Market Overview:

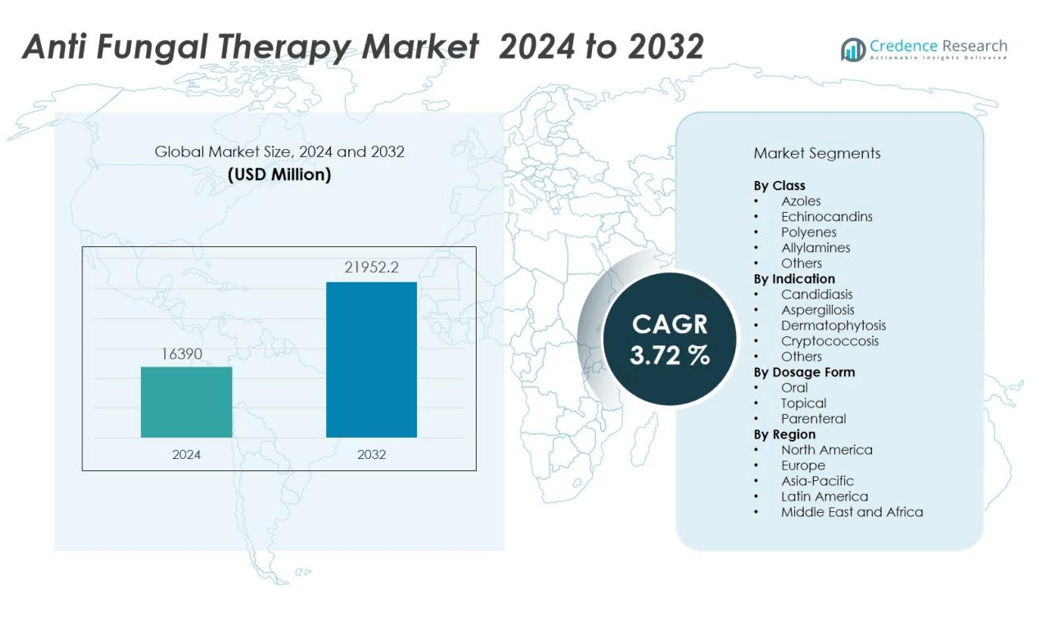

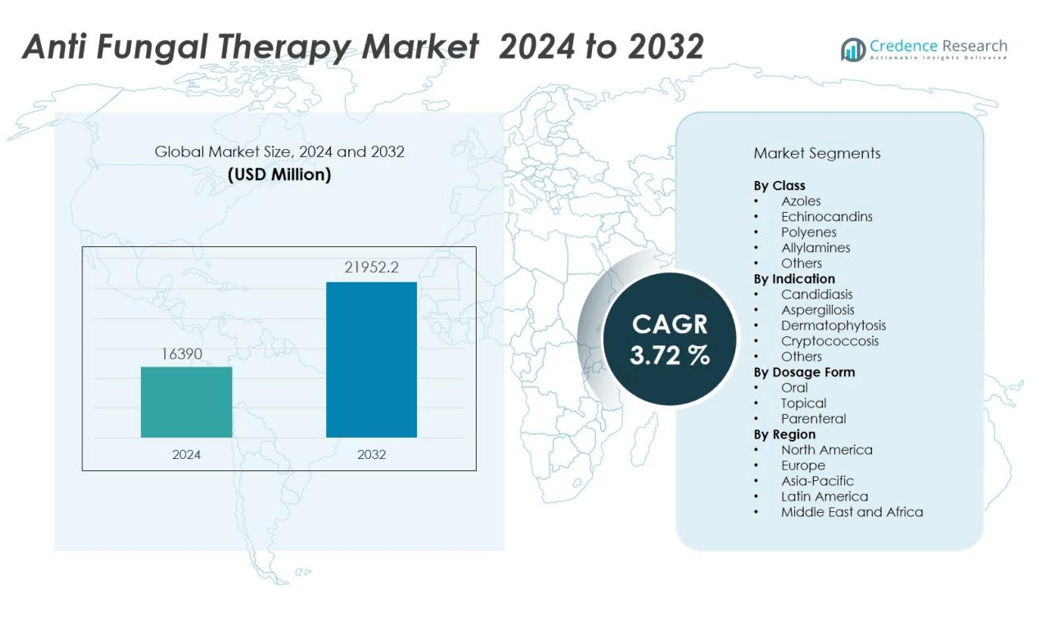

The anti fungal therapy market size was valued at USD 16390 million in 2024 and is anticipated to reach USD 21952.2 million by 2032, at a CAGR of 3.72 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-Fungal Therapy Market Size 2024 |

USD 16390 million |

| Anti-Fungal Therapy Market, CAGR |

3.72% |

| Anti-Fungal Therapy Market Size 2032 |

USD 21952.2 million |

Key drivers fueling the anti-fungal therapy market include rising prevalence of chronic diseases such as diabetes, cancer, and HIV/AIDS, which increase susceptibility to opportunistic fungal infections. The widespread use of immunosuppressive therapies and invasive surgical procedures has contributed to a higher burden of hospital-acquired fungal infections. Market participants are prioritizing the development of novel antifungal agents with improved efficacy, reduced toxicity, and broader activity spectrum to address growing resistance to existing therapies. Increased investment in R&D and regulatory approvals of innovative drugs further accelerate market expansion, while public health initiatives and awareness campaigns drive early diagnosis and prompt treatment adoption.

North America holds the largest share of the anti-fungal therapy market, supported by advanced healthcare infrastructure, high patient awareness, robust reimbursement frameworks, and the presence of leading companies such as Bayer AG, GSK plc, Sanofi, Novartis AG, Astellas Pharma, Inc., and Pfizer, Inc. The United States leads with strong pharmaceutical manufacturing and clinical research capabilities. Europe follows, driven by strict infection control standards and an increasing prevalence of invasive fungal diseases. Asia Pacific shows the fastest growth due to rising healthcare access, increasing cases of fungal infections, and investments in hospital infrastructure across China, India, and Southeast Asia. Latin America and the Middle East & Africa see steady growth, supported by better diagnostics and growing awareness of antifungal therapies.

Market Insights:

- The anti fungal therapy market was valued at USD 16,390 million in 2024 and is projected to reach USD 21,952.2 million by 2032 at a CAGR of 3.72%.

- Rising prevalence of chronic diseases and immunosuppressive therapies increases susceptibility to opportunistic fungal infections globally.

- Increasing antifungal resistance drives pharmaceutical companies to invest in next-generation therapies with broader activity and improved safety profiles.

- Advances in diagnostics, including PCR and next-generation sequencing, enable earlier detection and more effective treatment of fungal infections.

- Government initiatives and public health campaigns promote early diagnosis, education, and expanded access to antifungal medicines.

- North America leads the market with a 35% share, supported by advanced healthcare infrastructure and the presence of major pharmaceutical companies.

- Asia Pacific shows the fastest growth rate, fueled by increased healthcare spending, rising incidence of fungal infections, and expanding diagnostic capabilities across China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Prevalence of Fungal Infections and Vulnerable Patient Populations:

The anti fungal therapy market witnesses significant growth due to the rising prevalence of superficial and invasive fungal infections worldwide. Increased occurrence of chronic diseases, such as diabetes and cancer, elevates the risk of opportunistic infections among patients. Immunocompromised populations, including organ transplant recipients and individuals living with HIV/AIDS, require timely and effective antifungal treatments. The global burden of hospital-acquired fungal infections continues to increase, driving greater demand for reliable and efficient therapeutic options. Fungal outbreaks in community and healthcare settings further reinforce the need for advanced antifungal agents. Market participants focus on product innovation to address these rising clinical challenges.

Growing Antifungal Resistance Necessitates New Drug Development:

The anti fungal therapy market faces persistent challenges from emerging antifungal resistance among common pathogens, including Candida and Aspergillus species. It prompts pharmaceutical manufacturers and research organizations to accelerate the development of next-generation antifungal agents with novel mechanisms of action. R&D efforts now emphasize improving efficacy, safety, and broad-spectrum activity, ensuring that new therapies can overcome limitations of current treatment options. Rising regulatory approvals for innovative formulations and combination therapies expand market offerings. Investment in clinical trials and collaborations with academic institutions supports a robust pipeline of antifungal drugs, strengthening long-term market growth.

- For instance, Olorofim (F901318), developed by F2G Ltd., is the first in a new class called orotomides and exhibited a favorable safety profile with an overall success rate of 28.7% at day 42 in a Phase 2b open-label study for rare mold infections, with trials ongoing for further indications.

Advancements in Diagnostics and Early Detection Improve Treatment Outcomes:

The anti fungal therapy market benefits from technological progress in diagnostics, allowing for more accurate and timely detection of fungal pathogens. Modern diagnostic tools, including PCR assays and next-generation sequencing, enable clinicians to identify infections at an early stage. Rapid and precise diagnosis improves patient outcomes and reduces the risk of treatment failure. Healthcare providers increasingly adopt these tools, which directly supports prompt initiation of appropriate antifungal therapy. It drives the integration of advanced diagnostics with antifungal stewardship programs, enhancing overall disease management strategies.

Government Initiatives and Public Health Awareness Fuel Market Expansion:

The anti fungal therapy market grows through government-sponsored health initiatives that target early diagnosis, patient education, and prevention of fungal infections. Public health agencies and global organizations launch awareness campaigns that highlight risk factors, symptoms, and treatment options. Healthcare systems prioritize training for medical staff on best practices for antifungal use and infection control. These coordinated efforts support earlier intervention and increase uptake of antifungal therapies across hospitals and community health centers. Rising funding for healthcare infrastructure and expanded access to medicines further strengthen the market’s foundation for sustainable growth.

- For instance, Bayer’s Canesten® campaign in India reached over 30million consumers with targeted public health messaging, and a study found that 94% of surveyed Indian women aged 20–35 experienced a fungal skin infection at least once in the year, prompting 50% to use ineffective solutions—Canesten®’s intervention drove a substantial educational shift toward evidence-based treatment.

Market Trends:

Introduction of Novel Drug Classes and Formulations Accelerates Innovation:

The anti fungal therapy market is witnessing strong momentum from the introduction of novel drug classes and innovative formulations that address limitations of traditional therapies. Pharmaceutical companies invest in the development of next-generation antifungal agents, including triazoles, echinocandins, and polyenes, with enhanced safety profiles and efficacy against drug-resistant strains. Topical, oral, and intravenous formulations tailored for specific clinical needs offer patients and physicians expanded treatment choices. Liposomal and nanoparticle-based delivery systems improve drug bioavailability and minimize toxicity, advancing patient outcomes. Companies also explore combination therapies to overcome resistance and provide comprehensive coverage against a broad spectrum of pathogens. This continuous innovation supports market differentiation and meets growing clinical demands.

- For instance, in a single-arm Phase 2 study, the novel antifungal ibrexafungerp (Scynexis) achieved clinical cure rates of 52% for acute vulvovaginal candidiasis at day 10, and complete resolution of symptoms in 63% at day 25 in moderate to severe cases (studied in 186 women).

Integration of Digital Health and Telemedicine Strengthens Access and Adherence:

The anti fungal therapy market benefits from rapid integration of digital health solutions, telemedicine platforms, and remote monitoring technologies. Healthcare providers use digital tools to track patient adherence, monitor therapeutic outcomes, and deliver timely intervention in case of adverse effects or therapy adjustments. Telemedicine expands patient access to antifungal specialists, especially in remote or underserved regions, ensuring prompt diagnosis and treatment initiation. Mobile health applications and digital prescriptions simplify medication management for patients, leading to better adherence and reduced relapse rates. It encourages pharmaceutical firms and healthcare systems to invest in digital infrastructure, strengthening patient engagement and optimizing clinical workflows in antifungal care.

- For instance, the MicroGuide™ app, adopted in over 100 NHS Trusts in the UK, offers real-time, guideline-based antifungal prescribing recommendations and has demonstrated that 71% of direct-to-consumer telehealth visits adhered to evidence-based stewardship guidelines, surpassing traditional urgent care rates.

Market Challenges Analysis:

Escalating Antifungal Resistance and Limited Treatment Options Hamper Progress:

The anti fungal therapy market faces serious challenges from escalating antifungal resistance among common pathogenic species. Widespread use of existing antifungal agents in both healthcare and agriculture has contributed to the emergence of resistant strains. It narrows the spectrum of effective therapies, complicates clinical management, and leads to higher rates of treatment failure. Pharmaceutical pipelines for new antifungal drugs remain limited compared to antibiotics, slowing the introduction of novel options. Patients with resistant infections experience longer hospital stays and higher healthcare costs, pressuring health systems globally. The urgent need for innovative, broad-spectrum therapies persists across all regions.

Regulatory Hurdles and Diagnostic Delays Impede Timely Treatment:

The anti fungal therapy market encounters regulatory hurdles that delay drug approvals and increase time to market for new therapies. Complex clinical trial requirements and stringent safety standards extend development timelines, limiting patient access to the latest treatments. Diagnostic delays further exacerbate challenges, as early detection of invasive fungal infections remains difficult in many healthcare settings. Limited access to advanced diagnostic tools in low- and middle-income regions hampers prompt intervention and effective disease management. It emphasizes the need for investment in faster diagnostics and streamlined regulatory pathways to accelerate progress in antifungal care.

Market Opportunities:

Expansion of Innovative Therapeutics and Targeted Drug Delivery Solutions:

The anti fungal therapy market offers significant opportunities through the development of innovative therapeutics and targeted drug delivery systems. Pharmaceutical companies are investing in the discovery of new antifungal agents with unique mechanisms of action, addressing the limitations of current treatments. Liposomal, nanoparticle, and biodegradable polymer-based delivery platforms can enhance drug efficacy while reducing systemic toxicity. Targeted therapies tailored to specific patient groups, including immunocompromised individuals, open new avenues for market growth. It supports the introduction of combination therapies that maximize effectiveness against resistant fungal strains. Collaborations between academia and industry can accelerate breakthroughs in antifungal research and commercialization.

Rising Demand in Emerging Markets and Expansion of Diagnostic Infrastructure:

The anti fungal therapy market holds strong growth potential in emerging economies where the burden of fungal infections is rising. Expanding healthcare infrastructure and increased government funding drive better access to antifungal treatments across Asia Pacific, Latin America, and Africa. Investments in diagnostic laboratories and point-of-care testing improve early detection rates and support rapid initiation of therapy. Pharmaceutical companies can benefit from strategic partnerships with local stakeholders to expand market presence and reach underserved populations. It encourages wider adoption of advanced diagnostics and novel antifungal therapies, supporting sustainable market expansion in high-need regions.

Market Segmentation Analysis:

By Class:

The anti fungal therapy market is segmented by drug class into azoles, echinocandins, polyenes, allylamines, and others. Azoles hold the largest share due to their broad-spectrum activity and established safety profiles in treating both superficial and systemic infections. Echinocandins continue to gain traction for severe, invasive fungal diseases, especially among immunocompromised patients, while polyenes are reserved for refractory cases due to potential toxicity. Allylamines mainly address dermatophytic infections and benefit from rising over-the-counter demand.\

- For instance, a 2024 analysis of 1,879 medical records found the median duration of amphotericin B treatment was 14 days, with a 65% overall success rate for severe fungal infections.

By Indication:

Segmenting the anti fungal therapy market by indication highlights strong demand for therapies targeting candidiasis, aspergillosis, dermatophytosis, cryptococcosis, and other rare mycoses. Candidiasis leads with the highest treatment volumes, reflecting its prevalence in hospital and community settings. Rising incidence of aspergillosis and cryptococcosis among immunocompromised individuals fuels the need for specialized therapies. Dermatophytosis remains widespread, supporting sustained growth in topical antifungal sales.

- For instance, in hospitalized patients with hematologic malignancies, the incidence of invasive aspergillosis can be as high as 1.6 per 1,000 patient-days, highlighting the demand for novel azole antifungals and improved diagnostic technology.

By Dosage Form:

The anti fungal therapy market is categorized by dosage form into oral, topical, and parenteral formulations. Oral therapies remain the most preferred option for both convenience and efficacy across multiple indications. Topical agents serve frontline management for superficial infections, driving strong retail segment performance. Parenteral antifungals address critical care and hospital-based needs, especially for life-threatening invasive infections, ensuring comprehensive therapeutic coverage.

Segmentations:

By Class:

- Azoles

- Echinocandins

- Polyenes

- Allylamines

- Others

By Indication:

- Candidiasis

- Aspergillosis

- Dermatophytosis

- Cryptococcosis

- Others

By Dosage Form:

By Regions:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America accounts for 35% market share in the anti fungal therapy market, with the United States leading regional performance. The region benefits from robust healthcare infrastructure, high patient awareness, and rapid adoption of innovative antifungal therapies. Strong presence of global pharmaceutical companies and active clinical research networks supports a dynamic product pipeline. Healthcare providers prioritize early diagnosis and evidence-based treatment, driving continuous demand for both branded and generic antifungal agents. Reimbursement policies and access to advanced diagnostic tools further reinforce North America’s leadership in the global landscape. It consistently attracts major investments from leading market participants seeking to expand their antifungal portfolios.

Europe :

Europe secures a 28% market share in the anti fungal therapy market, led by Germany, the United Kingdom, and France. The region enforces rigorous infection control standards and monitors antifungal resistance trends through coordinated health authorities. Public health campaigns and structured reimbursement systems facilitate timely access to essential therapies for diverse patient groups. Research collaborations with academic institutions support a steady flow of clinical data and new product launches. Expanding diagnostic infrastructure and well-established hospital networks enable earlier identification and management of invasive fungal diseases. It enables European markets to achieve strong patient outcomes and high treatment uptake.

Asia Pacific :

Asia Pacific posts the fastest CAGR in the anti fungal therapy market, driven by rising incidence of fungal infections and government investments in healthcare infrastructure. China, India, and Japan act as primary contributors, supported by growing middle-class populations and increased healthcare spending. The region experiences rapid expansion of diagnostic laboratories and wider access to advanced antifungal agents. Pharmaceutical manufacturers focus on strategic partnerships to reach underserved populations and adapt product portfolios to local needs. It presents substantial opportunities for both global and regional players targeting future market expansion. Strong momentum in Asia Pacific continues to reshape the competitive landscape and accelerate innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bayer AG

- GSK plc

- Sanofi

- Novartis AG

- Astellas Pharma, Inc.

- Pfizer, Inc.

- Merck & Co., Inc.

- Abbott

- Enzon Pharmaceuticals, Inc.

- Glenmark

Competitive Analysis:

The anti fungal therapy market features intense competition among leading global pharmaceutical companies, including Bayer AG, GSK plc, Sanofi, Novartis AG, Astellas Pharma, Inc., and Pfizer, Inc. It demonstrates a dynamic landscape shaped by robust R&D pipelines, frequent product launches, and a focus on novel mechanisms of action. Companies invest in developing therapies with improved efficacy and safety to address rising antifungal resistance and unmet clinical needs. Strategic collaborations and licensing agreements expand product portfolios and accelerate market access. Market leaders maintain a strong presence through established distribution networks and broad therapeutic offerings. The competitive environment encourages continuous innovation and drives high standards for product quality, regulatory compliance, and clinical effectiveness.

Recent Developments:

- In January 2025, Bayer AG: Bayer acquired the camelina assets and intellectual property from Smart Earth Camelina Corp. to expand into biomass-based feedstock for renewable fuels.

- In July 2025, GSK completed its acquisition of efimosfermin alfa from Boston Pharmaceuticals for up to $2 billion, expanding its pipeline for specialty liver and fibro-inflammatory diseases.

- In May 2025, Sanofi agreed to acquire Vigil Neuroscience, Inc., adding a new Alzheimer’s disease investigational medicine to its neurology pipeline and reinforcing its strategic focus on neurodegenerative diseases.

Market Concentration & Characteristics:

The anti fungal therapy market demonstrates moderate concentration, with a mix of established multinational pharmaceutical companies and specialized biotechnology firms driving innovation and competition. It features a diverse portfolio of branded and generic products, including topical, oral, and intravenous formulations tailored to various clinical needs. Leading players such as Pfizer, Merck & Co., Astellas Pharma, and Gilead Sciences maintain significant market influence through strong R&D pipelines and strategic collaborations. Barriers to entry remain high due to complex regulatory requirements and the need for robust clinical data. The market continues to evolve with a focus on novel mechanisms of action, improved safety profiles, and expanded indications to address the growing challenge of antifungal resistance.

Report Coverage:

The research report offers an in-depth analysis based on Class, Indication, Dosage Form and Regions. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Global demand grows due to rising prevalence of fungal infections among immunocompromised individuals.

- Pharmaceutical firms accelerate development of novel antifungal agents targeting resistant strains.

- Liposomal and nanoparticle-based drug delivery platforms gain traction to enhance efficacy and reduce toxicity.

- Combination therapies with synergistic mechanisms expand treatment options for invasive infections.

- Rapid diagnostic technologies, including PCR assays and next-generation sequencing, integrate into clinical workflows.

- Telemedicine and digital health tools drive improved patient adherence and remote monitoring.

- Emerging markets in Asia Pacific, Latin America, and Africa offer substantial opportunity through expanding healthcare infrastructure.

- Academic‑industry collaborations increase in scope to support faster commercialization of antifungal innovations.

- Health authorities streamline regulatory pathways to support accelerated approval of new therapies.

- Investment in public health programs and diagnostic capacity strengthens trial recruitment and treatment access.