Market Overview:

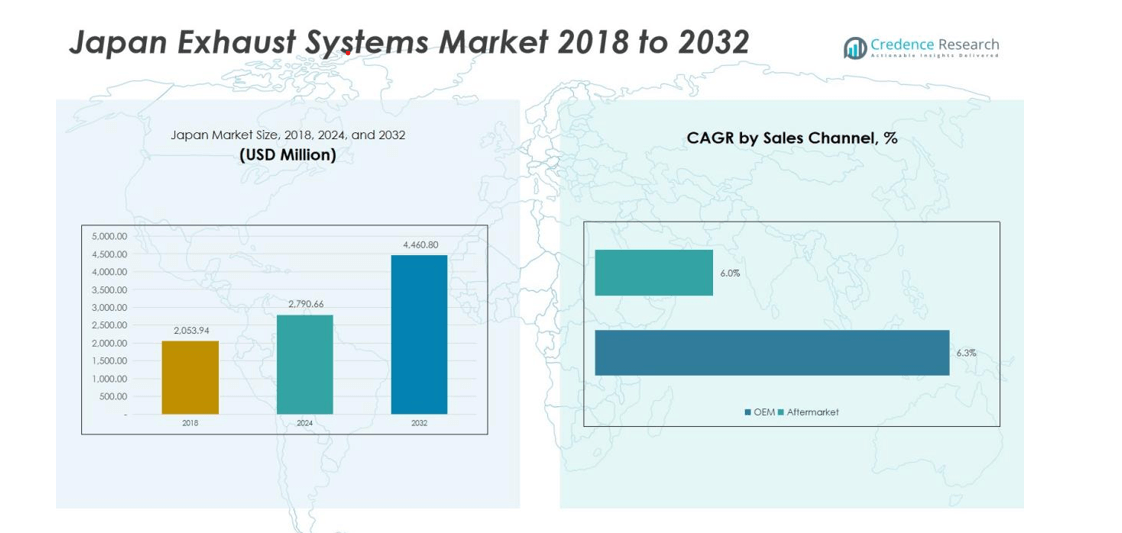

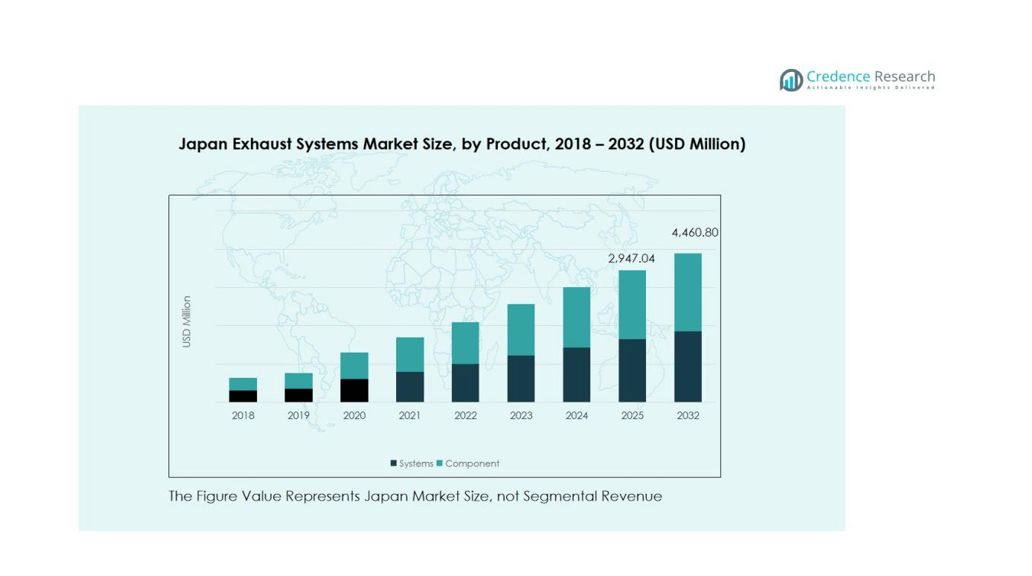

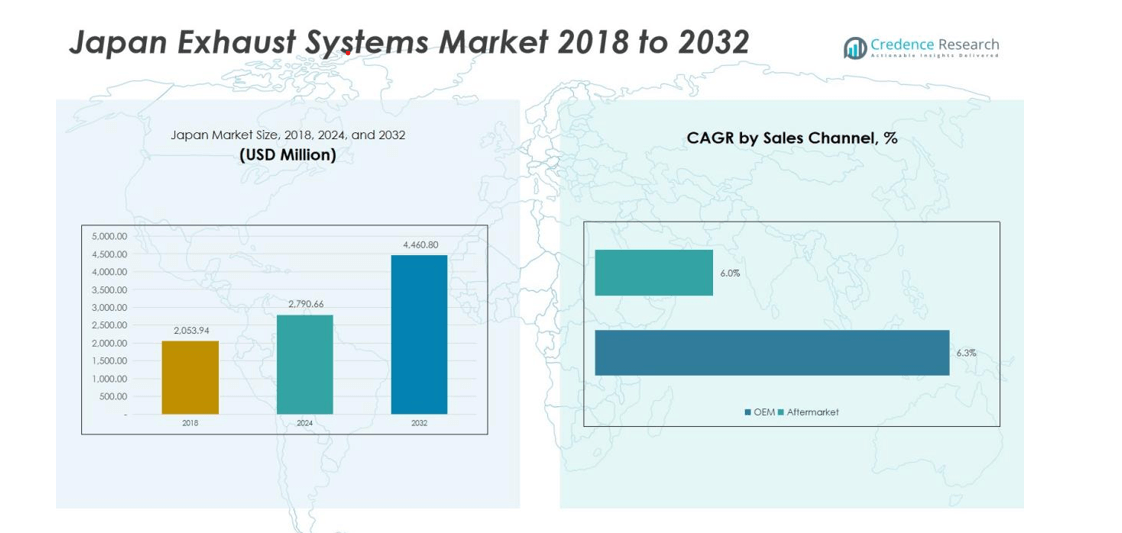

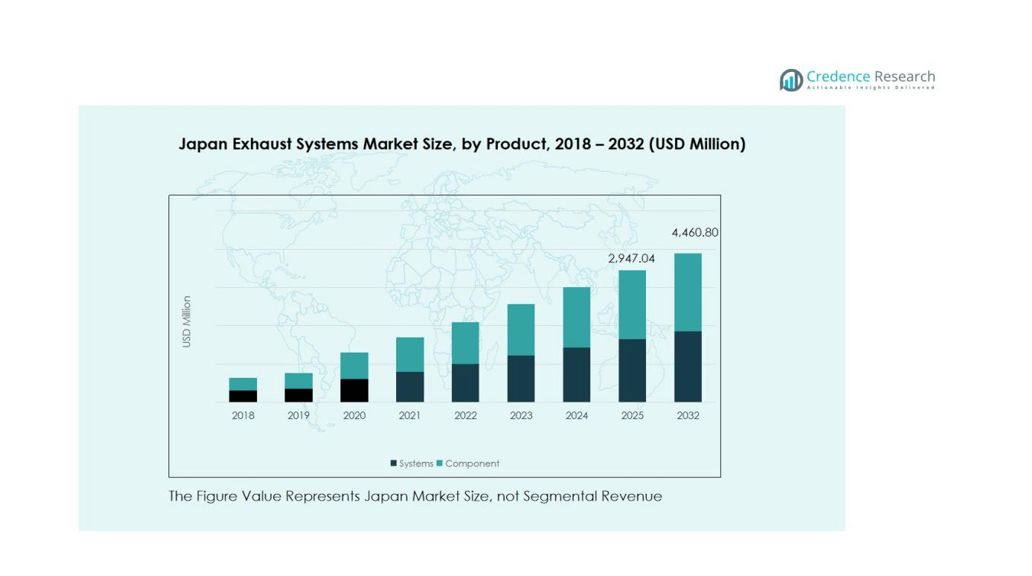

The Japan Exhaust Systems Market size was valued at USD 2,053.94 million in 2018 to USD 2,790.66 million in 2024 and is anticipated to reach USD 4,460.80 million by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Exhaust Systems Market Size 2024 |

USD 2,790.66 million |

| Japan Exhaust Systems Market, CAGR |

5.6% |

| Japan Exhaust Systems Market Size 2032 |

USD 4,460.80 million |

Japan’s strict emission control policies and environmental regulations are key growth drivers. The push toward carbon neutrality encourages manufacturers to adopt advanced catalytic converters, mufflers, and lightweight materials. Increased consumer awareness regarding fuel efficiency and the expansion of the electric vehicle segment also enhance demand for innovative exhaust solutions that support cleaner mobility.

Japan dominates the Asia-Pacific automotive exhaust component production, driven by strong OEM presence and R&D investments from companies like Toyota, Honda, and Nissan. The market benefits from domestic innovation and integration of advanced after-treatment technologies. Government support for sustainable automotive engineering and the country’s focus on reducing greenhouse gas emissions further strengthen Japan’s position in the regional exhaust systems market.

Market Insights:

- The Japan Exhaust Systems Market was valued at USD 2,053.94 million in 2018, reached USD 2,790.66 million in 2024, and is projected to attain USD 4,460.80 million by 2032, growing at a CAGR of 5.6%.

- Japan accounts for 41% of the Asia-Pacific exhaust systems market, followed by South Korea with 23% and China with 21%, supported by strong automotive manufacturing and emission compliance efforts.

- Asia-Pacific remains the fastest-growing region, driven by Japan’s innovation in hybrid vehicle exhausts, government carbon reduction policies, and heavy R&D investments.

- By product type, catalytic converters dominate with 38% share due to strict emission regulations, while mufflers contribute 27% owing to increasing adoption in hybrid and urban passenger vehicles.

- By vehicle segment, passenger cars hold 64% of the market, supported by strong domestic demand, whereas commercial vehicles account for 25%, driven by rising logistics and transportation activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Emission Norms and Environmental Regulations Driving Innovation

The Japan Exhaust Systems Market is driven by the country’s rigorous emission standards aimed at reducing carbon and nitrogen oxide levels. The government enforces strict compliance with environmental guidelines under initiatives like the Japan Clean Air Act. Automakers are investing in advanced after-treatment systems, including selective catalytic reduction (SCR) and diesel particulate filters (DPF), to meet these standards. These regulations push continuous innovation in exhaust system design, materials, and performance efficiency.

- For Instance, Toyota released the Land Cruiser “250” series with a diesel powertrain, which incorporates its latest Selective Catalytic Reduction (SCR) technology to reduce nitrogen oxide (\(\text{NO}_{x}\)) emissions.

Growing Demand for Fuel-Efficient and Lightweight Vehicles

The rising consumer focus on fuel efficiency is accelerating demand for lightweight exhaust components. Manufacturers are using high-grade stainless steel, titanium, and composite alloys to reduce vehicle weight without compromising durability. The shift toward compact, fuel-efficient vehicles supports the adoption of advanced exhaust technologies that improve gas flow and engine performance. It also encourages suppliers to integrate design optimization and cost-effective production processes.

- For instance, JCR Developments’ Titanium SuperLight Race Pipe Kit for the Porsche 991.2 GT3 RS weighs just 5.32 kg, yielding a 23.73 kg reduction in rear-axle mass compared to the OEM silenced configuration.

Expansion of Hybrid and Electric Vehicle Production

Japan’s strong presence in hybrid and electric vehicle manufacturing influences exhaust system advancements. Hybrid vehicles still require efficient exhaust solutions to manage emissions from internal combustion engines. Companies are designing smaller, quieter, and thermally optimized systems tailored for hybrid models. It enables smoother vehicle operation and compliance with low-emission vehicle standards.

Continuous Technological Advancements and R&D Investments

Continuous R&D investments by leading OEMs and component manufacturers strengthen the market’s technological base. Automation, simulation, and 3D modeling tools are enhancing design accuracy and production speed. Partnerships between automotive firms and research institutes promote the development of next-generation catalytic materials and noise reduction systems. These advancements enhance product quality, reliability, and environmental sustainability within the Japan Exhaust Systems Market.

Market Trends:

Adoption of Advanced After-Treatment Technologies and Lightweight Materials

The Japan Exhaust Systems Market is witnessing a strong shift toward advanced after-treatment solutions to meet emission control targets. Manufacturers are integrating selective catalytic reduction (SCR), gasoline particulate filters (GPF), and diesel oxidation catalysts (DOC) to improve emission efficiency. Lightweight materials such as aluminum, stainless steel, and titanium are gaining traction to enhance performance and fuel economy. The industry is focusing on modular designs that simplify assembly and maintenance while reducing production costs. Growing demand for hybrid vehicles is encouraging suppliers to develop compact, thermally efficient exhaust layouts. It supports quieter operations and aligns with Japan’s long-term carbon neutrality goals. Continuous advancements in material science and manufacturing automation are helping improve system reliability and reduce lifecycle costs.

- For instance, Nissan Motor Co.’s AD Van CNGV achieved a 75% reduction in exhaust emissions compared to Japan’s 2000 regulation limits.

Rising Integration of Smart Sensors and Thermal Management Systems

The integration of smart sensors is becoming a defining trend across Japan’s exhaust system production landscape. Manufacturers are embedding temperature, oxygen, and pressure sensors to enable real-time performance monitoring and predictive maintenance. These innovations enhance compliance with emission standards while improving engine response and vehicle safety. Thermal management systems are evolving to regulate exhaust heat recovery and optimize catalytic efficiency. It contributes to improved fuel economy and lower emissions in both conventional and hybrid vehicles. Japanese OEMs are also expanding collaborations with electronics companies to integrate IoT-based diagnostic systems for enhanced operational visibility. The focus on intelligent exhaust components is strengthening Japan’s position as a hub for advanced automotive innovation.

- For Instance, DENSO expanded its PowerEdge aftermarket line with new NOx sensors that cover nearly 40 medium- and heavy-duty vehicle models for real-time NOx monitoring.

Market Challenges Analysis:

Rising Transition Toward Electric Vehicles Limiting Exhaust System Demand

The Japan Exhaust Systems Market faces pressure from the rapid adoption of electric vehicles that operate without traditional exhaust components. The government’s strong incentives for zero-emission vehicles reduce demand for conventional exhaust systems. It forces manufacturers to diversify their portfolios toward hybrid and alternative propulsion technologies. The declining internal combustion engine segment limits future growth opportunities for exhaust component suppliers. Companies are investing in system miniaturization and multifunctional designs to remain competitive. The gradual shift in consumer preference toward electric mobility challenges long-term market sustainability.

High Raw Material Costs and Complex Manufacturing Processes

Fluctuating prices of metals such as stainless steel, nickel, and titanium create financial strain for manufacturers. The complex fabrication and assembly of advanced exhaust systems increase production costs and impact profit margins. It also requires high precision and advanced welding technologies, which raise operational expenses. Smaller suppliers struggle to maintain competitiveness against large integrated firms with automated production lines. Stringent quality standards demand continuous testing and certification, further increasing lead times. Managing these production and cost challenges remains critical for maintaining efficiency and profitability in the Japan Exhaust Systems Market.

Market Opportunities:

Growing Demand for Hybrid Vehicle Exhaust Solutions

The Japan Exhaust Systems Market presents strong opportunities through the growing production of hybrid vehicles. Hybrid models continue to rely on efficient exhaust systems for optimized emission control and thermal management. Manufacturers are developing compact, lightweight, and noise-reducing systems tailored for hybrid configurations. It supports the country’s push toward low-emission mobility while sustaining market relevance for traditional exhaust suppliers. Advancements in catalytic converter design and exhaust gas recirculation systems enhance compatibility with hybrid powertrains. Expanding R&D programs focused on cleaner combustion and extended component life further strengthen this growth avenue.

Expansion of Smart and Sustainable Exhaust Technologies

Increasing adoption of smart exhaust systems with sensor-based monitoring creates a new opportunity segment. Integration of IoT and AI-driven diagnostics improves real-time tracking of emissions and component health. It allows predictive maintenance and better compliance with Japan’s tightening emission norms. Manufacturers investing in eco-friendly coatings, corrosion-resistant materials, and heat recovery technologies can gain a competitive edge. Partnerships between automakers and technology firms will drive innovation in performance optimization and sustainability. The growing focus on digital and sustainable exhaust solutions positions Japan as a leader in next-generation automotive technologies.

Market Segmentation Analysis:

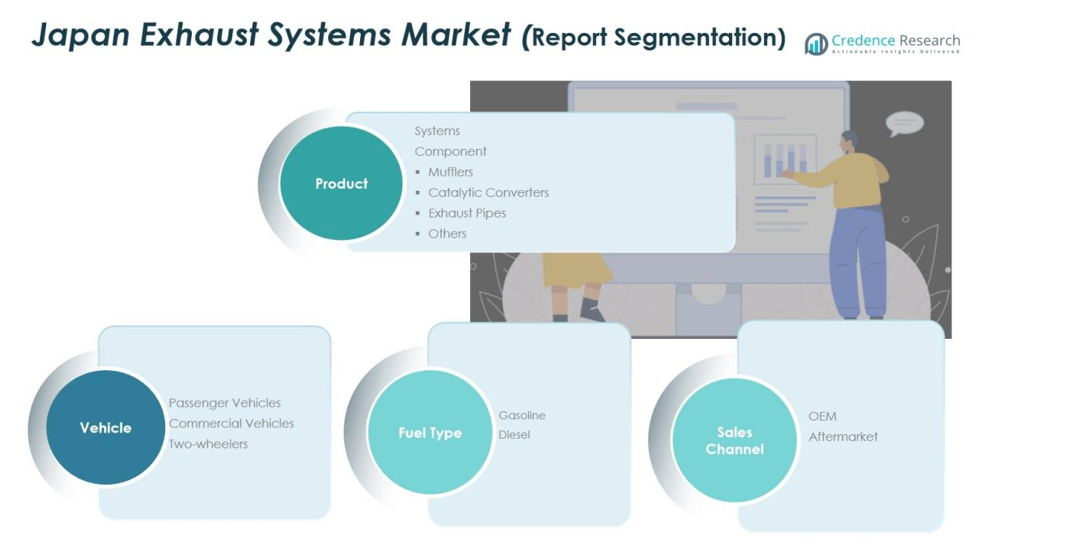

By Product Type

The Japan Exhaust Systems Market includes systems and components such as mufflers, catalytic converters, and exhaust pipes. Catalytic converters hold a major share due to strict emission standards requiring efficient pollutant reduction. Mufflers are in strong demand for noise control in hybrid and compact vehicles. Exhaust pipes remain essential for performance optimization and thermal management. It continues to see advancements in lightweight alloys and corrosion-resistant materials to improve efficiency and durability.

- For instance, Faurecia’s Electrically Heated Catalyst achieves a 75% reduction in NOₓ emissions in diesel applications by rapidly heating the catalyst to operating temperature within 20 seconds of engine start-up.

By Vehicle

Passenger vehicles account for a dominant share supported by Japan’s strong automotive production and consumer demand for fuel-efficient models. Commercial vehicles contribute significantly due to their need for durable and high-capacity exhaust systems. The two-wheeler segment shows steady growth driven by rising urban mobility and stricter emission norms for motorcycles. It encourages manufacturers to design compact exhaust systems with improved catalytic performance.

- For instance, Toyota’s 2.0-liter Dynamic Force hybrid engine employs high-speed combustion and a dual-injection system to achieve a world-leading thermal efficiency of 41%

By Fuel Type

Gasoline vehicles lead the market due to their large production base and strong domestic sales. Diesel vehicles hold a smaller yet stable share driven by commercial fleets and heavy-duty transportation. Increasing adoption of hybrid vehicles is creating new opportunities for specialized exhaust designs compatible with dual propulsion systems. It reflects Japan’s transition toward cleaner and more efficient automotive technologies.

Segmentations:

By Product Type Segment

- Systems

- Components

- Mufflers

- Catalytic Converters

- Exhaust Pipes

- Others

By Vehicle Segment

- Passenger Vehicles

- Commercial Vehicles

- Two-wheelers

By Fuel Type Segment

By Sales Channel Segment

Regional Analysis:

Strong Domestic Automotive Manufacturing Driving Market Growth

The Japan Exhaust Systems Market benefits from a robust automotive manufacturing ecosystem led by global OEMs such as Toyota, Honda, and Nissan. These manufacturers continuously invest in emission control technologies and lightweight materials to comply with environmental regulations. The integration of advanced exhaust treatment systems, including SCR and GPF, supports the nation’s carbon reduction goals. It also drives innovation in catalytic converter design, heat-resistant alloys, and modular component integration. Strong government initiatives toward cleaner mobility enhance local production capacity and technological competitiveness.

Growing Hybrid Vehicle Adoption Strengthening Market Opportunities

Hybrid vehicle production in Japan is expanding rapidly, creating consistent demand for efficient exhaust systems. Hybrid models require smaller yet high-performance exhaust assemblies capable of managing intermittent engine operations. It promotes the development of thermal control systems and low-noise mufflers suited for urban driving conditions. The focus on low-emission hybrid technology enables suppliers to adapt existing designs for evolving propulsion systems. Steady investment in research and localized supply chains strengthens Japan’s position as a hub for advanced exhaust technologies.

Technological Advancements and Export Potential Boosting Market Presence

Technological leadership and precision engineering provide Japan a competitive advantage in the regional and global exhaust systems industry. Domestic companies are expanding exports of high-quality components to markets in Asia and Europe, leveraging strong R&D and production efficiency. It supports international partnerships and helps Japanese suppliers gain access to global automotive platforms. Continuous innovation in corrosion resistance, acoustic optimization, and smart exhaust monitoring strengthens Japan’s global footprint. The country remains a key contributor to next-generation emission control and vehicle efficiency solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Japan Exhaust Systems Market is highly competitive, characterized by strong domestic and international players focusing on innovation, cost efficiency, and emission compliance. Key companies include SANGO Co., Ltd., Futaba Industrial Co., Ltd., MagnaFlow, ATJ Automotive GmbH, AP Emissions, and The Axces Group. These firms emphasize product performance, lightweight materials, and noise reduction technologies to meet Japan’s stringent emission standards. It continues to evolve with growing investment in hybrid-compatible exhaust systems and smart thermal management solutions. Strategic partnerships with OEMs and R&D initiatives enhance competitive positioning and expand global reach. Leading manufacturers are also integrating automation and precision manufacturing to reduce costs while maintaining quality standards.

Recent Developments:

- In September 2025, Futaba Industrial released its Earnings Results Presentation for the first three months of the fiscal year ending March 31, 2025 (112th term).

- In October 2025, MagnaFlow announced the expansion of its operations in Oceanside, California, by adding a new 100,000-square-foot facility, increasing its total footprint to over 500,000 square feet.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Vehicle, Fuel Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Japan Exhaust Systems Market will continue to grow driven by the country’s focus on reducing vehicle emissions.

- Hybrid vehicle production will create sustained demand for compact, thermally efficient exhaust systems.

- Manufacturers will invest heavily in smart exhaust solutions featuring IoT and sensor-based monitoring technologies.

- R&D spending will increase to develop corrosion-resistant and lightweight materials for performance optimization.

- Electric vehicle adoption will gradually reduce demand for traditional exhaust systems, pushing diversification toward hybrid-specific components.

- Collaboration between OEMs and technology firms will expand to integrate advanced emission control and predictive maintenance systems.

- Exports of high-quality exhaust components from Japan to other Asian and European markets will rise steadily.

- Automation and precision engineering will strengthen production efficiency and cost competitiveness among domestic manufacturers.

- Government regulations promoting carbon neutrality will continue to shape material innovation and product design.

- Japan will maintain its role as a key regional hub for sustainable and high-performance exhaust system technologies.