Market Overview

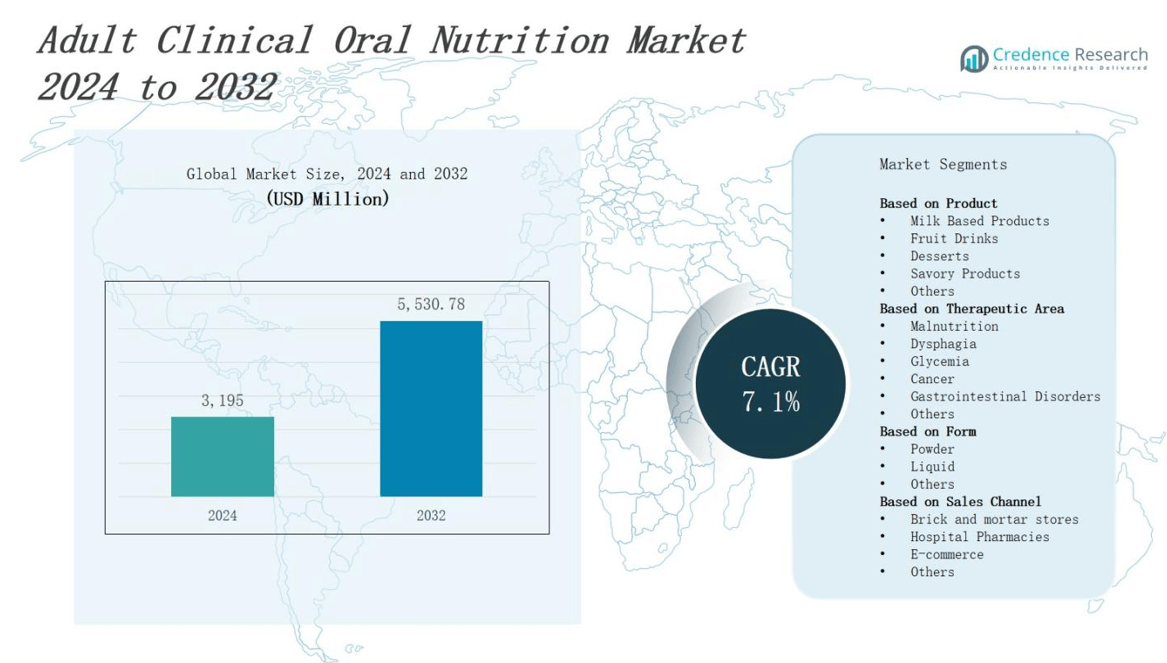

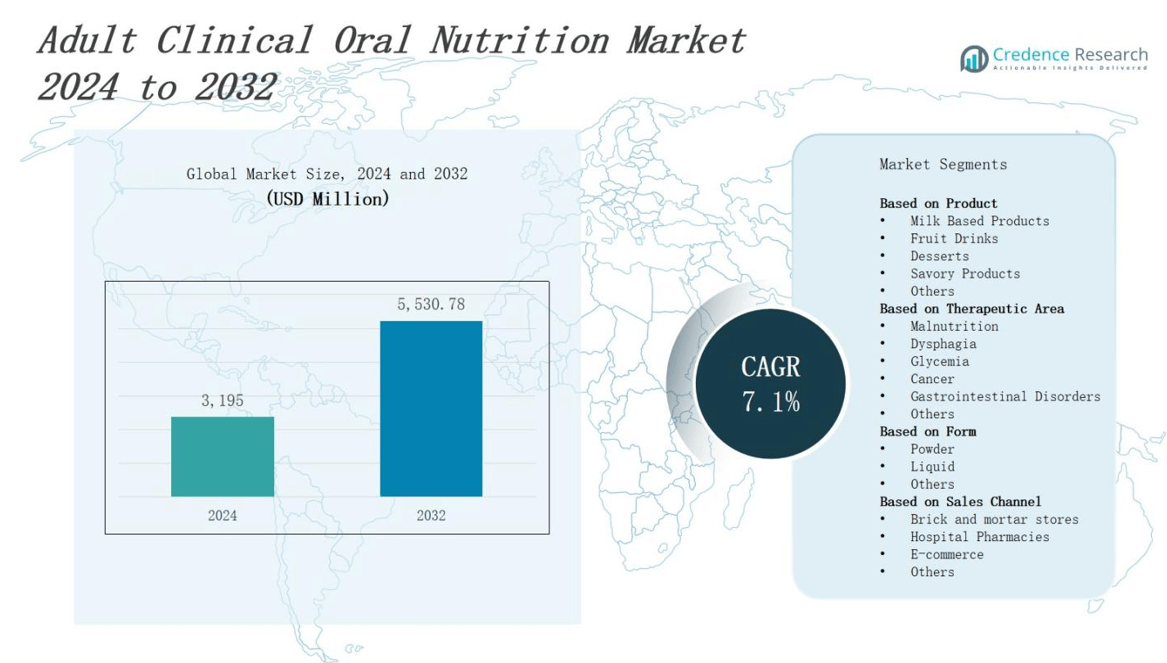

The adult clinical oral nutrition market is projected to grow from USD 3,195 million in 2024 to USD 5,530.78 million by 2032, registering a compound annual growth rate (CAGR) of 7.1%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Adult Clinical Oral Nutrition Market Size 2024 |

USD 3,195 million |

| Adult Clinical Oral Nutrition Market, CAGR |

7.1% |

| Adult Clinical Oral Nutrition Market Size 2032 |

USD 5,530.78 million |

The adult clinical oral nutrition market grows steadily due to rising prevalence of chronic diseases and malnutrition among the aging population. Increasing awareness of the benefits of nutritional support in improving patient outcomes drives demand. Advances in formulation technologies enhance product efficacy and patient compliance, further boosting adoption. Healthcare providers emphasize early nutritional intervention in clinical settings, supporting market expansion. Additionally, the shift toward outpatient care and home nutrition therapy fuels growth. Innovations such as specialized nutrient blends and flavor improvements align with patient preferences. Growing investments by manufacturers in product development and marketing sustain positive market momentum globally.

The adult clinical oral nutrition market spans key regions including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America and Europe lead with the largest market shares due to advanced healthcare infrastructure and high awareness. Asia-Pacific shows rapid growth driven by expanding healthcare access and aging populations. Latin America and the Middle East and Africa present emerging opportunities despite infrastructure challenges. Leading players such as Perrigo Company, Danone, Fresenius Kabi AG, Ajinomoto Cambrooke, and Otsuka Pharmaceutical Co., Ltd. compete globally, focusing on innovation and regional expansion to capture market share.

Market Insights

- The adult clinical oral nutrition market is projected to grow from USD 3,195 million in 2024 to USD 5,530.78 million by 2032, with a CAGR of 7.1%.

- Rising prevalence of chronic diseases and malnutrition among the aging population drives steady market growth, supported by increasing awareness of nutritional support benefits in patient care.

- Advances in formulation technologies improve product efficacy and patient compliance, boosting adoption across clinical and homecare settings.

- Healthcare providers emphasize early nutritional intervention, while the shift toward outpatient care and home nutrition therapy fuels demand.

- The market spans North America (35% share), Europe (28%), Asia-Pacific (22%), Latin America (10%), and the Middle East and Africa (5%), with North America and Europe leading due to advanced healthcare infrastructure.

- Regulatory compliance and stringent quality standards pose challenges, requiring significant investment in clinical trials and documentation, while navigating varied regional regulations delays product launches.

- Patient acceptance and high costs restrict adoption, especially in low- and middle-income regions, where limited reimbursement and insurance coverage create financial barriers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Chronic Diseases and Malnutrition

The adult clinical oral nutrition market benefits from the growing incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders, which often cause nutritional deficiencies. Patients with these conditions require specialized nutritional support to improve recovery and maintain health. Malnutrition among the elderly population further drives demand for oral nutrition products. Healthcare providers increasingly recognize the importance of targeted nutritional interventions to reduce complications and hospital stays, boosting market growth. Increasing life expectancy and aging demographics sustain this demand globally.

- For instance, in May 2023, Otsuka Pharmaceutical Factory launched an updated ENORAS Liquid with coffee and tea flavors designed for oral and feeding tube administration, improving nutritional support for patients with chronic illnesses.

Advancements in Formulation and Product Development

It continuously evolves through innovations in product formulations that improve nutrient absorption, taste, and texture. Manufacturers focus on developing specialized blends tailored to specific medical conditions, enhancing patient compliance and outcomes. Fortification with vitamins, minerals, and probiotics supports comprehensive nutritional needs. These advancements increase the acceptance of oral nutrition products in both clinical and homecare settings. Enhanced shelf life and convenience features further encourage adoption. Innovation remains a core factor driving market expansion.

- For instance, Solutex has developed omega-3 supplements in monoglyceride (MAG) form, which offer up to three times higher absorption efficiency compared to traditional omega-3 formats, enhancing bioavailability and sensory appeal.

Shift Toward Outpatient and Home-Based Care

The adult clinical oral nutrition market experiences growth due to the healthcare sector’s shift from inpatient to outpatient and home-based care models. Patients increasingly receive nutritional therapy outside hospitals, reducing healthcare costs and improving comfort. Oral nutrition products provide an effective, non-invasive method to meet dietary requirements in these settings. This transition encourages healthcare providers to recommend oral nutrition solutions for long-term management. Convenience, ease of use, and accessibility of products support sustained market demand in evolving care environments.

Increased Awareness and Healthcare Initiatives

Growing awareness among healthcare professionals and patients about the benefits of clinical nutrition fuels market expansion. Educational programs and clinical guidelines emphasize early nutritional intervention to prevent malnutrition-related complications. Public health campaigns highlight the role of nutrition in recovery and quality of life improvement. Government initiatives to integrate nutritional support into standard care pathways create favorable market conditions. Companies actively promote product benefits through targeted marketing, increasing adoption across diverse patient groups. These factors collectively drive steady market growth.

Market Trends

Growing Focus on Personalized Nutrition Solutions

The adult clinical oral nutrition market shows a clear shift toward personalized nutrition tailored to individual patient needs. Advances in diagnostic tools allow clinicians to design customized nutritional plans based on specific health conditions and metabolic requirements. It encourages manufacturers to develop targeted formulas addressing deficiencies in protein, vitamins, and minerals. Personalized approaches improve patient compliance and clinical outcomes. Increasing adoption of digital health platforms supports real-time monitoring and adjustment of nutritional therapy, reinforcing this trend. This focus aligns with broader healthcare moves toward precision medicine.

- For instance, Otsuka Pharmaceutical Factory updated its ENORAS Liquid formula in 2023 to include coffee and tea flavors, enhancing palatability for patients requiring tube or oral feeding.

Integration of Plant-Based and Clean Label Ingredients

It incorporates a growing demand for plant-based and clean-label ingredients within clinical oral nutrition products. Consumers and healthcare providers seek formulations with natural, non-GMO, and allergen-free components to enhance safety and acceptance. The market responds with products containing plant proteins, fibers, and natural sweeteners, catering to health-conscious patients. Transparent labeling and sustainable sourcing practices gain prominence, reflecting evolving consumer values. This trend drives innovation and expands the product portfolio available to meet diverse dietary preferences and restrictions.

- For instance, OsomeFood offers a range of clean-label, plant-based meals made primarily from fungi, algae, nuts, and plant proteins, free from artificial additives and GMOs, designed to enhance nutrition and gut health.

Expansion of Distribution Channels and Digital Access

The adult clinical oral nutrition market leverages expansion in distribution channels, including e-commerce and specialty online pharmacies. Digital platforms facilitate direct-to-patient sales, increasing accessibility and convenience, particularly for homecare users. It enables manufacturers to reach broader patient populations efficiently and collect consumer feedback for product improvements. Partnerships with healthcare providers and insurers support integration into care plans. Omnichannel strategies combining traditional retail and online presence enhance market penetration and customer engagement, strengthening competitive positioning.

Focus on Functional Benefits and Enhanced Formulations

The market experiences rising demand for clinical oral nutrition products offering functional benefits beyond basic nutrition. It includes formulations enriched with immune-supporting compounds, antioxidants, and probiotics to aid recovery and overall health. Research-driven ingredient combinations aim to improve muscle mass, cognitive function, and gut health in adults with specific clinical needs. Continuous product enhancement focuses on taste, texture, and ease of digestion to increase patient adherence. This trend reflects growing consumer expectation for multipurpose nutritional solutions that contribute to holistic wellness.

Market Challenges Analysis

Regulatory Compliance and Stringent Quality Standards

The adult clinical oral nutrition market faces challenges due to complex regulatory requirements across different regions. Manufacturers must ensure strict adherence to safety, efficacy, and labeling standards set by authorities such as the FDA and EMA. It requires significant investment in clinical trials, documentation, and quality control processes. Navigating varied regulations delays product launches and increases development costs. Maintaining consistent quality while innovating presents operational difficulties. Regulatory uncertainties in emerging markets further complicate expansion efforts, posing risks to manufacturers’ strategic planning and compliance frameworks.

Patient Acceptance and Cost Constraints

It confronts challenges related to patient acceptance and affordability of clinical oral nutrition products. Some patients reject oral nutrition due to taste, texture, or gastrointestinal discomfort, limiting widespread adoption. Healthcare providers must balance clinical benefits with patient preferences to improve compliance. High product costs restrict access, particularly in low- and middle-income regions, affecting market penetration. Limited reimbursement policies and insurance coverage create financial barriers for many patients. Overcoming these obstacles requires focused efforts on product formulation, education, and pricing strategies to enhance acceptance and affordability across diverse healthcare settings.

Market Opportunities

Expansion into Emerging Markets with Growing Healthcare Infrastructure

The adult clinical oral nutrition market holds significant opportunities in emerging economies where improving healthcare infrastructure drives demand for nutritional support. Rising awareness of malnutrition and chronic disease management creates a fertile environment for market growth. It allows manufacturers to introduce affordable, region-specific formulations tailored to local dietary needs. Increasing government initiatives to improve public health and nutrition offer collaboration prospects. Expanding distribution networks and healthcare access enhance product availability. These factors combine to create new revenue streams and broaden the market’s global footprint.

Development of Innovative and Functional Nutrition Products

It presents opportunities through the creation of advanced oral nutrition products that deliver targeted functional benefits beyond basic sustenance. Innovations incorporating immune-enhancing ingredients, cognitive support compounds, and gut health boosters attract health-conscious patients and clinicians. The market can capitalize on trends in personalized nutrition and integrative healthcare by developing condition-specific formulations. Improved palatability and convenience features increase patient adherence. Collaborations with research institutions and clinical experts accelerate product validation and acceptance. This focus on innovation supports differentiation and long-term competitive advantage within the market.

Market Segmentation Analysis:

By Product Type

The adult clinical oral nutrition market divides into milk-based products, fruit drinks, desserts, savory products, and others. Milk-based products dominate due to their high protein content and versatility in clinical settings. Fruit drinks and desserts gain traction for their palatability and ease of consumption, appealing to patients with taste sensitivities. Savory products offer alternatives for those preferring non-sweet options, expanding market reach. Manufacturers continuously innovate within these categories to improve nutritional profiles and patient compliance, driving growth across diverse product types.

- For instance, Nestlé launched its N3 milk—a milk-based product developed using proprietary technology, which offers high protein, prebiotic fibers, and reduced lactose content. Clinical studies confirm it promotes gut microbiome health and supports the needs of adults with lactose sensitivities or higher protein requirements.

By Therapeutic Area

It segments based on therapeutic areas including malnutrition, dysphagia, glycemia, cancer, gastrointestinal disorders, and others. Malnutrition represents the largest segment, reflecting high global prevalence and urgent need for nutritional intervention. Dysphagia-focused products address swallowing difficulties, critical for elderly and neurological patients. Cancer-related nutrition supports recovery and treatment tolerance, while glycemia-specific formulas aid diabetic patients. Gastrointestinal disorder segments target nutrient absorption and digestive health. Tailored formulations within these therapeutic areas enhance clinical outcomes and market penetration.

- For instance, in addressing dysphagia, Abbott Nutrition produces specialized thickened liquids and texture-modified foods that ensure safe swallowing and adequate nutrition for elderly and neurological patients.

By Form

The adult clinical oral nutrition market categorizes products into powders, liquids, and others. Powders hold significant market share due to longer shelf life, cost-effectiveness, and ease of storage. Liquids offer ready-to-consume convenience, favored in hospital and homecare environments for immediate use. Other forms include gels and bars, providing alternative delivery methods for specific patient preferences. Manufacturers focus on improving solubility, taste, and nutrient stability across forms to meet diverse clinical and patient needs, strengthening market adoption globally.

Segments:

Based on Product

- Milk Based Products

- Fruit Drinks

- Desserts

- Savory Products

- Others

Based on Therapeutic Area

- Malnutrition

- Dysphagia

- Glycemia

- Cancer

- Gastrointestinal Disorders

- Others

Based on Form

Based on Sales Channel

- Brick and mortar stores

- Hospital Pharmacies

- E-commerce

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the adult clinical oral nutrition market with a market share of 35%. The region benefits from a well-established healthcare infrastructure and high awareness of clinical nutrition’s role in disease management. It features strong reimbursement policies and widespread adoption of advanced oral nutrition products. Healthcare providers emphasize early nutritional intervention, driving demand in hospitals and homecare settings. Continuous investments in research and development foster innovation and product launches. The aging population and rising chronic disease prevalence sustain market growth. Regulatory frameworks support product safety and efficacy, facilitating market expansion.

Europe

Europe holds 28% of the adult clinical oral nutrition market share, driven by increasing focus on elderly care and malnutrition prevention. Governments promote nutritional guidelines and support initiatives targeting chronic disease management. It offers favorable reimbursement environments and growing consumer awareness regarding clinical nutrition benefits. Healthcare facilities prioritize patient-centric nutritional therapies, boosting product demand. The region witnesses significant innovation in formulation and product variety. Aging demographics and rising healthcare expenditure reinforce growth. Collaboration among manufacturers, healthcare providers, and regulatory bodies ensures market stability.

Asia-Pacific

Asia-Pacific accounts for 22% of the adult clinical oral nutrition market share, fueled by expanding healthcare infrastructure and rising chronic disease incidence. Increasing government investments improve healthcare accessibility and nutrition awareness. It experiences growing adoption of clinical nutrition in hospitals and homecare, especially in urban centers. Market players target affordable and region-specific products to meet diverse dietary habits. Rapid urbanization and improving standards of living further boost demand. Regulatory frameworks evolve to support product approvals and safety. The rising elderly population amplifies the need for specialized nutritional solutions.

Latin America

Latin America captures 10% of the adult clinical oral nutrition market share, supported by increasing healthcare modernization and awareness of malnutrition. Growing prevalence of lifestyle diseases and aging populations drive demand for clinical oral nutrition. It faces challenges from cost constraints and limited reimbursement policies but benefits from expanding private healthcare sectors. Market participants focus on educational initiatives and localized product development. Urbanization and improved healthcare access stimulate growth opportunities. Government programs to address nutritional deficiencies further encourage adoption. The market steadily progresses despite infrastructure limitations.

Middle East and Africa

The Middle East and Africa represent 5% of the adult clinical oral nutrition market share. Healthcare systems undergo gradual modernization, increasing demand for clinical nutrition products. Rising chronic disease burden and malnutrition prevalence highlight the need for targeted nutritional therapies. It faces challenges including limited awareness, infrastructure gaps, and affordability issues. Market players pursue partnerships and localized strategies to expand reach. Investments in healthcare facilities and nutrition programs provide growth potential. Despite slower adoption rates, the region shows promising long-term prospects for market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The adult clinical oral nutrition market features intense competition among leading global players focused on innovation, product differentiation, and expanding market reach. Key companies such as Perrigo Company, Ajinomoto Cambrooke, Inc., Danone, Fresenius Kabi AG, and Otsuka Pharmaceutical Co., Ltd. actively invest in research and development to enhance formulation efficacy and patient compliance. It experiences continuous product launches targeting specific therapeutic areas like malnutrition, cancer, and gastrointestinal disorders. Market participants adopt strategic collaborations, mergers, and acquisitions to strengthen distribution networks and geographic presence. Companies emphasize regulatory compliance and quality assurance to maintain trust among healthcare providers. Competitive pricing and tailored nutritional solutions drive customer loyalty. The market also sees growing focus on personalized nutrition and sustainable, plant-based ingredients. It demands agility and innovation from players to address evolving patient needs and healthcare trends, ensuring sustained growth and leadership in a dynamic environment.

Recent Developments

- In May 2024, Danone acquired Functional Formularies, a U.S.-based provider of whole food tube feeding solutions, strengthening its Medical Nutrition portfolio and expanding its enteral tube feeding products in the U.S. market.

- In March 2025, Nutrisens Group acquired a majority stake in Prodiet, a Brazilian company specializing in clinical nutrition for medical use, marking Nutrisens’ entry into the Latin American market and expanding its regional presence.

- In May 2023, Otsuka Pharmaceutical Factory launched an updated ENORAS Liquid featuring new coffee and tea flavors, designed for both tube and oral feeding to improve patient palatability and compliance.

- In April 2024, Nestlé India and Dr. Reddy’s Laboratories announced a joint venture to bring Nestlé Health Science’s nutraceutical portfolio to consumers across India and other agreed territories.

Market Concentration & Characteristics

The adult clinical oral nutrition market exhibits a moderately concentrated competitive landscape dominated by a few key players such as Perrigo Company, Danone, Fresenius Kabi AG, Ajinomoto Cambrooke, and Otsuka Pharmaceutical Co., Ltd. These companies leverage strong research capabilities, extensive distribution networks, and robust regulatory compliance to maintain market leadership. It demands continuous innovation in formulation, product efficacy, and patient-centric solutions to address diverse therapeutic needs. Mid-sized and regional players contribute by offering specialized and cost-effective products catering to niche markets. The market’s growth encourages strategic partnerships, mergers, and acquisitions to enhance geographic presence and expand product portfolios. Pricing strategies and adherence to stringent quality standards influence competitive dynamics. It emphasizes tailored nutritional interventions and sustainable ingredient sourcing, aligning with evolving healthcare trends and patient preferences. This combination of factors shapes a dynamic environment where innovation and strategic agility define market success

Report Coverage

The research report offers an in-depth analysis based on Product, Therapeutic Area, Form, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased demand due to rising chronic disease prevalence and aging populations worldwide.

- Personalized nutrition solutions will gain prominence to address specific patient needs effectively.

- Innovations in formulation will improve taste, texture, and nutrient absorption, enhancing patient compliance.

- Expansion of homecare and outpatient services will drive growth in oral nutrition product usage.

- Growing awareness among healthcare professionals will promote early nutritional interventions.

- Plant-based and clean-label ingredients will become more popular in clinical nutrition products.

- Digital health technologies will enable better monitoring and customization of nutritional therapies.

- Emerging markets will offer new growth opportunities due to improving healthcare infrastructure.

- Strategic partnerships and mergers will shape competitive dynamics and broaden product portfolios.

- Regulatory frameworks will evolve, requiring continuous compliance and quality improvements from manufacturers.