Market Overview:

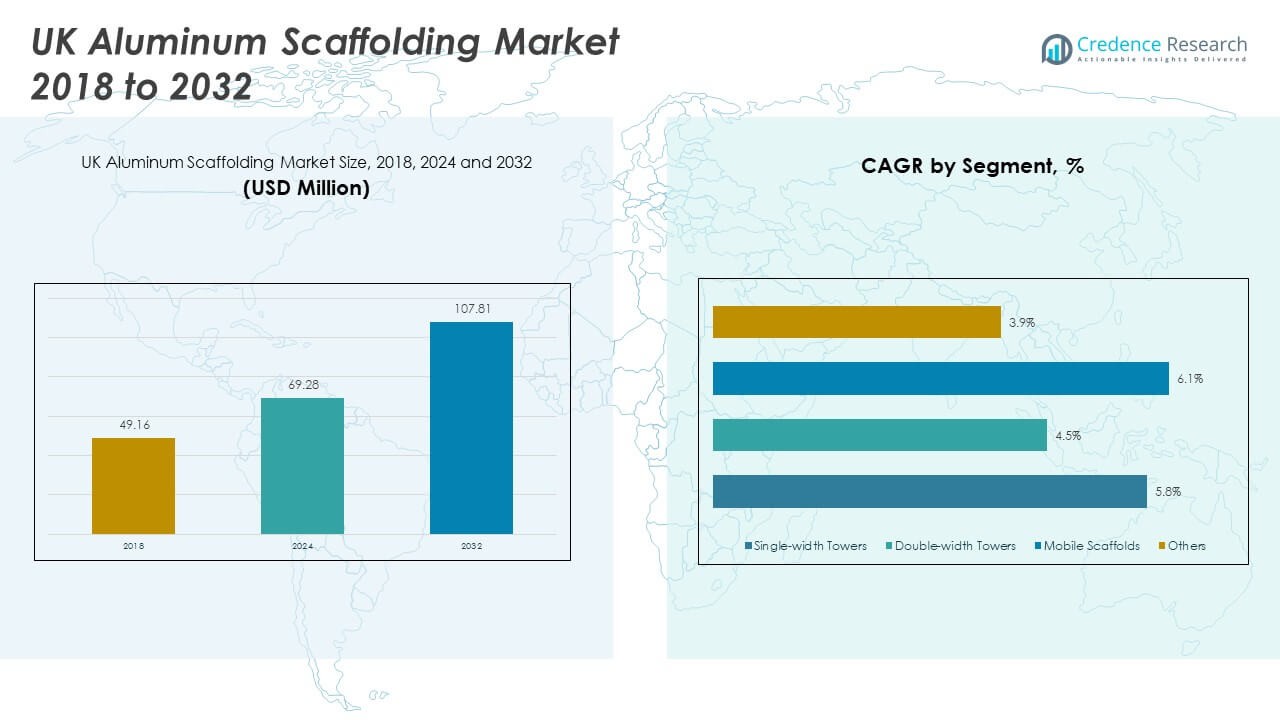

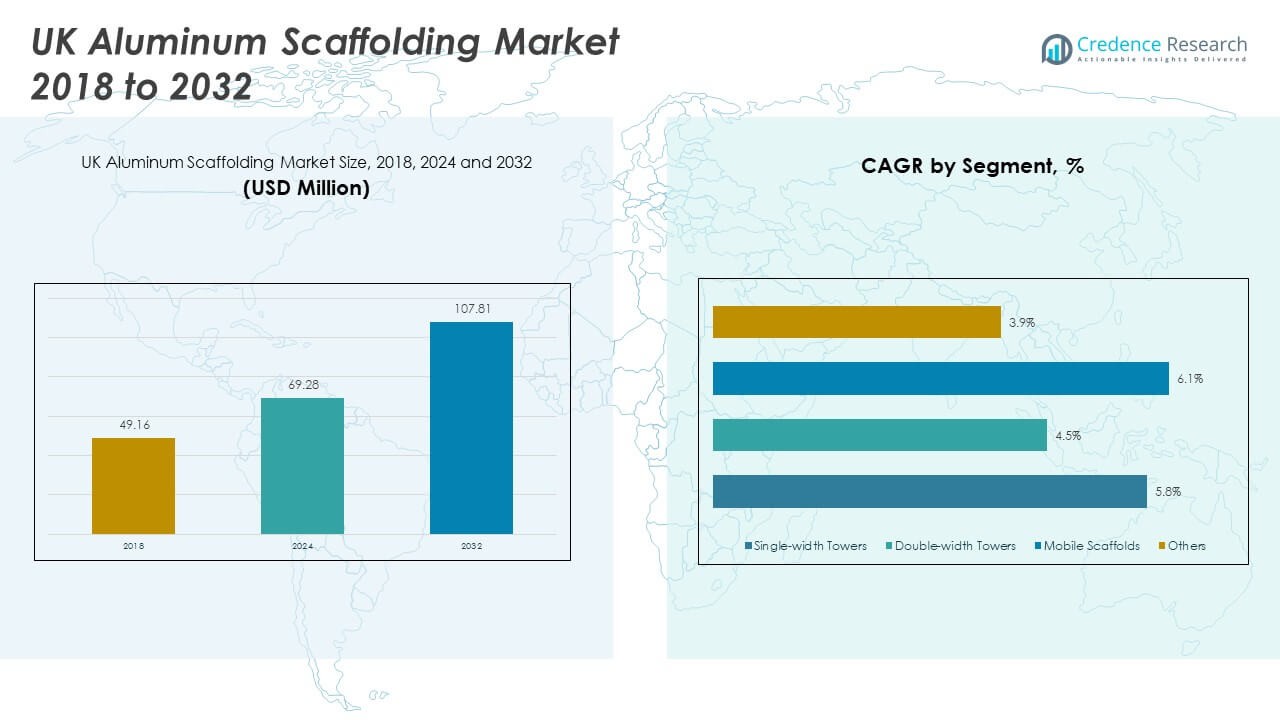

The UK Aluminum Scaffolding Market size was valued at USD 49.16 million in 2018 to USD 69.28 million in 2024 and is anticipated to reach USD 107.81 million by 2032, at a CAGR of 5.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Aluminum Scaffolding Market Size 2024 |

USD 69.28 Million |

| UK Aluminum Scaffolding Market, CAGR |

5.76% |

| UK Aluminum Scaffolding Market Size 2032 |

USD 107.81 Million |

The growth of the UK Aluminum Scaffolding Market is driven by increasing construction and maintenance activities across commercial and industrial sectors. Demand is rising for lightweight, portable, and corrosion-resistant scaffolding systems that enhance worker safety and operational efficiency. Strict health and safety regulations in the UK construction industry are accelerating the adoption of aluminum scaffolding over traditional steel. Furthermore, rising infrastructure investments and ongoing renovations of historic and public buildings have increased the need for versatile scaffolding solutions that are quick to assemble and easy to transport.

Within the UK, England represents the dominant regional market, driven by dense urban development, high-rise construction, and extensive refurbishment projects in cities like London, Manchester, and Birmingham. Scotland and Wales are emerging regions, with growing investments in housing and infrastructure developments. These regions are also benefiting from increased government funding for public infrastructure, as well as expansion in industrial zones, which support the broader market demand for aluminum scaffolding.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Aluminum Scaffolding Market was valued at USD 69.28 million in 2024 and is projected to reach USD 107.81 million by 2032, growing at a CAGR of 5.76%.

- The Global Aluminum Scaffolding Market size was valued at USD 1,221.32 million in 2018 to USD 1,721.17 million in 2024 and is anticipated to reach USD 2,678.48 million by 2032, at a CAGR of 5.29% during the forecast period.

- Rising infrastructure modernization and retrofitting initiatives are fueling market demand for lightweight and modular scaffolding systems.

- Strict health and safety regulations in the construction sector are accelerating the adoption of aluminum scaffolding over traditional steel alternatives.

- High initial investment costs and raw material price volatility remain key restraints affecting smaller contractors and rental firms.

- England accounted for the largest regional share in 2024, supported by concentrated urban development and high-rise construction in cities like London and Manchester.

- The maintenance and industrial sectors continue to drive consistent demand due to recurring repair needs and safety-compliant access requirements.

- Skilled labor shortages and inadequate training for advanced scaffold systems hinder efficient deployment in smaller and mid-sized projects.

Market Drivers:

Surge in Construction and Infrastructure Modernization Projects

The UK Aluminum Scaffolding Market is gaining momentum due to the sustained expansion of infrastructure projects across the country. Construction of high-rise buildings, commercial complexes, and transport infrastructure creates demand for safe and lightweight scaffolding systems. Public sector investments into urban renewal and redevelopment have spurred a rise in temporary structures and access solutions. It supports contractors who prioritize easy assembly, corrosion resistance, and reduced labor fatigue. Aluminum scaffolding’s portability is crucial in fast-paced construction schedules. Local authorities are enforcing strict compliance with safety standards, prompting widespread use of certified systems. It enables efficient operations in congested urban settings. The push toward energy-efficient building retrofits also sustains aluminum scaffold demand.

Health and Safety Compliance Fueling Adoption

Occupational safety regulations remain a primary factor driving the UK Aluminum Scaffolding Market. Contractors face increasing scrutiny regarding worker protection and risk mitigation. Compliance with Work at Height Regulations and updated British safety codes fosters the preference for lightweight scaffolding solutions. Aluminum’s non-slip surfaces, high load-bearing strength, and design flexibility reduce accident risks on active construction sites. Construction managers prioritize rapid inspection and compliance documentation, which aluminum systems support with modular designs. It improves safety monitoring and supports continuous work cycles. Frequent training programs in the UK construction sector emphasize the role of reliable access platforms. This regulatory landscape continues to boost demand across both new builds and refurbishments.

- For example, in the Layher scaffolding portfolio, the company integrates built-in safety features such as lock‑in decks that secure against lift‑off, anti‑slip platform surfaces, and optimized internal access decks including hatch decks with inside ladders. These products comply with ISO 9001:2015-certified quality management and undergo rigorous destructive testing and structural integrity assessments

Rising Maintenance and Retrofit Demand in Urban Areas

The market is benefitting from the growing need for refurbishment and maintenance across aging urban infrastructure. London and other major UK cities possess a large stock of heritage and commercial buildings requiring periodic restoration. Aluminum scaffolding is ideal for these environments due to its compatibility with fragile structures and limited-space assembly. It allows workers to perform façade cleaning, insulation upgrades, and rooftop repairs without heavy lifting machinery. Contractors favor it for swift mobilization and teardown in time-sensitive environments. This trend is reinforced by property owners investing in compliance upgrades and energy-efficient retrofitting. It aligns well with the UK’s building sustainability goals. The demand for mobile tower scaffolds in maintenance continues to grow consistently.

- For instance, SGB’s Du-AL aluminum scaffold system features lightweight modular beams, including the T150 twin-web section, designed for high strength and reduced weight. These components support safe working loads and enable efficient assembly, making them suitable for use in confined or sensitive environments such as heritage maintenance sites.

Growth in Industrial Sector and Utility Projects

The industrial and energy sectors are creating significant demand for aluminum scaffolding in the UK. Ongoing construction of energy-efficient plants, water treatment facilities, and renewable energy projects requires durable access systems. Aluminum scaffolding offers a lightweight, customizable option for these high-risk environments. It performs well in both indoor and outdoor conditions and supports modular expansion for complex utility layouts. Site managers rely on rapid deployment systems to avoid costly delays. The aluminum scaffold’s resistance to corrosion supports utility contractors working in chemically exposed environments. It meets operational needs for inspection, maintenance, and structural modifications. The UK Aluminum Scaffolding Market gains from these long-term industrial infrastructure developments.

Market Trends:

Integration of Smart Tracking and Inspection Technologies

The UK Aluminum Scaffolding Market is experiencing a shift toward digital integration for operational oversight and safety compliance. Companies are implementing RFID-based asset tracking and barcode-scanning systems to monitor scaffold components. These digital tools streamline inspection documentation, reduce human error, and improve asset traceability. Construction firms benefit from real-time data for inventory management and maintenance scheduling. It enhances accountability across teams and reduces downtime caused by misplaced parts. Mobile apps are being adopted to record scaffold inspections with geo-tagged images. This trend aligns with the digital transformation of UK construction logistics. Scaffolding suppliers are embedding tech features to meet demand from tech-savvy contractors.

Customization and Modular Expansion Gaining Popularity

Demand for modular and customizable aluminum scaffolding is rising in the UK. Projects increasingly require access systems tailored to irregular shapes, tight spaces, and unique height conditions. Manufacturers are offering interlocking frames, quick-lock joints, and adjustable base plates to accommodate diverse job site demands. Contractors prioritize scaffolding systems that support easy modifications without dismantling core units. This modularity improves productivity during multi-phase builds and renovations. It enables scaffolding to adapt to evolving site needs with minimal cost impact. Custom kits for roof work, bridge access, and interior refurbishments are gaining traction. The UK Aluminum Scaffolding Market reflects this growing appetite for flexibility and design precision.

- For instance, Krause Systems offers modular aluminum scaffold solutions designed for complex industrial environments, including confined maintenance areas. Their systems are built using standardized components and innovative connection techniques that enable safe, rapid assembly and structural adaptability. These scaffolds support a wide range of maintenance and assembly tasks, offering flexibility and compliance with industry safety standards.

Rise in Equipment Rentals and Fleet Outsourcing

A growing trend in the UK Aluminum Scaffolding Market is the preference for renting equipment rather than owning it. Contractors, especially SMEs, seek cost-effective solutions to meet temporary project demands. Equipment rental firms are expanding fleets of mobile towers, cantilever scaffolds, and stair access towers to meet this surge. It allows construction companies to scale scaffold use without incurring long-term capital expenditure. Rental providers are also offering value-added services such as delivery, on-site setup, and safety training. This trend supports project flexibility while minimizing maintenance liabilities. The rise of digital platforms for scaffold rental booking is accelerating market accessibility across regions.

Sustainability and Circular Economy Driving Procurement

The UK construction sector is increasingly aligning with sustainability targets, influencing scaffold material choices. Aluminum scaffolding fits circular economy principles due to its recyclability and long service life. Procurement teams favor aluminum for its environmental footprint compared to steel or timber alternatives. It supports green certification goals and helps contractors meet carbon reduction commitments. Manufacturers are investing in production technologies that reduce emissions during extrusion and coating. Some vendors offer buy-back schemes to encourage material reuse. It positions aluminum scaffolding as a long-term sustainable asset. The UK Aluminum Scaffolding Market responds to this pressure by enhancing eco-labeling and lifecycle transparency.

- For example, BDC Scaffolding emphasizes use of aluminum scaffolding components recognized for full recyclability and long service life. These systems support circular economy objectives by enabling multi-use life cycles and end-of-life recycling without performance loss.

Market Challenges Analysis:

High Initial Investment and Price Volatility Impact Adoption

The UK Aluminum Scaffolding Market faces challenges associated with the high upfront cost of aluminum-based systems. Compared to steel or traditional timber scaffolds, aluminum units often require a larger capital investment due to material and fabrication costs. While long-term durability offers ROI, smaller contractors face barriers to entry. It discourages bulk procurement among cost-sensitive operators, especially in smaller urban or rural projects. Global price fluctuations in raw aluminum driven by trade conditions or supply chain disruptions can further complicate budgeting. It creates uncertainty for buyers and rental operators alike. The risk of inventory shortages during price spikes leads to delayed project mobilization. Stakeholders need to plan scaffold usage in advance to offset procurement risks.

Skilled Labor Shortage and Training Gaps Limit Usage Efficiency

Another key challenge in the UK Aluminum Scaffolding Market is the shortage of adequately trained workers to assemble and operate advanced scaffolding systems. Many job sites continue to face gaps in technical knowledge, increasing the likelihood of improper setup or safety violations. It affects both productivity and compliance, especially under UK safety legislation. Smaller construction firms struggle to invest in recurring scaffold safety certification. The issue is compounded by a lack of industry-wide training infrastructure focused on modular aluminum scaffold systems. Labor turnover and contractor subcontracting further reduce skill consistency on-site. These limitations reduce the overall efficiency of scaffold deployment and project safety outcomes.

Market Opportunities:

Expansion in Green Building and Retrofits Segment

The rising momentum of the UK’s green building initiatives provides significant growth opportunities for the aluminum scaffolding market. Property owners increasingly focus on retrofitting buildings with energy-efficient façades, windows, and insulation materials. These projects demand scaffolding systems that minimize surface damage and allow non-invasive installation. The UK Aluminum Scaffolding Market can capitalize by offering lightweight, adjustable solutions for retrofit and refurbishment needs. It meets the requirement for temporary access in eco-certification projects, driving future procurement growth.

Emergence of E-Commerce and Direct-to-Site Distribution

The shift toward online equipment procurement and digital contractor networks offers a growth channel for scaffolding suppliers. E-commerce platforms are enabling direct-to-site delivery of scaffold systems, especially mobile towers and compact modular kits. The UK Aluminum Scaffolding Market can benefit from reduced distribution friction and expanded customer outreach. It allows manufacturers and rental companies to scale operations without heavy investment in physical branches, meeting project demands quickly across regions.

Market Segmentation Analysis:

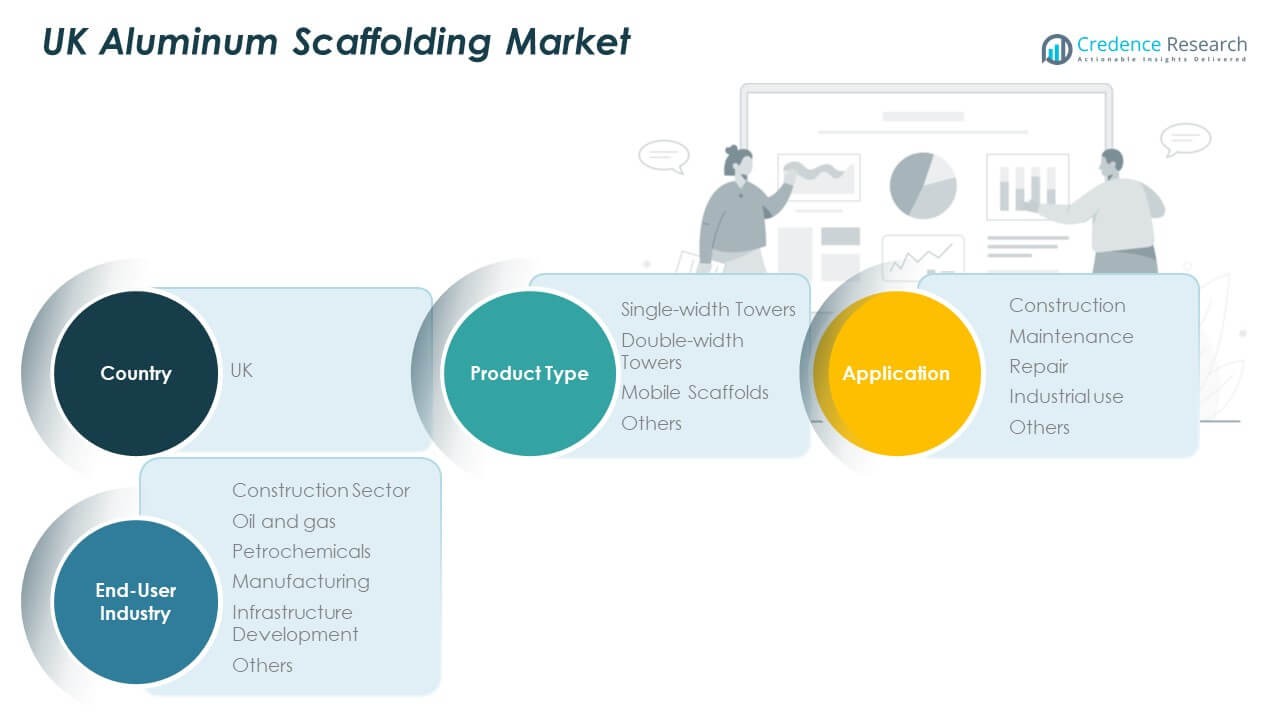

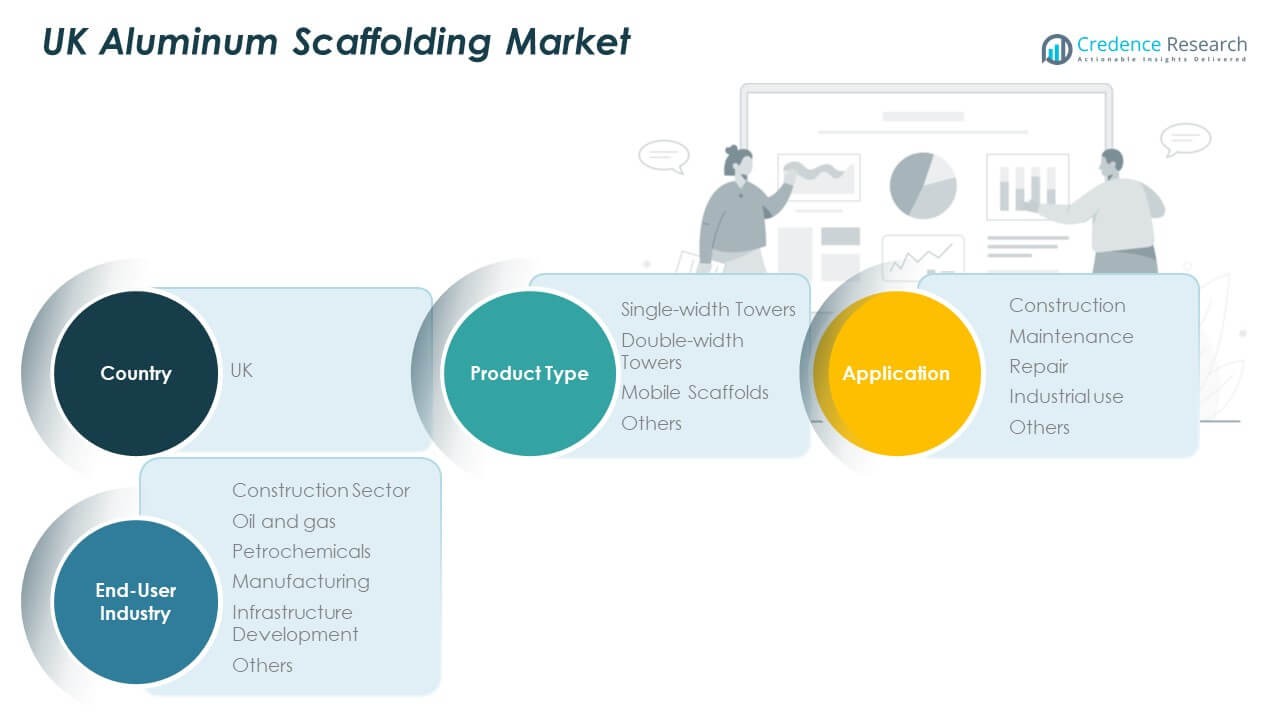

By product type

Mobile scaffolds lead the UK Aluminum Scaffolding Market due to their flexibility, ease of transportation, and suitability for dynamic construction and maintenance environments. Double-width towers hold a significant share, preferred in high-rise and large-scale applications where greater platform space is required. Single-width towers are widely used for indoor tasks and confined areas. The “others” segment includes modular and specialty scaffolding solutions that are gaining traction for custom projects and irregular structures.

- For example, HERMEQ’s Double Width Scaffold Tower supports heavy-duty applications up to 12.2m in height (indoors), providing up to 275kg per platform. UK construction teams utilize such towers for safe, high-capacity access on large building sites, conforming to BS EN1004 certification and the PASMA 3T safety assembly standard.

By application

Construction dominates the market, driven by ongoing infrastructure development, commercial expansion, and residential building projects. Maintenance is the next major segment, supported by refurbishment demands across public buildings, transportation hubs, and energy facilities. Repair applications hold consistent demand, especially in urban centers. Industrial use is expanding with increased scaffolding deployment in processing plants, refineries, and large-scale manufacturing environments. Other applications include event setups and temporary access for inspections.

By end-user industry

The construction sector represents the largest share, reflecting the UK’s strong focus on urban development. The oil and gas and petrochemicals industries rely on lightweight scaffolding for offshore and hazardous environments. Manufacturing plants adopt aluminum scaffolding for equipment maintenance and facility upgrades. Infrastructure development, including transport and utilities, continues to offer long-term deployment opportunities. It serves a diverse range of verticals, ensuring broad market relevance across the UK.

- For example, Providers such as Doka deliver modular scaffolding for bridges, utility facilities, and large-scale projects, allowing phased, long-term deployment and adaptation as project needs evolve.

Segmentation:

By Product Type:

- Single-width Towers

- Double-width Towers

- Mobile Scaffolds

- Others

By Application:

- Construction

- Maintenance

- Repair

- Industrial Use

- Others

By End-User Industry:

- Construction Sector

- Oil and Gas

- Petrochemicals

- Manufacturing

- Infrastructure Development

- Others

Regional Analysis:

England dominates the UK Aluminum Scaffolding Market with a market share of 64%, driven by high-density urbanization, robust commercial development, and large-scale infrastructure investments. Major cities like London, Manchester, and Birmingham are at the forefront of high-rise construction and ongoing urban regeneration. These projects demand lightweight, mobile, and modular scaffolding systems for safe and efficient access. It supports rapid deployment across multiple construction phases, making aluminum scaffolds a preferred choice. Strong adherence to safety regulations and widespread adoption of digital project management tools also contribute to the region’s leadership. The presence of key manufacturers and equipment rental providers further consolidates England’s dominant position.

Scotland accounts for 18% of the UK Aluminum Scaffolding Market, supported by growing investments in residential housing, offshore energy infrastructure, and public works. The Scottish government’s focus on sustainable infrastructure and the refurbishment of aging housing stock sustains demand for aluminum scaffolding. It is used extensively in energy sector projects, including wind farms and hydro facilities, where height and weather resistance are critical. The market benefits from strategic collaborations between contractors and local authorities to enhance compliance and efficiency. Urban centers such as Glasgow and Edinburgh are emerging hubs for construction and restoration work. This growth is likely to strengthen scaffold fleet modernization across the region.

Wales and Northern Ireland collectively hold an 18% share of the UK Aluminum Scaffolding Market, with rising demand for scaffolding in transport infrastructure and industrial renovation projects. Wales is witnessing scaffold demand in railway upgrades, public housing initiatives, and university infrastructure. Northern Ireland is focusing on revitalizing manufacturing sites and commercial spaces, driving scaffold usage in confined and high-access areas. It presents opportunities for rental companies to expand reach and offer tailored modular systems. Though smaller in market size, both regions are expected to show steady growth due to increased construction grants and EU-backed infrastructure transition programs. The market remains fragmented, but local players are actively investing in safety-certified and quick-assembly scaffolding systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Altrad UK

- kaefer

- Lyndon SGB

- TRAD Group

- Enigma Industrial

- Alltask

- Brogan Group

- GKR Scaffolding

- Palmers Scaffolding

- PHD Modular Access

Competitive Analysis:

The UK Aluminum Scaffolding Market features a competitive landscape with both domestic manufacturers and international players actively shaping market dynamics. Key companies such as Altrad, Instant Upright, Lyte Ladders & Towers, and BoSS dominate through robust distribution networks and product innovation. These firms focus on lightweight tower systems, modular platforms, and compliance with British safety standards. It encourages R&D investments in ergonomic designs and quick-assembly mechanisms to meet contractor demands. Rental companies play a strategic role, offering fleet management services and safety-certified scaffolds across regions. Competitive pricing, after-sales support, and customization capabilities remain core differentiators. Market competition is intensifying with rising demand for digital integration and sustainable materials in scaffolding systems.

Recent Developments:

- In February 2025, Altrad made significant strides in the UK market with the acquisition of Stork UK, marking the integration of Stork TS Holdings Limited and its 1,900 staff into the Altrad family. This move aims to boost Altrad’s scale and service offerings in both the UK’s offshore and onshore sectors.

- In July 2025, Kaefer UK & Ireland announced a five-year contract extension with Babcock International Group, reinforcing Kaefer’s position in the UK’s industrial and defence services sectors. Earlier, Kaefer’s commitment to innovation was reflected in the launch and development of digital and fire protection solutions under its ENERGY Products range.

- In Sep 2022, Altrad Group completed the acquisition of Doosan Babcock Limited, strengthening its UK footprint in industrial and construction-related services.

Market Concentration & Characteristics:

The UK Aluminum Scaffolding Market is moderately concentrated, with a mix of established manufacturers and a growing number of regional rental providers. It is characterized by steady technological advancement, strict adherence to regulatory standards, and strong service-oriented competition. The market favors lightweight, corrosion-resistant scaffolding with modular versatility. Companies prioritize certifications such as EN 1004 and British Standards to secure institutional and industrial contracts. Short product life cycles and high replacement frequency encourage innovation in materials and joint systems. The rental segment holds a substantial share, with service efficiency and availability shaping vendor selection. Growth opportunities exist for firms offering digital tracking, training support, and eco-friendly solutions.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK Aluminum Scaffolding Market is expected to witness steady expansion driven by ongoing infrastructure modernization and urban redevelopment projects.

- Demand for modular and lightweight systems will grow as contractors prioritize flexible scaffolding solutions that support quick assembly in confined spaces.

- Rental services will gain further traction due to rising preference for asset-light operations among small and mid-sized construction firms.

- Sustainability initiatives and low-carbon construction policies will encourage the adoption of recyclable aluminum scaffolding materials.

- Innovation in digital scaffold management tools, including RFID tracking and compliance software, will enhance operational efficiency and safety.

- Refurbishment of historic buildings and retrofitting of aging structures will remain a key demand driver for mobile tower scaffolds.

- Growth in public transport, energy, and education infrastructure projects will create new opportunities for scaffold deployment.

- Training and certification programs will expand, addressing the growing need for skilled labor to handle modular scaffold systems.

- Regional players will increase investments in fleet modernization and safety-enhancing technologies to remain competitive.

- Product customization and direct-to-site logistics will become critical differentiators in an increasingly service-focused market environment.