Market Overview

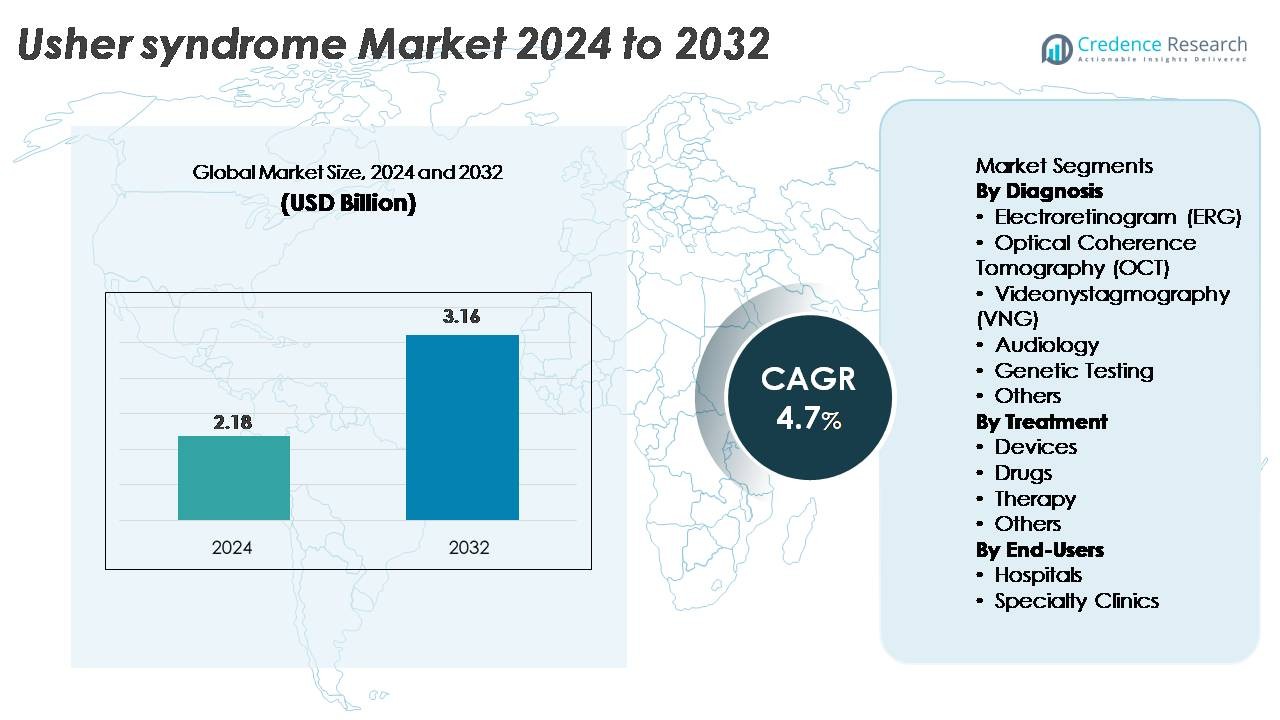

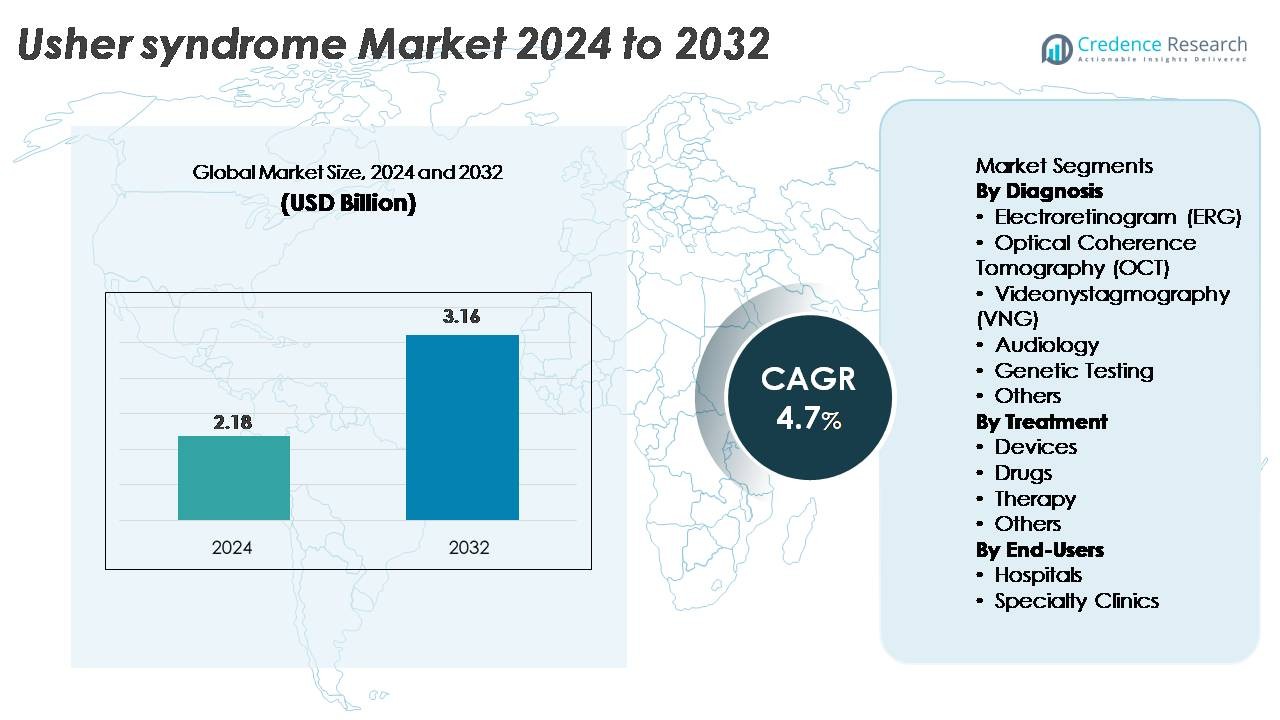

The global Usher syndrome market was valued at USD 2.18 billion in 2024 and is projected to reach USD 3.16 billion by 2032, expanding at a CAGR of 4.7% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Usher Syndrome Market Size 2024 |

USD 2.18 Billion |

| Usher Syndrome Market, CAGR |

4.7% |

| Usher Syndrome Market Size 2032 |

USD 3.16 Billion |

North America dominates the Usher syndrome market with an approximate 38% market share, supported by strong diagnostic infrastructure and high adoption of cochlear implants and genetic testing. Key players actively shaping the competitive landscape include Starkey, Century Hearing Aids, Zounds Hearing, Audina Hearing Instruments Inc., Johnson & Johnson Services, Inc., Ionis Pharmaceuticals, Inc., and Amgen Inc., all of which contribute to advancements in hearing restoration, auditory devices, and therapeutic research. International companies such as Sanofi (France), MeiraGTx (U.K.), and Sivantos Pte. Ltd (Singapore) further strengthen global innovation through gene therapy programs, RNA-based platforms, and next-generation hearing technologies. Collectively, these companies drive ongoing progress in both treatment and diagnostics for Usher syndrome.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global Usher syndrome market was valued at USD 2.18 billion in 2024 and is projected to reach USD 3.16 billion by 2032, expanding at a CAGR of 4.7%, supported by rising diagnostic adoption and expanding therapeutic innovation.

- Growth is driven by increased utilization of genetic testing, the dominant diagnosis segment, along with strong uptake of cochlear implants and hearing devices, which lead the treatment category due to expanding early-intervention programs.

- Market trends highlight accelerated development of gene and RNA-based therapies, broader integration of digital assistive technologies, and improved availability of multimodal screening tools such as ERG, OCT, and audiology platforms.

- The competitive landscape features active contributions from hearing device manufacturers and biopharmaceutical developers, while market restraints include high diagnostic costs, limited vision-preserving treatments, and uneven global access to specialty care.

- North America holds 38% of the market, followed by Europe at 31% and Asia-Pacific at 22%, supported by strong infrastructure and screening programs; hospitals remain the leading end-user segment in all major regions.

Market Segmentation Analysis:

By Diagnosis

Genetic testing represents the dominant diagnostic sub-segment in the Usher syndrome market, capturing the largest share due to its ability to identify pathogenic variants across USH1, USH2, and USH3 gene clusters with high accuracy. As next-generation sequencing panels and whole-exome workflows become more accessible, clinicians increasingly prioritize molecular confirmation to guide prognosis and eligibility for emerging gene therapies. Audiology and electroretinography also remain widely utilized for functional assessment, while OCT and VNG support early detection of retinal degeneration and vestibular impairment, strengthening comprehensive diagnostic workflows across hospitals and specialty centers.

- For instance, Illumina’s NovaSeq X Plus platform can generate up to 16 terabases of sequencing data per day, enabling high-depth sequencing of large inherited-retinal-disease panels with enhanced variant-calling precision.

By Treatment

Devices constitute the leading treatment sub-segment, holding the highest market share as adoption grows for advanced cochlear implants, digital hearing systems, and assistive vision technologies designed to manage dual-sensory loss. Demand is fueled by continuous innovations in multi-channel implant processors, improved speech recognition software, and low-vision mobility aids. Drug-based interventions, including off-label retinoprotective agents and emerging gene-delivery candidates, remain in development but represent a smaller market portion. Therapy services such as vestibular rehabilitation and low-vision training are gaining traction as integrated care models expand, supporting long-term functional support for patients.

- For instance, Cochlear Limited’s Nucleus Profile Plus implant provides 22 intracochlear electrodes that support flexible mapping and ACE sound-processing. Clinics often use about 900 pps per channel, which helps deliver clear auditory cues for severe-to-profound hearing loss.

By End-Users

Hospitals dominate the end-user landscape, accounting for the largest share owing to their advanced diagnostic infrastructure, access to multidisciplinary specialists, and capacity to deliver coordinated care for genetically complex conditions like Usher syndrome. High-volume ophthalmology and otology departments enable comprehensive evaluation using OCT, ERG, VNG, and molecular testing platforms. Specialty clinics, although growing rapidly, serve primarily for continuity care, auditory rehabilitation, and genetic counseling. Increasing referral pathways, expanding clinical research programs, and earlier screening initiatives continue to reinforce the role of hospitals as the primary hubs for diagnosis, treatment planning, and long-term patient management.

Key Growth Drivers

Advancements in Genetic Diagnostics and Molecular Profiling

Rapid progress in genetic diagnostics remains a central growth driver, enabling accurate identification of pathogenic mutations responsible for Usher syndrome subtypes. Widespread adoption of next-generation sequencing, targeted mutation panels, and whole-exome sequencing has significantly improved diagnostic yield, allowing clinicians to differentiate between USH1, USH2, and USH3 variants with greater precision. As molecular profiling becomes more accessible, healthcare providers can offer early intervention planning, customized monitoring, and eligibility assessment for emerging gene therapy trials. The increasing integration of bioinformatics-driven variant analysis, automated reporting systems, and genotype–phenotype correlation tools further accelerates adoption across hospital and specialty clinical settings. This diagnostic shift not only reduces the historical delay associated with sensory impairment evaluation but also supports long-term clinical management strategies. As more countries implement newborn genomic screening pilots and reimbursement pathways strengthen for hereditary retinal disease testing, the overall demand for standardized, high-throughput genetic confirmation continues to rise, driving sustained market expansion.

- For example, Thermo Fisher Scientific’s Ion Torrent Genexus System delivers a fully automated sample-to-report workflow in about 24 hours and supports run formats with up to 32 samples. This throughput enables fast molecular confirmation for inherited retinal diseases using targeted NGS panels.

Growing Adoption of Cochlear Implants and Advanced Hearing Devices

Technological improvements in auditory devices are expanding therapeutic uptake and strengthening overall market growth. Modern cochlear implants feature enhanced sound processors, multi-channel arrays, improved speech perception algorithms, and wireless connectivity, enabling significant functional gains for individuals with Usher-related sensorineural hearing loss. The increasing availability of bilateral implantation programs, pediatric early-intervention protocols, and AI-enabled hearing aids supports broader patient adoption. Healthcare systems are also expanding funding and reimbursement for implantable devices, further increasing access. Manufacturers continue to integrate real-time noise management, low-energy wireless communication, and smartphone-based adjustments, positioning hearing devices as highly effective long-term solutions. Additionally, the emphasis on early implantation supported by clinical evidence that early auditory stimulation improves developmental and educational outcomes drives higher demand across both developed and emerging markets. As device reliability improves and surgical workflows become more standardized, utilization of hearing restoration technologies continues to surge.

- For instance, Cochlear Limited’s Nucleus 8 sound processor performs up to 55 million sound-adjustment operations each hour, helping users adapt to complex listening scenes. The processor also supports 4-GHz wireless streaming, which enables stable real-time audio transmission.

Expanding Pipeline of Gene and Cell-Based Therapeutics

Development of gene therapies, RNA-based treatments, and regenerative approaches is emerging as a transformative driver for the Usher syndrome market. Biopharmaceutical companies and academic research groups are actively pursuing AAV-mediated gene replacement, genome editing modalities, antisense oligonucleotides, and optogenetic strategies aimed at restoring photoreceptor function or slowing retinal degeneration. Early clinical programs targeting USH2A and MYO7A mutations have demonstrated promising safety and biomarker outcomes, encouraging broader investment across the field. Regulatory agencies are granting orphan-drug designations and fast-track pathways, accelerating trial progress and improving commercial incentives. Growth is further supported by advancements in viral vector engineering, high-capacity delivery platforms, and scalable manufacturing technologies capable of producing gene therapy batches for rare-disease populations. As long-term efficacy data accumulate and more candidates progress into mid- and late-stage trials, gene-based interventions have the potential to significantly reshape the therapeutic landscape.

Key Trends & Opportunities

Integration of Multimodal Digital Health and Assistive Technologies

A major trend shaping the market is the integration of digital health solutions with physical assistive technologies to support individuals with dual-sensory impairments. Smartphone-based navigation aids, wearable haptic feedback devices, AI-powered speech-to-text tools, and low-vision mobility platforms are creating new opportunities for technologically enhanced daily living support. Companies are developing multimodal solutions that synchronize auditory, visual, and tactile cues, enabling safer mobility, improved communication, and greater independence. Tele-audiology and remote low-vision rehabilitation services are also expanding, reducing geographic barriers to specialized care. As digital accessibility standards evolve, manufacturers are incorporating voice recognition, real-time environment mapping, and cloud-based device personalization features. These trends, combined with increasing funding for assistive innovation, open new opportunities for cross-industry collaborations between medtech firms, software developers, and rehabilitation specialists.

- For instance, OrCam states that its MyEye Pro uses a 13-megapixel smart camera with integrated AI that processes text, faces, and objects in real time. The device provides instant audio feedback, and the vision engine remains functional in low-light environments.

Rising Focus on Early Screening and Population-Level Identification Programs

Health systems worldwide are strengthening early-screening programs for congenital hearing loss and hereditary retinal diseases, creating substantial opportunities for earlier diagnosis of Usher syndrome. Universal newborn hearing screening, school-based vision testing, and targeted genetic screening programs allow detection of sensory deficits before clinical symptoms fully manifest. Public health agencies are investing in awareness campaigns that emphasize the importance of early diagnosis and multidisciplinary management. As costs for comprehensive genomic sequencing decline, population-level screening becomes increasingly viable, particularly for high-risk groups or regions with elevated consanguinity rates. The shift toward proactive identification enhances long-term outcomes by enabling earlier referral to audiology services, timely cochlear implantation, and monitoring of progressive retinal decline. This push for early detection also strengthens the foundation for future clinical adoption of gene therapies and precision treatments.

- For instance, Natus Medical’s ALGO® 5 AABR system completes newborn hearing screening in about 5–15 minutes, with 4–5 minutes per ear in routine conditions. This speed supports high-throughput workflows in maternity hospitals and ensures consistent objective pass/refer results.

Key Challenges

Limited Treatment Options for Retinal Degeneration Progression

Despite significant advancements in hearing restoration technologies, controlled management of retinal degeneration remains a major challenge. Current therapeutic options are limited to supportive care, visual rehabilitation, and experimental interventions that are still under evaluation in clinical trials. Retinal degeneration in Usher syndrome progresses unpredictably, and disease heterogeneity across subtypes complicates both therapeutic targeting and trial design. Structural deterioration of photoreceptors often continues even after auditory deficits are managed, reducing overall quality of life. The lack of approved disease-modifying retinal treatments restricts clinicians to monitoring and symptomatic support. Moreover, the complexity of delivering large genes such as USH2A and the difficulty of achieving widespread photoreceptor transduction remain significant scientific barriers. These limitations slow clinical adoption and hinder the pace of therapeutic innovation for vision preservation.

High Cost of Care, Limited Access, and Reimbursement Constraints

The high cost associated with diagnostic evaluations, cochlear implants, assistive technologies, and emerging genetic tests presents a persistent challenge for patients and healthcare systems. In many regions, reimbursement remains partial or highly variable, limiting access to comprehensive care. Advanced diagnostics such as whole-exome sequencing or retinal imaging require specialized equipment and trained personnel, which are often concentrated in urban centers. The financial burden increases further for families requiring long-term rehabilitation services, multiple device upgrades, or travel to specialty clinics. These access disparities reduce early intervention rates and contribute to delays in receiving comprehensive care. As gene and cell-based therapies progress toward commercialization, cost-related challenges may intensify, making reimbursement reform essential for widespread adoption.

Regional Analysis

North America

North America holds the largest share of the Usher syndrome market at approximately 38%, driven by strong adoption of genetic diagnostics, advanced audiology infrastructure, and early access to cochlear implant technologies. The U.S. leads regional demand due to widespread newborn screening programs, high awareness of hereditary retinal diseases, and active enrollment in gene therapy clinical trials. Major academic centers such as NEI-supported ophthalmic research institutes and leading otology hospitals strengthen early detection and multidisciplinary care. Increasing reimbursement coverage for sequencing panels and implantable devices further enhances patient access, reinforcing North America’s dominant position in the global landscape.

Europe

Europe accounts for roughly 31% of the market, supported by well-established genetic counseling frameworks, strong ophthalmology and audiology networks, and extensive rare disease registries. Countries such as Germany, France, the U.K., and the Nordic region lead adoption of advanced diagnostic imaging, including OCT and ERG, while also participating actively in EU-funded research programs targeting USH2A and MYO7A gene therapies. Expansion of early hearing detection programs and government-backed reimbursement schemes for cochlear implants strengthen regional uptake. Increased collaboration between academic research centers and biotechnology firms continues to accelerate the availability of precision diagnostic and therapeutic pathways across Europe.

Asia-Pacific

Asia-Pacific captures around 22% of market share, propelled by rising awareness of hereditary disorders, growing adoption of newborn hearing screening, and expanding access to molecular testing in major economies such as China, Japan, South Korea, and Australia. Japan and South Korea lead in cochlear implant penetration due to strong governmental support and advanced audiology infrastructure. China shows rapid growth as urban hospitals integrate ERG, OCT, and genetic panels into routine diagnostic workflows. Increasing investment in ophthalmic research and regional participation in multinational clinical trials are further strengthening the development of targeted therapies for Usher syndrome.

Latin America

Latin America accounts for about 6% of the global market, with growth driven by expanding audiology services, improved screening programs, and increasing access to diagnostic imaging tools in Brazil, Mexico, Chile, and Argentina. Uptake remains concentrated in urban tertiary hospitals equipped with OCT and ERG systems, while genetic testing availability continues to grow through partnerships with global laboratories. Limited reimbursement and uneven distribution of specialty clinics pose challenges, yet rising awareness campaigns and NGO-supported early-intervention programs are improving diagnostic timelines. As regional health systems modernize, adoption of cochlear implants and supportive therapies is gradually strengthening.

Middle East & Africa

The Middle East & Africa region holds approximately 3% of the global market, reflecting gradual improvements in sensory impairment screening and access to specialized care. Countries such as Saudi Arabia, the UAE, and South Africa are expanding genetic testing availability through national programs and partnerships with international diagnostic laboratories. Cochlear implant adoption continues to rise due to government-sponsored healthcare initiatives, although access to advanced retinal diagnostics remains uneven. Awareness of dual-sensory genetic disorders is increasing, prompting investments in audiology and ophthalmology infrastructure. Despite resource limitations, the region shows steady progression toward enhanced diagnostic and treatment capabilities.

Market Segmentations:

By Diagnosis

- Electroretinogram (ERG)

- Optical Coherence Tomography (OCT)

- Videonystagmography (VNG)

- Audiology

- Genetic Testing

- Others

By Treatment

- Devices

- Drugs

- Therapy

- Others

By End-Users

- Hospitals

- Specialty Clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Usher syndrome market is shaped by a mix of biotechnology companies, diagnostic firms, implant manufacturers, and academic research institutions advancing therapeutic and diagnostic innovation. Companies developing gene therapies and RNA-based treatments for USH2A, MYO7A, and CLRN1 mutations are expanding clinical pipelines through strategic collaborations with universities and ophthalmology research centers. Leading cochlear implant manufacturers continue to strengthen their position by integrating advanced speech processors, wireless connectivity, and AI-driven sound optimization into implantable devices tailored for dual-sensory impairment. Diagnostic laboratories are enhancing accessibility to next-generation sequencing panels and comprehensive genetic profiling, enabling earlier and more accurate subtype identification. Nonprofit organizations and rare disease networks also play a significant role by funding research, supporting patient registries, and accelerating trial recruitment. As multiple gene therapy candidates advance into mid-stage studies and assistive technologies evolve rapidly, competition is intensifying across both therapeutic and diagnostic segments of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sanofi (France)

- Century Hearing Aids (U.S.)

- MeiraGTx (U.K.)

- Zounds Hearing (U.S.)

- Ionis Pharmaceuticals, Inc. (U.S.)

- Sivantos Pte. Ltd (Singapore)

- Audina Hearing Instruments Inc. (U.S.)

- Amgen Inc. (U.S.)

- Starkey (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

Recent Developments

- In June 2025, Johnson & Johnson Services, members of the retinal-disease research community publicly urged Johnson & Johnson to seek regulatory approval for its gene therapy candidate for X-linked retinitis pigmentosa, reflecting growing expectations that J&J’s retinal efforts could extend to other inherited retinal disorders, potentially including syndromic conditions such as Usher syndrome.

- In May 2024, Johnson & Johnson Services announced the creation of a global registry for inherited retinal diseases, dubbed EYE-RD Global Registry, and presented real-world data on the economic value of early genetic testing and the use of deep learning–based imaging algorithms at a major ophthalmology conference.

Report Coverage

The research report offers an in-depth analysis based on Diagnosis, Treatment, End-Users and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Gene therapy programs targeting USH1, USH2, and USH3 mutations will progress into later-stage clinical trials, improving prospects for disease-modifying treatments.

- RNA-based therapeutics and antisense oligonucleotides will gain momentum as precision tools for correcting specific splice defects.

- Cochlear implant technology will continue to advance with AI-driven sound processing, wireless integration, and improved speech recognition performance.

- Early screening programs will expand globally, enabling earlier diagnosis through newborn hearing tests and genetic profiling.

- Digital assistive technologies, including wearable navigation tools and haptic mobility devices, will see broader adoption among patients with dual-sensory impairment.

- Multidisciplinary care models combining ophthalmology, audiology, and genetics will become standard across major healthcare systems.

- Investment in rare disease research and clinical infrastructure will increase, improving trial recruitment and access to innovative therapies.

- Partnerships between biotechnology firms and academic centers will accelerate translational research pipelines.

- Reimbursement frameworks for diagnostics and implantable devices will strengthen, expanding patient access to care.

- Emerging optogenetic and cell-based approaches will offer new pathways for addressing progressive retinal degeneration.