Market Overview:

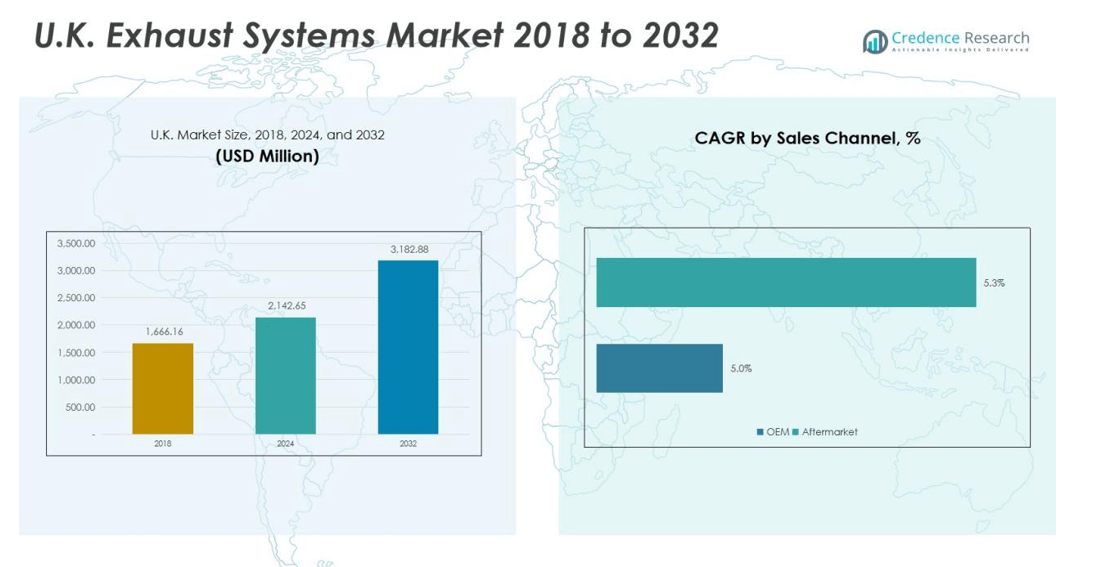

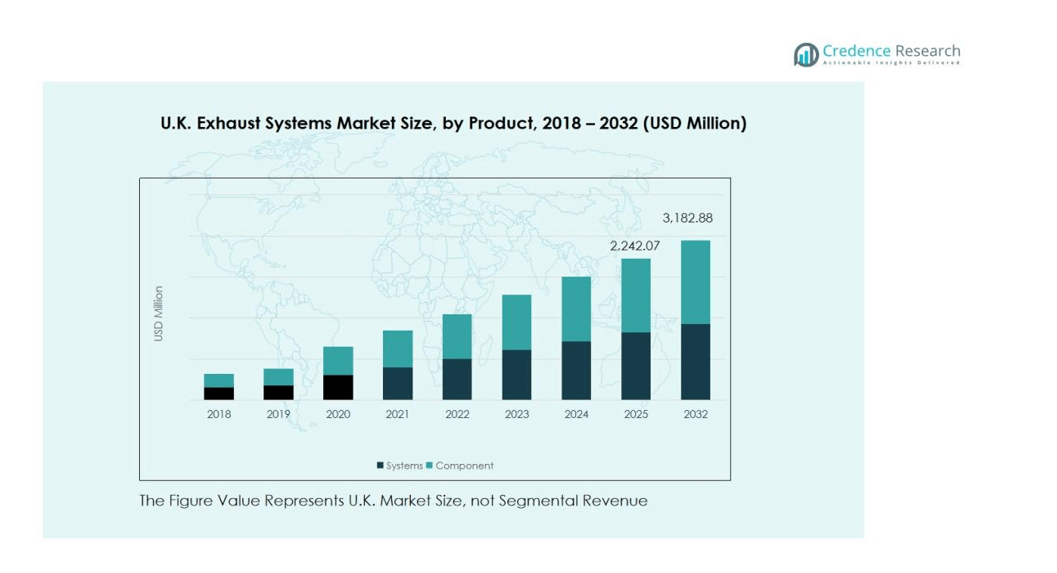

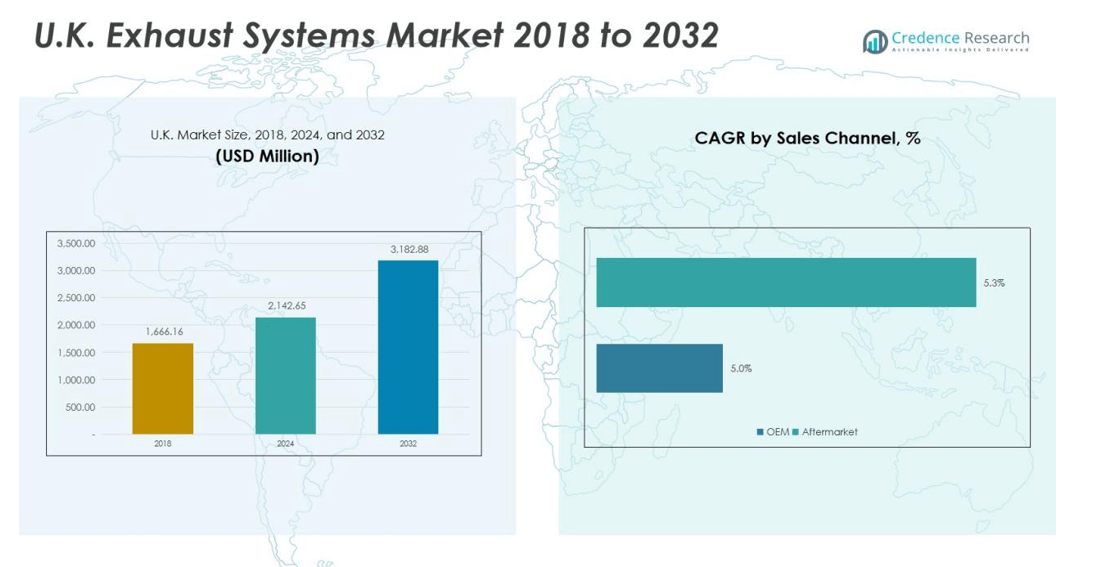

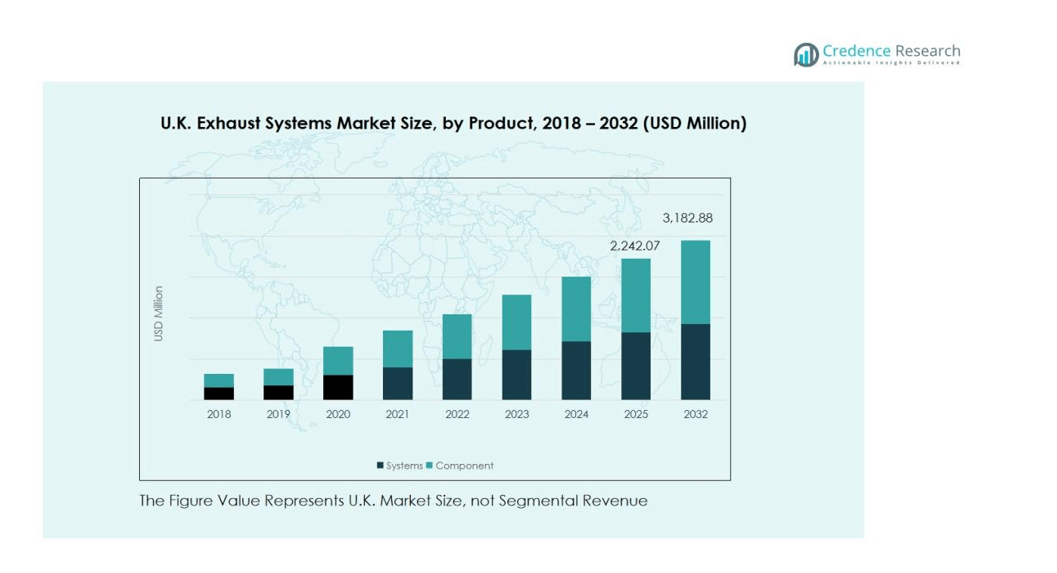

The U.K Exhaust Systems Market size was valued at USD 1,666.16 million in 2018 to USD 2,142.65 million in 2024 and is anticipated to reach USD 3,182.88 million by 2032, at a CAGR of 4.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K Exhaust Systems Market Size 2024 |

USD 2,142.65 million |

| U.K Exhaust Systems Market, CAGR |

4.73% |

| U.K Exhaust Systems Market Size 2032 |

USD 3,182.88 million |

Stringent emission norms aligned with Euro 6 and the upcoming Euro 7 standards drive innovation in exhaust system design. Manufacturers are developing advanced catalytic converters, diesel particulate filters, and lightweight materials to improve fuel efficiency and reduce emissions. The shift toward hybrid and plug-in hybrid vehicles boosts demand for efficient exhaust solutions that maintain performance while meeting sustainability goals.

Regionally, England remains the primary hub for the exhaust systems industry due to its strong automotive manufacturing base, R&D facilities, and presence of leading OEMs. The Midlands and Northern England contribute significantly through specialized component production and engineering innovation. Wales and Scotland are emerging markets, driven by new investments in green mobility and government initiatives supporting low-emission vehicle manufacturing.

Market Insights:

- The U.K. Exhaust Systems Market was valued at USD 1,666.16 million in 2018, reached USD 2,142.65 million in 2024, and is expected to attain USD 3,182.88 million by 2032, growing at a CAGR of 4.73% during the forecast period.

- England accounts for nearly 58% of the market share, driven by a strong automotive manufacturing base and major OEM presence. The Midlands and Northern England contribute about 25% combined, supported by advanced R&D centers and specialized component production facilities.

- Wales and Scotland together hold around 12% of the market and represent the fastest-growing regions, fueled by investments in green mobility infrastructure and hybrid vehicle component manufacturing.

- By product type, components dominate with approximately 68% share, led by catalytic converters, mufflers, and exhaust pipes, which are vital for emission reduction.

- By vehicle type, passenger vehicles represent nearly 61% of total market revenue, driven by high ownership rates and strong demand for efficient, low-emission mobility solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Emission Norms Driving Innovation and Compliance

The U.K. Exhaust Systems Market is strongly influenced by strict emission regulations aligned with Euro 6 and upcoming Euro 7 standards. These policies compel manufacturers to integrate advanced catalytic converters, diesel particulate filters, and selective catalytic reduction systems. It fosters continuous innovation in exhaust materials and designs that enhance performance while meeting environmental targets. The regulatory environment pushes OEMs to adopt lightweight alloys and composite structures, reducing emissions without compromising engine output.

- For instance, in July 2025, Bentley Motors introduced a new titanium Akrapovič sports exhaust system for its Continental GT, GT Convertible, and Flying Spur models, achieving a weight reduction of up to 10 kilograms while maintaining acoustic refinement and compliance with Euro 7 requirements.

Rising Adoption of Hybrid and Plug-In Hybrid Vehicles

The growing shift toward hybrid and plug-in hybrid vehicles acts as a major growth driver for the U.K. Exhaust Systems Market. Hybrid powertrains still require efficient exhaust management to control emissions from combustion engines during operation. It drives demand for compact and thermally efficient exhaust systems capable of managing variable temperature and flow conditions. Automakers are investing in flexible exhaust architectures that ensure durability and performance under hybrid usage patterns.

- For Instance, Faurecia equipped the Hyundai IONIQ Hybrid with a compact Exhaust Heat Recovery System. The system was capable of capturing up to 75% of exhaust heat and contributed to fuel savings of up to 7% by enabling faster engine and cabin warm-up, which allowed the hybrid to operate more often in electric mode.

Increasing Focus on Lightweight and High-Performance Materials

Manufacturers are prioritizing lightweight materials such as stainless steel, aluminum, and titanium in exhaust design. This transition reduces vehicle weight, improving fuel economy and cutting emissions. The U.K. automotive sector’s emphasis on high-performance vehicles further supports innovation in heat-resistant and corrosion-proof materials. It creates a competitive edge for domestic suppliers and encourages partnerships with global material technology firms.

Government Incentives and Expansion of Sustainable Mobility Programs

Government policies promoting low-emission mobility and electric-hybrid integration are accelerating exhaust technology upgrades. The U.K. government’s Clean Air Strategy and zero-emission vehicle mandates are encouraging innovation in emission control components. Public and private funding for sustainable automotive R&D strengthens technological advancement in exhaust systems. It enhances the nation’s capacity to meet long-term carbon reduction goals while supporting automotive sector competitiveness.

Market Trends:

Integration of Advanced Emission Control and Thermal Management Technologies

The U.K. Exhaust Systems Market is witnessing a major shift toward advanced emission control systems that combine efficiency and durability. Manufacturers are integrating selective catalytic reduction (SCR), gasoline particulate filters (GPF), and active regeneration systems to meet future Euro 7 standards. It reflects the automotive industry’s focus on optimizing temperature management and exhaust gas treatment across all driving conditions. Demand for intelligent exhaust valves and heat recovery mechanisms is increasing to improve engine performance and reduce energy losses. Tier-1 suppliers are investing in smart sensors and electronic control units that monitor emission levels in real time. This trend strengthens compliance, enhances vehicle reliability, and aligns with the country’s carbon neutrality objectives by 2050.

- For instance, Faurecia (now FORVIA) introduced its Compact Exhaust Heat Recovery System (EHRS) weighing under 3 kilograms, delivering up to 7% improvement in fuel efficiency for hybrid vehicles such as the Hyundai IONIQ and Ford F-150 through faster heat recovery and improved thermal control.

Adoption of Lightweight, Modular, and Electrified Exhaust Architectures

The transition toward electrification and hybridization is reshaping design priorities for exhaust systems in the United Kingdom. Manufacturers are adopting modular exhaust platforms made from lightweight materials like titanium and composite alloys to reduce mass and manufacturing costs. The integration of electric heating elements and noise control modules enhances thermal management in hybrid vehicles. It promotes consistent emission reduction even under cold-start conditions, a key focus for urban emission control. The market is also seeing a rise in 3D printing and digital simulation tools that accelerate prototype development and customization. These innovations improve system adaptability across diverse vehicle categories, supporting sustainable mobility goals and driving steady growth within the U.K. Exhaust Systems Market.

- For instance, Tenneco and Eaton jointly developed an integrated exhaust thermal management system in 2025 that uses Eaton’s TVS Roots blower to heat the SCR catalyst to around 250°C, cutting cold-start nitrogen oxide emissions by over 90% for Euro 7-compliant vehicles in the UK automotive market.

Market Challenges Analysis:

Rising Electric Vehicle Adoption Reducing Demand for Conventional Exhaust Systems

The growing shift toward electric vehicles poses a long-term challenge for the U.K. Exhaust Systems Market. Pure electric vehicles eliminate the need for exhaust systems, directly impacting future demand. It pressures manufacturers to diversify into hybrid-compatible or alternative thermal management components. The government’s 2035 ban on new petrol and diesel cars further accelerates this transition. OEMs and suppliers must adapt their production strategies to remain relevant in a changing mobility landscape. The transition requires heavy investment in R&D and supply chain restructuring to sustain profitability.

High Production Costs and Supply Chain Disruptions Impacting Competitiveness

Rising costs of raw materials such as stainless steel, nickel, and titanium are increasing the overall production expenses for exhaust system manufacturers. It affects pricing flexibility and reduces margins for small and medium suppliers. Global supply chain disruptions and fluctuating import tariffs have further complicated component availability. Manufacturers face pressure to balance quality with cost efficiency while maintaining compliance with strict emission regulations. The need for advanced testing, certification, and material sourcing also adds operational complexity. These challenges slow product innovation and hinder competitiveness within the U.K. Exhaust Systems Market.

Market Opportunities:

Expansion of Hybrid and Plug-In Hybrid Vehicle Segment Creating Growth Avenues

The rapid growth of hybrid and plug-in hybrid vehicles presents strong opportunities for the U.K. Exhaust Systems Market. These vehicles still rely on efficient exhaust systems to manage emissions during combustion engine operation. It encourages innovation in compact, thermally stable, and energy-efficient exhaust solutions. Manufacturers are focusing on integrating smart sensors and lightweight materials to enhance system performance and durability. The market can benefit from the government’s continued investment in hybrid mobility programs that bridge the transition to full electrification. This segment offers a sustainable revenue stream for suppliers adapting to changing propulsion technologies.

Adoption of Smart Manufacturing and Advanced Material Technologies

The shift toward Industry 4.0 and smart manufacturing creates new opportunities for local exhaust system producers. Automation, robotics, and AI-driven design tools help improve precision, reduce waste, and shorten production cycles. It supports the creation of modular and customizable exhaust platforms tailored for diverse vehicle types. Advanced material technologies such as ceramic coatings and corrosion-resistant alloys further expand product longevity. Collaborations between research institutions and OEMs enhance R&D capabilities and accelerate innovation. These advancements position the U.K. Exhaust Systems Market to strengthen its global competitiveness while meeting evolving emission and performance standards.

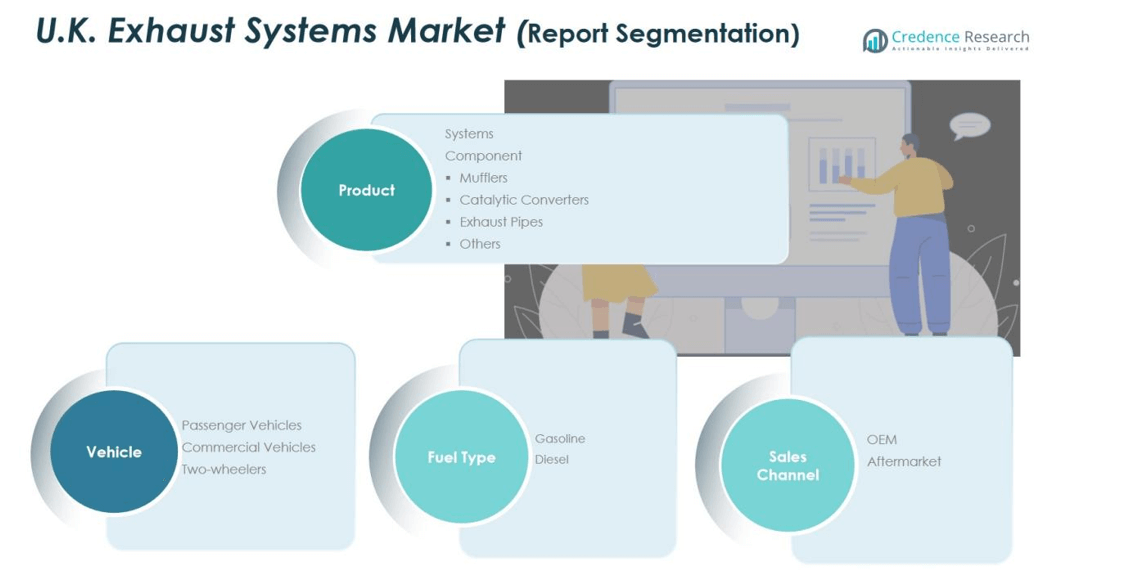

Market Segmentation Analysis:

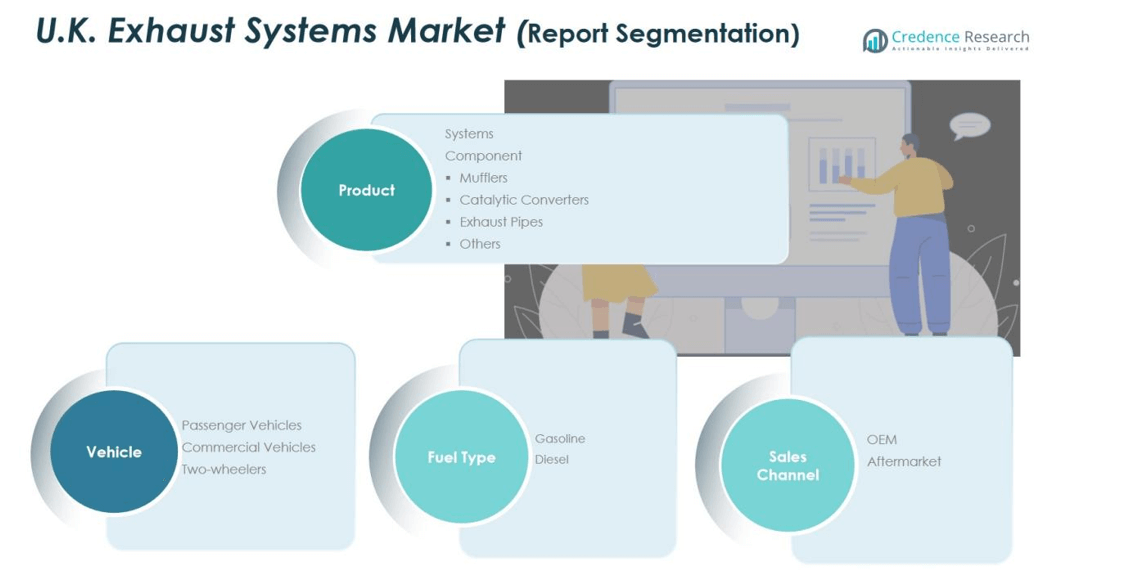

By Product Type

The U.K. Exhaust Systems Market is segmented into systems and components, including mufflers, catalytic converters, exhaust pipes, and others. Components hold a major share due to their critical role in emission reduction and noise control. It benefits from increasing demand for advanced catalytic converters and particulate filters to meet Euro 6 and Euro 7 standards. Manufacturers are investing in lightweight and corrosion-resistant materials to extend product life and enhance fuel efficiency. The systems segment continues to grow with integration of modular and hybrid-compatible exhaust assemblies in new vehicle platforms.

- For Instance, Milltek also offers systems for the Cupra Formentor 1.4 TSi e-hybrid, these were available before 2024, with some products dating back to 2022.

By Vehicle Type

Passenger vehicles dominate the market due to high ownership rates and consumer demand for cleaner, efficient mobility solutions. The commercial vehicle segment shows steady growth driven by logistics and public transport expansion. It focuses on robust exhaust designs capable of handling higher emission volumes and extended operational hours. Two-wheelers contribute a smaller share but benefit from urban mobility programs and rising motorcycle sales across cities.

- For Instance, Hero MotoCorp launched the Splendor Plus Xtec 2.0 in 2024, which features i3S idle start-stop technology and has an ARAI-certified mileage of 73 kmpl.

By Fuel Type

Gasoline-powered vehicles lead the U.K. Exhaust Systems Market due to their widespread adoption and ongoing upgrades in emission control technologies. Diesel vehicles continue to hold relevance in the commercial and heavy-duty sectors, supported by advancements in selective catalytic reduction (SCR) systems. It faces regulatory pressure to reduce particulate and NOx emissions, encouraging adoption of cleaner alternatives and hybrid-compatible exhaust solutions.

Segmentations:

By Product Type

- Systems

- Components

- Mufflers

- Catalytic Converters

- Exhaust Pipes

- Others

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

By Fuel Type

By Sales Channel

Regional Analysis:

Dominance of England Driven by Strong Automotive Manufacturing Base

England represents the largest share of the U.K. Exhaust Systems Market due to its well-established automotive ecosystem. The Midlands and Northern England serve as major production hubs for OEMs and Tier-1 suppliers, including companies specializing in emission control technologies. It benefits from advanced R&D facilities, engineering expertise, and proximity to global automotive leaders. The presence of brands such as Jaguar Land Rover and Ford supports consistent demand for high-performance exhaust components. Government incentives for sustainable manufacturing and innovation strengthen England’s position as the core region for exhaust system development.

Emerging Growth in Wales and Scotland Through Green Mobility Investments

Wales and Scotland are emerging regional contributors, supported by growing investments in low-emission vehicle infrastructure and component manufacturing. The expansion of local assembly units and supplier networks improves the regional value chain for exhaust production. It benefits from national programs promoting clean mobility and the shift toward hybrid and plug-in hybrid vehicles. Research partnerships between universities and automotive companies are fostering innovation in lightweight and recyclable exhaust materials. These developments create new opportunities for suppliers focusing on eco-friendly designs and cost-efficient production methods.

Northern Ireland’s Focus on Aftermarket and Export Opportunities

Northern Ireland plays a smaller but strategic role in the U.K. Exhaust Systems Market through its aftermarket and export-oriented operations. The region supports component manufacturing for replacement parts and specialized exhaust assemblies. It leverages its logistics connectivity and technical workforce to cater to European demand. Local firms are investing in digital manufacturing processes to enhance precision and quality standards. The region’s focus on value-added exports positions it as an emerging contributor within the overall U.K. exhaust systems landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- GT Exhausts

- Futaba Industrial Co., Ltd.

- MagnaFlow

- Yutaka Giken

- Eberspächer

- PD Gough

- BOSAL

- Sejong Industrial Co., Ltd.

- Milltek

- Continental AG

Competitive Analysis:

The U.K. Exhaust Systems Market is moderately consolidated, with competition centered on technology innovation, material efficiency, and emission compliance. Key players include GT Exhausts, Futaba Industrial Co., Ltd., MagnaFlow, Yutaka Giken, Eberspächer, PD Gough, and BOSAL. It focuses on developing lightweight, high-durability exhaust components to meet Euro 7 standards and reduce carbon output. Companies are expanding R&D capabilities and forming strategic alliances with OEMs to enhance product performance and cost efficiency. Local firms emphasize customization and precision engineering to maintain competitiveness against global brands. Continuous investment in smart manufacturing and hybrid-compatible exhaust systems strengthens market positioning and supports long-term growth.

Recent Developments:

- In September 2025, Futaba Industrial released its Earnings Results Presentation for the first three months of the fiscal year ending March 31, 2025 (112th term).

- In September 2025, Purem by Eberspächer developed Direct Air Capture Technology designed to remove CO₂ from the atmosphere, expanding the company’s expertise beyond traditional exhaust systems.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Vehicle Type, Fuel Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.K. Exhaust Systems Market will evolve through increased focus on emission reduction and system efficiency.

- Manufacturers will prioritize R&D for lightweight and hybrid-compatible exhaust architectures.

- The adoption of Euro 7 standards will accelerate demand for advanced catalytic converters and particulate filters.

- OEMs will invest in intelligent exhaust monitoring systems with integrated sensors and data analytics.

- Hybrid and plug-in hybrid vehicles will continue to offer steady opportunities for system innovation.

- Automation and AI-driven manufacturing will improve precision, consistency, and production speed.

- Sustainability initiatives will drive greater use of recyclable and corrosion-resistant materials.

- Aftermarket demand will remain stable, supported by replacement and upgrade needs in older vehicles.

- Collaborations between local firms and international suppliers will expand technological capabilities and export reach.

- Long-term growth will depend on balancing regulatory compliance with cost efficiency and design innovation.