Market Overview:

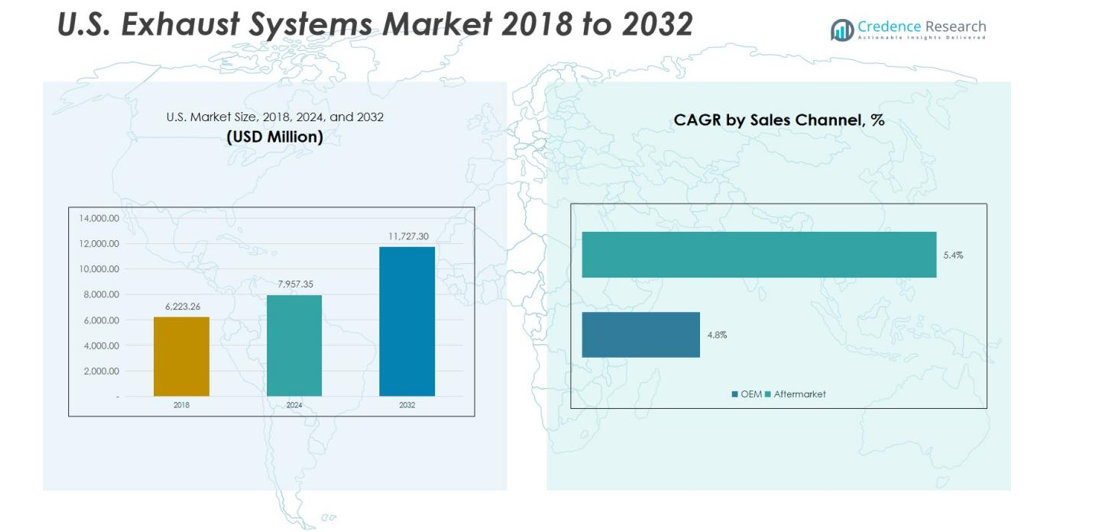

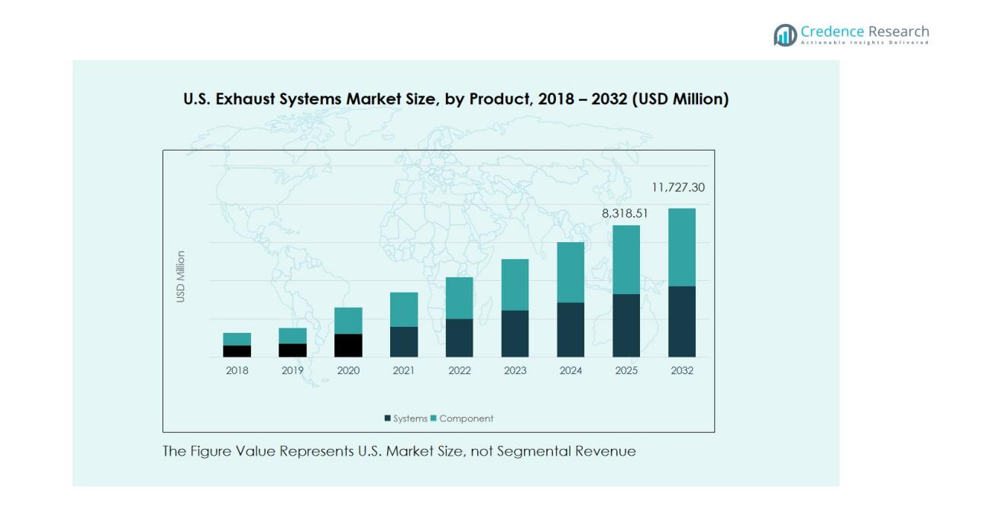

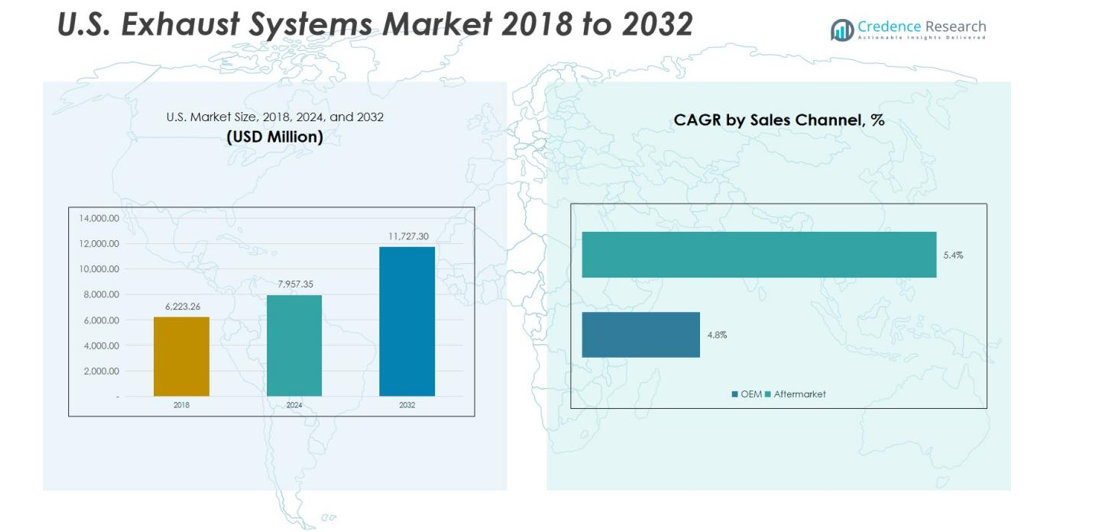

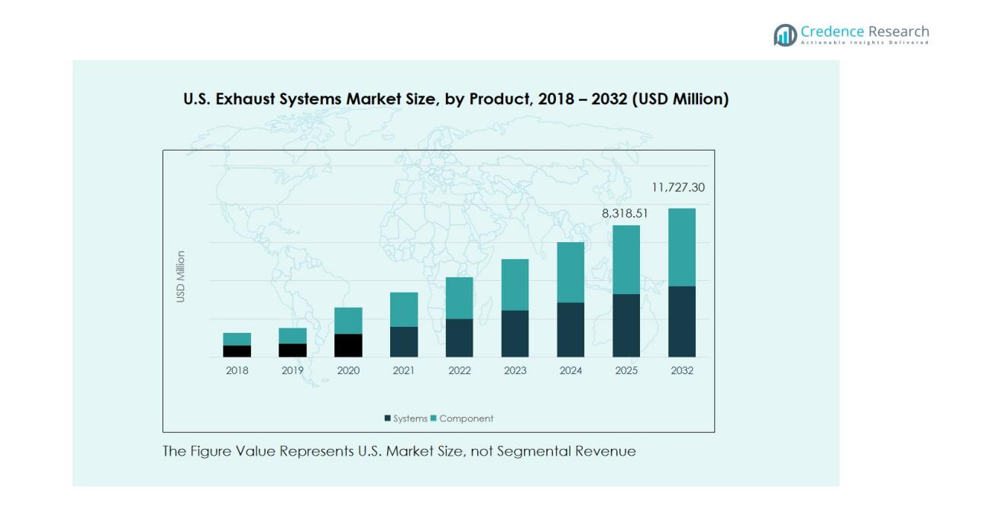

The U.S. Exhaust Systems Market size was valued at USD 6,223.26 million in 2018 to USD 7,957.35 million in 2024 and is anticipated to reach USD 11,727.30 million by 2032, at a CAGR of 4.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Exhaust Systems Market Size 2024 |

USD 7,957.35 million |

| U.S. Exhaust Systems Market, CAGR |

4.71% |

| U.S. Exhaust Systems Market Size 2032 |

USD 11,727.30 million |

Stringent emission regulations enforced by the Environmental Protection Agency (EPA) continue to push automakers to adopt cleaner exhaust technologies, such as selective catalytic reduction (SCR) and gasoline particulate filters (GPF). Increasing adoption of hybrid and plug-in hybrid vehicles further accelerates demand for advanced exhaust solutions that optimize thermal management and noise control while reducing pollutants. Continuous R&D investment and technological upgrades by key manufacturers strengthen the market outlook.

Regionally, the U.S. dominates North America’s exhaust system production, supported by major automotive OEMs and established supply networks. States such as Michigan, Ohio, and Tennessee host extensive manufacturing bases, while California’s clean-air policies encourage innovation in emission-reduction systems. Growing EV infrastructure and hybrid vehicle sales ensure long-term sustainability and innovation opportunities across the national market.

Market Insights:

- The U.S. Exhaust Systems Market was valued at USD 6,223.26 million in 2018, reached USD 7,957.35 million in 2024, and is projected to attain USD 11,727.30 million by 2032, registering a CAGR of 4.71% during the forecast period.

- The Midwest region holds the largest share at 38% due to the presence of major automotive OEMs and manufacturing facilities in Michigan, Ohio, and Tennessee. The West region accounts for 27%, led by California’s strong regulatory policies promoting cleaner vehicle technologies, while the South region holds 21%, supported by extensive production and aftermarket networks.

- The West is the fastest-growing region with a CAGR above the national average, driven by investments in emission-reduction systems, hybrid vehicle adoption, and sustainable mobility initiatives.

- By product type, catalytic converters dominate with a 41% market share, supported by strict emission regulations and widespread use in both gasoline and diesel vehicles.

- By vehicle type, passenger vehicles account for 63% of total market revenue, driven by strong production volumes and growing demand for fuel-efficient and low-emission models across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Emission Regulations and Environmental Policies Driving Technological Innovation

The U.S. Exhaust Systems Market is driven by strict emission norms imposed by the Environmental Protection Agency (EPA) and state-level agencies. These regulations aim to reduce greenhouse gas and nitrogen oxide emissions from vehicles, prompting automakers to develop cleaner and more efficient exhaust solutions. Technologies such as selective catalytic reduction (SCR), diesel particulate filters (DPF), and gasoline particulate filters (GPF) are increasingly used to meet compliance targets. Continuous pressure to meet emission standards fosters innovation in catalytic materials and system design.

- For Instance, The Cummins Single Module™ aftertreatment system is an ultra-high-efficiency SCR technology that can achieve very high NOx reduction, often exceeding 90%, but specific performance levels depend on the engine, application, and operating conditions

Growing Demand for Lightweight and High-Performance Materials Enhancing Efficiency

Rising focus on vehicle weight reduction and fuel efficiency boosts demand for lightweight exhaust system components. The market benefits from the increasing use of stainless steel, titanium, and composite materials that enhance durability and thermal resistance. It helps automakers improve fuel economy while maintaining structural strength and emission performance. The ongoing shift toward high-performance materials supports both environmental sustainability and long-term cost efficiency for manufacturers.

- For Instance, BMW announced upgrades for the 2025 M4 Competition, including a power increase for the Competition xDrive model to 523 horsepower.

Rising Hybrid and Plug-In Hybrid Vehicle Adoption Supporting Market Growth

The growing adoption of hybrid and plug-in hybrid vehicles creates fresh demand for advanced exhaust technologies. These vehicles require specialized thermal management and noise reduction systems to operate efficiently under variable load conditions. The U.S. automotive industry is investing heavily in exhaust solutions compatible with electrified powertrains. This transition supports continuous product innovation across OEMs and component suppliers.

Increased R&D Investments and Strategic Collaborations Strengthening Market Expansion

The U.S. Exhaust Systems Market benefits from sustained research and collaboration among automakers, suppliers, and research institutions. Companies are investing in digital simulation tools, additive manufacturing, and smart sensors to improve system design accuracy and emission control. Partnerships between technology firms and OEMs help integrate data-driven monitoring solutions into exhaust systems. This collective effort strengthens the industry’s capability to meet evolving emission and performance standards.

Market Trends:

Integration of Advanced After-Treatment and Sensor Technologies Enhancing Emission Control

The U.S. Exhaust Systems Market is witnessing a major shift toward integrating advanced after-treatment and sensor-based technologies. Automakers are adopting intelligent exhaust systems equipped with sensors that monitor emission levels in real time to ensure compliance with EPA standards. These systems use adaptive control units to regulate exhaust gas recirculation and optimize catalytic converter efficiency. Demand for selective catalytic reduction (SCR) and diesel oxidation catalyst (DOC) technologies is growing across passenger and commercial vehicles. The trend aligns with the push for cleaner mobility and reduced nitrogen oxide emissions. It also encourages manufacturers to invest in smart exhaust solutions that combine data analytics with predictive maintenance capabilities, improving performance and reliability.

- For Instance, North American Class 8 truck market, Cummins has been testing and developing engine platforms, such as the X15, to meet stricter 2027 EPA regulations, which will require significant NOx reductions.

Adoption of Lightweight Structures and Modular Design Improving Vehicle Efficiency

Manufacturers are focusing on lightweight exhaust components that improve vehicle efficiency and reduce carbon footprints. The use of stainless steel, titanium, and aluminum alloys is increasing to lower system weight while maintaining heat resistance. It helps automakers meet stringent Corporate Average Fuel Economy (CAFE) targets without compromising durability. The U.S. market is also embracing modular exhaust designs that simplify assembly, reduce production costs, and support faster model upgrades. Demand for 3D-printed and laser-welded components is expanding as companies adopt advanced manufacturing methods. The combination of modularity and lightweight design improves both performance and recyclability, aligning with sustainability goals in the automotive sector.

- For instance, Speedwerx’s L2 Competition Series titanium muffler, released in December 2024, weighs just 2.2 lbs—16.35 lbs lighter than the stock version, delivering exceptional weight reduction and durability gains.

Market Challenges Analysis:

Rising Electric Vehicle Adoption Reducing Demand for Conventional Exhaust Systems

The U.S. Exhaust Systems Market faces challenges due to the growing penetration of electric vehicles that operate without internal combustion engines. The expanding EV infrastructure and federal incentives for zero-emission vehicles reduce long-term demand for exhaust components. Automakers are shifting R&D budgets toward battery and motor technologies, which limits investment in traditional exhaust development. It pressures suppliers to diversify product portfolios toward hybrid-compatible and thermal management solutions. The transition to electric mobility threatens the volume base for conventional systems, impacting revenue streams across OEM and aftermarket segments.

High Raw Material Costs and Supply Chain Disruptions Impacting Profit Margins

Fluctuating prices of stainless steel, aluminum, and titanium increase production costs for exhaust system manufacturers. The U.S. market continues to experience logistical challenges and supply shortages, particularly for catalytic converter materials such as platinum and palladium. It creates volatility in pricing and affects profit margins for both component suppliers and OEMs. Manufacturers must balance cost control with innovation and quality compliance under strict emission regulations. The dependence on global suppliers for raw materials further intensifies production risks and delays in system delivery.

Market Opportunities:

Expansion of Hybrid Vehicle Segment Creating New Avenues for Exhaust Innovation

The U.S. Exhaust Systems Market is positioned to benefit from the rapid expansion of the hybrid vehicle segment. Hybrid powertrains still rely on internal combustion engines, creating demand for specialized exhaust systems that manage variable engine loads and thermal conditions. Manufacturers are developing compact, lightweight, and thermally efficient systems designed for hybrid integration. It supports emission control and noise reduction while maintaining vehicle performance. The shift toward plug-in hybrids offers long-term growth opportunities for suppliers focusing on adaptive designs and modular configurations. Continuous federal support for cleaner hybrid technologies strengthens this emerging market segment.

Adoption of Smart and Connected Exhaust Systems Supporting Sustainable Mobility

Growing adoption of connected vehicle technologies opens opportunities for smart exhaust systems with integrated sensors and analytics. These systems help optimize engine efficiency, monitor component wear, and track emission levels in real time. The integration of IoT and AI-based diagnostics supports predictive maintenance, improving vehicle reliability and lifespan. It allows automakers to meet emission standards while enhancing overall fuel performance. Increasing demand for sustainable and data-driven automotive solutions encourages investments in digitalized exhaust control platforms. This transition aligns with the broader industry movement toward intelligent and eco-friendly vehicle technologies.

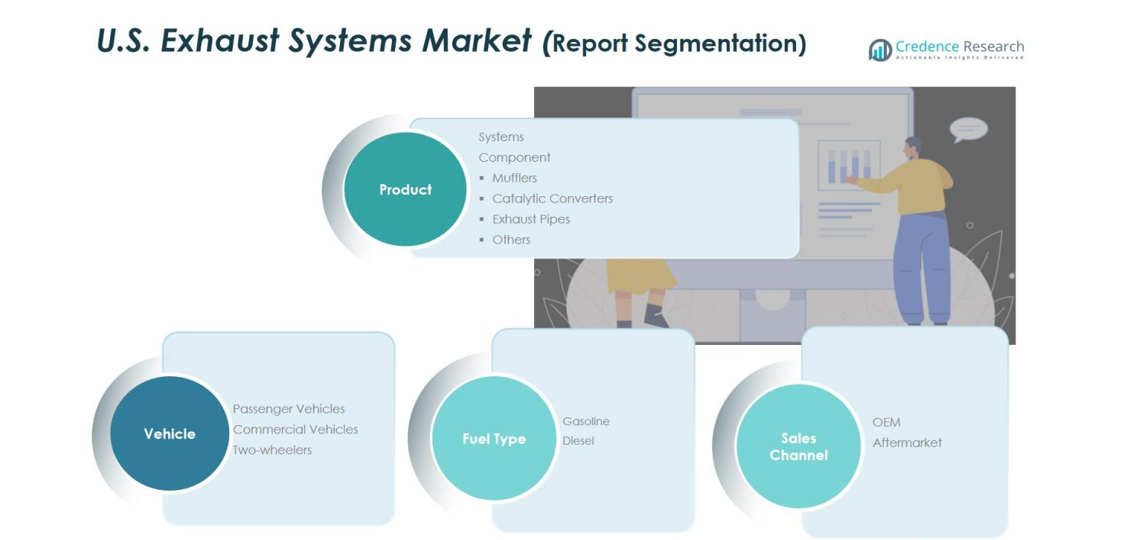

Market Segmentation Analysis:

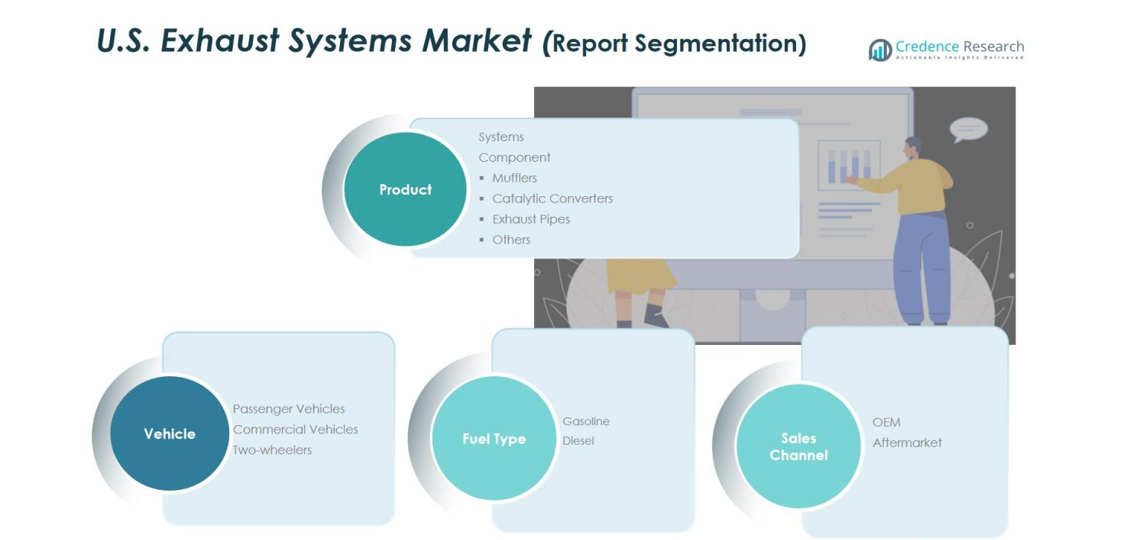

By Product Type

The U.S. Exhaust Systems Market is categorized by product type into systems and components, including mufflers, catalytic converters, exhaust pipes, and others. Catalytic converters hold a major share due to strict emission standards and widespread use in both gasoline and diesel vehicles. Mufflers and exhaust pipes contribute significantly to noise control and engine performance. The market experiences growing demand for lightweight and corrosion-resistant materials that enhance durability and efficiency. It continues to evolve toward modular and integrated exhaust architectures for improved vehicle compatibility.

By Vehicle

Passenger vehicles account for the largest share in the market due to their high production volume and consumer preference for fuel-efficient models. Commercial vehicles also contribute strongly, driven by logistics expansion and regulatory compliance requirements for emission reduction. The two-wheeler segment is smaller but shows steady adoption of compact exhaust solutions for improved thermal management. It benefits from rising demand for high-performance aftermarket components in motorcycles and scooters.

- For instance, in September 2024, BorgWarner introduced high-performance twin turbochargers integrated with exhaust manifolds for General Motors’ Corvette ZR1, producing 1,064 horsepower and 828 lb-ft torque while optimizing exhaust flow and reducing back pressure for improved engine efficiency.

By Fuel Type

Gasoline-powered vehicles dominate the market due to their widespread presence in the U.S. automotive fleet. Diesel vehicles maintain a strong base in the commercial segment, supported by advancements in selective catalytic reduction and particulate filtration systems. It continues to see steady innovation focused on reducing NOx emissions and improving combustion efficiency. The market is adapting to hybrid powertrains that combine internal combustion systems with electrified propulsion, sustaining demand for advanced exhaust technologies.

- For instance, Toyota’s 2.0 L Dynamic Force engine—introduced in 2018—achieves a world-best 41 percent thermal efficiency in hybrid applications and 40 percent in gas-only vehicles, thanks to a high compression ratio and advanced D-4S dual injection system.

Segmentations:

By Product Type Segment

- Systems

- Component

- Mufflers

- Catalytic Converters

- Exhaust Pipes

- Others

By Vehicle Segment

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

By Fuel Type Segment

By Sales Channel Segment

Regional Analysis:

Strong Automotive Manufacturing Base Supporting Market Growth

The U.S. Exhaust Systems Market benefits from a robust automotive manufacturing base concentrated in states such as Michigan, Ohio, and Tennessee. These regions host leading OEMs and Tier 1 suppliers, creating strong demand for advanced exhaust technologies. The presence of established production facilities and supply chains enables consistent output and cost efficiency. It continues to attract investments in R&D focused on emission control and lightweight materials. Proximity to raw material suppliers and component manufacturers further enhances regional competitiveness and operational flexibility.

Regulatory Environment Encouraging Technological Advancements

Strict regulations enforced by the Environmental Protection Agency (EPA) and state-level agencies drive innovation in exhaust treatment systems. California remains a major center for emission research and clean vehicle initiatives, pushing automakers to adopt advanced catalytic converters and selective catalytic reduction systems. The market is seeing increased demand for low-emission and noise-reducing components to comply with evolving standards. It supports continuous collaboration between industry players and environmental agencies to develop sustainable exhaust solutions. These policies ensure that manufacturers maintain a balance between performance, cost, and compliance.

Expanding Aftermarket and Hybrid Adoption Strengthening Regional Demand

The growing aftermarket sector and hybrid vehicle penetration are key contributors to market expansion across the United States. Consumers are replacing aging exhaust components with high-efficiency systems that meet new environmental requirements. The Midwest and Southern regions experience strong aftermarket sales due to extensive vehicle ownership and long driving distances. It reflects an increasing preference for durable, corrosion-resistant materials and advanced noise reduction systems. Hybrid vehicle growth in urban centers also fuels demand for innovative exhaust solutions designed for partial-electric powertrains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.S. Exhaust Systems Market is highly competitive, with leading companies focusing on innovation, quality, and regulatory compliance. Major players include Tenneco Inc., Futaba Industrial Co., Ltd., MagnaFlow, Yutaka Giken, Eberspächer, Auto-jet, and BOSAL. These companies compete through advanced emission control technologies, lightweight materials, and modular exhaust designs. It emphasizes continuous product development to meet evolving EPA standards and consumer demand for efficient and durable systems. Partnerships between OEMs and component manufacturers enhance production efficiency and market reach. Companies are also investing in hybrid-compatible systems and smart exhaust technologies to align with the shift toward cleaner mobility. The competitive landscape is shaped by product differentiation, pricing strategy, and strong distribution networks across OEM and aftermarket channels.

Recent Developments:

- In September 2025, Futaba Industrial released its Earnings Results Presentation for the first three months of the fiscal year ending March 31, 2025 (112th term).

- In September 2025, Purem by Eberspächer developed Direct Air Capture Technology designed to remove CO₂ from the atmosphere, expanding the company’s expertise beyond traditional exhaust systems.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Vehicle, Fuel Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. Exhaust Systems Market will experience steady growth supported by advancements in emission control technologies and evolving environmental standards.

- Demand for lightweight exhaust materials such as stainless steel, titanium, and composites will continue to rise to improve vehicle fuel efficiency.

- Hybrid and plug-in hybrid vehicle expansion will sustain long-term demand for specialized exhaust systems designed for thermal and acoustic efficiency.

- Smart exhaust systems equipped with sensors and IoT-based monitoring will gain adoption for real-time emission tracking and predictive maintenance.

- Manufacturers will focus on modular and compact exhaust architectures to reduce assembly costs and improve system integration.

- Investment in research and development will intensify, targeting innovations in catalytic converter design and noise reduction performance.

- Aftermarket sales will remain strong due to aging vehicle fleets and the need for replacement parts that meet new regulatory norms.

- Strategic collaborations between OEMs and component suppliers will drive technological upgrades and production scalability.

- Sustainability initiatives and stricter state-level emission policies will accelerate the adoption of eco-friendly exhaust solutions.

- Digital manufacturing and 3D printing will reshape production efficiency, enabling customization and faster response to shifting market needs.