Market Overview:

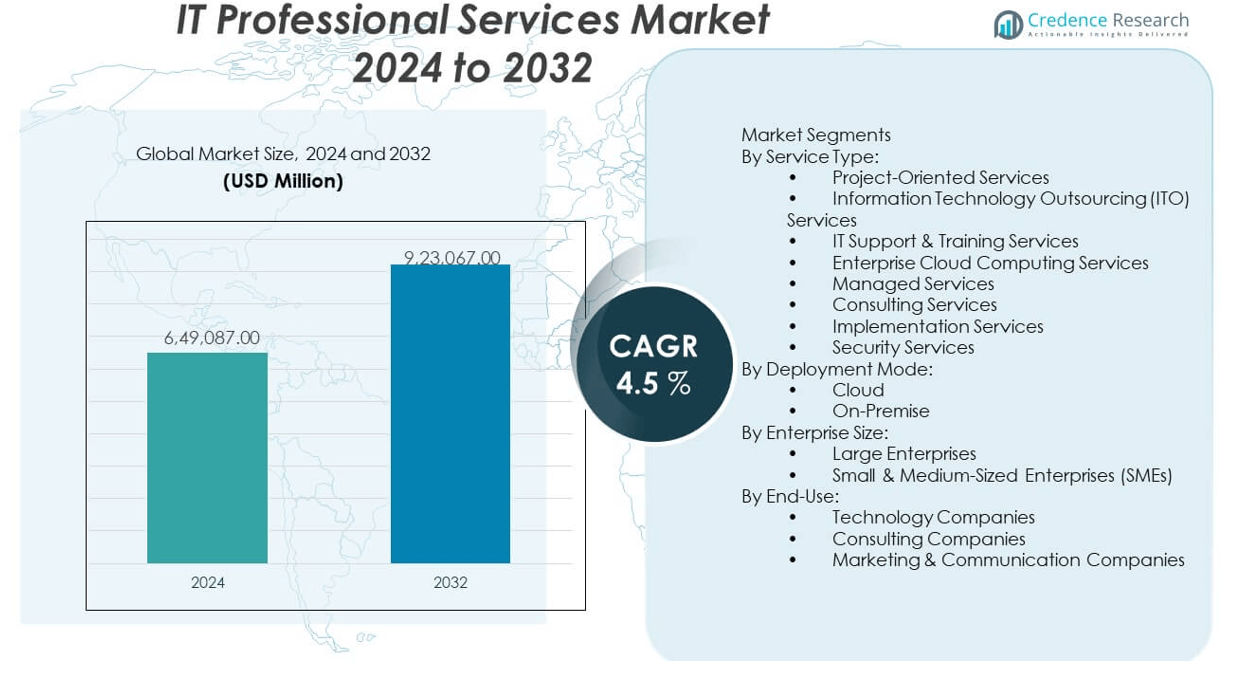

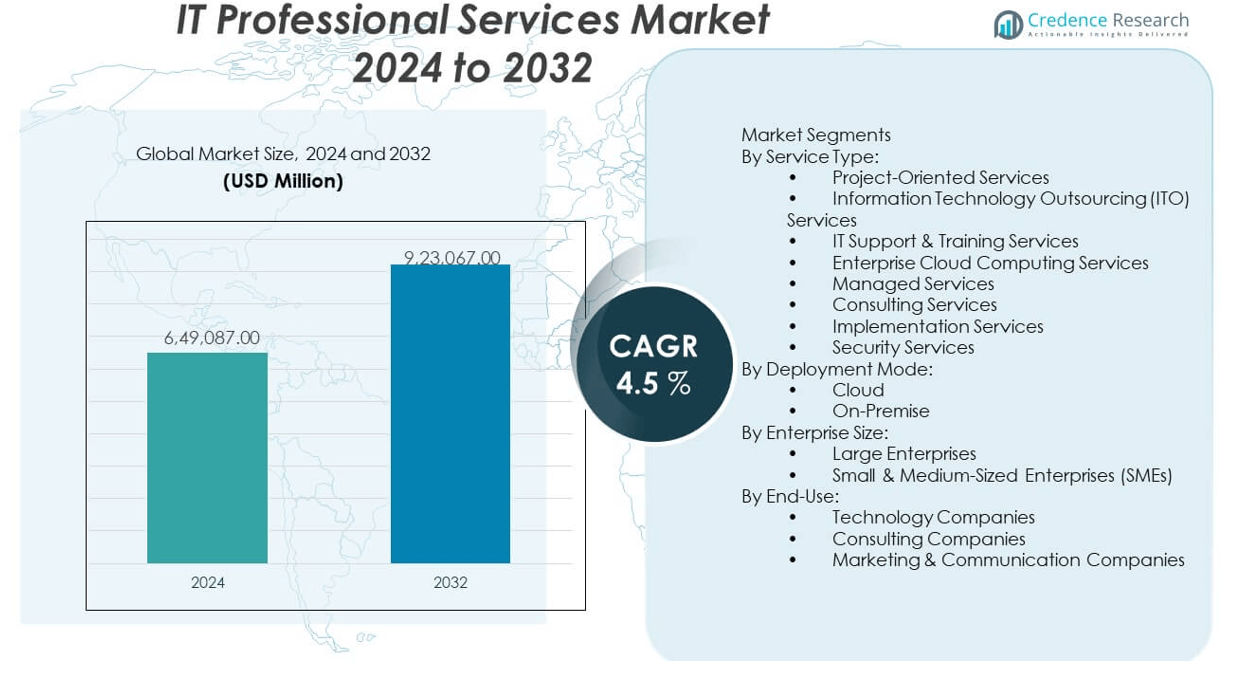

The IT professional services market is projected to grow from USD 649,087 million in 2024 to an estimated USD 923,067 million by 2032, with a compound annual growth rate (CAGR) of 4.5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| IT Professional Services MarketSize 2024 |

USD 649,087 million |

| IT Professional Services Market, CAGR |

4.5% |

| IT Professional Services Market Size 2032 |

USD 923,067 million |

The growth of the IT professional services market is primarily driven by the increasing demand for digital transformation across industries. Organizations are embracing cloud computing, big data analytics, and cybersecurity services to enhance operational efficiency and customer engagement. The proliferation of remote work, coupled with the need for advanced IT infrastructure, further accelerates the adoption of consulting, system integration, and managed services. Businesses rely on IT professional services to stay competitive, optimize costs, and ensure regulatory compliance in rapidly evolving digital environments.

North America dominates the IT professional services market due to its advanced technological infrastructure, presence of major global service providers, and high adoption of cloud and digital technologies. Europe follows closely, with strong demand from sectors like finance, manufacturing, and healthcare. Meanwhile, Asia-Pacific is emerging as a key growth region, driven by rapid digitalization, increasing IT investments, and expanding business ecosystems in countries like India, China, and Southeast Asia. Latin America and the Middle East are gradually adopting IT services, propelled by economic reforms and growing enterprise IT needs.

Market Insights:

- The IT professional services market is projected to grow from USD 649,087 million in 2024 to USD 923,067 million by 2032, registering a CAGR of 4.5%.

- Digital transformation initiatives across industries drive strong demand for consulting, implementation, and managed IT services.

- Growing reliance on cloud computing, AI integration, and cybersecurity infrastructure boosts service adoption across enterprise sectors.

- Talent shortages in advanced IT domains and high turnover rates challenge service scalability and timely project delivery.

- Vendor lock-in concerns and integration complexities with legacy systems limit adoption for some enterprises.

- North America leads with a 39.6% market share, followed by Europe at 27.5% and Asia-Pacific at 23.3%, reflecting varied maturity and digital investment levels.

- Regulatory compliance needs, particularly in Europe and financial sectors, increase demand for professional services that support risk management and data protection.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rapid Digital Transformation Across Industries Fuels IT Service Adoption:

Businesses across sectors continue to prioritize digital transformation initiatives, creating strong demand in the IT professional services market. Enterprises seek robust solutions to modernize legacy systems and improve customer experience. They deploy IT services to drive efficiency, automation, and cost reduction across operations. Cloud computing, AI, and edge technologies play a central role in shaping these modernization efforts. Companies rely on IT professionals for system integration and platform customization. IT professional services ensure scalability and compliance while accelerating time-to-market. Large corporations and mid-sized firms invest heavily to stay competitive. This growing need for modernization consistently propels market expansion.

- For instance, Accenture has completed over 1,300 large-scale cloud transformation projects worldwide, helping clients modernize infrastructure and accelerate business outcomes through its Cloud First initiative.

Surging Demand for Cybersecurity and Risk Management Expertise:

Heightened concerns about cyber threats increase the need for professional IT support. Organizations face complex security challenges that require expert mitigation strategies. IT professional services help clients build secure networks, manage access controls, and conduct vulnerability assessments. It also supports regulatory compliance and protection of sensitive data. Financial institutions, healthcare providers, and government bodies lead in adopting cybersecurity consulting. The market benefits from continuous updates in threat intelligence and evolving risk frameworks. Cyber-resilient infrastructure remains a priority for most enterprises. This heightened focus on risk reduction drives significant demand for specialized IT services.

- For instance, IBM’s Security division reported blocking more than 150 billion security events daily for its customers, highlighting its expertise in real-time threat detection and mitigation.

Cloud Migration Accelerates Strategic IT Investments:

Enterprises moving from on-premise systems to cloud-based environments generate substantial service opportunities. The IT professional services market sees growing requests for cloud strategy, implementation, and management. Firms adopt multi-cloud and hybrid models to gain agility and scalability. Service providers assist clients in aligning cloud deployment with business goals. IT professionals design customized cloud architectures and ensure smooth transitions. Cloud integration also unlocks capabilities in data analytics, AI, and IoT. It simplifies infrastructure, reduces maintenance costs, and enhances application performance. This shift continues to fuel consistent service growth across global industries.

Rise of Remote Work and Hybrid Models Drives Infrastructure Modernization:

The shift to remote and hybrid work structures demands secure, flexible IT environments. Businesses need robust infrastructure, collaboration tools, and endpoint management solutions. IT professional services address these requirements by implementing scalable and secure platforms. It also supports virtual desktop infrastructure and real-time communication systems. Enterprises depend on IT consultants to design remote-ready IT ecosystems. Managed services play a crucial role in ongoing performance monitoring and troubleshooting. The market continues to evolve with employee mobility and flexible work trends. This shift reshapes long-term IT priorities for businesses of all sizes.

Market Trends:

Integration of Artificial Intelligence Into Service Portfolios Gains Momentum:

Service providers incorporate AI capabilities into their offerings to deliver smarter, faster solutions. AI-powered automation reduces manual workloads and improves service efficiency. The IT professional services market benefits from growing enterprise interest in intelligent tools. Clients seek AI-based analytics, chatbots, and predictive maintenance solutions. Service firms invest in AI-driven platforms to enhance value delivery. AI integration improves decision-making and enhances user experience. It also helps manage large datasets and optimize workflows. This trend marks a shift toward intelligent IT operations across industries.

- For instance, Capgemini reported that by 2023, more than 600 enterprise clients had deployed AI-powered solutions through its Intelligent Automation platform, resulting in measurable process efficiency gains.

Platform Engineering and Low-Code Development Reshape Service Delivery:

Businesses adopt low-code and no-code platforms to accelerate application development cycles. IT professional services firms support clients by enabling rapid deployment through simplified interfaces. Platform engineering enhances DevOps, streamlines testing, and reduces technical debt. It allows organizations to iterate faster and respond to market changes swiftly. Service providers enable integration of these tools within enterprise systems. This trend shortens delivery timelines and empowers non-technical users. The IT professional services market adapts its models to meet these changing demands. This transformation supports agility and business responsiveness.

- For instance, Microsoft’s Power Platform surpassed 10 million monthly active users in 2024, as organizations rapidly built and deployed custom business apps with low-code tools supported by Microsoft’s professional services.

Demand for Industry-Specific Solutions and Domain Expertise Increases:

Clients increasingly request tailored IT services aligned with their industry requirements. IT professional services providers build sector-specific solutions for healthcare, finance, retail, and manufacturing. Deep domain expertise helps address compliance, workflow, and data requirements. Customization improves ROI and accelerates deployment. Firms with strong vertical capabilities gain a competitive edge. It also leads to better alignment between IT outcomes and business KPIs. The trend supports specialization and niche market expansion. Providers that master industry nuances strengthen their market position.

Data-Driven Service Models and Analytics-Led Decision Support Expand:

Enterprises emphasize data-backed decision-making for operational efficiency. IT professional services integrate analytics into all phases of engagement. From strategy to implementation, data insights inform design, delivery, and performance measurement. Clients demand dashboards, KPIs, and advanced reporting tools. It enhances governance, risk management, and business agility. Service firms build data lakes, implement BI tools, and create custom metrics frameworks. The IT professional services market evolves to support deeper analytics capabilities. This data-first approach transforms client engagement models.

Market Challenges Analysis:

Shortage of Skilled IT Professionals and High Talent Turnover Rates:

The IT professional services market faces a persistent shortage of skilled professionals in critical areas like cybersecurity, AI, and cloud architecture. Organizations struggle to find and retain talent capable of managing complex IT projects. It creates project delays, increases labor costs, and limits service scalability. Smaller firms face difficulty competing with larger service providers for top talent. High turnover disrupts client continuity and project outcomes. Training programs often lag behind emerging technologies, widening the skills gap further. Clients expect faster delivery, placing additional strain on limited talent pools. This human capital challenge threatens the industry’s ability to meet rising demand.

Vendor Lock-in, Legacy System Integration, and Changing Client Expectations:

Clients remain cautious about vendor lock-in, particularly in long-term managed service agreements. Legacy system integration poses technical challenges and increases project complexity. The IT professional services market must also adapt to rapidly evolving client expectations. It needs to deliver faster results with greater flexibility and transparency. Contract structures, service level agreements, and value delivery models undergo constant revision. Security and compliance requirements vary by region, complicating multinational service execution. Service providers must balance innovation with operational continuity. These factors create execution risk and limit seamless scaling across client portfolios.

Market Opportunities:

Growing Digital Transformation in Emerging Economies Unlocks New Revenue Avenues:

Emerging markets offer strong potential for service providers expanding their geographic footprint. Rapid urbanization and digital government initiatives in Asia, Latin America, and Africa increase demand. The IT professional services market benefits from investments in smart cities, fintech, and e-governance platforms. SMEs in these regions also seek affordable IT solutions to modernize operations. Service providers entering these markets can offer scalable, modular services. Local partnerships and language localization improve service relevance and penetration. These regions provide significant untapped business value for global and regional players.

Sustainability and Green IT Drive New Consulting Opportunities:

Environmental sustainability becomes a core priority for enterprise IT strategy. Clients seek support for green data centers, energy-efficient systems, and carbon accounting tools. The IT professional services market helps companies align with ESG goals through optimized IT infrastructure. It enables resource-efficient computing, cloud consolidation, and IT asset lifecycle management. Service providers who lead in sustainability consulting stand to capture early market share. This shift opens new revenue streams aligned with global environmental priorities.

Market Segmentation Analysis:

By Service Type

The IT professional services market covers a wide range of service offerings. Project-oriented services remain prominent for addressing specific business goals through time-bound engagements. Information Technology Outsourcing (ITO) helps enterprises reduce operational costs and focus on core competencies. IT support and training services ensure smooth technology adoption and employee readiness. Enterprise cloud computing services continue to see high demand with the shift toward digital ecosystems. Managed services offer continuous infrastructure and application oversight. Consulting services provide critical strategic input for digital transformation. Implementation services execute system integrations and platform deployments. Security services gain importance due to rising threats and compliance needs.

- For instance, Deloitte’s consulting division facilitated over 500 digital transformation projects for Fortune 500 companies in 2023, illustrating the range and impact of professional service engagements.

By Deployment Mode

Deployment preferences reflect operational priorities and risk tolerance. Cloud deployment dominates due to flexibility, reduced infrastructure costs, and ease of access. On-premise deployment persists in industries where control over data and infrastructure is essential. Hybrid models are emerging to balance agility with governance requirements.

- For instance, AWS reported that more than 80% of its enterprise customers adopted hybrid or multi-cloud strategies in 2024, leveraging its cloud-native services alongside on-premises infrastructure through AWS Outposts.

By Enterprise Size

Large enterprises lead in service adoption due to complex IT needs and bigger budgets. They engage in large-scale implementations, cybersecurity frameworks, and enterprise-wide cloud strategies. Small and medium-sized enterprises (SMEs) contribute significantly to growth through demand for scalable, cost-efficient, and outsourced services. Vendors tailor offerings to suit SME agility and resource constraints.

By End-Use/Application

Technology companies rely heavily on IT professional services to maintain innovation and scalability. Consulting firms use IT services to modernize operations and support client solutions. Marketing and communication companies leverage digital platforms, data analytics, and automation tools to optimize campaign execution and customer engagement. The IT professional services market supports these diverse user needs with tailored solutions across sectors.

Segmentation:

By Service Type:

- Project-Oriented Services

- Information Technology Outsourcing (ITO) Services

- IT Support & Training Services

- Enterprise Cloud Computing Services

- Managed Services

- Consulting Services

- Implementation Services

- Security Services

By Deployment Mode:

By Enterprise Size:

- Large Enterprises

- Small & Medium-Sized Enterprises (SMEs)

By End-Use:

- Technology Companies

- Consulting Companies

- Marketing & Communication Companies

Regional Analysis:

North America Leads with Strong Digital Infrastructure and Enterprise Demand

North America holds the largest share in the IT professional services market, accounting for approximately 39.6% of the global market. The region benefits from early adoption of digital technologies, strong enterprise IT spending, and the presence of major global players such as IBM, Microsoft, and Accenture. High demand for cloud computing, cybersecurity, and advanced analytics drives service uptake across industries. The United States leads in both volume and innovation, driven by large-scale digital transformation projects in finance, healthcare, and retail. Canada also contributes significantly, supported by national tech policy initiatives and cross-sector IT investments. The market remains competitive and innovation-driven, with firms seeking value through managed and consulting services.

Europe Maintains Strong Position Driven by Regulatory Compliance and Cloud Adoption

Europe represents around 27.5% of the global IT professional services market. Demand is driven by stringent data privacy regulations such as GDPR, which require professional support in cybersecurity and compliance. The region shows strong adoption of cloud services, particularly in Western European economies like Germany, the UK, and France. Companies in manufacturing, financial services, and government sectors seek consulting and implementation support to modernize infrastructure and meet regulatory standards. Eastern Europe is gaining attention due to its cost-competitive IT service hubs in Poland, Romania, and the Czech Republic. The market benefits from a mature enterprise base and regional initiatives aimed at digital transformation across the EU.

Asia-Pacific Emerges as a High-Growth Market with Expanding IT Ecosystems

Asia-Pacific accounts for approximately 23.3% of the IT professional services market, reflecting its role as a fast-growing technology hub. The region sees rapid digitalization in countries like China, India, Japan, South Korea, and Australia. Enterprises in the region increasingly seek cloud migration, IT consulting, and cybersecurity services. India stands out both as a service provider and a growing consumer of professional IT solutions. China’s tech sector drives domestic demand, particularly in e-commerce, telecom, and manufacturing. Local and regional firms compete with global providers to meet demand from SMEs and government-led digital initiatives. It continues to expand with rising IT investment, urbanization, and supportive digital policy frameworks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Accenture PLC

- Capgemini

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Cognizant

- Deloitte

- Fujitsu Limited

- Hewlett Packard Enterprise (HPE)

- Amazon Web Services (AWS)

- DXC Technology Company

- Tata Consultancy Services (TCS)

- Wipro

- Infosys

- SAP

- Cisco Systems

- Salesforce

- Atos

- CGI Inc.

Competitive Analysis:

The IT professional services market features intense competition among global consulting firms, technology service providers, and cloud specialists. Leading players such as Accenture, IBM, Deloitte, Tata Consultancy Services, and Capgemini dominate with diversified service portfolios and global delivery capabilities. These firms leverage long-term client relationships, extensive domain expertise, and scalable service models. Mid-tier companies and emerging regional players compete through specialization and price differentiation. It witnesses continuous investment in AI, cloud, and cybersecurity services to sustain competitive edge. Strategic partnerships and acquisitions remain common as firms expand capabilities and client reach across geographies and verticals.

Recent Developments:

- In July 2024, Accenture completed the acquisition of OPENSTREAM HOLDINGS and its subsidiaries, Open Stream and Neutral. This move aims to strengthen Accenture’s cloud, digital engineering, and manufacturing capabilities, and adds approximately 1,000 experts to support client modernization and adoption of technologies such as AI and IoT.

- In July 2025, Capgemini announced its agreement to acquire WNS, an India-based business process management company, for $3.3 billion. This acquisition is targeted at expanding Capgemini’s offerings in intelligent operations, particularly in agentic AI, and is expected to close by the end of 2025.

- On April 24, 2024, IBM revealed its intention to acquire HashiCorp Inc., a leader in multi-cloud infrastructure automation, for $6.4 billion. The acquisition will bolster IBM’s hybrid cloud and AI platform capabilities for enterprises managing complex infrastructure and application environments.

- On October 3, 2024, Microsoft and Rezolve AI announced a strategic partnership to drive innovation in global retail using AI-powered commerce solutions. The collaboration will see Rezolve AI’s product suite available on Microsoft Azure Marketplace, leveraging the Microsoft Cloud for advanced retail engagement.

- On June 11, 2024, Oracle and Google Cloud launched a groundbreaking multicloud partnership. This collaboration allows enterprises to combine Oracle Cloud Infrastructure (OCI) with Google Cloud, simplifying cloud migrations and multicloud deployments and offering features such as Oracle Database@Google Cloud.

Market Concentration & Characteristics:

The IT professional services market is moderately consolidated, with a few large firms capturing significant global share. It is characterized by high service diversification, strong demand for digital consulting, and recurring client engagement models. Barriers to entry include talent acquisition, technological expertise, and global delivery capabilities. Clients favor providers offering end-to-end solutions, regulatory compliance support, and sector-specific knowledge. It evolves continuously with emerging technologies, regulatory shifts, and changing enterprise IT priorities.

Report Coverage:

The research report offers an in-depth analysis based on type, deployment mode, enterprise size, and end-use application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for AI-integrated IT services will expand across industries.

- Cloud-native solutions will replace traditional IT infrastructure in new projects.

- Cybersecurity consulting will become central to service portfolios.

- SMEs will adopt modular, scalable IT services at a higher rate.

- Sustainability consulting will gain traction in IT infrastructure planning.

- Hybrid deployment models will support flexibility and compliance needs.

- Demand for industry-specific digital transformation will grow.

- Talent shortages will push automation in service delivery models.

- Partnerships between tech firms and consultancies will accelerate.

- Emerging markets will present new revenue streams for global providers.