Market overview

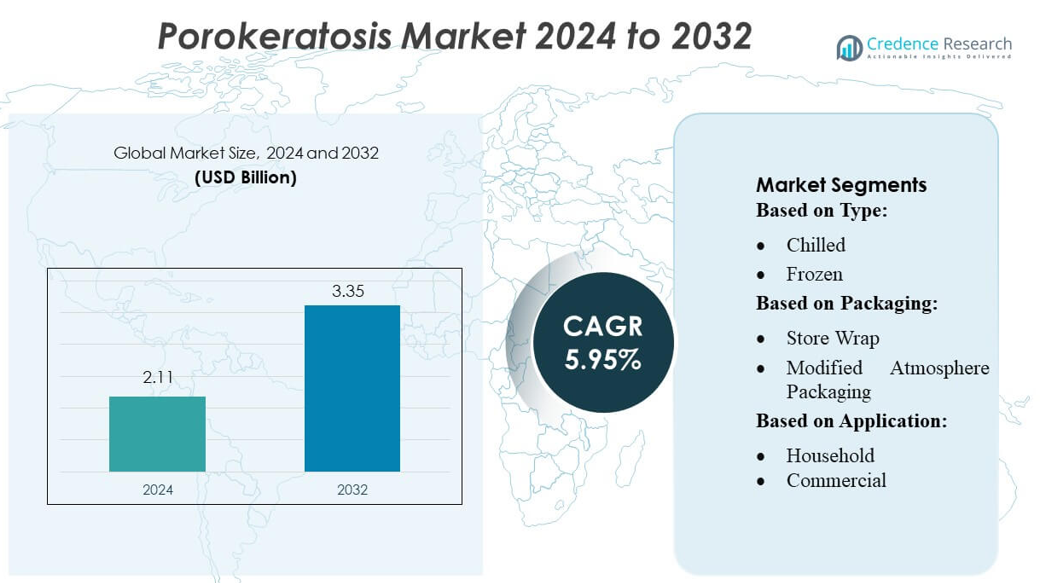

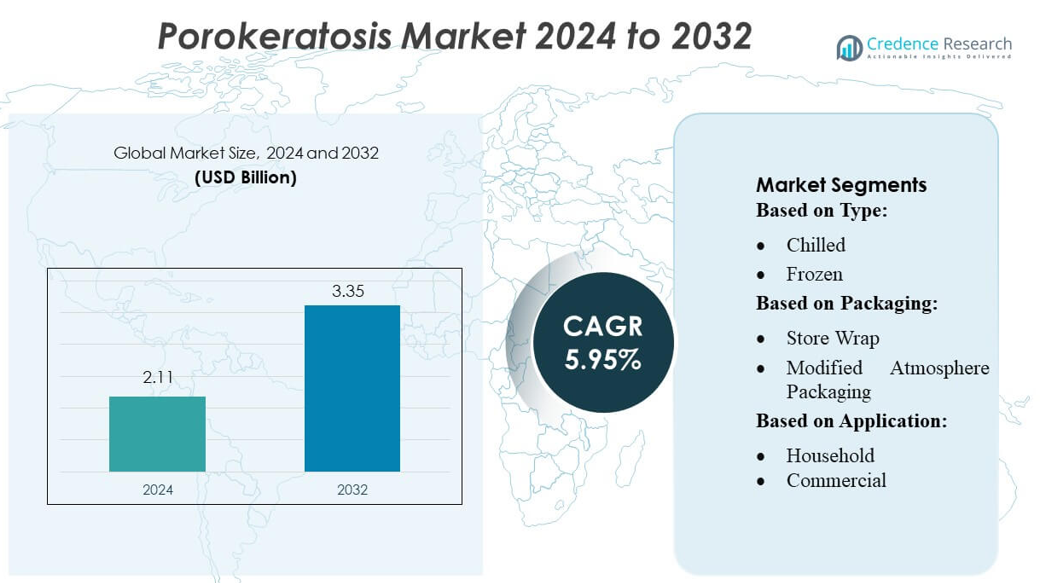

Porokeratosis Market size was valued USD 2.11 billion in 2024 and is anticipated to reach USD 3.35 billion by 2032, at a CAGR of 5.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Porokeratosis Market Size 2024 |

USD 2.11 billion |

| Porokeratosis Market, CAGR |

5.95% |

| Porokeratosis Market Size 2032 |

USD 3.35 billion |

The Porokeratosis Market is shaped by a focused group of dermatology-specialized pharmaceutical companies, biotechnology innovators, and medical device manufacturers developing advanced topical formulations, photodynamic therapy systems, and laser-based solutions. These companies compete through R&D investments, clinical trial advancements, and expansion of precision-medicine tools that enhance diagnosis and treatment outcomes for chronic porokeratosis subtypes. North America leads the global market with approximately 35% share, supported by strong dermatology infrastructure, high awareness of rare skin disorders, and rapid adoption of advanced diagnostic and therapeutic technologies, positioning the region at the forefront of innovation and commercial growth.

Market Insights

- The Porokeratosis Market was valued at USD 2.11 billion in 2024 and is projected to reach USD 3.35 billion by 2032, expanding at a CAGR of 5.95%, reflecting steady global demand for improved diagnostic and therapeutic solutions.

- Market growth is driven by rising diagnostic awareness, increasing prevalence of keratinization disorders, and the adoption of advanced treatments such as photodynamic therapy, laser procedures, and targeted topical formulations.

- Emerging trends include expanding precision dermatology, AI-enabled skin analysis, and growing clinical adoption of combination therapies that improve patient outcomes and reduce recurrence rates.

- Competitive activity is intensifying as dermatology-focused pharmaceutical companies and device manufacturers accelerate R&D investments, advance clinical pipelines, and strengthen partnerships to address unmet needs in chronic porokeratosis management.

- Regionally, North America holds 35% share, followed by Europe at 28% and Asia-Pacific at 25%, while treatment-type segmentation shows topical therapies dominating with nearly 40% share due to high accessibility and strong clinical preference.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Porokeratosis market, segmented by Chilled and Frozen formulations, shows Frozen products holding the largest market share due to their longer shelf stability, reduced degradation of active dermatological compounds, and wider suitability for bulk distribution. Frozen formats dominate as manufacturers prioritize controlled-temperature logistics to maintain potency across extended supply chains. Chilled variants continue to serve niche hospital and specialty pharmacy requirements, but the increasing adoption of long-life dermatological preparations drives the prominence of Frozen products. Growth is further supported by improvements in cold-chain infrastructure and rising clinical preference for formulations with consistent bioavailability.

- For instance, Palvella Therapeutics is developing a topical pitavastatin gel (QTORIN™) for disseminated superficial actinic porokeratosis, aiming to enroll approximately 10–20 patients in a Phase 2 trial planned for the second half of 2026.

By Packaging

Within packaging formats, Modified Atmosphere Packaging (MAP) accounts for the dominant market share, driven by its ability to preserve formulation integrity, extend stability timelines, and minimize oxidative degradation of sensitive dermatological ingredients used in Porokeratosis treatment products. MAP’s controlled gas composition makes it preferable for pharmaceutical distributors seeking enhanced durability during transit. Vacuum Packaging and Store Wrap serve cost-efficient roles in short-duration storage, while Shrink Bags and Others support secondary or bulk handling. However, MAP leads due to its superior contamination prevention, longer preservation capability, and compatibility with sterile product handling processes.

- For instance, Marfrig has strongly committed to sustainability through its Verde+ program, investing BRL 500 million to ensure a deforestation-free cattle supply chain.

By Application

In application segments, Commercial use—encompassing hospitals, dermatology clinics, and specialty treatment centers—holds the majority market share. This dominance stems from higher patient footfall, greater reliance on clinically validated formulations, and continual procurement of temperature-controlled dermatological products. The Commercial segment benefits from structured treatment protocols, specialized storage facilities, and stronger demand for advanced Porokeratosis therapies. Household usage is gradually rising as awareness grows, but remains smaller due to prescription-based access, clinical supervision requirements, and limited patient capability to manage chilled or frozen therapeutic products at home.

Key Growth Drivers

Growing Prevalence of Genetic and Immunologic Disorders

The rising incidence of genetic mutations affecting keratinization pathways and the growing population with immunocompromised conditions such as organ-transplant recipients significantly drive market growth. Increased diagnostic awareness and improved dermatological screening have expanded the patient pool, leading to higher demand for targeted therapies. Advancements in genetic testing help clinicians identify subtype-specific markers, enabling more accurate diagnosis and earlier intervention. This trend strengthens the need for personalized treatment approaches and supports steady demand for both topical and systemic therapies across global healthcare settings.

- For instance, WH Group reported US$ 173 million in R&D investment in its 2024 annual report. It holds at least 15 patents in meat-processing and flavor technologies, according to a VRIO analysis.

Advancements in Dermatology and Targeted Treatment Modalities

Technological progress in dermatology, including improved photodynamic therapy systems, laser-based interventions, and emerging immunomodulators, fuels treatment adoption. Pharmaceutical innovation in retinoid formulations, kinase inhibitors, and non-invasive procedures has accelerated clinical acceptance of new regimens. Clinicians now have improved tools to manage difficult-to-treat subtypes such as disseminated superficial actinic porokeratosis (DSAP). The continuous pipeline of investigational drugs and device-based solutions further strengthens market expansion, offering safer, more effective treatment alternatives that align with evolving patient expectations for convenience and rapid results.

- For instance, Cargill Beauty division reports offering a broad portfolio of nature-derived ingredients for personal care, including bio-actives, emollients, and emulsifiers, such as the skin-lipid-mimetic ingredient L22®.

Increasing Focus on Rare Disease Research and Funding Support

Growing prioritization of rare dermatological disorders is boosting research funding, clinical trials, and collaborative programs aimed at improving understanding of porokeratosis. Government agencies and private foundations are increasingly supporting studies that explore pathogenesis, genetic markers, and therapeutic targets. This financial support encourages pharmaceutical companies to invest in niche dermatology portfolios. Expanding patient-registries and multi-center collaborations also generate stronger epidemiological data, helping stakeholders assess unmet clinical needs and justify advancements in therapy development, ultimately contributing to steady long-term market growth.

Key Trends & Opportunities

Growing Adoption of Precision and Personalized Dermatology

Precision-medicine approaches are gaining traction as clinicians use molecular diagnostics, AI-based dermoscopy, and genetic profiling to guide treatment decisions for porokeratosis. This shift creates opportunities for targeted drug development, particularly therapies that modulate keratinization pathways or address mutation-specific subtypes. Personalized dosing strategies and treatment planning tools enhance clinical outcomes, encouraging healthcare providers to adopt advanced technologies. Companies focusing on biomarker-driven dermatology solutions are well-positioned to capitalize on demand for tailored therapies and predictive decision-support platforms.

- For instance, Tyson Ventures selected 6 AI-driven startups—including Prevera, which designs antimicrobial proteins, and Proxy Foods, whose AI “virtual scientist” aims to accelerate R&D timelines by up to half.

Rising Integration of Non-Invasive and Combination Therapies

Combination regimens, including topical agents paired with laser, cryotherapy, or photodynamic therapy, are increasingly preferred for improved efficacy and reduced recurrence in chronic cases. Demand for non-invasive options is rising as patients seek safer alternatives with minimal downtime. Innovations in light-based systems and next-generation topical formulations expand treatment variety, creating opportunities for device manufacturers and specialty pharmaceutical companies. Enhanced clinician training and improved reimbursement frameworks further support the adoption of multimodal approaches across hospital and dermatology clinic settings.

- For instance, JBS reports deploying over 210 intelligent automation solutions to streamline business processes, which as of 2022, had saved the company an estimated.

Expanding Tele-Dermatology and Digital Monitoring Solutions

The rapid adoption of tele-dermatology platforms provides new opportunities for remote assessment, long-term monitoring, and image-based diagnosis of porokeratosis lesions. Digital tools, including AI-enhanced skin-analytics applications, support earlier detection and reduce diagnostic delays, particularly in underserved regions. These technologies help dermatologists track lesion progression, optimize treatment adjustments, and improve patient compliance. The trend accelerates market penetration for topical therapies and medical devices by enabling consistent follow-up and treatment continuity, strengthening digital health’s role in dermatology care pathways.

Key Challenges

Limited Availability of Curative Therapies and High Recurrence Rates

Porokeratosis lacks a definitive cure, creating persistent challenges for patients and clinicians. Existing therapies primarily focus on symptom management and cosmetic improvement, yet recurrence remains common, especially in chronic or genetically driven subtypes. Limited therapeutic efficacy and inconsistent long-term outcomes hinder patient satisfaction and complicate clinical decision-making. The scarcity of robust clinical trial data and FDA-approved targeted treatments further slows innovation. These limitations restrict broader market adoption and emphasize the need for research into more durable and disease-modifying therapies.

Diagnosis Complexity and Under-Recognition in Early Stages

Diagnostic challenges stem from porokeratosis’ diverse clinical presentations, overlapping symptoms with other keratinization disorders, and limited awareness among general practitioners. Early-stage lesions are often misdiagnosed or overlooked, resulting in delayed treatment and increased risk of malignant transformation in certain subtypes. Variation in diagnostic standards across regions further complicates disease identification and reporting accuracy. These barriers reduce treatment uptake and create inconsistencies in patient management, underscoring the need for improved training, standardized diagnostic protocols, and expanded access to dermatology specialists.

Regional Analysis

North America

North America leads the porokeratosis market with approximately 35% share, driven by high dermatology care access, strong awareness of rare skin disorders, and advanced diagnostic infrastructure. The region benefits from well-established reimbursement frameworks that support photodynamic therapy, laser procedures, and prescription dermatological products. Extensive clinical research initiatives and active participation in rare disease registries strengthen early detection and management. The U.S. dominates regional revenue due to a high concentration of dermatology specialists and innovative treatment providers. Growing investment in genetic research and precision dermatology further enhances therapeutic adoption.

Europe

Europe accounts for roughly 28% of the market, supported by robust healthcare systems, high dermatology specialization, and strong regulatory oversight that encourages adoption of safe, evidence-based therapies. Countries such as Germany, France, and the U.K. dominate due to widespread clinical use of combination therapies, including cryotherapy, topical retinoids, and laser-based solutions. Growing initiatives to improve rare disease reporting and increased funding for skin cancer prevention indirectly support porokeratosis diagnosis and treatment. The EU’s structured patient pathways and cross-border healthcare collaborations further enhance clinical outcomes and market expansion.

Asia-Pacific

Asia-Pacific holds an estimated 25% market share and represents the fastest-growing region due to its large patient base and rising awareness of keratinization disorders. Countries such as China, Japan, India, and South Korea are witnessing expanding dermatology services, improved diagnostic accuracy, and increased adoption of minimally invasive treatments. Economic growth and healthcare modernization further support uptake of topical and device-based therapies. Regional research interest in genetic variants of porokeratosis enhances clinical understanding. However, uneven specialist availability and varying reimbursement structures create market disparities across urban and rural areas.

Latin America

Latin America captures around 7% of the global market, supported by gradual improvements in dermatology infrastructure and growing public awareness of chronic and rare skin conditions. Brazil and Mexico remain the primary contributors due to better access to dermatology clinics and increasing adoption of photodynamic therapy and topical solutions. However, limited specialist coverage in remote areas and inconsistent reimbursement limit advanced therapy uptake. Rising medical tourism and government efforts to strengthen specialty healthcare services present opportunities for market expansion, especially as diagnostic technologies become more widely available.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of the porokeratosis market, constrained by limited dermatology services and delayed diagnosis of rare skin disorders. Wealthier GCC nations, led by Saudi Arabia and the UAE, contribute most revenue due to higher adoption of advanced dermatology treatments and investment in specialty clinics. In contrast, many African regions experience low awareness, restricted treatment availability, and reliance on basic topical therapies. Expanding healthcare modernization programs and tele-dermatology adoption are expected to gradually improve diagnosis and treatment access across the region.

Market Segmentations:

By Type:

By Packaging:

- Store Wrap

- Modified Atmosphere Packaging

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Porokeratosis Market features diverse participation, with companies such as Sysco Corporation, Marfrig Global Foods S.A., WH Group Limited, Cargill, Incorporated, BRF S.A. (Sadia), Tyson Foods, Inc., Clemens Food Group, JBS S.A., Hormel Foods Corporation, and Smithfield Foods, Inc. mentioned only as reference in the opening line. the Porokeratosis Market is characterized by a concentrated group of dermatology-focused pharmaceutical companies, biotechnology firms, and medical device manufacturers investing in advanced therapeutic solutions. Market participants compete primarily on innovation, clinical efficacy, and the ability to deliver targeted treatments that address the chronic nature and recurrence challenges of porokeratosis. Companies emphasize developing novel topical formulations, improved photodynamic therapy systems, and minimally invasive laser technologies to enhance patient outcomes. Strategic collaborations with research institutions, expansion of clinical trial pipelines, and the integration of digital diagnostic tools further strengthen competitive positioning, enabling firms to capture emerging opportunities in precision dermatology.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Olymel launched a new line of pork products in Quebec grocery stores, emphasizing convenience and quality with a focus on upscale home cooking. The products include new cuts like Pork T-bone, Chimichurri pork flank steak, Hotel cut pork chops, Pork capicola steak, and Greek-style pork sirloin skewers.

- In March 2025, Prairie Fresh expanded its product line with new ground pork chubs, including both Prairie Fresh Ground Pork and Prairie Fresh Pork Sausage, to meet increased consumer demand for convenient and versatile pork options for everyday meals.

- In March 2025, Creta Farm introduced pork from animals fed exclusively with olive oil and olive oil extract. This feeding method produces meat with higher Omega-3 and lower Omega-6 fatty acid content.

- In February 2025, OSI Group acquired the UK-based Karnova Food Group from private equity firm Endless LLP to expand its global operations, particularly in Europe. This acquisition strengthens OSI’s capabilities in the sourcing, processing, and distribution of pork products, integrating Karnova’s operations, which were formed in 2024 from Yorkshire Premier Meat and Smithfield Murray, into OSI’s business

Report Coverage

The research report offers an in-depth analysis based on Type, Packaging, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as diagnostic awareness and early detection of porokeratosis improve worldwide.

- Precision dermatology will expand, with genetic profiling and biomarker-based approaches guiding personalized treatment plans.

- Advanced topical formulations and combination therapies will gain higher adoption due to improved efficacy and patient convenience.

- Photodynamic therapy and next-generation laser technologies will evolve, offering safer and more targeted clinical outcomes.

- Digital dermatology tools, including AI-driven lesion analysis, will enhance remote monitoring and treatment optimization.

- Research funding for rare skin disorders will increase, accelerating development of disease-modifying therapies.

- Pharmaceutical pipelines will expand with more immunomodulators and keratinization-targeting candidates entering clinical trials.

- Reimbursement support for advanced dermatology procedures will improve in developed markets, boosting treatment uptake.

- Healthcare modernization in emerging regions will enhance access to specialized dermatology services.

- Collaborations between clinicians, researchers, and industry partners will strengthen innovation and standardize care pathways.