Market Overview:

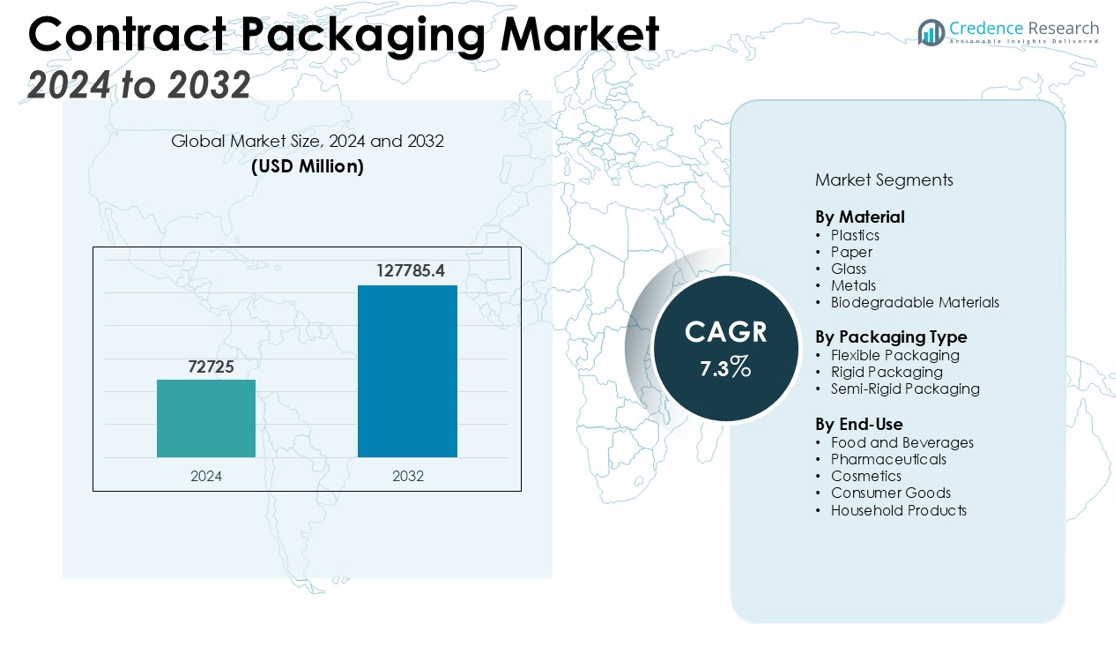

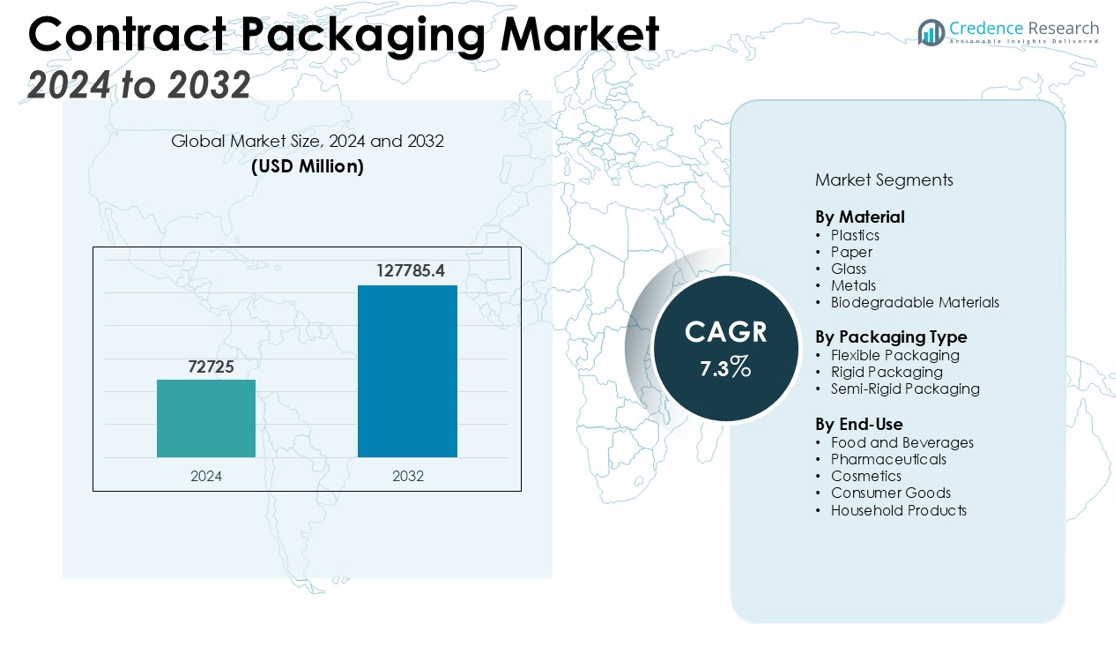

The Contract Packaging Market size was valued at USD 72725 million in 2024 and is anticipated to reach USD 127785.4 million by 2032, at a CAGR of 7.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Contract Packaging Market Size 2024 |

USD 72725 million |

| Contract Packaging Market, CAGR |

7.3% |

| Contract Packaging Market Size 2032 |

USD 127785.4 million |

Several factors drive the growth of the contract packaging market. First, the rising need for custom packaging solutions across various industries such as food and beverages, pharmaceuticals, and consumer goods is fueling market demand. The shift towards premium and eco-friendly packaging designs is further accelerating this growth. Additionally, advancements in packaging technologies, coupled with sustainability efforts to reduce environmental impact, are propelling the adoption of innovative packaging materials and designs. This trend is further supported by stricter regulations on waste management and packaging sustainability. The market is also driven by the growing trend of e-commerce, which requires efficient packaging for direct-to-consumer deliveries. This has led to an increased focus on optimizing packaging for shipping, storage, and retail display.

Regionally, North America holds a substantial market share due to its well-established manufacturing infrastructure and high demand for contract packaging services, especially in consumer goods and pharmaceuticals. The presence of major packaging companies and a robust supply chain network further strengthens the region’s position. The Asia Pacific region is expected to witness the highest growth rate, driven by rapid industrialization, increased consumer demand, and the growing adoption of third-party packaging solutions in emerging economies like China and India. Additionally, the expanding middle-class population in these countries contributes to the demand for packaged goods.

Market Insights:

- The Contract Packaging Market is projected to grow from USD 72,725 million in 2024 to USD 127,785.4 million by 2032, at a CAGR of 7.3% during the forecast period.

- Rising demand for custom packaging solutions across industries such as food, beverages, pharmaceuticals, and consumer goods is fueling market growth.

- Technological advancements in automation, robotics, and smart packaging are enhancing efficiency and production cycles in contract packaging.

- Increasing consumer awareness and stricter regulations are driving the shift toward eco-friendly and sustainable packaging solutions.

- The growth of e-commerce and direct-to-consumer deliveries is driving the demand for secure, efficient, and cost-effective packaging.

- North America holds a significant 35% market share, while Asia Pacific is expected to experience the highest growth rate due to industrialization and rising consumer demand.

- Challenges like raw material price volatility and regulatory compliance pressures are prompting businesses to diversify supply chains and adopt sustainable practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Custom Packaging Solutions

The Contract Packaging Market is seeing a surge in demand for custom packaging solutions across diverse industries. Consumer preferences are shifting towards personalized and innovative packaging that enhances product appeal and functionality. Industries such as food and beverages, pharmaceuticals, and consumer goods are particularly focused on developing packaging that aligns with brand identity and consumer expectations. As a result, companies are increasingly turning to contract packaging providers who can offer tailored solutions that meet specific needs in design, materials, and functionality. This growing demand for customization drives market expansion.

Technological Advancements in Packaging

Technological advancements in packaging play a significant role in propelling the growth of the Contract Packaging Market. Automation, robotics, and digital printing technologies are enhancing packaging efficiency and quality. These innovations enable packaging companies to meet the rising consumer demand for faster production cycles and improved product differentiation. The integration of smart packaging technologies, such as QR codes and RFID, is also gaining traction, offering consumers interactive experiences while improving supply chain management. These technological advancements are pivotal in shaping the future of the contract packaging industry.

- For instance, Nespresso achieved an order throughput of 625 orders per hour using ABB’s FlexPicker robotic system.

Shift Toward Sustainable and Eco-friendly Packaging

Sustainability has become a key driver in the Contract Packaging Market. With increased consumer awareness about environmental issues, there is a growing preference for eco-friendly packaging materials and solutions. Companies are now prioritizing the use of recyclable, biodegradable, and compostable materials in their packaging. As governments and regulatory bodies enforce stricter packaging waste regulations, businesses are more inclined to partner with contract packaging providers who specialize in sustainable packaging practices. This shift towards greener alternatives is fueling demand in the market.

- For instance, Eco Flexibles’ Northampton site investment totals 40,000 square feet with Jet Press FP790 as of 2024.

Growth of E-commerce and Direct-to-Consumer Deliveries

The rapid growth of e-commerce and direct-to-consumer (DTC) deliveries is another major driver of the Contract Packaging Market. As more consumers turn to online shopping, the need for efficient, secure, and cost-effective packaging solutions has intensified. Contract packaging providers are adapting to this demand by offering packaging that ensures product protection during transit while being lightweight and space-efficient. This trend is especially relevant in industries like cosmetics, food, and electronics, where packaging plays a critical role in maintaining product integrity during delivery.

Market Trends:

Shift Toward Automated and Smart Packaging Solutions

The Contract Packaging Market is increasingly moving toward automation and smart packaging solutions to enhance efficiency and reduce costs. Automation is revolutionizing packaging lines, enabling faster production rates and minimizing human error. Packaging machinery that can handle diverse product types and sizes allows companies to scale operations quickly and meet growing demand. Smart packaging technologies, such as QR codes and NFC chips, are becoming more popular for consumer interaction, product tracking, and authentication. This trend is driven by the need for improved operational efficiency, consumer engagement, and advanced supply chain management, particularly in industries like food and beverages, pharmaceuticals, and personal care.

- For example, Akuratemp’s smart temperature-controlled packaging, used in the healthcare industry, integrates IoT sensors for real-time thermal integrity and location monitoring, reliably maintaining sensitive payloads within strict temperature ranges for more than 48 hours during transit.

Rising Focus on Sustainable and Eco-friendly Materials

Sustainability remains a major trend shaping the Contract Packaging Market. With growing consumer demand for environmentally conscious products, brands are increasingly adopting eco-friendly materials in their packaging solutions. Recyclable, biodegradable, and compostable materials are in high demand as consumers prefer products that align with their values. Contract packaging companies are also exploring new technologies that reduce packaging waste and improve the environmental footprint of packaging materials. Governments and regulatory bodies worldwide are tightening laws around packaging waste management, further encouraging businesses to seek sustainable alternatives. This trend reflects the broader shift towards more responsible production practices and is expected to continue driving innovation within the market.

- For instance, the Coca-Cola Company introduced its first-ever 100% plant-based plastic bottle in 2024, with 900 bottles successfully produced during its test run, marking a significant move toward eliminating oil-based plastics in commercial packaging.

Market Challenges Analysis:

Supply Chain and Raw Material Challenges

The Contract Packaging Market faces significant challenges related to supply chain disruptions and the volatility of raw material prices. Companies often rely on a global network of suppliers for materials such as plastics, glass, and metals, which can be subject to fluctuations in availability and cost. These disruptions, exacerbated by global events or trade restrictions, can delay production timelines and increase operational costs. Packaging manufacturers must adapt to these uncertainties by maintaining flexible supply chains and seeking alternative sources for raw materials to ensure continuity and avoid production bottlenecks.

Regulatory Compliance and Sustainability Pressures

Regulatory compliance presents another challenge for the Contract Packaging Market, especially as governments enforce stricter environmental and waste management regulations. Packaging providers must invest in ensuring that their products meet various compliance standards, including those related to recycling and disposal. Navigating these complex regulations often requires significant adjustments in packaging materials, design, and production processes. As sustainability concerns grow, businesses face increasing pressure to balance eco-friendly packaging initiatives with cost-efficiency, which can sometimes hinder the ability to implement widespread changes quickly without impacting profitability.

Market Opportunities:

Expansion into Emerging Markets

The Contract Packaging Market presents significant opportunities for expansion into emerging markets. As economies in regions like Asia Pacific, Latin America, and the Middle East continue to grow, there is increasing demand for packaged products across industries such as food and beverages, cosmetics, and pharmaceuticals. This rise in consumer spending, combined with rapid urbanization, creates a fertile environment for contract packaging companies to offer tailored packaging solutions. Companies can leverage these markets by establishing local production facilities or forming strategic partnerships with regional players to expand their footprint and capture new market share.

Increasing Demand for Sustainable Packaging Solutions

Sustainability remains a key opportunity for growth in the Contract Packaging Market. With consumers and businesses alike becoming more environmentally conscious, there is a growing demand for sustainable packaging options. Packaging providers can capitalize on this by investing in eco-friendly materials and packaging designs that meet both consumer and regulatory expectations. Companies that can innovate with recyclable, biodegradable, or compostable materials are well-positioned to gain a competitive edge. By aligning with sustainability trends, contract packaging companies can attract eco-conscious brands and build long-term customer loyalty, particularly in industries that are heavily focused on environmental impact.

Market Segmentation Analysis:

By Material

The market is driven by a wide range of materials used in packaging, including plastics, paper, glass, and metals. Plastics dominate due to their versatility, cost-effectiveness, and suitability for various products. Paper and biodegradable materials are gaining popularity as consumer demand for eco-friendly packaging solutions increases. Glass and metal materials continue to serve premium and high-end product packaging segments, offering protection and aesthetic value.

By Packaging Type

Packaging types in the Contract Packaging Market include flexible, rigid, and semi-rigid packaging. Flexible packaging, such as pouches and bags, is widely used in the food and beverage sector for its convenience and cost-effectiveness. Rigid packaging, including bottles and containers, is prevalent in pharmaceuticals and consumer goods due to its durability. Semi-rigid packaging is gaining traction as it combines the benefits of both rigid and flexible packaging, offering convenience and protection.

- For example, Graphic Packaging International’s mono-plastic PE and PET pouches are now engineered for full recycling compatibility, with proprietary lidding films optimized for automated tray-sealing lines—at speeds up to 450 packages/minute.

By End-Use

The market caters to various industries such as food and beverages, pharmaceuticals, cosmetics, and consumer goods. The food and beverage industry is a significant segment due to the increasing demand for packaged products. Pharmaceuticals rely heavily on contract packaging to meet regulatory standards and ensure product safety. The cosmetics industry is embracing innovative packaging solutions to attract consumers, while the consumer goods sector continues to demand efficient and cost-effective packaging options.

- For instance, Metro Supply Chain’s Contract Packaging division managed more than 355 million consumer pharmaceutical units in 2024, showcasing the operational scale achieved through AI-driven automation in the packaging process.

Segmentations:

By Material

- Plastics

- Paper

- Glass

- Metals

- Biodegradable Materials

By Packaging Type

- Flexible Packaging

- Rigid Packaging

- Semi-Rigid Packaging

By End-Use

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Consumer Goods

- Household Products

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Established Market with Robust Demand

North America holds a dominant share of 35% in the Contract Packaging Market, driven by a well-established infrastructure and high demand for packaging services. The U.S. and Canada, with their advanced manufacturing capabilities, continue to lead the market, providing a solid base for contract packaging providers. Companies in this region focus on technological innovations and sustainability initiatives, adapting packaging solutions to meet consumer preferences and regulatory demands. The high concentration of major packaging players further strengthens North America’s market position.

Europe: Strong Growth in Eco-friendly Packaging

Europe holds a market share of 28% in the Contract Packaging Market, largely due to the increasing demand for sustainable and eco-friendly packaging solutions. European countries are at the forefront of adopting green packaging alternatives, driven by both consumer demand and stringent environmental regulations. The region’s well-developed manufacturing infrastructure supports the widespread adoption of innovative packaging technologies. Countries like Germany, France, and the UK are major players in driving demand for contract packaging services, particularly within the food, beverage, and pharmaceutical industries. The rise of e-commerce also contributes to the demand for efficient, secure packaging solutions in Europe.

Asia Pacific: High Growth Potential

Asia Pacific commands a growing market share of 25% in the Contract Packaging Market, driven by rapid industrialization, urbanization, and rising consumer demand. Key markets such as China, India, and Japan offer substantial opportunities for contract packaging companies, particularly in the food, beverage, and electronics sectors. The growing middle class, combined with increasing disposable incomes, is fueling the demand for packaged goods. E-commerce growth in this region further drives the need for innovative and cost-effective packaging solutions. As local manufacturers increasingly turn to third-party packaging providers, the market is poised for continued expansion in Asia Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sepha

- Peoria Production Solutions

- MDI

- WestRock Company

- Co-Pak

- Vynx Private Limited

- Jonco Industries

- Jam Jams Group

- ProStar

- Packservice Group

- ActionPak

- Hollingsworth

Competitive Analysis:

The Contract Packaging Market is highly competitive, characterized by the presence of both large multinational corporations and regional players. Major companies like Amcor plc, Sonoco Products Company, and WestRock Company lead the market through extensive service portfolios, innovation, and strong supply chain networks. These players invest in technology to enhance packaging efficiency, such as automation and smart packaging solutions, while also focusing on sustainable and eco-friendly materials to meet regulatory demands and consumer expectations. Regional companies like Smurfit Kappa Group and Berry Global differentiate themselves by offering specialized solutions for local industries, creating a diverse market landscape. Smaller firms focus on niche markets, often providing highly customized or cost-effective packaging options. The competitive dynamics of the Contract Packaging Market are driven by strategic partnerships, mergers and acquisitions, and continuous efforts toward product differentiation, sustainability, and operational efficiency.

Recent Developments:

- In July 2025, Westrock Coffee Company, part of WestRock, opened a new state-of-the-art manufacturing facility in Conway, Arkansas, aimed at meeting the growing demand for single-serve coffee products.

- In February 2025, The National Bankers Association released the 2025 MDI Leaders Report, revealing a focus on enhancing customer service technologies, expanding branch networks, and advancements in digital banking, such as digital account openings and real-time payments.

- In January 2023, Hollingsworth & Vose announced an investment of $40.2 million to expand its advanced materials manufacturing facility in Floyd County, Virginia, adding more than 28,000 square feet and creating 25 jobs.

Market Concentration & Characteristics:

The Contract Packaging Market exhibits moderate concentration, with a few large players dominating the industry, including companies like Amcor plc, WestRock Company, and Sonoco Products. These market leaders command a significant share through their established manufacturing capabilities, extensive distribution networks, and diverse packaging solutions. The market is characterized by high competition, driven by the increasing demand for custom and sustainable packaging across various sectors. Companies are focusing on innovation, sustainability, and efficiency to differentiate their offerings and meet evolving consumer preferences. The industry also has a large number of smaller regional players, which contribute to the market’s fragmented nature. These companies often cater to niche markets or offer specialized packaging services, enhancing market diversity and creating opportunities for growth. The Contract Packaging Market is dynamic, with evolving consumer needs and technological advancements continually shaping its characteristics.

Report Coverage:

The research report offers an in-depth analysis based on Material, Packaging Type, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- There is a growing demand for customized packaging solutions across various industries, including food and beverages, pharmaceuticals, and consumer goods.

- Technological advancements in packaging materials and processes are enhancing efficiency and product appeal.

- The shift towards sustainable and eco-friendly packaging materials is gaining momentum, influenced by consumer preferences and regulatory pressures.

- The rise of e-commerce and direct-to-consumer delivery models is increasing the need for efficient and protective packaging solutions.

- North America continues to dominate the market, driven by established infrastructure and high demand for contract packaging services.

- The Asia Pacific region is experiencing rapid growth, fueled by industrialization and increasing consumer demand in emerging economies.

- Companies are focusing on automation and smart packaging technologies to improve operational efficiency and meet consumer expectations.

- Regulatory compliance and sustainability pressures are encouraging businesses to adopt environmentally friendly packaging practices.

- The market is witnessing consolidation, with mergers and acquisitions shaping the competitive landscape.

- Emerging markets present new opportunities for growth, particularly in regions with expanding middle-class populations and increasing disposable incomes.