Market Overview:

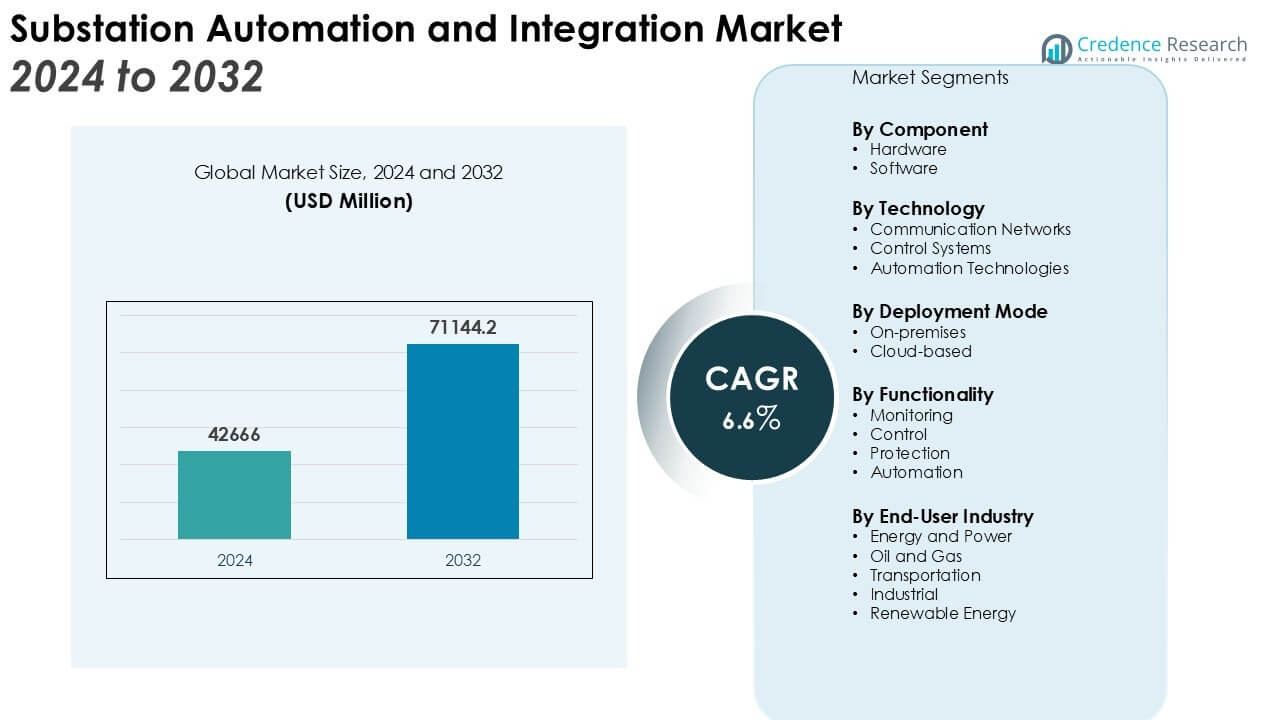

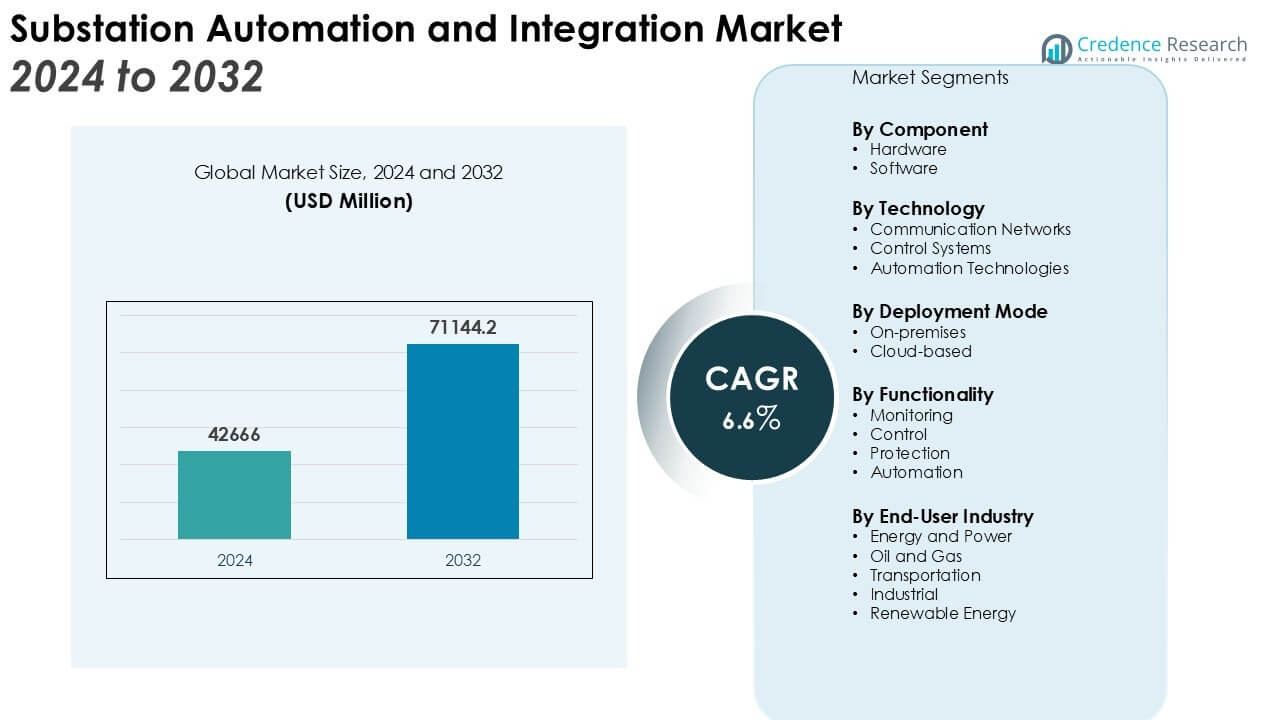

The Substation Automation and Integration Market size was valued at USD 42666 million in 2024 and is anticipated to reach USD 71144.2 million by 2032, at a CAGR of 6.6% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Substation Automation and Integration Market Size 2024 |

USD 42666 million |

| Substation Automation and Integration Market, CAGR |

6.6% |

| Substation Automation and Integration Market Size 2032 |

USD 71144.2 million |

Key drivers of market growth include the growing adoption of smart grid technologies, which enable better monitoring, control, and automation of substations. The integration of renewable energy sources into the grid and the growing need for real-time data analytics are also significant factors driving the market. Additionally, advancements in communication technologies such as the Internet of Things (IoT) and artificial intelligence (AI) are revolutionizing substation automation, enhancing system performance and reducing operational costs.

Regionally, North America holds the largest market share due to substantial investments in grid modernization and the increasing emphasis on smart grid deployment. Europe follows closely, with significant growth driven by energy efficiency regulations and renewable energy integration. The Asia-Pacific region is expected to witness the highest growth, fueled by rapid urbanization, industrialization, and government initiatives to enhance grid infrastructure in countries like China and India. Increased investments in smart cities and renewable energy integration further boost the market in this region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Substation Automation and Integration Market is valued at USD 42.67 billion in 2024 and is expected to reach USD 71.14 billion by 2032, growing at a CAGR of 6.6% during the forecast period.

- The increasing adoption of smart grid technologies is driving the market, enabling real-time monitoring and improved automation of substation operations for enhanced grid efficiency and reliability.

- As renewable energy sources like solar and wind integrate into the grid, substation automation plays a critical role in stabilizing fluctuating energy inputs and ensuring reliable energy delivery.

- The application of Internet of Things (IoT) and Artificial Intelligence (AI) in substation automation enhances system performance, predictive maintenance, and fault detection, contributing to reduced downtime and improved operational efficiency.

- North America holds the largest market share, with 38% attributed to significant investments in grid modernization and the integration of renewable energy, supported by government policies and incentives.

- Europe, with 29% market share, is driving market growth through a strong commitment to sustainability, carbon neutrality, and renewable energy integration, leading to a significant demand for advanced automation technologies.

- The Asia-Pacific region, holding 23% of the market, is expected to see the highest growth, fueled by rapid urbanization, industrialization, and government efforts to modernize grid infrastructure and promote renewable energy.

Market Drivers:

Growing Adoption of Smart Grid Technologies

The Substation Automation and Integration Market is experiencing significant growth due to the increasing adoption of smart grid technologies. These systems enable utilities to monitor and control substation operations in real time, improving the overall efficiency of power distribution. By incorporating advanced sensors, automated control systems, and real-time data analytics, smart grids enhance grid reliability, reduce outages, and optimize energy consumption. As smart grid deployment expands, substation automation becomes an essential component in managing complex energy systems.

- For instance, BC Hydro partnered with Cisco to modernize its grid, deploying an advanced smart metering system that improved the reliability and efficiency of electricity supply for more than 1 service call.

Integration of Renewable Energy Sources

The shift toward renewable energy is a key driver in the Substation Automation and Integration Market. The integration of renewable energy sources like solar and wind into the grid requires advanced automation systems to manage fluctuating energy inputs. Substations equipped with automated controls allow for seamless integration, ensuring stability and minimizing disruptions. The growing emphasis on clean energy drives the need for sophisticated substation systems to handle increased grid complexity and ensure reliable energy delivery.

- For instance, Hitachi Energy is collaborating with SP Energy Networks to add up to 280 megawatts of renewable energy to the UK’s electricity grid, which has the potential to power over 360,000 homes.

Advancements in Communication and IoT Technologies

Advancements in communication technologies, particularly the Internet of Things (IoT), are enhancing substation automation. IoT enables continuous monitoring, data collection, and predictive maintenance, optimizing system performance and minimizing downtime. These technologies improve communication between substations and central control systems, enhancing the ability to detect faults, adjust settings, and manage assets proactively. The widespread use of IoT is transforming traditional substations into smart facilities capable of handling complex grid demands.

Increasing Focus on Grid Reliability and Efficiency

The increasing demand for grid reliability and operational efficiency is another driving factor in the Substation Automation and Integration Market. Utilities are investing in automation solutions to enhance grid resilience, reduce operational costs, and minimize human error. By automating routine tasks and improving fault detection, substations can operate more efficiently and provide uninterrupted service. The focus on minimizing downtime and optimizing power flow pushes utilities to adopt cutting-edge automation solutions that enhance grid performance.

Market Trends:

Increasing Implementation of Advanced Automation Solutions

The Substation Automation and Integration Market is witnessing a significant shift towards the implementation of advanced automation solutions. These systems enhance the operational efficiency and reliability of substations by automating routine tasks such as fault detection, load management, and energy distribution. With the adoption of intelligent Electronic Devices (IEDs), Remote Terminal Units (RTUs), and supervisory control systems, utilities are optimizing grid operations and minimizing the risk of outages. The trend towards advanced automation is also driven by the increasing need for real-time data analytics, which enables quicker decision-making and enhances overall grid performance. These innovations are making substations smarter, offering more efficient energy management and improving grid resilience in the face of growing energy demands.

- For instance, Siemens’ advanced SICAM A8000 series is a modular device range capable of supporting telecontrol and automation applications by managing up to 200,000 data points within a single system.

Growth of Decentralized Energy Systems and Renewable Integration

Another prominent trend shaping the Substation Automation and Integration Market is the growing adoption of decentralized energy systems and the integration of renewable energy sources. The push for cleaner energy solutions is driving investments in automated substations that can efficiently handle distributed generation sources such as solar, wind, and battery storage. Automated substations facilitate the smooth integration of renewable energy into the grid by balancing intermittent power generation and demand. As the energy landscape shifts toward more sustainable and decentralized models, substations must become more flexible and capable of handling variable energy inputs. This trend is leading to increased demand for substation automation technologies that ensure grid stability, enhance renewable energy integration, and support the transition to a more sustainable energy infrastructure.

- For example, Hitachi Energy supplied critical components for the Noor Abu Dhabi solar plant, helping to integrate the power from 3.2 million solar panels into the electrical grid.

Market Challenges Analysis:

High Initial Investment and Deployment Costs

One of the significant challenges in the Substation Automation and Integration Market is the high initial investment and deployment costs. The implementation of advanced automation systems, including smart grid technologies, requires substantial capital expenditure for equipment, software, and integration. Utilities often face budget constraints, particularly in developing regions, where financial resources are limited. The complex nature of installing and configuring these systems can lead to delays in project timelines and additional costs. Despite the long-term benefits, such as reduced operational expenses and improved efficiency, the initial capital required for automation adoption can deter smaller utilities and slow market growth in some regions.

Integration with Legacy Systems and Interoperability Issues

Another challenge hindering the Substation Automation and Integration Market is the integration of new automation technologies with existing legacy systems. Many substations still rely on outdated infrastructure that may not be compatible with modern automation solutions. The process of retrofitting or upgrading these systems can be time-consuming and costly. Interoperability issues also arise when integrating devices from multiple vendors, which can result in communication breakdowns or inefficiencies. The need for standardized protocols and seamless integration between new and legacy systems remains a key challenge, limiting the full potential of automation technologies in certain markets.

Market Opportunities:

Expansion of Smart Grid and Renewable Energy Integration

The Substation Automation and Integration Market presents significant opportunities driven by the expansion of smart grids and the integration of renewable energy sources. Governments and utilities worldwide are investing in grid modernization to improve efficiency, resilience, and sustainability. Automated substations play a crucial role in integrating renewable energy, such as solar and wind, into the grid by managing fluctuations in power generation and ensuring stability. The global shift towards decarbonization and clean energy provides substantial growth prospects for automation technologies that facilitate smoother integration and better energy management.

Advancements in Artificial Intelligence and IoT for Automation

Another key opportunity in the Substation Automation and Integration Market lies in the advancements of artificial intelligence (AI) and the Internet of Things (IoT). These technologies enable real-time data analytics, predictive maintenance, and remote monitoring, significantly enhancing operational efficiency. AI-powered systems can detect and resolve faults more effectively, reducing downtime and maintenance costs. IoT-enabled devices facilitate seamless communication between equipment, improving system performance and enabling more efficient energy distribution. The increasing reliance on these technologies in the power sector creates ample opportunities for innovation and market growth in substation automation.

Market Segmentation Analysis:

By Component

The Substation Automation and Integration Market is divided into hardware and software components. Hardware includes sensors, control systems, and automation devices that enhance substation operations. Software solutions, such as SCADA systems and real-time analytics, are essential for efficient data management and predictive maintenance. The hardware segment holds a larger market share, driven by the growing demand for physical automation devices that enable better monitoring and control of substations.

- For instance, NovaTech Automation’s Hermes 2000 series utility-grade Ethernet switch provides robust hardware for digital substations, offering up to 28 Gigabit Ethernet ports for high-speed data communication.

By Technology

The market is segmented into communication networks, control systems, and automation technologies. Communication networks ensure seamless connectivity between devices and central systems, which is vital for data transmission in automated substations. Control systems, including digital relays and intelligent electronic devices (IEDs), are integral for grid management and fault detection. Automation technologies, such as advanced control and monitoring systems, optimize power distribution and enhance grid stability. The control systems segment is expected to see rapid growth, fueled by the increasing adoption of smart grid technologies.

- For instance, Cisco offers advanced hardware for these critical environments, such as the Catalyst IE9300 Rugged Series switches which provide up to 28 Gigabit Ethernet fiber ports for secure and low-latency communication.

By Deployment Mode

The market is further divided into on-premises and cloud-based deployment modes. On-premises deployment continues to dominate, particularly in regions with established infrastructure and advanced grid systems. However, cloud-based deployment is gaining popularity due to its scalability, cost-efficiency, and real-time data access. This segment is expected to grow significantly as utilities seek to modernize their grids with cloud solutions that offer improved operational flexibility and reduced costs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentations:

By Component

By Technology

- Communication Networks

- Control Systems

- Automation Technologies

By Deployment Mode

By Functionality

- Monitoring

- Control

- Protection

- Automation

By End-User Industry

- Energy and Power

- Oil and Gas

- Transportation

- Industrial

- Renewable Energy

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading the Substation Automation and Integration Market

North America holds the largest market share in the Substation Automation and Integration Market, accounting for 38% of the global market. This dominance is attributed to substantial investments in grid modernization, as well as the adoption of advanced energy technologies across the U.S. and Canada. The region’s focus on improving grid reliability and integrating renewable energy sources drives significant demand for substation automation solutions. Government incentives and policies aimed at enhancing energy efficiency further support the growth of automation technologies. The ongoing efforts to reduce energy consumption and enhance grid resilience to natural disasters also strengthen market demand. North America’s robust infrastructure and technological advancements ensure its continued leadership in the market.

Europe: A Focus on Sustainability and Grid Efficiency

Europe holds 29% of the global Substation Automation and Integration Market share, driven by a strong emphasis on sustainability and energy efficiency. The region is committed to carbon neutrality and renewable energy integration, creating a significant market for automation technologies. Key countries such as Germany, the UK, and France lead investments in modernizing grid infrastructure to accommodate the increasing renewable energy production. Policies like the European Union’s Green Deal are accelerating the adoption of smart grid systems and decentralized energy solutions. Europe’s focus on reducing carbon emissions and enhancing energy efficiency ensures sustained demand for advanced automation technologies, positioning it as a key player in the market.

Asia-Pacific: Rapid Growth in Energy Demand and Infrastructure Modernization

The Asia-Pacific region commands 23% of the global Substation Automation and Integration Market share, experiencing the highest growth rate. The region’s rapid urbanization, industrialization, and rising energy demand, particularly in countries like China, India, and Japan, are the primary drivers for increased substation automation adoption. Government initiatives aimed at modernizing energy infrastructure and integrating renewable energy are further fueling market expansion. Significant investments in smart cities and renewable energy projects enhance the demand for automation technologies in the region. As energy consumption rises, the need for more efficient and automated grid systems becomes critical to ensure grid stability and efficiency in Asia-Pacific.

Key Player Analysis:

- Dashiell

- Eaton

- ABB

- Beijing Sifang Automation

- Black & Veatch

- BPL Global

- ABB Tropos Networks

- Alstom

- Amperion

- Automated Control Concepts

- Cisco Systems

- Cooper Power Systems

Competitive Analysis:

The Substation Automation and Integration Market is highly competitive, with several key players dominating the landscape. Major companies such as Siemens AG, ABB Ltd., Schneider Electric, and General Electric lead the market with their advanced automation solutions and extensive industry experience. These companies focus on innovation and technological advancements to enhance grid management, optimize efficiency, and integrate renewable energy sources seamlessly. They leverage partnerships and acquisitions to expand their market presence and improve product offerings. The market also sees increasing participation from emerging players and regional firms offering specialized solutions tailored to specific market needs. Companies are focusing on expanding their product portfolios with cloud-based and AI-powered solutions, which are gaining traction due to their scalability, flexibility, and real-time data processing capabilities. Competition is intensifying as companies aim to capitalize on the growing demand for smart grid and automation technologies, especially in developing regions with rapidly modernizing infrastructure.

Recent Developments:

- In September, 2024, ABB Robotics launched a new Ultra Accuracy feature, which improves the path accuracy of its collaborative robots by more than ten times.

- In May 2025, ABB announced an agreement to acquire BrightLoop, a French power electronics company, with the transaction expected to close in the third quarter of 2025.

- In June 2024,ABB launched OmniCore, a next-generation robotics control platform, supported by a $170 million investment.

Market Concentration & Characteristics:

The Substation Automation and Integration Market is moderately concentrated, with a few key players holding significant market share, including Siemens AG, ABB Ltd., Schneider Electric, and General Electric. These companies dominate through their technological expertise, extensive product portfolios, and global reach. The market exhibits high barriers to entry due to the large capital investment required for research, development, and deployment of automation solutions. The industry is characterized by rapid technological advancements, including the integration of AI, IoT, and cloud-based solutions, which continue to transform grid management. Companies focus on expanding their geographic presence, especially in emerging markets, by offering tailored solutions that cater to specific regional requirements. The competitive environment drives continuous innovation, enhancing grid reliability, efficiency, and the seamless integration of renewable energy sources, which is a critical factor in sustaining market growth.

Report Coverage:

The research report offers an in-depth analysis based on Component, Technology, Deployment Mode, Functionality, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Substation Automation and Integration Market is set to experience significant growth as utilities worldwide modernize aging infrastructure to enhance grid reliability and efficiency.

- Integration of renewable energy sources will drive demand for advanced automation systems capable of managing variable power inputs and ensuring grid stability.

- Increasing adoption of smart grid technologies will enable real-time monitoring and control, improving operational efficiency and reducing downtime.

- Advancements in communication technologies, such as 5G and IoT, will facilitate seamless connectivity and data exchange between substations and central control systems.

- Deployment of AI and machine learning algorithms will enhance predictive maintenance capabilities, reducing the risk of equipment failures and optimizing asset management.

- Growing emphasis on cybersecurity will lead to the development of robust protection mechanisms to safeguard critical infrastructure from cyber threats.

- Expansion of electric vehicle charging networks will necessitate upgrades to substation infrastructure to accommodate increased power demands.

- Government initiatives and regulatory frameworks supporting grid modernization and clean energy adoption will further propel market growth.

- Emerging markets in Asia-Pacific and Africa will present new opportunities for automation solutions as urbanization and industrialization accelerate.

- Strategic partnerships and collaborations among key industry players will foster innovation and accelerate the development of next-generation substation automation technologies.