Market Overview

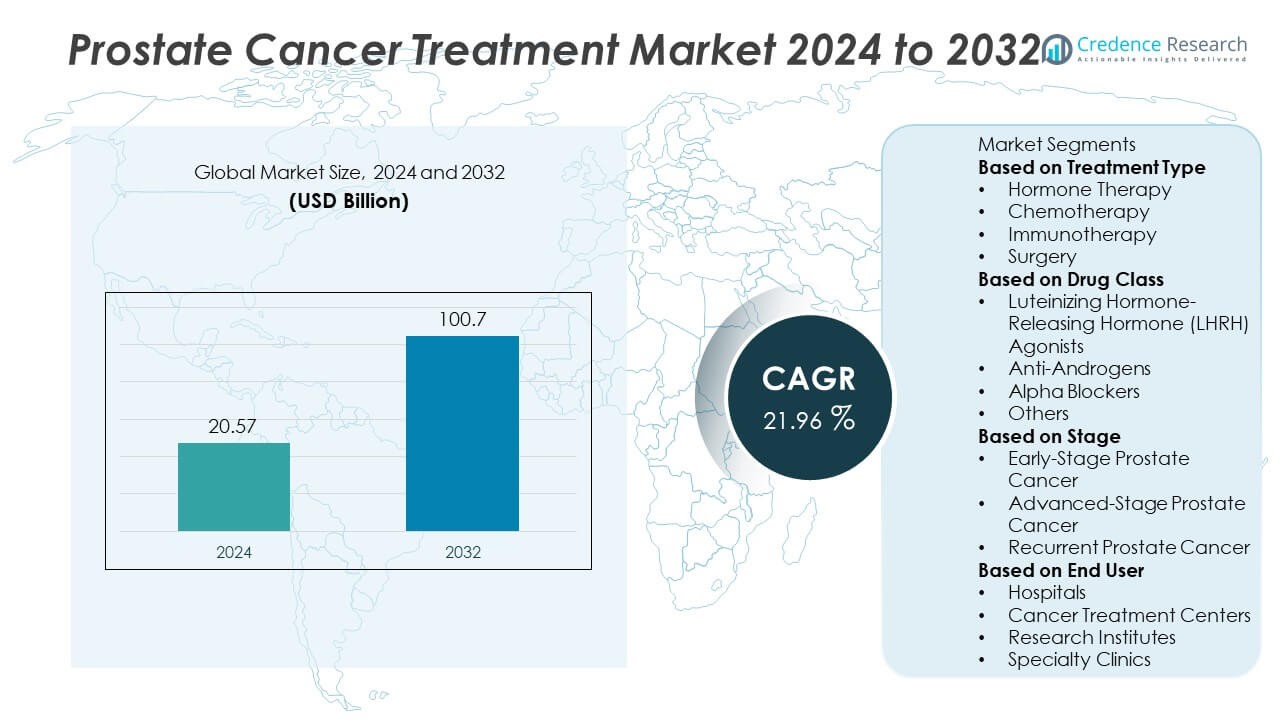

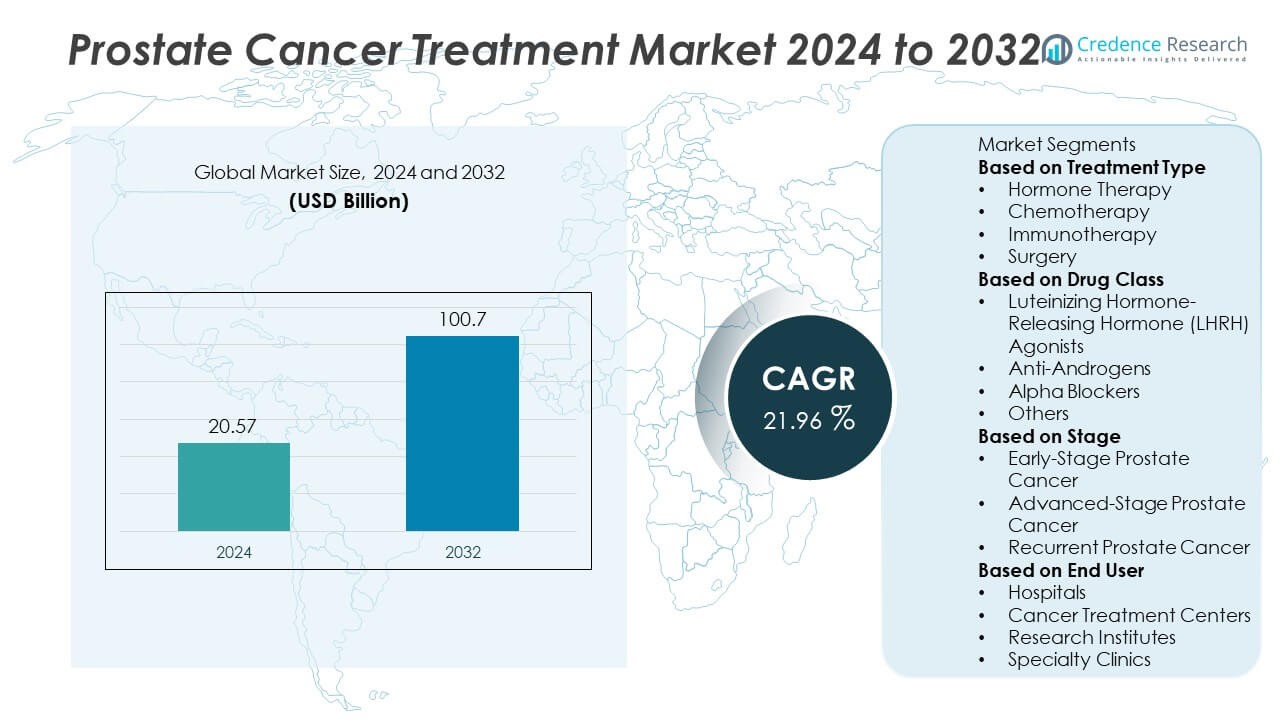

The global prostate cancer treatment market was valued at USD 20.57 billion in 2024 and is projected to reach USD 100.7 billion by 2032, expanding at a strong CAGR of 21.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prostate Cancer Treatment Market Size 2024 |

USD 20.57 Billion |

| Prostate Cancer Treatment Market, CAGR |

21.96% |

| Prostate Cancer Treatment Market Size 2032 |

USD 100.7 Billion |

The prostate cancer treatment market is dominated by leading companies such as Pfizer Inc., Johnson & Johnson (Janssen Pharmaceuticals), Astellas Pharma Inc., Bayer AG, Novartis AG, AstraZeneca plc, Merck & Co., Inc., Sanofi S.A., F. Hoffmann-La Roche Ltd., and Bristol-Myers Squibb Company. These players maintain strong market positions through advanced drug development, extensive clinical pipelines, and global distribution networks. North America leads the market with a 41.3% share in 2024, driven by early disease detection, advanced healthcare infrastructure, and rapid adoption of targeted therapies. Europe follows with a 29.4% share, while Asia-Pacific represents the fastest-growing region supported by expanding oncology facilities and rising awareness of prostate cancer management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The prostate cancer treatment market was valued at USD 20.57 billion in 2024 and is projected to reach USD 100.7 billion by 2032, growing at a CAGR of 21.96%.

- Rising prevalence of prostate cancer and growing adoption of targeted and immuno-oncology therapies are driving market growth globally.

- The market is witnessing strong trends toward precision medicine, radioligand therapies, and combination regimens that improve long-term survival outcomes.

- Key players such as Pfizer Inc., Johnson & Johnson, AstraZeneca plc, and Bayer AG focus on strategic partnerships, clinical trials, and new drug approvals to strengthen their global footprint.

- North America dominates with a 41.3% share, followed by Europe at 29.4%, while hormone therapy holds the largest treatment segment with a 42.8% share driven by its proven efficacy in advanced and recurrent prostate cancer cases.

Market Segmentation Analysis:

By Treatment Type

Hormone therapy dominates the prostate cancer treatment market, accounting for 42.8% share in 2024. This dominance is driven by its effectiveness in managing advanced and metastatic stages by reducing androgen levels that fuel cancer growth. The segment benefits from the wide use of LHRH agonists and antagonists, along with newer androgen receptor inhibitors. Chemotherapy and immunotherapy are gaining traction due to growing adoption of combination treatment strategies and advances in immune checkpoint inhibitors, while surgery remains preferred for localized cases with curative intent.

- For instance, Enzalutamide (by Astellas Pharma Inc./Pfizer Inc.) was studied in 1,717 men with advanced prostate cancer: outcomes showed progression in 118 men (14 %) in the Enzalutamide + ADT group versus 320 men (40 %) in ADT alone.

By Drug Class

Luteinizing Hormone-Releasing Hormone (LHRH) agonists lead the market with 36.5% share in 2024. Their ability to suppress testosterone production effectively makes them the cornerstone of hormone-based therapies for advanced and recurrent prostate cancer. Anti-androgens follow closely, supported by the rise of next-generation drugs such as enzalutamide and apalutamide that improve survival outcomes. The use of alpha blockers and other supportive drugs continues to grow for managing urinary symptoms and treatment-related side effects in patients undergoing long-term therapy.

- For instance, results published for Apalutamide (by Johnson & Johnson) in metastatic castration-sensitive prostate cancer showed 87.6 % of patients were alive at 24 months when treated with Apalutamide, compared to lower survival in the comparator arm.

By Stage

Advanced-stage prostate cancer represents the largest market segment, holding 47.2% share in 2024. The growth is fueled by the increasing diagnosis of metastatic and castration-resistant cases requiring multi-line systemic treatments. Rising clinical adoption of targeted and immuno-oncology drugs has expanded therapeutic options in this category. Early-stage prostate cancer benefits from growing screening programs and minimally invasive surgical advancements, while recurrent prostate cancer cases are driving demand for precision therapies and radioligand treatments aimed at prolonging survival and improving patient quality of life.

Key Growth Drivers

Rising Global Prevalence of Prostate Cancer

The increasing incidence of prostate cancer worldwide is a major growth driver for the market. Aging male populations, lifestyle changes, and enhanced screening programs contribute to higher detection rates. Early diagnosis through prostate-specific antigen (PSA) testing has improved survival outcomes and treatment initiation. Growing awareness campaigns by healthcare organizations and governments are encouraging early intervention, fueling consistent demand for advanced therapeutic options across all stages of the disease.

- For instance, World Health Organization data indicate that the number of prostate cancer cases globally rose from 3,596,220 in 1990 to 10,387,521 by 2021.

Advancements in Targeted and Immuno-Oncology Therapies

Continuous progress in molecular biology and immuno-oncology has transformed prostate cancer management. The introduction of targeted therapies, including androgen receptor inhibitors and PARP inhibitors, enhances treatment precision and reduces side effects. Immunotherapies such as checkpoint inhibitors and cancer vaccines are gaining approval for advanced and castration-resistant stages. Pharmaceutical companies are investing heavily in R&D to develop combination regimens, boosting clinical success rates and expanding treatment choices for patients globally.

- For instance, a phase III study reported that patients receiving a next-generation androgen-receptor pathway inhibitor achieved a median overall survival of 38.7 months, compared to 21.7 months for taxane chemotherapy in metastatic castration-resistant prostate cancer.

Increasing Access to Advanced Healthcare Infrastructure

Expanding healthcare infrastructure, particularly in emerging economies, supports wider availability of prostate cancer treatment. Improved diagnostic facilities, reimbursement programs, and rising healthcare expenditure enable faster adoption of modern therapies. Hospitals and cancer treatment centers are integrating robotic surgeries, radioligand therapies, and personalized care models. This broader access allows earlier treatment interventions, enhancing patient survival and driving overall market growth in both developed and developing regions.

Key Trends and Opportunities

Integration of Precision Medicine and Genetic Profiling

The shift toward personalized medicine is reshaping prostate cancer treatment strategies. Genetic and biomarker testing enables tailored therapy selection, improving efficacy and minimizing resistance. The use of next-generation sequencing supports identification of actionable mutations, leading to more effective targeted therapy combinations. Growing adoption of precision medicine creates opportunities for pharmaceutical innovators to develop genetic-driven drug pipelines and companion diagnostics.

- For instance, AstraZeneca and Merck & Co., Inc. reported from their PROpel Phase III trial in metastatic castration-resistant prostate cancer that the median overall survival was 42.1 months for patients treated with their PARP inhibitor plus abiraterone, compared to 34.7 months for the control arm.

Expansion of Radioligand and Combination Therapies

Radioligand therapies and combination regimens are emerging as promising treatment approaches for advanced prostate cancer. These therapies deliver targeted radiation directly to cancer cells, minimizing systemic toxicity. The growing clinical success of agents like Lutetium-177–based compounds highlights the potential for integration with hormone and immunotherapies. This trend opens opportunities for drug developers to expand therapeutic portfolios and achieve durable disease control.

- For instance, Novartis AG’s radioligand therapy ^177Lu-PSMA-617 added to best standard of care showed a median overall survival of 15.3 months compared to 11.3 months for standard care alone in the VISION phase III study involving PSMA-positive metastatic castration-resistant prostate cancer.

Key Challenges

High Cost of Targeted and Immunotherapy Treatments

The elevated cost of next-generation prostate cancer treatments remains a significant barrier, particularly in low- and middle-income countries. Advanced therapies such as PARP inhibitors and immunotherapies require high investment in manufacturing and clinical validation. Limited insurance coverage and high out-of-pocket expenses restrict patient access, slowing market penetration. Reducing treatment costs through generic competition and value-based pricing will be crucial for broader adoption.

Drug Resistance and Adverse Side Effects

Therapeutic resistance continues to challenge the long-term management of prostate cancer, especially in metastatic and castration-resistant stages. Prolonged hormone therapy often leads to reduced treatment efficacy and disease recurrence. Additionally, chemotherapy and immunotherapy can cause severe side effects impacting patient compliance. Addressing these challenges requires development of combination regimens, improved drug formulations, and novel targets that enhance response durability and patient tolerability.

Regional Analysis

North America

North America dominates the prostate cancer treatment market with a 41.3% share in 2024. High disease prevalence, strong healthcare infrastructure, and rapid adoption of advanced therapies drive regional growth. The United States leads with widespread use of targeted, hormonal, and immuno-oncology treatments supported by favorable reimbursement policies. Continuous R&D investments and strong clinical trial participation further enhance innovation. The region’s focus on early screening, advanced diagnostics, and patient awareness programs contributes to sustained market leadership and high treatment accessibility across hospitals and cancer care centers.

Europe

Europe holds a 29.4% share in the global prostate cancer treatment market in 2024. The region benefits from an expanding elderly male population and strong emphasis on cancer prevention and early detection. Countries such as Germany, France, and the United Kingdom lead due to well-developed oncology care systems and adoption of novel therapeutics. Favorable government initiatives supporting precision oncology and clinical research drive steady demand. Increasing access to robotic-assisted surgeries and targeted therapies continues to boost the region’s overall treatment capacity and patient survival outcomes.

Asia-Pacific

Asia-Pacific accounts for 21.8% of the prostate cancer treatment market in 2024 and represents the fastest-growing region. Rapid urbanization, increasing awareness about prostate health, and improving healthcare access are key growth drivers. China, Japan, and India dominate due to expanding diagnostic networks and rising incidence of prostate cancer linked to aging populations. Governments are enhancing cancer screening initiatives and promoting investments in oncology infrastructure. The growing adoption of hormone and immunotherapy treatments, along with partnerships between local and global drug manufacturers, accelerates regional market expansion.

Latin America

Latin America captures 4.6% share of the prostate cancer treatment market in 2024. Growth is supported by increasing cancer screening programs, rising healthcare investments, and improved access to modern therapies. Brazil and Mexico lead due to higher awareness levels and adoption of advanced surgical and hormonal treatments. Regional growth is further driven by expanding oncology departments in hospitals and the introduction of government-led cancer control programs. However, disparities in healthcare access and affordability continue to limit treatment availability across smaller markets in the region.

Middle East & Africa

The Middle East & Africa region holds a 2.9% share in the prostate cancer treatment market in 2024. Rising cancer incidence, healthcare modernization, and expanding diagnostic capabilities are driving growth. The United Arab Emirates, Saudi Arabia, and South Africa are key contributors, with increasing adoption of radiation and targeted therapies. Government investments in oncology infrastructure and partnerships with international pharmaceutical companies strengthen market presence. Despite progress, limited awareness and high treatment costs in several African countries continue to restrain broader market development.

Market Segmentations:

By Treatment Type

- Hormone Therapy

- Chemotherapy

- Immunotherapy

- Surgery

By Drug Class

- Luteinizing Hormone-Releasing Hormone (LHRH) Agonists

- Anti-Androgens

- Alpha Blockers

- Others

By Stage

- Early-Stage Prostate Cancer

- Advanced-Stage Prostate Cancer

- Recurrent Prostate Cancer

By End User

- Hospitals

- Cancer Treatment Centers

- Research Institutes

- Specialty Clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the prostate cancer treatment market is defined by the strong presence of leading pharmaceutical companies such as Pfizer Inc., Johnson & Johnson (Janssen Pharmaceuticals), Astellas Pharma Inc., Bayer AG, Novartis AG, AstraZeneca plc, Merck & Co., Inc., Sanofi S.A., F. Hoffmann-La Roche Ltd., and Bristol-Myers Squibb Company. These players are actively engaged in developing advanced therapies including androgen receptor inhibitors, radioligand therapies, and immuno-oncology drugs. Strategic collaborations, mergers, and product launches remain central to expanding treatment portfolios and global reach. Companies are heavily investing in R&D to discover next-generation targeted and combination therapies that improve survival outcomes in both metastatic and castration-resistant prostate cancer. Competitive intensity is further fueled by pipeline diversification, regulatory approvals, and precision medicine integration, positioning key players to capture emerging opportunities in high-growth regions such as Asia-Pacific and Latin America.

Key Player Analysis

- Pfizer Inc.

- Johnson & Johnson (Janssen Pharmaceuticals)

- Astellas Pharma Inc.

- Bayer AG

- Novartis AG

- AstraZeneca plc

- Merck & Co., Inc.

- Sanofi S.A.

- Hoffmann-La Roche Ltd.

- Bristol-Myers Squibb Company

Recent Developments

- In October 2025, Novartis AG presented results from the PSMAddition Phase III trial showing that PLUVICTO™ (lutetium-177 vipivotide tetraxetan) plus standard of care reduced the risk of radiographic progression or death by 28 % (hazard ratio 0.72) versus standard of care alone in PSMA-positive metastatic hormone-sensitive prostate cancer (mHSPC).

- In May 2025, Astellas Pharma Inc. and Pfizer reported five-year follow-up data from the ARCHES trial showing that XTANDI plus androgen deprivation therapy (ADT) provided a 66 % probability of survival at five years compared with 53 % for placebo plus ADT in men with metastatic hormone-sensitive prostate cancer (mHSPC).

- In February 2025, Pfizer Inc. announced that the combination of its TALZENNA® (talazoparib) and XTANDI® (enzalutamide) achieved a statistically significant improvement in overall survival in men with metastatic castration-resistant prostate cancer (mCRPC) compared to enzalutamide alone.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Drug Class, Stage, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of targeted and immuno-oncology therapies will transform prostate cancer care.

- Advances in precision medicine will enable more personalized treatment options for patients.

- Expansion of radioligand therapies will improve survival rates in advanced cancer stages.

- Increasing use of genetic and biomarker testing will enhance early detection and treatment planning.

- Pharmaceutical collaborations will accelerate innovation in drug development and clinical research.

- Emerging economies will witness higher treatment adoption due to better healthcare access.

- Integration of AI and digital diagnostics will support faster and more accurate disease monitoring.

- Regulatory approvals for combination therapies will expand treatment choices globally.

- Rising investments in oncology infrastructure will strengthen patient care and accessibility.

- Continuous R&D in next-generation hormone and immune therapies will drive long-term market growth.