Market Overview

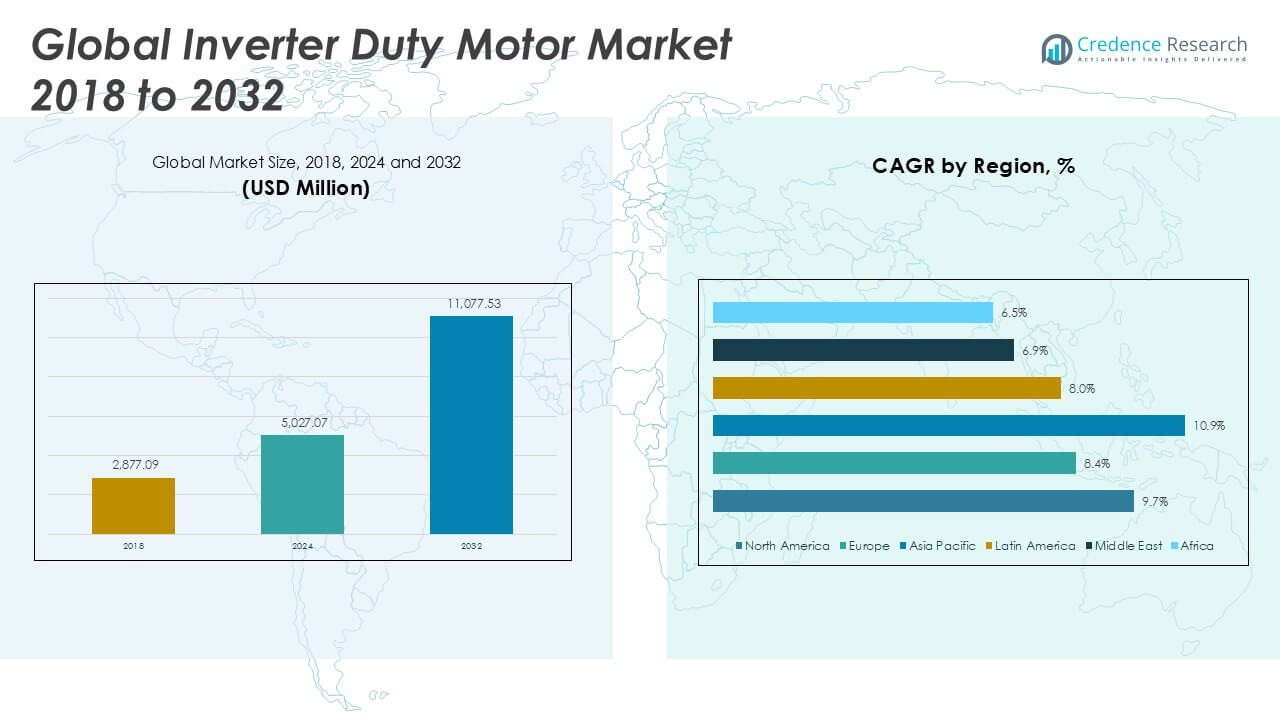

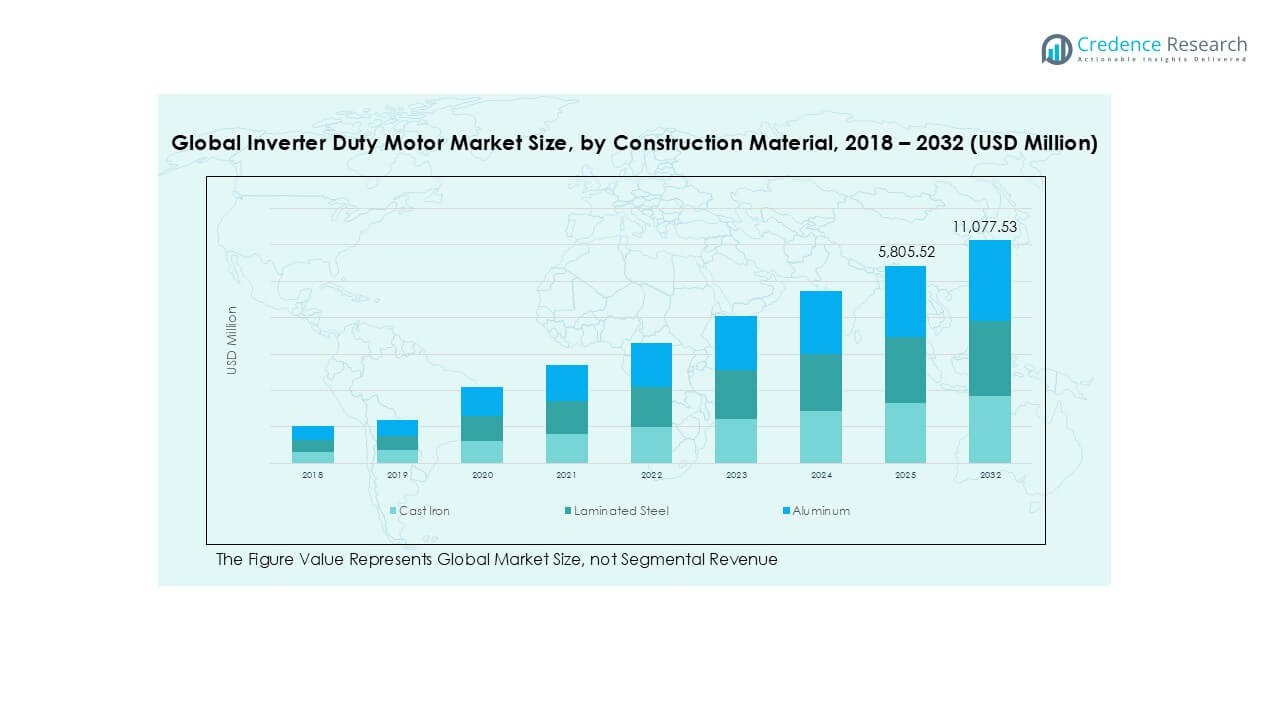

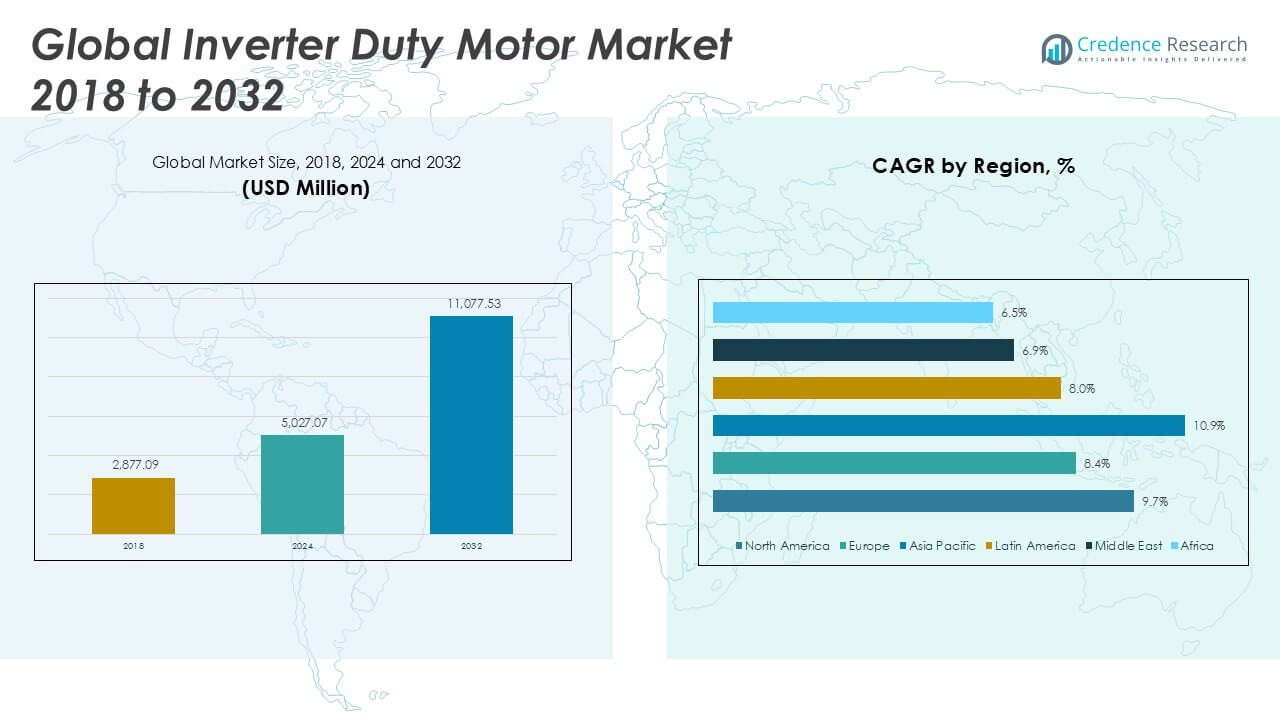

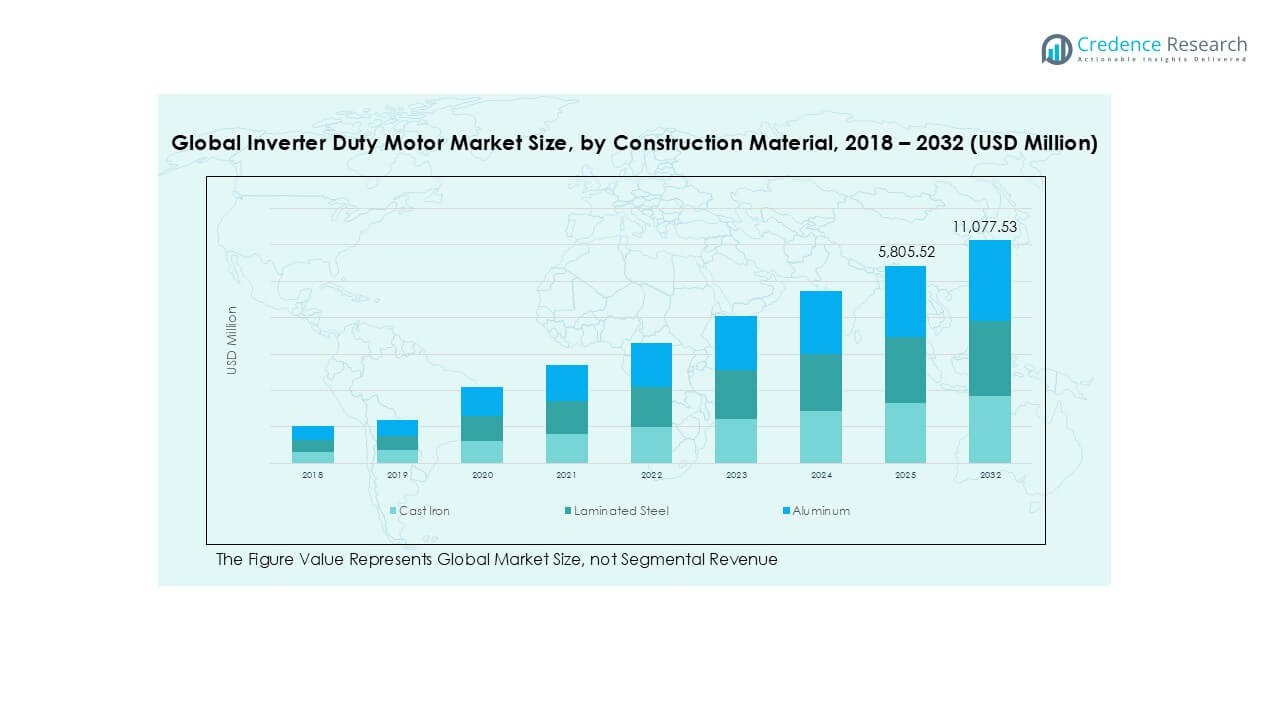

Global Inverter Duty Motor market size was valued at USD 2,877.09 million in 2018 to USD 5,027.07 million in 2024 and is anticipated to reach USD 11,077.53 million by 2032, at a CAGR of 9.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Inverter Duty Motor Market Size 2024 |

USD 5,027.07 Million |

| Inverter Duty Motor Market, CAGR |

9.67% |

| Inverter Duty Motor Market Size 2032 |

USD 11,077.53 Million |

The global inverter duty motor market is led by prominent companies including Regal Rexnord, ABB Ltd., Siemens AG, General Electric Company, Nidec Motor Corporation, Rockwell Automation, and Havells India Ltd. These players dominate through broad product portfolios, strong R&D focus, and global service networks. Asia Pacific emerges as the leading region, holding 36% of the global market share in 2024, driven by rapid industrialization, infrastructure projects, and growing automation in China and India. North America follows with 32% share, supported by strict efficiency regulations and advanced automation adoption, while Europe accounts for 20% share, strengthened by renewable energy integration and sustainability initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Inverter Duty Motor Market size was valued at USD 2,877.09 million in 2018, expected to reach USD 11,077.53 million by 2032, growing at a CAGR of 9.67%.

- Rising demand for energy-efficient solutions and increasing adoption of automation across chemicals, oil & gas, and manufacturing industries drive consistent market expansion worldwide.

- Key trends include integration of IoT-enabled monitoring systems, adoption in renewable energy applications, and customization for heavy-duty sectors such as cement, pulp & paper, and mining.

- The competitive landscape is dominated by Regal Rexnord, ABB, Siemens, GE, Nidec, Rockwell Automation, and Havells India, focusing on advanced product portfolios, R&D investments, and strategic partnerships to expand regional reach.

- Asia Pacific leads with 36% share, followed by North America at 32%, Europe at 20%, and others collectively at 12%; by construction material, cast iron motors dominate with the highest share due to their durability in heavy industries.

Market Segmentation Analysis:

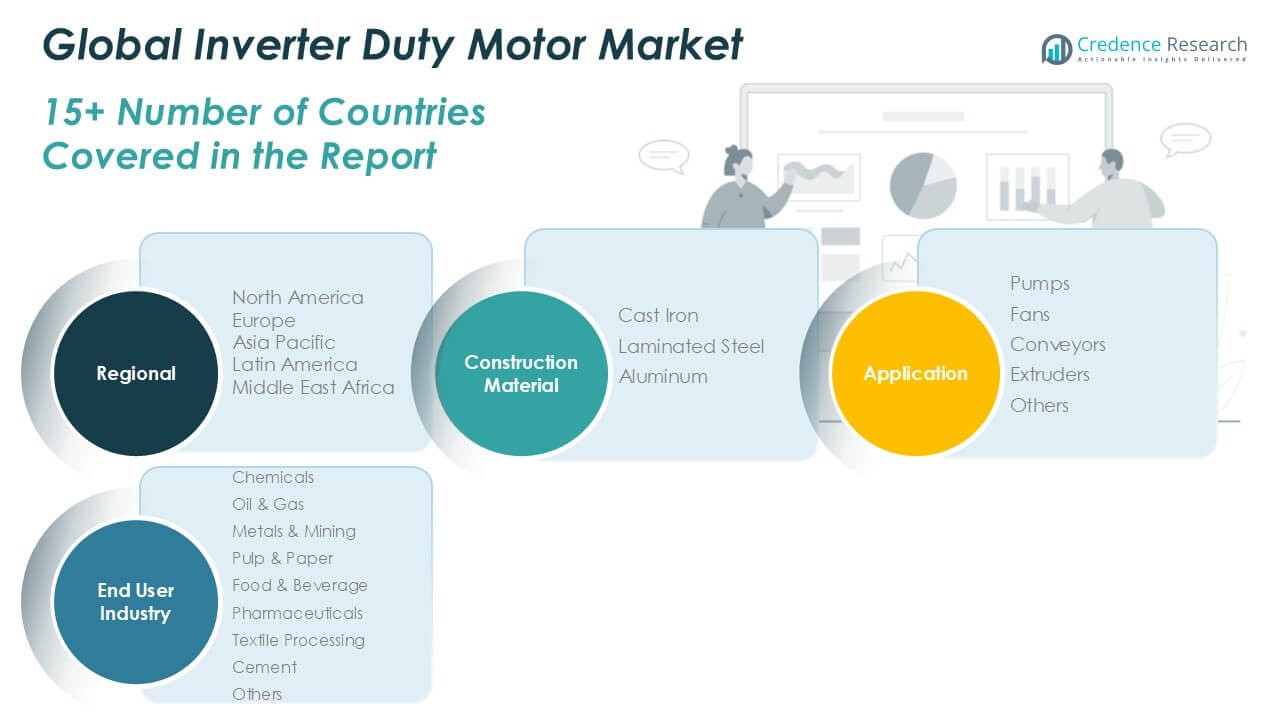

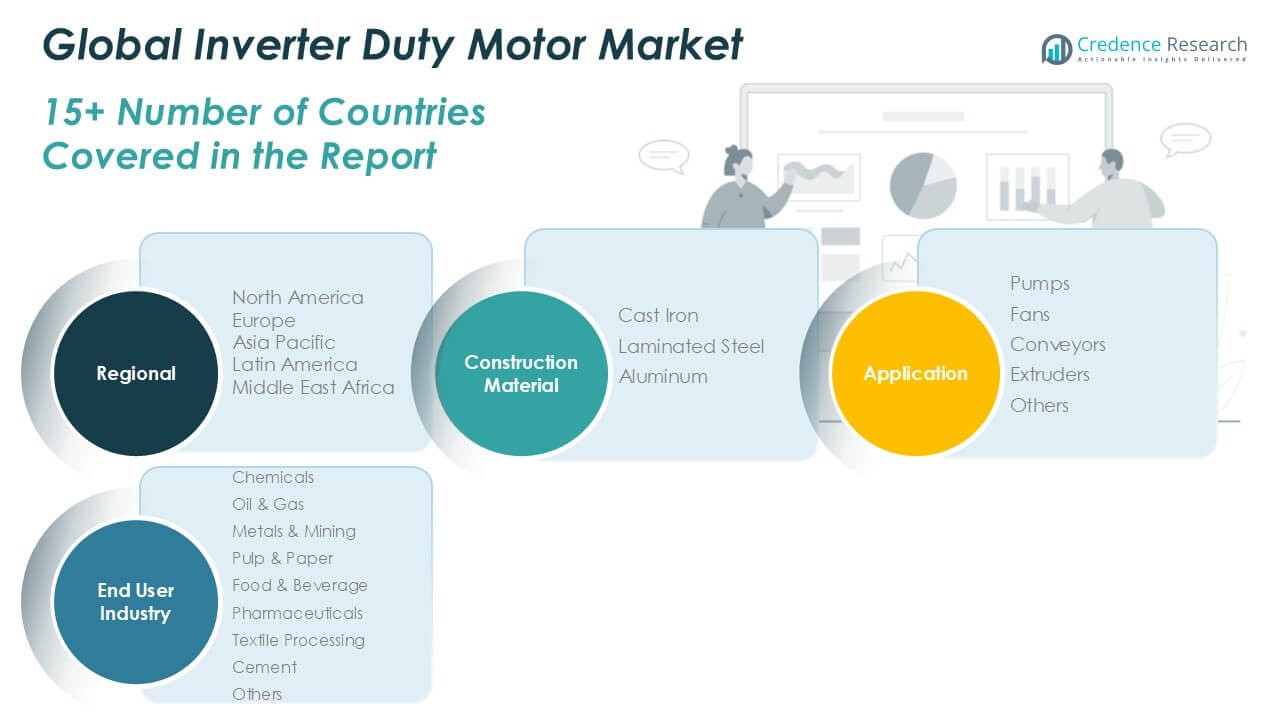

By Construction Material

Cast iron dominates the inverter duty motor market, accounting for the largest share due to its durability, cost-effectiveness, and ability to withstand harsh industrial environments. Laminated steel follows, driven by its efficiency in reducing core losses and improving energy performance, making it suitable for high-efficiency motor designs. Aluminum maintains steady demand, especially in lightweight applications and industries prioritizing thermal conductivity and corrosion resistance. The dominance of cast iron is supported by its widespread use in heavy-duty machinery across oil & gas, mining, and cement plants, where reliability under extreme conditions is essential.

- For instance, ABB is a global leader in power and automation technologies, manufacturing a wide range of robust cast-iron motors for heavy-duty industrial applications, including cement and mining. Its product offerings include inverter duty motors, which are designed to be reliably controlled by variable frequency drives.

By Application

Pumps represent the leading application segment, holding the largest market share owing to their extensive use in water treatment, oil & gas, chemicals, and food processing industries. Fans follow as a key segment, particularly in HVAC systems and ventilation for industrial facilities. Conveyors and extruders show consistent adoption, supported by growth in manufacturing and processing sectors, while other applications contribute to niche demand. The pump segment’s dominance stems from the continuous requirement for reliable fluid movement across critical industrial processes, reinforcing the role of inverter duty motors in operational efficiency and process optimization.

- For instance, WEG supplies a variety of electric motors, including high-efficiency and inverter duty motors, for pump applications in large-scale water treatment projects, such as desalination plants. The company has provided motors and drives for significant desalination facilities, such as the Rabigh 3 plant in Saudi Arabia, which has a production capacity of 600,000 cubic meters of water per day. Another project, the Keppel Marina East Desalination Plant in Singapore, produces 137,000 cubic meters of water per day.

By End User Industry

The chemicals industry holds the dominant market share among end-user segments, driven by the need for precise, reliable, and energy-efficient motor operations in chemical processing plants. Oil & gas stands as the second major segment, supported by investments in upstream and downstream facilities requiring motors for pumps, compressors, and fans. Metals & mining, pulp & paper, and cement sectors also contribute significantly, demanding heavy-duty motors for rugged operations. Meanwhile, food & beverage, pharmaceuticals, and textile processing show growing adoption due to automation and regulatory focus on quality. The chemical sector’s leadership is reinforced by high-volume operations and strict safety standards.

Key Growth Drivers

Rising Demand for Energy Efficiency

The growing focus on energy conservation across industries drives adoption of inverter duty motors. These motors provide higher efficiency and lower energy losses when paired with variable frequency drives. Governments worldwide enforce energy efficiency standards that encourage industries to replace conventional motors. Industries such as chemicals, cement, and pulp & paper rely heavily on motors for continuous processes, making efficiency improvements highly impactful. The ability of inverter duty motors to reduce operational costs and comply with global efficiency norms underpins their strong market growth.

- For instance, the Siemens SIMOTICS SD next-generation low-voltage motors were launched in 2017 and are designed for severe-duty applications, including the chemical and cement industries. Some models meet the Super Premium Efficiency (IE4) class, and others are capable of up to 98% efficiency.

Expansion of Industrial Automation

Industrial automation has become a key driver, increasing demand for motors that deliver precision and reliability. Inverter duty motors support advanced automation by providing smooth speed control and high torque performance under variable loads. Manufacturing, food & beverage, and pharmaceuticals increasingly use these motors in automated production lines. With Industry 4.0 and smart factory initiatives, demand for motors compatible with sensors and control systems continues to rise. Their adaptability to modern automation platforms ensures long-term relevance, fueling significant growth across industrial sectors.

Infrastructure and Process Industry Growth

Rapid expansion of infrastructure projects and growth in process industries such as oil & gas, mining, and water treatment boost inverter duty motor adoption. These sectors require robust motors capable of handling harsh operating conditions with high reliability. Pumps, fans, and conveyors, widely deployed in these industries, benefit from inverter duty motors’ performance under fluctuating loads. Urbanization and investment in utilities also expand motor demand for HVAC and fluid management applications. The increasing scale of infrastructure development globally strengthens the long-term prospects of this market segment.

Key Trends & Opportunities

Integration with Smart Monitoring Systems

A major trend is the integration of inverter duty motors with smart sensors and monitoring systems. Digital connectivity allows predictive maintenance, efficiency tracking, and real-time diagnostics. This reduces downtime and improves asset utilization, which is vital for industries running continuous operations. Vendors are developing motors compatible with IoT platforms, enabling seamless integration into smart factories. The opportunity lies in offering advanced solutions that combine motor performance with intelligent monitoring, aligning with the shift toward digital industrial ecosystems and maintenance-as-a-service models.

- For instance, WEG’s Motor Scan is a monitoring solution that uses wireless sensors and Internet of Things (IoT) technology for predictive maintenance. It is an optional add-on that can be fitted to both newly manufactured WEG motors and existing installations.

Growth in Renewable Energy Applications

Inverter duty motors increasingly find applications in renewable energy infrastructure, particularly in wind and solar projects. These motors are used in tracking systems, pumps, and auxiliary operations where variable speeds are essential. The global push toward decarbonization accelerates adoption, supported by government incentives for clean energy investments. Manufacturers are capitalizing on this opportunity by designing motors suited for energy-efficient and sustainable projects. As renewable energy capacity expands, inverter duty motors play a crucial role in enabling reliable operations, creating steady opportunities for growth.

- For instance, Siemens, through its spin-off company Innomotics, offers a wide range of inverter duty motors and related drive technologies for industrial applications.

Key Challenges

High Initial Investment Costs

One of the major challenges in inverter duty motor adoption is the higher upfront cost compared to standard motors. While long-term energy savings offset this investment, industries with tight capital budgets often hesitate to upgrade. Small and medium enterprises, in particular, face barriers in financing such replacements despite efficiency gains. This cost sensitivity slows market penetration, especially in developing regions. Addressing this challenge requires manufacturers and policymakers to highlight lifecycle cost benefits and promote financial incentives to encourage early adoption.

Operational Complexity and Maintenance Issues

Another challenge stems from the complexity of operating inverter duty motors with variable frequency drives. Incorrect installation or mismatched components can lead to failures, reducing operational efficiency. Maintenance requires skilled technicians familiar with advanced motor and drive systems, which creates dependency on specialized labor. In regions with limited technical expertise, downtime risks increase. This challenge impacts user confidence, particularly in industries where reliability is mission-critical. Market players must focus on training programs and after-sales support to overcome these operational hurdles.

Regional Analysis

North America

North America held the largest share of the inverter duty motor market, valued at USD 1,269.47 million in 2018. The region reached USD 2,195.32 million in 2024 and is projected to attain USD 4,850.84 million by 2032, registering a CAGR of 9.7%. The market benefits from strong adoption in oil & gas, chemicals, and infrastructure sectors, where energy-efficient motors are essential. The U.S. dominates the regional share, driven by industrial modernization and regulatory frameworks promoting efficiency. North America consistently accounts for a significant portion of the global market due to advanced industrial automation investments.

Europe

Europe accounted for USD 536.13 million in 2018, expanding to USD 885.36 million in 2024, and is expected to reach USD 1,773.71 million by 2032. The region grows at a CAGR of 8.4%, supported by stringent energy efficiency regulations under the EU framework. Countries like Germany, France, and the UK drive adoption through automation in manufacturing and renewable energy projects. The region maintains a notable share in the global market, strengthened by advanced technologies and strong regulatory compliance. Demand in Europe reflects the transition toward sustainable and energy-optimized industrial operations across multiple process industries.

Asia Pacific

Asia Pacific represents the fastest-growing regional market, valued at USD 818.82 million in 2018. It is estimated at USD 1,511.82 million in 2024 and projected to reach USD 3,637.58 million by 2032, with a CAGR of 10.9%. The region’s growth is fueled by rapid industrialization, strong infrastructure investment, and rising automation in China, India, and Southeast Asia. Asia Pacific holds a substantial share of the global market due to its expanding manufacturing base and growing energy needs. Increasing demand from cement, textiles, and metals & mining industries further accelerates adoption across this high-growth region.

Latin America

Latin America’s inverter duty motor market stood at USD 138.76 million in 2018, increasing to USD 239.50 million in 2024, and is expected to reach USD 468.39 million by 2032. The market expands at a CAGR of 8.0%, supported by demand in oil & gas, mining, and water treatment industries. Brazil and Mexico dominate regional share, benefiting from investments in industrial automation and infrastructure modernization. Although smaller in size compared to North America and Asia Pacific, Latin America contributes a steady portion of the global market. Growth is anchored by expanding energy-efficient motor applications across industrial sectors.

Middle East

The Middle East market was valued at USD 70.66 million in 2018, increasing to USD 111.37 million in 2024, and is projected to reach USD 201.10 million by 2032, growing at a CAGR of 6.9%. Regional demand is driven primarily by oil & gas, petrochemical, and utility sectors where reliable motor performance is critical. Countries such as Saudi Arabia and the UAE dominate the share with investments in energy-efficient solutions. Although holding a moderate portion of the global market, the Middle East continues to prioritize motor upgrades in high-demand process industries to improve operational efficiency.

Africa

Africa’s inverter duty motor market was USD 43.25 million in 2018, expanding to USD 83.71 million in 2024, and is anticipated to reach USD 145.91 million by 2032. The region grows at a CAGR of 6.5%, the slowest among all regions, reflecting gradual industrial development. South Africa leads the market share, supported by demand in mining, cement, and water treatment sectors. Although its global market share remains relatively small, Africa shows consistent adoption of inverter duty motors as industrial automation gradually expands. Rising investments in energy and infrastructure projects support long-term growth prospects in the region.

Market Segmentations:

By Construction Material

- Cast Iron

- Laminated Steel

- Aluminum

By Application

- Pumps

- Fans

- Conveyors

- Extruders

- Others

By End User Industry

- Chemicals

- Oil & Gas

- Metals & Mining

- Pulp & Paper

- Food & Beverage

- Pharmaceuticals

- Textile Processing

- Cement

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The global inverter duty motor market is characterized by strong competition among leading multinational corporations and regional manufacturers. Key players such as Regal Rexnord, ABB Ltd., Siemens AG, General Electric Company, Nidec Motor Corporation, Rockwell Automation, and Havells India Ltd. dominate the landscape with extensive product portfolios, global distribution networks, and continuous technological advancements. These companies focus on energy-efficient designs, IoT-enabled monitoring systems, and customized solutions to meet diverse industrial needs. Strategic initiatives, including mergers, acquisitions, and partnerships, strengthen their market presence while enabling expansion into high-growth regions such as Asia Pacific and Latin America. Financial strength and R&D investments allow these leaders to maintain a competitive edge by addressing strict regulatory standards and rising demand for sustainable operations. Regional players, meanwhile, compete by offering cost-effective solutions tailored for local markets. Overall, the competitive environment emphasizes innovation, operational reliability, and compliance with global efficiency benchmarks to sustain long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Regal Beloit Corporation (now Regal Rexnord)

- ABB Ltd.

- Siemens AG

- General Electric Company (GE)

- Nidec Motor Corporation

- Rockwell Automation, Inc.

- Havells India Ltd.

Recent Developments

- In May 2025, the European Union implemented new energy efficiency regulations, mandating the use of inverter duty motors in specific applications to reduce energy consumption and carbon emissions. This policy change is expected to drive market growth and boost demand for energy-efficient motor solutions (European Commission press release, 2025).

- In January 2024, ABB and Schneider Electric formed a strategic partnership to collaborate on developing and marketing integrated power conversion solutions. This collaboration combines ABB’s expertise in power conversion technology with Schneider Electric’s strength in electrical distribution and automation systems (ABB press release, 2024).

- In August 2023, Bosch commenced production of 800-volt powertrain components, including inverters and electric motors, enhancing electric vehicle charging speed and efficiency. Leveraging silicon carbide technology, these components deliver increased range and compact design, with a German automaker already adopting the new electric motor’s core components.

- In March 2023, Siemens Energy announced the launch of its new multilevel converter technology, which enables higher power density and efficiency for inverter duty motors. This innovation reduces energy losses and enhances overall system performance (Siemens Energy press release, 2023).

Report Coverage

The research report offers an in-depth analysis based on Construction Material, Application, End User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily, supported by rising energy efficiency regulations worldwide.

- Adoption of inverter duty motors in industrial automation will expand with Industry 4.0 initiatives.

- Demand from renewable energy projects such as solar and wind will strengthen long-term growth.

- Cast iron motors will remain the preferred construction material for heavy-duty industrial applications.

- Pumps will continue to hold the dominant share among applications due to wide usage across industries.

- Chemicals will retain leadership among end-user industries, driven by high-volume continuous processes.

- Asia Pacific will maintain its leading position, supported by rapid industrialization and infrastructure development.

- North America and Europe will witness growth driven by modernization and sustainability mandates.

- Integration of IoT-enabled smart monitoring systems will enhance reliability and predictive maintenance.

- Competitive strategies will focus on advanced designs, product customization, and regional expansion in emerging markets.