Market overview

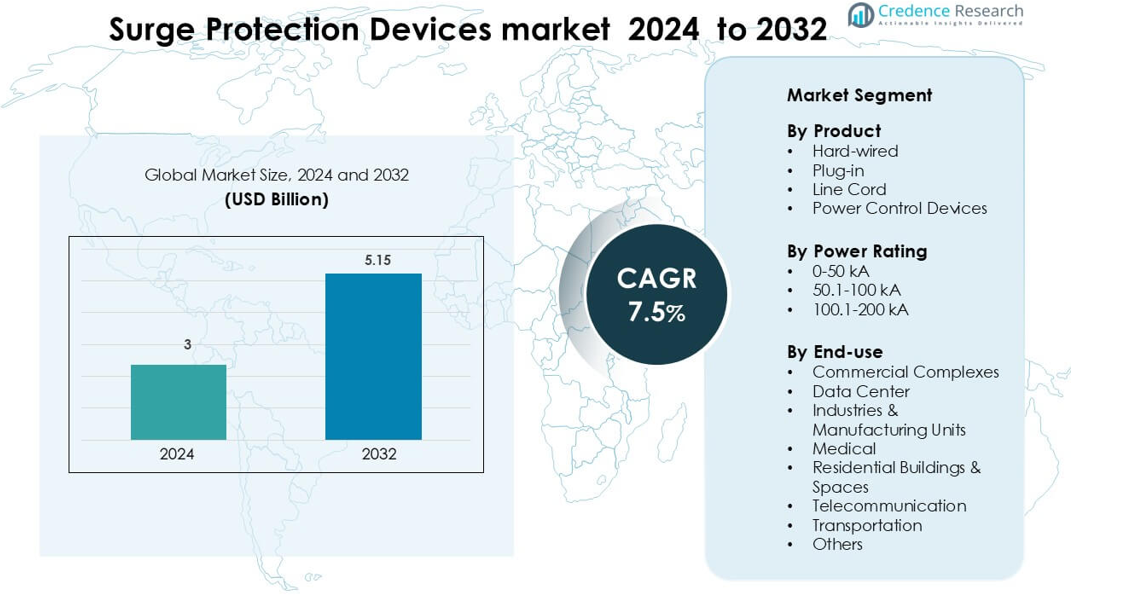

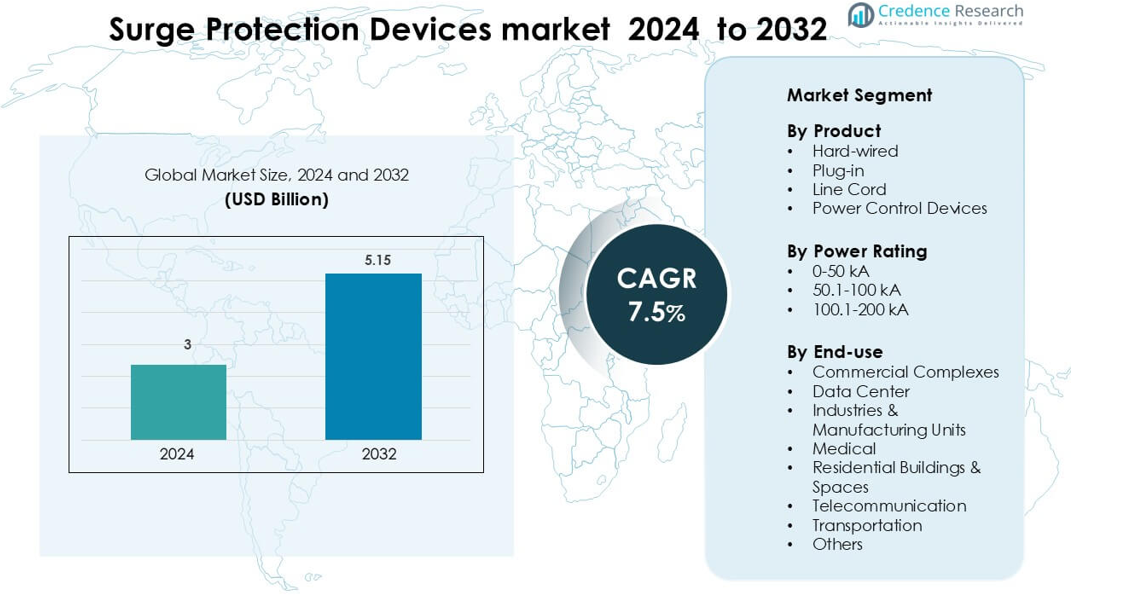

Surge Protection Devices market was valued at USD 3 billion in 2024 and is anticipated to reach USD 5.15 billion by 2032, growing at a CAGR of 7.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Surge Protection Devices Market Size 2024 |

USD 3 billion |

| Surge Protection Devices Market, CAGR |

7.5% |

| Surge Protection Devices Market Size 2032 |

USD 5.15 billion |

The Surge Protection Devices market is shaped by leading companies such as CG Power and Industrial Solutions Limited, Bourns Inc., Eaton Corporation plc, Siemens, Littelfuse Inc., Legrand, Emerson Electric Co., ABB Ltd., General Electric Company, and Schneider Electric. These companies compete through advanced hard-wired systems, smart monitoring features, and high-capacity kA-rated designs that support commercial, industrial, and telecom infrastructure. Product launches and compliance with evolving safety standards strengthen their global presence across developing and mature markets. North America leads the market with about 34% share, supported by strong adoption in data centers, commercial buildings, and growing smart-home installations.

Market Insights

- The Surge Protection Devices market is valued at 3 billion in 2024 and is projected to reach 5.15 billion by 2032, growing at a 7.5 % CAGR.

- Strong demand comes from rising grid instability, higher lightning activity, and increased use of sensitive electronics across commercial, industrial, and residential spaces.

- Smart SPDs with real-time monitoring gain traction as data centers, telecom towers, and EV charging stations expand worldwide.

- Competition strengthens among CG Power, Bourns, Eaton, Siemens, Littelfuse, Legrand, Emerson, ABB, GE, and Schneider as they develop high-kA systems, modular units, and IoT-enabled designs.

- North America holds 34% share, followed by Asia-Pacific at 30% and Europe at 27%, while hard-wired devices lead the product segment and 50.1–100 kA dominates the power rating category.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Hard-wired surge protection devices lead this segment with about 52% share due to strong adoption in commercial buildings, industrial plants, and telecom sites. Hard-wired units offer stable protection for large electrical panels and sensitive loads, which drives steady demand across high-risk environments. Plug-in devices grow in residential spaces due to simple installation, while line cord and power control devices see moderate use in office equipment and retail electronics. Growth in automation and rising grid disturbances strengthen the preference for hard-wired systems across expanding infrastructure projects.

- For instance, Eaton’s SPD Series hard-wired surge protection devices are integrated directly into its panelboards, switchboards, motor-control centres, and switchgear, and offer a nominal discharge current rating of 20 kA per phase.

By Power Rating

The 50.1–100 kA class dominates the power rating segment with nearly 46% share because most commercial facilities, data centers, and small industrial units rely on this capacity for stable surge mitigation. This class balances cost and performance, supporting adoption across low-to-medium exposure sites. The 0–50 kA range grows in residential and small office spaces, while higher classes, such as 100.1–200 kA, serve heavy industrial machinery and high-fault locations. Increasing use of power-sensitive electronics and stricter electrical safety codes drive demand for mid-capacity surge protection.

- For instance, Eaton’s PSPD series surge protective devices provide a 100 kA surge-current capacity per phase, along with a nominal discharge current of 20 kA and a short-circuit current rating (SCCR) of 200 kA, making them well-suited for data-centre and commercial switchgear applications.

By End-use

Commercial complexes lead the end-use segment with about 28% share, supported by heavy reliance on HVAC systems, elevators, digital signage, and building automation networks. Data centers follow due to rising deployment of high-density servers that require continuous surge monitoring. Industries and manufacturing units adopt high-capacity devices to protect motors, drives, and PLC systems. Residential buildings grow steadily as smart-home devices expand. Medical, telecommunication, and transportation facilities use advanced SPDs to secure critical equipment. Rising grid fluctuations and expanding digital infrastructure sustain strong growth across all major applications.

Key Growth Drivers

Rising Grid Instability and Increasing Lightning Strikes

Grid instability continues to rise as power networks handle heavier loads from commercial buildings, industrial machinery, and expanding digital infrastructure. Voltage fluctuations, switching surges, and frequent outages expose sensitive devices to serious damage, which increases the adoption of surge protection devices across all sectors. Lightning activity has also increased in many regions due to climate shifts, raising the risk of external surges that can impact residential and commercial installations. Businesses and households use more electronic systems than ever, including automation equipment, HVAC controls, data servers, medical devices, and telecom assets. These systems need high reliability, which drives stronger demand for stable surge mitigation. Regulatory bodies in Europe, North America, and parts of Asia now enforce safety standards for surge protection in critical facilities. All these factors push surge protection devices into mainstream electrical planning and installation practices.

- For instance, In the United States, the NEC 2020 (National Electrical Code) mandates that all new residential service panels must include surge protective devices under Article 230.67.

Growth of Data Centers and Connected Digital Infrastructure

The expansion of data centers drives strong demand for surge protection devices because server racks, cooling systems, and power distribution units depend on clean and stable electricity. Global hyperscale data center investments continue to grow as cloud computing and AI workloads rise, increasing the need for multi-level surge protection across distribution boards and rack-level power units. The rollout of 5G networks further boosts the need for surge protection at telecom towers, small cells, and edge computing sites. Commercial complexes deploy more smart lighting, building automation, and IoT-enabled devices, which remain vulnerable to transient surges. Manufacturing plants also integrate advanced robotics and PLC-based control systems that require continuous surge monitoring. The growing dependence on sensitive digital infrastructure makes surge protection a core requirement for operational continuity and equipment safety.

- For instance, by the early 2025, there were 1,136 hyperscale data centers worldwide, up from just around 700 a few years prior, driven largely by AI-oriented cloud providers such as Amazon Web Services, Google, and Microsoft.

Strict Electrical Safety Policies and Rapid Adoption in Residential Spaces

Stricter safety codes from regulatory agencies encourage the use of certified surge protection in commercial, industrial, and residential applications. Many countries now mandate surge protection at main distribution boards, especially in new buildings, hospitals, data centers, and communication hubs. Rising home electrification, adoption of smart-home ecosystems, and increasing use of expensive appliances push residential users toward plug-in and panel-based surge protection systems. Consumer awareness rises due to frequent grid fluctuations in emerging economies, where households seek affordable ways to protect televisions, refrigerators, inverters, and connected devices. Insurance companies also promote surge protection as part of risk-mitigation practices. These combined forces strengthen long-term adoption across urban and suburban homes.

Key Trends & Opportunities

Adoption of Smart SPDs with Monitoring and Remote Diagnostics

A major trend is the shift toward smart surge protection devices that offer real-time monitoring, performance tracking, and predictive maintenance capabilities. These devices integrate sensors, digital indicators, and communication protocols that allow facility managers to monitor surge events and analyze equipment health. Smart SPDs support IoT platforms, enabling remote diagnostics for large buildings, data centers, telecom sites, and industrial plants. Vendors explore cloud-linked dashboards and automated alerts, which help reduce downtime and improve asset protection. This opens strong opportunities for manufacturers to introduce advanced, software-enabled products aimed at high-value installations such as hyperscale data centers and automated industrial lines.

- For instance, Shenzhen Techwin’s SPD Status Monitoring Terminal (model TDZ-SZJ) monitors leakage current (100 µA to 150 mA), temperature, humidity, PE connection, and lightning-strike counts (up to 100 kA), and supports RS-485 or Ethernet remote communication.

Growing Use of SPDs in EV Charging Infrastructure and Renewable Energy

The growth of electric vehicle (EV) charging stations fuels new demand for surge protection because chargers operate with high-power electronics that remain highly sensitive to surges and voltage spikes. Renewable energy systems—particularly rooftop solar, utility-scale PV farms, and wind turbines—also require surge mitigation due to unpredictable power fluctuations. Countries expand clean energy capacity, which increases the need for DC-side and AC-side surge protection. Manufacturers have opportunities to design systems optimized for EV charging hubs, solar inverters, battery storage units, and microgrid controllers. These applications represent fast-growing installation hubs where surge protection becomes essential for performance and safety.

- For instance, Prosurge’s DB12.5 V2T DC SPD, specifically designed for EV charging stations and energy storage, supports a surge discharge capacity of 15 kA (10/350 µs) and up to 60 kA (8/20 µs) per pole, with a short-circuit current rating of 50 kA, making it well-suited to protect DC fast-charger inputs.

Key Challenges

High Installation Costs and Limited Awareness in Developing Regions

Surge protection devices often require professional installation especially hard-wired systems used in commercial and industrial settings. This increases total cost for small businesses, residential buyers, and facilities in cost-sensitive markets. Many developing regions still lack awareness about surge risks, which delays adoption unless government regulations mandate installation. Customers usually invest only after equipment damage occurs, reducing proactive demand. The lack of trained technicians in remote areas also restricts proper SPD deployment, limiting the market’s growth potential in emerging economies.

Compatibility Limitations and Risk of Improper Integration

Another challenge is ensuring proper SPD compatibility with diverse electrical systems, especially in older buildings where wiring and grounding may not meet modern standards. Improper grounding reduces SPD effectiveness, and incompatibility with panel designs limits installation. Complex industrial setups require coordinated surge protection across multiple levels, and incorrect integration can cause failure during high-energy surges. These risks make some facility operators reluctant to upgrade systems, slowing market penetration in legacy infrastructure environments.

Regional Analysis

North America

North America leads the Surge Protection Devices market with about 34% share due to high installation rates across commercial buildings, data centers, and industrial facilities. Strong enforcement of electrical safety codes and widespread use of advanced electronics drive consistent adoption across the United States and Canada. Telecom towers, 5G rollouts, and hyperscale data centers further strengthen demand for high-capacity SPDs. Residential use grows as consumers adopt smart-home devices and EV chargers. Frequent grid disturbances, aging power networks, and rising storm activity continue to support steady demand for hard-wired and plug-in surge protection solutions in the region.

Europe

Europe holds nearly 27% share of the global market, supported by strict electrical safety regulations and mandatory surge protection requirements across commercial complexes, transportation hubs, hospitals, and residential buildings. Countries such as Germany, France, the U.K., and the Nordics adopt SPDs to protect automation systems, renewable energy networks, and industrial machinery. Strong expansion of solar PV and wind installations boosts demand for AC/DC surge protection. Growth in smart-building infrastructure and energy-efficient homes increases adoption in both new construction and retrofit projects. Lightning-prone regions in Central Europe also contribute to the rising deployment of high-power SPDs.

Asia-Pacific

Asia-Pacific accounts for about 30% share and stands as the fastest-growing region due to rapid urbanization, industrial expansion, and increasing dependence on digital infrastructure. China, India, Japan, and South Korea drive large-scale adoption of SPDs across data centers, telecom networks, and manufacturing facilities. Rising electricity demand and frequent grid fluctuations push commercial and residential users toward stable surge mitigation. Growth in renewable energy installations and EV charging networks further increases SPD deployment. Expanding semiconductor, electronics, and automotive industries create strong long-term opportunities for high-capacity and smart surge protection devices across major APAC economies.

Latin America

Latin America holds roughly 6% share of the global market, driven by rising installation of surge protection devices in commercial complexes, telecom sites, and residential buildings. Countries like Brazil, Mexico, Chile, and Colombia experience frequent voltage fluctuations due to aging grid infrastructure, which increases demand for reliable surge mitigation. Expansion of renewable energy projects, especially solar PV installations, accelerates adoption across industrial facilities. Growth in mid-scale data centers and rising consumer awareness support steady market penetration. Economic constraints remain a challenge, but government initiatives for electrical safety improvement help boost adoption across key urban areas.

Middle East & Africa

The Middle East & Africa region accounts for nearly 3% share, supported by expanding infrastructure projects, commercial developments, and growing digital transformation efforts. Gulf countries invest in smart cities, telecom networks, and large commercial buildings, driving adoption of high-capacity surge protection systems. Africa sees increasing use of SPDs in residential and small commercial settings due to unstable grid conditions and frequent power surges. The rise of solar installations across the region creates additional demand for AC/DC surge protection. Limited technical awareness and high installation costs slow widespread adoption but growth potential remains strong.

Market Segmentations:

By Product

- Hard-wired

- Plug-in

- Line Cord

- Power Control Devices

By Power Rating

- 0-50 kA

- 1-100 kA

- 1-200 kA

By End-use

- Commercial Complexes

- Data Center

- Industries & Manufacturing Units

- Medical

- Residential Buildings & Spaces

- Telecommunication

- Transportation

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Surge Protection Devices market features strong competition among global players such as CG Power and Industrial Solutions Limited, Bourns Inc., Eaton Corporation plc, Siemens, Littelfuse Inc., Legrand, Emerson Electric Co., ABB Ltd., General Electric Company, and Schneider Electric. These companies compete through advanced product lines that address rising demand across commercial, industrial, telecom, and residential applications. Many players focus on smart surge protection systems with monitoring, diagnostics, and IoT connectivity to serve data centers and automated facilities. Manufacturers expand portfolios through modular designs, higher kA-rated devices, and improved thermal protection technologies. Partnerships with construction firms, energy utilities, and OEMs help strengthen market presence. Companies also invest in R&D to meet evolving standards such as IEC and UL, while regional players target cost-sensitive markets with affordable solutions. Continuous innovation and strong global distribution networks shape competitive dynamics across North America, Europe, and Asia-Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, CG Power and Industrial Solutions Limited’s board approved a new greenfield switchgear plant in western India, a ₹748 crore project to double capacity in MV and EHV switchgear, substation automation, and power electronics, supporting its wider surge arrester and overvoltage protection portfolio serving grids up to 1200 kV.

- In April 2025, Eaton acquired Fibrebond, a leading modular electrical and data center infrastructure provider. This strategic move enhances Eaton’s capabilities in delivering engineered-to-order enclosures that integrate power distribution and backup systems. The acquisition strengthens Eaton’s position in the data center, utility, and industrial markets, aligning with its focus on resilient, scalable, and protected power solutions.

- In March 2025, Schneider Electric announced a landmark investment of over USD 700 million in its US operations, marking the company’s largest-ever capital commitment in the region. This investment, set to be deployed through 2027, will support the expansion and modernization of eight manufacturing sites across states, including Texas, Tennessee, Ohio, North Carolina, Massachusetts, and Missouri. The initiative is aimed at meeting the surging demand for data centers, energy infrastructure, and automation solutions, driven largely by the rapid growth of artificial intelligence and digitalization.

Report Coverage

The research report offers an in-depth analysis based on Product, Power Rating, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as buildings adopt more automation, sensors, and connected electrical systems.

- Data centers and cloud facilities will drive higher use of multi-level surge protection.

- Smart SPDs with real-time monitoring will gain strong adoption in commercial and industrial sites.

- EV charging stations will require advanced surge protection for AC and DC lines.

- Renewable energy projects will boost demand for high-capacity surge systems to protect inverters and storage units.

- Residential installations will grow as smart-home adoption increases in urban areas.

- Manufacturers will add IoT integration and predictive maintenance features to improve reliability.

- Global standards will tighten, pushing builders to adopt certified surge protection in new construction.

- Cost-effective SPDs will expand adoption in developing regions with unstable grids.

- Long-term growth will come from wider replacement cycles as aging electrical systems upgrade to modern surge solutions.