Market Overview

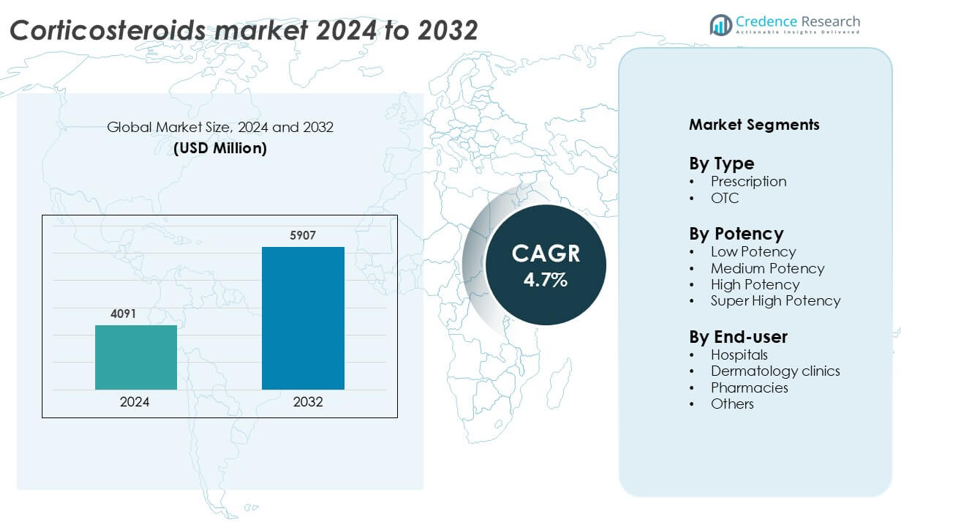

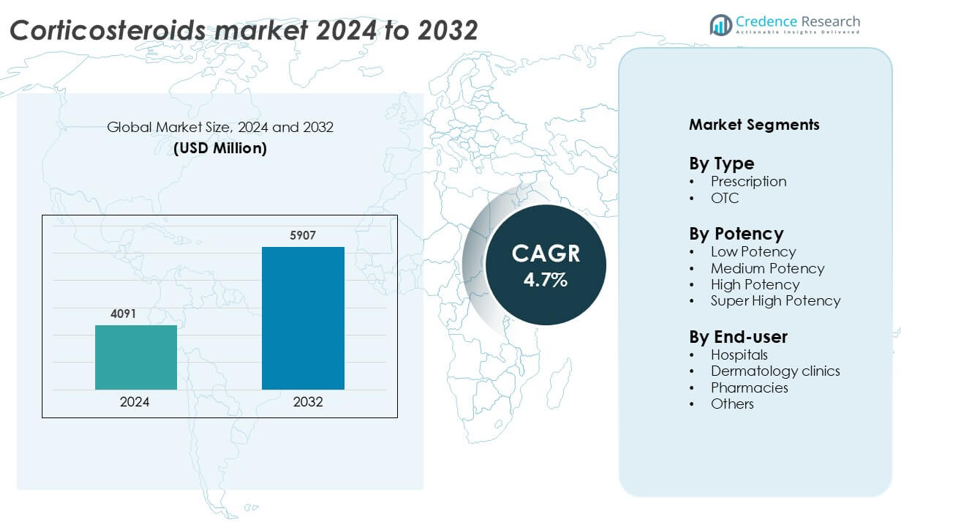

Corticosteroids Market was valued at USD 4091million in 2024 and is anticipated to reach USD 5907 million by 2032, growing at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Corticosteroids Market Size 2024 |

USD 4091 million |

| Corticosteroids Market, CAGR |

4.7% |

| Corticosteroids Market Size 2032 |

USD 5907 million |

The corticosteroids market is dominated by leading pharmaceutical companies such as AbbVie Inc., AstraZeneca Plc, Bayer AG, GlaxoSmithKline Plc, Eli Lilly and Co., Cipla Inc., Dr. Reddy’s Laboratories Ltd., Astellas Pharma Inc., Bausch Health Companies Inc., and Galderma SA. These firms focus on innovation in inhaled and topical corticosteroid formulations, advanced delivery systems, and strategic partnerships to expand therapeutic applications. North America leads the global market with a 37% share, supported by robust healthcare infrastructure, strong regulatory frameworks, and widespread adoption of corticosteroids for chronic inflammatory and autoimmune disease management across the U.S. and Canada.

Market Insights

- The global corticosteroids market was valued at USD 4091 million in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2032.

- Rising cases of chronic inflammatory and autoimmune disorders such as asthma, arthritis, and psoriasis are driving corticosteroid demand across both prescription and OTC segments.

- Market trends highlight growing adoption of inhaled and topical corticosteroids, supported by advanced drug delivery systems and combination therapies for improved efficacy.

- The competitive landscape features key players like AbbVie Inc., AstraZeneca Plc, Bayer AG, GlaxoSmithKline Plc, and Cipla Inc., focusing on innovation and global expansion.

- North America leads the market with a 37% regional share, while the prescription segment dominates with 78% share; Asia-Pacific is emerging as the fastest-growing region driven by increasing healthcare investments and rising awareness of chronic disease management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The prescription segment dominates the corticosteroids market with a 78% share in 2024. This dominance is driven by the rising prevalence of chronic inflammatory and autoimmune disorders such as asthma, arthritis, and eczema that require medical supervision. Physicians prefer prescription corticosteroids for their controlled dosage and monitored administration, ensuring treatment safety and efficacy. Additionally, stringent regulatory policies and the risk of side effects associated with long-term corticosteroid use further reinforce the preference for prescribed formulations over over-the-counter (OTC) products.

- For instance, in the treatment of asthma, inhaled corticosteroids like fluticasone propionate are prescribed at 100–264 micrograms per day in adults via dry-powder inhaler for maintenance therapy.

By Potency

High-potency corticosteroids lead the market with a 41% share, driven by their effectiveness in managing severe inflammatory skin conditions, allergic reactions, and autoimmune diseases. These formulations offer rapid symptom relief and shorter treatment durations, making them the preferred choice among dermatologists and healthcare providers. The availability of advanced high-potency topical formulations and injectables, coupled with innovations in drug delivery systems, continues to expand their clinical adoption. Increasing patient demand for fast-acting therapies also supports the strong market position of this sub-segment.

- For instance, GlaxoSmithKline Plc developed clobetasol propionate 0.05% cream a Class I ultra-high potency topical corticosteroid whose usage guidelines limit treatment to 50 g per week for up to 4 weeks.

By End-User

Hospitals account for the largest market share at 46%, supported by their role in providing specialized care and access to advanced corticosteroid therapies. Hospitals are primary treatment centers for patients requiring systemic administration and close monitoring of corticosteroid effects. The availability of multidisciplinary medical teams and high patient admission rates further strengthen their dominance. Growing adoption of corticosteroids for inpatient treatments, post-surgical inflammation, and emergency care also contributes to the hospital segment’s leadership in the overall market.

Key Growth Drivers

Rising Incidence of Chronic and Autoimmune Disorders

The global rise in chronic and autoimmune conditions such as asthma, rheumatoid arthritis, inflammatory bowel disease, and eczema continues to drive corticosteroid demand. These drugs are vital in managing inflammation and immune response, making them a mainstay in long-term treatment plans. The increasing geriatric population—more susceptible to chronic illnesses—further amplifies consumption rates. Pharmaceutical companies are expanding their corticosteroid portfolios to meet growing clinical needs across systemic and topical formulations. Enhanced awareness among healthcare professionals about early disease intervention also boosts prescription rates, consolidating corticosteroids as a cornerstone therapy in chronic disease management.

- For instance, AbbVie Inc. reported that its research and-development pipeline includes 50 programmes in mid- and late-stage development and more than 375 clinical trials across over 50 countries, underscoring its expanding focus on autoimmune therapies.

Technological Advancements in Drug Delivery Systems

Advancements in delivery technologies have revolutionized corticosteroid effectiveness and patient safety. Innovations such as metered-dose inhalers, transdermal patches, liposomal formulations, and nasal sprays enable targeted delivery with reduced systemic side effects. Inhaled corticosteroids like budesonide and fluticasone dominate asthma and COPD therapies for their localized action. Controlled-release and nanoparticle-based formulations enhance bioavailability and prolong drug efficacy. Companies are integrating advanced formulation technologies to improve patient adherence and minimize dosage frequency. These advancements support a shift toward more precise, efficient, and patient-friendly corticosteroid treatments globally.

- For instance, GlaxoSmithKline Plc’s Flixotide Inhaler delivers fluticasone propionate at either 50 µg, 125 µg or 250 µg per actuation via a metered-dose inhaler with 120 actuations per canister.

Expanding Over-the-Counter (OTC) Accessibility

The increasing availability of OTC corticosteroid products is creating significant growth potential. Consumers are increasingly turning to low-dose corticosteroid creams, ointments, and nasal sprays for minor allergic and dermatological conditions. Regulatory approvals for OTC formulations with proven safety profiles encourage broader market penetration. Retail and online pharmacy expansion has also made these products more accessible, particularly in emerging economies. Pharmaceutical manufacturers are focusing on developing safer, user-friendly, and affordable OTC variants to capture self-medication trends. This transition enhances consumer convenience and strengthens brand presence in both developed and developing regions.

Key Trends & Opportunities

Shift Toward Topical and Inhaled Formulations

The corticosteroids market is experiencing a growing shift toward topical and inhaled therapies due to their targeted action and fewer systemic effects. Topical formulations, including creams, gels, and foams, are increasingly used for skin conditions such as psoriasis and eczema, while inhaled corticosteroids are preferred for respiratory disorders. These routes offer faster relief and greater patient compliance. The trend aligns with rising demand for personalized medicine and advanced delivery mechanisms. Companies are investing in innovative formulations with improved absorption and reduced adverse effects to meet evolving clinical and patient needs.

- For instance, Galderma SA’s Clobex Spray (clobetasol propionate 0.05 %) comes in a 50 g bottle and instructs a maximum weekly dosage of 50 mL for up to 4 weeks.

Integration of Digital Health and Remote Monitoring Tools

Digital health technologies are emerging as valuable enablers in corticosteroid therapy management. Smart inhalers and connected devices help track patient adherence and optimize dosage accuracy in asthma and COPD treatments. Integration with mobile health applications and AI-driven monitoring platforms enables real-time feedback and improved treatment outcomes. Pharmaceutical companies are collaborating with health-tech providers to enhance patient engagement and ensure compliance. This trend not only supports better disease control but also opens new revenue streams through digital therapeutics and data-driven healthcare services.

- For instance, Adherium Limited’s Hailie® sensor received U.S. FDA 510(k) clearance and expanded its coverage from 71 medications to 91 of the top 20 branded inhaler therapies while upgrading physiological-parameter monitoring from 11 % to 32 % of that range. Integration with mobile health applications and AI-driven monitoring platforms enables real-time feedback and improved treatment outcomes.

Key Challenges

Adverse Effects and Long-Term Safety Concerns

Corticosteroids are associated with several adverse effects, including osteoporosis, hypertension, weight gain, and immunosuppression, especially during prolonged use. These side effects limit prescription frequency and duration, prompting physicians to explore alternative or combination therapies. Patient hesitation regarding long-term use further restricts market expansion. Regulatory authorities emphasize stringent usage guidelines to minimize health risks. Addressing safety concerns through advanced formulation technologies and low-dose therapies remains a top priority for manufacturers to sustain market growth while maintaining clinical trust.

Stringent Regulatory Framework and Approval Delays

Corticosteroids face rigorous regulatory scrutiny due to their potent pharmacological effects and safety concerns. New formulations and delivery systems undergo extensive testing and clinical evaluation before approval, often leading to lengthy development cycles and high compliance costs. Frequent changes in international regulatory standards further complicate product registration and market entry. Smaller pharmaceutical firms struggle to meet these complex requirements, limiting innovation and global competitiveness. Streamlining approval processes and harmonizing standards across regions could ease regulatory challenges and accelerate product commercialization.

Regional Analysis

North America

North America leads the global corticosteroids market with a 37% share, driven by high disease prevalence and advanced healthcare infrastructure. The U.S. dominates regional growth due to strong pharmaceutical research, widespread use of inhaled and topical corticosteroids, and favorable reimbursement systems. The region’s focus on chronic disease management and continuous drug innovation supports sustained demand. Strategic collaborations between healthcare providers and pharmaceutical companies further enhance market penetration. Growing adoption of self-administered formulations and increased awareness of asthma and autoimmune diseases continue to strengthen North America’s leadership in the corticosteroids market.

Europe

Europe holds a 29% share of the corticosteroids market, supported by strong regulatory frameworks and established healthcare systems. The United Kingdom, Germany, and France drive regional demand with high prescription rates for respiratory and dermatological disorders. Rising healthcare expenditure and an aging population contribute to sustained market growth. The presence of leading pharmaceutical companies and increasing adoption of advanced topical formulations strengthen the region’s position. Government initiatives promoting effective treatment access and ongoing research into corticosteroid safety and delivery innovation are expected to maintain Europe’s steady market expansion.

Asia-Pacific

Asia-Pacific accounts for a 23% market share and represents the fastest-growing region in the corticosteroids market. Rapid urbanization, increasing healthcare investments, and rising incidence of asthma, arthritis, and eczema drive demand. Countries like China, India, and Japan are expanding domestic drug manufacturing and enhancing access to affordable corticosteroid therapies. Growing awareness of respiratory and skin conditions, coupled with government healthcare reforms, supports market growth. Expanding retail pharmacy networks and rising acceptance of OTC corticosteroids further accelerate regional adoption, positioning Asia-Pacific as a key growth hub for corticosteroid manufacturers.

Latin America

Latin America captures a 7% share of the corticosteroids market, led by Brazil and Mexico. Rising prevalence of chronic respiratory diseases and increased access to healthcare facilities are key drivers. Expanding pharmaceutical distribution networks and growing acceptance of generic corticosteroids promote market penetration. Governments are emphasizing affordable medication access, encouraging both public and private sector investments in drug manufacturing. However, economic instability and inconsistent regulatory frameworks limit faster adoption. Despite these challenges, urbanization and growing patient awareness are expected to sustain moderate market growth across Latin American countries.

Middle East & Africa

The Middle East & Africa region holds a 4% share of the corticosteroids market, driven by increasing healthcare infrastructure development and rising diagnosis rates of inflammatory disorders. Gulf Cooperation Council (GCC) countries lead regional demand due to improving hospital networks and expanding pharmaceutical imports. Governments are investing in modern treatment facilities and promoting chronic disease management programs. However, limited awareness in low-income regions and high drug costs restrict broader adoption. Despite these barriers, ongoing healthcare modernization and partnerships with global pharmaceutical firms support gradual corticosteroid market growth in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

By Potency

- Low Potency

- Medium Potency

- High Potency

- Super High Potency

By End-user

- Hospitals

- Dermatology clinics

- Pharmacies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The corticosteroids market is highly competitive, characterized by the presence of global pharmaceutical leaders focusing on innovation, product expansion, and strategic collaborations. Key players such as AbbVie Inc., AstraZeneca Plc, Bayer AG, GlaxoSmithKline Plc, and Eli Lilly and Co. dominate through extensive research pipelines and diversified product portfolios covering inhaled, topical, and systemic formulations. Companies like Cipla Inc. and Dr. Reddy’s Laboratories Ltd. strengthen market accessibility through cost-effective generic alternatives, particularly in emerging regions. Major firms emphasize developing advanced delivery systems such as inhalers, nasal sprays, and transdermal patches—to enhance efficacy and patient compliance. Strategic alliances, mergers, and acquisitions further shape market consolidation, enabling global players to strengthen distribution networks and expand geographic reach. Continuous R&D investment and regulatory approvals for new corticosteroid combinations underscore the industry’s focus on improving safety profiles and addressing unmet medical needs across chronic inflammatory and autoimmune disorders.

Key Player Analysis

- AbbVie Inc.

- Astellas Pharma Inc.

- AstraZeneca Plc

- Bausch Health Companies Inc.

- Bayer AG

- Cipla Inc.

- Reddy’s Laboratories Ltd.

- Eli Lilly and Co.

- Galderma SA

- GlaxoSmithKline Plc

Recent Developments

- June 2025: Amneal Pharmaceuticals won FDA approval for prednisolone acetate ophthalmic suspension 1% referencing Pred Forte, with launch slated for Q3 2025.

- May 2025: Eton Pharmaceuticals secured FDA clearance for Khindivi (hydrocortisone) oral solution for pediatric adrenocortical insufficiency.

- March 2025: Mallinckrodt and Endo announced a strategic merger to create a diversified global pharmaceuticals entity.

- March 2025: ANI Pharmaceuticals obtained FDA approval for Purified Cortrophin Gel in a prefilled syringe format.

Report Coverage

The research report offers an in-depth analysis based on Type, Potency, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The corticosteroids market will continue expanding due to the rising prevalence of chronic and autoimmune diseases.

- Demand for inhaled and topical corticosteroids will grow as patients prefer localized treatments with fewer side effects.

- Pharmaceutical companies will focus on developing advanced delivery systems such as nanoparticle-based and transdermal formulations.

- Combination therapies integrating corticosteroids with biologics or immunomodulators will gain popularity for complex disease management.

- OTC corticosteroid products will witness increased demand driven by growing self-medication trends and easier accessibility.

- Regulatory bodies will emphasize safety and quality compliance, encouraging manufacturers to innovate safer formulations.

- Digital health integration, including smart inhalers and adherence-tracking apps, will enhance patient management.

- Emerging economies in Asia-Pacific and Latin America will offer new opportunities due to improving healthcare access.

- Strategic mergers and acquisitions among leading companies will strengthen market presence and product portfolios.

- Personalized corticosteroid therapies tailored to genetic and metabolic profiles will shape the next phase of market evolution.