Market Overview:

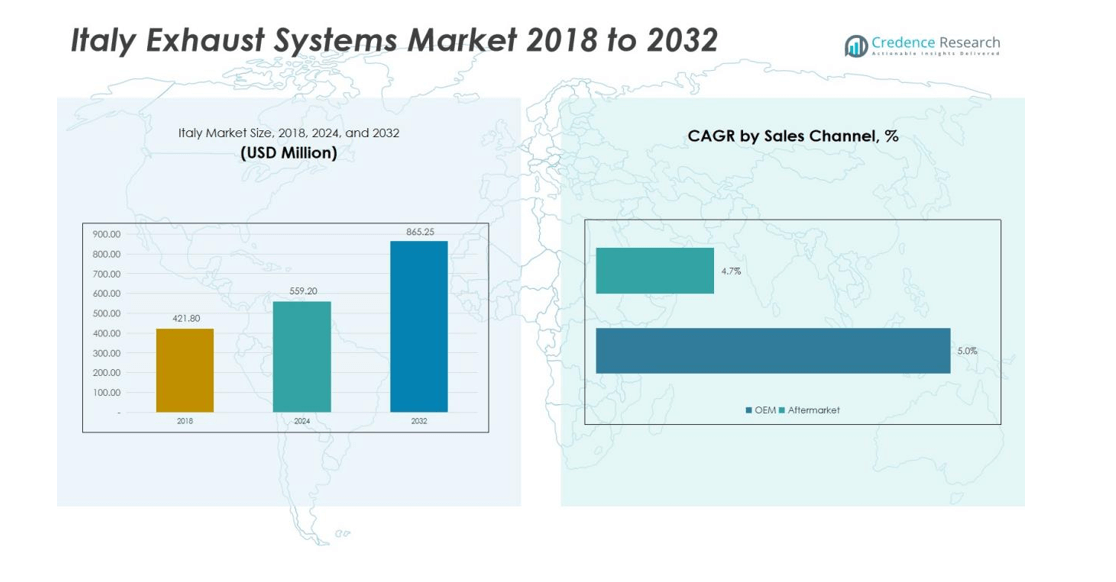

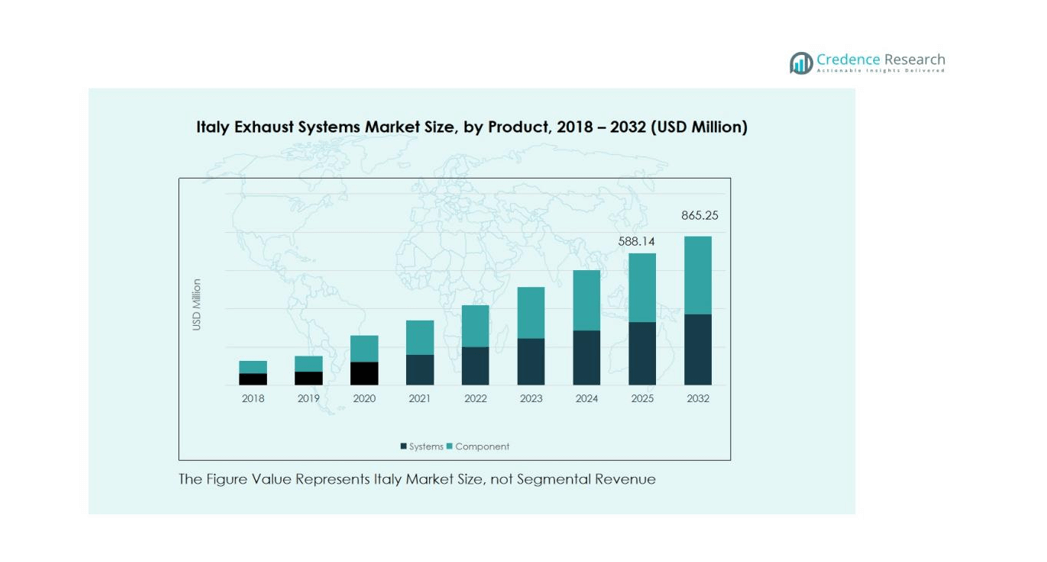

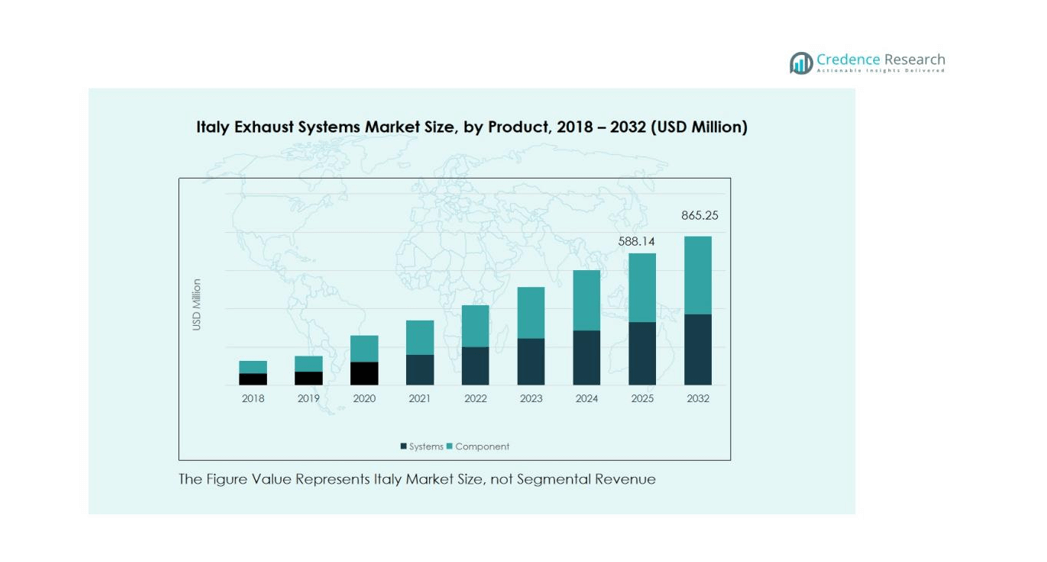

The Italy Exhaust Systems Market size was valued at USD 421.80 million in 2018 to USD 559.20 million in 2024 and is anticipated to reach USD 865.25 million by 2032, at a CAGR of 5.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Exhaust Systems Market Size 2024 |

USD 559.20 million |

| Italy Exhaust Systems Market, CAGR |

5.29% |

| Italy Exhaust Systems Market Size 2032 |

USD 865.25 million |

Stringent emission standards enforced by the European Union and Italy’s national environmental directives are major market drivers. Automotive manufacturers are adopting advanced catalytic converters, mufflers, and particulate filters to meet regulatory norms. Rising demand for hybrid and plug-in hybrid vehicles further accelerates adoption of efficient exhaust systems optimized for cleaner operation and fuel economy.

Regionally, Northern Italy dominates the market due to its strong automotive production base in Lombardy, Piedmont, and Emilia-Romagna. These regions host several OEMs and component manufacturers that supply both domestic and export markets. Southern regions are witnessing gradual growth driven by new investments, government incentives, and infrastructure improvements promoting low-emission vehicle production and adoption across the nation.

Market Insights:

- The Italy Exhaust Systems Market was valued at USD 421.80 million in 2018, reaching USD 559.20 million in 2024, and is projected to attain USD 865.25 million by 2032, registering a CAGR of 5.29% during the forecast period.

- Northern Italy holds the largest share of 52% owing to its strong automotive manufacturing base in Lombardy, Piedmont, and Emilia-Romagna, supported by advanced infrastructure and OEM presence.

- Central Italy accounts for 28% of the market, driven by its focus on R&D, technological innovation, and engineering collaborations that enhance system efficiency and emission control performance.

- Southern Italy represents 20% of the share and is the fastest-growing region, supported by government incentives, industrial expansion, and investments in sustainable automotive component production.

- By product type, components contribute 63% of market revenue due to high demand for catalytic converters and mufflers, while the passenger vehicle segment leads with 58% share, driven by strong domestic sales and hybrid model adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Emission Regulations Driving Technological Advancements

The Italy Exhaust Systems Market is strongly driven by the nation’s compliance with European Union emission directives such as Euro 6 and upcoming Euro 7 standards. These regulations mandate significant reductions in carbon monoxide, nitrogen oxides, and particulate emissions. Automakers are investing in advanced catalytic converters, diesel particulate filters (DPF), and selective catalytic reduction (SCR) systems to meet evolving requirements. It continues to encourage innovation in lightweight exhaust materials and advanced thermal management solutions, supporting overall vehicle efficiency and environmental performance.

- For Instance, Bosch’s Denoxtronic 8 SCR system is an advanced diesel exhaust treatment technology designed to meet future emissions regulations with high efficiency

Rising Adoption of Hybrid and Plug-In Hybrid Vehicles

The increasing demand for hybrid and plug-in hybrid vehicles across Italy creates consistent growth opportunities for exhaust system manufacturers. While full electric vehicles have no tailpipes, hybrid variants still require efficient emission control systems to reduce pollutants during combustion phases. The integration of smart sensors and temperature-resistant components helps optimize exhaust flow and reduce energy losses. It aligns with Italy’s broader sustainability targets aimed at reducing urban pollution and promoting energy-efficient transportation.

- For instance, Stellantis expanded its eDCT-based hybrid powertrain across 30 European models in 2024, achieving a 20% CO₂ reduction and a 41% sales growth year-on-year through enhanced exhaust and combustion control systems.

Growing Focus on Fuel Efficiency and Lightweight Design

Automotive OEMs in Italy are shifting toward lightweight exhaust structures to enhance fuel efficiency without compromising performance. The use of stainless steel, titanium, and advanced alloys is helping reduce vehicle weight and improve heat resistance. It supports manufacturers in meeting consumer demand for efficient, high-performing vehicles with lower carbon footprints. Continuous R&D efforts to improve material strength and corrosion resistance further drive the adoption of advanced exhaust solutions.

Expansion of Domestic Automotive Manufacturing and Exports

Italy’s strong automotive sector, led by brands such as Fiat, Maserati, and Ferrari, continues to boost exhaust system demand. The expansion of local production facilities and component exports to other European markets sustains steady growth. Partnerships between OEMs and component suppliers ensure high-quality emission control technologies are developed domestically. It benefits from Italy’s strategic focus on innovation, export competitiveness, and sustainable automotive engineering.

Market Trends:

Integration of Advanced After-Treatment and Sensor Technologies

The Italy Exhaust Systems Market is witnessing a shift toward advanced after-treatment systems that enhance emission control and thermal efficiency. Manufacturers are integrating sensors, oxygen monitors, and temperature controllers to achieve real-time emission monitoring and optimize system performance. The development of active exhaust valves and electronically controlled mufflers is gaining traction among premium and hybrid vehicle segments. It helps automakers maintain compliance with Euro standards while improving driving dynamics and fuel economy. The trend toward intelligent exhaust management also supports predictive maintenance, reducing operational costs for fleet and commercial vehicles. Increasing collaboration between OEMs and technology firms is strengthening innovation pipelines in emission analytics and material science.

- For Instance, Bosch’s commercial vehicle NOx sensor delivers a measurement accuracy of ±5 ppm at 0 ppm and a response time of approximately 1,000 ms in Euro 6 applications, enabling real-time SCR dosing adjustments.

Transition Toward Lightweight Materials and Sustainable Manufacturing

The market is moving toward eco-friendly production methods and lightweight design to reduce both emissions and material waste. The adoption of stainless steel, titanium, and composite-based exhaust structures enhances durability and corrosion resistance. It helps automakers meet consumer expectations for performance and environmental responsibility while ensuring long-term cost savings. The push toward circular economy practices encourages recycling and reuse of exhaust materials in Italy’s automotive supply chain. Advanced forming and laser welding technologies are supporting this trend by improving precision and structural integrity in exhaust assemblies. Growing investments in sustainable manufacturing and lifecycle analysis are further reinforcing Italy’s role as a European leader in green automotive innovation.

- For Instance, Aftermarket titanium exhaust systems for the Ferrari SF90 Stradale/Spider can offer weight savings between 14 kg (31 lbs) and 15.5 kg (34 lbs), according to some manufacturers.

Market Challenges Analysis:

Rising Electric Vehicle Adoption Reducing Exhaust System Demand

The Italy Exhaust Systems Market faces a structural challenge due to the rapid transition toward electric mobility. Battery electric vehicles eliminate the need for exhaust components, directly impacting long-term demand for traditional systems. Government incentives promoting zero-emission vehicles further accelerate this trend. It compels exhaust system manufacturers to diversify into thermal management and energy recovery solutions to remain competitive. The shift also places pressure on small and mid-sized suppliers that rely heavily on combustion engine-based components. Adapting to new drivetrain technologies requires substantial capital investment and technical expertise.

High Raw Material Costs and Supply Chain Volatility

Fluctuations in the prices of stainless steel, nickel, and titanium pose major cost pressures for manufacturers. It affects profitability and limits flexibility in pricing strategies across OEM and aftermarket segments. The market also experiences challenges due to logistics disruptions and longer lead times for component imports. Compliance with evolving EU environmental regulations increases production complexity and operational costs. Exhaust system suppliers must balance cost efficiency with innovation to maintain competitiveness in a volatile economic environment. Strategic sourcing and localized production are becoming essential to mitigate these ongoing risks.

Market Opportunities:

Expansion of Hybrid and Plug-In Hybrid Vehicle Segment

The Italy Exhaust Systems Market holds significant opportunity through the growing demand for hybrid and plug-in hybrid vehicles. These vehicles still require efficient exhaust systems to manage intermittent combustion cycles and emission control. Manufacturers can leverage this demand by developing compact, lightweight, and temperature-resistant systems tailored for hybrid architectures. It benefits from Italy’s push toward partial electrification, where hybrid platforms bridge the gap between conventional and full-electric vehicles. Strategic collaborations between automakers and exhaust component suppliers can accelerate innovation in energy recovery and acoustic performance. The market is expected to witness steady growth as hybrid sales continue to rise under supportive government policies.

Adoption of Advanced Materials and Green Manufacturing Technologies

There is increasing potential for adopting advanced alloys, ceramics, and composite materials that improve performance and durability. It enables manufacturers to reduce exhaust weight and enhance corrosion resistance while maintaining thermal efficiency. The shift toward sustainable production methods aligns with Italy’s national climate goals and European Green Deal objectives. Manufacturers investing in eco-friendly coatings, additive manufacturing, and recyclable materials can gain a competitive edge. Growing emphasis on lifecycle optimization and material circularity opens new avenues for differentiation. The market is positioned to benefit from R&D incentives and investments in environmentally responsible automotive engineering.

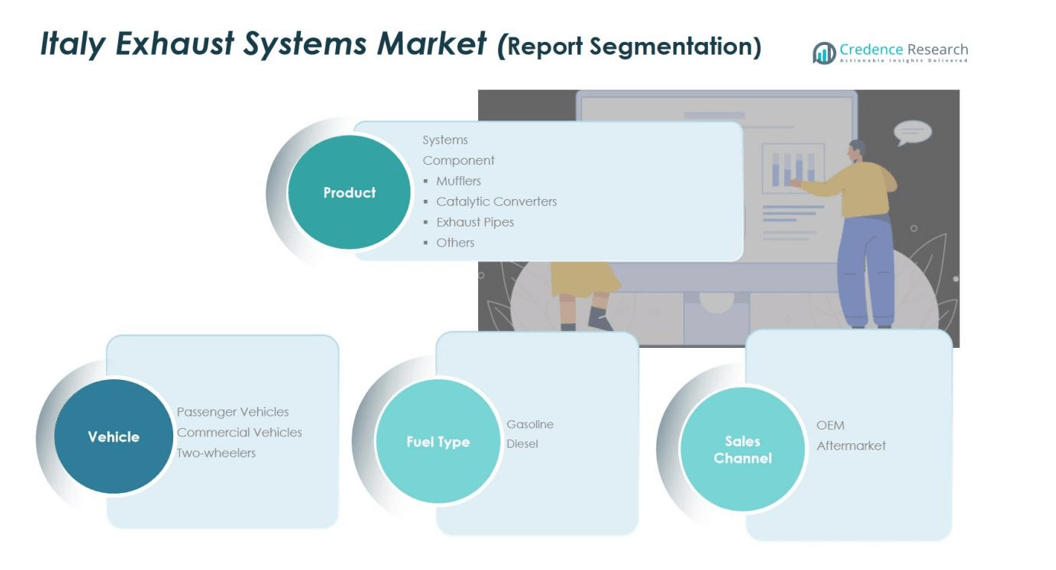

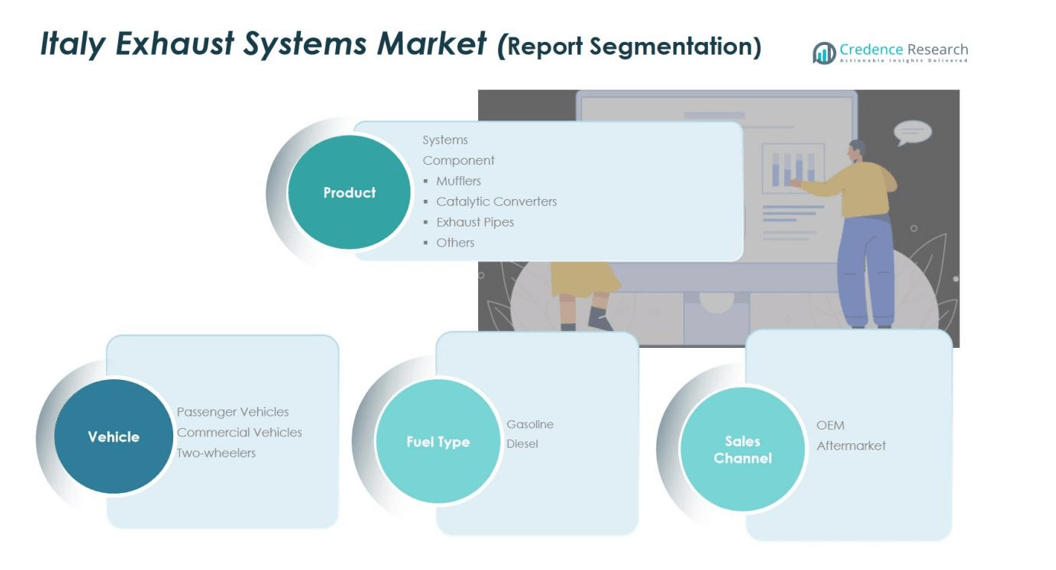

Market Segmentation Analysis:

By Product Type

The Italy Exhaust Systems Market is categorized into systems and components, including mufflers, catalytic converters, exhaust pipes, and others. Components dominate the segment due to rising demand for high-performance catalytic converters and mufflers that meet strict emission standards. It benefits from continuous material advancements such as stainless steel and titanium, enhancing durability and corrosion resistance. The systems segment also gains traction through integrated exhaust architectures that optimize flow dynamics and reduce engine backpressure. Growing adoption of modular exhaust designs by OEMs supports future scalability and lightweight construction.

- For instance, Faurecia’s Analysis Led Design and Virtual Validation (ALDVV) process—deployed in 2024—reduced inlet, axle, and tail pipe wall thickness from 1.5 mm to 1.2 mm, cutting system weight by 1.15 kg.

By Vehicle

Passenger vehicles hold the largest market share, driven by strong consumer demand for fuel-efficient and low-emission cars. It witnesses steady expansion supported by Italy’s focus on sustainable urban mobility. Commercial vehicles form a crucial segment where compliance with emission standards and fleet upgrades enhance exhaust system demand. The two-wheeler segment also contributes significantly due to Italy’s large scooter and motorcycle market. Manufacturers are incorporating compact catalytic converters and acoustic mufflers to improve sound quality and emission control.

- For Instance, Stellantis unveiled the new Fiat 600e in July 2023. The all-electric model features a WLTP-certified driving range of over 400 km, specifically around 409 km.

By Fuel Type

Gasoline-powered vehicles dominate the Italy Exhaust Systems Market due to their higher sales volume and broader consumer base. It is followed by diesel vehicles, where tightening emission rules are boosting the use of advanced diesel particulate filters and SCR systems. The trend toward cleaner fuels and hybrid engines continues to reshape exhaust system design across both categories.

Segmentations:

By Product Type Segment

- Systems

- Component

- Mufflers

- Catalytic Converters

- Exhaust Pipes

- Others

By Vehicle Segment

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

By Fuel Type Segment

By Sales Channel Segment

Regional Analysis:

Northern Italy Leading with Industrial Strength and OEM Presence

The Italy Exhaust Systems Market is led by Northern Italy, which hosts the country’s strongest automotive manufacturing base. Regions such as Lombardy, Piedmont, and Emilia-Romagna drive market growth with established OEM facilities and component suppliers. It benefits from advanced industrial infrastructure, skilled labor, and access to major export routes across Europe. The concentration of major automotive brands and R&D centers supports ongoing innovation in emission reduction and material efficiency. Strategic collaborations between manufacturers and research institutes further accelerate product development and technology upgrades in this region.

Central Italy Advancing Through R&D and Technological Collaboration

Central Italy contributes significantly by focusing on research, testing, and component engineering. Regions like Tuscany and Lazio are home to specialized automotive research institutions and engineering firms that enhance system performance. It supports the development of energy-efficient, lightweight, and heat-resistant exhaust systems suited for hybrid vehicles. Growing partnerships between academia and industry are fostering advancements in catalytic converter design and emission sensors. The central region also benefits from its proximity to supply chains, ensuring timely distribution and integration with major assembly plants in Northern Italy.

Southern Italy Expanding with Investments and Policy Support

Southern Italy is emerging as a promising growth zone supported by industrial expansion and government-backed incentives. Campania, Puglia, and Sicily are witnessing new manufacturing and assembly investments aimed at strengthening automotive component production. It gains from lower operational costs and expanding logistics networks connecting regional suppliers to European markets. Public-private initiatives are promoting skill development and sustainability-led automotive projects. The region’s growing integration into Italy’s national automotive network positions it for long-term participation in the country’s evolving exhaust system landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Italy Exhaust Systems Market features a moderately competitive landscape driven by global and regional manufacturers focusing on innovation and regulatory compliance. Key players include Forvia, Futaba Industrial Co., Ltd., MagnaFlow, ATJ Automotive GmbH, Eberspächer, The Axces Group, BOSAL, Sejong Industrial Co., Ltd., Vanstar, and Continental AG. It is characterized by continuous investment in lightweight materials, emission control technologies, and smart exhaust management systems. Leading companies are enhancing product efficiency and performance through advanced fabrication and sensor integration. Partnerships with OEMs and regional suppliers strengthen supply chain reliability and technological development. Competitive differentiation relies on sustainability, design precision, and adaptability to hybrid and low-emission vehicles. The market continues to evolve with companies prioritizing R&D, cost optimization, and localized production to maintain strategic advantage within Italy’s growing automotive manufacturing environment.

Recent Developments:

- In September 2025, Futaba Industrial released its Earnings Results Presentation for the first three months of the fiscal year ending March 31, 2025 (112th term).

- In September 2025, Purem by Eberspächer developed Direct Air Capture Technology designed to remove CO₂ from the atmosphere, expanding the company’s expertise beyond traditional exhaust systems.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Vehicle, Fuel Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Italy Exhaust Systems Market will witness steady growth driven by advancements in emission control technologies and lightweight materials.

- Hybrid and plug-in hybrid vehicles will create consistent demand for compact and efficient exhaust solutions.

- Investments in sensor-integrated and intelligent exhaust systems will enhance real-time emission monitoring and performance optimization.

- The adoption of stainless steel, titanium, and composite materials will improve durability and reduce system weight.

- Domestic manufacturing clusters in Northern Italy will strengthen production capacity and export competitiveness.

- Government incentives promoting sustainable automotive practices will encourage innovation and cleaner production methods.

- Manufacturers will expand partnerships with OEMs to co-develop systems aligned with Euro 7 emission standards.

- Aftermarket demand will rise as consumers seek high-quality replacement components meeting updated emission norms.

- Digitalization and predictive maintenance tools will improve efficiency in exhaust system operations and maintenance.

- The market will continue evolving toward greener technologies, supporting Italy’s transition to a low-carbon automotive industry.