Market Overview

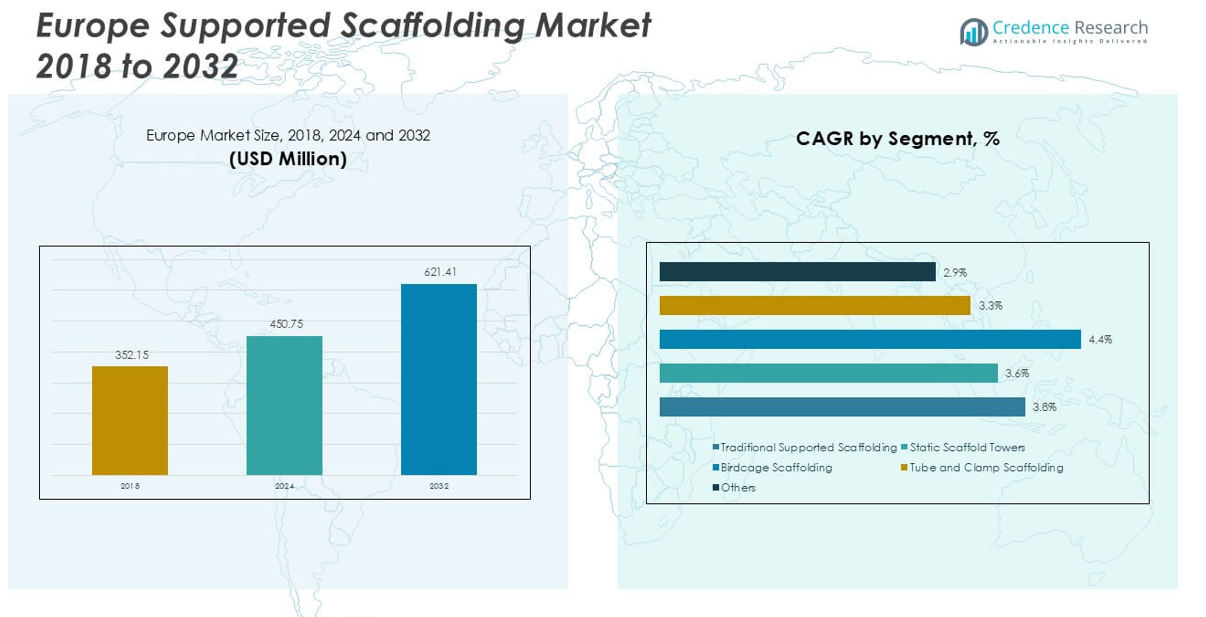

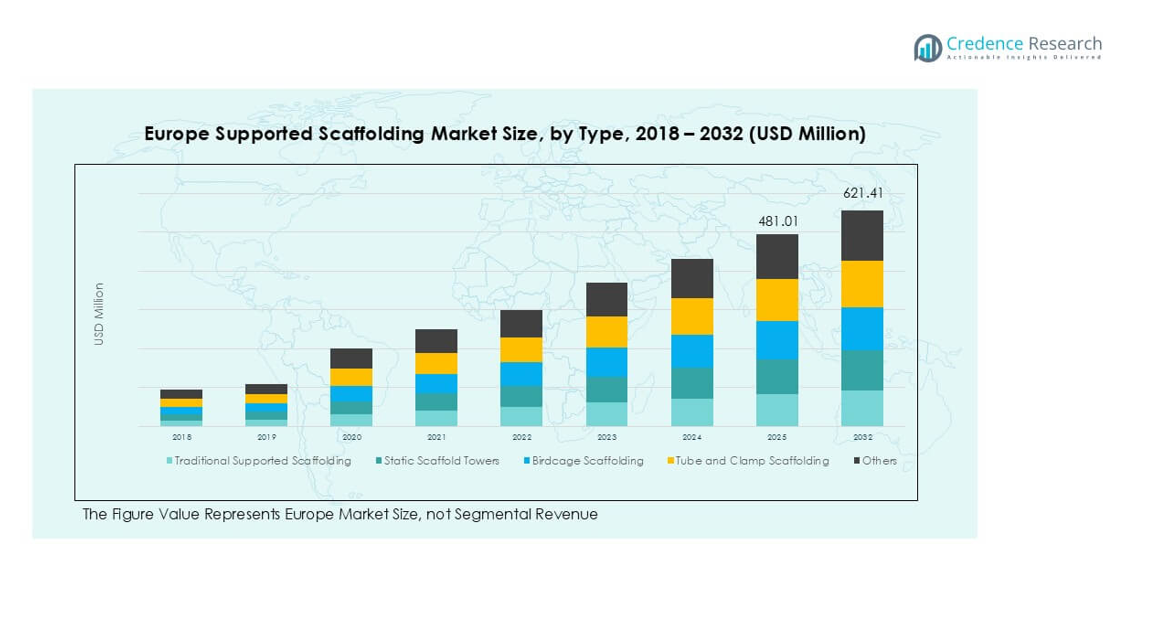

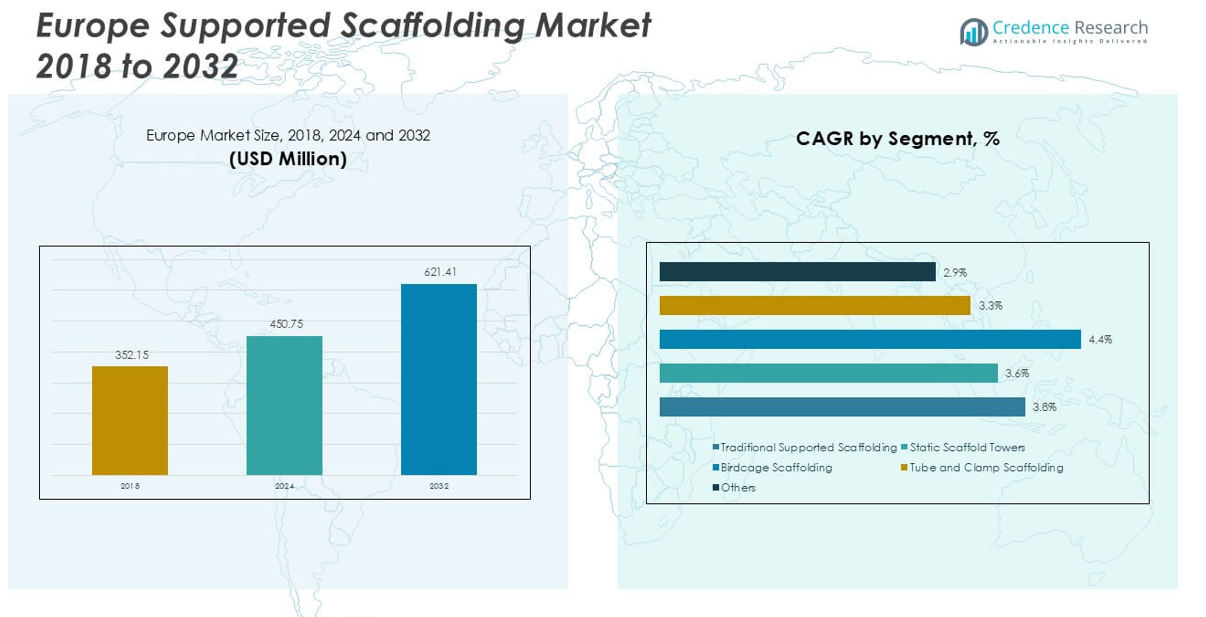

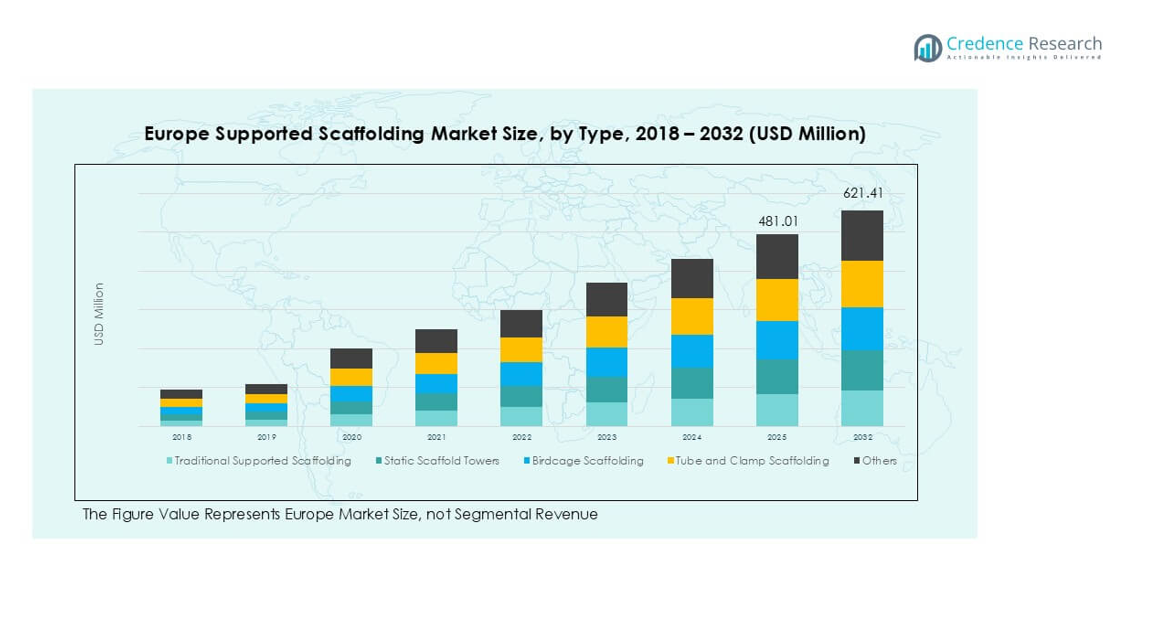

The Europe Supported Scaffolding market size was valued at USD 352.15 million in 2018, increased to USD 450.75 million in 2024, and is anticipated to reach USD 621.41 million by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Supported Scaffolding Market Size 2024 |

USD 450.75 million |

| Europe Supported Scaffolding Market, CAGR |

3.7% |

| Europe Supported Scaffolding Market Size 2032 |

USD 621.41 million |

The Europe Supported Scaffolding market is led by prominent players such as PERI Group, Altrad Group, ULMA C y E, S. Coop., and Brand Industrial Services, Inc., each recognized for their extensive product offerings, safety-compliant systems, and strong regional presence. Other notable companies include ADTO Industrial Group, MJ-Gerüst GmbH, Rohrer Group, and Atlantic Pacific Equipment (AT-PAC), LLC, which continue to expand through cost-effective solutions and targeted market strategies. Among the European regions, Germany holds the largest market share at 22%, driven by significant infrastructure investments, industrial construction, and rigorous safety regulations. The United Kingdom and France follow closely, supported by urban redevelopment and renovation activities. The competitive landscape reflects a blend of innovation, regulatory adherence, and strategic expansion across both established and emerging markets.

Market Insights

- The Europe Supported Scaffolding market was valued at USD 450.75 million in 2024 and is expected to reach USD 621.41 million by 2032, growing at a CAGR of 3.7% during the forecast period.

- Market growth is primarily driven by rising infrastructure development, strict worker safety regulations, and increasing demand for renovation and retrofitting projects across residential and commercial sectors.

- A key trend is the adoption of modular and lightweight aluminum scaffolding systems for faster installation and better portability, especially in maintenance and indoor applications.

- The market is moderately fragmented with key players like PERI Group, Altrad Group, and ULMA C y E holding strong positions; competition focuses on innovation, safety compliance, and expanding product portfolios.

- Germany leads with a 22% market share, followed by the UK (18%) and France (15%), while Traditional Supported Scaffolding and Steel Material segments dominate due to their stability, load capacity, and broad application in construction.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Traditional Supported Scaffolding segment dominated the market, capturing over 40% share in 2024, driven by its versatility and widespread use across construction and industrial projects. Static Scaffold Towers followed closely due to their stability in high-rise applications, while Birdcage Scaffolding found niche demand in indoor and maintenance works. Tube and Clamp Scaffolding remained popular for complex structures requiring adaptability. The “Others” category includes emerging types tailored for specialized environments, but Traditional Supported Scaffolding maintained leadership due to ease of assembly, proven safety, and cost-effectiveness.

- For instance, PERI Group’s PERI UP Flex system supports live loads up to 6.0 kN/m² and has been deployed in over 1,000 high-rise and industrial projects across Europe.

By Material

Steel Supported Scaffolding accounted for the largest market share of approximately 65% in 2024, owing to its superior strength, durability, and ability to support heavy loads across diverse construction sites. Aluminum Supported Scaffolding gained traction for projects requiring lightweight and portable solutions, particularly in maintenance and interior applications. Bamboo and Wood Supported Scaffolding retained minimal share, primarily limited to restoration or decorative works, reflecting traditional practices. The dominance of steel was propelled by rising safety standards and increasing adoption of modular scaffolding systems across Europe’s infrastructure and commercial developments.

- For instance, Layher’s Allround Scaffolding made of hot-dip galvanized steel supports vertical loads up to 7.5 kN per standard and is used in over 70% of major infrastructure sites in Germany alone.

By Application

Construction emerged as the leading application segment, representing nearly 55% of the market in 2024, driven by ongoing urban development and infrastructure modernization across Europe. Maintenance and Repairs held a significant share, supported by stringent building safety regulations and the need for periodic refurbishment of aging structures. Shipbuilding and Marine Maintenance demanded specialized scaffolding for complex geometries, while Electrical and Mechanical Trades leveraged supported scaffolding for installations and upgrades in industrial settings. Growth in construction was primarily fueled by public and private investments in residential and commercial projects, ensuring continued demand for reliable scaffolding systems.

Market Overview

Expansion of Infrastructure and Urban Development Projects

The continued expansion of infrastructure projects across Europe, including commercial complexes, transportation networks, and residential developments, is a major driver of supported scaffolding demand. Governments and private stakeholders are investing heavily in modernization and green infrastructure, particularly in countries like Germany, the UK, and France. These initiatives require safe and reliable access solutions during construction, repair, and maintenance phases, thus boosting the adoption of supported scaffolding. The demand is especially strong in urban areas undergoing vertical expansion and renovation.

- For instance, Altrad’s scaffolding division supplied over 25,000 m² of supported scaffolding during the refurbishment of the Marseille Saint-Charles railway station.

Stringent Worker Safety Regulations

The enforcement of strict safety regulations by the European Union and national bodies has significantly increased the need for high-quality scaffolding solutions. Supported scaffolding systems offer enhanced stability and load-bearing capacity, aligning with occupational safety guidelines. Companies are prioritizing compliance to avoid penalties and protect their workforce, which drives the shift from informal or outdated access systems to certified scaffolding structures. This regulatory landscape not only fuels demand but also encourages innovation in safer, modular, and standardized scaffolding designs.

- For instance, Hünnebeck’s Bosta 70 system, compliant with DIN EN 12811, is used by over 600 contractors in Europe and features integrated fall protection systems for increased worker safety.

Growth in Renovation and Retrofitting Activities

Europe’s aging infrastructure and historical buildings have led to a surge in renovation and retrofitting activities, further propelling market growth. Supported scaffolding is extensively used in restoration projects due to its adaptability to various architectural forms and surfaces. The shift toward energy-efficient upgrades and the need for facade repairs in older buildings also contribute to recurring scaffolding demand. Countries like Italy and Spain, with a high concentration of heritage structures, represent key markets for scaffolding in the renovation segment.

Key Trends & Opportunities

Rising Adoption of Modular and Prefabricated Scaffolding Systems

The market is witnessing a shift toward modular and prefabricated supported scaffolding systems due to their quick assembly, enhanced safety, and reduced labor costs. These systems improve operational efficiency on job sites, particularly in projects with tight timelines. Prefabricated scaffolding also supports repeatable designs and standardized safety features, which appeal to both contractors and regulators. As digital planning tools such as BIM (Building Information Modeling) integrate scaffolding layouts, the demand for modular solutions is expected to accelerate.

- For instance, ULMA Construction’s MK modular scaffolding system reduced on-site assembly time by 40% in over 300 commercial building projects across Spain and Italy.

Increasing Demand for Lightweight Aluminum Scaffolding

Lightweight aluminum supported scaffolding is gaining popularity in maintenance, refurbishment, and indoor applications. Its portability and corrosion resistance make it ideal for short-duration or multi-location projects, especially in sectors like commercial property management and industrial servicing. As labor shortages and productivity demands increase across Europe, scaffolding solutions that reduce physical strain and speed up deployment are being favored. This trend is particularly strong in Northern and Western Europe where compliance with ergonomic standards is a top priority.

- For instance, Instant Upright’s aluminum scaffolds weigh 45% less than steel equivalents and are deployed in over 12,000 maintenance projects annually across the UK and Ireland.

Key Challenges

High Cost of Installation and Labor

One of the primary challenges in the Europe Supported Scaffolding market is the high cost associated with installation, maintenance, and skilled labor. Supported scaffolding systems, especially steel-based ones, require trained professionals for safe assembly and disassembly. Rising labor costs in Western Europe add to the operational expenses for contractors, which can deter smaller firms from investing in advanced scaffolding systems. These cost pressures can limit adoption in smaller-scale or budget-constrained projects.

Disruption from Alternative Access Technologies

The growing use of alternative access technologies such as aerial work platforms, mast climbers, and suspended scaffolds poses a threat to traditional supported scaffolding. These alternatives offer faster setup and may be more cost-effective for specific use cases, especially in confined or high-rise environments. While supported scaffolding remains essential for large and complex projects, competition from these evolving technologies could reduce its market share in select sectors, particularly in high-tech construction and industrial maintenance.

Environmental and Sustainability Pressures

Sustainability concerns and environmental regulations are pushing manufacturers and contractors to adopt eco-friendly materials and reusable systems. However, the production and transport of steel scaffolding still carry a considerable carbon footprint. As the EU emphasizes carbon neutrality and green building practices, scaffolding providers may face pressure to innovate or shift toward recyclable materials and energy-efficient production methods. This transition can involve significant investment, posing a challenge for smaller players in the market.

Regional Analysis

United Kingdom

The United Kingdom accounted for approximately 18% of the Europe Supported Scaffolding market in 2024, driven by strong investments in commercial construction, public infrastructure, and housing redevelopment. Projects like HS2 and numerous urban regeneration programs have created sustained demand for supported scaffolding systems. The UK also demonstrates high compliance with health and safety standards, prompting the adoption of advanced modular scaffolding solutions. Additionally, renovation of heritage sites and high-rise refurbishments contribute significantly to market growth. The increasing focus on sustainable construction methods is also encouraging a shift toward recyclable materials and prefabricated scaffolding systems.

France

France held around 15% of the regional market share in 2024, supported by its robust building renovation sector and government-led infrastructure initiatives. The country’s stringent building codes and worker safety regulations encourage the use of standardized and durable scaffolding systems. Ongoing urban development in cities like Paris and Lyon, along with extensive retrofitting of older residential buildings, continues to fuel market demand. The rise in energy-efficient building renovations under national environmental policies further boosts supported scaffolding use, particularly in the residential and institutional sectors. Prefabricated and lightweight scaffolding solutions are gaining popularity in the French market.

Germany

Germany emerged as the largest market in Europe with a market share of approximately 22% in 2024, driven by large-scale infrastructure projects, industrial expansion, and strict occupational safety regulations. The country’s construction sector emphasizes precision, durability, and compliance, creating strong demand for steel-supported scaffolding systems. Public investments in rail, roads, and commercial developments contribute significantly to market size. Moreover, Germany’s focus on energy-efficient retrofitting under its national climate goals supports consistent demand for scaffolding in both urban and rural areas. Technological integration, such as BIM-compatible scaffolding designs, is also increasingly adopted.

Italy

Italy contributed nearly 13% to the Europe Supported Scaffolding market in 2024, with its growth anchored in the renovation of historical buildings and expanding residential upgrades. The country has a vast inventory of aging infrastructure and heritage architecture that necessitates safe and adaptable scaffolding systems. Government incentives for structural improvements and seismic upgrades further stimulate market activity. Birdcage and traditional supported scaffolding are particularly prevalent due to their adaptability to varied building forms. Italy’s construction industry also benefits from the tourism sector, where restoration of public and cultural sites remains a priority.

Spain

Spain represented around 10% of the regional market share in 2024, supported by recovery in the residential construction sector and increased renovation activities across urban areas. Government initiatives promoting green buildings and energy-efficient retrofits have driven demand for supported scaffolding, particularly aluminum-based systems for lighter applications. The tourism sector also contributes to market growth through restoration projects in historic cities. While the market faces some labor cost challenges, the trend toward modular scaffolding and increased public infrastructure investment has helped offset these constraints, ensuring steady market expansion.

Russia

Russia accounted for approximately 9% of the Europe Supported Scaffolding market in 2024. The demand is primarily driven by industrial construction, energy infrastructure, and large-scale public projects across urban centers like Moscow and St. Petersburg. Despite economic uncertainties and geopolitical challenges, government-backed infrastructure modernization programs continue to support scaffolding demand. Steel-supported scaffolding remains dominant due to its strength and suitability for harsh climates. However, logistical constraints and fluctuating raw material prices pose risks to stable market growth. Domestic manufacturers are focusing on improving modularity and transport efficiency to meet diverse construction needs.

Rest of Europe

The Rest of Europe, comprising smaller but steadily developing markets in Eastern and Northern Europe, collectively held about 13% of the market share in 2024. Countries such as Poland, the Netherlands, Belgium, and the Nordic nations are witnessing increasing investments in urban development, infrastructure renewal, and public facility upgrades. Scaffolding demand is rising in response to strict EU safety mandates and green construction standards. Modular scaffolding solutions, especially aluminum-based systems, are gaining ground in the region. Ongoing efforts to improve building energy efficiency and safety compliance are expected to drive further growth across these emerging submarkets.

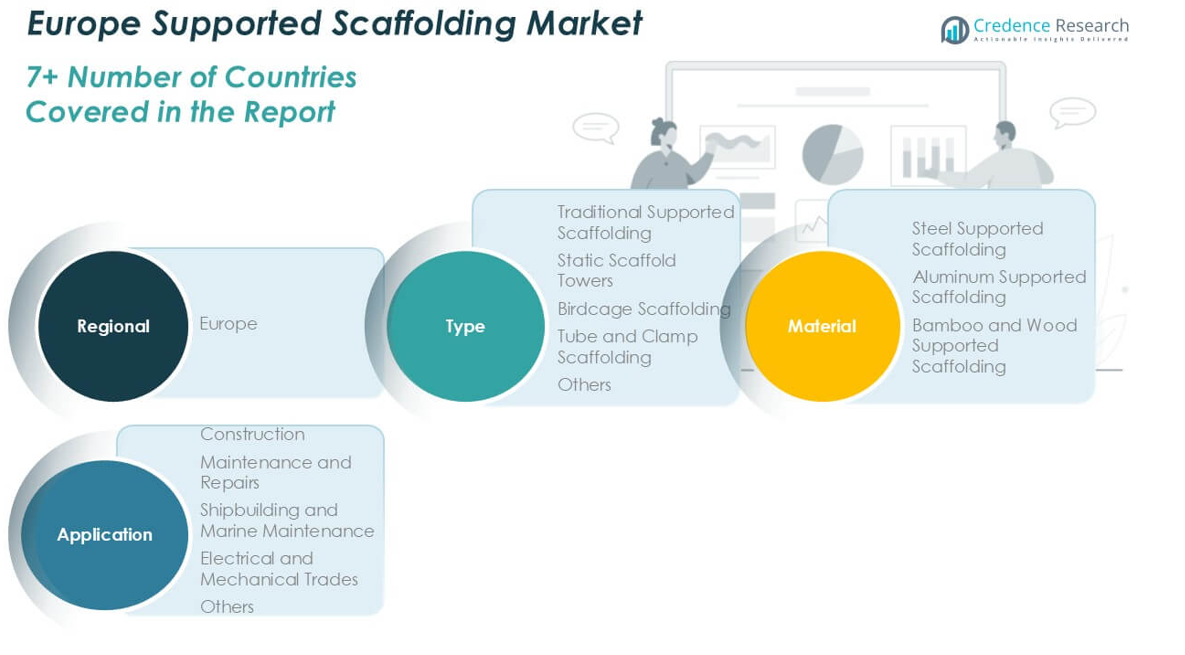

Market Segmentations:

By Type

- Traditional Supported Scaffolding

- Static Scaffold Towers

- Birdcage Scaffolding

- Tube and Clamp Scaffolding

- Others

By Material

- Steel Supported Scaffolding

- Aluminum Supported Scaffolding

- Bamboo and Wood Supported Scaffolding

By Application

- Construction

- Maintenance and Repairs

- Shipbuilding and Marine Maintenance

- Electrical and Mechanical Trades

- Others

By Geography

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Supported Scaffolding market is moderately fragmented, with a mix of global manufacturers and regional players competing on product quality, safety compliance, innovation, and service capabilities. Key players such as PERI Group, Altrad Group, ULMA C y E, and Brand Industrial Services, Inc. hold a significant share of the market due to their extensive product portfolios, strong distribution networks, and established customer relationships across construction, maintenance, and industrial sectors. These companies emphasize modular, durable, and high-load scaffolding systems that meet stringent European safety regulations. In contrast, emerging players like ADTO Industrial Group and MJ-Gerüst GmbH are expanding their presence by offering cost-effective and customized solutions tailored to regional demands. Mergers, acquisitions, and strategic partnerships are common as companies aim to enhance technological capabilities and broaden their market footprint. Additionally, the increasing focus on sustainable and prefabricated scaffolding solutions is driving innovation and differentiation, positioning technology adoption as a key competitive factor.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PERI Group

- ADTO Industrial Group

- Altrad Group

- ULMA C y E, S. Coop.

- MJ-Gerüst GmbH

- Waco Scaffolding and Equipment Company

- Atlantic Pacific Equipment (AT-PAC), LLC

- Brand Industrial Services, Inc.

- Cangzhou Weisitai Scaffolding Co. Ltd.

- Changli Xingminweiye Architecture Equipment Limited Corporation

- Rohrer Group

Recent Developments

- In July 2025, PERI UK achieved Constructionline Gold membership, demonstrating a commitment to enhancing construction efficiency and safety. This accreditation, part of PERI UK’s broader efforts to improve construction processes, places them in a strong position with the upcoming Procurement Act according to Building Design & Construction magazine.

- In April 2025, PERI Group announced the Vario Box at bauma 2025, a new product designed to serve as both a storage and organization solution for scaffolding construction companies and contractors. The Vario Box is intended to improve efficiency and order on construction sites by providing a dedicated space for scaffolding components and other materials.

- In October 2024, PERI supplied scaffolding for the Metrodom Green project in Budapest, Hungary, specifically for a complex green facade. The project involved a 36-meter-high green facade, requiring over 12,000 square meters of scaffolding.

Market Concentration & Characteristics

The Europe Supported Scaffolding Market exhibits moderate market concentration with a mix of global leaders and strong regional players competing across various segments. Large companies such as PERI Group, Altrad Group, and ULMA C y E command a significant share due to their broad product portfolios, advanced scaffolding technologies, and strong distribution networks. It remains characterized by high safety standards, regulatory compliance, and increasing demand for modular and prefabricated systems that enhance operational efficiency. While steel-supported scaffolding holds dominance due to its strength and durability, the market also sees rising interest in lightweight aluminum solutions for ease of handling and transport. Local manufacturers maintain relevance by offering cost-effective and customized systems for small and mid-sized projects. Market players focus on durability, safety, and modularity to meet the evolving demands of the construction, maintenance, and industrial sectors. The structure of competition relies heavily on innovation, service quality, and responsiveness to region-specific building codes and safety protocols.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by continued infrastructure development and urban expansion across major European economies.

- Renovation and retrofitting of aging buildings will remain a major contributor to scaffolding demand, particularly in countries with historical structures.

- Demand for modular and prefabricated scaffolding systems will increase due to their ease of installation and compliance with safety standards.

- Aluminum supported scaffolding will gain more traction in indoor and lightweight applications due to its portability and corrosion resistance.

- Construction will continue to be the leading application segment, supported by both public and private investments.

- Digital integration such as BIM in scaffolding planning and project management will enhance efficiency and accuracy.

- Sustainability concerns will drive manufacturers to explore recyclable materials and eco-friendly production processes.

- Labor shortages and rising wages may encourage the adoption of time-saving and ergonomic scaffolding solutions.

- Competition will intensify among regional and global players through product innovation and strategic collaborations.

- Northern and Western Europe will lead the market, while Eastern Europe presents emerging opportunities through infrastructure modernization.