Market Overview:

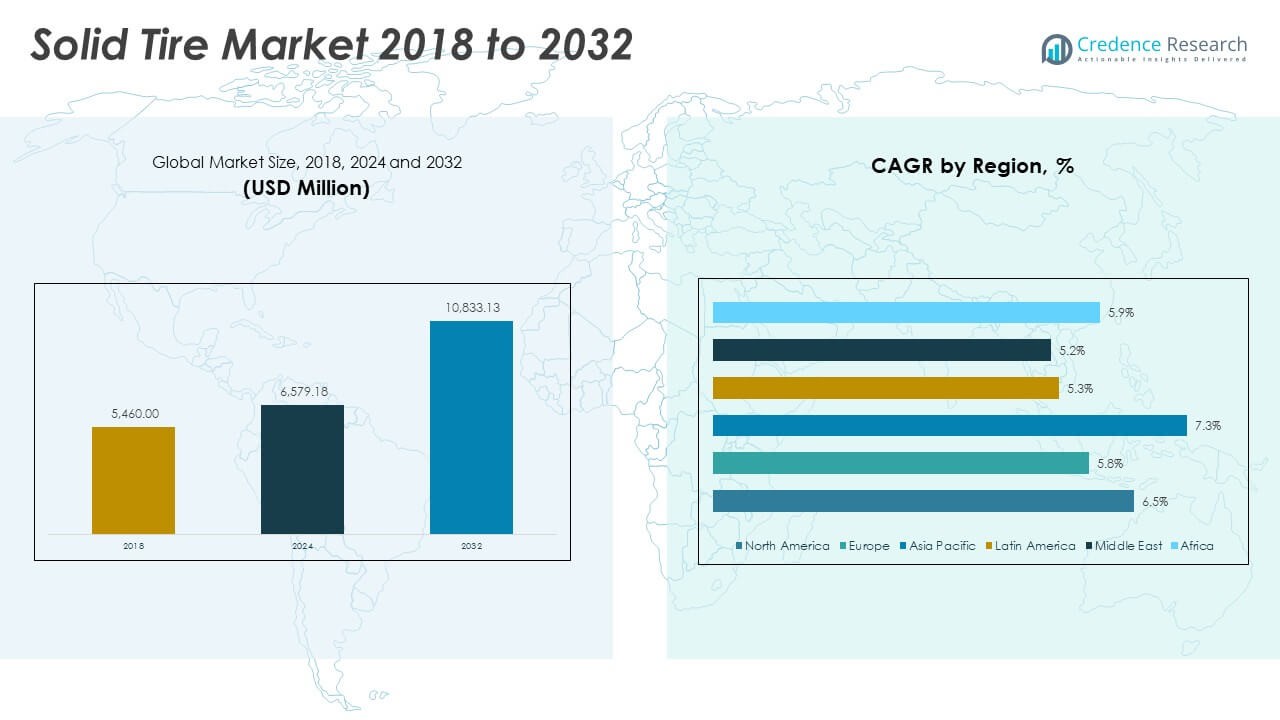

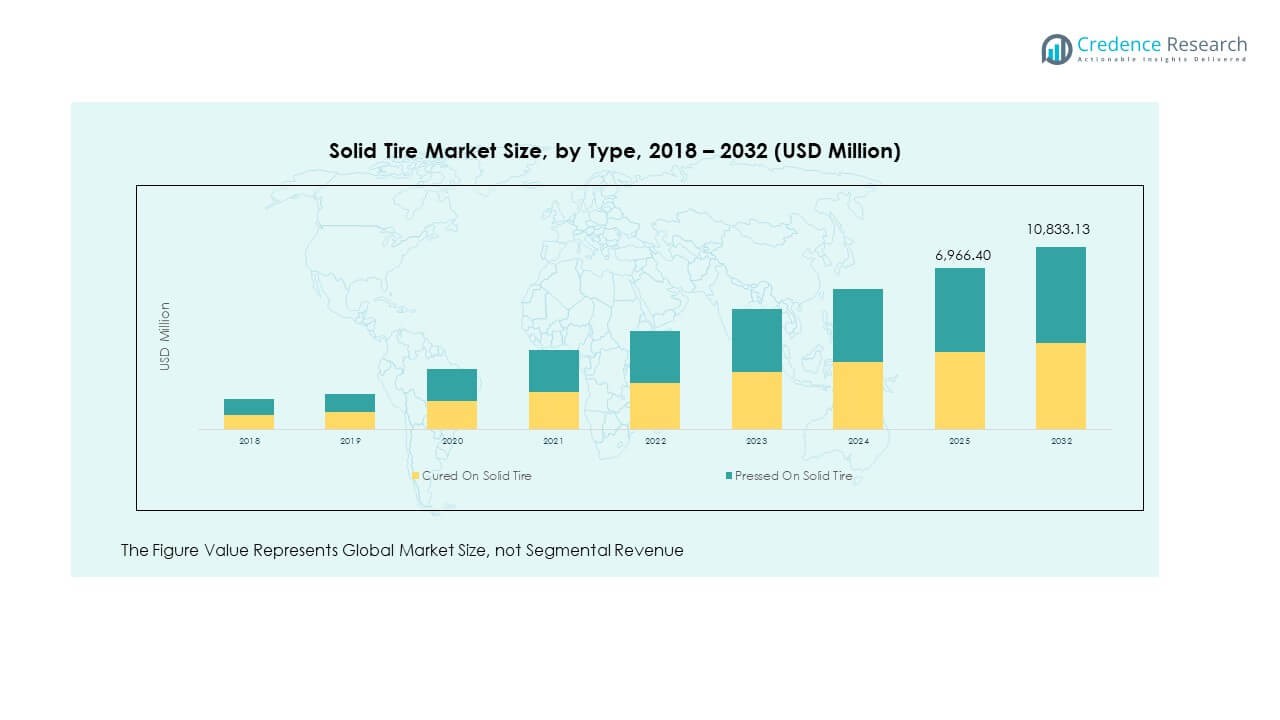

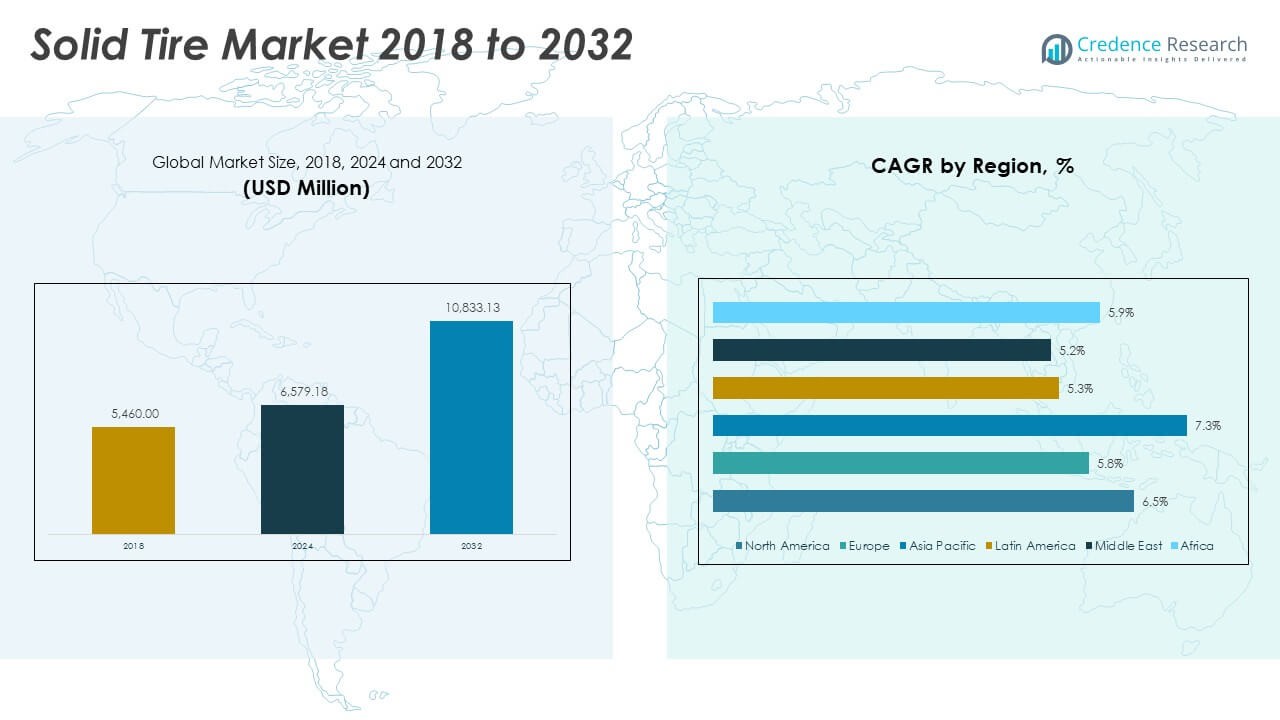

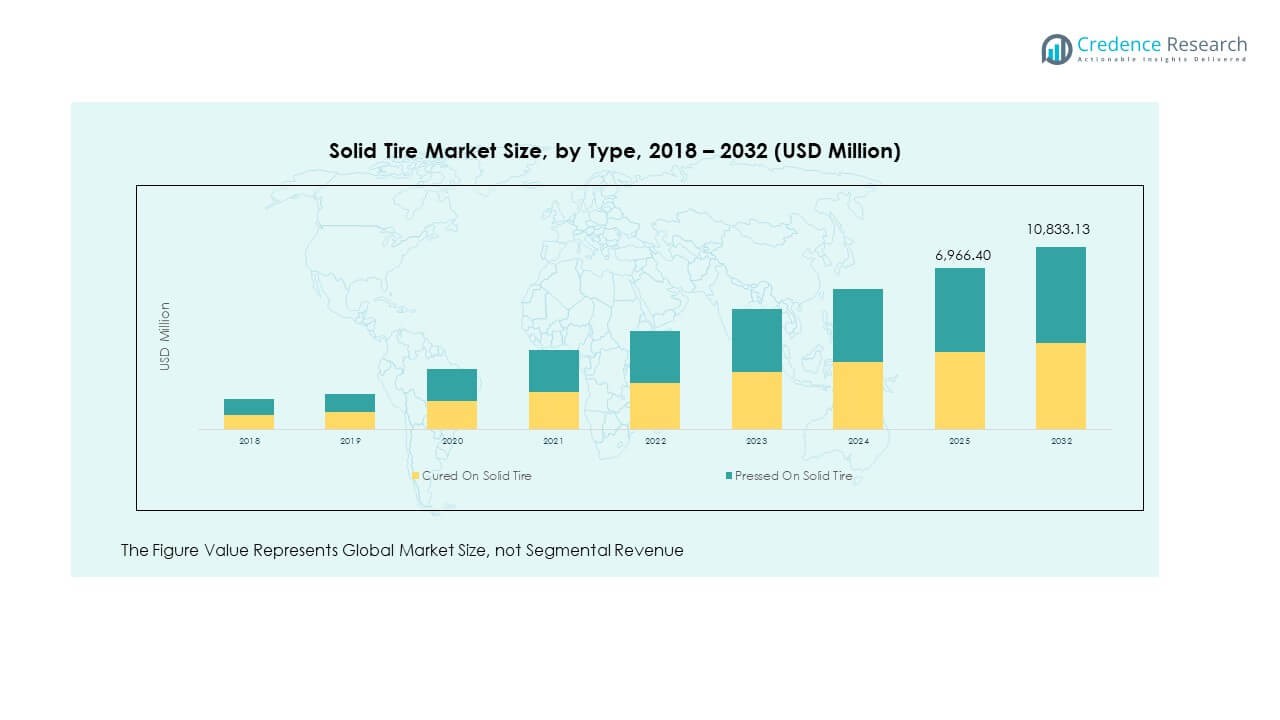

The Global Solid Tire Market size was valued at USD 5,460.00 million in 2018 to USD 6,579.18 million in 2024 and is anticipated to reach USD 10,833.13 million by 2032, at a CAGR of 6.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solid Tire Market Size 2024 |

USD 6,579.18 Million |

| Solid Tire Market, CAGR |

6.51% |

| Solid Tire Market Size 2032 |

USD 10,833.13 Million |

The Global Solid Tire Market is expanding due to rising demand in construction, industrial, and warehousing applications. These tires offer durability, puncture resistance, and low maintenance, making them highly suitable for heavy-duty vehicles operating in challenging environments. Growth is further driven by increasing adoption in forklifts, port handling equipment, and mining vehicles, where efficiency and reliability are critical. Rising investments in infrastructure projects worldwide are boosting the need for solid tires, while growing focus on cost reduction and operational safety strengthens adoption across end-user industries.

From a regional perspective, Asia-Pacific leads the market due to rapid industrialization, strong manufacturing activity, and extensive logistics operations. North America follows with steady demand supported by technological advancements and large-scale warehousing networks. Europe shows consistent growth due to strict workplace safety standards and the adoption of sustainable mobility solutions. Emerging markets in Latin America and the Middle East are gaining traction as infrastructure development accelerates and industries expand, creating new opportunities for solid tire manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Solid Tire Market size was valued at USD 5,460.00 million in 2018, reached USD 6,579.18 million in 2024, and is projected to hit USD 10,833.13 million by 2032, growing at a CAGR of 6.51%.

- Asia-Pacific holds the largest share at 41%, driven by rapid industrialization, strong manufacturing hubs, and logistics expansion.

- North America accounts for 27% due to technological advancements, large-scale warehousing, and stable demand from material handling equipment.

- Europe secures 22% market share, supported by strict safety regulations, automation in industries, and a focus on sustainable tire solutions.

- By type, Pressed-On Solid Tires lead with 58% share, while Cured-On Solid Tires account for 42%, showing steady demand across construction and warehouse applications.

Market Drivers:

Rising Demand from Industrial and Construction Applications:

The Global Solid Tire Market is gaining momentum due to expanding construction, warehousing, and industrial sectors. Solid tires are preferred for their ability to withstand heavy loads and rough terrains. Their resistance to punctures and reduced maintenance needs make them suitable for forklifts, loaders, and port equipment. Rising infrastructure development projects across Asia-Pacific and North America are further boosting demand. Industrialization and logistics expansion are driving steady adoption across warehouses and distribution centers. Their long service life offers cost savings compared to pneumatic alternatives. Companies are investing in these solutions to improve operational efficiency. It continues to attract attention from heavy-duty industries focused on durability and safety.

- For example, forklifts accounted for the material handling equipment tire market share in 2023, highlighting the importance of solid tires in such vehicles. Rising infrastructure development projects across Asia-Pacific and North America, regions that held the second-largest market shares respectively as of 2023, further boost demand.

Growth in Material Handling Equipment Utilization:

The market is driven strongly by the rising use of material handling equipment across ports, airports, and manufacturing facilities. Solid tires offer stability and reliability for forklifts, cranes, and conveyor vehicles. The surge in global trade has pushed the need for reliable port handling solutions. Warehouses and e-commerce hubs are deploying more vehicles that rely on solid tire efficiency. Their strong load-bearing capacity supports round-the-clock operations without frequent replacement. Demand is also strengthened by government initiatives for logistics modernization. The Global Solid Tire Market benefits from higher automation and equipment use. It is supported by rising adoption in developed and emerging economies where logistics efficiency is crucial.

- For instance, Solid tires’ stability and strong load-bearing capacity support round-the-clock operations without frequent replacements, a critical factor as warehouses and e-commerce hubs expand logistics fleets. Automation and electric forklifts demand tires engineered for longer wear and efficiency, benefiting the global solid tire market.

Increased Focus on Safety and Low Maintenance Costs:

Workplace safety regulations are influencing greater demand for solid tires across industries. Companies prioritize solutions that reduce downtime and minimize accident risks. Solid tires are non-pneumatic, removing risks of sudden air loss or blowouts. Their reliability on uneven terrains enhances operator confidence and reduces workplace hazards. Low maintenance costs also encourage preference over pneumatic alternatives. Businesses in manufacturing and mining sectors see strong cost-efficiency benefits. The Global Solid Tire Market reflects these preferences by expanding product development aligned with safety standards. It is expanding in regions with strong focus on employee welfare and equipment sustainability.

Infrastructure Investments and Global Urbanization Growth:

Large-scale investments in infrastructure projects are creating consistent demand for construction vehicles and equipment. Solid tires provide reliable support for vehicles working in harsh construction environments. Their robustness reduces operating costs for contractors and project owners. Urbanization is driving higher demand for material transport vehicles within city projects. The Global Solid Tire Market benefits from government-backed infrastructure expansion in emerging economies. Demand for cost-effective, long-lasting tires is rising among contractors seeking efficiency. Mining and energy projects are also expanding usage of these solutions. It remains a critical enabler of growth in regions where development projects are accelerating.

Market Trends:

Adoption of Sustainable and Eco-Friendly Tire Manufacturing Practices:

Sustainability is becoming a key trend shaping the market. Manufacturers are investing in eco-friendly materials and recycling initiatives to meet environmental standards. Green tire production focuses on reducing emissions during manufacturing. The Global Solid Tire Market reflects these efforts as companies develop biodegradable and recyclable products. Sustainability is also driving new partnerships in the supply chain. End-users prefer vendors aligned with green initiatives. Government regulations on waste management encourage investment in sustainable product development. It is expected to gain further traction as industries prioritize eco-conscious procurement strategies.

- For instance, market research confirms a growing demand for sustainable tire materials, expected to be driven by EPR and other environmental policies.

Technological Advancements in Tire Design and Performance Enhancement:

The introduction of advanced compounds and smart designs is improving solid tire performance. Manufacturers are focusing on reducing rolling resistance to enhance efficiency. New product launches are emphasizing longer lifespan and better heat resistance. The Global Solid Tire Market benefits from continuous R&D in materials engineering. Demand for specialized tires tailored to specific equipment types is growing. Automation in factories and ports increases the need for precision-designed tires. Technological progress is improving safety and operator comfort. It represents a major differentiating factor for companies competing in high-demand industries.

- For instance, Innovations yield lightweight designs and smart tires embedded with sensors to monitor temperature, pressure, and wear in real time, enabling predictive maintenance and operational efficiency improvements.

Customization for Industry-Specific Applications and Niche Segments:

Manufacturers are increasingly offering customized solutions for industries such as mining, aviation, and defense. Tailor-made designs address unique performance challenges in specialized environments. The Global Solid Tire Market highlights these shifts as customization becomes a competitive edge. End-users demand tires capable of handling extreme conditions while ensuring cost efficiency. OEMs collaborate with tire manufacturers to integrate customized designs into their vehicles. This trend enhances user satisfaction and equipment performance. Growing demand for sector-specific solutions is driving innovation pipelines. It is shaping competition among global and regional tire makers.

Integration of Digital Tools for Supply Chain and Maintenance Optimization:

Digitalization is influencing how companies manage tire procurement and maintenance. Smart tracking systems help monitor wear patterns and predict replacement cycles. Manufacturers use digital tools to streamline distribution and inventory processes. The Global Solid Tire Market demonstrates this integration through improved operational efficiency. Predictive maintenance tools are reducing downtime for industrial equipment. E-commerce platforms are expanding online availability of solid tires. Businesses prefer suppliers with transparent, digital-friendly systems. It strengthens competitiveness in a market where efficiency and cost control are priorities.

Market Challenges Analysis:

High Initial Costs and Limited Comfort in Applications:

The Global Solid Tire Market faces challenges related to higher upfront costs compared to pneumatic tires. Businesses often hesitate to invest due to larger initial budgets despite long-term savings. Operators sometimes report less comfort due to rigid structures in demanding applications. The limited shock absorption capacity can create challenges in industries sensitive to operator fatigue. Price-sensitive regions are slower to adopt these solutions despite their durability. Manufacturers must invest in innovation to reduce costs while improving ride quality. It must balance durability with affordability to enhance adoption. Growing competition among manufacturers can reduce prices, yet profitability pressures remain high.

Supply Chain Pressures and Raw Material Constraints:

Volatility in raw material prices presents a strong challenge for tire manufacturers. Fluctuating rubber and compound costs increase production expenses and reduce profit margins. Supply chain disruptions also impact delivery timelines and inventory stability. The Global Solid Tire Market experiences delays in manufacturing and product distribution during shortages. Limited access to high-quality raw materials in some regions restricts scaling efforts. Manufacturers struggle to maintain price competitiveness during periods of high input costs. It requires companies to diversify sourcing strategies and improve supply resilience. Long-term stability depends on sustainable sourcing and efficient logistics management.

Market Opportunities:

Expansion in Emerging Economies and Infrastructure Development:

Emerging economies are presenting strong opportunities for solid tire manufacturers. Rapid urbanization and infrastructure projects increase demand for construction vehicles. Industrial expansion is boosting adoption in logistics, mining, and manufacturing. The Global Solid Tire Market benefits from rising government investments in roads, ports, and airports. Growth in e-commerce also drives higher usage of forklifts and handling equipment. New entrants and regional manufacturers can tap into underserved markets. It provides room for collaborations with OEMs to expand presence. Opportunities remain strong where industrialization is progressing at a fast pace.

Product Innovation and Growing Demand for Specialized Applications:

Continuous innovation offers fresh opportunities for solid tire manufacturers. Development of advanced compounds enhances durability and performance. Specialized tires for niche applications like aviation, defense, and heavy mining gain traction. The Global Solid Tire Market benefits from growing need for tailor-made designs. Companies investing in R&D create stronger competitive positioning. Partnerships with industrial equipment makers broaden market penetration. It encourages diversification into premium and performance-driven product segments. Opportunities align with industries requiring highly durable and cost-efficient tire solutions.

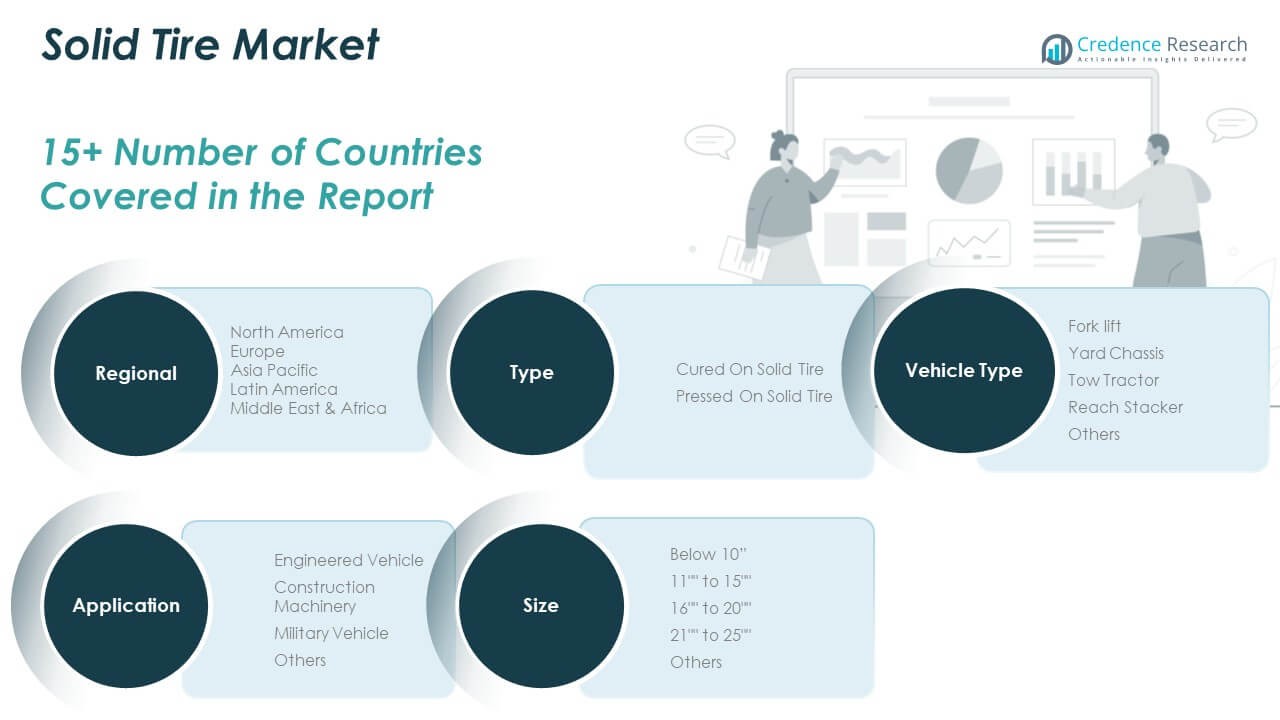

Market Segmentation Analysis:

By Type

The Global Solid Tire Market is segmented into cured on solid tires and pressed on solid tires. Pressed on solid tires dominate due to their easy installation, cost efficiency, and strong use in forklifts and warehouse vehicles. Cured on solid tires maintain relevance in heavy-duty environments where superior durability is required.

- For instance, Camso’s pressed-on tires, widely used in warehouse forklifts, are professionally installed on-site using specialized equipment, offer load capacities exceeding 1,500 kg per tire, and, via mobile service, enable efficient replacement to minimize downtime in busy industrial settings. Conversely, cured-on solid tires remain relevant in heavy-duty environments, including rugged outdoor conditions, where their puncture resistance and superior durability are highly valued.

By Application

Construction machinery and engineered vehicles account for the largest application share, driven by infrastructure projects and industrial expansion. Military vehicles adopt solid tires for reliability in rugged terrains, while other specialized sectors contribute to steady growth. It shows resilience across applications where performance and low maintenance are critical.

- For example, Michelin supplies military-grade solid tires with run-flat capabilities and optimized tread designs enabling vehicles to maintain mobility under extreme off-road conditions, backed by their rigorous R&D on durability in varied climates ensuring operational readiness.

By Size

Segments include below 10”, 11” to 15”, 16” to 20”, 21” to 25”, and others. Tires in the 11” to 15” category lead the market due to extensive use in forklifts and handling equipment. Larger sizes find demand in construction and mining vehicles, while smaller sizes support compact and specialized machinery.

By Vehicle Type

Forklifts represent the leading segment, supported by growth in logistics, warehousing, and e-commerce distribution. Yard chassis, tow tractors, and reach stackers contribute significantly, reflecting increased deployment in ports and cargo hubs. Others provide steady demand across smaller industrial and commercial fleets. It underscores versatility across multiple vehicle types used in global supply chains.

Segmentation:

By Type

- Cured On Solid Tire

- Pressed On Solid Tire

By Application

- Engineered Vehicle

- Construction Machinery

- Military Vehicle

- Others

By Size

- Below 10”

- 11” to 15”

- 16” to 20”

- 21” to 25”

- Others

By Vehicle Type

- Forklift

- Yard Chassis

- Tow Tractor

- Reach Stacker

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Solid Tire Market size was valued at USD 1,285.28 million in 2018 to USD 1,519.75 million in 2024 and is anticipated to reach USD 2,489.34 million by 2032, at a CAGR of 6.5% during the forecast period. North America accounts for 23.1% of the Global Solid Tire Market in 2024. Growth is driven by expanding logistics networks, strong demand for forklifts, and rising adoption in warehousing and distribution hubs. Industrial expansion and automation in material handling support consistent consumption. The U.S. dominates regional demand, while Canada and Mexico contribute through manufacturing and construction sectors. Regulatory focus on workplace safety reinforces the need for durable tires. It continues to gain traction through advanced technology integration and premium product launches. Investments in e-commerce and supply chain infrastructure will maintain solid growth in the region.

Europe

The Europe Solid Tire Market size was valued at USD 1,451.27 million in 2018 to USD 1,681.46 million in 2024 and is anticipated to reach USD 2,616.77 million by 2032, at a CAGR of 5.8% during the forecast period. Europe holds 25.5% of the Global Solid Tire Market in 2024. Strong demand stems from construction machinery and warehousing equipment across Germany, France, and the UK. The presence of leading tire manufacturers enhances innovation and product availability. Environmental regulations drive the use of sustainable solid tire solutions. Demand from the automotive supply chain supports steady expansion. Eastern Europe is emerging as a growth pocket with increasing industrialization. It benefits from modernization programs across ports and logistics. The region is positioned to maintain steady long-term adoption driven by safety standards and durable designs.

Asia Pacific

Asia Pacific holds about 34.0% of the Global Solid Tire Market in 2024. Growth is led by rapid industrialization, urban development, and strong manufacturing activity in China and India. Japan and South Korea provide stable demand through advanced industries and logistics hubs. Expanding e-commerce and rising infrastructure investments accelerate forklift and construction equipment adoption. Mining operations in Australia and Southeast Asia drive further traction. The region is the fastest-growing due to its scale and infrastructure needs. It benefits from favorable government policies and low-cost manufacturing advantages. Strong supplier networks position Asia Pacific as the leading regional market.

Latin America

Latin America accounts for around 7.1% of the Global Solid Tire Market in 2024. Demand is driven by industrial growth in Brazil, Mexico, and Argentina. Expanding construction projects create consistent opportunities for solid tires in heavy machinery. Ports and logistics upgrades also support forklift demand. Regional challenges include fluctuating economic stability and high import costs. Local manufacturing is limited, but partnerships with global brands are growing. It reflects potential for expansion as supply chain networks modernize. Investment in mining and energy further boosts regional adoption. Latin America offers long-term opportunities despite slower initial growth.

Middle East

The Middle East holds about 5.2% of the Global Solid Tire Market in 2024. Strong demand originates from construction and infrastructure development in GCC countries. Ports and oil-driven industries create stable requirements for forklifts and yard equipment. Israel and Turkey show demand growth in industrial machinery. Economic diversification programs in the Gulf enhance adoption in non-oil sectors. High infrastructure spending in Saudi Arabia and UAE supports the segment. Import reliance remains high, but global suppliers strengthen distribution presence. It is set for moderate growth driven by large-scale projects.

Africa

Africa contributes nearly 5.1% of the Global Solid Tire Market in 2024. South Africa dominates regional consumption with strong mining and industrial activity. Egypt follows with rising construction projects and logistics upgrades. Limited local production creates dependence on imports from Asia and Europe. Demand is steadily expanding due to urbanization and infrastructure programs. Growth opportunities lie in mining, energy, and transportation sectors. The presence of global suppliers enhances availability in key markets. It shows steady improvement as governments increase spending on industrial growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- CAMSO (Michelin)

- Continental AG

- Global Rubber Industries

- Initial Appearance LLC

- NEXEN TIRE

- Setco Solid Tire & Rim Assembly

- Superior Tire & Rubber Corp

- Trelleborg

- Tube & Solid Tire

- TY Cushion Tire

- Maxam Tire

- Yantai Balsanse Rubber Co., LTD.

- Balkrishna Industries Limited (BKT)

Competitive Analysis:

The Global Solid Tire Market is characterized by strong competition among international and regional manufacturers. Leading players such as Michelin (Camso), Continental AG, Trelleborg, and Balkrishna Industries hold significant positions through product diversity and broad distribution networks. Smaller manufacturers compete by focusing on niche markets and cost-efficient solutions. Companies are investing in research and development to improve tire durability, reduce rolling resistance, and offer eco-friendly alternatives. The market is also witnessing consolidation through mergers and partnerships aimed at expanding geographic reach. Price competitiveness remains high, pushing firms to enhance customer service and aftersales support. It reflects a balance of global giants setting benchmarks and regional players strengthening localized supply. The dynamic competition ensures continuous innovation and steady evolution of industry standards.

Recent Developments:

- In August 2025, Superior Tire & Rubber Corp. announced a multi-million-dollar investment plan to scale capacity and optimize production across its facilities, including a recently opened manufacturing plant dedicated to agricultural and construction remanufacturing operations. The company focuses on automation and workforce expansion to meet growing demand in material handling and construction markets.

- In April 2025, Continental AG announced a strategic plan to spin off its ContiTech division, aiming to focus solely on its global tire business. The spin-off is expected to occur in 2026, transforming Continental into a pure-play tire manufacturer. This move is part of a broader restructuring including the sale of its automotive group sector and aligning the company towards high-margin tire manufacturing with projected stable growth and profitability.

- In April 2025, NEXEN TIRE reported record-high quarterly sales driven by expanded production capacities and premium product launches, including high-inch tires. The company’s increased original equipment supply to major automakers and increased sales in Europe contributed to a 13.7% year-on-year revenue increase in Q1 2025.

Report Coverage:

The research report offers an in-depth analysis based on type, application, size, and vehicle type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for forklifts will continue driving tire adoption in logistics and e-commerce.

- Construction machinery expansion will support steady growth across infrastructure projects.

- Military and defense vehicles will increasingly adopt solid tires for rugged terrains.

- Larger tire sizes will gain traction with the growth of mining and heavy-duty equipment.

- Asia Pacific will remain the fastest-growing region due to industrialization and urban expansion.

- Sustainable tire manufacturing will become a key differentiator among global players.

- Digital platforms will expand distribution and aftermarket sales channels globally.

- R&D investments will focus on enhancing durability and reducing rolling resistance.

- Strategic partnerships between OEMs and tire companies will intensify to meet demand.

- The market will show resilience, driven by industrial safety and cost efficiency.