlaxoSmithKline, Lion Corporation, Johnson & Johnson, Patanjali Ayurved, Henkel, Reckitt Benckiser, and Church & Dwight strengthen market growth through broad portfolios covering toothpaste, toothbrushes, mouthwash, whitening solutions, and herbal formulations. These companies focus on product upgrades, targeted marketing, and strong pharmacy and retail networks to expand consumer reach. Asia-Pacific remained the leading region in 2024 with about 36% share, supported by rising disposable incomes, strong urban demand, and expanding awareness of preventive oral care.

Market Insights:

- The Oral Care Market reached USD 47288 Million in 2024 and is set to reach USD 71478.91 Million by 2032 at a CAGR of 5.3%.

- Rising focus on preventive dental hygiene drives demand for toothpaste, mouthwash, and sensitivity-care products.

- Natural, whitening, and herbal formulations gain strong traction, while electric toothbrush adoption grows steadily.

- Key players compete through product innovation, herbal lines, whitening solutions, and strong pharmacy networks; toothpaste dominated with about 48% share in 2024.

- Asia-Pacific led the market with nearly 36% share in 2024, followed by North America at about 32%, while Europe held around 27%, supported by strong dental awareness and premium product adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Toothpaste led the product segment in 2024 with about 48% share. Strong demand came from daily use habits and rising focus on plaque control, whitening, and enamel repair. Brands expanded fluoride and herbal lines, which boosted routine adoption among urban buyers. Toothbrushes grew steadily as consumers shifted toward electric and soft-bristle options for gum safety, while mouthwash gained traction due to rising awareness of oral bacteria control. Denture products and dental accessories held smaller shares but saw stable demand from aging populations and growing at-home dental care.

- For instance, the global toothbrush market was estimated at USD 8.00 billion in 2024, highlighting the steady demand for brushing tools alongside toothpaste.

By Age Group

Adults dominated the age group segment in 2024 with nearly 63% share. Higher spending on complete oral hygiene kits, whitening solutions, and sensitivity-care products supported this lead. Strong marketing and product innovation around gum health drove repeat purchases among working adults. Kids represented a growing group due to flavored pastes and character-based packaging that encouraged early brushing habits. The geriatric group expanded at a steady pace as rising cases of dry mouth, gum disease, and denture use increased demand for targeted oral health solutions.

- For instance, in the United States, over 1 billion toothbrush units are sold annually underscoring the scale of adult usage of oral-hygiene tools.

By Distribution Channel

Supermarkets and hypermarkets led distribution in 2024 with about 52% share. Shoppers favored these outlets because they offer wide product ranges, competitive pricing, and easy access to new launches. Strong in-store visibility and bulk-buy promotions helped maintain their lead. Pharmacies grew steadily due to demand for dentist-recommended pastes and specialized treatments. Online retail rose quickly as buyers adopted doorstep delivery and subscription packs for routine refills. Convenience stores held a smaller share but remained important for quick single-item purchases.

Key Growth Drivers:

Growing Focus on Preventive Dental Health

Preventive dental care has become a top priority for consumers, and this shift strongly supports the Oral Care Market. Rising awareness of plaque control, cavity prevention, and gum health encourages households to follow complete oral hygiene routines. Dental associations continue to promote early diagnosis and routine brushing, which boosts demand for toothpaste, mouthwash, and interdental tools. School-based hygiene programs and public campaigns also help young users build consistent brushing habits. Urban buyers now prefer products with fluoride, herbal extracts, and enamel-strengthening agents. This growing focus on preventive habits drives higher product penetration across all age groups.

- For instance, the World Health Organization (WHO) estimates that nearly 3.5 billion people worldwide suffer from oral diseases highlighting the sheer scale of need for preventive oral-care products.

Rising Incidence of Dental Problems

Higher cases of dental caries, gum disease, and tooth sensitivity drive strong demand for advanced oral care products. Lifestyle changes, such as increased sugar intake and irregular brushing habits, contribute to these issues. As dental treatment costs rise, consumers adopt preventive solutions to reduce long-term expenses. Sensitivity toothpaste, medicated mouthwash, and gum-care formulas show fast adoption due to dentist recommendations. Aging populations also face higher risks of tooth loss and dry mouth, increasing demand for denture care products. Strong clinical endorsement and the availability of specialized products support this market driver.

- For instance, in the global elderly population, the prevalence of dental caries was estimated at 60.7% in a recent meta-analysis, underscoring the high need for gum-care, sensitivity relief, and denture-related solutions among older adults.

Expansion of Premium and Specialized Oral Products

Premium oral care products gain traction as consumers seek solutions beyond basic cleaning. Whitening strips, enamel-repair pastes, herbal mouthwash, charcoal formulations, and electric toothbrushes attract buyers seeking better performance. Social media exposure and influencer campaigns increase interest in visible results and cosmetic enhancement. Brands invest in R&D to develop plaque-targeting formulations, probiotic blends, and teeth-strengthening technologies. Dental clinics increasingly recommend premium and professional-grade products, further boosting adoption. This shift toward specialized and value-added solutions accelerates premiumization across retail channels and shapes long-term market growth.

Key Trends & Opportunities:

Shift Toward Natural and Chemical-Free Formulations

Consumers increasingly choose oral care products with herbal, fluoride-free, and chemical-free compositions. Natural ingredients such as neem, clove, charcoal, aloe vera, and tea tree oil gain strong appeal among health-conscious buyers. This trend grows as shoppers avoid artificial preservatives, parabens, and harsh abrasives. Brands expand clean-label toothpaste and mouthwash lines while highlighting sustainability and plant-based benefits. The rise of vegan-friendly products and eco-friendly packaging further supports this shift. This trend creates strong opportunities for manufacturers to diversify portfolios, attract premium buyers, and enter niche categories within the Oral Care Market.

Growth of E-Commerce and Subscription Models

Online platforms reshape purchasing behavior by offering convenient access to oral care products and exclusive bundles. E-commerce growth allows brands to showcase specialized products that may not be widely available in physical stores. Subscription models for toothpaste, brush heads, and whitening kits encourage recurring purchases and strengthen brand loyalty. Digital campaigns and targeted ads help brands reach younger consumers who prefer online shopping. This shift creates opportunities for niche brands, direct-to-consumer companies, and premium product launches supported by influencer-led promotions and real-time customer feedback.

Key Challenges:

High Cost of Advanced and Premium Products

Premium oral care solutions often come at higher price points, limiting adoption among price-sensitive consumers. Electric toothbrushes, whitening systems, and medicated formulations appeal mainly to urban buyers with higher disposable income. In many regions, low-income households rely on basic toothpaste and manual brushes due to affordability concerns. This gap restricts wider penetration of advanced technologies. Competitive pricing pressures also challenge brands to maintain margins while offering value-driven solutions. As a result, high costs remain a major barrier that constrains market expansion in developing markets.

Limited Access to Dental Awareness in Rural Areas

Rural populations often have limited awareness of oral hygiene practices, which reduces the uptake of advanced oral care products. Poor access to dental education, fewer clinics, and lack of routine checkup culture contribute to this challenge. Many households use traditional or home-based cleaning methods, slowing the adoption of fluoride-based and medicated products. Distribution barriers also limit product availability in remote areas. As a result, rural penetration remains lower than urban markets. Addressing this challenge requires awareness campaigns, affordable SKUs, and stronger retail presence in underserved regions.

Regional Analysis:

North America

North America held about 32% share of the Oral Care Market in 2024. Strong awareness of preventive dental routines and high spending on premium oral products supported steady growth. Consumers adopted whitening pastes, electric toothbrushes, and medicated mouthwash due to strong dentist recommendations. Retailers also expanded natural and chemical-free product lines that appealed to health-conscious buyers. Online channels gained traction as shoppers used subscription deliveries for routine products. High dental insurance coverage and frequent checkups further boosted demand for specialized solutions across the region.

Europe

Europe accounted for nearly 27% share in 2024, driven by strong regulatory standards and rising demand for eco-friendly oral products. Consumers showed higher interest in herbal pastes, bio-based packaging, and fluoride-free mouthwash. Western Europe led adoption due to well-established oral hygiene habits and frequent dental visits. Eastern Europe showed improving demand as income levels increased and awareness campaigns expanded. Retailers promoted whitening solutions and sensitivity-care pastes, which gained solid traction. Broad pharmacy networks and strong recommendations from dental professionals supported consistent market expansion.

Asia-Pacific

Asia-Pacific dominated the global market with about 36% share in 2024. Rapid urbanization, rising disposable incomes, and strong marketing campaigns drove high adoption of toothpaste, toothbrushes, and mouthwash. India, China, Japan, and South Korea led demand due to growing awareness of preventive care. Local brands expanded herbal lines featuring neem, charcoal, and clove to meet cultural preferences. E-commerce platforms strengthened presence with wide product varieties and promotional offers. Expanding middle-class populations and improved dental education programs continued to boost regional growth.

Latin America

Latin America captured around 8% share in 2024, supported by rising awareness of oral diseases and broader availability of affordable products. Brazil and Mexico led regional demand due to strong retail networks and increasing consumer interest in whitening and sensitivity-care products. Economic fluctuations limited growth in some markets, yet promotional pricing and small-pack options maintained steady adoption. Local manufacturers introduced herbal and low-cost variants to reach price-sensitive buyers. Growing urban populations and strengthened pharmacy channels improved access to medicated oral care solutions.

Middle East & Africa

The Middle East & Africa region held nearly 7% share in 2024. Higher dental disease prevalence and limited routine checkup culture continued to shape demand patterns. Urban centers in the UAE, Saudi Arabia, and South Africa showed growing interest in premium pastes, whitening strips, and antibacterial mouthwash. Rural areas relied more on basic products due to limited availability and lower awareness. Retail expansion and digital platforms improved access to branded oral care solutions. Public health campaigns and rising disposable incomes gradually increased product adoption across major markets.

Market Segmentations:

By Product

- Toothbrush

- Toothpaste

- Mouthwash/Rinse

- Denture Products

- Dental Accessories

By Age Group

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online retail stores

- Pharmacies and drug stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The Oral Care Market features strong competition driven by global brands, regional players, and emerging natural product companies. Leading firms such as Colgate-Palmolive, Unilever, Procter & Gamble, GlaxoSmithKline, Lion Corporation, and Patanjali Ayurved focus on broad portfolios covering toothpaste, toothbrushes, mouthwash, whitening kits, and specialty formulas. These companies invest in R&D to develop advanced solutions for sensitivity relief, enamel repair, and gum health. Growing demand for herbal and chemical-free products encourages brands to expand natural formulations and eco-friendly packaging. Digital marketing, dentist endorsements, and influencer partnerships support stronger brand visibility. Companies also strengthen e-commerce presence through subscription models and targeted online campaigns. Price competition remains strong in emerging markets, where local players offer affordable options tailored to regional preferences. As a result, competitive dynamics are shaped by innovation speed, product differentiation, and strong distribution networks across retail, pharmacy, and online channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Lion Corporation

- Church & Dwight Co. Inc.

- GlaxoSmithKline Plc.

- Unilever

- Patanjali Ayurved Ltd.

- Reckitt Benckiser Group Plc.

- Procter & Gamble Co.

- Henkel AG & Co. KG Aa

- Colgate Palmolive Co.

- Johnson & Johnson

Recent Developments:

- In October 2025, Colgate-Palmolive expanded its Small Acts, Big Smiles toothpaste-tube recycling program with Watsons Hong Kong. In the second phase, Colgate installed dedicated collection bins in 120 stores and increased loyalty rewards, encouraging consumers to return empty toothpaste tubes for recycling and upcycling into new oral-care related items.

- In October 2025, In its Q3 2025 results, Church & Dwight reported net sales up 5.0% (organic growth 3.4%), with strong international growth (+7.7%) and performance across many of its brands including oral-care lines.

- In March 2025, Kenvue s Listerine brand, formerly part of Johnson & Johnson s consumer-health business, hosted the Listerine Labs event in India. Timed around World Oral Health Day, the immersive event promoted a holistic oral care routine with daily mouthwash use and showcased clinical evidence that Listerine mouthwash removes 99.9% of germs while reducing plaque and gum problems

Report Coverage:

The research report offers an in-depth analysis based on Product, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Preventive oral care adoption will rise as consumers seek long-term dental health.

- Demand for herbal, clean-label, and chemical-free formulations will continue to strengthen.

- Electric toothbrushes and smart oral devices will gain wider acceptance across age groups.

- Whitening and enamel-repair solutions will see stronger growth due to cosmetic preferences.

- E-commerce and subscription-based oral care packs will expand rapidly among young buyers.

- Personalized oral care products will increase as brands use digital tools and AI insights.

- Affordable toothpaste and toothbrush variants will grow in developing markets with rising awareness.

- Dental professionals will influence product choices through targeted recommendations.

- Sustainable packaging and eco-friendly manufacturing will become a key competitive focus.

- Premium and specialized solutions will expand faster than basic oral hygiene products.