| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Starter Culture Market Size 2024 |

USD 1,386.1 million |

| Starter Culture Market, CAGR |

5.16% |

| Starter Culture Market Size 2032 |

USD 2,077.8 million |

Market Overview:

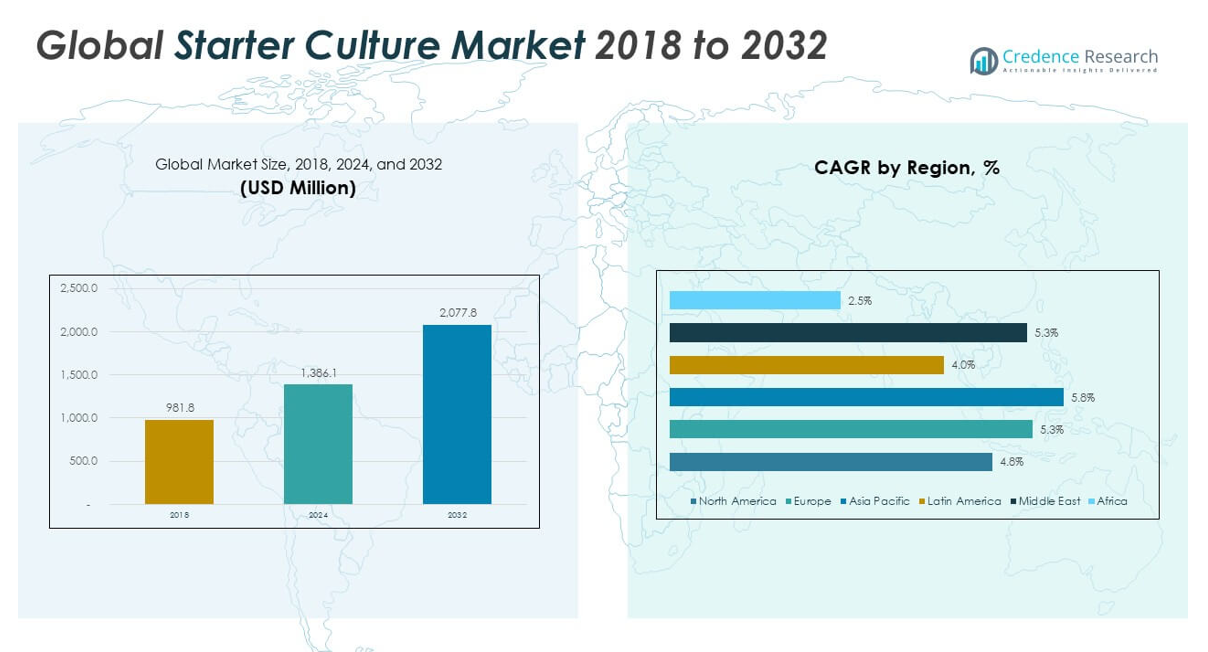

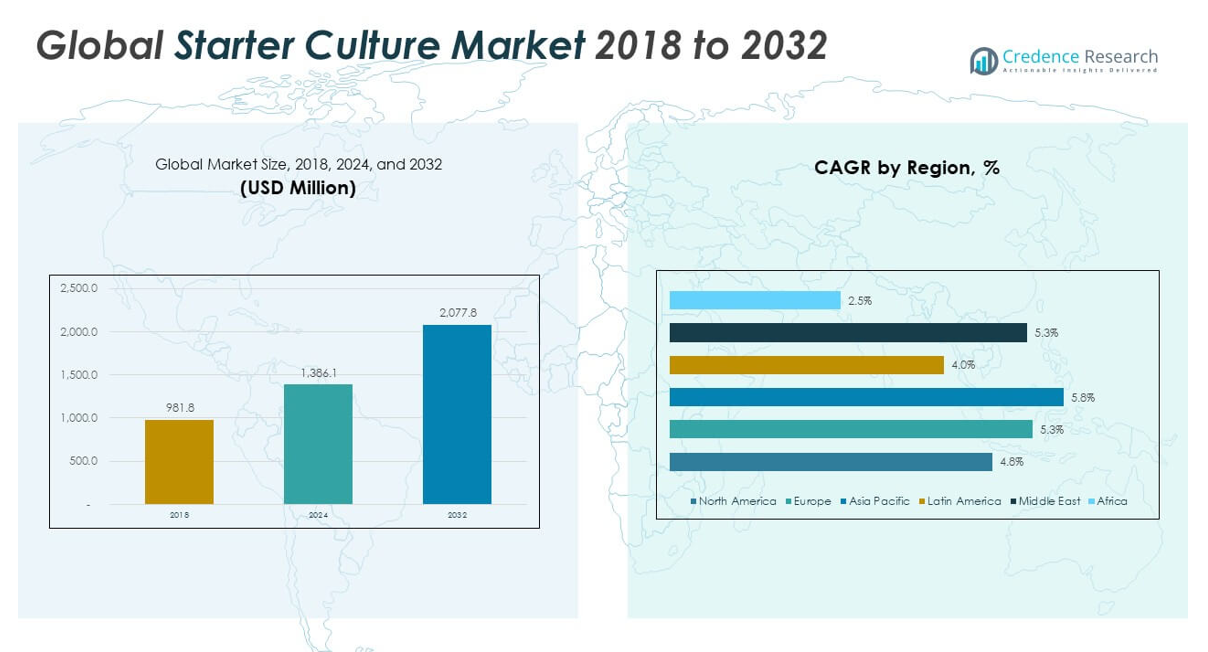

The Global Starter Culture Market size was valued at USD 981.8 million in 2018 to USD 1,386.1 million in 2024 and is anticipated to reach USD 2,077.8 million by 2032, at a CAGR of 5.16% during the forecast period.

One of the primary drivers of the Global Starter Culture Market is the rising consumer preference for natural, minimally processed, and probiotic-rich foods. Fermented products such as yogurt, kefir, cheese, sourdough, kombucha, and fermented meats are gaining popularity due to their digestive and immune health benefits. This trend aligns with the broader shift toward gut health awareness, especially in developed markets. Additionally, increased demand for plant-based and dairy-free fermented alternatives has created new application areas for non-dairy starter cultures. The food processing industry is investing in fermentation technologies to enhance product consistency, reduce spoilage, and extend shelf life. These functions are especially vital in ready-to-eat and convenience foods, which require reliable microbial control without compromising taste or quality. Technological advancements in strain development, microencapsulation, and freeze-drying methods are further enhancing the viability and shelf stability of starter cultures. Manufacturers are also focusing on strain selection based on regional taste preferences, production process requirements, and regulatory compliance.

Regionally, Europe holds the largest share of the Global Starter Culture Market, driven by the region’s long-standing tradition of fermented foods, stringent food safety regulations, and strong presence of leading culture producers. Countries like France, Germany, Italy, and the Netherlands have well-established dairy and meat industries that rely heavily on starter cultures for quality assurance and product innovation. North America follows closely, with growing interest in probiotics, clean-label food trends, and specialty cheese and meat production fueling market growth. The United States in particular is witnessing increased demand for craft fermentation and functional food offerings. The Asia-Pacific region is emerging as the fastest-growing market, led by expanding middle-class populations, rising health consciousness, and dietary diversification in countries such as China, India, Japan, and South Korea. Traditional fermented foods like kimchi, miso, natto, and fermented beverages are being commercialized and modernized, creating new opportunities for starter culture suppliers. In Latin America and the Middle East & Africa, growth is slower but steady, supported by improving food processing capabilities, urbanization, and a gradual shift toward packaged and fortified food options. Government initiatives to promote food safety, reduce waste, and support local production also contribute to adoption in these emerging regions.

Market Insights:

- The Global Starter Culture Market was valued at USD 981.8 million in 2018, reached USD 1,386.1 million in 2024, and is projected to reach USD 2,077.8 million by 2032, growing at a CAGR of 5.16% during the forecast period.

- Rising demand for fermented foods like yogurt, kefir, kombucha, kimchi, cheese, and sourdough is driving the market, as these products support gut health and immune function, which increases the use of high-quality microbial strains in production.

- Consumer preference for natural, clean-label, and minimally processed foods has created significant demand for starter cultures as they replace artificial preservatives and additives while enhancing flavor, safety, and shelf life.

- The growth of the processed and packaged food industry—driven by urbanization and changing dietary habits—has increased the use of starter cultures to ensure consistency, safety, and scalability in products like ready-to-eat meals.

- Technological advancements such as freeze-drying, microencapsulation, and targeted strain development have improved the shelf life and performance of starter cultures across diverse storage and production conditions.

- High production and storage costs, along with cold chain dependency, limit accessibility in price-sensitive markets, especially in Latin America, the Middle East & Africa, where small producers face infrastructure and affordability challenges.

- Europe dominates the global market, with leading countries like France, Germany, Italy, and the Netherlands, while Asia-Pacific is the fastest-growing region, led by demand from China, India, Japan, and South Korea for traditional and functional fermented foods.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Fermented and Functional Foods Enhances Market Appeal:

Consumers are increasingly drawn to fermented foods for their nutritional value and digestive health benefits. Products like yogurt, kefir, kombucha, and kimchi are widely accepted across age groups, especially among health-conscious consumers. The Global Starter Culture Market benefits directly from this trend by supplying essential microbial strains that initiate fermentation and enhance food quality. It supports the development of products rich in probiotics, which aid gut health and strengthen immune function. Manufacturers leverage starter cultures to create consistent taste and texture while extending product shelf life. The demand for fermented plant-based alternatives is also expanding the application of non-dairy starter cultures.

- For instance, Chr. Hansen’s probiotic starter cultures are used in over 1 billion servings of fermented dairy products daily worldwide, and their BB-12® Bifidobacterium animalis subsp. lactis strain has been clinically shown to improve gastrointestinal health in more than 180 published studies.

Clean-Label Movement and Natural Ingredient Demand Strengthen Growth Trajectory:

Shoppers are prioritizing foods with transparent ingredient lists, free from artificial preservatives, additives, and colorants. Starter cultures offer a natural way to enhance flavor, safety, and shelf life, aligning well with clean-label trends. The Global Starter Culture Market addresses this demand by offering microbial solutions that meet consumer expectations for minimal processing. It enables food producers to maintain quality without resorting to synthetic additives. Clean-label positioning is especially influential in dairy, baked goods, and ready-to-eat meals. This shift toward simpler ingredient profiles is helping starter cultures gain relevance in mainstream food categories.

- For instance, DuPont Nutrition & Health’s HOLDBAC® protective cultures extend the shelf life of yogurt by up to 10 days without artificial preservatives, as validated in commercial-scale trials with leading European dairy producers.

Expanding Processed and Packaged Food Industry Boosts Commercial Utilization:

The global rise in demand for processed, convenient, and ready-to-consume food drives the need for reliable and scalable fermentation technologies. Starter cultures help manufacturers ensure uniformity, safety, and shelf stability across high-volume production. The Global Starter Culture Market is responding with strain combinations tailored to diverse industrial applications. It supports food processors in meeting production efficiency goals while preserving sensory and nutritional attributes. Rapid urbanization and changing dietary habits in emerging markets are further accelerating the consumption of packaged foods. This shift amplifies the demand for dependable starter culture systems.

Advancements in Strain Development and Preservation Technology Improve Product Performance:

Ongoing innovations in biotechnology are enabling more targeted strain development with specific flavor, texture, or preservation characteristics. Enhanced freeze-drying and microencapsulation techniques are improving the viability and shelf life of starter cultures under varied storage conditions. The Global Starter Culture Market is incorporating these advancements to offer robust, application-specific solutions for different processing environments. It allows manufacturers to customize products for regional palates and regulatory preferences. R&D investments are also focusing on multi-strain and multifunctional cultures that deliver consistent results across product lines. These innovations are reinforcing customer confidence and broadening market reach.

Market Trends:

Adoption of Customized and Multi-Strain Cultures Drives Product Differentiation:

Manufacturers are increasingly seeking starter cultures tailored to specific applications, formulations, and processing conditions. Multi-strain blends are gaining popularity for their ability to deliver unique flavor profiles, texture modifications, and extended shelf stability. The Global Starter Culture Market is evolving to meet this demand through advanced strain selection and formulation technologies. It enables food producers to achieve greater control over fermentation outcomes and product consistency. Customized solutions help differentiate brands in competitive markets by aligning with regional taste preferences and functional claims. This trend supports innovation across dairy, bakery, plant-based, and beverage segments.

- For instance, DSM’s Delvo®Fresh multi-strain cultures have enabled more than 200 new yogurt product launches globally since 2022, with documented improvements in creaminess and flavor stability in both dairy and plant-based applications.

Expansion of Vegan and Plant-Based Product Lines Fuels Non-Dairy Culture Innovation:

The growing demand for plant-based alternatives has created new opportunities for non-dairy starter cultures. Traditional dairy-based strains are being replaced or adapted to work effectively in soy, almond, oat, and coconut substrates. The Global Starter Culture Market is expanding its product offerings to serve producers of non-dairy yogurt, cheese, beverages, and probiotic snacks. It addresses the challenges of achieving desired texture and flavor in plant-based formulations while ensuring microbial stability. As vegan diets gain global traction, demand for adaptable and clean-label culture solutions continues to grow. Companies that invest in non-dairy fermentation expertise are securing a competitive edge.

- For instance, Chr. Hansen’s VEGA™ culture range is used in over 100 commercial plant-based dairy-alternative products worldwide, delivering consistent fermentation performance and flavor development, as reported in their 2024 annual sustainability report.

Use of Biotechnology and Genomic Tools Enhances Strain Performance and Consistency:

Advances in microbial genomics and fermentation science are enabling precise characterization and optimization of starter cultures. Genomic sequencing and metabolic profiling allow for better strain selection, improved fermentation control, and enhanced safety verification. The Global Starter Culture Market benefits from these innovations by offering higher-performing cultures with predictable outcomes. It supports compliance with regulatory requirements while optimizing production efficiency. Food companies can now source strains with proven functionality, stability, and resilience under industrial conditions. This precision approach is transforming how cultures are developed, tested, and commercialized.

Digitalization and Traceability Systems Support Quality Assurance Across Supply Chains:

Food manufacturers are adopting digital tools to monitor, trace, and verify fermentation processes from production to packaging. IoT-enabled fermentation systems, cloud-based quality management platforms, and blockchain-based traceability tools are improving transparency and operational control. The Global Starter Culture Market is aligning with these developments by integrating culture performance data and traceability features into supply chain systems. It enables real-time monitoring of microbial activity and environmental conditions to reduce batch variability. This digital infrastructure supports food safety, regulatory compliance, and brand reputation. Integration of data analytics is becoming an essential component of modern fermentation practices.

Market Challenges Analysis:

High Production Costs and Cold Chain Dependence Limit Accessibility in Emerging Markets:

Starter cultures require precise fermentation, isolation, and preservation techniques, which contribute to higher production and storage costs. Maintaining viability during transportation demands strict cold chain management, especially for freeze-dried and frozen cultures. The Global Starter Culture Market faces challenges in reaching cost-sensitive and infrastructure-limited regions due to these constraints. It must navigate logistical hurdles, limited refrigeration capacity, and uneven distribution networks. Smaller food producers in emerging markets often lack the resources to integrate premium starter cultures into their processes. These factors restrict market penetration and slow adoption in low- and middle-income economies.

Regulatory Complexity and Strain Approval Delays Affect Product Commercialization:

Regulatory frameworks for microbial cultures vary significantly across regions, requiring extensive documentation and safety validation before approval. Strain-specific assessments, labeling rules, and differing standards for food-grade organisms increase the time and cost of market entry. The Global Starter Culture Market must manage a fragmented regulatory landscape that complicates international expansion. It also faces delays in registering novel strains, particularly in jurisdictions with slow review processes or limited harmonization with global standards. Companies investing in innovation must allocate resources for compliance and adapt formulations to meet regional requirements. These regulatory barriers can discourage smaller firms and slow down time-to-market for new applications.

Market Opportunities:

Emerging Demand in Non-Traditional Fermented Foods and Beverages Creates New Applications:

Global interest in functional foods and ethnic cuisines is expanding the use of starter cultures beyond traditional dairy and meat categories. Fermented plant-based beverages, probiotic cereals, sourdough snacks, and novel condiments are gaining popularity among health-conscious and adventurous consumers. The Global Starter Culture Market can capitalize on this diversification by developing strain blends tailored for non-traditional substrates and unique fermentation profiles. It enables food innovators to deliver new flavor experiences while maintaining product safety and shelf life. The trend supports cross-category experimentation and expands the customer base beyond conventional processors. Companies that focus on flexible, substrate-specific cultures can unlock niche and premium market segments.

Expansion of Localized Production and Artisanal Brands Supports Small-Scale Adoption:

The rise of regional food movements and small-batch manufacturing presents opportunities for starter culture suppliers to serve artisanal and specialty producers. These businesses value high-quality, traceable ingredients that deliver consistent fermentation with minimal processing. The Global Starter Culture Market can support this segment by offering smaller pack sizes, technical guidance, and strain customizations suited to traditional recipes or local taste profiles. It helps bridge the gap between industrial-scale solutions and craft production needs. This approach promotes culture adoption in underpenetrated regions while strengthening supplier relationships with emerging food brands.

Market Segmentation Analysis:

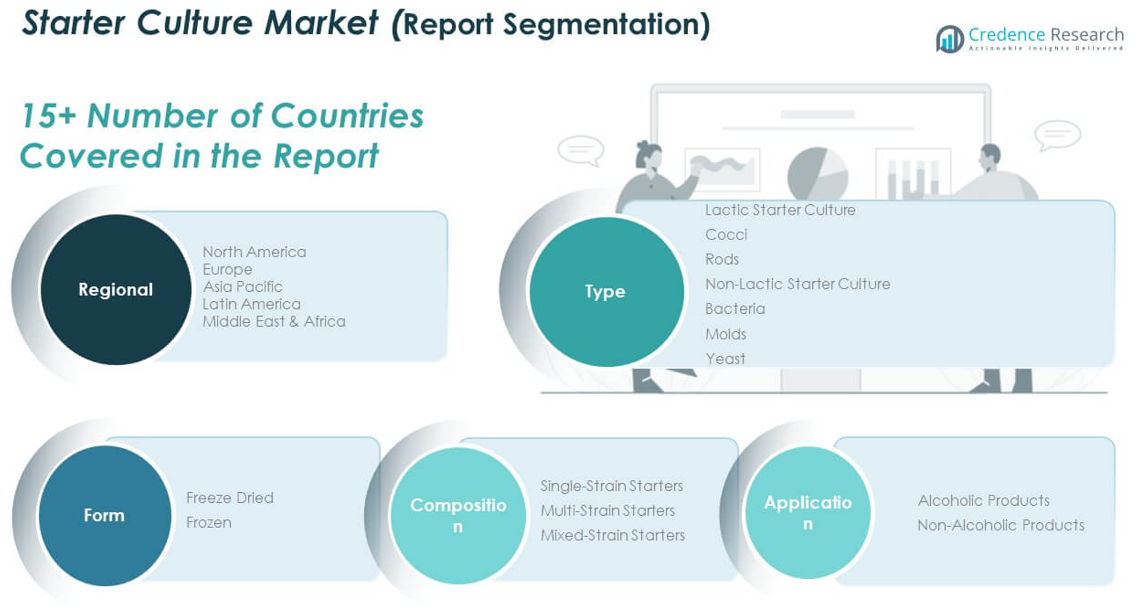

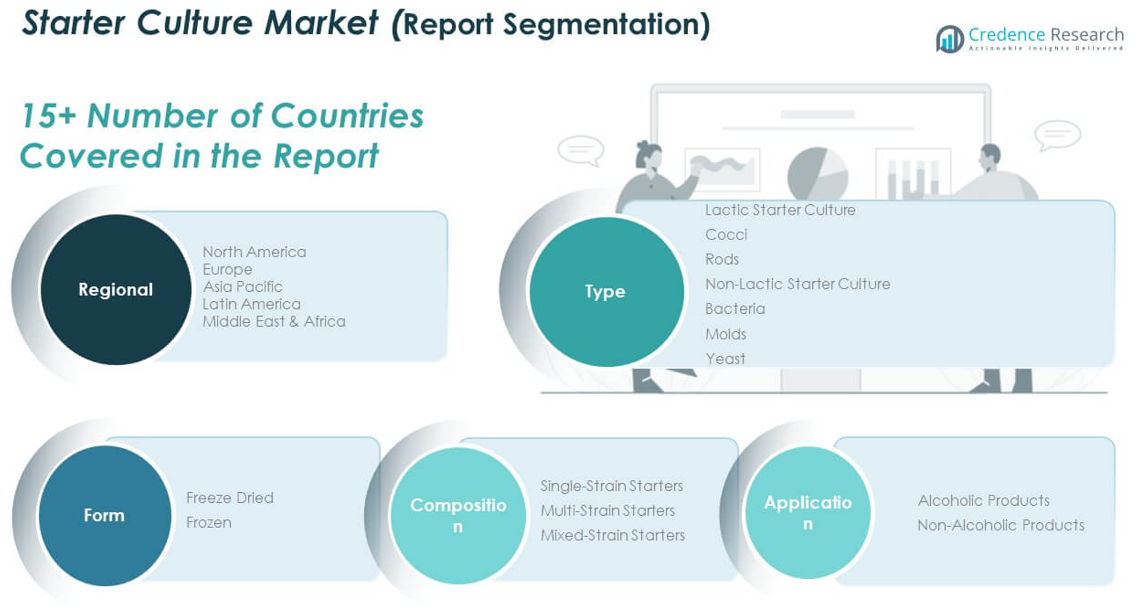

By Type Segment

The Global Starter Culture Market is segmented into lactic and non-lactic starter cultures. Lactic starter cultures, including cocci and rods, hold a dominant position due to their essential role in dairy fermentation. Cocci strains are known for rapid acidification, while rods contribute to texture and flavor. Non-lactic starter cultures—comprising bacteria, molds, and yeast—are used in specialized applications such as fermented meats, alcoholic beverages, and plant-based foods, offering distinctive sensory and preservative benefits.

- For instance, Sacco System’s Streptococcus thermophilus and Lactobacillus delbrueckii subsp. bulgaricus strains are used in over 60% of industrial yogurt production in Europe, according to 2023 industry data.

By Form Segment

By form, freeze-dried starter cultures lead the market, favored for their long shelf life, easy handling, and stable performance across diverse environments. Frozen starter cultures are widely adopted in industrial setups where high microbial viability and immediate activity are critical. Both formats cater to varying production scales and storage infrastructures.

- For instance, Lallemand’s freeze-dried starter cultures maintain cell viability after 12 months of storage at ambient temperature, as validated in third-party laboratory tests.

By Composition Segment

The market includes single-strain, multi-strain, and mixed-strain starters. Single-strain cultures provide specific fermentation outcomes and are ideal for precision-based food formulations. Multi-strain and mixed-strain cultures offer broader functionality, enabling enhanced flavor, safety, and consistency across batches. Their adaptability supports a wide array of food processing needs.

By Application Segment

Non-alcoholic products form the largest application segment, including dairy, bakery, fermented vegetables, and plant-based alternatives. These categories benefit from growing demand for probiotic-rich and functional foods. Alcoholic product applications—such as in beer, wine, and traditional liquors—continue expanding, driven by the craft and specialty beverage trends. This segmentation highlights the diverse use of starter cultures across global food and beverage industries.

Segmentation:

By Type

- Lactic Starter Culture

- Non-Lactic Starter Culture

By Form

By Composition

- Single-Strain Starters

- Multi-Strain Starters

- Mixed-Strain Starters

By Application

- Alcoholic Products

- Non-Alcoholic Products

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Starter Culture Market size was valued at USD 273.83 million in 2018 to USD 377.92 million in 2024 and is anticipated to reach USD 549.17 million by 2032, at a CAGR of 4.8% during the forecast period. The Global Starter Culture Market in North America is supported by strong demand for probiotic foods and clean-label ingredients. The United States leads the region, driven by functional dairy, plant-based alternatives, and fermented beverages. Widespread use of artisanal fermentation and innovation in microbial technology contributes to product diversity. Regulatory clarity and advanced processing infrastructure foster high adoption rates across the food industry. Both large-scale manufacturers and craft producers use starter cultures to ensure consistency and shelf life. It holds a significant market share due to its mature food processing ecosystem and health-conscious consumer base.

Europe

The Europe Starter Culture Market size was valued at USD 223.66 million in 2018 to USD 318.91 million in 2024 and is anticipated to reach USD 484.34 million by 2032, at a CAGR of 5.3% during the forecast period. Europe holds the largest share in the Global Starter Culture Market, backed by its rich tradition in fermented dairy, meats, and baked goods. France, Germany, and Italy dominate the regional landscape with well-established usage of cultures in cheese, yogurt, and sourdough. Food safety regulations and regional taste preferences guide innovation in strain selection. Strong manufacturing capabilities and local suppliers support a broad product portfolio. The market benefits from the growing demand for natural preservation and functional ingredients. It remains the leader in volume and technological advancement.

Asia Pacific

The Asia Pacific Starter Culture Market size was valued at USD 312.02 million in 2018 to USD 457.68 million in 2024 and is anticipated to reach USD 720.39 million by 2032, at a CAGR of 5.8% during the forecast period. The Global Starter Culture Market in Asia Pacific is expanding rapidly due to growing health awareness and demand for modernized traditional foods. China, Japan, South Korea, and India lead in adopting starter cultures in miso, kimchi, yogurt, and fermented beverages. Urbanization, rising income levels, and dietary diversification are accelerating demand. Manufacturers are adopting advanced fermentation techniques to improve quality and shelf life. Governments support food safety upgrades, boosting domestic production and imports. It records the highest CAGR, driven by evolving consumer preferences and product innovation.

Latin America

The Latin America Starter Culture Market size was valued at USD 56.75 million in 2018 to USD 75.49 million in 2024 and is anticipated to reach USD 103.89 million by 2032, at a CAGR of 4.0% during the forecast period. The Global Starter Culture Market in Latin America is growing steadily, led by Brazil and Argentina. Rising awareness of food quality, fermentation benefits, and clean-label products is fueling demand. Local manufacturers are adopting starter cultures in dairy, bakery, and beverage segments. Cost sensitivity and cold chain limitations pose moderate challenges. Gradual urbanization and improved food processing infrastructure support market expansion. It remains a developing market with potential for steady adoption across mainstream food categories.

Middle East

The Middle East Starter Culture Market size was valued at USD 70.89 million in 2018 to USD 100.67 million in 2024 and is anticipated to reach USD 152.10 million by 2032, at a CAGR of 5.3% during the forecast period. In the Global Starter Culture Market, the Middle East is gaining traction with rising demand for safe, high-quality fermented foods. Countries like the UAE, Saudi Arabia, and Israel are investing in local food production and advanced technologies. Starter cultures are increasingly used in dairy, yogurt drinks, and bakery products. The market is supported by premium food trends, retail expansion, and government initiatives in food safety. Imports continue to dominate but local manufacturing is gradually increasing. It shows stable growth potential driven by innovation and food system modernization.

Africa

The Africa Starter Culture Market size was valued at USD 44.67 million in 2018 to USD 55.47 million in 2024 and is anticipated to reach USD 67.95 million by 2032, at a CAGR of 2.5% during the forecast period. Africa accounts for the smallest share in the Global Starter Culture Market. South Africa and Egypt lead regional demand, primarily for fermented dairy and beverages. Growth is limited by cold chain constraints, cost barriers, and lack of awareness. Government-led food safety programs and donor-funded nutrition initiatives are helping raise interest in fermentation technology. Market access remains low due to reliance on imports and limited domestic production. It is expected to grow slowly with progress tied to infrastructure development and training in food manufacturing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Hansen Holding A/S

- IFF (International Flavors & Fragrances Inc.)

- DSM

- LB Bulgaricums

- Biochem SRL

- Dalton Biotecnologie S.R.L.

- Döhler Group

- Angel Yeast Co. Ltd.

- Tetra Pak International SA

- Lallemand, Inc.

- Lesaffre Group

- Wyeast Laboratories, Inc.

- Other Key Players

Competitive Analysis:

The Global Starter Culture Market is moderately consolidated, with a few major players holding significant market share through established product portfolios, global reach, and technical expertise. Key companies include Chr. Hansen Holding A/S, DuPont (IFF), DSM, Lallemand Inc., and Bioprox. These players compete by investing in strain innovation, customized solutions, and application-specific developments across dairy, meat, bakery, and beverage sectors. The market favors companies that can offer high-performance cultures with consistent functionality, strong technical support, and regulatory compliance. The Global Starter Culture Market also includes regional and niche firms that serve local preferences and artisanal producers with tailored offerings. Strategic collaborations with food manufacturers, investment in microbial genomics, and expansion into plant-based applications enhance competitive positioning. Players that align innovation with clean-label and functional food trends maintain a strong advantage in capturing evolving consumer demand.

Recent Developments:

- In June 2024, DSM-Firmenich launched Delvo®ONE, a portfolio of five all-in-one starter culture blends for yogurt and fermented milk. Developed using DSM’s AI-powered Culture Co-Creation Platform, Delvo®ONE optimizes taste, texture, and health benefits, while streamlining production for dairy manufacturers.

- In March 2024, Döhler Group acquired a majority stake in SVZ, a Dutch company specializing in fruit and vegetable ingredients. This acquisition strengthens Döhler’s capabilities in natural ingredients and fermentation solutions, including starter cultures for beverages and plant-based foods.

- In February 2024, Tetra Pak International SA announced a partnership with Chr. Hansen Holding A/S to develop integrated fermentation and packaging solutions for plant-based yogurt alternatives. This collaboration aims to streamline production and improve quality for manufacturers in the plant-based sector.

Market Concentration & Characteristics:

The Global Starter Culture Market exhibits moderate concentration, with a handful of multinational companies dominating through innovation, scale, and established customer relationships. It features a mix of global leaders and specialized regional firms catering to diverse application needs in dairy, meat, bakery, and beverage segments. The market favors companies that offer consistent product quality, strong R&D capabilities, and regulatory expertise. It demands strain reliability, fermentation control, and compatibility with clean-label and functional food requirements. The Global Starter Culture Market is characterized by its focus on microbial precision, safety, and adaptability to both industrial and artisanal production environments. Customization, shelf stability, and process efficiency are key differentiators across competitive offerings.

Report Coverage:

The research report offers an in-depth analysis based on by type, form, composition, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising global demand for fermented foods will continue to drive starter culture usage across categories.

- Increased consumer focus on gut health will expand applications in functional and probiotic-rich products.

- Growth in plant-based and non-dairy alternatives will create new opportunities for culture innovation.

- Technological advancements in strain development will enhance performance, safety, and customization.

- Clean-label trends will boost demand for natural fermentation agents without synthetic additives.

- Expansion of artisanal and small-scale food production will support adoption of culture solutions at local levels.

- Improved cold chain infrastructure in emerging markets will increase accessibility and distribution reach.

- Integration of digital tools and traceability systems will strengthen quality control and compliance.

- Regional product preferences will drive the need for geographically tailored strain formulations.

- Strategic collaborations between culture producers and food manufacturers will accelerate innovation and market penetration.