Market Overview

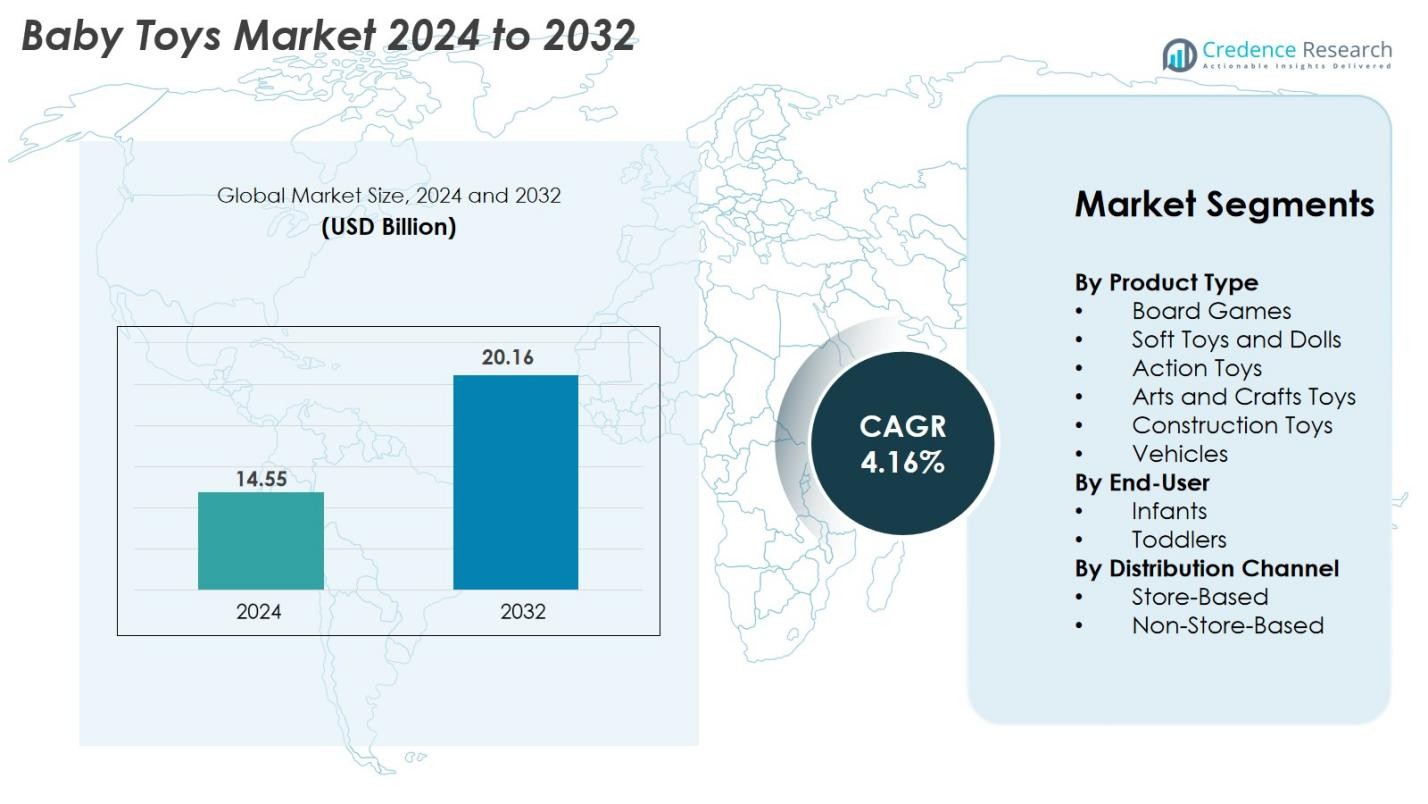

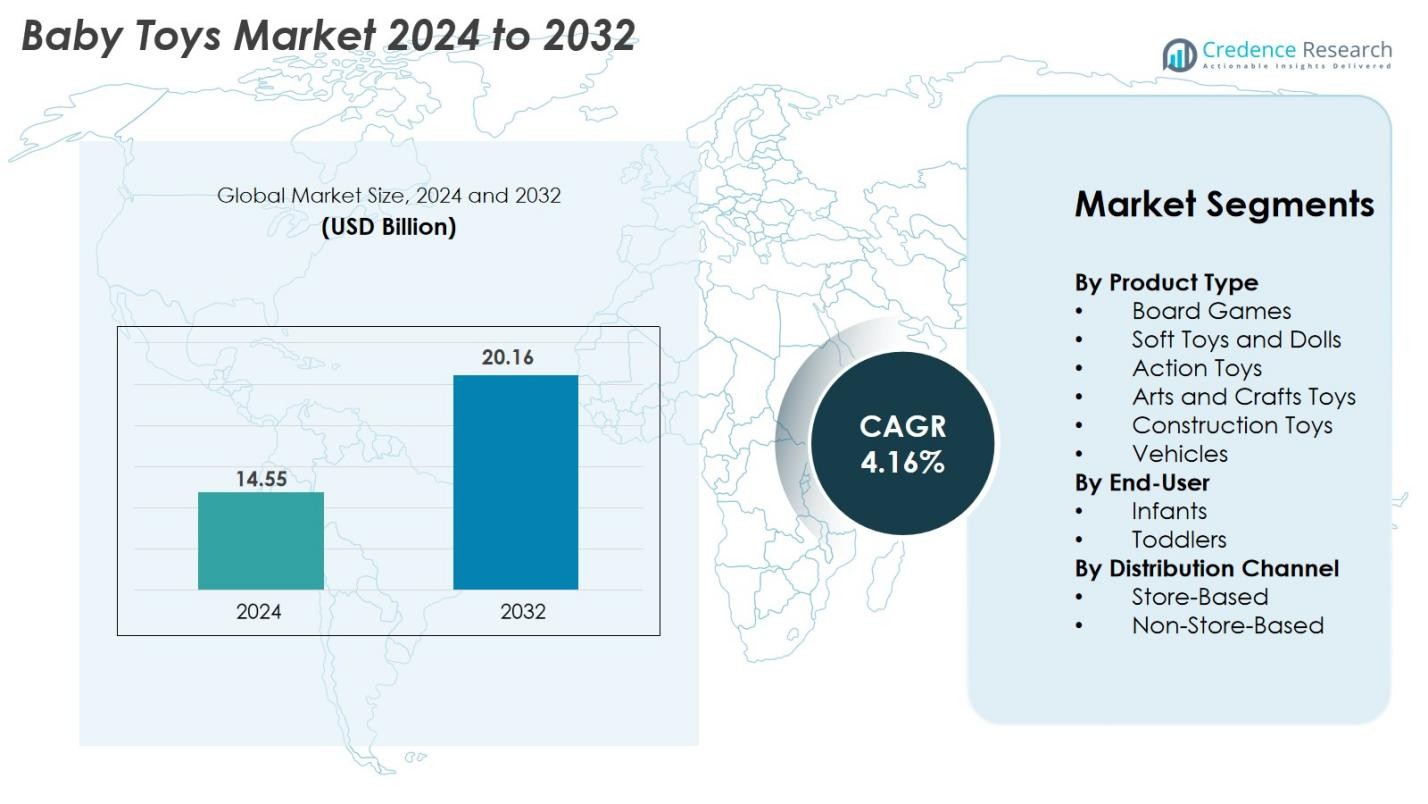

Baby Toys Market size was valued at USD 14.55 Billion in 2024 and is anticipated to reach USD 20.16 Billion by 2032, at a CAGR of 4.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Baby Toys Market Size 2024 |

USD 14.55 Billion |

| Baby Toys Market, CAGR |

4.16% |

| Baby Toys Market Size 2032 |

USD 20.16 Billion |

The Baby Toys Market is shaped by the strong presence of global leaders including LEGO System A/S, Mattel Inc., Hasbro Inc., Bandai Namco Holdings Inc., Spin Master, Kids II Inc., Nintendo Co. Ltd., Brandstätter Group, and Tomy Company Ltd., all of which drive innovation through branded product lines, sustainable designs, and extensive retail and e-commerce networks. These companies hold significant competitive advantage due to widespread distribution and high brand recognition. Regionally, Asia Pacific leads the market with a 34.8% share, supported by rising birth rates, expanding e-commerce adoption, and strong manufacturing capabilities, making it the most influential and fastest-growing regional market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Baby Toys Market was valued at USD 14.55 billion in 2024 and is expected to reach USD 20.16 billion by 2032, growing at a CAGR of 4.16% during the forecast period.

- Market growth is driven by rising awareness of early childhood development, increasing disposable incomes, and strong demand for soft toys and dolls, which hold a leading 32.4% share due to safety, comfort, and emotional engagement benefits.

- Emerging trends include the rapid adoption of eco-friendly materials, sustainability-focused designs, and increasing integration of interactive and sensory features that enhance cognitive and motor skills.

- The competitive landscape features major players such as LEGO System A/S, Mattel Inc., Hasbro Inc., Bandai Namco Holdings Inc., and Spin Master, with competition intensifying due to price sensitivity and the presence of low-cost regional manufacturers.

- Asia Pacific leads the market with a 34.8% regional share, followed by North America at 31.2% and Europe at 27.5%, supported by strong retail networks, rising online penetration, and increasing demand for educational and developmental toys.

Market Segmentation Analysis

By Product Type

The Baby Toys Market by product type is dominated by Soft Toys and Dolls, accounting for 32.4% of the total share in 2024. This dominance is driven by rising parental focus on safety, emotional development, and comfort-based toys suitable for infants and toddlers. Construction toys and board games are also gaining traction due to growing demand for cognitive skill-enhancing products, while action toys and arts & crafts toys continue expanding with increasing exposure to themed entertainment. Vehicles remain a steady segment supported by motor-skill development needs. Overall, demand is strengthened by innovations in materials and early-learning designs.

- For Instance, Hasbro produces a range of Playskool vehicles designed for durability and motor skill development in toddlers, using child-safe, robust plastic materials that undergo internal safety and quality assurance testing.

By End-User

Among end users, Toddlers lead the Baby Toys Market with 58.7% share in 2024, primarily due to their expanding engagement with interactive, skill-building, and motor-development toys. This age group benefits from a broader selection of categories including action toys, construction sets, and vehicles, driving higher spending compared to infants. The infant segment, though smaller, continues to grow through rising adoption of sensory toys and soft dolls prioritizing safety, tactile stimulation, and early emotional bonding. Increasing household income levels and premiumization trends further support market expansion across both age groups.

- For instance, Jellycat tested its infant plush collections to withstand tensile forces up to 90 newtons, ensuring compliance with EN71 safety standards across all stitched components

By Distribution Channel

The Baby Toys Market is dominated by Store-Based channels, holding nearly 69.5% share in 2024, driven by strong consumer preference for physical inspection of toys, immediate availability, and enhanced trust in quality and safety. Specialty toy stores, supermarkets, and hypermarkets continue to attract parents seeking certified and branded products. Meanwhile, the Non-Store-Based segment is expanding rapidly with growing e-commerce penetration, convenience of doorstep delivery, and wider assortment offered by online platforms. Digital promotions, user reviews, and bundled offers are accelerating the shift toward online purchases, especially among urban consumers.

Key Growth Drivers

Rising Focus on Early Childhood Development

The Baby Toys Market is increasingly driven by the rising global emphasis on early childhood development, with parents prioritizing toys that stimulate cognitive, sensory, emotional, and motor skills. As awareness grows around developmental milestones between zero and three years, demand accelerates for toys that support learning through play, including soft toys, educational activity sets, and interactive sensory products. Pediatric recommendations encouraging tactile stimulation, hand–eye coordination, and language-building activities further strengthen the adoption of developmental toys. Manufacturers are responding with innovative designs incorporating safe materials, vibrant textures, and learning features tailored to each age group. Government programs promoting early education and increasing investment in childcare environments also add momentum. This heightened developmental focus continues to shift consumer spending toward purposeful, skill-building baby toys, reinforcing steady market expansion.

- For instance, Hape manufactures its wooden baby toys using water-based paints tested for heavy-metal content below 90 parts per million, meeting stringent global safety thresholds.

Increasing Disposable Income and Premiumization Trends

Growing disposable incomes across emerging and developed economies significantly support the Baby Toys Market, as parents increasingly invest in high-quality, durable, and branded toys. Premiumization has become a notable driver, with consumers preferring eco-friendly materials, enhanced safety features, and multi-functional toys that offer extended value. Higher purchasing capacity encourages adoption of technologically advanced products, such as interactive learning toys, smart plush toys, and customizable play sets designed to stimulate creativity. Brands are also expanding their premium lines with character-themed collections, licensed entertainment merchandise, and feature-rich construction toys. The trend is further supported by evolving gifting cultures, rising birth rates in certain regions, and improved retail ecosystems that showcase premium toy assortments. As parents continue prioritizing superior quality, premium materials, and safety certifications, the shift toward premium baby toys is expected to fuel consistent market growth.

- For instance, LeapFrog toys incorporate durable, touch-sensitive technology designed for children’s use. The company states its products, like the LeapPad Ultimate, feature touchscreens and other input methods and undergo rigorous quality and durability testing to withstand typical play.

Rapid Expansion of E-Commerce and Digital Retailing

The rapid expansion of e-commerce plays a crucial role in driving the Baby Toys Market, offering consumers convenience, broader choices, and competitive pricing. Online platforms provide access to extensive product catalogs, user reviews, safety certifications, and bundled promotional offers that influence purchasing decisions. The increasing preference for doorstep delivery, especially among busy parents, accelerates online sales of baby toys. Major brands are strengthening their digital presence through direct-to-consumer models, personalized recommendations, subscription toy boxes, and exclusive online product lines. Social media marketing, influencer endorsements, and targeted ads further enhance product visibility. With e-commerce adoption rising across urban and semi-urban areas, digital retailing continues to provide strong growth momentum, enabling manufacturers to reach global audiences and expand their customer base efficiently.

Key Trends & Opportunities

Growing Adoption of Eco-Friendly and Sustainable Toys

One of the most prominent trends in the Baby Toys Market is the rising demand for eco-friendly and sustainable toys made from organic cotton, recycled plastics, responsibly sourced wood, and non-toxic dyes. Parents are increasingly concerned about chemical exposure and environmental impact, prompting them to choose toys that ensure safe play while supporting sustainability. This trend presents major opportunities for manufacturers to innovate with biodegradable materials, circular-product designs, and sustainable packaging. Certifications such as FSC, OEKO-TEX, and ASTM further influence buying behavior. Brands that incorporate sustainability messaging, transparent sourcing, and eco-conscious product lines are witnessing stronger customer loyalty. As environmental awareness continues rising, the shift toward green and ethical toy production will unlock new growth avenues for industry players.

- For instance, Green Toys manufactures its baby toy range entirely from recycled HDPE, processing more than 50 million post-consumer milk jugs each year through its proprietary closed-loop recycling system.

Increasing Integration of Technology in Infant and Toddler Toys

Technological integration in baby toys is emerging as a key opportunity, driven by advancements in interactive learning tools, AI-enabled features, and digital connectivity. Parents seek innovative toys that enhance early education through sound recognition, motion sensors, and interactive storytelling. Smart plush toys, app-connected play items, digital learning boards, and subscription-based interactive kits are gaining momentum. These tech-enhanced toys offer personalized learning experiences and real-time engagement, supporting speech development, problem-solving, and sensory learning. The expansion of IoT ecosystems and safe digital interfaces for children has further accelerated the adoption of intelligent baby toys. As technology becomes safer and more accessible for younger age groups, manufacturers will continue leveraging connected learning experiences as a key avenue for differentiation and growth.

· For instance, Steiff produces a range of its organic baby plush toys using GOTS-certified organic cotton. These products undergo rigorous, independent quality testing through institutions like TÜV and Dekra, in addition to over 12,000 internal tests performed annually in the Steiff laboratory.

Key Challenges

Strict Safety Regulations and Compliance Requirements

The Baby Toys Market faces significant challenges due to stringent global safety regulations aimed at preventing choking hazards, toxic exposure, and mechanical injuries. Standards such as EN71, ASTM F963, and CPSIA impose strict guidelines regarding material safety, chemical composition, size specifications, and labeling. Manufacturers must invest heavily in rigorous testing, quality checks, and compliance documentation, which increases production costs and time-to-market. Frequent regulatory updates across regions add further complexity. For smaller manufacturers, meeting certification requirements can restrict innovation and limit product expansion. Ensuring consistent safety compliance while maintaining affordability and design creativity remains one of the most demanding challenges for industry players.

Intense Market Competition and Price Sensitivity

The Baby Toys Market experiences intense competition from global brands, regional manufacturers, and low-cost unorganized players. Price sensitivity among consumers, especially in developing economies, creates a highly competitive landscape where premium brands often struggle to justify higher pricing despite offering superior quality and safety features. Low-cost products from local manufacturers and online marketplaces amplify the pricing pressure, affecting profitability for established brands. Counterfeit and imitation toys further complicate market dynamics by undermining consumer trust and posing safety risks. To remain competitive, companies must continuously innovate, optimize supply chains, and differentiate through branding and value-added features, making competition a persistent challenge.

Regional Analysis

North America

North America holds a significant position in the Baby Toys Market, accounting for 31.2% of the global share in 2024. The region benefits from high consumer spending on early-learning toys, strong awareness of child development, and widespread adoption of premium and branded products. The presence of major toy manufacturers, well-established retail networks, and rapid penetration of e-commerce further support market growth. Demand is also driven by trends such as eco-friendly materials, STEM-based learning toys, and character-licensed products. Rising gifting culture and product innovation continue enhancing the region’s revenue potential.

Europe

Europe captures 27.5% of the Baby Toys Market in 2024, supported by strict safety regulations, rising sustainability preferences, and increasing adoption of educational and developmental toys. Countries such as Germany, France, and the U.K. lead demand due to high parental emphasis on cognitive skill-building and preference for durable, certified products. The region’s strong tradition of wooden and eco-conscious toys contributes to steady growth. Additionally, expanding specialty toy stores, premium product availability, and government-backed early childhood programs further stimulate purchasing. The market continues to shift toward ethically sourced materials and high-quality craftsmanship.

Asia Pacific

Asia Pacific dominates the Baby Toys Market with the largest share of 34.8% in 2024, driven by rising birth rates, rapid urbanization, and increasing disposable incomes across China, India, and Southeast Asia. Growing awareness of early childhood development and expanding access to online retail platforms significantly boost sales. The region also benefits from strong manufacturing capabilities, wide product availability, and affordability across categories. Parents increasingly prefer interactive, skill-building, and sensory-focused toys. As e-commerce penetration accelerates and premium toy adoption rises among urban households, Asia Pacific remains the fastest-growing regional market.

Latin America

Latin America accounts for 4.2% of the Baby Toys Market share in 2024, with growth supported by expanding middle-class populations and increasing consumer interest in developmental and educational toys. Brazil and Mexico lead regional demand due to improving retail infrastructure and rising adoption of branded products. The market is gradually shifting from low-cost traditional toys toward safer, higher-quality, and themed product ranges. E-commerce growth and digital marketing campaigns are enhancing product accessibility. Despite economic fluctuations, rising awareness regarding child development and improving urban consumption patterns are contributing to stable market expansion.

Middle East & Africa (MEA)

The Middle East & Africa region represents 2.3% of the Baby Toys Market in 2024, with growth fueled by increasing urbanization, rising birth rates, and expanding modern retail formats. The Gulf countries, particularly the UAE and Saudi Arabia, lead demand due to high purchasing power and preference for premium, imported toys. Educational, sensory, and character-based toys continue gaining traction. In Africa, affordability and accessibility remain key factors, with growing interest in functional and durable toys. The region is gradually seeing increased online retail penetration, offering new opportunities for global toy brands to expand their footprint.

Market Segmentations

By Product Type

- Board Games

- Soft Toys and Dolls

- Action Toys

- Arts and Crafts Toys

- Construction Toys

- Vehicles

By End-User

By Distribution Channel

- Store-Based

- Non-Store-Based

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Baby Toys Market is characterized by the strong presence of global brands, regional manufacturers, and emerging innovative players competing across quality, safety, design, and pricing. Leading companies such as LEGO System A/S, Mattel Inc., Hasbro Inc., Bandai Namco Holdings Inc., Spin Master, Kids II Inc., Nintendo Co. Ltd., Brandstätter Group, and Tomy Company Ltd. dominate the market through extensive product portfolios, established retail networks, and strong brand equity. These players continually invest in product innovation, sustainability initiatives, and digital engagement to strengthen market positioning. Partnerships with entertainment franchises, expansion into STEM-based learning toys, and the introduction of eco-friendly and sensory-focused products further enhance competitiveness. Meanwhile, regional manufacturers compete by offering affordable options, contributing to price sensitivity and market fragmentation. The growing influence of e-commerce is enabling both global and local players to expand reach, intensifying competition across markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nintendo Co., Ltd.

- Brandstätter Group

- Hasbro, Inc.

- Kids II, Inc.

- Spin Master Corp.

- Tomy Company, Ltd.

- LEGO System A/S

- Mattel, Inc.

- Bandai Namco Holdings Inc.

- Basic Fun!

Recent Developments

- In July 2025, Steelbird Hi‑Tech India Ltd. (via its baby-toy division Steelbird Baby Toys) announced a ₹10 crore investment to expand its infant-toy product line and manufacturing footprint.

- In June 2025, Mattel, Inc. announced a strategic collaboration with OpenAI to integrate AI-powered experiences into its toy brands.

- In April 2025, Sunny Days Entertainment and Mattel, Inc. announced a partnership to manufacture a new range of bath-toys and potty products in late 2025, followed by sports items in 2026.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Baby Toys Market will experience steady growth driven by rising focus on early childhood learning and developmental play.

- Demand for eco-friendly and sustainable toys will increase as parents prioritize non-toxic, ethically sourced materials.

- Technology-integrated baby toys, including interactive and sensory products, will gain stronger adoption across urban households.

- Premiumization will rise as parents invest more in high-quality, durable, and branded toys offering long-term value.

- E-commerce will continue expanding as a primary distribution channel due to convenience, wider assortments, and personalized recommendations.

- Character-licensed and themed toys will grow with increasing influence of global entertainment content.

- Safety compliance will remain a critical focus, driving innovation in certified and regulation-ready product designs.

- Regional players will strengthen their presence by offering affordable alternatives to global brands.

- Asia Pacific will remain the fastest-growing region due to rising birth rates, expanding urbanization, and digital retail penetration.

- Manufacturers will increasingly adopt recyclable packaging and sustainable production processes to meet evolving consumer expectations.