Market Overview

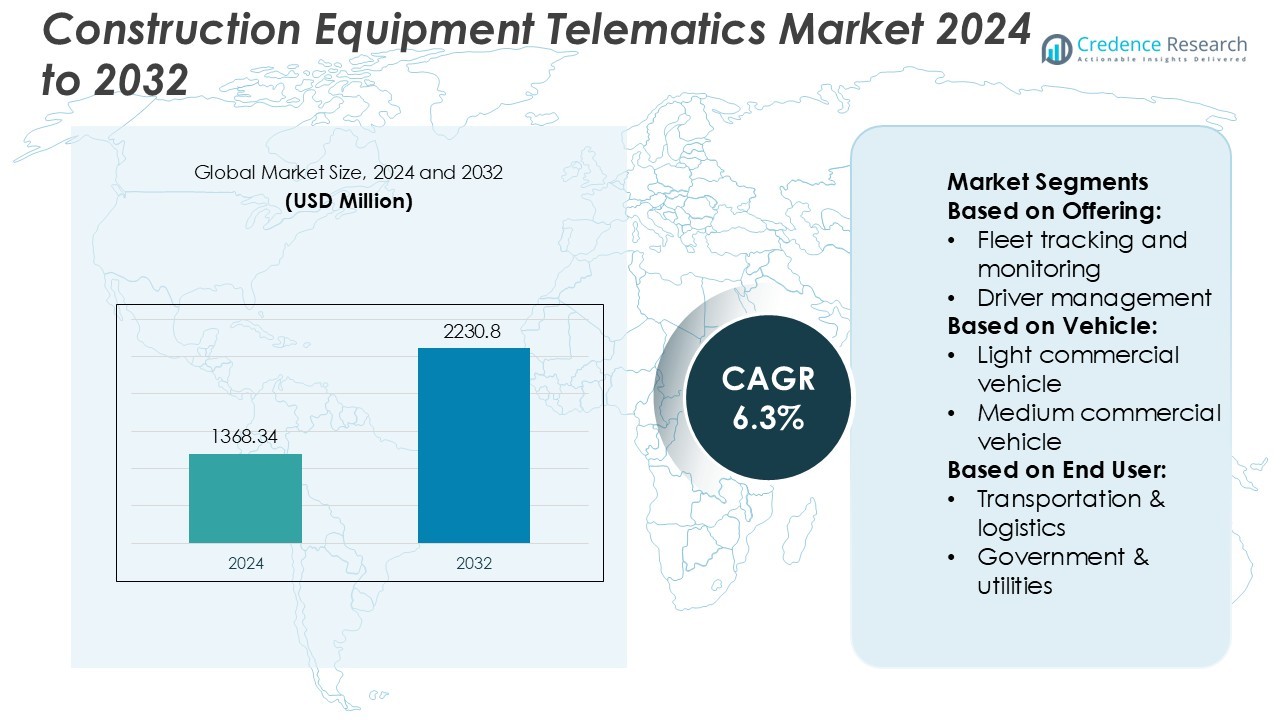

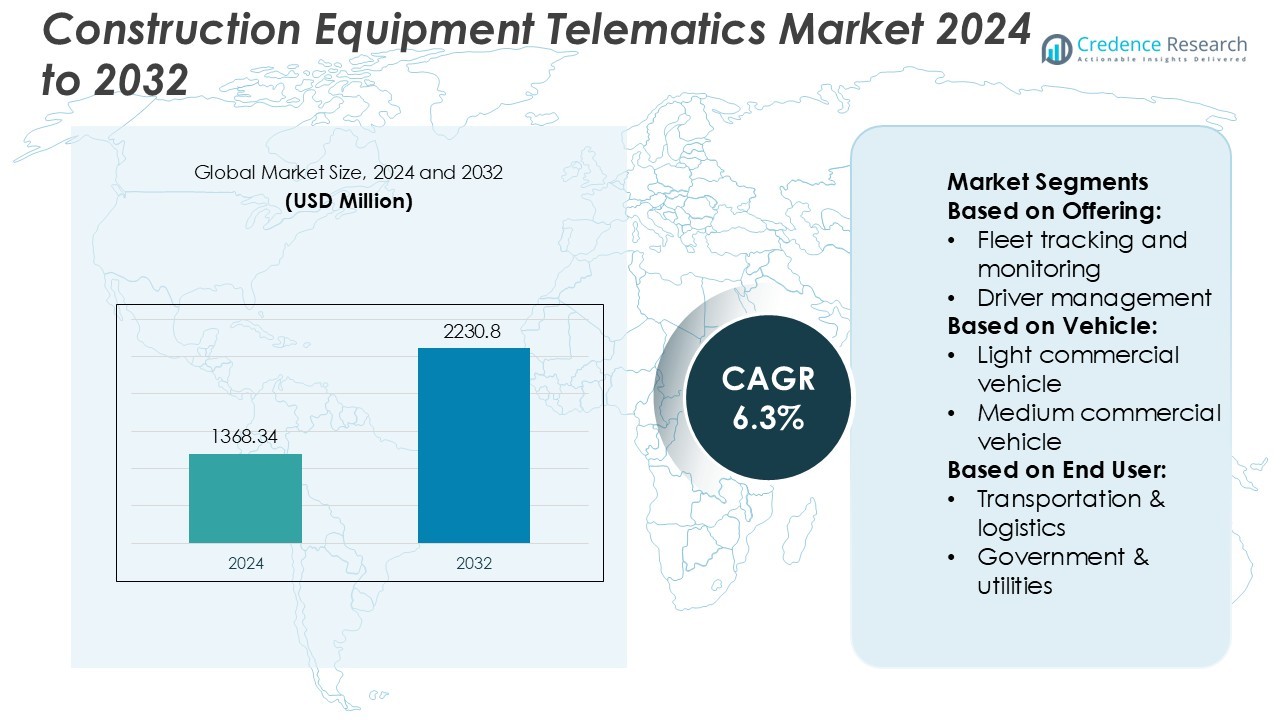

Construction Equipment Telematics Market size was valued USD 1368.34 million in 2024 and is anticipated to reach USD 2230.8 million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Equipment Telematics Market Size 2024 |

USD 1368.34 Million |

| Construction Equipment Telematics Market, CAGR |

6.3% |

| Construction Equipment Telematics Market Size 2032 |

USD 2230.8 Million |

The Construction Equipment Telematics Market features strong competition from OEMs and software-driven telematics providers that focus on fleet visibility, predictive maintenance, and safety compliance. Established players offer IoT-enabled tracking, real-time diagnostics, and automated reporting for heavy and mid-sized machinery. Rental companies increasingly partner with telematics vendors to improve utilization and prevent unauthorized use. The market continues to shift toward analytics-based service models and mobile dashboards that support mixed fleets on urban and remote jobsites. North America holds the leading position with a 32% market share, supported by advanced digital infrastructure, strict emission standards, and high adoption of telematics-equipped construction fleets.

Market Insights

- Construction Equipment Telematics Market size was valued at USD 1368.34 million in 2024 and is projected to reach USD 2230.8 million by 2032 at a 6.3% CAGR.

- The market grows as contractors adopt telematics for fuel control, reduced idle time, and predictive maintenance, improving fleet productivity across small, medium, and heavy machines.

- Analytics-based dashboards, IoT sensors, and mobile applications shape new trends, helping operators monitor safety, equipment misuse, and real-time performance across mixed-brand fleets.

- The competitive landscape includes OEM-installed systems and cloud telematics providers, but high installation cost and data security concerns limit adoption for small contractors.

- North America leads with 32% share, while large construction fleets remain the dominant application segment, driven by digital infrastructure, emission norms, and strong presence of rental companies integrating telematics for utilization and compliance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Offering

Solutions lead the Construction Equipment Telematics Market with a 62% share in 2024, driven by strong demand for fleet tracking and monitoring. Fleet tracking holds the largest portion within solutions due to high adoption among rental fleets, contractors, and logistics firms seeking real-time vehicle location, utilization analysis, and fuel control. Driver management and safety compliance tools also grow as operators reduce accidents and downtime. Insurance telematics and advanced analytics support risk scoring and faster claims. Services form the remaining share, mainly installation, training, and maintenance, but the segment expands as more legacy fleets digitalize operations.

- For instance, MiX Telematics announced that it had surpassed 600 000 active vehicle subscriptions globally. The company’s KPI Manager dashboard allows fleets to track daily incidents such as speeding or idling.

By Vehicle

Heavy commercial vehicles dominate the market with a 58% share, supported by rising usage of excavators, loaders, cranes, haul trucks, and mixers across construction and mining projects. High asset value and higher fuel consumption drive rapid telematics adoption for predictive maintenance, idle reduction, and productivity tracking. Medium commercial vehicles capture noticeable growth in municipal work and regional logistics. Light commercial vehicles follow through pickup fleets used for on-site material movement and workforce mobility. Contractors prefer integrated dashboards that merge heavy and support vehicles for centralized fleet visibility.

- For instance, Samsara’s Vehicle Gateway device provides real-time connectivity via 4G LTE and built-in WiFi hotspot — delivering up to 10× speed advantage over 3G devices.

By End User

Construction accounts for a 41% share, making it the leading end user due to demand for optimized equipment utilization, operator safety monitoring, and preventive maintenance. Large infrastructure plans, rental fleet expansion, and cost control strategies encourage adoption. Transportation and logistics follow as fleet owners use telematics for routing, fuel analytics, and regulatory compliance. Government and utilities increase deployment to manage public works machinery and emergency response fleets. Travel and tourism use tracking for buses and service fleets, while other industries adopt solutions for site management, mining, and agriculture operations.

Key Growth Drivers

Rising Need for Fleet Visibility and Uptime Optimization

Construction companies want real-time tracking to reduce fuel loss, theft, and idle time. Telematics platforms use GPS, sensor data, and predictive alerts to increase utilization rates and prevent unplanned breakdowns. Fleet managers gain better control over asset location, usage hours, and maintenance planning. As projects face tight timelines, operators rely on remote monitoring and data-driven decision-making to keep machinery productive. This demand pushes OEMs and rental firms to integrate factory-installed telematics units, strengthening adoption among contractors across large and mid-sized construction fleets.

- For instance, Geotab currently processes approximately 100 billion data points per day from its connected vehicles. The figure of 55 billion mentioned in the original statement was accurate in earlier reporting periods.

Strict Compliance with Safety and Emission Regulations

Governments enforce emission norms, operator safety rules, and equipment health standards. Telematics supports compliance with automated reporting, over-speed alerts, geo-fencing, and operator behavior analysis. Monitoring engine hours, load cycles, and fuel burn allows businesses to meet sustainability goals and reduce carbon output. Construction firms adopt digital compliance solutions to avoid penalties and maintain operational transparency. Insurance providers also promote telematics-based safety scoring, encouraging the industry to deploy connected systems that improve worksite discipline and reduce accident risks.

- For instance, HCSS Telematics integrates directly with HCSS Safety and HeavyJob, capturing more than 60 field safety forms and incident types on a single cloud platform, and its GPS modules log vehicle data at 1-second intervals to verify speeding, idling, and restricted-zone violations.

Shift Toward Predictive and Remote Maintenance Models

Unplanned downtime increases project delays and repair costs. Telematics-enabled diagnostics track engine temperature, vibration levels, hydraulic pressure, and fault codes, helping teams detect issues before failures occur. Construction firms move from scheduled servicing to predictive maintenance to extend equipment life. OEMs and service partners offer subscription-based maintenance packages that rely on equipment data for faster troubleshooting. This shift boosts telematics adoption because remote maintenance cuts field technician visits, reduces spare parts consumption, and ensures continuous operation of costly assets.

Key Trends & Opportunities

Integration with AI, IoT, and Analytics Platforms

Telematics data is becoming more intelligent with AI-based insights for fuel optimization, operator scoring, and automated reporting. IoT sensors on engines, brakes, and hydraulics enhance diagnostics accuracy. Analytics platforms convert large data sets into actionable insights for fleet forecasting. OEMs now launch advanced dashboards with mobile accessibility and digital twins to simulate machine performance. The trend creates opportunities for software vendors and rental companies to deliver value-added telematics services with real-time analytics and automated maintenance scheduling.

- For instance, Komatsu’s KOMTRAX Plus system on mining machines monitors major components via satellite telemetry, covering machines such as the HD785 and PC8000, and offers remote access to engine data, GPS position and machine health at no extra subscription cost.

Expansion of Rental and Subscription-Based Telematics Models

Construction contractors prefer renting high-cost machinery to avoid capital investment. Rental companies deploy telematics to track usage hours, manage contracts, and prevent misuse. Subscription models make connected solutions more affordable for small contractors. OEMs bundle telematics with equipment leases, ensuring constant system use throughout machine life. This trend supports higher market penetration, especially in emerging regions where construction demand is strong but ownership costs remain high.

- For instance, Omnitracs’ XRS plug-and-play device installs in about 10 minutes, connects to the engine via three-wire link and instantly begins transmitting location and diagnostic data via Bluetooth to a mobile app and cloud.

Integration with Site Management and BIM Platforms (Opportunity)

Telematics now connects with Building Information Modeling and site planning systems. Combined data gives contractors real-time visibility of machinery location, job progress, and productivity versus schedule. Construction managers can coordinate material movement, workforce planning, and equipment allocation more accurately. This integration offers strong growth potential for software companies and IoT solution providers offering connected jobsite platforms.

Key Challenges

Data Security and Cyber Risks

Connected machinery transmits sensitive information such as project location, fleet routes, and asset utilization. Hackers can exploit unsecured networks, leading to data theft or remote control attempts. Companies must invest in encryption, secure cloud hosting, and identity management. Smaller contractors may hesitate to adopt telematics due to cybersecurity concerns. Vendors must build trust with compliance certifications and safe communication protocols to protect the growing number of connected assets.

High Cost of Installation and Technology Complexity

Hardware devices, IoT sensors, and annual subscription fees increase operating costs. Many small contractors still rely on manual fleet logs and avoid digital platforms. Integrating telematics with legacy machines also requires additional retrofitting. Operators need training to use dashboards and interpret analytics. These cost and complexity barriers slow adoption in low-margin projects and developing markets. Vendors offering low-cost devices, simple dashboards, and pay-as-you-use pricing can overcome this challenge and expand adoption.

Regional Analysis

North America

North America holds the leading share of the Construction Equipment Telematics Market with nearly 32% of global revenue. Strong adoption of IoT-enabled machinery, advanced digital infrastructure, and strict regulatory standards drive consistent demand. Contractors deploy telematics to optimize fleet productivity, reduce idle time, and comply with EPA emission norms. Rising investment in highways, commercial construction, and smart city projects supports wider integration of connected assets. Rental companies and OEMs bundle factory-installed telematics into new machines, accelerating market penetration. The U.S. remains the primary growth hub, supported by high equipment utilization rates and strong replacement cycles.

Europe

Europe accounts for roughly 27% of the market, driven by the presence of major OEMs, rental companies, and strong environmental regulations. Construction firms use telematics to meet Euro Stage emission norms and enhance jobsite efficiency. Government focus on sustainable construction and fuel monitoring encourages wider platform adoption. Advanced road, rail, and infrastructure projects across Germany, the U.K., France, and the Nordics boost demand for connected machines. The region also sees high uptake of AI-based analytics and predictive maintenance, creating opportunities for software providers and equipment suppliers offering integrated data-driven platforms.

Asia-Pacific

Asia-Pacific captures nearly 30% of global share and ranks as the fastest-growing region. Massive roadbuilding, metros, mining, and industrial construction drive demand for connected equipment. China, Japan, India, and South Korea lead telematics deployment as contractors seek higher fleet utilization and uptime. OEMs launch entry-level and mid-tier telematics solutions to suit cost-sensitive markets. Government focus on digital infrastructure, smart cities, and emission control enhances adoption. Rental equipment penetration is rising, pushing telematics integration into large and small fleets. The region’s scale of construction activity positions Asia-Pacific as a long-term growth engine for vendors and fleet operators.

Latin America

Latin America holds close to 6% of the market, supported by steady construction activity in Brazil, Mexico, Argentina, and Chile. Contractors adopt telematics to reduce fuel theft, equipment misuse, and downtime in remote and high-risk sites. Economic recovery and public infrastructure spending create opportunities for connected rental fleets. However, cost sensitivity and limited digital infrastructure slow broader penetration. Vendors target the region with affordable platforms and pay-per-use models. Growing mining operations, road modernization, and government-backed urban projects will gradually expand telematics demand across medium and heavy equipment categories.

Middle East & Africa

The Middle East & Africa represent nearly 5% of global share, driven by ongoing megaprojects, oil-and-gas infrastructure, and urban development. Countries like the UAE, Saudi Arabia, and Qatar integrate telematics for fleet visibility and compliance in harsh operating conditions. Contractors benefit from real-time maintenance alerts that prevent breakdowns in remote deserts and industrial zones. Africa sees rising adoption in mining and energy projects, though price barriers remain. OEM-backed solutions and rental telematics services support gradual market expansion. Government digitalization efforts will enhance long-term penetration across utilities, construction, and industrial fleets.

Market Segmentations:

By Offering:

- Fleet tracking and monitoring

- Driver management

By Vehicle:

- Light commercial vehicle

- Medium commercial vehicle

By End User:

- Transportation & logistics

- Government & utilities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Construction Equipment Telematics Market includes Teletrac Navman, Tenna, MiX Telematics, Samsara, Geotab, HCSS, KOMATSU (Komtrax), Omnitracs, Fleet Complete, and Caterpillar. The Construction Equipment Telematics Market is defined by continuous technology upgrades, data-driven platforms, and integrated hardware–software ecosystems. Vendors compete by offering advanced GPS tracking, IoT sensors, and cloud analytics that improve fleet visibility, fuel management, predictive maintenance, and operator safety. Many providers bundle real-time alerts, geo-fencing, machine diagnostics, and automated reporting to reduce idle time and prevent equipment misuse. OEMs strengthen their position through factory-installed telematics in new machines, while software companies focus on scalable solutions that support mixed-brand fleets. Subscription pricing models, mobile dashboards, and API integrations with project management tools help expand customer adoption. Partnerships with rental companies and construction firms increase system deployment on both heavy and mid-sized fleets. As smart jobsite automation grows, companies invest in AI-based analytics, digital twins, and remote servicing capabilities to differentiate offerings and build long-term service contracts. This shift toward connected fleets makes telematics a core requirement in modern construction operations.

Key Player Analysis

- Teletrac Navman

- Tenna

- MiX Telematics

- Samsara

- Geotab

- HCSS

- KOMATSU (Komtrax)

- Omnitracs

- Fleet Complete

- Caterpillar

Recent Developments

- In July 2025, New Holland added to their lineup of C Series compact wheel loaders by introducing the all-new W100D compact wheel loader. The new model features a new cab to provide added operator comfort, new attachment capabilities, as well as a complimentary telematics package to improve connectivity and management of your fleet.

- In January 2025, Caterpillar announced their new line of next generation Cat telehandlers – models TH0642, TH0842, TH1055, and TH1255 – which will replace the TL series of telehandlers. The new machines are powered by the Cat C3.6TA engine, with new and enhanced capabilities in operator safety, performance, and maintenance.

- In September 2024, Cummins, Bosch and India’s KPIT partnered to launch Eclipse CANought, a new open telematics software for commercial vehicles. Eclipse CANought offers standardised and secure access to vehicle ECUs (Electronic Control Units) for telematics applications.

- In March 2024, Hitachi Construction Machinery (Europe) NV (HCME) announced a strategic partnership with fleet management systems provider ShareMat in France. The partnership is geared toward transforming equipment management by the combination of Hitachi’s machinery and ShareMat’s sophisticated software solutions that begin to offer enhanced transparency and efficiency of fleet operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Offering, Vehicle, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider use of AI-based analytics for predictive maintenance and fuel optimization.

- More contractors will adopt telematics to reduce idle time, theft, and unauthorized machine use.

- Rental companies will expand connected fleets, making telematics a standard feature across heavy and mid-sized equipment.

- OEMs will integrate factory-installed telematics units in most new machines to increase aftermarket service revenue.

- Cloud dashboards and mobile apps will become simpler, supporting small and medium contractors.

- Telematics will connect with BIM and digital project planning tools for real-time productivity tracking.

- Data from sensors will support sustainability goals, emission monitoring, and green construction initiatives.

- Edge computing and 5G connectivity will strengthen real-time diagnostics and remote machine control.

- API-based integrations will link telematics with billing, dispatch, and equipment management systems.

- Predictive service contracts and subscription models will grow as vendors focus on long-term customer engagement.