Market Overview:

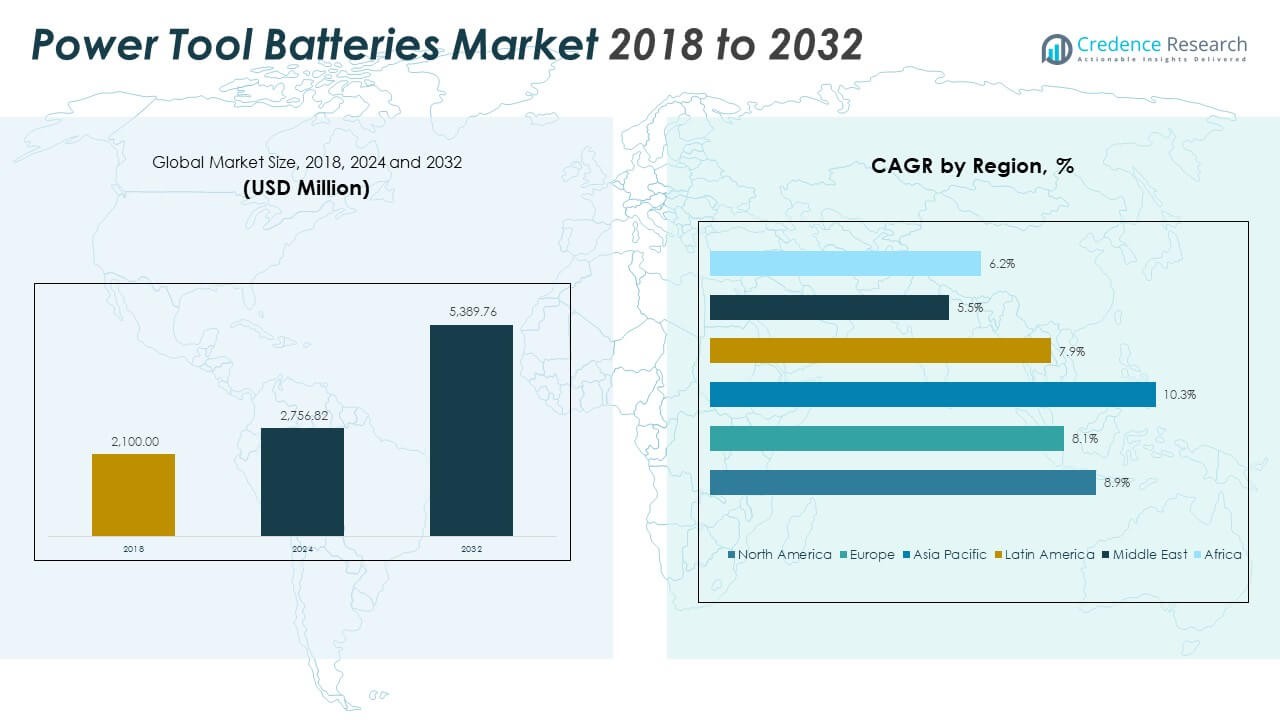

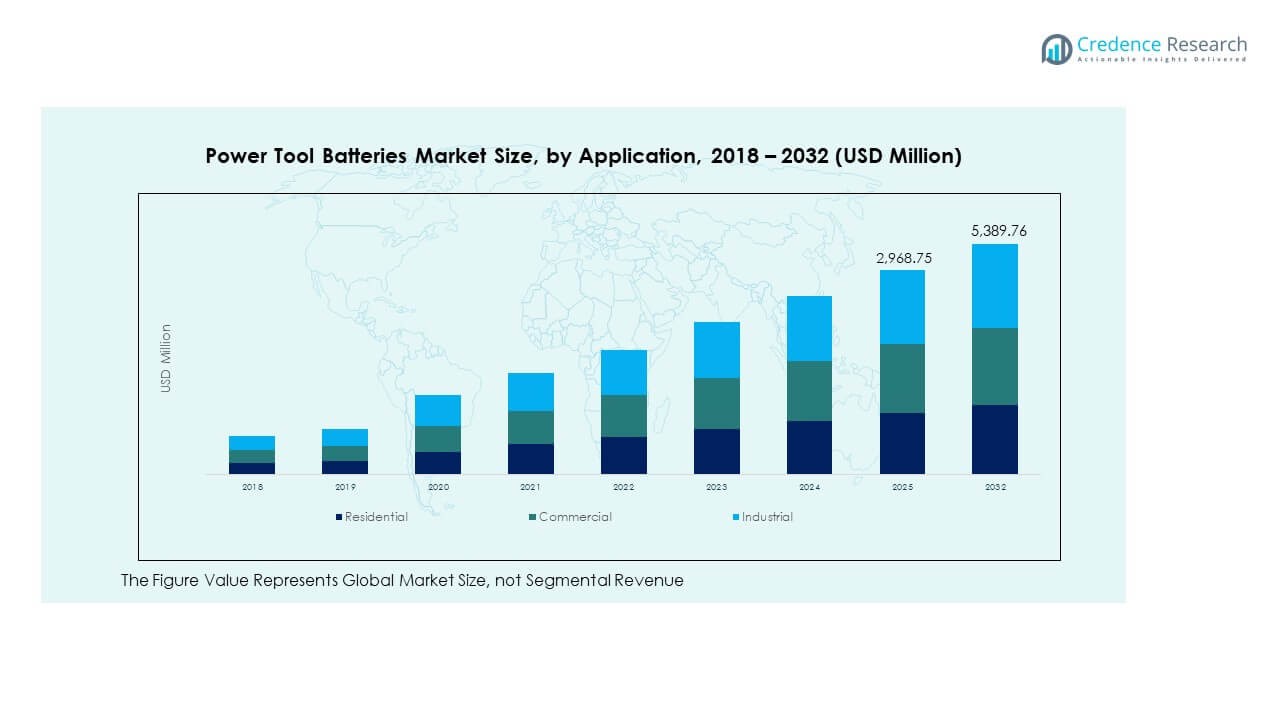

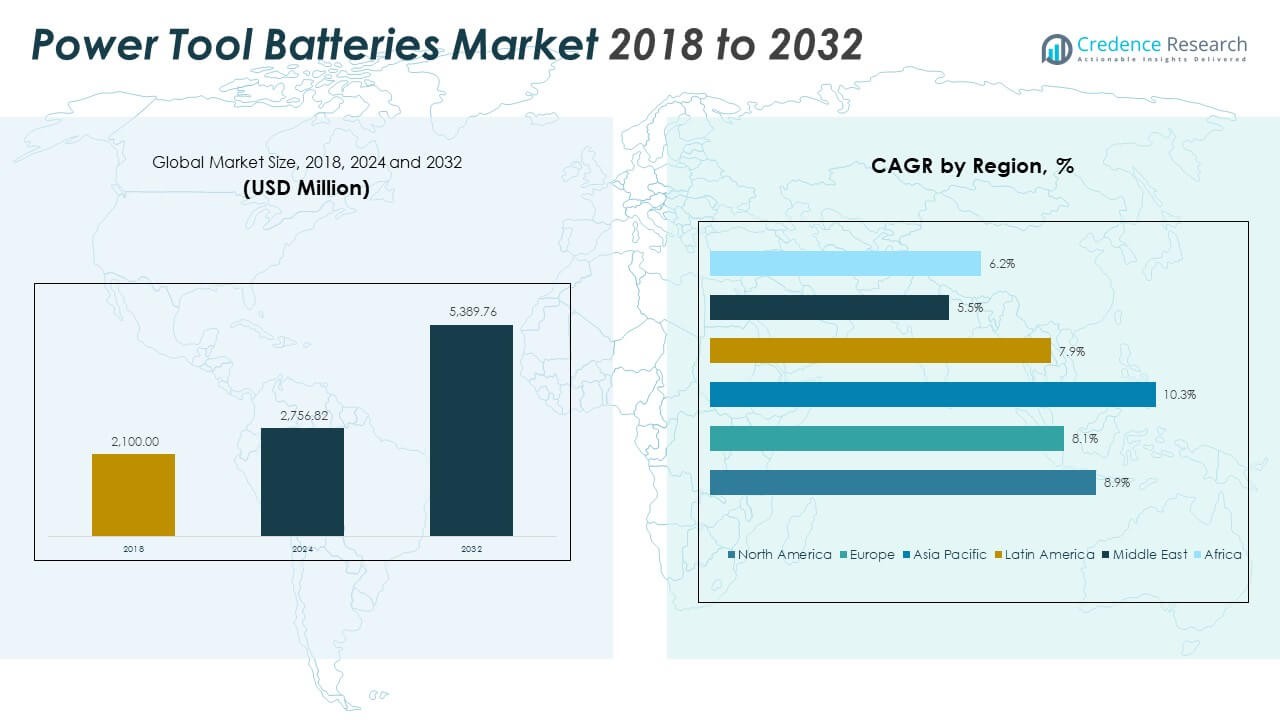

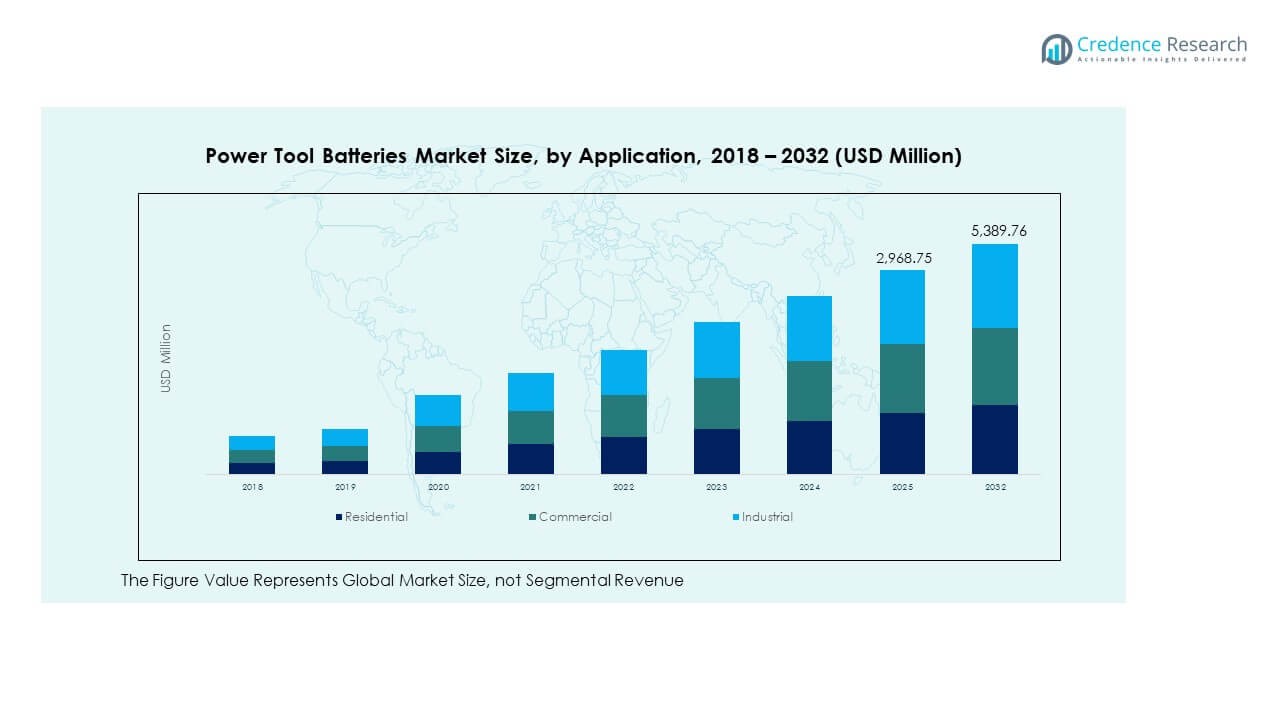

The Power Tool Batteries Market size was valued at USD 2,100.00 million in 2018 to USD 2,756.82 million in 2024 and is anticipated to reach USD 5,389.76 million by 2032, at a CAGR of 8.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Tool Batteries Market Size 2024 |

USD 2,756.82 Million |

| Power Tool Batteries Market, CAGR |

8.89% |

| Power Tool Batteries Market Size 2032 |

USD 5,389.76 Million |

The market is driven by the rising adoption of cordless power tools across industrial, commercial, and residential applications. Growing demand for efficient, lightweight, and durable batteries has accelerated innovation in lithium-ion and solid-state technologies. It benefits from increasing investments in R&D and the development of smart battery management systems that improve energy output and lifespan. Expanding DIY activities, coupled with the growth of construction and automotive sectors, continues to strengthen the demand for high-performance rechargeable battery systems.

Regionally, North America leads the market due to strong construction activities and widespread cordless tool adoption. Europe follows, supported by sustainability goals and industrial modernization. The Asia-Pacific region shows the fastest growth, fueled by rapid urbanization and expansion of manufacturing and infrastructure projects. Latin America and the Middle East are emerging with growing industrial demand, while Africa is gradually developing with rising tool electrification and localized production efforts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Power Tool Batteries Market was valued at USD 2,100.00 million in 2018, reached USD 2,756.82 million in 2024, and is projected to attain USD 5,389.76 million by 2032, growing at a CAGR of 8.89%.

- North America leads with a 34% share, supported by mature construction industries, strong cordless tool adoption, and high R&D investment in lithium-ion technology.

- Europe holds a 28% share, driven by sustainability initiatives and industrial modernization, while Asia Pacific follows with 31% due to rapid urbanization and manufacturing expansion.

- Asia Pacific remains the fastest-growing region with strong infrastructure development, local manufacturing capacity, and increasing exports of battery-powered tools.

- The industrial segment accounts for roughly 45% of the market, followed by the commercial segment at 35%, while residential applications contribute around 20%, reflecting balanced multi-sectoral growth.

Market Drivers

Rising Demand for Cordless Tools in Construction and Industrial Applications

The Power Tool Batteries Market benefits from the rising preference for cordless power tools in construction, manufacturing, and maintenance activities. Professionals favor cordless tools for flexibility, mobility, and improved safety on-site. It supports long working hours without reliance on fixed power sources, enhancing productivity. Expanding infrastructure projects in emerging economies drive heavy adoption of cordless drills, grinders, and saws. Battery efficiency improvements enable longer runtime and faster recharging cycles. Leading manufacturers are introducing compact, lightweight batteries for improved ergonomics. The integration of battery management systems further enhances safety and performance. These developments strengthen product reliability and user convenience.

Growing Shift Toward Lithium-Ion Technology and Battery Innovation

Manufacturers in the Power Tool Batteries Market are rapidly transitioning from nickel-cadmium to lithium-ion technologies. Lithium-ion batteries deliver higher energy density, reduced self-discharge, and longer lifecycles. It allows compact designs and lighter tool configurations, improving user comfort. Technological advancements have reduced charging time while increasing output voltage. Companies focus on introducing durable and high-capacity batteries suitable for demanding industrial environments. Smart charging systems are also being developed to prevent overheating and optimize energy use. The global focus on sustainable power solutions further accelerates lithium-ion adoption. These innovations improve efficiency and extend product value.

- For example, Makita’s 40V max XGT 8.0Ah lithium-ion battery (BL4080F) fully charges in 76 minutes or less and provides up to twice the sustained power in heavy-load applications compared to prior models. This battery features advanced digital communication for optimized performance and protection.

Rising Professional and DIY Tool Adoption Worldwide

The increasing popularity of DIY activities across residential users stimulates consistent demand for power tools. It encourages households to invest in compact, battery-driven devices for repairs and improvements. The Power Tool Batteries Market experiences growth from a surge in home renovation trends. Growing consumer awareness regarding performance and ease of use drives retail sales. Manufacturers are focusing on portable designs suitable for personal use. Online retail expansion provides easier product accessibility, supporting higher adoption rates. Professional users in the automotive and manufacturing sectors also prefer cordless options for mobility and convenience. This widespread application enhances product penetration globally.

Focus on Sustainability and Energy-Efficient Manufacturing

Environmental concerns push manufacturers to adopt recyclable materials and energy-efficient production. Companies are focusing on minimizing toxic components within battery cells. It supports compliance with international sustainability standards and waste reduction goals. The Power Tool Batteries Market benefits from eco-friendly production techniques and extended product life. Manufacturers invest in closed-loop recycling to recover lithium and cobalt efficiently. Governments across developed nations promote green energy use in industrial tools. The rise of environmentally conscious consumers motivates companies to design eco-compliant products. Such sustainable initiatives enhance brand reputation and reduce long-term environmental impact.

- For instance, in September 2025 American Battery Technology Company and Call2Recycle publicly announced a strategic partnership for advanced lithium-ion battery recycling in the U.S., leveraging a national network of drop-off locations to recover critical minerals such as lithium, cobalt, nickel, and manganese efficiently, directly supporting a more sustainable circular battery supply chain.

Market Trends

Integration of Smart Battery Management and IoT Capabilities

The Power Tool Batteries Market is witnessing strong integration of IoT-enabled smart battery systems. These technologies enable real-time monitoring of charge cycles and temperature. It ensures optimal performance and prevents premature degradation. Connectivity features allow users to track tool usage through mobile applications. Manufacturers are embedding sensors to enhance predictive maintenance and improve battery health. Such innovations support improved safety and lower operational downtime. Industrial sectors favor connected batteries for better asset management. The inclusion of smart analytics optimizes battery replacement schedules, improving cost-efficiency.

Expansion of Fast-Charging and Modular Battery Platforms

Companies are investing in fast-charging platforms that reduce tool downtime significantly. It enhances productivity for professionals using multiple devices daily. The Power Tool Batteries Market benefits from modular systems allowing compatibility across various tools. Such designs reduce the number of batteries required per toolkit. Manufacturers focus on universal chargers to simplify user experience. Advanced power management systems maintain battery performance under high-load conditions. Improved thermal management prevents overheating and increases lifespan. These modular and fast-charging systems align with evolving customer expectations for efficiency.

- For instance, the Bosch GAL 18V-160 C Professional Fast Charger is able to charge an 8.0Ah ProCORE18V battery from 0% to 80% in just 32 minutes, with Bluetooth connectivity to control charging modes via smartphone and ensure compatibility with over 200 Bosch Professional 18V system tools as of 2025.

Advancements in Solid-State Battery Development

Solid-state technology is emerging as a transformative trend within the Power Tool Batteries Market. It offers higher safety, superior energy density, and longer durability compared to traditional batteries. Companies explore solid electrolytes to overcome leakage and overheating issues. It enables thinner, lighter, and more powerful designs suitable for handheld tools. Manufacturers are scaling pilot production for commercial applications. Industry players invest in partnerships to accelerate solid-state innovation. The shift supports safer and more reliable performance for heavy-duty operations. Solid-state technology promises to redefine power tool design standards.

Increased Collaboration Between Tool and Battery Manufacturers

Strategic alliances between tool producers and battery specialists are growing steadily. The Power Tool Batteries Market benefits from co-developed energy systems ensuring better compatibility and performance. Such collaborations enable faster product innovation cycles. It enhances user confidence through improved tool-battery synchronization. Cross-brand partnerships focus on optimizing battery dimensions and voltage parameters. Manufacturers are also sharing R&D resources to reduce production costs. Joint ventures support unified charging platforms across brands. These cooperative developments strengthen technological advancement and market expansion.

- For instance, Metabo HPT introduced its MultiVolt 36V system, which enables tools to operate using either a battery or an AC adapter. The platform supports over 100 tools and delivers consistent power output for professional-grade applications, representing one of the industry’s most flexible cordless-corded systems.

Market Challenges Analysis

High Manufacturing Costs and Raw Material Dependence

Manufacturing advanced lithium-ion batteries demands significant capital and specialized equipment. The Power Tool Batteries Market faces challenges due to volatile raw material prices, including lithium, cobalt, and nickel. It raises production costs and limits profitability for small manufacturers. Supply chain disruptions further affect consistent material availability. Geopolitical instability in mining regions increases procurement risks. Companies must balance cost-efficiency with innovation to remain competitive. Regulatory restrictions on mining practices create additional hurdles. These factors pressure manufacturers to explore alternative chemistries or localized sourcing strategies.

Concerns Over Battery Disposal, Safety, and Performance Degradation

Environmental and safety concerns continue to challenge battery adoption. Used batteries pose risks of contamination and fire hazards if not disposed of correctly. The Power Tool Batteries Market struggles with performance degradation after prolonged use. It affects end-user confidence and drives demand for replacement solutions. Manufacturers face strict recycling regulations that increase operational costs. Developing safe and efficient recycling processes remains complex and costly. Heat buildup and overcharging incidents further limit user trust. Companies must invest in safer chemistries and recycling technologies to overcome these challenges.

Market Opportunities

Rising Demand from Emerging Economies and Urbanization Growth

Developing economies across Asia-Pacific, Latin America, and the Middle East present untapped opportunities. Rapid urbanization and industrial expansion drive higher demand for cordless tools. The Power Tool Batteries Market gains from local construction and manufacturing investments. It creates new prospects for regional production facilities. Expanding small-scale businesses and repair services further stimulate consumption. Governments encourage domestic manufacturing of electronic components, supporting market entry. Improved distribution channels strengthen accessibility for new consumers. Emerging markets offer long-term potential for manufacturers with adaptive pricing strategies.

Technological Advancements in Battery Design and Recycling Solutions

Advances in solid-state, lithium-sulfur, and graphene-enhanced batteries open growth avenues. These technologies extend operational life and deliver faster charging capabilities. It supports innovation in lightweight and high-performance tool designs. The Power Tool Batteries Market benefits from rising interest in circular economy models. Companies focusing on efficient recycling and material recovery gain competitive strength. Research investments enhance eco-friendly and cost-effective battery production. Integration of renewable energy in manufacturing reduces carbon emissions. These innovations create a sustainable roadmap for future growth.

Market Segmentation Analysis:

The Power Tool Batteries Market is segmented

By type into lithium-ion, nickel-cadmium, nickel-metal hydride, and others. Lithium-ion batteries dominate the segment due to their high energy density, light weight, and long lifecycle. It delivers consistent power output and supports quick charging, making it ideal for professional-grade cordless tools. Nickel-cadmium batteries continue to serve applications requiring durability in extreme conditions. Nickel-metal hydride batteries offer an eco-friendly alternative with moderate cost and performance balance. The “others” category includes emerging chemistries targeting improved safety and recyclability in specialized applications.

- For instance, American Battery Technology Company (ABTC) began operations at its commercial-scale lithium-ion battery recycling facility in Nevada in early 2024. The plant is designed to process battery materials and recover lithium, nickel, and cobalt for reuse, supporting the circular economy and sustainable supply chain development in North America.

By application, the market is divided into residential, commercial, and industrial segments. Residential users drive demand through the growing adoption of DIY and home improvement tools. It encourages manufacturers to offer compact, user-friendly designs with affordable pricing. The commercial segment benefits from increased use in construction, repair, and maintenance activities that rely on cordless mobility. The industrial segment records steady growth through automation and heavy-duty tool operations demanding high-capacity batteries. Rising emphasis on operational efficiency and power reliability continues to shape product development across all segments, strengthening long-term market performance.

- For instance, Metabo HPT’s MultiVolt platform features battery packs built with 21700-size lithium-ion cells, delivering 4.0Ah at 36V or 8.0Ah at 18V. The system supports both 36V high-power tools and backward compatibility with 18V models, offering flexibility across more than 100 cordless and corded tools.

Segmentation:

By Type

- Lithium-ion

- Nickel-Cadmium

- Nickel-Metal Hydride

- Others

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Power Tool Batteries Market size was valued at USD 835.80 million in 2018 to USD 1,085.07 million in 2024 and is anticipated to reach USD 2,118.72 million by 2032, at a CAGR of 8.9% during the forecast period. North America holds a 34% share of the global market, supported by strong construction activity, established industrial infrastructure, and high adoption of cordless tools. The region benefits from the presence of leading manufacturers and advanced R&D facilities. It shows consistent demand from professional users and DIY consumers seeking efficient and durable battery systems. Innovation in lithium-ion technology and integration of smart battery management drive further adoption. The U.S. dominates the regional landscape, followed by Canada and Mexico, with increasing focus on energy-efficient and eco-compliant batteries. Growth in home renovation trends and trade partnerships also strengthen regional expansion. Rising emphasis on workplace safety continues to fuel cordless tool usage across multiple sectors.

Europe

The Europe Power Tool Batteries Market size was valued at USD 562.80 million in 2018 to USD 710.63 million in 2024 and is anticipated to reach USD 1,313.77 million by 2032, at a CAGR of 8.1% during the forecast period. Europe accounts for 28% of the market share, supported by sustainability policies and industrial modernization. Strong demand from automotive manufacturing, metal fabrication, and construction industries sustains regional growth. It benefits from stringent environmental regulations encouraging recyclable battery materials. Germany, France, and the UK are the key contributors with active innovation in cordless systems. Market players focus on expanding lithium-ion and solid-state battery adoption to improve performance. Government initiatives promoting carbon reduction encourage tool electrification across industries. Technological upgrades and localized production enhance competitive positioning. The market also gains traction from rising consumer awareness and steady investments in green manufacturing practices.

Asia Pacific

The Asia Pacific Power Tool Batteries Market size was valued at USD 494.34 million in 2018 to USD 678.86 million in 2024 and is anticipated to reach USD 1,469.79 million by 2032, at a CAGR of 10.3% during the forecast period. Asia Pacific leads the market with a 31% share, supported by strong industrialization and infrastructure expansion. Rapid urban development in China, India, and Southeast Asia drives tool consumption. It benefits from competitive manufacturing costs and a large skilled workforce. Growing construction activity and housing projects generate significant battery demand. Technological innovation by Japanese and South Korean firms accelerates efficiency and safety features. Local battery suppliers expand capacity to meet increasing OEM requirements. Governments support electrification and digital manufacturing policies, reinforcing regional production. Rising exports of battery-powered tools enhance the region’s global influence in supply chains.

Latin America

The Latin America Power Tool Batteries Market size was valued at USD 128.10 million in 2018 to USD 166.48 million in 2024 and is anticipated to reach USD 301.13 million by 2032, at a CAGR of 7.9% during the forecast period. Latin America represents a 10% market share, driven by expanding construction and manufacturing activities. Brazil and Mexico serve as major centers for tool imports and assembly. It gains momentum from industrial modernization programs and increased DIY tool use among consumers. Infrastructure investments in residential and commercial projects boost cordless tool deployment. Local distributors collaborate with global brands to improve regional reach. Market growth is supported by rising awareness of energy-efficient solutions. Limited domestic battery manufacturing remains a challenge but offers future opportunities for localization. Government-backed trade initiatives and economic recovery efforts strengthen overall demand outlook.

Middle East

The Middle East Power Tool Batteries Market size was valued at USD 37.80 million in 2018 to USD 42.99 million in 2024 and is anticipated to reach USD 65.25 million by 2032, at a CAGR of 5.5% during the forecast period. The region holds a 4% market share, supported by ongoing construction and infrastructure diversification projects. It experiences rising demand for cordless tools in the oil, gas, and utilities sectors. Increasing government investments in industrial automation promote advanced power tool usage. The GCC countries lead regional adoption, followed by Turkey and Israel. It benefits from expanding trade relationships with European and Asian manufacturers. Modernization in maintenance services fuels replacement battery demand. Local assembly initiatives aim to reduce dependency on imports. The emphasis on durable and energy-efficient battery systems aligns with regional sustainability goals.

Africa

The Africa Power Tool Batteries Market size was valued at USD 41.16 million in 2018 to USD 72.79 million in 2024 and is anticipated to reach USD 121.10 million by 2032, at a CAGR of 6.2% during the forecast period. Africa accounts for a 3% market share, reflecting gradual progress in tool electrification and industrial development. South Africa dominates the regional market with a growing construction and automotive sector. It benefits from rising investments in infrastructure and urban housing. Emerging economies in North and East Africa show potential for future growth. Limited local manufacturing capacity drives reliance on imports from Asia and Europe. Companies focus on affordable lithium-ion solutions suited to local demand. Expansion of retail channels supports product availability in remote markets. Increasing adoption of battery-powered tools in mining and agriculture sectors enhances long-term regional prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bosch Ltd

- Hilti Corporation

- Hitachi Ltd

- Makita Corporation

- Panasonic Corporation

- Ryobi Limited

- Samsung SDI Co. Ltd

- Sony Group Corporation

- Stanley Black & Decker Inc.

- Techtronic Industries Company Limited

Competitive Analysis:

The Power Tool Batteries Market features strong competition among global and regional manufacturers focusing on innovation and product reliability. Leading companies such as Bosch Ltd, Makita Corporation, Panasonic Corporation, Techtronic Industries, and Stanley Black & Decker emphasize lithium-ion battery advancements and extended lifecycle performance. It demonstrates a continuous shift toward smart battery systems with integrated diagnostics and fast-charging capabilities. Firms invest heavily in R&D to enhance energy density and safety standards. Strategic mergers, regional expansions, and portfolio diversification strengthen brand positioning. Emerging players from Asia-Pacific increase price competitiveness through large-scale production and supply chain integration. Market leaders maintain their edge through technology partnerships and sustainability-driven initiatives aimed at improving battery recyclability and operational efficiency.

Recent Developments:

- In October 2025, Toshiba made headlines in the power tool batteries market with the launch of its new SCiB 24V lithium-ion battery pack, targeting both heavy equipment and power tool applications. This development aims to address growing industry demands for efficient, high-performance solutions across diverse sectors, highlighting Toshiba’s commitment to advancing battery technology within the market.

Report Coverage:

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing demand for cordless tools across construction, manufacturing, and automotive sectors will drive long-term growth.

- Advancements in lithium-ion and solid-state technologies will enhance safety, power density, and lifecycle performance.

- Expansion of smart battery management systems with IoT integration will optimize performance monitoring and predictive maintenance.

- The growing shift toward energy-efficient and recyclable battery materials will align with global sustainability goals.

- Continuous R&D investments will support compact, fast-charging solutions catering to both professional and consumer applications.

- Strategic collaborations between tool manufacturers and battery producers will accelerate innovation and standardization.

- Emerging economies in Asia-Pacific and Latin America will offer new revenue potential through infrastructure expansion.

- Strong emphasis on localized manufacturing will reduce supply chain dependency and improve cost efficiency.

- Expanding e-commerce distribution will make advanced power tool batteries more accessible to global consumers.

- Rising replacement demand from industrial users will sustain aftermarket growth and long-term market stability.