| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Banana Bread Market Size 2024 |

USD 1,514.30 million |

| Banana Bread Market, CAGR |

4.16% |

| Banana Bread Market Size 2032 |

USD 2,147.97 million |

Market Overview

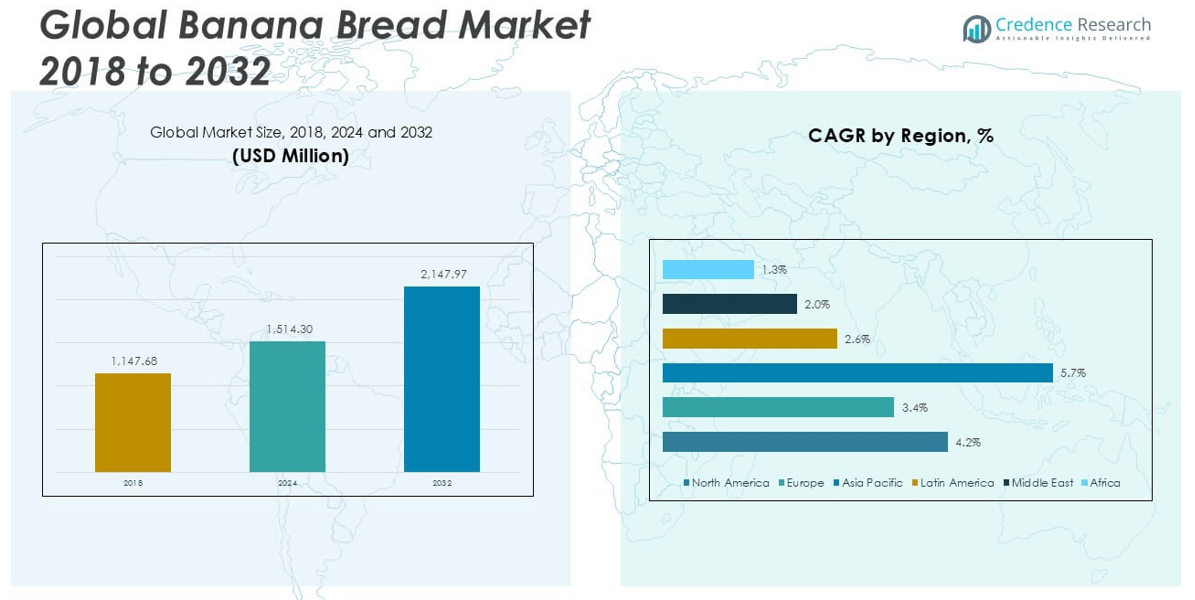

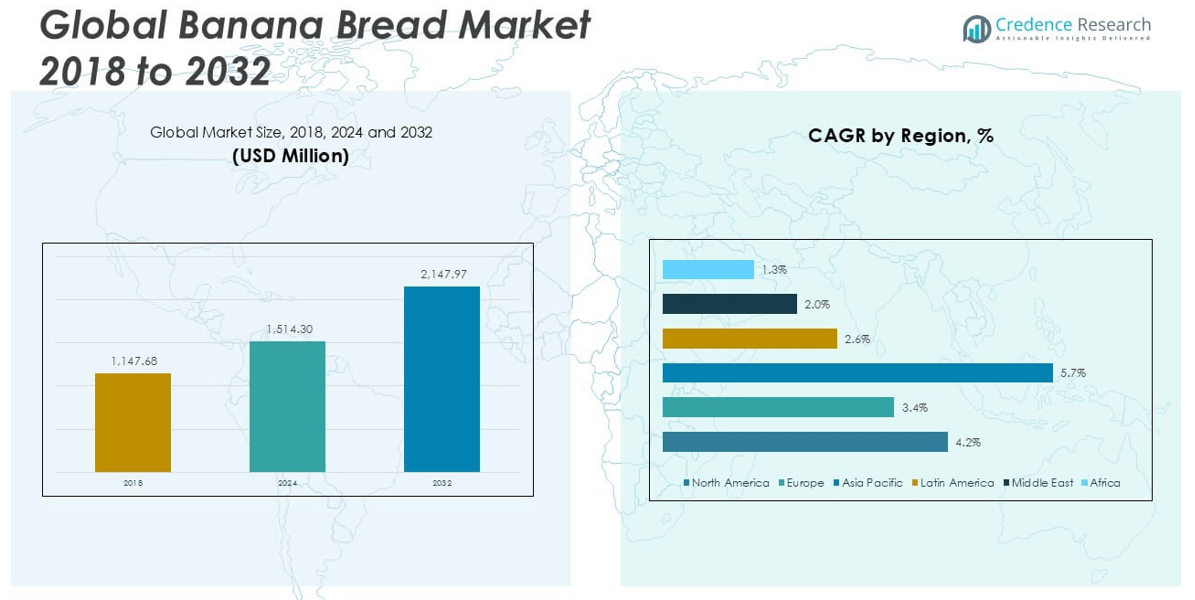

The Banana Bread market size was valued at USD 1,147.68 million in 2018, reached USD 1,514.30 million in 2024, and is anticipated to reach USD 2,147.97 million by 2032, at a CAGR of 4.16% during the forecast period.

The Banana Bread market is led by key players such as General Mills Inc., King Arthur Baking Company, Inc., Simple Mills, Mama Kaz Bakery, and Dank Banana Bread, each leveraging product innovation, clean-label formulations, and expanding retail footprints to strengthen their market positions. These companies focus on offering flavored, gluten-free, and plant-based variants to meet evolving consumer preferences. North America stands as the leading region in this market, accounting for approximately 40.9% of the global market share in 2024, driven by high consumption of baked goods, strong retail infrastructure, and widespread adoption of health-conscious snacking habits.

Market Insights

- The Banana Bread market was valued at USD 1,514.30 million in 2024 and is expected to reach USD 2,147.97 million by 2032, growing at a CAGR of 4.16% during the forecast period.

- Rising demand for nutritious and convenient bakery products, especially flavored and plant-based options, is driving market growth globally.

- Increasing popularity of clean-label and functional ingredients, along with growing online and artisanal bakery channels, is shaping evolving market trends.

- The market is highly competitive with key players like General Mills Inc., Simple Mills, and King Arthur Baking Company focusing on innovation, premium product lines, and expanding retail presence.

- North America held the largest regional share at 40.9% in 2024, while the flavored segment accounted for 62% of product type share, indicating strong consumer preference for variety and indulgence in bakery choices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

In the Banana Bread market, the flavored segment holds the dominant share, accounting for approximately 62% of the market in 2024. The popularity of flavored variants—such as chocolate chip, walnut, and blueberry is driven by evolving consumer preferences for variety and indulgence in baked goods. Additionally, the rising demand for convenient breakfast and snack options with enhanced taste has accelerated the adoption of flavored banana bread across cafes, bakeries, and packaged retail formats. The unflavored segment, while catering to traditional consumers, is expected to grow steadily, driven by demand for cleaner labels and fewer additives.

- For instance, Simple Mills sold over 2.6 million units of its Almond Flour Banana Muffin & Bread Mix in the U.S. in 2023, according to IRI retail sales data, highlighting strong consumer traction in flavored variants.

By Distribution Channel:

The hypermarket and supermarket segment led the market with a share of around 48% in 2024, owing to their broad shelf space, wider product variety, and consistent availability of fresh and packaged banana bread. Consumers prefer purchasing baked goods from these outlets due to quality assurance and promotional discounts. Meanwhile, convenience stores captured a significant share due to their strategic location in urban areas and impulse buying behavior. Their growth is supported by the rising number of working professionals seeking quick and accessible bakery products during daily commutes. The online segment is witnessing the fastest growth, holding approximately 19% of the market share in 2024, fueled by increasing digital penetration, growing e-commerce platforms, and consumer preference for doorstep delivery. The ability to access a diverse range of banana bread products, read reviews, and avail subscription-based bakery services is contributing to this surge.

- For instance, General Mills reported a 64% increase in e-commerce sales across its baking product category in fiscal 2023, driven in part by digital promotions for its Pillsbury Banana Bread offerings via Walmart and Amazon.

Market Overview

Rising Health Consciousness and Demand for Nutritional Snacks

Consumers are increasingly opting for bakery products that offer both taste and nutritional value. Banana bread, particularly those enriched with whole grains, nuts, or natural sweeteners, is gaining traction as a healthier alternative to traditional cakes and pastries. This shift is driven by the growing awareness around fiber-rich diets and natural ingredients. Brands have capitalized on this trend by introducing low-sugar, gluten-free, and protein-fortified banana bread, which continues to attract health-focused consumers, particularly in urban regions with high demand for functional and clean-label foods.

- For instance, The Essential Baking Company distributed over 180,000 units of its organic banana bread loaves to retailers like Whole Foods and PCC Community Markets in 2023, with 100% of its ingredients USDA-certified organic.

Expansion of Organized Retail and Bakery Chains

The proliferation of supermarkets, hypermarkets, and organized bakery chains has significantly boosted the visibility and availability of banana bread across both developed and emerging markets. These retail formats offer better storage, consistent product quality, and brand promotions, enabling consumers to explore and trust packaged banana bread options. Additionally, the integration of bakery sections within modern retail stores has contributed to higher impulse buying. The global footprint of bakery franchises and café chains has further popularized banana bread as a mainstream product, particularly among younger and on-the-go consumers.

- For instance, King Arthur Baking Company expanded its retail presence to over 10,000 stores across North America in 2023, including a 750-store rollout of banana bread mix SKUs through Kroger, according to the company’s 2023 annual review.

Growth of Online Food Retail and E-Commerce Platforms

The increasing preference for online shopping has propelled the growth of banana bread sales through e-commerce platforms. Customers are attracted to the convenience of browsing diverse product ranges, accessing specialty or artisanal options, and benefitting from home delivery services. Subscription-based bakery models and partnerships with third-party food delivery apps have also expanded the digital footprint of banana bread producers. This digital transformation allows small and mid-size bakeries to reach a wider customer base, thus fueling growth, particularly in regions with high smartphone and internet penetration.

Key Trends & Opportunities

Innovation in Flavors and Functional Ingredients

Manufacturers are increasingly introducing new flavor variants such as cinnamon swirl, chocolate chip, and vegan banana bread to cater to varied taste preferences. Additionally, the incorporation of functional ingredients like chia seeds, almond flour, and probiotics presents an opportunity to attract health-focused demographics. This trend aligns with consumer expectations for novelty and health in bakery products. The fusion of indulgence with wellness is expected to drive premium product launches and brand differentiation in a highly competitive baked goods market.

- For instance, in 2023, Simple Mills launched a Banana Muffin & Bread Mix with 1g of added sugar per serving and 6 ingredients total, and it achieved nationwide distribution through 8,500 retail stores including Target and Whole Foods.

Rising Demand for Clean Label and Plant-Based Options

There is a growing trend towards clean-label banana bread products that contain fewer artificial preservatives, emulsifiers, or synthetic flavors. Simultaneously, plant-based and vegan variants are seeing increased demand, particularly among millennials and Gen Z consumers prioritizing sustainability and ethical consumption. This has encouraged manufacturers to reformulate recipes using natural sweeteners, dairy alternatives, and organic bananas. The clean-label and plant-based positioning not only enhances brand image but also opens up opportunities in niche health-conscious and environmentally aware consumer segments.

- For instance, Dank Banana Bread reported over 100,000 units sold in 2022 and became fully plant-based by mid-2021, resulting in a 2.3x increase in year-over-year revenue by the end of 2023, as per company interviews with local distributors.

Key Challenges

Shelf Life and Preservation Issues

Banana bread, especially when made with natural or fewer preservatives, has a limited shelf life due to its high moisture content. This poses a challenge for mass distribution, especially in hot or humid climates where spoilage risks increase. Maintaining product freshness while meeting logistical and distribution demands can be difficult, particularly for small-scale producers. Manufacturers must invest in advanced packaging and preservation techniques to extend shelf life without compromising on quality or clean-label claims.

Intense Market Competition and Price Sensitivity

The banana bread market is increasingly fragmented, with local bakeries, artisanal brands, and private-label offerings competing for shelf space and customer attention. This intense competition often leads to price wars, impacting profit margins, especially for premium and specialty product segments. Consumers in price-sensitive regions may prioritize cost over quality or brand loyalty, posing a challenge for brands trying to maintain differentiation based on ingredients or health benefits.

Volatility in Raw Material Supply and Costs

The banana bread market is heavily reliant on key ingredients such as bananas, flour, eggs, and sugar. Fluctuations in banana production due to climate conditions, diseases like Panama disease, or global supply chain disruptions can directly impact pricing and availability. Additionally, rising input costs and inflationary pressures on raw materials may force manufacturers to either increase prices or compromise on ingredient quality, both of which could affect consumer demand and brand perception.

Regional Analysis

North America

North America dominated the Banana Bread market in 2024 with a market value of USD 619.06 million, representing a market share of approximately 40.9%. The region grew from USD 474.39 million in 2018 and is projected to reach USD 880.69 million by 2032, registering a CAGR of 4.2%. The growth is driven by high consumption of baked goods, demand for healthy snacks, and widespread availability in supermarkets and cafes. The presence of leading bakery brands and strong retail infrastructure further supports market expansion across the United States and Canada.

Europe

Europe accounted for USD 434.78 million in 2024, holding a market share of around 28.8%. The market grew from USD 341.26 million in 2018 and is forecasted to reach USD 582.35 million by 2032, growing at a CAGR of 3.4%. The demand for premium and flavored banana bread, along with the region’s strong artisanal bakery culture, supports consistent growth. Additionally, increasing consumer interest in clean-label and vegan baked goods continues to drive innovation and product adoption across Germany, the U.K., and France.

Asia Pacific

Asia Pacific has emerged as the fastest-growing region, expanding from USD 226.49 million in 2018 to USD 323.27 million in 2024, and is expected to reach USD 517.92 million by 2032, reflecting a CAGR of 5.7%. It holds a market share of 21.3% in 2024. Growth is attributed to rapid urbanization, rising disposable income, and the growing popularity of Western-style baked products across China, India, Japan, and Southeast Asia. The proliferation of online bakery platforms and increasing health awareness are also fueling demand for nutritious banana bread variants.

Latin America

Latin America reached USD 70.81 million in 2024, up from USD 54.34 million in 2018, and is projected to attain USD 88.92 million by 2032, with a CAGR of 2.6%. The region holds a market share of approximately 4.7%. Growth is moderate and primarily driven by urban middle-class consumers in Brazil, Mexico, and Argentina. Expansion of retail networks and increased exposure to international bakery trends have boosted banana bread consumption, though price sensitivity and limited product variety still restrain wider market penetration.

Middle East

The Middle East Banana Bread market reached USD 39.27 million in 2024, growing from USD 32.53 million in 2018, and is projected to hit USD 47.11 million by 2032, registering a CAGR of 2.0%. It captured a market share of around 2.6%. While demand remains niche, the market is gaining traction in urban centers such as Dubai and Riyadh, supported by the growing presence of international café chains and interest in Western bakery items. However, conservative consumption patterns and limited regional production still pose growth challenges.

Africa

Africa’s Banana Bread market was valued at USD 27.11 million in 2024, rising from USD 18.68 million in 2018, and is forecasted to reach USD 30.98 million by 2032, with a CAGR of 1.3%. The region holds the smallest market share of about 1.8%. Market growth is limited due to low per capita bakery consumption, underdeveloped retail distribution, and economic constraints. However, gradual urbanization and the emergence of local bakery chains in countries like South Africa and Nigeria are expected to contribute marginally to future market expansion.

Market Segmentations:

By Product Type:

By Distribution Channel:

- Hypermarket & Supermarket

- Convenience Stores

- Online

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Banana Bread market features a mix of multinational food corporations and specialized artisanal bakeries competing for market share. Leading players such as General Mills Inc., Simple Mills, and King Arthur Baking Company, Inc. leverage their extensive distribution networks, established brand recognition, and diversified product portfolios to maintain a strong presence in retail and online channels. Meanwhile, emerging brands like Dank Banana Bread, Mama Kaz Bakery, and The Elegant Farmer are gaining traction by offering premium, clean-label, and flavor-focused banana bread products that appeal to health-conscious and gourmet consumers. Strategic initiatives such as new product launches, online expansion, and collaborations with cafes and grocery chains are commonly adopted to enhance visibility and reach. Companies are also investing in sustainable packaging, gluten-free formulations, and plant-based variants to align with evolving consumer preferences. The competitive intensity remains high as players continuously innovate to differentiate offerings in a market where product freshness, taste, and convenience drive purchasing decisions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- General Mills Inc.

- Banana Bread Company

- Mama Kaz Bakery

- King Arthur Baking Company, Inc.

- Papa Joe’s Bakehouse

- The Elegant Farmer

- Dank Banana Bread

- The Essential Baking Company

- Simple Mills

- DD IP Holder LLC

Recent Developments

- In 2025, Papa Joe’s continues to be a prominent supplier of banana bread to both food service and retail sectors, upholding its established reputation as a manufacturer since 1996, according to industry reports and other market analysis sites. The company maintains its position in the market, offering a consistent supply of banana bread to various food businesses and retail outlets.

- In 2025, The Essential Baking Company is recognized as a key player in the banana bread market, actively shaping trends with its focus on clean-label, organic, and preservative-free products.

- In June 2023, General Mills’ brand Pillsbury launched a ready-to-bake banana bread batter called “Cut & Squeeze.” This product simplifies the banana bread baking process by providing a pre-made batter made with real bananas, eliminating the need to wait for bananas to ripen. The “Cut & Squeeze” batter is available in major grocery stores.

- In June 2023, Mama Kaz, a bakery company, added a “banana and blueberry bread” to its product line, aiming to cater to consumer demand for diverse, healthier flavor options within the banana bread category by combining bananas with blueberries in a new bread offering.

Market Concentration & Characteristics

The Banana Bread Market is moderately fragmented, characterized by the presence of both large multinational food corporations and regional artisanal bakeries. It demonstrates a balanced mix of branded packaged goods and fresh in-store bakery offerings. The market is driven by consumer demand for healthier snacking options, clean-label ingredients, and flavor innovations. It reflects a dynamic product landscape where premium, plant-based, and gluten-free varieties are gaining traction. While major players benefit from established distribution networks and brand loyalty, smaller companies leverage product differentiation and local appeal. It exhibits steady growth, supported by strong retail and e-commerce penetration in developed markets.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Banana Bread market is projected to grow steadily due to increasing demand for healthier bakery alternatives.

- Flavored banana bread variants will continue to dominate as consumers seek variety and indulgence.

- Online retail and e-commerce platforms will play a larger role in product distribution and brand visibility.

- Clean-label and plant-based formulations are expected to see rising consumer preference.

- Innovation in packaging to improve shelf life without preservatives will gain importance.

- Regional and artisanal brands will find opportunities in local and niche markets.

- Expansion of organized retail in developing economies will boost product accessibility.

- Demand for gluten-free and allergen-friendly options will continue to rise.

- Strategic collaborations between bakery brands and cafes will support brand exposure.

- Rising disposable incomes and urbanization in Asia Pacific will drive future market expansion.