Market Overview:

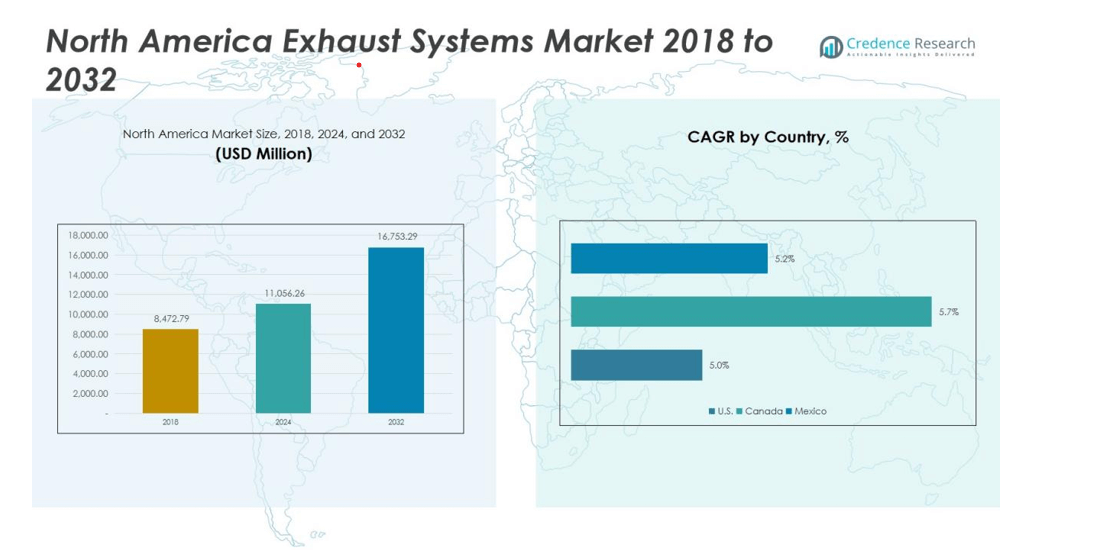

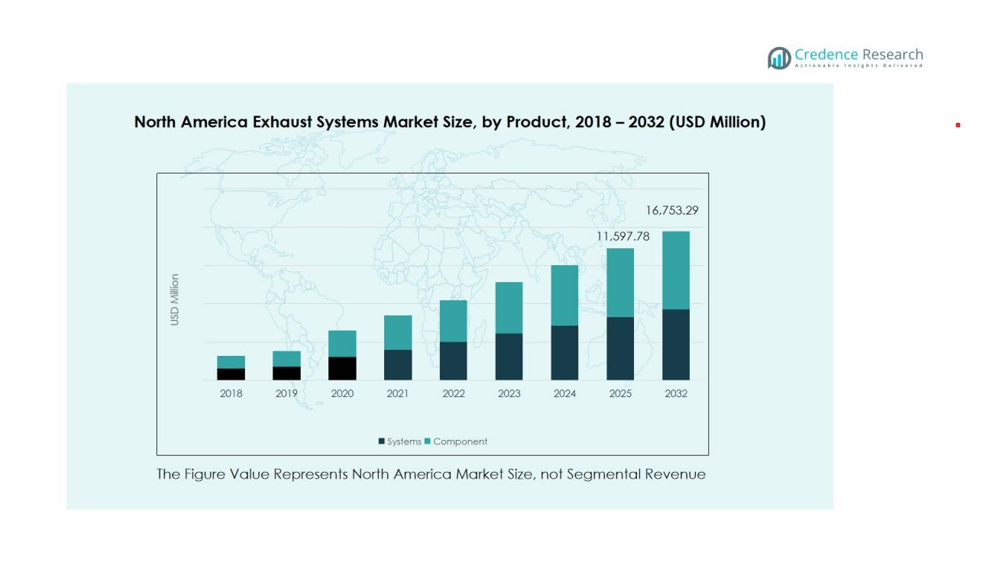

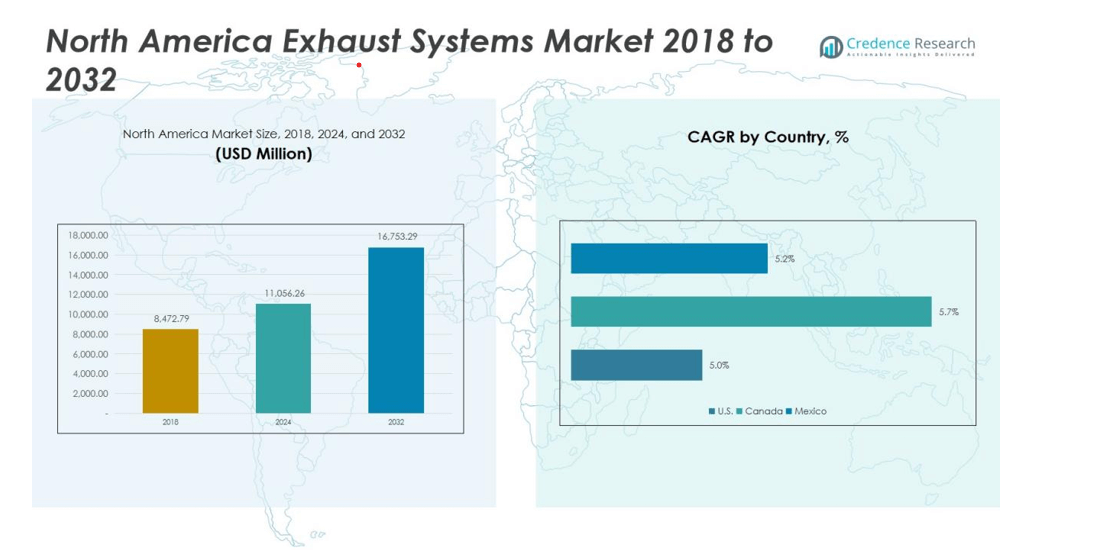

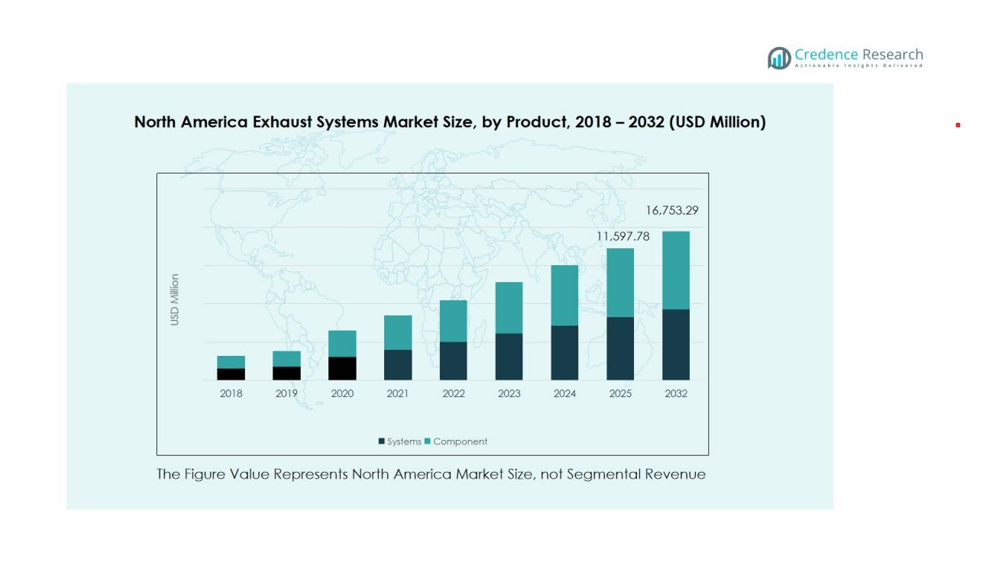

The North America Exhaust Systems Market size was valued at USD 8,472.79 million in 2018 to USD 11,056.26 million in 2024 and is anticipated to reach USD 16,753.29 million by 2032, at a CAGR of 40.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Exhaust Systems Market Size 2024 |

USD 11,056.26 million |

| North America Exhaust Systems Market, CAGR |

40.62% |

| North America Exhaust Systems Market Size 2032 |

USD 16,753.29 million |

Growth is primarily driven by strict regulatory norms enforced by the U.S. Environmental Protection Agency (EPA) and Transport Canada to reduce carbon emissions. Increasing adoption of hybrid and fuel-efficient vehicles and a focus on lightweight exhaust materials such as stainless steel, titanium, and aluminum are propelling market demand. Automakers are integrating advanced exhaust after-treatment systems like selective catalytic reduction (SCR) and gasoline particulate filters (GPF) to meet emission limits while improving engine performance.

Regionally, the United States dominates the North America Exhaust Systems Market due to its strong automotive manufacturing base, high vehicle ownership, and large aftermarket service network. Canada shows steady growth driven by electric and hybrid vehicle integration. Mexico continues to expand as a production hub, attracting major OEM investments and supporting regional supply chain growth in the exhaust systems industry.

Market Insights:

- The North America Exhaust Systems Market was valued at USD 8,472.79 million in 2018, reached USD 11,056.26 million in 2024, and is projected to attain USD 16,753.29 million by 2032, growing at a CAGR of 40.62% during the forecast period.

- The United States holds the largest share of 56%, driven by its strong automotive production base, high vehicle ownership, and advanced emission regulations enforced by the EPA.

- Canada accounts for 24% of the market, supported by hybrid vehicle adoption and government-led green mobility initiatives promoting sustainable transportation.

- Mexico captures 20% of the regional share and remains the fastest-growing market, supported by OEM expansion, cost-effective production, and growing export-oriented automotive manufacturing.

- By product type, catalytic converters lead with a 35% share, followed by mufflers at 28%, reflecting strong demand for efficient emission control and noise-reducing systems across both passenger and commercial vehicles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Emission Norms Driving Adoption of Advanced Exhaust Technologies

Tight environmental regulations by the U.S. Environmental Protection Agency (EPA) and Transport Canada are key growth drivers for the North America Exhaust Systems Market. These regulations aim to reduce greenhouse gas and nitrogen oxide emissions from vehicles. Automakers are adopting technologies such as selective catalytic reduction (SCR) and gasoline particulate filters (GPF) to comply with evolving standards. It encourages innovation in exhaust design and manufacturing processes to improve emission efficiency and durability.

- For instance, in May 2025, Tata AutoComp Systems Ltd. and Katcon Global established a joint venture to produce advanced composite exhaust components, targeting lightweight design and achieving up to 15% reduction in nitrogen oxide emissions across North American passenger and commercial fleets.

Shift Toward Lightweight and Fuel-Efficient Vehicle Designs

The demand for lightweight vehicles to improve fuel economy and reduce emissions supports market expansion. Manufacturers are using stainless steel, titanium, and aluminum to reduce exhaust system weight without compromising strength. The trend toward downsized engines and turbocharging also requires efficient exhaust flow management. It creates opportunities for suppliers to develop materials and designs that enhance thermal performance and efficiency.

- For Instance, Akrapovič’s titanium exhaust parts for the Porsche 911 GT3 (992) achieve a notable weight reduction compared to the stock stainless-steel systems. Their Slip-On Race Line system, for instance, reduces weight by 3.5 kg (20.7%) over the standard exhaust.

Rising Production of Passenger and Commercial Vehicles

High vehicle production rates across the United States, Canada, and Mexico contribute significantly to market growth. Automakers are expanding facilities and introducing advanced exhaust systems that meet both performance and regulatory needs. The increasing production of light trucks, SUVs, and commercial fleets fuels steady demand for exhaust components. It strengthens the regional manufacturing base and creates growth opportunities for both OEM and aftermarket players.

Technological Advancements and Integration of Smart Exhaust Systems

The integration of sensors, thermal management solutions, and smart control units is transforming exhaust systems into intelligent performance components. Real-time monitoring improves vehicle diagnostics, maintenance, and emission control efficiency. The North America Exhaust Systems Market benefits from this technological evolution, promoting product differentiation and value addition. It positions exhaust systems as vital contributors to cleaner, connected, and more efficient automotive technologies.

Market Trends:

Integration of Electrification and Hybrid Vehicle Exhaust Solutions

The transition toward hybrid and electric vehicles is influencing the design and function of exhaust systems across North America. Automakers are developing hybrid-compatible exhaust solutions that optimize engine efficiency during partial load operations. Thermal management technologies are gaining importance to maintain catalyst activation in hybrid powertrains. The North America Exhaust Systems Market is adapting through innovations in active exhaust valves, heat recovery systems, and low-emission catalysts. Manufacturers are investing in compact, energy-efficient designs that align with the shift toward vehicle electrification. It reflects the industry’s movement toward sustainability while maintaining compliance with regional emission standards.

- For instance, in 2025, Tenneco and Eaton jointly introduced an integrated Exhaust Thermal Management System featuring Tenneco’s Cold Start Thermal Unit (CSTU) and Eaton’s TVS blower, capable of rapidly heating the SCR catalyst to approximately 250°C—enabling up to 90% reduction in NOx emissions and optimized performance in hybrid configurations.

Advancement in Material Innovation and Acoustic Performance Enhancement

Growing emphasis on noise reduction and vehicle comfort is driving advancements in muffler and resonator technologies. Manufacturers are adopting advanced alloys and composite materials to improve corrosion resistance and heat tolerance. The integration of active noise control systems and tunable exhaust valves is gaining traction in premium and performance vehicles. The North America Exhaust Systems Market is witnessing material innovations that support lightweight structures while maintaining structural rigidity. It encourages the development of modular designs that simplify maintenance and customization. This trend aligns with rising consumer expectations for quieter, cleaner, and more efficient vehicles, strengthening the market’s focus on technological refinement and driver experience.

- For Instance, Forvia (formerly Faurecia)’s NAFILite composite material, which features a microcell structure, achieved a 29% weight reduction for interior components

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Disruptions

Fluctuating prices of stainless steel, aluminum, and rare metals used in catalytic converters are pressuring production margins. Supply chain instability across North America and global sourcing challenges have increased lead times for key exhaust components. The North America Exhaust Systems Market faces cost volatility that affects both OEMs and aftermarket suppliers. It compels manufacturers to adopt localized sourcing and strategic partnerships to maintain stability. Environmental regulations on metal extraction and trade restrictions further strain material availability. Managing these fluctuations remains critical to sustaining profitability and production efficiency.

Growing Impact of Electric Vehicle Adoption on Exhaust Demand

The accelerating shift toward fully electric vehicles presents a structural challenge to exhaust system manufacturers. Electric powertrains eliminate the need for traditional exhaust assemblies, reducing long-term product demand. Hybrid vehicles still require exhaust solutions, but in smaller volumes compared to conventional models. The North America Exhaust Systems Market must diversify through thermal management, acoustic control, and lightweight structural applications. It encourages leading suppliers to realign portfolios and explore new automotive technologies. The gradual decline in internal combustion engine vehicle sales will continue to reshape the competitive landscape.\

Market Opportunities:

Expansion of Aftermarket Services and Performance Upgrades

The growing preference for vehicle customization and performance enhancement presents new revenue streams for manufacturers and distributors. Consumers are investing in premium exhaust systems that offer better sound control, improved efficiency, and longer lifespan. The North America Exhaust Systems Market benefits from strong aftermarket demand across sports, off-road, and luxury vehicles. It allows suppliers to develop modular, high-performance systems tailored to specific vehicle categories. Digital sales channels and direct-to-consumer models are also boosting aftermarket accessibility. This expanding service ecosystem creates continuous opportunities for component upgrades and replacement solutions.

Innovation in Sustainable Materials and Green Manufacturing Practices

Increasing focus on sustainability is driving investment in recyclable and low-carbon exhaust materials. Manufacturers are experimenting with composite alloys, advanced ceramics, and eco-friendly coatings to reduce environmental impact. The North America Exhaust Systems Market can capitalize on this shift by adopting cleaner manufacturing technologies and circular economy principles. It enables companies to align with evolving emission policies while appealing to environmentally conscious consumers. Collaboration with research institutes and automotive OEMs enhances material innovation and testing. This transition toward sustainable production strengthens long-term competitiveness and market credibility across the region.

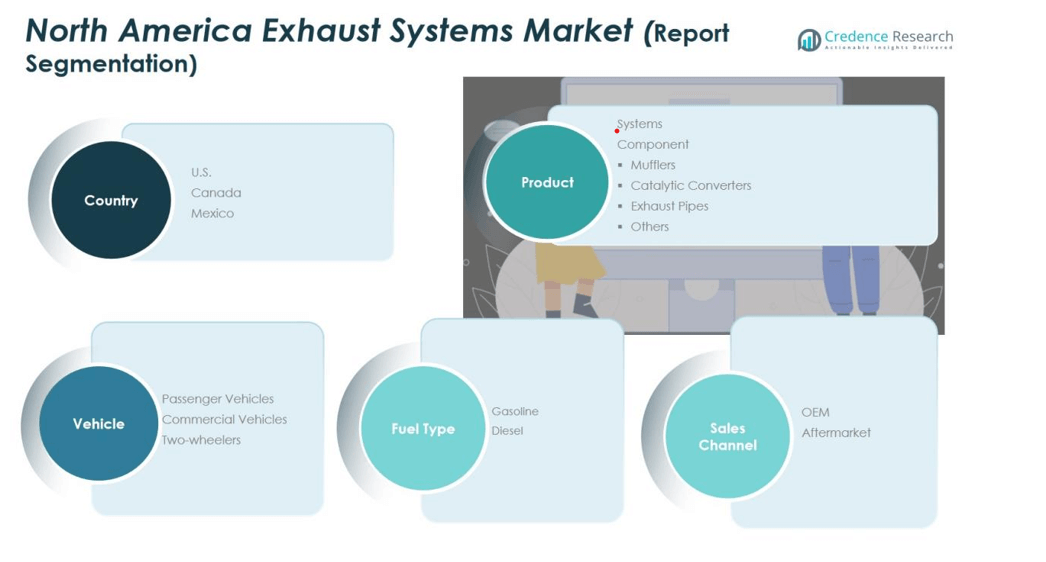

Market Segmentation Analysis:

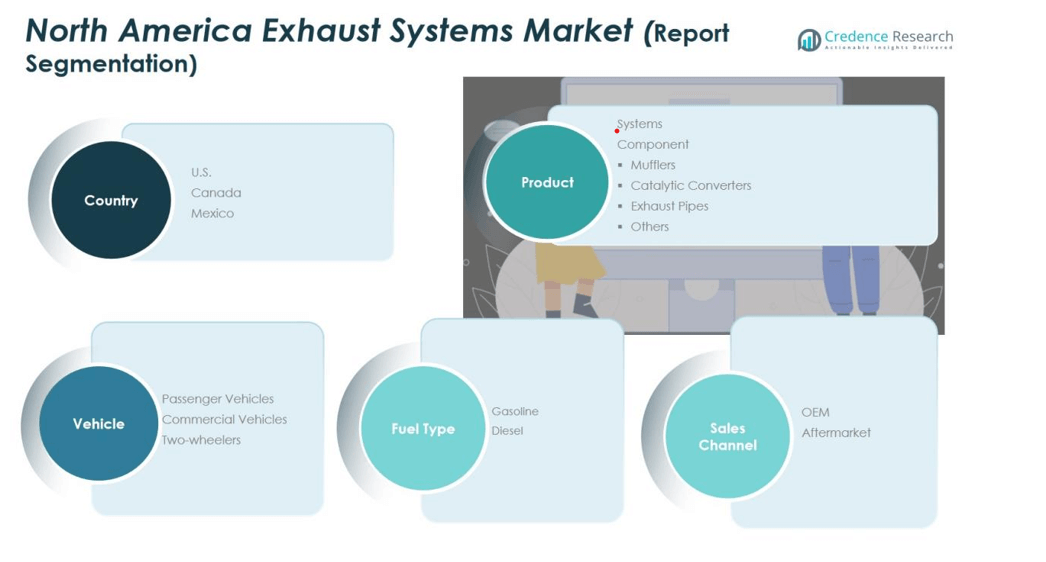

By Product Type

The North America Exhaust Systems Market is segmented into systems and components, including mufflers, catalytic converters, exhaust pipes, and others. Catalytic converters hold the largest share due to strict emission control standards and rising hybrid vehicle production. Mufflers and pipes also show strong demand from passenger and commercial vehicles seeking improved performance and reduced noise levels. It continues to evolve with lightweight materials and advanced coatings that enhance durability and thermal efficiency. The component segment’s growth is supported by continuous technological innovation and the expansion of aftermarket replacement demand.

- For instance, Faurecia’s Electrically Heated Catalyst reaches its optimal 400 °C activation temperature within 20 seconds, achieving an 85% reduction in cold-start emissions.

By Vehicle Type

Passenger vehicles dominate the market due to their high production volume and widespread use across the region. Commercial vehicles also represent a key segment, driven by logistics expansion and demand for durable emission systems. The market benefits from increased adoption of fuel-efficient technologies and hybrid powertrains across all categories. It continues to expand as automakers integrate advanced exhaust technologies that meet both performance and regulatory standards.

- For instance, Volvo launched its 2025.5 XC90 T8 plug-in hybrid SUV featuring a combined output of 455 horsepower and an EPA-rated electric-only range of 33 miles, marking a major advancement in passenger hybrid performance and efficiency.

By Sales Channel

The OEM segment leads the market, supported by strong partnerships with leading automakers and high vehicle production rates in the U.S. and Mexico. The aftermarket segment shows steady growth, fueled by replacement demand and performance upgrades. It provides opportunities for manufacturers to supply customizable and high-efficiency exhaust solutions tailored for diverse vehicle types.

Segmentations:

By Product Type

- Systems

- Components

- Mufflers

- Catalytic Converters

- Exhaust Pipes

- Others

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

By Fuel Type

By Sales Channel

By Country

- United States

- Canada

- Mexico

Regional Analysis:

United States: Strong Automotive Manufacturing and Regulatory Influence

The United States leads the North America Exhaust Systems Market with a dominant revenue share driven by high vehicle production and strict emission standards. The Environmental Protection Agency (EPA) enforces rigorous emission norms, compelling automakers to invest in advanced catalytic converters and lightweight exhaust materials. The country’s extensive aftermarket network supports consistent demand for replacement and performance systems. It benefits from robust research and development in thermal management, acoustic control, and hybrid-compatible exhaust technologies. Continuous innovation and consumer preference for high-performance vehicles strengthen its position in the regional market.

Canada: Steady Growth Through Hybrid Vehicle Integration and Green Initiatives

Canada’s market growth is supported by the rising adoption of hybrid vehicles and government initiatives promoting cleaner transportation technologies. The country’s focus on reducing carbon emissions aligns with automaker efforts to develop efficient and sustainable exhaust systems. The North America Exhaust Systems Market in Canada benefits from strategic collaborations between OEMs and technology providers to enhance emission control. It also gains momentum from advancements in lightweight metals and corrosion-resistant alloys suitable for extreme climates. Growing investment in R&D and supply chain localization further supports steady market expansion.

Mexico: Emerging Production Hub with Expanding OEM Presence

Mexico continues to strengthen its role as a major automotive manufacturing hub, serving both domestic and export markets. Favorable trade agreements and low production costs attract international exhaust system manufacturers and component suppliers. The North America Exhaust Systems Market in Mexico is witnessing new facility setups and partnerships with global OEMs to support regional demand. It benefits from the country’s integration into cross-border supply chains and proximity to the U.S. automotive sector. Growing focus on emission compliance and energy-efficient technologies positions Mexico as a key contributor to future regional growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The North America Exhaust Systems Market features a competitive landscape dominated by global and regional manufacturers focused on innovation and regulatory compliance. Key players include Tenneco Inc., Futaba Industrial Co., Ltd., Sango Co., Ltd., Yutaka Giken, Eberspächer, Forvia, and BOSAL. These companies emphasize product efficiency, lightweight materials, and advanced emission control technologies to maintain market leadership. It is witnessing continuous investment in hybrid-compatible exhaust systems, catalytic converters, and smart exhaust sensors. Strategic collaborations with automakers and R&D initiatives targeting thermal management and noise reduction are shaping competition. The market’s focus on sustainability, performance optimization, and regulatory alignment strengthens long-term positioning for established players while creating entry barriers for new competitors.

Recent Developments:

- In September 2025, Futaba Industrial released its Earnings Results Presentation for the first three months of the fiscal year ending March 31, 2025 (112th term).

- In September 2025, Purem by Eberspächer developed Direct Air Capture Technology designed to remove CO₂ from the atmosphere, expanding the company’s expertise beyond traditional exhaust systems.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Vehicle Type, Fuel Type, Sales Channel and Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North America Exhaust Systems Market will experience sustained growth driven by evolving emission regulations and clean mobility initiatives.

- Manufacturers will invest in hybrid-compatible exhaust solutions that balance performance with reduced emissions.

- Adoption of advanced catalytic materials and nanotechnology will enhance system efficiency and durability.

- Integration of sensors and smart diagnostics will transform exhaust systems into intelligent vehicle components.

- Lightweight alloys and composite materials will gain traction to support fuel-efficient vehicle designs.

- Aftermarket demand for performance-oriented exhaust upgrades will expand across premium and sports segments.

- Electric vehicle growth will drive diversification into thermal management and acoustic control technologies.

- Partnerships between OEMs and material innovators will accelerate sustainable manufacturing practices.

- Regional supply chain localization will strengthen competitiveness and reduce dependency on imports.

- The market will continue evolving toward modular, recyclable, and connected exhaust solutions aligned with future emission standards.