Market Overview:

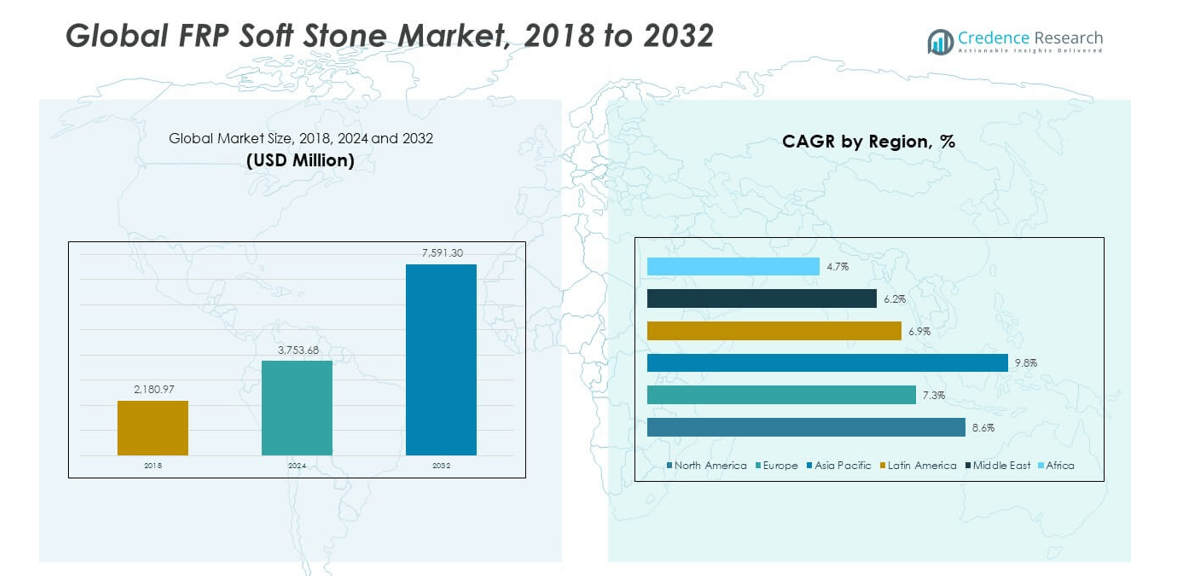

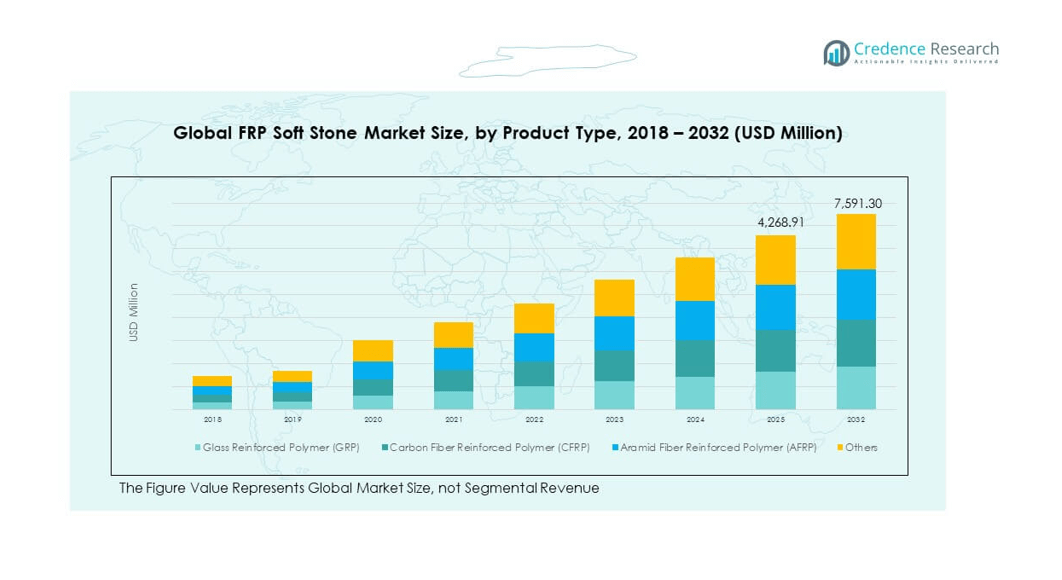

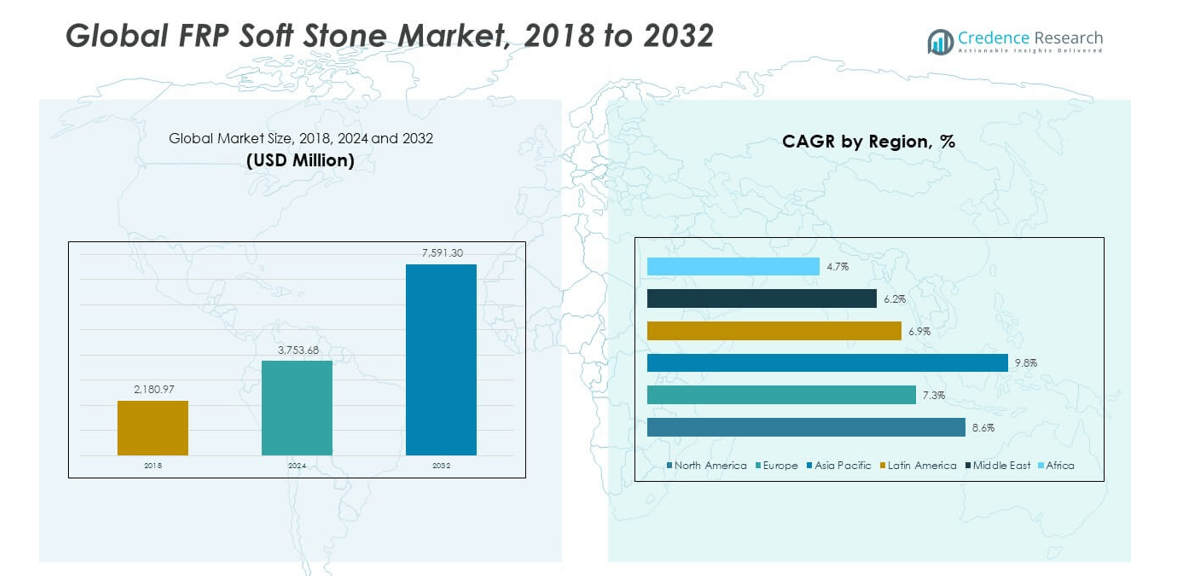

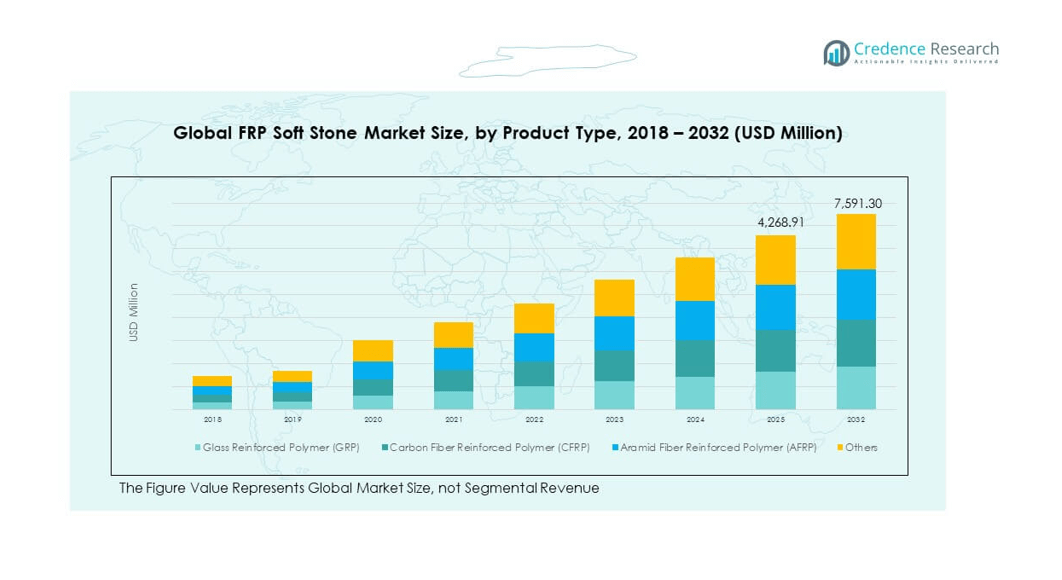

The Global FRP Soft Stone Market size was valued at USD 2,180.97 million in 2018, increased to USD 3,753.68 million in 2024, and is anticipated to reach USD 7,591.30 million by 2032, at a CAGR of 8.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| FRP Soft Stone Market Size 2024 |

USD 3,753.68 million |

| FRP Soft Stone Market, CAGR |

8.57% |

| FRP Soft Stone Market Size 2032 |

USD 7,591.30 million |

The market growth is driven by rising adoption of lightweight and durable building materials in modern architecture. FRP soft stone combines flexibility, corrosion resistance, and design versatility, making it a preferred alternative to traditional cladding and decorative materials. Increasing construction in commercial and residential sectors, along with green building initiatives, further boosts demand. Its easy installation, cost efficiency, and adaptability to curved surfaces enhance its appeal for interior and exterior applications across developing urban markets.

Regionally, Asia Pacific leads the FRP Soft Stone Market due to robust construction activity and rapid infrastructure modernization in China, India, and Southeast Asia. North America follows, supported by sustainable construction trends and renovation of aging structures. Europe records steady adoption, driven by eco-friendly architectural designs. Meanwhile, the Middle East shows growing potential with luxury real estate developments and high demand for innovative façade materials, making it an emerging region for FRP soft stone applications.

Market Insights:

- The Global FRP Soft Stone Market was valued at USD 2,180.97 million in 2018, reached USD 3,753.68 million in 2024, and is projected to attain USD 7,591.30 million by 2032, expanding at a CAGR of 8.57% during the forecast period.

- Asia Pacific leads with 34% share, driven by rapid urbanization, infrastructure expansion, and growing adoption of sustainable materials across China, India, and Southeast Asia.

- North America follows with 28% share, supported by advanced construction practices, renovation activities, and demand for energy-efficient façades; Europe ranks third with 17% share, driven by strict environmental standards and green architecture.

- Asia Pacific is also the fastest-growing region, fueled by government investments, industrialization, and preference for lightweight, durable, and affordable building materials.

- By product type, Glass Reinforced Polymer (GRP) dominates with about 45% share, followed by Carbon Fiber Reinforced Polymer (CFRP) at 30%, while Aramid Fiber Reinforced Polymer (AFRP) and others collectively account for 25%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Lightweight and Flexible Building Materials Across Infrastructure Projects

The construction industry increasingly adopts FRP soft stone due to its lightweight and flexible structure that reduces installation time and structural load. Architects prefer this material for modern designs requiring curves and intricate surface finishes. It supports energy-efficient construction by minimizing maintenance and reducing transportation costs. The Global FRP Soft Stone Market benefits from urban expansion and rising renovation projects in both developed and developing countries. It helps builders achieve aesthetic appeal while ensuring durability and resistance to corrosion. The ability to mimic natural stone appearance strengthens its adoption in high-end projects. Contractors also favor FRP soft stone for façade cladding due to its weather resistance and long service life. Government initiatives promoting sustainable and eco-friendly materials further accelerate its demand in construction applications.

- For instance, industry guidelines report that panel cladding using FRP composites may weigh 2 to 6 lbs per square foot compared with 4 to 7 times more for glass-fiber reinforced concrete.

Expanding Use in Interior and Exterior Architectural Applications Driving Market Adoption

Interior designers and builders increasingly integrate FRP soft stone into wall panels, ceilings, and flooring for premium aesthetics. It enhances building interiors by providing natural stone textures without added weight. The material’s adaptability to complex shapes allows innovative design execution in commercial and hospitality spaces. Rising global investments in luxury residential construction contribute to stronger demand. The Global FRP Soft Stone Market grows as architects explore creative uses for façades and decorative installations. It maintains high mechanical strength even under temperature variations, ensuring longer lifespan in outdoor conditions. Developers also prefer FRP soft stone for low maintenance and moisture resistance. It serves as a modern alternative for replacing marble, granite, and traditional tiles in high-traffic environments.

- For instance, a social housing project in Nova Friburgo, Brazil, utilized sustainable building techniques, such as ferrocement stairs, demonstrating the application of innovative, alternative materials in construction aimed at lower-income groups.

Increasing Focus on Sustainable and Energy-Efficient Construction Materials

Sustainability remains a major factor shaping demand for FRP soft stone across global infrastructure projects. It offers lower carbon emissions compared to traditional heavy stone materials, aligning with environmental regulations. Manufacturers develop recyclable and eco-friendly resin formulations to reduce ecological impact. The Global FRP Soft Stone Market gains traction through projects aiming for green building certifications. It also supports resource conservation by reducing the need for quarrying and heavy processing. Construction firms prioritize FRP soft stone for its energy-efficient performance and minimal waste generation. Governments in Asia-Pacific and Europe encourage such materials through sustainability incentives. Its high durability and weather tolerance reduce replacement frequency, supporting circular economy principles.

Technological Advancements Enhancing Product Performance and Design Capabilities

Continuous research drives innovation in resin systems, fiber composites, and surface finishing techniques. Modern FRP soft stone exhibits superior strength-to-weight ratios and enhanced UV resistance. The Global FRP Soft Stone Market benefits from advancements in digital design and molding technologies. It enables custom textures, patterns, and color variations tailored to project needs. Companies invest in automated production lines to maintain consistency and reduce material defects. Enhanced fire retardancy and thermal insulation broaden its use in commercial buildings. It also supports smart construction integration with sensors and temperature control systems. Ongoing R&D ensures product differentiation and greater acceptance among architects and construction engineers.

Market Trends:

Integration of Smart Material Technologies for Functional Building Surfaces

Smart construction materials increasingly feature in architectural design, and FRP soft stone aligns with this evolution. The integration of nanotechnology improves resistance to UV, abrasion, and microbial growth. The Global FRP Soft Stone Market observes steady adoption in projects combining beauty with functionality. It offers heat insulation and noise reduction properties ideal for modern smart homes. Manufacturers experiment with embedded lighting and sensor technologies for interactive designs. Growing demand for multi-functional cladding systems drives material innovation. Builders prefer products combining strength with thermal regulation in high-performance buildings. These smart trends position FRP soft stone as a futuristic material in global architecture.

- For instance, a manufacturer like 3M Company introduced structural adhesives engineered for composites, offering over 1000 psi of overlap shear strength for panel-to-frame bonding.

Rising Customization in Design and Aesthetic Appeal Across Construction Sectors

Architectural flexibility drives demand for customized FRP soft stone panels with natural stone-like patterns. Designers value its compatibility with diverse color palettes and textures for contemporary spaces. The Global FRP Soft Stone Market evolves with digital fabrication techniques offering precision design outputs. Manufacturers introduce 3D printing for mold development and aesthetic detailing. Customized panel thickness and surface patterns cater to luxury retail and hospitality spaces. The trend enhances artistic expression in building exteriors and interiors. It empowers architects to create visually dynamic façades without structural constraints. Increased preference for personalized finishes continues to transform the decorative materials landscape.

Growing Role of Prefabrication and Modular Construction in Market Expansion

FRP soft stone supports the prefabrication trend by enabling easy transport and quick on-site assembly. It suits modular building systems designed for efficiency and reduced construction time. The Global FRP Soft Stone Market aligns with rapid urbanization and demand for scalable housing solutions. Its lightweight nature allows larger panel sizes with minimal jointing. Prefabricated wall panels and cladding modules reduce labor costs and wastage. Builders adopt it for high-rise structures requiring lightweight exterior skins. The combination of design freedom and performance consistency strengthens its use in modular designs. The shift toward industrialized construction continues to amplify market potential.

Increased Adoption in Renovation and Retrofitting of Existing Structures

Renovation projects increasingly use FRP soft stone due to its adaptability and minimal installation effort. It revitalizes aging structures without altering their base framework. The Global FRP Soft Stone Market expands with rising refurbishment demand across cities. It ensures modern visual appeal while offering strength and weather resistance. Property owners favor it for upgrading façades and interiors cost-effectively. FRP’s low maintenance requirement supports its long-term usage in building restoration. The trend aligns with sustainability goals through extended building lifecycles. Renovation-driven demand reinforces the market’s stability and long-term relevance in construction industries.

Market Challenges Analysis:

High Initial Production and Installation Costs Limiting Widespread Market Penetration

FRP soft stone manufacturing requires advanced equipment and composite materials, raising overall production costs. The need for skilled labor during installation further adds to project expenses. The Global FRP Soft Stone Market faces price competition from low-cost alternatives such as PVC and ceramic tiles. It limits adoption among small and mid-scale builders with tight budgets. Raw material volatility, especially in resin and fiber supplies, impacts profitability for producers. High shipping costs associated with large panel transportation also constrain market reach. Developers in cost-sensitive regions often prefer traditional cladding due to affordability. Limited consumer awareness of long-term benefits restricts faster acceptance in emerging markets.

Regulatory Complexity and Lack of Standardization Affecting Global Market Growth

Diverse regulatory standards for composite building materials across regions create entry barriers for manufacturers. The Global FRP Soft Stone Market experiences delays due to differing certification and fire safety requirements. It challenges producers to customize formulations per region, increasing R&D expenditure. Absence of unified quality benchmarks impacts global supply chain consistency. Strict environmental norms in Europe and North America require compliance with emission and recyclability limits. Smaller manufacturers struggle to meet these evolving standards, reducing competitiveness. Limited testing infrastructure in developing nations further complicates product validation. These regulatory variations hinder large-scale adoption despite growing material advantages.

Market Opportunities:

Expanding Infrastructure Development and Smart City Initiatives Creating New Growth Prospects

The surge in smart city construction worldwide opens strong opportunities for FRP soft stone applications. Governments promote sustainable and durable materials for urban development. The Global FRP Soft Stone Market benefits from investments in commercial complexes, airports, and civic projects. It aligns with global initiatives emphasizing green architecture and long-lasting façades. Rising middle-class housing demand in Asia-Pacific boosts new construction volume. Builders prioritize modern, low-maintenance materials with aesthetic flexibility. Growing demand for energy-efficient surfaces further strengthens product appeal. These infrastructure investments ensure consistent long-term growth for industry participants.

R&D Investments and Material Innovation Driving Product Diversification and Global Reach

Companies invest in advanced resins, recycled fibers, and hybrid composites to enhance FRP soft stone properties. The Global FRP Soft Stone Market evolves with improved weather resistance and acoustic insulation. It opens opportunities in high-performance and specialty architectural projects. Manufacturers explore lightweight variants for portable and temporary structures. Digital simulation tools optimize product design and performance testing. Collaborative ventures with architects help accelerate tailored applications across sectors. Expanding e-commerce channels enable better material visibility and international distribution. Continuous product innovation positions FRP soft stone as a next-generation building solution.

Market Segmentation Analysis:

Glass Reinforced Polymer (GRP)

GRP holds the largest share due to its superior strength, flexibility, and cost efficiency. It provides an excellent balance of durability and design adaptability for façades, wall panels, and interior applications. The material’s resistance to corrosion and UV exposure supports long-term use in exterior cladding. Architects prefer GRP for projects requiring lightweight structures without compromising on appearance. The Global FRP Soft Stone Market benefits from GRP’s easy installation and reduced maintenance requirements. It enables enhanced design creativity while maintaining energy efficiency.

- For instance, one UK supplier reported that their GRP profiles exhibited “superior tensile strength equal to or greater than steel equivalents” and were “75 % lighter than steel equivalents”.

Carbon Fiber Reinforced Polymer (CFRP)

CFRP offers exceptional stiffness and tensile strength, making it ideal for high-performance and industrial structures. It supports large-scale architectural applications that demand advanced material performance. CFRP panels deliver high load-bearing capacity with minimal weight. It is gaining attention in commercial and infrastructure projects seeking longer service life. Technological improvements in fiber manufacturing strengthen its competitiveness within composite materials.

Aramid Fiber Reinforced Polymer (AFRP)

AFRP provides strong resistance to impact and fatigue, ensuring long-term reliability in heavy-duty applications. It combines lightweight structure with thermal and chemical stability. AFRP’s high toughness enhances safety in industrial environments and high-rise construction. Demand increases across regions focusing on resilient and flexible building systems.

By Application

Residential Construction

Residential construction accounts for a major share, supported by growing urban housing and renovation activities. Homeowners and builders prefer FRP soft stone for its lightweight design, durability, and natural stone aesthetics. It enhances interiors and façades with improved resistance to moisture, stains, and temperature variations. The Global FRP Soft Stone Market benefits from its adoption in wall panels, ceilings, and decorative installations. It reduces structural load while offering modern visual appeal. Its easy installation and minimal maintenance make it suitable for apartments and luxury villas. Rising demand for eco-friendly materials further strengthens usage in sustainable housing projects.

Commercial Construction

Commercial buildings, including malls, offices, and hotels, increasingly use FRP soft stone for both interior and exterior finishes. Architects favor the material for its design flexibility and uniform appearance across large surfaces. It ensures a professional aesthetic while maintaining long-term durability under high foot traffic. It also supports acoustic control and energy efficiency, enhancing occupant comfort. Its lightweight panels simplify retrofitting in renovation projects. Demand from retail and hospitality infrastructure remains strong due to design innovation and long-lasting finishes.

Industrial Applications

Industrial facilities use FRP soft stone for durable wall coverings, protective panels, and exterior structures exposed to harsh conditions. It provides high impact and chemical resistance, reducing maintenance needs in manufacturing environments. Its low weight simplifies transportation and installation in large industrial complexes. It remains a preferred option for facilities seeking corrosion resistance and structural stability.

Segmentation:

By Material Type

- Glass Reinforced Polymer (GRP)

- Carbon Fiber Reinforced Polymer (CFRP)

- Aramid Fiber Reinforced Polymer (AFRP)

- Others

By Application

- Residential Construction

- Commercial Construction

- Industrial Applications

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America FRP Soft Stone Market size was valued at USD 964.74 million in 2018, increased to USD 1,643.40 million in 2024, and is anticipated to reach USD 3,332.66 million by 2032, at a CAGR of 8.6% during the forecast period. North America holds approximately 28% of the global market share, driven by the strong adoption of advanced composite materials in construction and interior design. The region benefits from renovation projects across commercial and residential sectors, emphasizing energy-efficient and sustainable materials. The Global FRP Soft Stone Market gains traction through the U.S. and Canada’s focus on lightweight cladding solutions and durable façades. Builders and architects favor FRP soft stone for retrofitting due to its low maintenance and aesthetic flexibility. It aligns with LEED and green building standards, boosting adoption across major metropolitan projects. Continuous innovation by regional manufacturers supports market expansion and cost efficiency.

Europe

The Europe FRP Soft Stone Market size was valued at USD 403.99 million in 2018, reached USD 656.92 million in 2024, and is projected to attain USD 1,207.07 million by 2032, at a CAGR of 7.3% during the forecast period. Europe accounts for around 17% of the total market share, led by nations emphasizing sustainable construction practices. The region promotes eco-friendly materials through strict environmental standards and green certification programs. The Global FRP Soft Stone Market benefits from growing adoption in architectural restoration and heritage building renovation. Western European countries such as Germany, France, and the UK lead innovation in fiber-reinforced composites. FRP soft stone is widely used in façades, panels, and decorative interiors. Government incentives and smart city development initiatives continue to boost demand.

Asia Pacific

The Asia Pacific FRP Soft Stone Market size was valued at USD 624.75 million in 2018, grew to USD 1,135.83 million in 2024, and is forecasted to reach USD 2,506.88 million by 2032, at a CAGR of 9.8% during the forecast period. The region dominates with approximately 34% of the global market share, fueled by rapid urbanization and infrastructure expansion. The Global FRP Soft Stone Market thrives in China, India, and Southeast Asia, where large-scale housing and commercial projects are accelerating. Increasing government investment in sustainable building materials supports market growth. Local manufacturers focus on affordability and large-scale supply for public infrastructure. FRP soft stone’s versatility suits tropical climates and modern architectural designs. Rising disposable income and demand for luxury residential spaces further contribute to regional expansion.

Latin America

The Latin America FRP Soft Stone Market size was valued at USD 101.08 million in 2018, rose to USD 171.76 million in 2024, and is projected to reach USD 306.67 million by 2032, at a CAGR of 6.9% during the forecast period. Latin America represents roughly 9% of the total market share, supported by growing commercial construction and renovation activity. The Global FRP Soft Stone Market grows steadily in Brazil and Mexico, driven by demand for lightweight, cost-effective materials. Builders prefer FRP soft stone for decorative interiors and durable exterior applications. Economic development and tourism infrastructure projects increase product visibility. Limited local production capacity encourages imports from Asia. Efforts to modernize construction standards and adopt sustainable materials foster future growth potential.

Middle East

The Middle East FRP Soft Stone Market size was valued at USD 59.64 million in 2018, reached USD 93.61 million in 2024, and is estimated to hit USD 158.95 million by 2032, at a CAGR of 6.2% during the forecast period. The region contributes about 7% of the global market share, supported by large-scale real estate and luxury development projects. The Global FRP Soft Stone Market benefits from high demand in the UAE, Saudi Arabia, and Qatar for modern architectural façades. The material’s weather and heat resistance make it ideal for desert environments. Ongoing investment in hospitality, commercial, and cultural projects sustains steady growth. Architects prioritize lightweight, aesthetically appealing materials that align with sustainable urban planning goals.

Africa

The Africa FRP Soft Stone Market size was valued at USD 26.77 million in 2018, reached USD 52.16 million in 2024, and is expected to reach USD 79.06 million by 2032, at a CAGR of 4.7% during the forecast period. Africa holds around 5% of the total market share, led by construction growth in South Africa, Egypt, and Nigeria. The Global FRP Soft Stone Market gains momentum through government-backed housing initiatives and public infrastructure projects. Limited awareness and high import dependence restrict rapid adoption. It remains an emerging market with rising interest in lightweight composite materials. The region’s push for affordable housing and sustainable urban projects provides future opportunities. Expansion of local manufacturing capabilities could strengthen market accessibility and competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- REVONO

- MaterialSyi

- Huntsman Corporation

- Owens Corning

- Johns Manville

- 3M Company

- Hexcel Corporation

- Rockwool International

- Fibertex Nonwovens

- Jushi Group

Competitive Analysis:

The Global FRP Soft Stone Market is moderately fragmented, featuring both multinational corporations and regional manufacturers. Companies focus on material innovation, lightweight designs, and enhanced performance characteristics to strengthen their position. It emphasizes product differentiation through advanced composite formulations and sustainable resins. Key players compete on quality, pricing, and large-scale project capabilities. Strategic partnerships and mergers help companies expand their distribution networks and geographical reach. Continuous R&D investment supports development of eco-friendly and customizable FRP panels. Competitive intensity remains high due to the rising presence of local manufacturers in Asia-Pacific. Companies prioritize collaboration with architects and construction firms to boost visibility and long-term contracts.

Recent Developments:

- In June 2025, Hexcel Corporation signed a long-term partnership agreement with Kongsberg Defence & Aerospace AS at the Paris Air Show. Under this five-year partnership agreement, Hexcel committed to supplying its HexWeb® engineered honeycombs and HexPly® prepregs for KONGSBERG’s strategic defense and aerospace production programs, reflecting a strong relationship between the two companies and securing business for key defense market applications.

- In September 2025, Hexcel Corporation’s Neumarkt manufacturing site was acquired by members of the management team, Paul Leitner and Manfred Bankhammer, in a strategic transaction. This acquisition represents a transition in facility ownership while maintaining continuity in advanced composite materials manufacturing at the location.

- In February 2025, Johns Manville announced plans for a new Climate Pro® production line in Winder, Georgia, representing a significant investment in its insulation business. Construction was expected to start in early 2026, with the new production line becoming operational in mid-2027. Upon completion, Johns Manville will employ more than 350 people in Winder, demonstrating the company’s commitment to meeting growing market demand for blowing wool insulation.

- In February 2025, Owens Corning announced an agreement to sell its glass reinforcements business to India-based Praana Group in a strategic transaction valued at $755 million. This acquisition represents a significant restructuring for Owens Corning, allowing the company to divest from the glass fiber reinforcements sector and focus on its residential and commercial building products operations in North America and Europe. The transaction was expected to close in 2025 pending regulatory approvals and customary closing conditions.

Report Coverage:

The research report offers an in-depth analysis based on material type and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for sustainable, lightweight materials will shape architectural preferences.

- Increasing infrastructure investments across Asia-Pacific will accelerate product penetration.

- Integration of smart and functional material technologies will enhance design appeal.

- Manufacturers will expand capacity to meet regional construction growth.

- Eco-friendly resin formulations will strengthen compliance with green standards.

- Demand for customized façades and decorative interiors will continue to rise.

- Partnerships with design firms will improve product innovation and awareness.

- Prefabrication and modular construction trends will drive material adoption.

- Renovation and refurbishment projects will sustain long-term demand.

- Digital simulation tools and automation will redefine product development efficiency.