Market Overview

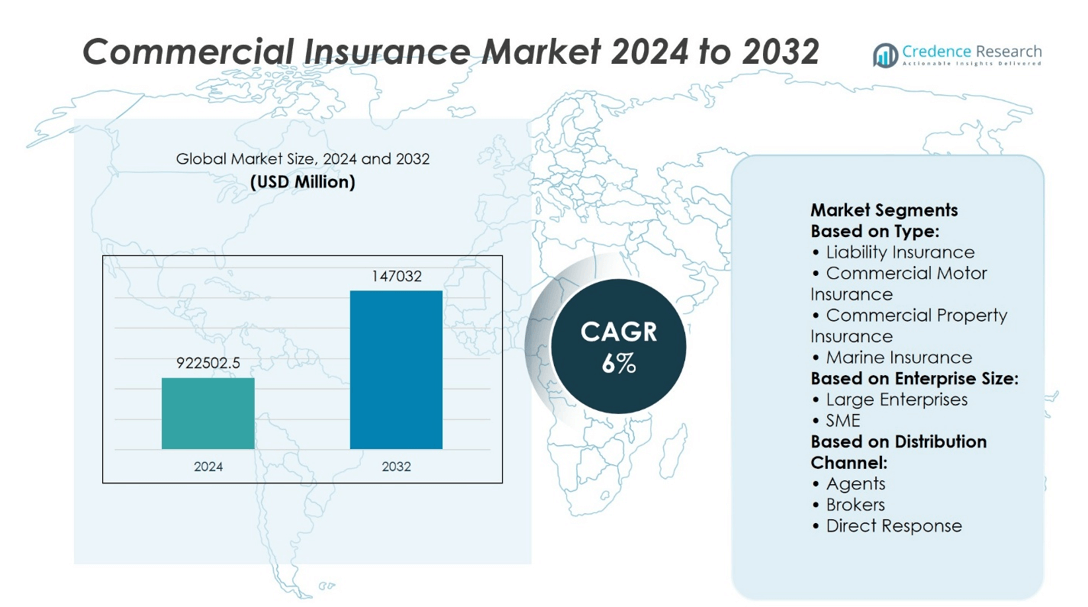

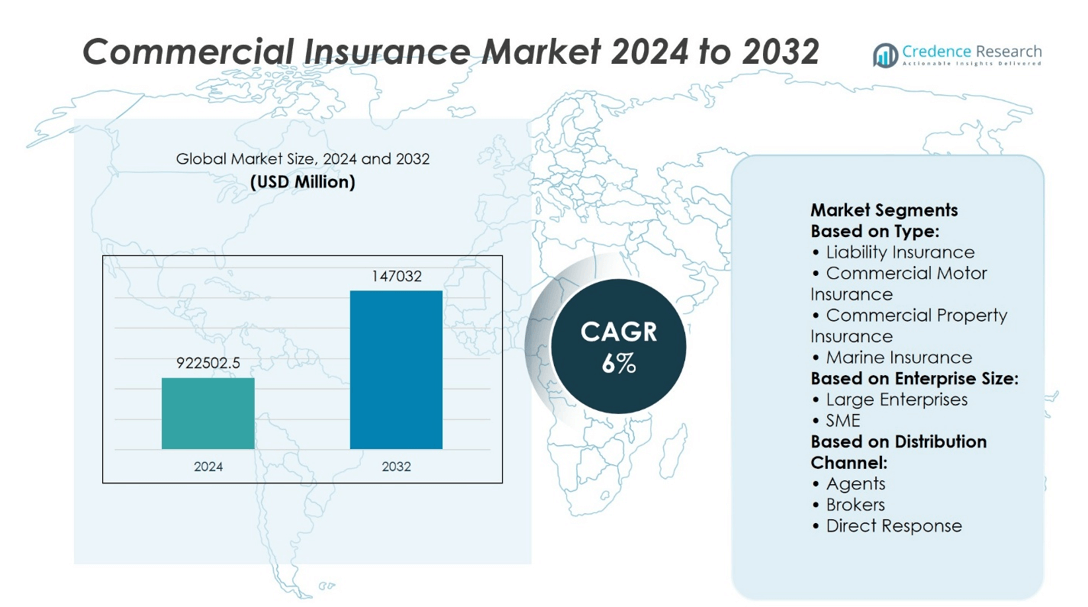

Commercial Insurance Market size was valued at USD 922502.5 million in 2024 and is anticipated to reach USD 147032 million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Insurance Market Size 2024 |

USD 922502.5 million |

| Commercial Insurance Market, CAGR |

6% |

| Commercial Insurance Market Size 2032 |

USD 147032 million |

The Commercial Insurance Market experiences strong growth driven by increasing business complexities, regulatory compliance demands, and rising exposure to emerging risks such as cyber threats and climate change. Companies seek comprehensive coverage to protect assets and ensure continuity amid evolving challenges. Technological advancements accelerate digital adoption, enabling more efficient underwriting, claims management, and customer engagement. Market trends emphasize tailored, industry-specific solutions and greater integration of ESG principles in product offerings. Additionally, the expansion of insurance penetration in emerging economies and the shift toward automated distribution channels further support market development and competitive differentiation.

The Commercial Insurance Market shows strong regional variations, with North America holding the largest share, followed by Europe and Asia-Pacific, which experiences rapid growth. Emerging markets in Latin America and the Middle East & Africa offer expanding opportunities driven by industrialization and infrastructure development. Key players such as Zurich, AXA, Chubb Limited, Aon Plc, Marsh LLC, Willis Towers Watson, Allianz, and AIG dominate globally, leveraging extensive networks and diverse product portfolios to meet complex risk demands across industries and regions.

Market Insights

- The Commercial Insurance Market size was valued at USD 922,502.5 million in 2024 and is expected to reach USD 147032 million by 2032, growing at a CAGR of 6%.

- Growth is driven by increasing business complexities, stricter regulatory compliance, and rising risks such as cyber threats and climate change.

- Companies demand comprehensive coverage to protect assets and maintain business continuity amid evolving challenges.

- Technological advances promote digital adoption, improving underwriting efficiency, claims processing, and customer engagement.

- Market trends focus on customized, industry-specific solutions and stronger integration of ESG principles in insurance products.

- North America holds the largest market share, followed by Europe and rapidly growing Asia-Pacific, while emerging markets in Latin America and the Middle East & Africa present new opportunities.

- Leading players like Zurich, AXA, Chubb, Aon, Marsh, and Allianz leverage broad networks and diversified portfolios to address complex risks worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Evolving Regulatory Landscape Drives Demand for Specialized Insurance Products

Tighter regulations across sectors such as construction, healthcare, and manufacturing create new liabilities for businesses. The Commercial Insurance Market responds with policies designed to meet specific compliance requirements. Companies must now insure against emerging risks, including environmental liabilities and data privacy breaches. It leads insurers to expand product portfolios and create sector-specific coverage. Regulatory changes also require more transparency and risk reporting, pushing businesses to maintain continuous coverage. The market continues to evolve in alignment with legislative developments.

- For instance, Chubb implemented its Risk Engineering platform, which conducts over 12,000 risk assessments annually worldwide, helping clients meet regulatory compliance through detailed reports and actionable insights, enhancing risk management and reducing claim incidences.

Digital Transformation and Cybersecurity Threats Reshape Risk Management Strategies

Widespread adoption of digital systems has introduced new exposures across industries. The Commercial Insurance Market adjusts to these shifts by offering cyber liability insurance and technology risk solutions. Businesses increasingly recognize the impact of cyberattacks on operations and reputation. It forces insurers to refine policies that address data breaches, ransomware, and IT system failures. The market emphasizes proactive risk assessment tools to support policyholders. Underwriters focus more on digital resilience when evaluating risk profiles.

- For instance, AIG’s Cyber Resiliency Program notified over 400 policyholders about critical vulnerabilities during their coverage period and reviewed more than 10,000 cyber claims to improve risk management strategies.

Rising Frequency and Severity of Catastrophic Events Increase Demand for Coverage

The growing occurrence of natural disasters and extreme weather events continues to push demand in the Commercial Insurance Market. Businesses face higher risks from floods, wildfires, hurricanes, and other climate-related disruptions. These events often cause substantial financial losses, prompting firms to seek broader and more comprehensive insurance solutions. Insurers respond by reassessing underwriting standards and updating premium structures. It forces companies to invest more in coverage that protects assets and operational continuity. The market adapts by offering tailored solutions to industries exposed to environmental volatility.

Changing Workforce Models and Liability Risks Impact Policy Design and Pricing

The shift to hybrid and remote work environments alters traditional liability structures. The Commercial Insurance Market must address new challenges related to employee safety, equipment use, and employer responsibilities. Insurers update general liability and workers’ compensation policies to reflect these realities. It requires greater flexibility in policy terms and claims management. Businesses seek guidance on mitigating risks tied to non-traditional workplaces. The market remains responsive to the changing dynamics of labor and operational exposure.

Market Trends

Increased Use of Data Analytics and AI Enhances Underwriting and Risk Assessment

Insurers are adopting advanced technologies to improve accuracy in underwriting and pricing. Data analytics and AI provide real-time insights into risk factors and claims history, supporting better decision-making. The Commercial Insurance Market integrates these tools to streamline processes and improve customer outcomes. It allows insurers to detect fraud, reduce manual errors, and tailor coverage more effectively. Predictive modeling also helps identify emerging risks before they impact portfolios. These innovations drive operational efficiency and improve risk transparency.

Growing Demand for Customized and Industry-Specific Insurance Solutions

Businesses seek policies that align closely with their operational models and sector-specific risks. The Commercial Insurance Market responds by developing tailored products that meet the needs of industries such as logistics, healthcare, and technology. It reflects a broader shift from one-size-fits-all policies to modular and flexible offerings. Brokers and carriers now collaborate more closely with clients to identify coverage gaps. Demand rises for endorsements and add-ons that support specialized activities. This trend reinforces the need for adaptability in policy development.

- For instance, Marsh LLC implemented a data-driven solution that analyzed over 2,500 industry-specific risk factors across 1,200 clients.

Expansion of Cyber Insurance Reflects Rising Digital Exposure Across Sectors

With businesses becoming more reliant on digital infrastructure, cyber insurance gains greater relevance. The Commercial Insurance Market sees rapid growth in demand for policies that cover data breaches, system outages, and cyber extortion. It pushes insurers to expand coverage terms and increase policy limits. Risk managers place more emphasis on digital safeguards when evaluating insurance needs. Cybersecurity audits and compliance requirements now play a larger role in underwriting. The market aligns its offerings with evolving threat landscapes.

- For instance, Zurich’s Cyber Risk team responded to over 1,200 cyber incidents globally in the past year, coordinating real-time support for affected clients.

Focus on ESG Considerations Shapes Product Development and Investment Strategy

Environmental, Social, and Governance (ESG) criteria increasingly influence underwriting decisions and investment practices. The Commercial Insurance Market incorporates ESG metrics into risk evaluation and portfolio management. It prompts insurers to support clients with sustainability-focused products and advisory services. Coverage for green buildings, renewable energy projects, and ethical supply chains gains traction. Insurers also assess their own ESG impact, shaping long-term strategies. The trend reflects rising stakeholder expectations around responsible business practices.

Market Challenges Analysis

Rising Claims Costs and Loss Ratios Put Pressure on Profitability Across the Industry

Escalating claims costs challenge the financial stability of insurers across multiple lines. The Commercial Insurance Market faces increasing payouts driven by inflation, supply chain disruptions, and higher repair or replacement costs. It affects pricing strategies and forces underwriters to reassess risk appetite and policy terms. Long-tail liabilities, especially in casualty and professional lines, create further uncertainty around reserve adequacy. Insurers must strike a balance between competitive pricing and sustainable margins. The need for more accurate forecasting and tighter claims management grows stronger under these conditions.

Regulatory Complexity and Global Instability Disrupt Strategic Planning and Compliance

Changing regulatory requirements across jurisdictions complicate compliance and product standardization. The Commercial Insurance Market must navigate evolving rules related to data privacy, environmental risk, and corporate governance. It limits the speed at which insurers can launch or adapt offerings in global markets. Political instability and economic uncertainty further complicate strategic planning and capital allocation. Insurers need agile operating models to respond quickly to regulatory and geopolitical shifts. Compliance teams face increased pressure to ensure risk exposure remains aligned with legal obligations.

Market Opportunities

Emerging Risks and New Business Models Create Demand for Innovative Insurance Solutions

The growth of digital platforms, green energy, and decentralized operations opens new frontiers for insurers. The Commercial Insurance Market can capitalize on unmet needs by developing products that address non-traditional risks. It includes coverage for gig economy workers, renewable energy infrastructure, and digital assets. Companies entering new markets or adopting agile models require flexible, responsive insurance support. Insurers that invest in product innovation and sector-specific knowledge can capture long-term value. This shift rewards adaptability and deeper engagement with clients’ evolving business models.

Technological Advancements Enable Scalable Solutions and Better Customer Experiences

Advanced technologies such as automation, IoT, and blockchain allow insurers to enhance service delivery and operational efficiency. The Commercial Insurance Market benefits from tools that reduce costs, improve underwriting precision, and accelerate claims processing. It opens opportunities to serve small and mid-sized enterprises with more accessible, streamlined products. Digital platforms also improve broker and client engagement through real-time data and analytics. Insurers can use these capabilities to deliver value-added services and proactive risk management support. The opportunity lies in combining efficiency with personalization at scale.

Market Segmentation Analysis:

By Type

The Commercial Insurance Market is segmented by type into liability insurance, commercial motor insurance, commercial property insurance, and marine insurance. Liability insurance leads due to growing legal exposures and stricter compliance standards across industries. Commercial property insurance sees strong demand as businesses protect physical assets from fire, theft, and natural disasters. Commercial motor insurance remains essential for transportation, logistics, and fleet-based operations. Marine insurance supports global trade by covering risks related to cargo, shipping, and port operations. Each segment addresses specific risk profiles, requiring insurers to maintain a broad and adaptable portfolio.

- For instance, Chubb Limited processed 220,000 liability claims globally last year, leveraging an AI-driven system that saved 30,000 hours in claims processing time.

By Enterprise Size

Large enterprises account for the majority share due to their complex risk exposure, global operations, and high asset values. The Commercial Insurance Market serves this segment with tailored products, high-limit policies, and dedicated risk management support. These organizations often engage directly with brokers to structure multi-line coverage across regions. Small and medium-sized enterprises (SMEs) present growing potential, particularly in emerging markets. SMEs demand affordable, easy-to-understand insurance solutions that align with their limited resources. It drives insurers to offer simplified underwriting, bundled products, and more accessible digital platforms.

- For instance, Aon Plc deployed a risk management platform that analyzed data from over 5,000 multinational clients, reducing risk assessment turnaround time by 18,000 hours annually.

By Distribution Channel

Agents and brokers dominate distribution, especially for large businesses with complex coverage needs. Their advisory role and ability to negotiate terms provide value that self-service models cannot fully replace. Direct response channels are expanding, supported by digital tools and rising demand from tech-savvy SMEs. The Commercial Insurance Market leverages these platforms to offer fast quotes, instant policy issuance, and lower distribution costs. It reflects a shift toward hybrid models where personal advice and digital convenience coexist. Insurers must optimize both channels to stay competitive and meet diverse buyer preferences.

Segments:

Based on Type:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

Based on Enterprise Size:

Based on Distribution Channel:

- Agents

- Brokers

- Direct Response

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share in the global commercial insurance market, accounting for approximately 38% to 40%. The region benefits from a mature insurance ecosystem, high corporate awareness of risk, and well-established regulatory structures. The United States remains the dominant market, driven by complex liability exposures, high-value commercial assets, and extensive cyber risk coverage requirements. Canada also contributes significantly, with growing demand for property and environmental liability coverage. Insurers in this region leverage advanced technologies, such as AI and predictive analytics, to enhance underwriting, pricing, and claims processing. It maintains its leadership through continuous product innovation, robust broker networks, and the ability to service a wide range of industries with customized solutions.

Europe

Europe represents the second-largest regional segment, contributing between 20% and 27% of the global market share. The region includes key markets such as the United Kingdom, Germany, and France, all of which demonstrate strong demand for commercial insurance driven by regulatory compliance, corporate governance, and cross-border operations. The UK market, particularly through the London insurance and reinsurance hub, plays a central role in serving international and specialty lines. Strict regulatory standards under frameworks such as Solvency II encourage disciplined underwriting and capital management. It positions Europe as a center for innovation in ESG-linked policies, professional indemnity, and specialty risk transfer. Market players prioritize sustainability, digital transformation, and tailored risk advisory to strengthen their regional presence.

Asia-Pacific

Asia-Pacific holds an estimated 24% to 25% share of the global commercial insurance market and remains the fastest-growing region. Countries such as China, India, Japan, and Australia are key contributors, supported by rapid industrialization, infrastructure expansion, and increasing insurance awareness. SMEs in this region are beginning to recognize the importance of business continuity planning and financial protection. Regulatory reforms across several Asia-Pacific nations have improved transparency and encouraged greater insurance adoption. It creates strong opportunities for insurers offering scalable and tech-enabled solutions. Multinational carriers and local firms invest in digital platforms, risk education, and diversified product lines to meet the needs of a dynamic and evolving business environment.

Latin America

Latin America contributes roughly 7% to the global commercial insurance market. Brazil and Mexico lead in terms of premium volume, supported by growing commercial activity and investments in infrastructure, energy, and transportation. It presents opportunities for property, casualty, and construction insurance. However, insurers in this region face challenges such as economic volatility, inflation, and regulatory inconsistency. Firms that offer localized underwriting, responsive claims services, and competitive pricing can achieve sustainable growth. The region’s growing SME sector also creates long-term potential for simplified and affordable insurance solutions.

Middle East & Africa

The Middle East & Africa region accounts for approximately 8% to 11% of the global commercial insurance market. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa drive growth through investments in real estate, oil and gas, and infrastructure. Governments increasingly promote insurance adoption through public-private partnerships and regulatory modernization. It fuels demand for liability, engineering, and marine insurance. Despite regional economic disparities, insurers targeting specific industries and offering risk advisory services gain a competitive edge. Long-term growth depends on continued regulatory alignment, financial literacy, and insurance market liberalization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Marsh LLC

- Direct Line Insurance Group PLC

- American International Group Inc.

- Aon Plc

- Aviva

- Zurich

- AXA

- Chubb Limited

- Allianz

- Willis Towers Watson

Competitive Analysis

The Commercial Insurance Market include Zurich, AXA, Chubb Limited, Aon Plc, Marsh LLC, Willis Towers Watson, Direct Line Insurance Group PLC, Allianz, American International Group Inc., and Aviva. The commercial insurance market operates within a highly competitive environment characterized by rapid innovation, evolving customer demands, and complex risk landscapes. Insurers continuously enhance their underwriting capabilities by leveraging advanced data analytics, artificial intelligence, and automation to improve risk assessment and pricing accuracy. The market also faces mounting challenges from increasing frequency of natural disasters, cyber threats, and regulatory compliance requirements, which compel companies to develop more comprehensive and flexible coverage solutions. Digital transformation plays a critical role in streamlining distribution channels and improving customer engagement through real-time policy management and claims processing. Firms prioritize developing industry-specific products tailored to the unique risks of sectors such as construction, manufacturing, healthcare, and technology. To sustain growth, many companies pursue strategic partnerships, mergers, and geographic expansion into emerging markets where insurance penetration remains relatively low but demand is rising. Additionally, the integration of Environmental, Social, and Governance (ESG) criteria into underwriting processes and investment strategies reflects growing stakeholder expectations for responsible business practices.

Recent Developments

- In July 2025, Global commercial insurance rates declined 4% in Q2 2025, marking the fourth consecutive quarterly drop after years of increases. Marsh enhanced insurer competition, more favorable pricing and coverage options, and increased of alternative risk-financing solutions (like captives and parametric coverage).

- In July 2025, Aviva completed its acquisition of Direct Line Insurance Group, further cementing its leadership in the UK commercial insurance market and expanding its customer reach and product set.

- In June 2025, its Investor Day, Aon reaffirmed its guidance for double-digit free cash flow CAGR through 2026 and sustained organic revenue and dividend growth, by global demand for risk consulting and commercial risk solutions.

- In March 2025, Direct Line Group reported successful progress in its turnaround strategy, delivering a £395M increase in ongoing operating profit for 2024 and significantly improving its net insurance margin.

Market Concentration & Characteristics

The Commercial Insurance Market exhibits a moderate to high level of concentration, dominated by several global insurers and brokers with extensive networks and diversified portfolios. Market leaders hold significant shares due to their strong brand recognition, financial strength, and ability to offer tailored solutions across multiple industry sectors. It fosters competitive dynamics where innovation in product development, technology adoption, and risk management capabilities determine market positioning. The presence of well-established players creates high entry barriers for smaller firms, which often focus on niche segments or regional markets to maintain relevance. Distribution channels remain a critical factor, with agents, brokers, and digital platforms playing complementary roles in reaching diverse customer bases. The market’s characteristics include increasing complexity of risks, especially in cyber, environmental liability, and emerging industries, requiring sophisticated underwriting expertise. Regulatory frameworks across regions influence product design and capital requirements, driving consistency in global risk standards while allowing localized adaptation. The demand for customized policies and value-added advisory services further shapes competitive strategies. Overall, the Commercial Insurance Market balances concentration with innovation and client-centric approaches to address evolving risk landscapes and maintain long-term growth.

Report Coverage

The research report offers an in-depth analysis based on Type, Enterprise Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Commercial Insurance Market will experience steady growth driven by rising business risks and regulatory requirements.

- Insurers will increasingly adopt digital technologies to improve underwriting accuracy and customer service.

- Cybersecurity coverage will expand rapidly due to growing cyber threats and data breaches.

- Demand for sustainable and ESG-compliant insurance products will gain momentum across industries.

- Emerging markets will offer significant opportunities as insurance penetration improves.

- Insurers will focus on personalized, industry-specific solutions to meet complex client needs.

- Automation and AI will streamline claims processing and reduce operational costs.

- Collaboration between insurers, brokers, and technology providers will strengthen to enhance product innovation.

- Regulatory changes will continue to influence market dynamics, requiring agile compliance strategies.

- Insurers will invest in advanced risk modelling to better manage emerging and systemic risks.