Market Overview:

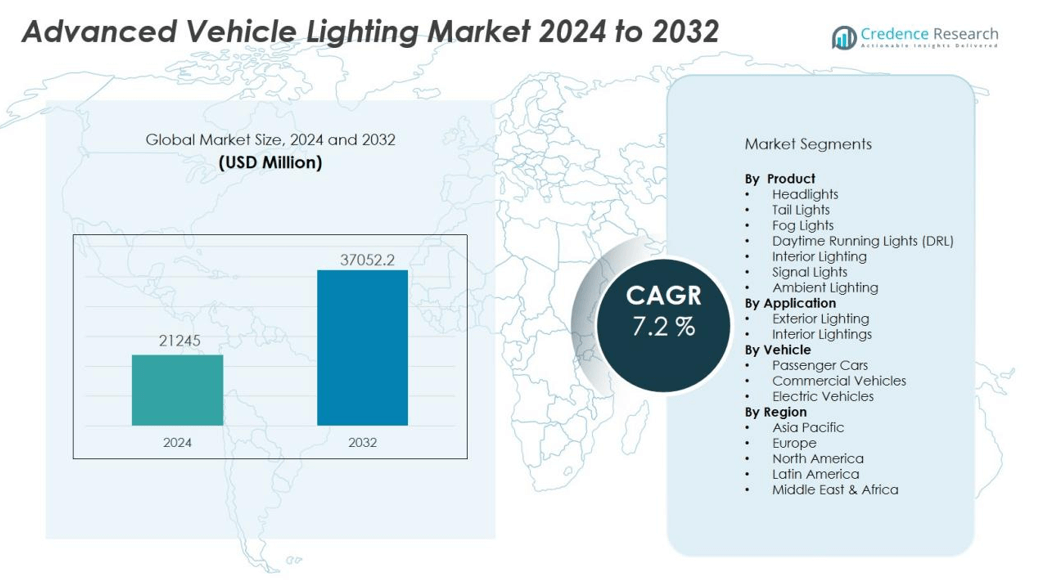

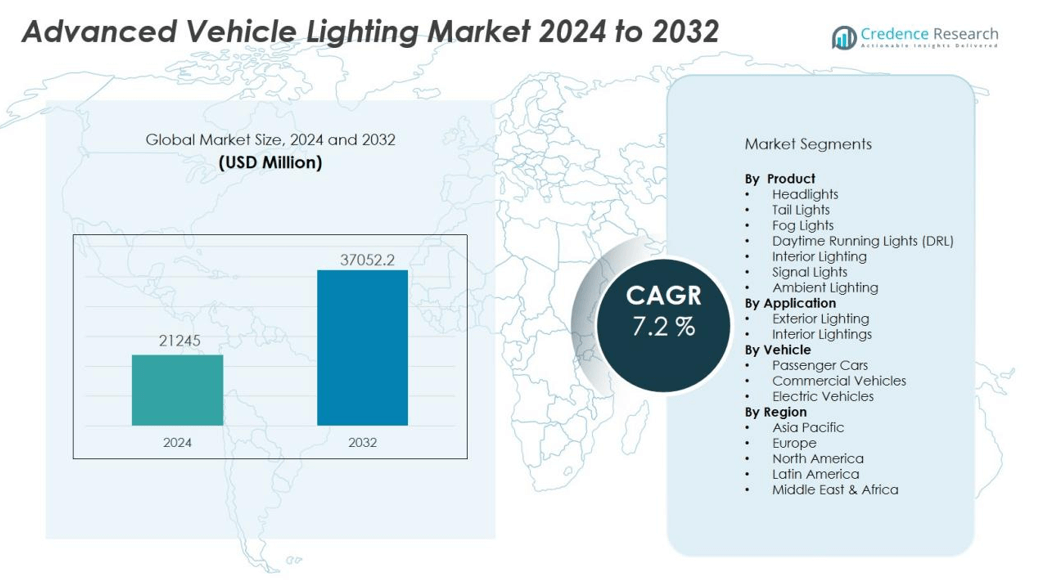

The advanced vehicle lighting market size was valued at USD 21245 million in 2024 and is anticipated to reach USD 37052.2 million by 2032, at a CAGR of 7.2 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Advanced Vehicle Lighting Market Size 2024 |

USD 21245 million |

| Advanced Vehicle Lighting Market, CAGR |

7.2% |

| Advanced Vehicle Lighting Market Size 2032 |

USD 37052.2 million |

Key drivers for the advanced vehicle lighting market include stringent government regulations on road safety, rising consumer demand for enhanced vehicle styling, and the integration of advanced driver assistance systems (ADAS). The shift toward electric and autonomous vehicles further accelerates innovation in lighting technologies, with features such as matrix LEDs, dynamic lighting, and intelligent adaptive headlights enhancing driver visibility and pedestrian safety. The automotive industry’s focus on energy efficiency and longer component life also supports the increased adoption of next-generation lighting solutions.

Regionally, Asia-Pacific leads the advanced vehicle lighting market, supported by high vehicle production, increasing automotive exports, and rapid adoption of advanced technologies in countries such as China, Japan, and South Korea. Europe and North America follow, driven by stringent safety norms, premium vehicle demand, and the presence of leading automotive lighting manufacturers.

Market Insights:

- The advanced vehicle lighting market reached USD 21,245 million in 2024 and will grow to USD 37,052.2 million by 2032, driven by a CAGR of 7.2%.

- Stringent global safety regulations accelerate innovation and mandate advanced lighting solutions that enhance road safety and compliance.

- Rising adoption of LED, laser, and OLED technologies aligns with the industry’s focus on energy efficiency and eco-friendly lighting components.

- Advancements in adaptive, matrix, and smart ambient lighting improve visibility, user experience, and vehicle appeal through personalized illumination.

- High costs of advanced lighting systems and complex integration challenges restrict widespread adoption, especially in mass-market and price-sensitive segments.

- Asia-Pacific dominates with 45% market share due to strong automotive production, technology adoption, and government-backed safety initiatives in China, Japan, and South Korea.

- Europe holds 27% and North America 19% market share, both regions shaped by stringent safety standards, premium brand demand, and continuous product innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Safety Regulations and Standards Propel Lighting Innovation:

Stringent global safety regulations drive continuous innovation in the advanced vehicle lighting market. Governments mandate high-performance lighting systems to improve road safety, leading manufacturers to invest in new technologies. Regulatory requirements for daytime running lights, adaptive headlamps, and automatic emergency lighting systems stimulate demand for advanced solutions. Automakers prioritize compliance, spurring the integration of intelligent lighting features that enhance visibility and accident prevention.

- For instance, Mercedes-Benz developed its DIGITAL LIGHT technology featuring over 2 million pixels of light per vehicle, where each headlamp contains over 1 million micro-reflectors for ultra-high resolution adaptive lighting.

Rising Demand for Energy-Efficient and Sustainable Lighting Solutions:

The automotive industry’s push toward sustainability supports the shift to energy-efficient lighting. OEMs adopt LED, laser, and OLED technologies to reduce energy consumption and extend component life, addressing environmental concerns. The advanced vehicle lighting market benefits from the industry’s focus on eco-friendly components that offer lower emissions and longer service intervals. This demand aligns with global efforts to reduce the automotive sector’s carbon footprint and promote greener mobility.

- For instance, Audi’s digital OLED technology in the Q5 model consumes significantly lower energy than LED optics when achieving similar homogeneity, with each OLED unit measuring just 1 millimeter thin compared to LED solutions requiring 20-30 millimeters installation depth.

Technological Advancements Drive Enhanced Functionality and User Experience:

Rapid advancements in lighting technologies transform vehicle design and driver experience. Features such as adaptive headlights, matrix LEDs, and smart ambient lighting improve visibility and allow personalized illumination. The advanced vehicle lighting market leverages innovations in sensors and electronics, enabling dynamic control and integration with driver assistance systems. Automakers use advanced lighting as a key differentiator, boosting vehicle appeal and brand value.

Growth in Electric and Autonomous Vehicles Expands Application Scope:

The transition to electric and autonomous vehicles expands the application scope for advanced lighting systems. It increases the need for innovative signaling, communication, and design elements tailored to new vehicle architectures. The advanced vehicle lighting market addresses the unique requirements of EVs and self-driving cars, supporting safety, functionality, and aesthetics. OEMs collaborate with technology providers to deliver integrated, future-ready lighting solutions for next-generation vehicles.

Market Trends:

Integration of Adaptive and Intelligent Lighting Technologies Sets New Industry Benchmarks:

The integration of adaptive and intelligent lighting technologies stands out as a defining trend in the advanced vehicle lighting market. Automakers now prioritize adaptive headlights, matrix LED systems, and smart lighting modules that dynamically adjust to driving conditions, speed, and surrounding environments. These advancements improve visibility and safety while delivering a customizable driving experience for consumers. Manufacturers incorporate sensors, cameras, and advanced control units to synchronize lighting functions with ADAS and vehicle-to-everything (V2X) systems. The advanced vehicle lighting market benefits from a focus on digitalization and connectivity, which drives further investments in innovation. Companies seek to differentiate their offerings through features like glare-free high beams, automatic cornering lights, and personalized ambient interior lighting.

- For instance, Ford’s glare-free high beam technology employs a windscreen-mounted camera that can detect headlights and taillights of vehicles up to 800 meters away, automatically adjusting beam intensity and angle based on multiple parameters.

Focus on Design, Sustainability, and Next-Generation Vehicle Platforms Shapes Market Direction:

A strong focus on design and sustainability shapes the future of the advanced vehicle lighting market. Automakers embrace slim, lightweight, and aesthetically appealing lighting profiles, made possible by compact LED and OLED technologies. The market witnesses increasing use of recyclable materials and modular lighting systems, supporting both environmental and economic goals. Next-generation vehicle platforms—especially electric and autonomous vehicles—demand new lighting functionalities, such as communication signals and distinctive branding elements. The advanced vehicle lighting market evolves rapidly to meet these demands, with manufacturers developing customizable lighting signatures and energy-saving features. Strategic partnerships and R&D investments accelerate the rollout of innovative solutions, positioning lighting as a core component of modern vehicle identity and user experience.

- For instance, the Audi Q6 e-tron features six digital rear OLED 2.0 panels containing 360 individually addressable segments that can refresh images every 10 milliseconds.

Market Challenges Analysis:

High Cost of Advanced Lighting Technologies Restricts Widespread Adoption:

The high cost of advanced lighting technologies creates a significant barrier for broader adoption across all vehicle segments. The advanced vehicle lighting market faces challenges in reducing production and integration costs for LEDs, lasers, and OLEDs, particularly in price-sensitive markets. Many consumers and fleet buyers hesitate to pay premiums for sophisticated lighting features, which limits penetration beyond premium and luxury vehicles. Automakers must balance innovation with affordability, making it difficult to scale advanced lighting solutions in mass-market models. The need for specialized manufacturing processes and high-quality materials further increases overall system costs.

Complex Integration and Reliability Concerns Complicate System Deployment:

Complex integration and reliability issues also challenge the advanced vehicle lighting market. New lighting technologies require seamless compatibility with a vehicle’s electronic architecture and driver assistance systems. It must ensure consistent performance under varying operating conditions, such as extreme temperatures and humidity. Failure rates, maintenance challenges, and regulatory compliance add further complexity for manufacturers. Addressing these concerns requires ongoing investment in R&D and rigorous quality assurance, impacting development timelines and operational efficiency.

Market Opportunities:

High Cost of Advanced Lighting Technologies Restricts Widespread Adoption:

The high cost of advanced lighting technologies creates a significant barrier for broader adoption across all vehicle segments. The advanced vehicle lighting market faces challenges in reducing production and integration costs for LEDs, lasers, and OLEDs, particularly in price-sensitive markets. Many consumers and fleet buyers hesitate to pay premiums for sophisticated lighting features, which limits penetration beyond premium and luxury vehicles. Automakers must balance innovation with affordability, making it difficult to scale advanced lighting solutions in mass-market models. The need for specialized manufacturing processes and high-quality materials further increases overall system costs.

Complex Integration and Reliability Concerns Complicate System Deployment:

Complex integration and reliability issues also challenge the advanced vehicle lighting market. New lighting technologies require seamless compatibility with a vehicle’s electronic architecture and driver assistance systems. It must ensure consistent performance under varying operating conditions, such as extreme temperatures and humidity. Failure rates, maintenance challenges, and regulatory compliance add further complexity for manufacturers. Addressing these concerns requires ongoing investment in R&D and rigorous quality assurance, impacting development timelines and operational efficiency.

Market Segmentation Analysis:

By Product:

The advanced vehicle lighting market features a diverse product portfolio that includes headlights, tail lights, fog lights, daytime running lights, and interior lighting systems. Headlights, particularly LED and matrix LED variants, hold the largest share due to their vital role in safety and visibility. Tail lights and fog lights incorporate advanced technologies to improve energy efficiency and aesthetics, while interior lighting evolves with the demand for ambient and customizable solutions. Manufacturers focus on innovation and integration of smart features across all product categories to address evolving consumer and regulatory requirements.

- For instance, Porsche’s HD Matrix LED technology combines over 16,000 individually controllable micro-LEDs onto a surface area the size of a thumbnail, offering high-resolution light distribution up to twice as bright as previous systems.

By Application:

Application-wise, the advanced vehicle lighting market serves exterior and interior lighting needs. Exterior lighting dominates with a significant share, led by adaptive headlights, dynamic indicators, and advanced signal lamps that enhance on-road safety and vehicle recognition. Interior lighting gains traction through the adoption of personalized, mood-based, and connected illumination options. Both segments reflect increased integration of smart sensors and electronics to elevate safety, user experience, and energy savings.

- For instance, BASF and Philips developed transparent OLED lighting technology for car roofs that is just 1.8 millimeters thin, providing interior illumination when switched on while maintaining transparency when off.

By Vehicle:

The market caters to a range of vehicle types, including passenger cars, commercial vehicles, and electric vehicles. Passenger cars represent the largest segment, with growing consumer preference for advanced lighting features across all price points. Commercial vehicles prioritize durability, visibility, and regulatory compliance, while electric vehicles drive demand for energy-efficient and futuristic lighting designs. The advanced vehicle lighting market adapts solutions to meet the performance, efficiency, and design expectations unique to each vehicle category.

Segmentations:

By Product:

- Headlights

- Tail Lights

- Fog Lights

- Daytime Running Lights (DRL)

- Interior Lighting

- Signal Lights

- Ambient Lighting

By Application:

- Exterior Lighting

- Interior Lighting

By Vehicle:

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds a 45% market share in the advanced vehicle lighting market, making it the largest regional contributor. China, Japan, and South Korea drive regional dominance through high automotive production, rapid adoption of new technologies, and strong investments in research and development. The region benefits from a growing middle class and urbanization, increasing demand for both passenger and commercial vehicles equipped with advanced lighting features. Government policies focused on road safety and energy efficiency accelerate the integration of intelligent lighting systems. Major global lighting manufacturers establish local partnerships and production facilities, supporting cost-effective innovation. Competitive pricing and technology transfer further boost the market’s expansion.

Europe :

Europe secures a 27% share of the advanced vehicle lighting market, maintaining a reputation for premium automotive brands and stringent safety regulations. German, French, and British automakers set industry benchmarks by deploying LED, laser, and matrix lighting technologies in both luxury and mainstream segments. The region’s commitment to sustainability and carbon emission reduction propels the adoption of energy-efficient lighting components. It also hosts several leading lighting system suppliers, facilitating close collaboration with OEMs on design and innovation. Consumer preference for vehicle aesthetics and advanced features supports robust demand for customizable and adaptive lighting. European regulatory standards push continuous improvement in product safety and environmental compliance.

North America :

North America accounts for a 19% share of the advanced vehicle lighting market, with the United States leading regional growth. Strong consumer interest in advanced safety features, adaptive lighting, and vehicle personalization drives demand. The market reflects the influence of high vehicle ownership rates and rapid deployment of electric vehicles equipped with next-generation lighting. North American OEMs collaborate closely with technology providers to develop intelligent lighting integrated with ADAS and connectivity solutions. The region’s focus on customization, coupled with supportive regulatory frameworks, fosters ongoing product development. Competitive dynamics encourage manufacturers to invest in R&D and respond swiftly to changing consumer trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The advanced vehicle lighting market remains highly competitive, shaped by global players with strong technological capabilities and expansive distribution networks. Leading companies such as Hella, Hyundai, Marelli, Koito, Lumileds, Nichia, and Valeo dominate through continuous product innovation, partnerships with major OEMs, and robust research and development programs. These firms invest in next-generation technologies including matrix LED, laser lighting, and adaptive systems to secure competitive advantages and meet evolving safety and design standards. The advanced vehicle lighting market values reliability, product differentiation, and rapid response to regulatory changes, encouraging firms to enhance energy efficiency and aesthetic appeal. Strong focus on strategic collaborations and global market expansion ensures sustained leadership for top-tier players.

Recent Developments:

- In July 2025, FORVIA HELLA launched the highly integrated 48V Flatpack energy management solution in China.

- In April 2025, Hyundai launched the all-new NEXO fuel cell electric vehicle (FCEV) at the Seoul Mobility Show, featuring over 700km range and an improved powertrain.

- In April 2025, Marelli debuted new automotive lighting technologies at Auto Shanghai 2025, introducing innovations such as the world’s first OLED TFT Pixel Rear Lamp, Near-Field Ground Projection technology, and Thin Lit Line Headlamp.

Market Concentration & Characteristics:

The advanced vehicle lighting market exhibits moderate to high market concentration, dominated by a few global players with extensive technology portfolios and strong OEM partnerships. It features high entry barriers due to significant investment requirements in research, development, and certification of advanced lighting systems. Established companies leverage scale, innovation, and brand reputation to secure major supply contracts with leading automotive manufacturers. The advanced vehicle lighting market demonstrates a strong focus on continuous technological advancement, rapid integration with digital vehicle architectures, and adherence to evolving safety and sustainability standards. Competitive differentiation centers on product performance, customization, and energy efficiency, driving ongoing R&D investments and strategic collaborations.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, Vehicle and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Automakers integrate more adaptive and matrix LED systems to enhance safety and driving comfort.

- Smart lighting solutions expand in electric and autonomous vehicles to support vehicle‑to‑infrastructure communication and occupant engagement.

- OEMs adopt OLED and laser technologies to enable slimmer, more energy‑efficient lighting designs.

- Connected lighting systems work with ADAS and infotainment platforms to deliver personalized, context‑aware illumination.

- Emerging markets embrace advanced lighting features in mid‑segment vehicles, driving broader adoption beyond premium classes.

- Modular and upgradable lighting architectures gain traction, allowing consumers to add new features via software or retrofit kits.

- Suppliers leverage scalable manufacturing processes and localized production to reduce costs and improve availability.

- Consumers demand customizable ambient lighting and dynamic light signatures tied to brand identity and personalization.

- Partnerships and collaborations between lighting specialists and automotive OEMs accelerate development cycles and technology integration.

- Sustainability remains central, with manufacturers focus on recyclable materials, reduced energy use, and lighting components with longer lifespans.