Market Overview:

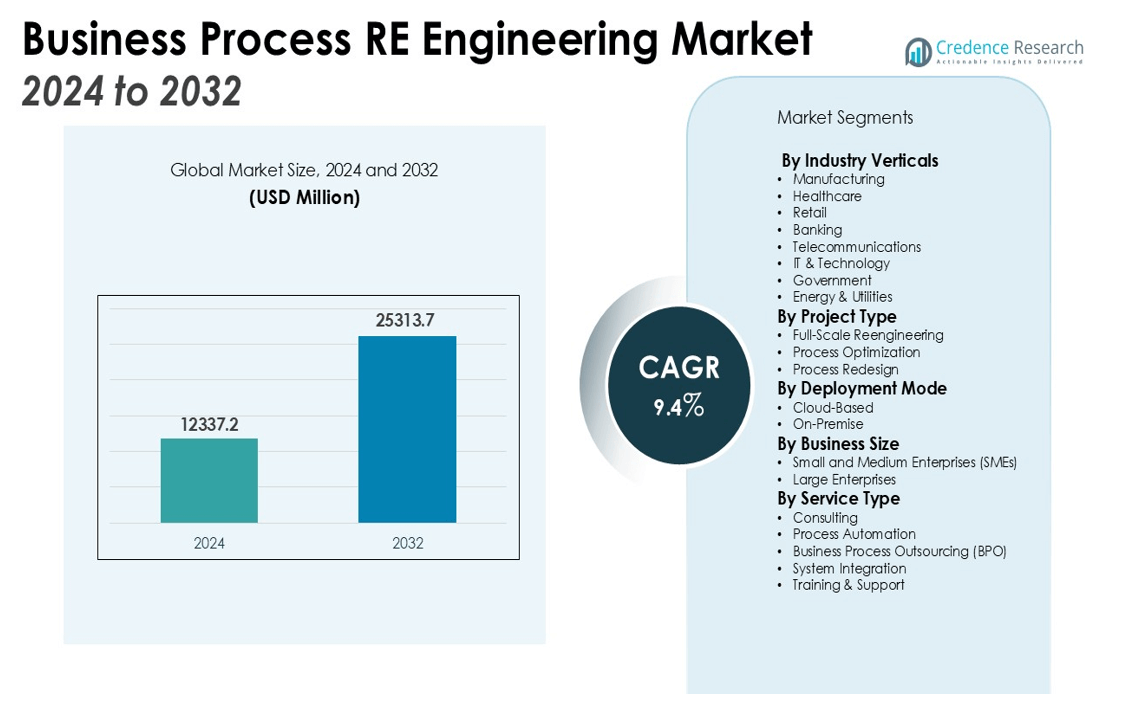

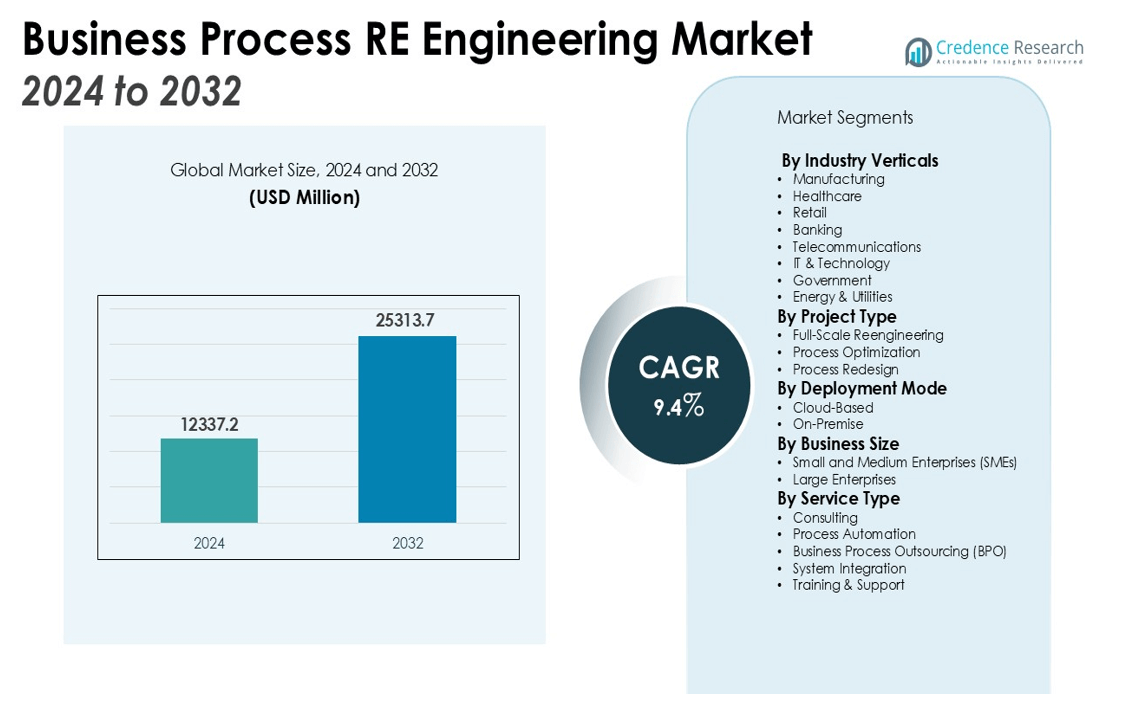

The Business Process RE Engineering Market size was valued at in 2024 and is anticipated to reach USD 25313.7 million by 2032, at a CAGR of 9.4% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Business Process RE Engineering Market Size 2024 |

USD 12337.2 million |

| Business Process RE Engineering Market, CAGR |

9.4% |

| Business Process RE Engineering Market Size 2032 |

USD 25313.7 million |

The key drivers of the BPR market include the growing adoption of digital transformation initiatives, the increasing focus on automation and AI-driven solutions, and the need to optimize workflows to reduce operational costs. Additionally, the rise in competitive pressures across industries has led companies to invest in reengineering processes to achieve greater productivity, agility, and innovation. The ongoing shift towards cloud-based solutions and the integration of data analytics are further fueling market growth.

Regionally, North America holds the largest market share, driven by advanced IT infrastructure, high investments in digitalization, and a large presence of BPR solution providers. The demand for BPR in this region is further strengthened by the increasing adoption of Industry 4.0 technologies across sectors such as healthcare, finance, and manufacturing. Europe follows with significant demand driven by the manufacturing and service sectors, while the Asia-Pacific region is expected to exhibit the highest growth rate. This growth is attributed to rapid industrialization, increasing technological adoption, and a growing number of small- and medium-sized enterprises (SMEs) looking to optimize their operations in emerging economies like India and China.

Market Insights:

- The Business Process Reengineering (BPR) market is valued at USD 12,337.2 million in 2024 and is expected to reach USD 25,313.7 million by 2032, growing at a CAGR of 9.4% during the forecast period.

- Digital transformation initiatives drive the BPR market, with businesses adopting cloud, big data, and IoT technologies to improve operational efficiency and customer experiences.

- AI and automation solutions are key drivers, enabling businesses to automate tasks, reduce errors, and enhance decision-making, fueling demand for BPR solutions.

- Competitive pressures push companies to adopt BPR strategies, optimizing workflows and increasing customer satisfaction, which supports innovation and productivity.

- The growing adoption of cloud-based solutions drives the BPR market by offering scalability, cost reduction, and improved collaboration across businesses.

- North America leads the BPR market with a 40% share, supported by advanced digital infrastructure, high investments in digitalization, and AI adoption in sectors like healthcare and finance.

- Europe holds a 30% market share, with demand from manufacturing and service sectors, driven by increasing digitalization and regulatory compliance needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Adoption of Digital Transformation Initiatives

The Business Process Reengineering (BPR) market is significantly driven by the increasing shift towards digital transformation across various industries. Companies are embracing digital tools to streamline operations, enhance customer experiences, and reduce operational costs. The integration of advanced technologies such as cloud computing, big data, and IoT plays a key role in enabling this transformation. BPR solutions help organizations restructure their processes to align with digital platforms, improving efficiency and fostering innovation.

- For instance, Water Corporation’s migration to a cloud-based infrastructure, managed by IBM Consulting, resulted in a reduction of its carbon emissions by approximately 150 metric tons each year.

Focus on Automation and Artificial Intelligence (AI)

Automation and AI-driven solutions are central to the growth of the BPR market. Organizations aim to automate repetitive tasks, reduce manual errors, and enhance decision-making processes with AI. These technologies enable businesses to optimize workflows and create more adaptive, scalable systems. As automation continues to evolve, companies increasingly rely on BPR strategies to integrate these solutions into their operations, thus accelerating their digital transformation journey.

- For instance, the banking firm JPMorgan Chase implemented an AI program to automate the review of commercial loan agreements, saving the company over 360,000 work hours annually.

Pressure to Enhance Productivity and Innovation

Competitive pressures in today’s fast-paced business environment push organizations to reengineer their processes continuously. Companies are adopting BPR to improve productivity and agility in response to market demands. This shift toward process optimization allows businesses to stay ahead by enhancing product offerings, improving customer satisfaction, and achieving faster time-to-market. Companies with effective BPR implementations can realize substantial cost savings, enabling them to reinvest in innovative solutions.

Increasing Investment in Cloud-Based Solutions

The growing trend toward cloud adoption is another important driver for the Business Process Reengineering market. Cloud technologies enable organizations to scale their operations, reduce infrastructure costs, and improve collaboration across geographies. As businesses migrate to cloud platforms, BPR solutions are integrated to ensure seamless workflow automation and process optimization. This shift to cloud-based models is crucial for businesses looking to modernize their operations and align with the demands of a rapidly evolving market.

Market Trends:

Integration of Advanced Technologies in Business Process Reengineering

One of the key trends shaping the Business Process Reengineering (BPR) market is the integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA). These technologies allow organizations to automate complex processes, improve decision-making, and optimize workflows in real-time. The increasing adoption of AI and ML-driven solutions helps businesses analyze large data sets, identify inefficiencies, and make data-driven decisions for process optimization. Businesses are increasingly relying on these technologies to enhance customer experiences, improve operational efficiency, and foster innovation, all of which drive the BPR market growth.

- For instance, IBM successfully infused AI into its Enterprise Contract Lifecycle Management to automate and streamline workflows. This initiative delivered yearly productivity savings of $9M.

Shift Toward Cloud-Based Business Process Reengineering Solutions

Cloud adoption is another significant trend impacting the BPR market. Organizations are shifting to cloud-based platforms for their business operations to lower costs and increase scalability. Cloud-based solutions offer flexibility, allowing companies to streamline their operations without the burden of maintaining on-premise infrastructure. These solutions also provide enhanced collaboration features and real-time access to data, making them critical for BPR implementations. The shift towards cloud infrastructure is a growing trend, especially among small and medium-sized enterprises (SMEs) that require cost-effective, scalable, and easy-to-implement solutions. This trend is expected to continue to fuel the demand for Business Process Reengineering solutions, as businesses strive to optimize their operations with modern, flexible platforms.

- For instance, IBM Credit Corp. reduced its credit application processing time from six days to two weeks down to 90 minutes, enabling them to handle a hundredfold greater volume of credit applications without increasing staff after reengineering their process.

Market Challenges Analysis:

Resistance to Change and Organizational Inertia

One of the primary challenges in the Business Process Reengineering (BPR) market is organizational resistance to change. Many companies are reluctant to overhaul their existing processes due to the perceived complexity and disruption that comes with reengineering. Employees and management may be hesitant to adopt new technologies or methodologies, fearing that it will disrupt current workflows and lead to temporary productivity losses. This resistance often slows down the implementation of BPR strategies and can hinder the overall success of process optimization efforts.

Integration and Compatibility Issues with Existing Systems

Another significant challenge in the BPR market is the difficulty of integrating new solutions with existing IT infrastructure. Legacy systems often lack the flexibility to accommodate modern BPR solutions, which can cause delays and increase costs during the implementation phase. Ensuring compatibility between new and old technologies requires significant investment in time and resources. Companies may face challenges in aligning BPR strategies with their current systems, impacting the overall effectiveness and efficiency of the reengineering process. These integration issues can lead to fragmented workflows and reduced ROI on BPR investments.

Market Opportunities:

Expansion in Emerging Markets and Small and Medium Enterprises (SMEs)

A significant opportunity for growth in the Business Process Reengineering (BPR) market lies in emerging economies, where businesses are increasingly seeking to optimize their processes. As industries in countries such as India, China, and Brazil continue to expand, the demand for BPR solutions is expected to rise. Small and medium-sized enterprises (SMEs) in these regions are also adopting BPR strategies to enhance their efficiency, reduce costs, and remain competitive. The growing digitalization trend in these markets presents a considerable opportunity for BPR solution providers to tailor their offerings to local business needs, driving market penetration and expansion.

Integration of Artificial Intelligence and Automation Technologies

The integration of AI and automation into BPR processes presents a significant opportunity for market growth. These technologies enable businesses to streamline operations, improve decision-making, and achieve greater efficiency. AI-powered tools can help businesses optimize workflows, reduce human errors, and enhance customer experiences, further driving the demand for BPR solutions. Companies that incorporate AI and automation into their BPR strategies stand to benefit from improved productivity and competitiveness. This technological shift is expected to create numerous opportunities for innovation and advancement in the BPR market, particularly in sectors such as healthcare, finance, and manufacturing.

Market Segmentation Analysis:

By Industry Verticals

The Business Process Reengineering (BPR) market is segmented by industry verticals, with significant demand from sectors such as manufacturing, healthcare, retail, and banking. The manufacturing industry leads the segment, driven by the need for process optimization, cost reduction, and enhanced operational efficiency. Healthcare organizations adopt BPR to streamline patient care processes, reduce costs, and meet regulatory requirements. Retailers use BPR to improve supply chain management and customer service. The banking sector applies BPR to enhance transaction efficiency, compliance, and customer experiences. The diverse applications across these industries contribute to the market’s expansion.

- For instance, IBM Credit Corporation reengineered its credit approval process, reducing the turnaround time for applications from between six days and two weeks to less than four hours.

By Project Type

The Business Process Reengineering market is also segmented by project type, including full-scale reengineering, process optimization, and process redesign. Full-scale reengineering involves complete overhauls of existing processes to achieve transformational improvements in performance. Process optimization focuses on fine-tuning existing processes to enhance efficiency, while process redesign addresses specific aspects of workflows to improve productivity. Organizations select these project types based on their specific needs, driving demand for tailored BPR solutions across various industries.

- For instance, General Electric’s adoption of Six Sigma for process optimization resulted in the company gaining $700 million in corporate benefits just two years after implementation.

By Deployment Mode

Deployment mode is another crucial segment in the BPR market, with cloud-based and on-premise solutions being the primary options. Cloud-based deployment is gaining popularity due to its scalability, lower upfront costs, and ease of integration with other digital tools. On-premise deployment remains preferred by organizations with strict data privacy requirements or those seeking full control over their systems. As businesses continue to prioritize flexibility and cost-efficiency, cloud-based deployment is expected to dominate the market, contributing to the overall growth of the Business Process Reengineering market.

Segmentations:

By Industry Verticals:

- Manufacturing

- Healthcare

- Retail

- Banking

- Telecommunications

- IT & Technology

- Government

- Energy & Utilities

By Project Type:

- Full-Scale Reengineering

- Process Optimization

- Process Redesign

By Deployment Mode:

By Business Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Service Type:

- Consulting

- Process Automation

- Business Process Outsourcing (BPO)

- System Integration

- Training & Support

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Market Dominance Driven by Strong Digital Infrastructure

North America holds a dominant share of 40% in the Business Process Reengineering (BPR) market, driven by advanced IT infrastructure and a strong presence of leading solution providers. The region’s well-established business environment, coupled with high investments in digital transformation, fuels the demand for BPR solutions. The United States, in particular, leads in sectors such as healthcare, finance, and manufacturing, where businesses are adopting BPR strategies to improve operational efficiency and drive innovation. The ongoing trend towards automation and AI-driven processes further supports market growth in this region.

Europe: Demand Driven by Manufacturing and Services Sectors

Europe accounts for 30% of the BPR market share, primarily driven by demand from the manufacturing and service industries. Countries like Germany, the UK, and France experience growing digitalization initiatives as companies aim to optimize their operations and reduce costs. Regulatory pressures related to data privacy and environmental standards further encourage businesses to reengineer their processes to remain compliant. Europe’s focus on sustainable practices and efficiency has contributed to steady growth in the BPR market, with increasing adoption across multiple sectors.

Asia-Pacific: High Growth Potential Due to Industrialization and Technology Adoption

The Asia-Pacific region captures 25% of the BPR market share and is expected to exhibit the highest growth rate. Rapid industrialization and the increasing adoption of advanced technologies such as AI and automation are driving this growth. Countries like India, China, and Southeast Asia are heavily investing in digital transformation, driving demand for BPR solutions. Small and medium-sized enterprises (SMEs) in these regions are also looking to optimize processes and improve efficiency, contributing to the growing BPR market share. As the region continues to expand economically, the demand for BPR solutions is expected to rise substantially.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Software AG

- Capgemini

- Accenture

- Blueprint

- IBM Corporation

- TIBCO Software

- Oracle Corporation

- Pegasystems Inc

- Fujitsu Ltd

- Selerant Corporation

- The Hackett Group

- Appian Corporation

Competitive Analysis:

The Business Process Reengineering (BPR) market is highly competitive, with key players focusing on offering advanced solutions that drive operational efficiency and process optimization. Leading companies such as Accenture, IBM, and Deloitte are adopting AI and automation technologies to enhance BPR processes, helping organizations streamline workflows and reduce operational costs. These companies emphasize providing end-to-end solutions, from consulting to implementation, to meet the diverse needs of industries such as healthcare, finance, and manufacturing. New entrants are also capitalizing on the growing demand for cloud-based BPR solutions, offering scalable and cost-effective services. With digital transformation initiatives accelerating globally, competition is expected to intensify as organizations seek partners capable of integrating cutting-edge technologies like IoT, big data, and advanced analytics into BPR strategies. The market is witnessing increasing investments in R&D to drive innovation and provide tailored solutions for different business verticals.

Recent Developments:

- In June 2025, Accenture announced expanded support for high-potential AI startups with a new engagement.

- In August 2025, The Hackett Group announced a collaboration with Celonis, a leader in process mining, to deliver intelligent enterprise automation by combining Celonis’ process intelligence with The Hackett Group’s AI XPLR™ and ZBrain™ platforms.

- In June 2025, Blueprint Technologies announced a strategic partnership with Sigma, an analytics platform, to accelerate data-driven innovation within the Databricks ecosystem.

Market Concentration & Characteristics:

The Business Process Reengineering (BPR) market exhibits moderate concentration, with a mix of established players and emerging companies offering specialized solutions. Leading players like Accenture, IBM, and Deloitte hold significant market shares due to their broad service offerings, strong brand recognition, and extensive global reach. These companies focus on providing end-to-end BPR services, integrating AI, automation, and cloud-based solutions to drive efficiency. Smaller, niche players are gaining traction by offering customized solutions tailored to specific industries or smaller enterprises. The market is characterized by rapid technological advancements, with companies continuously innovating to meet the growing demand for digital transformation and process optimization. As more organizations adopt BPR strategies, the competition is expected to intensify, with an increasing emphasis on providing scalable, cost-effective, and flexible solutions to meet diverse business needs.

Report Coverage:

The research report offers an in-depth analysis based on Industry Verticals, Project Type, Deployment Mode, Business Size, Service Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for Business Process Reengineering (BPR) solutions is expected to grow as companies increasingly adopt digital transformation strategies to stay competitive.

- Automation, AI, and machine learning will play a significant role in reshaping BPR processes, offering enhanced decision-making and workflow optimization.

- Cloud-based BPR solutions will continue to dominate, offering scalability, flexibility, and cost-efficiency for businesses of all sizes.

- Small and medium-sized enterprises (SMEs) will increasingly adopt BPR strategies to optimize their operations and compete with larger players in the market.

- Industry-specific BPR solutions will become more prevalent, with providers offering tailored solutions for sectors like healthcare, retail, and manufacturing.

- The integration of big data and analytics will drive future BPR innovations, helping organizations gain deeper insights into their operations and improve decision-making.

- Companies will place greater emphasis on customer-centric process reengineering, enhancing customer experiences and improving satisfaction.

- BPR adoption will expand in emerging economies as industries like IT, finance, and manufacturing undergo rapid digitalization.

- Regulatory compliance and sustainability efforts will drive the need for BPR solutions that align with evolving legal and environmental standards.

- Future BPR strategies will focus on agile, adaptive processes that support rapid market changes and enable organizations to respond quickly to customer needs and industry shifts.