Market Overview

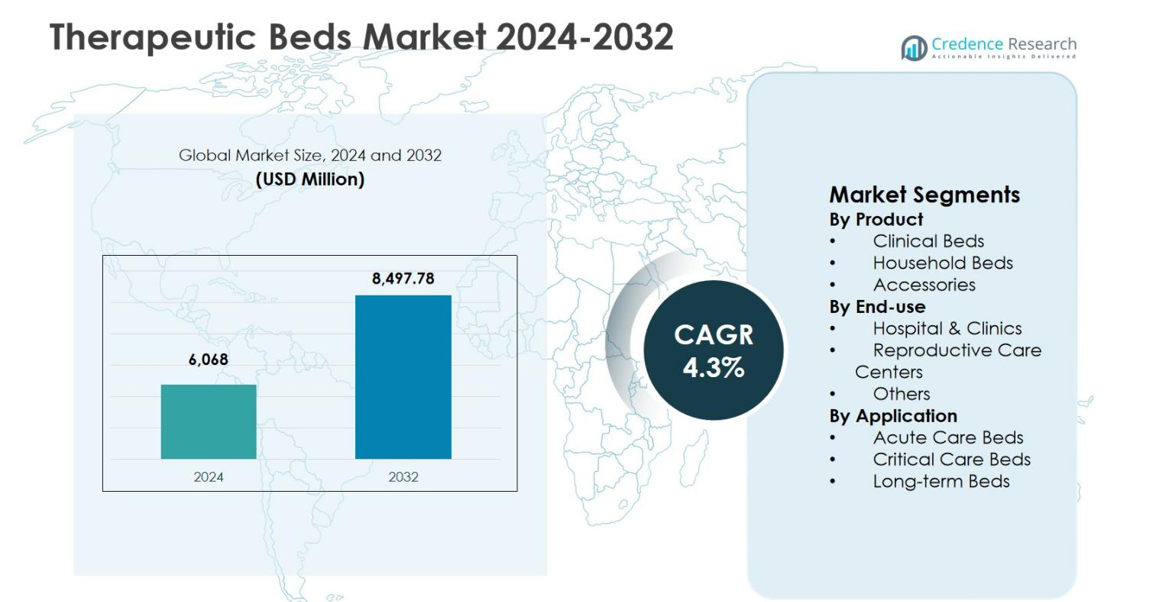

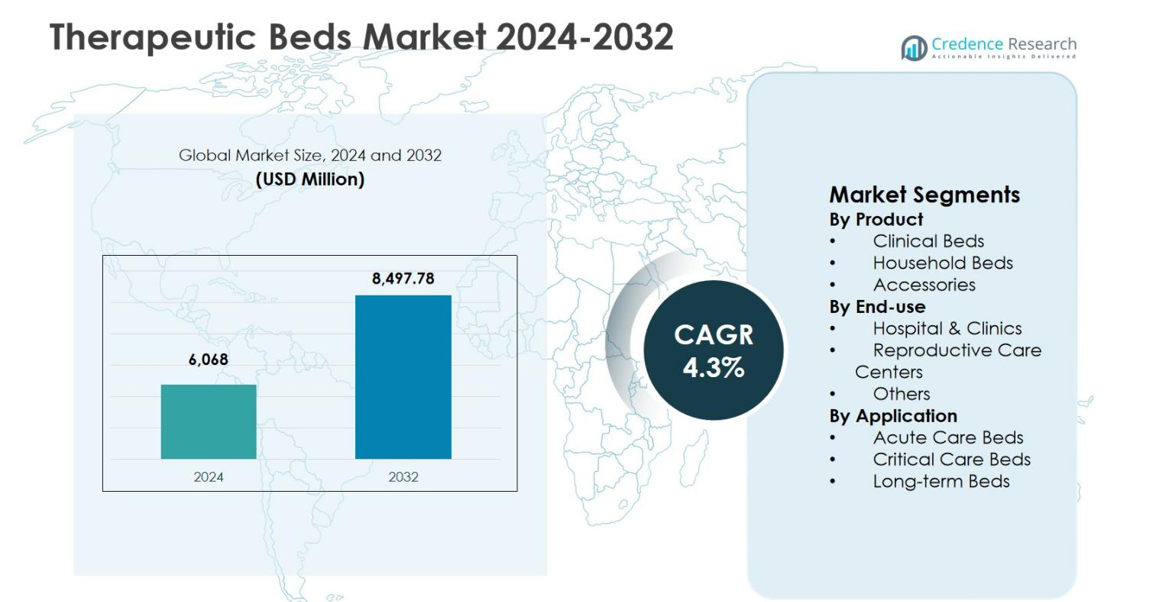

The Therapeutic Beds Market size was valued at USD 6,068 million in 2024 and is anticipated to reach USD 8,497.78 million by 2032, growing at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Therapeutic Beds Market Size 2024 |

USD 6,068 million |

| Therapeutic Beds Market, CAGR |

4.3% |

| Therapeutic Beds Market Size 2032 |

USD 8,497.78 million |

The Therapeutic Beds Market is driven by the strong presence of established medical equipment manufacturers that focus on advanced patient care solutions and broad product portfolios. Leading players such as Hill-Rom Holdings, Inc. (Baxter), Stryker Corporation, Invacare Corporation, Medline Industries, Inc., Arjo, Paramount Bed Holdings Co., Ltd., Joerns Healthcare LLC, Drive DeVilbiss Healthcare, GF Health Products, Inc., and Span-America Medical Systems, Inc. emphasize innovation, ergonomic design, and pressure management technologies to meet evolving clinical needs across hospital and homecare settings. North America led the Therapeutic Beds Market with a 38.2% share in 2024, supported by advanced healthcare infrastructure and high adoption of specialized beds, followed by Europe with 29.4% share and Asia Pacific with 22.1% share, driven by expanding healthcare facilities and rising patient care demand.

Market Insights

- Therapeutic Beds Market was valued at USD 6,068 million in 2024 and is expected to reach USD 8,497.78 million by 2032, registering a CAGR of 4.3% during the forecast period.

- Market growth is driven by rising hospitalization rates, expanding ICU capacity, aging population, and increasing demand for advanced patient care and pressure injury prevention solutions.

- Clinical Beds dominated with 58.6% segment share in 2024, supported by high adoption in hospitals, while Hospitals & Clinics held 64.9% end-use share and Critical Care Beds accounted for 42.8% application share.

- Leading players focus on product innovation, smart bed technologies, ergonomic design, and strong hospital and homecare distribution networks to strengthen market presence.

- North America led with 38.2% regional share in 2024, followed by Europe at 29.4% and Asia Pacific at 22.1%, supported by healthcare infrastructure expansion and rising care demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

The Therapeutic Beds Market by product is led by Clinical Beds, which accounted for 58.6% market share in 2024, driven by their extensive use across hospitals, long-term care facilities, and specialized treatment centers. Clinical beds offer advanced functionalities such as height adjustment, pressure redistribution, and patient monitoring compatibility, supporting effective patient care and caregiver efficiency. Rising hospitalization rates, growing elderly populations, and increasing prevalence of chronic conditions continue to drive demand. Household beds held 27.4% share, supported by home healthcare expansion, while accessories represented 14.0%, driven by upgrades and replacement demand.

- For instance, Hill-Rom’s Centrella Smart+ Bed features IntelliDrive powered transport for easier clinician mobility, Advanced SlideGuard technology to prevent pressure injuries, and contact-free continuous patient monitoring.

By End-use:

By end-use, Hospitals & Clinics dominated the Therapeutic Beds Market with a 64.9% share in 2024, reflecting high patient inflow, surgical volumes, and critical care requirements. Continuous investments in hospital infrastructure modernization and intensive care capacity expansion remain key growth drivers. Reproductive care centers accounted for 18.7% share, supported by rising maternal care focus and specialized birthing beds. The others segment held 16.4%, driven by rehabilitation centers and long-term care facilities, supported by increasing demand for specialized patient handling solutions and extended-care treatment environments.

- For instance, Mayo Clinic Health System in Mankato completed a $155 million bed-tower expansion in 2024, adding 41 ICU/PCU beds, 45 med/surg beds, and 38 birth center beds with digitally integrated tools to modernize patient care environments.

By Application:

In terms of application, Critical Care Beds led the Therapeutic Beds Market with a 42.8% market share in 2024, driven by rising ICU admissions, trauma cases, and demand for advanced monitoring-compatible beds. These beds support ventilated patients and complex clinical needs, making them essential in acute hospital settings. Acute care beds accounted for 34.6% share, supported by emergency admissions and post-surgical recovery needs. Long-term beds held 22.6%, driven by aging populations, chronic disease prevalence, and increasing adoption of extended-care and rehabilitation services globally.

Key Growth Drivers

Rising Hospitalization and Critical Care Demand

The Therapeutic Beds Market is strongly driven by increasing hospitalization rates and rising demand for critical care services globally. Growth in chronic diseases, trauma cases, and surgical procedures has significantly expanded the need for advanced hospital beds capable of supporting intensive care and acute treatment requirements. Hospitals continue to invest in technologically enhanced therapeutic beds that improve patient safety, pressure injury prevention, and caregiver efficiency. Expansion of ICU capacity and emergency care infrastructure, particularly in emerging economies, further accelerates adoption across public and private healthcare facilities.

- For instance, Stryker launched the SmartMedic platform in India in 2023, enhancing existing ICU beds with features to monitor patient weight changes, track turns from nurse stations, and enable X-rays without patient movement, thereby reducing discomfort and boosting caregiver productivity.

Aging Population and Long-Term Care Needs

The growing geriatric population is a major driver for the Therapeutic Beds Market, as older adults require prolonged medical care and mobility support. Age-related conditions such as cardiovascular disorders, musculoskeletal issues, and neurological diseases increase demand for long-term and rehabilitative care beds. Healthcare providers and homecare settings are increasingly adopting therapeutic beds that offer pressure redistribution, fall prevention, and adjustable positioning. Government support for elder care facilities and rising investments in nursing homes and assisted living centers continue to stimulate sustained market growth.

- For instance, Arjo launched the Citadel Patient Care System, a therapeutic bed with integrated C100 and C200 support surfaces for constant low pressure and alternating pressure therapy to prevent pressure injuries in elderly patients.

Expansion of Home Healthcare Services

Rapid expansion of home healthcare services is driving demand for therapeutic beds designed for household use. Cost pressures on hospitals and patient preference for home-based recovery have encouraged healthcare systems to shift toward decentralized care models. Therapeutic beds used in home settings improve patient comfort, reduce readmission rates, and support remote care delivery. Advancements in compact designs, ease of installation, and compatibility with monitoring devices are increasing adoption. Growth in insurance coverage for homecare equipment further strengthens this driver across developed and emerging markets.

Key Trends & Opportunities

Integration of Advanced Technologies

Integration of advanced technologies such as sensor-based monitoring, pressure mapping, and connectivity with hospital information systems is a key trend in the Therapeutic Beds Market. Manufacturers are focusing on smart beds that track patient movement, detect fall risks, and support clinical decision-making. These innovations improve patient outcomes while reducing caregiver workload. Opportunities exist in developing AI-enabled and data-driven therapeutic beds that support predictive care, particularly in intensive and long-term care environments, enhancing clinical efficiency and patient safety.

- For instance, Hillrom’s Centrella Smart+ Bed employs contact-free continuous monitoring and an enhanced 3-mode bed exit system to detect patient movements and prevent falls through visual projections and verbal prompts.

Growing Demand in Emerging Healthcare Markets

Emerging economies present strong growth opportunities for the Therapeutic Beds Market due to expanding healthcare infrastructure and increasing access to medical services. Rising healthcare expenditure, hospital construction projects, and government initiatives to strengthen critical care capacity are accelerating demand. Private healthcare investments and medical tourism growth further support adoption. Manufacturers offering cost-effective, durable, and modular therapeutic beds tailored to regional needs are well positioned to capitalize on unmet demand across Asia Pacific, Latin America, and the Middle East.

- For instance, Saudi German Hospitals Group operates a 400-bed facility in the Middle East, equipped with advanced therapeutic beds and medical equipment to support multidisciplinary critical care services.

Key Challenges

High Cost of Advanced Therapeutic Beds

High acquisition and maintenance costs of advanced therapeutic beds remain a key challenge for the market. Beds equipped with electronic controls, pressure management systems, and monitoring technologies require significant capital investment. Budget constraints in public hospitals and smaller healthcare facilities can limit adoption, particularly in price-sensitive regions. Maintenance, spare parts, and training costs further increase total ownership expenses, creating barriers for widespread deployment despite growing clinical demand.

Regulatory Compliance and Procurement Complexity

Regulatory compliance and complex procurement processes pose challenges for manufacturers and healthcare providers in the Therapeutic Beds Market. Therapeutic beds must meet stringent safety, quality, and performance standards, which vary across regions. Lengthy approval timelines and compliance costs can delay product launches. Additionally, hospital procurement cycles are often prolonged and price-driven, limiting flexibility for innovation-focused suppliers and intensifying competition based on cost rather than technological differentiation.

Regional Analysis

North America

North America led the Therapeutic Beds Market with a 38.2% market share in 2024, driven by advanced healthcare infrastructure, high hospital bed density, and strong adoption of technologically advanced medical equipment. The region benefits from rising hospitalization rates, a large aging population, and significant investment in critical care and long-term care facilities. High awareness of pressure injury prevention and patient safety standards further supports demand. Favorable reimbursement policies for hospital and home healthcare equipment, along with continuous product innovation by key manufacturers, continue to strengthen North America’s leadership position in the global market.

Europe

Europe accounted for a 29.4% share of the Therapeutic Beds Market in 2024, supported by well-established public healthcare systems and increasing focus on elderly care. Rising prevalence of chronic diseases and growing demand for long-term and rehabilitation services are major growth contributors. Countries across Western Europe continue to invest in hospital modernization and nursing home infrastructure, driving adoption of advanced therapeutic beds. Strict regulatory standards emphasizing patient safety and quality of care further promote replacement of conventional beds with specialized solutions, while Eastern Europe shows steady growth supported by healthcare infrastructure expansion.

Asia Pacific

Asia Pacific held a 22.1% market share in 2024, reflecting rapid healthcare infrastructure development and increasing access to medical services. Growing population, rising incidence of chronic diseases, and expanding hospital networks are key demand drivers. Governments across the region are investing in critical care capacity and elder care facilities, supporting therapeutic bed adoption. Increasing medical tourism and private healthcare investments further contribute to growth. Demand is particularly strong for cost-effective and durable therapeutic beds, making the region attractive for manufacturers focusing on scalable and locally adapted product offerings.

Latin America

Latin America represented a 6.1% share of the Therapeutic Beds Market in 2024, supported by gradual improvements in healthcare infrastructure and rising awareness of advanced patient care solutions. Expanding private hospital networks and increasing government healthcare spending are driving adoption. Demand is growing for therapeutic beds in acute and long-term care settings, particularly in urban centers. However, budget constraints and uneven access to advanced medical equipment across countries limit faster penetration. Ongoing hospital upgrades and rising chronic disease burden continue to create steady growth opportunities in the region.

Middle East & Africa

The Middle East & Africa accounted for a 4.2% market share in 2024, driven by expanding healthcare investments and rising demand for modern medical infrastructure. Gulf countries are leading adoption through large-scale hospital construction projects and emphasis on critical care services. Growing prevalence of lifestyle-related diseases and increasing focus on patient safety support market growth. In Africa, gradual improvements in healthcare access and international funding initiatives contribute to demand. Despite challenges related to cost sensitivity and infrastructure gaps, long-term opportunities remain supported by healthcare system modernization initiatives.

Market Segmentations:

By Product

- Clinical Beds

- Household Beds

- Accessories

By End-use

- Hospital & Clinics

- Reproductive Care Centers

- Others

By Application

- Acute Care Beds

- Critical Care Beds

- Long-term Beds

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Therapeutic Beds Market features a moderately consolidated competitive environment characterized by the presence of established global manufacturers and specialized healthcare equipment providers, including Hill-Rom Holdings, Inc. (Baxter), Stryker Corporation, Invacare Corporation, Medline Industries, Inc., Arjo, Paramount Bed Holdings Co., Ltd., Joerns Healthcare LLC, Drive DeVilbiss Healthcare, GF Health Products, Inc., and Span-America Medical Systems, Inc. These companies compete through product innovation, portfolio breadth, and strong distribution networks across hospital and homecare settings. Market participants emphasize advanced bed functionalities such as pressure redistribution, infection control surfaces, and smart monitoring integration to enhance patient safety and caregiver efficiency. Strategic initiatives including new product launches, geographic expansion, and partnerships with healthcare providers remain central to competitive positioning. Additionally, manufacturers focus on ergonomic design, durability, and compliance with regional regulatory standards to strengthen procurement success. Continuous investment in research and development enables differentiation, while cost optimization strategies support competitiveness in price-sensitive markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Drive DeVilbiss Healthcare

- Arjo

- Span-America Medical Systems, Inc.

- Hill-Rom Holdings, Inc. (Baxter)

- GF Health Products, Inc.

- Medline Industries, Inc.

- Paramount Bed Holdings Co., Ltd.

- Joerns Healthcare LLC

- Stryker Corporation

- Invacare Corporation

Recent Developments

- In February 2025, Stryker launched the ProCeed hospital bed, designed for markets outside the U.S. with features like low bed height to reduce fall risks and a fifth wheel to minimize caregiver injuries.

- In May 2025, Umano Medical unveiled a new generation of the ook snow bed, targeted for bariatric, med-surg, and palliative care applications.

- In July 2025, SonderCare launched certified home hospital beds tailored for middle-income seniors amid the long-term care crisis.

- In September 2025, Invacare launched the New Accent medical profiling bed for homecare and long-term care, emphasizing safety and ease of use.

Report Coverage

The research report offers an in-depth analysis based on Product, End Use, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Therapeutic Beds Market will continue to expand steadily, supported by rising hospitalization rates and increasing demand for advanced patient care solutions.

- Growing aging populations will drive sustained demand for long-term and rehabilitative therapeutic beds across healthcare facilities.

- Hospitals will prioritize replacement of conventional beds with technologically advanced therapeutic beds to improve patient safety and care efficiency.

- Adoption of smart and connected therapeutic beds will increase, enhancing patient monitoring and caregiver workflow management.

- Home healthcare settings will witness higher uptake of therapeutic beds as care models shift toward outpatient and home-based treatment.

- Demand for pressure injury prevention and infection control features will shape future product development strategies.

- Emerging economies will offer strong growth opportunities due to expanding healthcare infrastructure and critical care capacity.

- Manufacturers will focus on modular and cost-efficient designs to address budget constraints in public healthcare systems.

- Strategic partnerships with healthcare providers will strengthen market penetration and long-term supply agreements.

- Regulatory compliance and quality certifications will remain critical for sustaining competitive advantage and global market acces