Market Overview

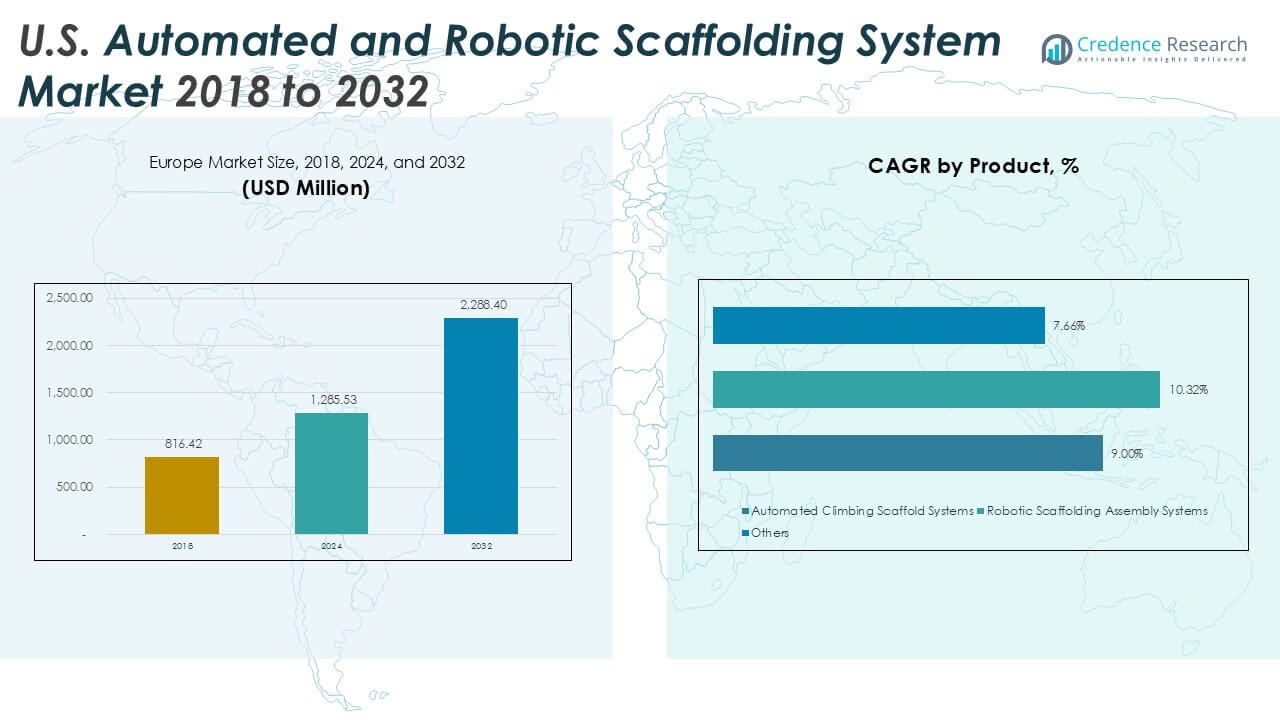

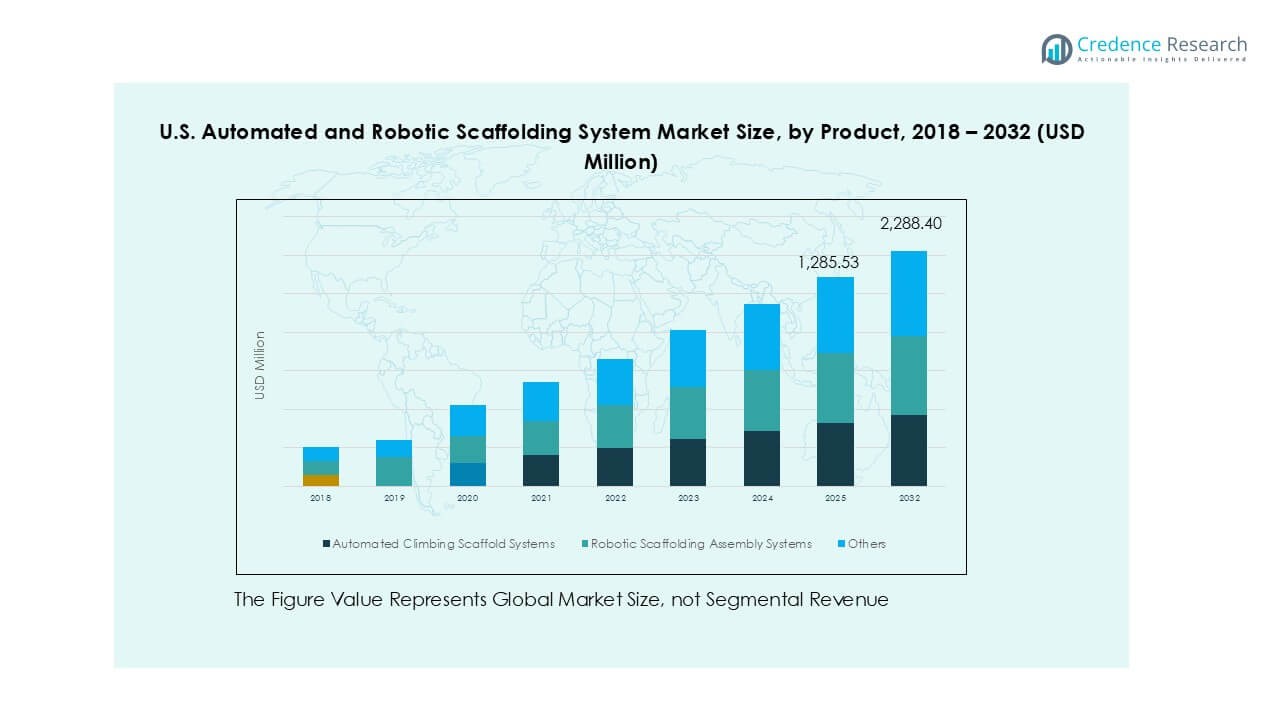

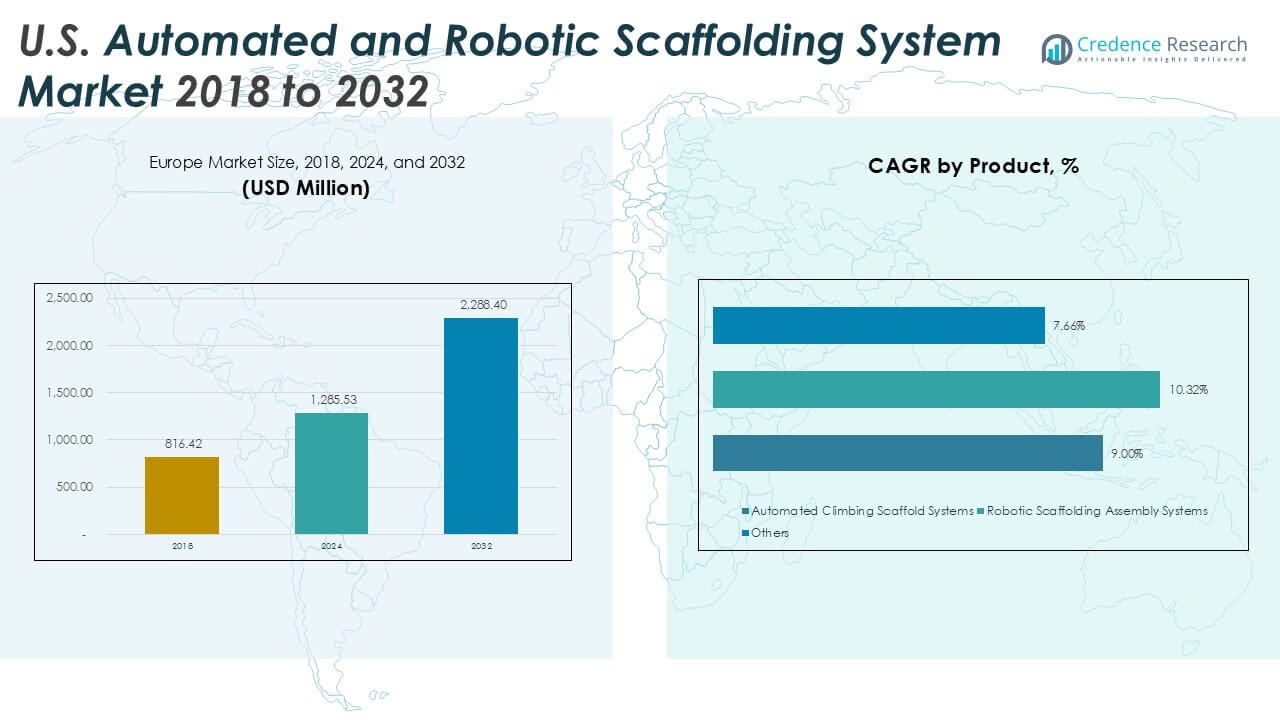

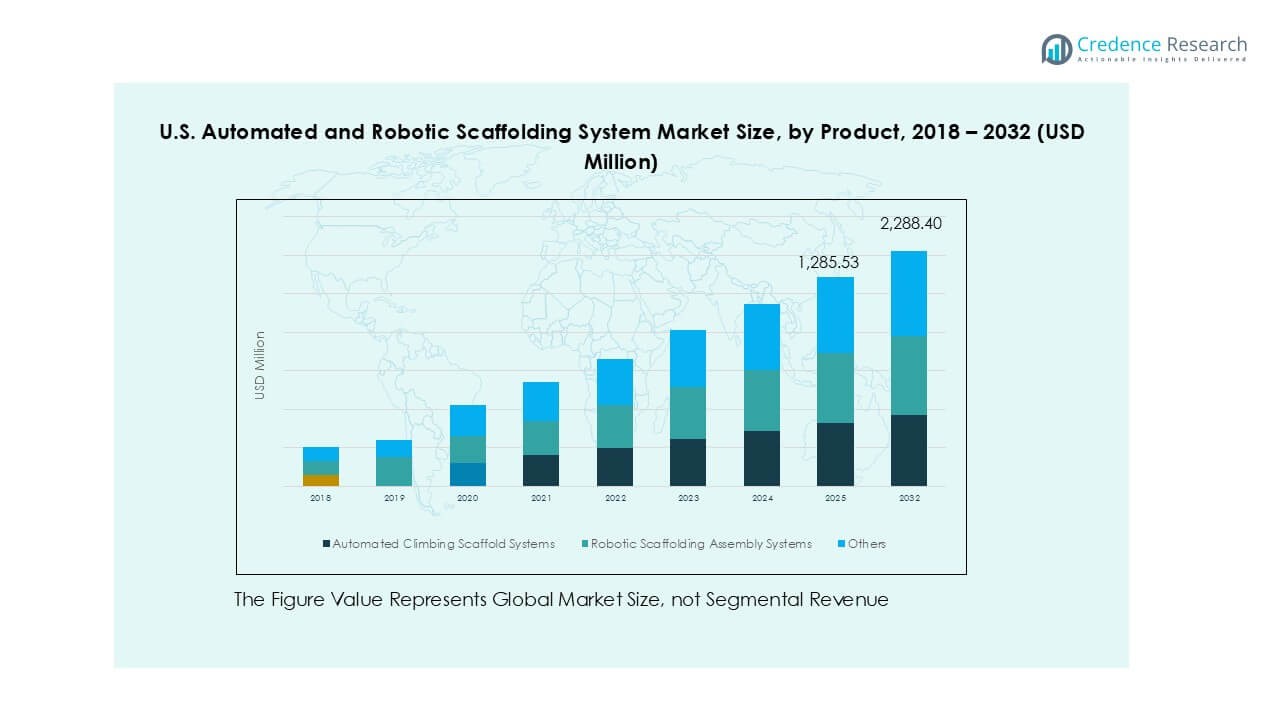

The U.S. Automated and Robotic Scaffolding System market was valued at USD 816.42 million in 2018, increased to USD 1285.53 million in 2024, and is anticipated to reach USD 2288.40 million by 2032, growing at a CAGR of 7.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Automated and Robotic Scaffolding System market Size 2024 |

USD XX Million |

| U.S. Automated and Robotic Scaffolding System market , CAGR |

XX |

| U.S. Automated and Robotic Scaffolding System market Size 2032 |

USD XX Million |

Top players in the U.S. Automated and Robotic Scaffolding System market include Layher, Inc., Kewazo, MEVA, Reo Lift, and KITSEN Scaffold & Formwork Technologies, all of which contribute to advancing construction automation through innovative scaffolding solutions. Layher, Inc. maintains a strong presence with its modular systems, while Kewazo leads in robotics integration. MEVA and Reo Lift focus on enhancing operational efficiency and site safety. Regionally, the South dominates the market with a 30% share, driven by large-scale commercial, residential, and industrial construction across Texas, Florida, and Georgia. The Northeast and West follow, holding 25% and 23% respectively, supported by urban redevelopment and smart construction initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Automated and Robotic Scaffolding System market was valued at USD 816.42 million in 2018, increased to USD 1285.53 million in 2024, and is anticipated to reach USD 2288.40 million by 2032, growing at a CAGR of 7.66% during the forecast period.

- Growth is driven by rising demand for construction automation, labor shortages, and the need to improve worker safety and operational efficiency across infrastructure and high-rise projects.

- Key trends include the integration of AI and IoT for predictive maintenance and real-time monitoring, with a growing shift toward modular, intelligent scaffolding systems.

- The market is moderately concentrated, with leading players such as Layher, Inc., Kewazo, and MEVA competing through innovation, product expansion, and strategic partnerships.

- The South holds the highest regional share at 30%, followed by the Northeast at 25% and the West at 23%; by application, installation and erection services lead in market share due to high usage in large-scale construction projects.

Market Segmentation Analysis:

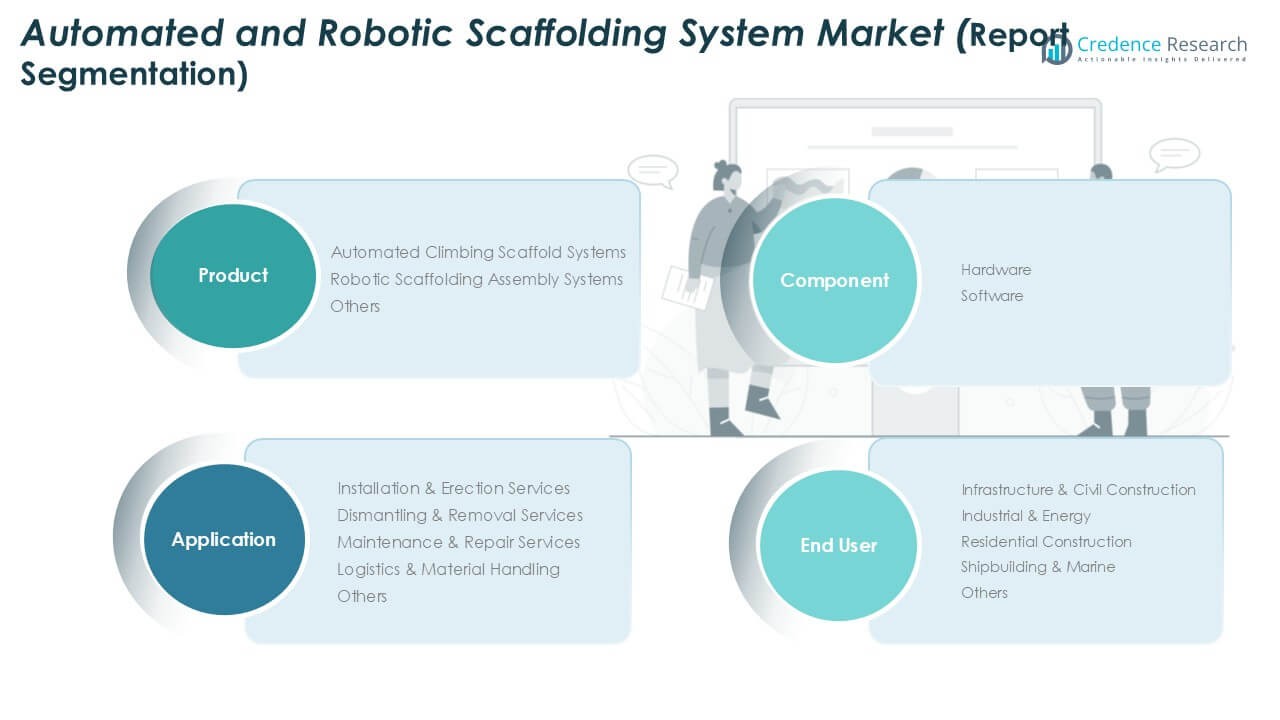

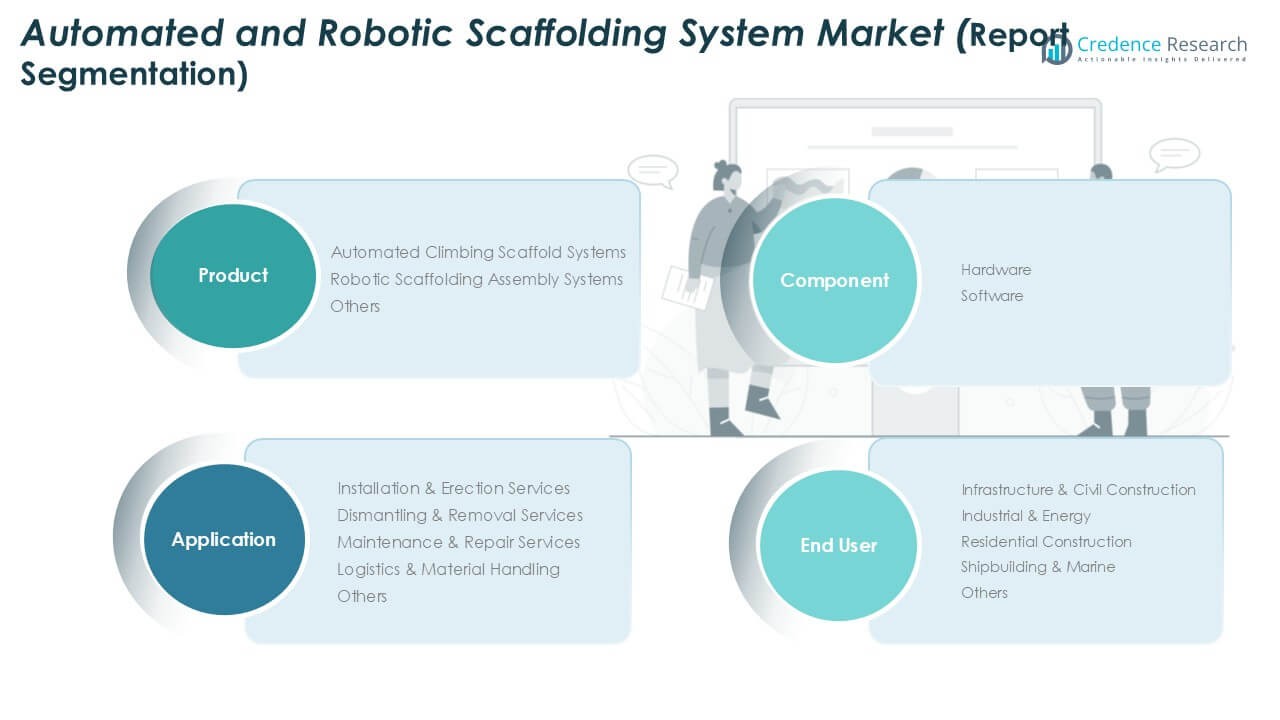

By Product

The U.S. Automated and Robotic Scaffolding System market, when segmented by product, is primarily driven by the Automated Climbing Scaffold Systems sub-segment, which holds the dominant market share. These systems offer significant labor savings and enhance worker safety by reducing manual handling and human error during vertical movement in high-rise projects. The growing demand for faster and safer scaffolding solutions in large-scale infrastructure and commercial construction projects continues to fuel the adoption of automated climbing systems. Meanwhile, Robotic Scaffolding Assembly Systems are gaining traction for complex structures where precision and repeatability are crucial.

- For instance, Kewazo’s LIFTBOT robotic scaffolding system has demonstrated labor savings of up to 44% on scaffolding assembly tasks and has completed over 18,000 scaffold transport cycles in active construction environments across Europe and North America.

By Application

Among applications, Installation & Erection Services emerge as the leading sub-segment, accounting for the highest revenue share in the U.S. market. This dominance is attributed to the high frequency of scaffold deployment in large-scale construction, maintenance, and retrofitting projects. The automation of erection processes minimizes downtime, increases precision, and reduces reliance on manual labor, aligning well with the industry’s shift toward digital and autonomous construction practices. Other segments like Dismantling and Maintenance & Repair Services are steadily expanding, driven by the need for operational efficiency and safety compliance in post-construction and renovation phases.

- For instance, Layher’s Allround Scaffolding system allows for rapid erection speeds, enabling over 1,000 square feet of scaffolding to be assembled in under 90 minutes with a crew of just three workers.

By Component

In the component analysis, Hardware constitutes the dominant sub-segment, holding the largest share of the U.S. market. This includes motors, sensors, control units, and structural elements that form the physical backbone of automated and robotic scaffolding systems. The demand for advanced, durable, and customizable hardware is increasing with the integration of robotics and AI technologies. While software plays a critical role in system optimization and real-time monitoring, its market share remains comparatively lower. However, rising investments in software-driven automation and predictive maintenance tools are expected to accelerate growth in this sub-segment.

Key Growth Drivers

Rising Demand for Construction Automation

The growing emphasis on automation across the construction sector is a major driver for the U.S. automated and robotic scaffolding system market. Contractors and developers are increasingly adopting automated solutions to enhance safety, reduce labor dependency, and accelerate project timelines. These systems reduce manual handling risks and improve installation accuracy, particularly in high-rise and large-scale infrastructure projects. As urbanization intensifies and labor shortages persist, construction firms are turning to robotic scaffolding as a reliable, efficient alternative, thereby driving consistent market demand.

- For instance, Reo Lift’s robotic scaffold lifter has been deployed in projects where it reduced vertical lifting time by over 60 hours per 10-story structure, significantly improving productivity.

Stringent Safety Regulations and Compliance

Strict safety standards imposed by regulatory bodies such as OSHA are compelling construction companies to adopt automated and robotic scaffolding systems. These systems help mitigate fall risks and workplace injuries by minimizing human intervention in high-risk activities such as scaffold erection and dismantling. Enhanced safety features and remote-controlled operations ensure compliance while reducing insurance liabilities. As regulatory scrutiny continues to grow, especially in urban construction zones, companies are investing more in automated scaffolding to meet compliance benchmarks and protect workers.

- For instance, MEVA’s automatic climbing systems are designed with integrated hydraulic lifting platforms that eliminate the need for crane lifts, reducing exposure to fall risks and aligning with OSHA’s fall protection standards under 29 CFR 1926.501.

Labor Shortages and Skilled Workforce Constraints

The ongoing shortage of skilled labor in the U.S. construction industry has accelerated the adoption of automation technologies, including robotic scaffolding systems. With a rapidly aging workforce and fewer young entrants pursuing construction trades, companies face increasing difficulty in staffing complex and labor-intensive tasks. Automated systems fill this gap by offering reliable, repeatable performance with minimal human input. This labor substitution not only ensures project continuity but also reduces the costs associated with recruiting, training, and retaining skilled scaffolders.

Key Trends & Opportunities

Integration of AI and IoT for Predictive Operations

A prominent trend in the market is the integration of AI and IoT technologies to enable predictive maintenance, real-time monitoring, and remote diagnostics of scaffolding systems. These smart features optimize performance, minimize downtime, and improve operational safety. IoT-enabled sensors can track structural load, alignment, and usage patterns, while AI-driven analytics can suggest adjustments or repairs. This trend presents significant growth opportunities for software developers and system integrators aiming to enhance automation capabilities within construction and infrastructure environments.

- For instance, Kewazo’s scaffolding robots are equipped with IoT sensors that generate over 1,200 data points per shift, feeding into an AI platform that delivers operational insights and predictive alerts.

Expansion into Maintenance and Industrial Applications

While initial adoption has centered on new construction, automated scaffolding is increasingly being deployed in maintenance, retrofitting, and industrial environments such as refineries, shipyards, and power plants. These sectors require frequent access to hard-to-reach areas with high safety risks and minimal downtime. Automated systems offer the flexibility and precision needed in such settings. This expansion opens new revenue streams for system providers and enables diversification beyond the traditional civil construction space.

- For instance, KITSEN Scaffold & Formwork Technologies has supplied automated scaffolding systems to over 100 industrial maintenance projects, including thermal power plants and shipyards, where deployment reduced assembly times by an average of 35 hours per structure.

Key Challenges

High Initial Investment Costs

One of the primary challenges facing the U.S. automated and robotic scaffolding market is the high upfront capital investment. These systems involve advanced machinery, sensors, software platforms, and training programs, which significantly increase the cost of adoption compared to conventional scaffolding. Small and mid-sized contractors, in particular, may hesitate to invest due to budget constraints and uncertain ROI. Overcoming this barrier requires strong value demonstration through cost-benefit analysis, leasing models, and financial incentives to encourage adoption.

Technological Integration with Legacy Systems

Integrating advanced robotic scaffolding systems with existing construction workflows and legacy equipment poses a notable challenge. Many construction sites operate with traditional infrastructure and workforce habits that are not easily compatible with automation. The lack of standardized protocols, training, and digital infrastructure can lead to delays and resistance during deployment. Successful integration demands strategic planning, cross-functional training, and strong technical support, without which adoption may remain limited to large-scale, tech-forward projects.

Regulatory and Liability Concerns

Despite improving safety outcomes, the deployment of robotic systems introduces new regulatory and liability complexities. Questions around system failures, data security, and accountability in the event of accidents involving automated machinery can create legal uncertainty. The current regulatory framework is still evolving to accommodate robotics in construction, which may delay widespread adoption. Companies must navigate this shifting landscape while ensuring insurance coverage, compliance documentation, and safety certifications are updated and clearly defined.

Regional Analysis

Northeast Region

The Northeast region holds a market share of approximately 25%, driven by extensive commercial construction and infrastructure redevelopment projects across major urban centers such as New York, Boston, and Philadelphia. The region’s focus on modernization, high-rise developments, and strict regulatory standards has accelerated the adoption of automated and robotic scaffolding systems. Labor shortages and elevated safety expectations further contribute to strong market demand. With established industry players and ongoing investment in smart construction technologies, the Northeast continues to demonstrate consistent growth and remains a strategic market for automation-led scaffolding solutions.

Midwest Region

Accounting for nearly 22% of the U.S. market, the Midwest region benefits from expanding industrial construction and infrastructure refurbishment initiatives. States like Illinois, Ohio, and Michigan are witnessing rising demand for automation in scaffolding due to aging infrastructure and workforce constraints. The region’s strong manufacturing and energy sectors present opportunities for deployment in maintenance and heavy industrial applications. While adoption is comparatively moderate due to budget limitations in rural areas, the trend toward efficiency and safety is prompting increased investment in robotic systems, especially in public infrastructure and large-scale facility upgrades.

South Region

The South region commands the largest market share at approximately 30%, fueled by booming residential, commercial, and industrial construction across states like Texas, Florida, and Georgia. Rapid urban expansion, coupled with favorable economic policies and a growing focus on technology-driven construction, has made the South a major adopter of automated scaffolding systems. High exposure to weather-related disruptions also increases the demand for quick, efficient erection and dismantling solutions. Major construction contractors in the region are actively integrating robotic systems to address labor shortages and meet aggressive project timelines, positioning the South as a dominant growth engine.

West Region

With a market share of around 23%, the West region is steadily expanding, driven by high-rise construction in California and major infrastructure investments in states like Washington and Arizona. Sustainability-focused building regulations and a strong technology ecosystem support the early adoption of automated scaffolding systems. The region’s seismic activity necessitates safe, precision-driven scaffolding operations, further reinforcing demand. Moreover, the tech-savvy construction landscape in Silicon Valley and Los Angeles fuels interest in integrating AI and IoT with scaffolding automation. As government initiatives support smart construction practices, the West continues to emerge as a key innovation hub in the market.

Market Segmentations:

By Product

- Automated Climbing Scaffold Systems

- Robotic Scaffolding Assembly Systems

- Others

By Application

- Installation & Erection Services

- Dismantling & Removal Services

- Maintenance & Repair Services

- Logistics & Material Handling

- Others

By Component

By End User

- Infrastructure & Civil Construction

- Industrial & Energy

- Residential Construction

- Shipbuilding & Marine

- Others

By Geography

- Northeast Region

- Midwest Region

- South Region

- West Region

Competitive Landscape

The competitive landscape of the U.S. Automated and Robotic Scaffolding System market is characterized by a mix of established players and innovative startups driving technological advancement and market expansion. Leading companies such as Layher, Inc., Kewazo, and MEVA are actively investing in R&D to enhance automation capabilities, safety features, and integration with AI and IoT platforms. These firms focus on offering modular and scalable solutions tailored to diverse construction needs. Emerging players like Reo Lift and KITSEN Scaffold & Formwork Technologies are leveraging robotics to disrupt traditional scaffolding practices with efficient and compact systems. Strategic partnerships, product launches, and geographic expansion remain key growth strategies, while acquisitions and collaborations with construction firms support market penetration. Competitive intensity is further fueled by growing demand for labor-saving technologies and compliance with safety regulations. As automation becomes central to modern construction practices, companies that offer innovative, cost-effective, and reliable scaffolding systems are positioned for long-term success.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Layher, Inc.

- Kewazo

- Reo Lift

- MEVA

- KITSEN Scaffold & Formwork Technologies

- Rohrer Group

- AFIX Group

Recent Developments

- In July 2025, Kewazo is continuing its deployment and upgrades of the LIFTBOT robotic scaffolding elevator/lift system. The LIFTBOT autonomously moves materials along scaffolding, enhancing both safety and productivity on construction sites. According to Kewazo, the system’s data analytics platform optimizes processes, leading to potential labor cost savings of up to 44% and improved safety.

- In April 2025, Layher commenced operations at their newest production facility, “Plant 3,” which is a highly automated and energy-efficient production center for their Allround scaffolding.

- In 2025, MEVA USA is actively promoting the MAC (MEVA Automatic Climbing) system in North America. This system is a hydraulically powered, crane-independent solution that allows entire scaffold assemblies to climb as a single unit. It enhances efficiency and safety in high-rise construction by reducing crane usage, minimizing material costs, and accelerating the overall construction timeline.

Market Concentration & Characteristics

The U.S. Automated and Robotic Scaffolding System Market features a moderately concentrated landscape with a mix of dominant global players and emerging technology-driven firms. A few key companies such as Layher, Inc., Kewazo, and MEVA hold significant market share due to their strong product portfolios, advanced automation capabilities, and established client relationships. It reflects a market characterized by innovation, performance efficiency, and safety compliance. The presence of start-ups and mid-sized firms focused on robotics integration and AI-enabled monitoring tools introduces healthy competition and continuous technological advancement. The market serves a wide range of applications including infrastructure, industrial maintenance, and high-rise construction, with demand particularly strong in urban and industrial regions. It shows clear segmentation by product, application, and end user, enabling companies to tailor offerings to specific needs. High entry costs and technical expertise requirements create a barrier for new entrants. It continues to evolve toward intelligent, connected, and modular scaffolding systems.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Component, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness increased adoption of AI-enabled scaffolding systems to enhance efficiency and safety.

- Demand for automated climbing scaffolds will continue to rise in high-rise and infrastructure projects.

- Companies will focus on integrating IoT for real-time monitoring and predictive maintenance.

- Labor shortages will drive greater reliance on robotic solutions across construction sites.

- Modular and customizable systems will gain traction due to their adaptability across project types.

- Investment in R&D will grow as firms compete to offer advanced automation features.

- The South region will maintain its lead, driven by rapid urban and industrial expansion.

- Software components will grow in relevance with increased need for intelligent control systems.

- Strategic collaborations between tech providers and construction firms will shape market growth.

- Regulatory support for safer construction practices will encourage faster adoption of robotic systems.