Market Overview:

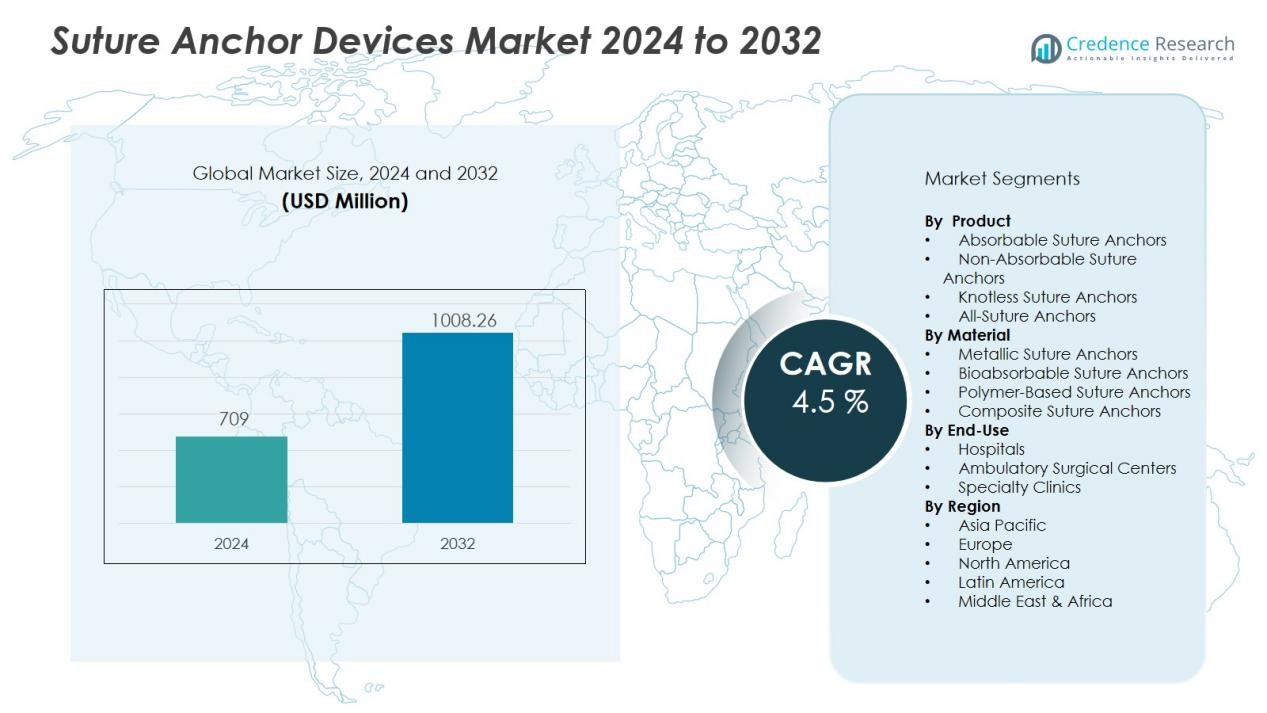

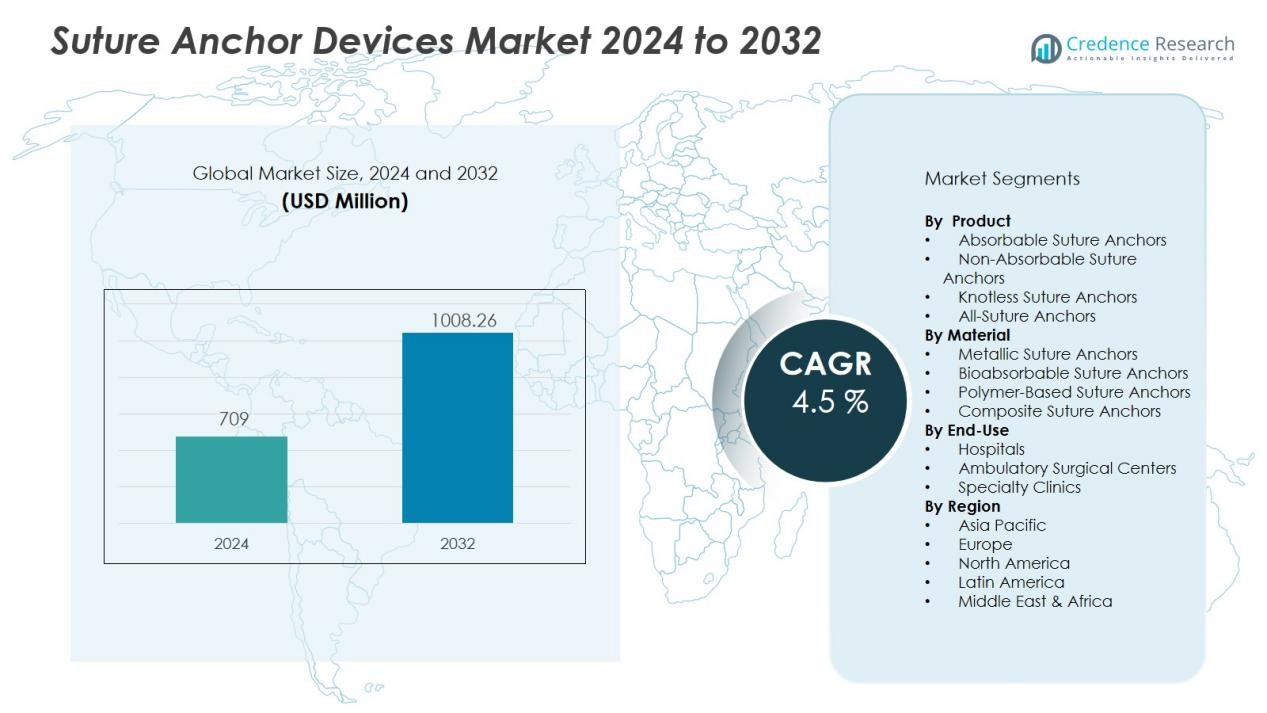

The Suture anchor devices market size was valued at USD 709 million in 2024 and is anticipated to reach USD 1008.26 million by 2032, at a CAGR of 4.5 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Suture anchor devices market Size 2024 |

USD 709 Million |

| Suture anchor devices market , CAGR |

4.5 % |

| Suture anchor devices market Size 2032 |

USD 1008.26 Million |

Key market drivers include the growing incidence of sports-related injuries, trauma cases, and degenerative joint diseases such as rotator cuff tears and shoulder dislocations. Surgeons prefer suture anchor devices for their ability to deliver reliable fixation, faster healing, and reduced postoperative complications. Advancements in bioabsorbable and all-suture anchor technologies further enhance procedural outcomes and patient recovery times, fueling greater adoption in both routine and complex orthopedic surgeries.

Regionally, North America leads the suture anchor devices market, benefiting from a well-established healthcare infrastructure, high volume of sports medicine procedures, and robust reimbursement policies. Europe follows closely due to an aging population and expanding orthopedic care. The Asia-Pacific region is poised for the fastest growth, driven by rising healthcare investments, increasing awareness, and a large patient base requiring musculoskeletal interventions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The suture anchor devices market reached USD 709 million in 2024 and is expected to hit USD 1,008.26 million by 2032, registering a 4.5% CAGR.

- Increased sports injuries, trauma cases, and degenerative joint diseases drive strong demand for suture anchor devices in both routine and complex orthopedic surgeries.

- Advancements in bioabsorbable and all-suture anchor technologies improve procedural outcomes, patient recovery, and device adoption.

- Surgeons and patients increasingly prefer minimally invasive procedures, supporting wider use of suture anchors in arthroscopic shoulder, knee, and hip repairs.

- North America leads the market with over 40% share, driven by advanced healthcare systems, high surgical volumes, and robust reimbursement frameworks.

- Europe follows with a 30% share, propelled by its aging population, public health infrastructure, and rapid uptake of advanced orthopedic solutions.

- Asia-Pacific shows the fastest growth, benefiting from healthcare modernization, rising awareness, increased investments, and a large patient base needing musculoskeletal interventions.

Market Drivers:

Surge in Sports Injuries and Orthopedic Procedures Elevates Demand:

The suture anchor devices market is expanding due to the increasing prevalence of sports injuries and a higher volume of orthopedic surgeries. Growing participation in professional and recreational sports has led to a rise in ligament, tendon, and joint injuries that require surgical intervention. Medical professionals are relying on suture anchor devices to ensure secure fixation and optimal healing outcomes. The expanding patient pool continues to propel adoption in both routine and complex musculoskeletal repair procedures.

- For instance, Arthrex’s SutureLoc™ implant was the first knotless, all-suture retensionable anchor specifically engineered for arthroscopic meniscal root repair, earning a Silver award at the 2024 Edison Awards and contributing to more than 1,000 new products the company develops annually

Technological Advancements Enhance Surgical Outcomes:

Innovations in suture anchor materials and designs are transforming the market landscape. Manufacturers are introducing bioabsorbable and all-suture anchors that promote better tissue integration and lower the risk of adverse reactions. It now offers improved flexibility, easier insertion, and enhanced fixation strength, addressing the diverse needs of orthopedic and arthroscopic procedures. These advancements support surgeons in delivering faster recovery and improved patient satisfaction.

- For instance, the Mitek ESP poly-L-lactic acid absorbable anchor reached a pull-out strength of 30 lbf by six weeks post-implantation in a ram femur model.

Preference for Minimally Invasive Solutions Drives Adoption:

Surgeons and patients are choosing minimally invasive procedures to reduce hospital stays and speed up rehabilitation. The suture anchor devices market benefits from this shift, with products designed for arthroscopic use gaining traction in shoulder, knee, and hip repairs. It provides smaller incision options and enables less postoperative pain, making these devices preferred in both ambulatory and inpatient settings. Health systems recognize the efficiency and cost-effectiveness of these solutions.

Rising Aging Population and Chronic Disease Burden Influence Growth:

A growing geriatric population and the rising burden of chronic musculoskeletal conditions support long-term market expansion. Older adults often present with degenerative joint diseases, rotator cuff tears, and weakened ligaments that require surgical repair. The suture anchor devices market meets the needs of this demographic by delivering durable, reliable fixation options. Increased life expectancy and greater healthcare access are set to sustain demand over the forecast period.

Market Trends:

Rapid Adoption of Bioabsorbable and All-Suture Anchor Technologies:

The shift toward bioabsorbable and all-suture anchor technologies defines a key trend in the suture anchor devices market. Hospitals and surgical centers are selecting bioabsorbable anchors to eliminate the need for removal and reduce long-term complications. Surgeons favor all-suture anchors for their flexibility, lower profile, and strong fixation in soft tissue repairs. It supports improved post-operative outcomes and patient comfort. Research and development investments are leading to next-generation devices with enhanced biocompatibility and performance. Regulatory approvals for innovative materials and products fuel commercial availability and physician adoption worldwide.

- For instance, Acuitive Technologies’ CITREFIX Knotless Suture Anchor achieved FDA 510(k) clearance in 2021 for its use of novel CITREGEN material, a synthetic polymer designed to aid natural tissue regeneration and reduce chronic inflammation, based on more than 15 years of academic research and five years of proprietary development.

Integration of Advanced Imaging and Navigation Tools in Orthopedic Surgery:

Another notable trend is the integration of advanced imaging and navigation tools in orthopedic and arthroscopic procedures. Surgeons now utilize intraoperative imaging and computer-assisted navigation to improve precision when placing suture anchors. It ensures optimal device positioning, reduces surgical risks, and enhances long-term repair integrity. The suture anchor devices market reflects this trend through partnerships between device manufacturers and digital health companies. Companies continue to launch anchors that are compatible with real-time imaging and robotic-assisted systems. Hospitals and specialty clinics prioritize these integrated solutions to achieve better clinical outcomes and strengthen patient satisfaction.

- For instance, Medtronic’s O-arm® imaging with its navigation platform reduced the anchor penetration rate in glenoid zone III from 40.9% to 15.7% in a pilot arthroscopic capsulolabral repair study involving 20 surgeries.

Market Challenges Analysis:

Stringent Regulatory Requirements and High Approval Costs Hinder Market Expansion:

Stringent regulatory requirements and high approval costs create significant barriers for new entrants in the suture anchor devices market. Companies must meet rigorous quality, safety, and clinical efficacy standards before product launches. It faces lengthy and expensive approval timelines across major markets such as the United States and Europe. Compliance with evolving regulations requires ongoing investments in research, documentation, and product testing. Smaller manufacturers often struggle to compete with established players due to resource constraints. Delays in regulatory clearance can limit market reach and slow innovation.

Cost Sensitivity and Reimbursement Challenges Affect Adoption Rates:

Cost sensitivity among healthcare providers and variable reimbursement policies challenge market growth. Hospitals and surgical centers operate within budgetary constraints that affect procurement decisions. The suture anchor devices market must address concerns about cost-effectiveness while demonstrating clinical value. It encounters disparities in insurance coverage and reimbursement rates across regions, which impact access to advanced devices. Pricing pressures can reduce margins and affect the pace of technology adoption, especially in price-sensitive emerging markets. These financial challenges require strategic adaptation by industry players.

Market Opportunities:

Emergence of Minimally Invasive and Outpatient Orthopedic Procedures Creates Growth Prospects:

The emergence of minimally invasive and outpatient orthopedic procedures creates significant growth prospects for the suture anchor devices market. Hospitals and ambulatory surgical centers increasingly favor arthroscopic techniques that require advanced fixation solutions. It addresses the demand for devices that enable shorter recovery periods and lower complication risks. Surgeons prefer these devices for their ease of use and ability to facilitate rapid patient turnover. Health systems benefit from cost savings and improved operational efficiency by expanding their minimally invasive surgery offerings. The growing trend toward same-day discharge supports wider market adoption.

Untapped Potential in Emerging Markets and Sports Medicine Applications:

Expanding healthcare infrastructure and rising awareness of sports injury management present new opportunities in emerging regions. The suture anchor devices market can capture growth by targeting countries with increasing healthcare spending and evolving orthopedic care standards. It supports the needs of both trauma and sports medicine specialists who require reliable fixation devices. Manufacturers introducing affordable and innovative products can gain early market leadership in these high-potential geographies. Stronger physician education and training initiatives will accelerate technology adoption. Strategic collaborations with local distributors and healthcare providers further expand reach and market share.

Market Segmentation Analysis:

By Product:

The suture anchor devices market segments by product into absorbable and non-absorbable anchors, with knotless and all-suture designs gaining traction. It sees strong demand for knotless anchors due to reduced surgical time and simplified procedures. All-suture anchors appeal to surgeons for their flexibility and minimal invasiveness, especially in arthroscopic repairs. Non-absorbable anchors maintain relevance for procedures requiring long-term fixation. Manufacturers focus on expanding portfolios to address diverse orthopedic and sports medicine needs.

- For example, the Arthrex FiberTak all-suture anchor requires only a 1.8mm diameter bone tunnel, preserving more bone while maintaining excellent fixation strength comparable to traditional solid anchors.

By Material:

Material segmentation includes metallic, bioabsorbable, and polymer-based anchors. The market sees rapid growth in bioabsorbable and composite materials, driven by the need for biocompatibility and elimination of removal procedures. Metallic anchors remain in demand for their strength and reliability in high-load applications. It continues to witness product launches featuring advanced polymers and hybrid materials that optimize strength, healing, and patient safety.

- For instance, Smith+Nephew’s HEALICOIL KNOTLESS bioabsorbable anchor utilizes the REGENESORB material, which is designed to be absorbed and replaced by bone within 24 months, optimizing healing and patient safety.

By End-Use:

End-use segmentation covers hospitals, ambulatory surgical centers, and specialty clinics. Hospitals account for the largest share, supported by high procedure volumes and access to advanced surgical technology. Ambulatory surgical centers register notable growth, driven by demand for minimally invasive and outpatient orthopedic procedures. Specialty clinics increasingly adopt advanced suture anchor devices for targeted musculoskeletal and sports injury management. The suture anchor devices market aligns product development and distribution strategies to cater to each end-use segment’s unique requirements.

Segmentations:

By Product:

- Absorbable Suture Anchors

- Non-Absorbable Suture Anchors

- Knotless Suture Anchors

- All-Suture Anchors

By Material:

- Metallic Suture Anchors

- Bioabsorbable Suture Anchors

- Polymer-Based Suture Anchors

- Composite Suture Anchors

By End-Use:

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

North America :

North America holds a market share exceeding 40% in the suture anchor devices market, supported by a mature healthcare system and high volumes of orthopedic and sports medicine procedures. It benefits from advanced surgical technologies, widespread adoption of minimally invasive techniques, and strong reimbursement frameworks. The region features a high concentration of specialized surgeons and well-equipped hospitals. Continuous investments in research and product innovation keep North America at the forefront of clinical advancements. Regulatory clarity and established quality standards streamline device approvals. Sports-related injuries and an active population further boost demand for suture anchor solutions.

Europe :

Europe secures a market share of roughly 30%, driven by a rising geriatric population and increased prevalence of musculoskeletal disorders. The suture anchor devices market in Europe benefits from expanding access to orthopedic care and robust public health systems. Countries such as Germany, France, and the United Kingdom contribute significantly to market demand through strong surgical infrastructure and established medical training programs. The adoption of bioabsorbable and advanced suture anchor devices continues to gain traction in both public and private hospitals. Regulatory harmonization across the European Union accelerates product launches. Ongoing emphasis on quality of life improvements supports steady growth in the region.

Asia-Pacific :

Asia-Pacific accounts for nearly 20% market share and demonstrates the fastest growth rate among all regions. Healthcare infrastructure modernization and rising awareness of advanced orthopedic procedures drive strong demand in China, India, Japan, and Southeast Asia. The suture anchor devices market capitalizes on growing investments from both public and private sectors. A large, underserved patient base and increasing sports participation further expand procedural volumes. Manufacturers introduce cost-effective and innovative solutions to meet diverse clinical needs. Partnerships with local healthcare providers enhance distribution and accelerate technology adoption across emerging economies.

Competitive Analysis:

The suture anchor devices market features intense competition, led by established global players such as Smith & Nephew, plc., Arthrex, Inc., Stryker, Johnson & Johnson Services, Inc., Zimmer Biomet Holdings, Inc., and CONMED Corporation. These companies invest in research and development to introduce innovative products that address evolving clinical needs. It emphasizes advancements in bioabsorbable, knotless, and all-suture anchors to strengthen market share and differentiate portfolios. Firms focus on strategic acquisitions, partnerships, and physician training to expand global reach and support clinical adoption. Regulatory compliance and product quality remain critical for maintaining competitive advantage. The suture anchor devices market values robust distribution networks and after-sales support, ensuring customer loyalty and consistent procurement across hospitals and surgical centers.

Recent Developments:

- In June 2025, marked Arthrex’s launch of the Synergy Power™ system, a battery-powered surgical instrument platform for sports medicine, arthroplasty, trauma, and distal extremities procedures.

- In April 2025, Johnson & Johnson Services, Inc. completed the acquisition of Intra-Cellular Therapies, Inc.

- In April 2025, Zimmer Biomet Holdings, Inc. completed the acquisition of Paragon 28, a leader in foot and ankle orthopedics.

Market Concentration & Characteristics:

The suture anchor devices market demonstrates moderate to high market concentration, with a few leading multinational companies holding significant shares. It features a mix of established medical device firms and emerging players focused on technological innovation and specialty products. Competitive dynamics center on product quality, regulatory compliance, clinical outcomes, and distribution reach. Major companies invest in research, product launches, and global expansion to strengthen their positions. The suture anchor devices market emphasizes high standards for safety, efficacy, and biocompatibility, driving continual product improvement. Strategic alliances, acquisitions, and physician training programs play a critical role in shaping market structure and competitive advantages.

Report Coverage:

The research report offers an in-depth analysis based on Product, Material, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for suture anchor devices will rise with increasing orthopedic and sports medicine procedures worldwide.

- Technological innovation will focus on bioabsorbable, all-suture, and knotless anchor designs to improve clinical outcomes.

- Surgeons will adopt minimally invasive arthroscopic techniques, further driving product utilization in joint repairs.

- Healthcare systems will prioritize solutions that offer quicker patient recovery and reduced postoperative complications.

- Emerging economies in Asia-Pacific and Latin America will provide new growth opportunities as healthcare infrastructure expands.

- Leading manufacturers will strengthen market positions through product launches, acquisitions, and global partnerships.

- Physician education and advanced training programs will accelerate adoption of new anchor technologies in both public and private sectors.

- Rising awareness of sports injuries and the need for effective musculoskeletal repair will sustain market momentum.

- Hospitals and ambulatory surgical centers will increase procurement of advanced anchor devices for both trauma and elective procedures.

- Integration of digital health and navigation tools in orthopedic surgery will enhance precision and improve long-term outcomes for patients.