Market Overview

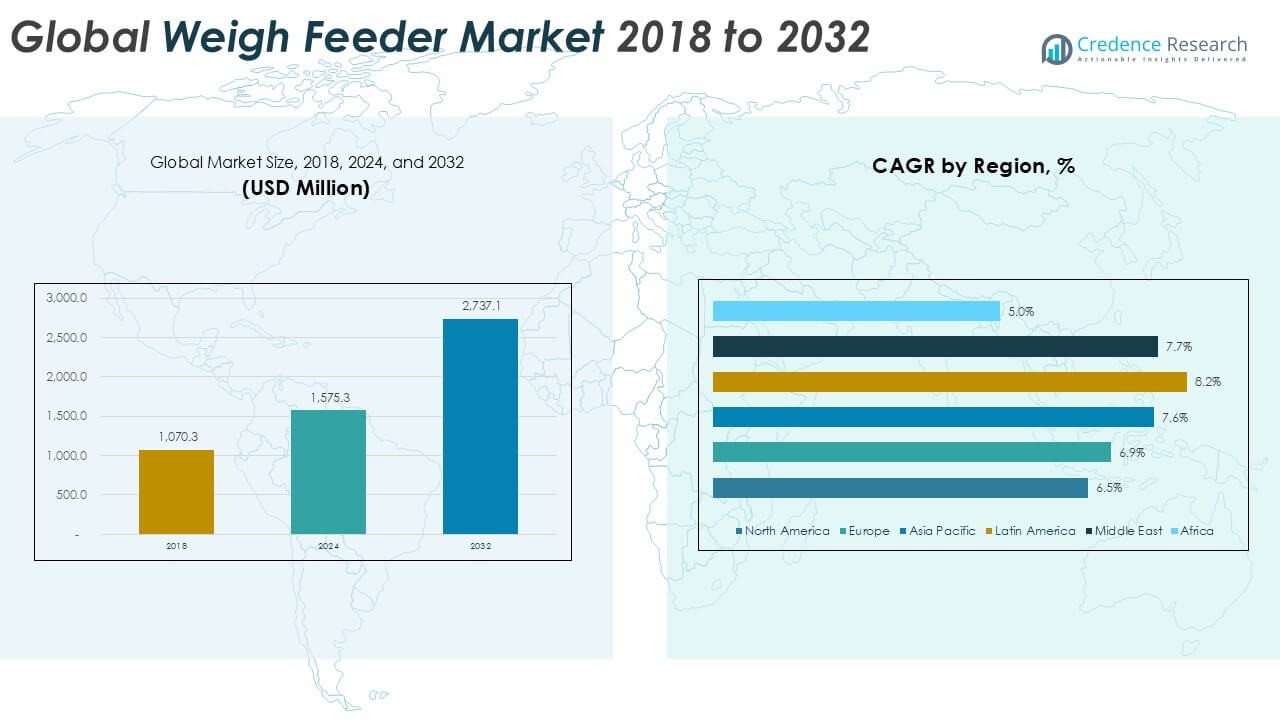

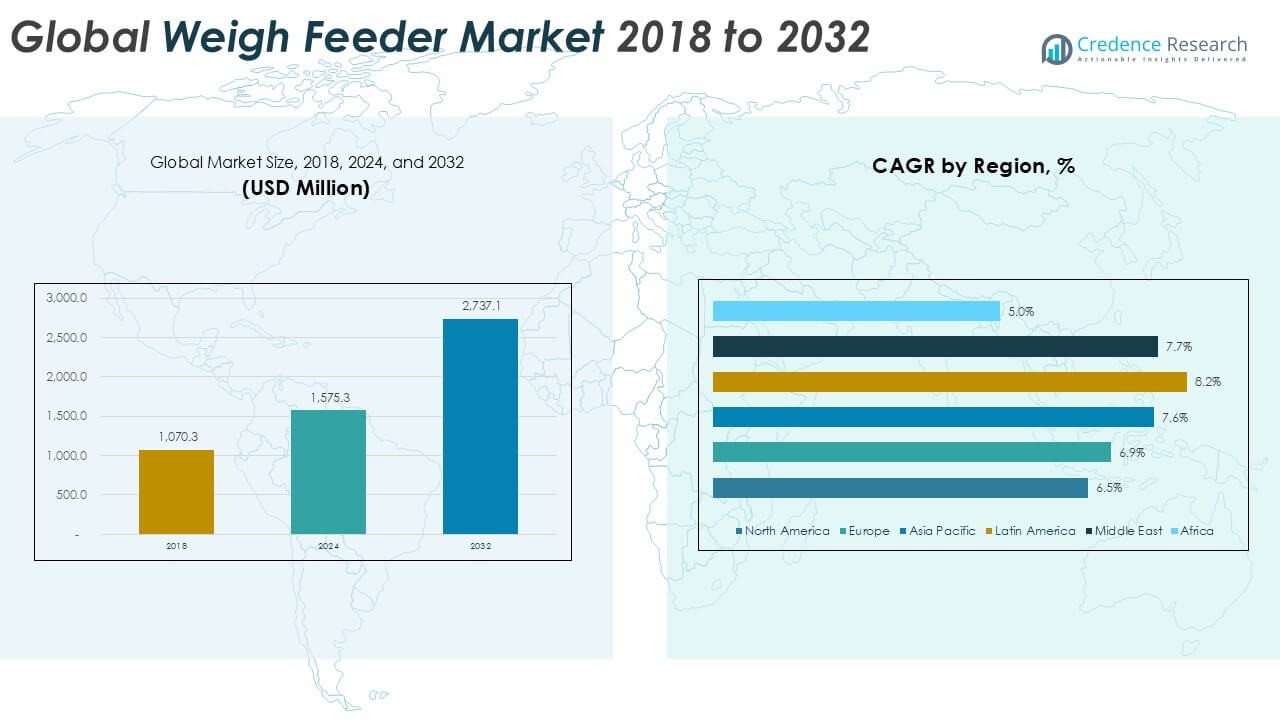

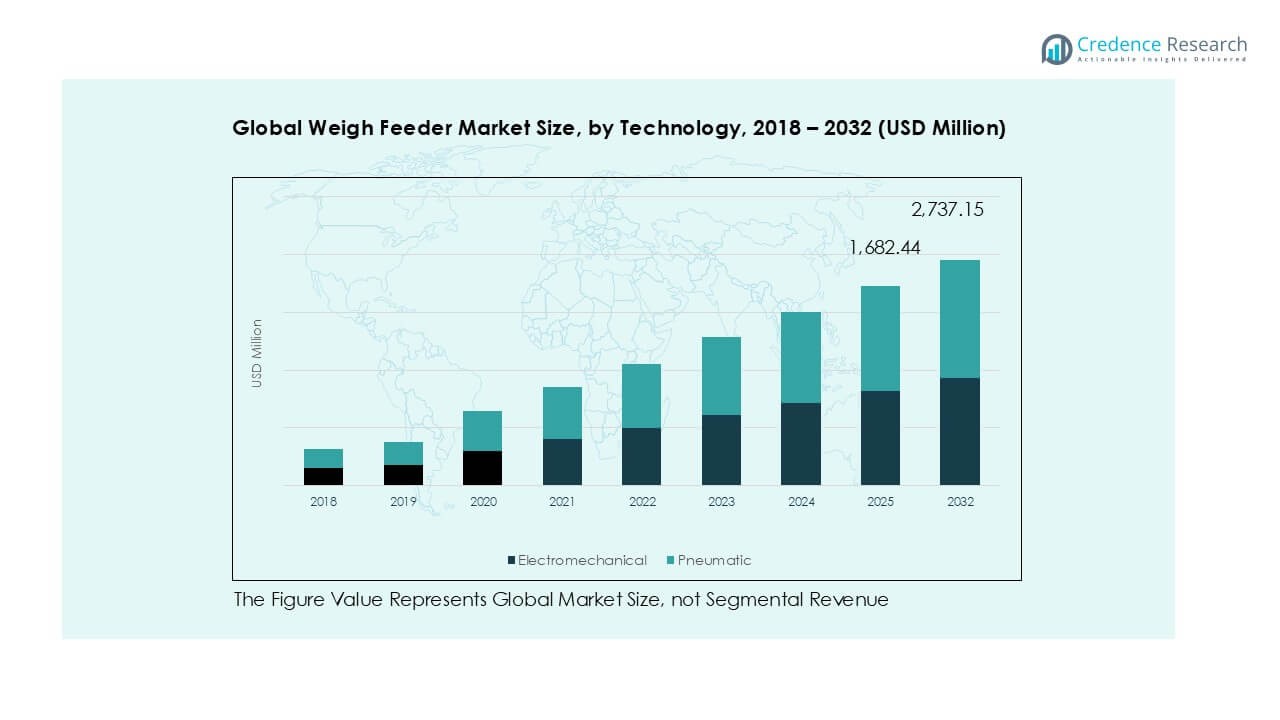

Global Weigh Feeder market size was valued at USD 1,070.3 million in 2018, reaching USD 1,575.3 million in 2024, and is anticipated to reach USD 2,737.1 million by 2032, at a CAGR of 7.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Weigh Feeder Market Size 2024 |

USD 1,575.3 Million |

| Weigh Feeder Market, CAGR |

7.20% |

| Weigh Feeder Market Size 2032 |

USD 2,737.1 Million |

The global weigh feeder market is led by established players such as Schenck Process Holding GmbH, Siemens AG, MTS Systems Corporation, Yamato Scale Co., Ltd., and Avery Weigh-Tronix LLC, who maintain strong positions through advanced product portfolios and global networks. Companies like Metso Corporation, Eastern Instruments, Acrison, Inc., and Saimo Technology Co., Ltd. further strengthen the market with specialized and cost-effective solutions. Regionally, Asia Pacific dominated the market with 35% share in 2024, driven by large-scale cement production, mining expansion, and industrial automation in China and India. Europe followed with a 27% share, supported by stringent regulations and advanced manufacturing infrastructure, while North America accounted for 21%, benefiting from strong automation adoption across industrial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global weigh feeder market was valued at USD 1,575.3 million in 2024 and is projected to reach USD 2,737.1 million by 2032, registering a CAGR of 7.20% during the forecast period.

- Rising demand from cement and mining industries is a major growth driver, with cement alone contributing over 30% share in 2024, supported by large-scale infrastructure projects and energy efficiency needs.

- A key trend is the integration of IoT and smart sensors in electromechanical feeders, which dominated with 65% share in 2024, offering real-time monitoring and predictive maintenance.

- The competitive landscape is marked by global leaders such as Schenck Process, Siemens AG, MTS Systems, and Yamato Scale, along with regional specialists providing tailored and cost-effective solutions.

- Regionally, Asia Pacific led with 35% share in 2024, followed by Europe at 27% and North America at 21%, while Latin America, Middle East, and Africa together contributed under 20%.

Market Segmentation Analysis:

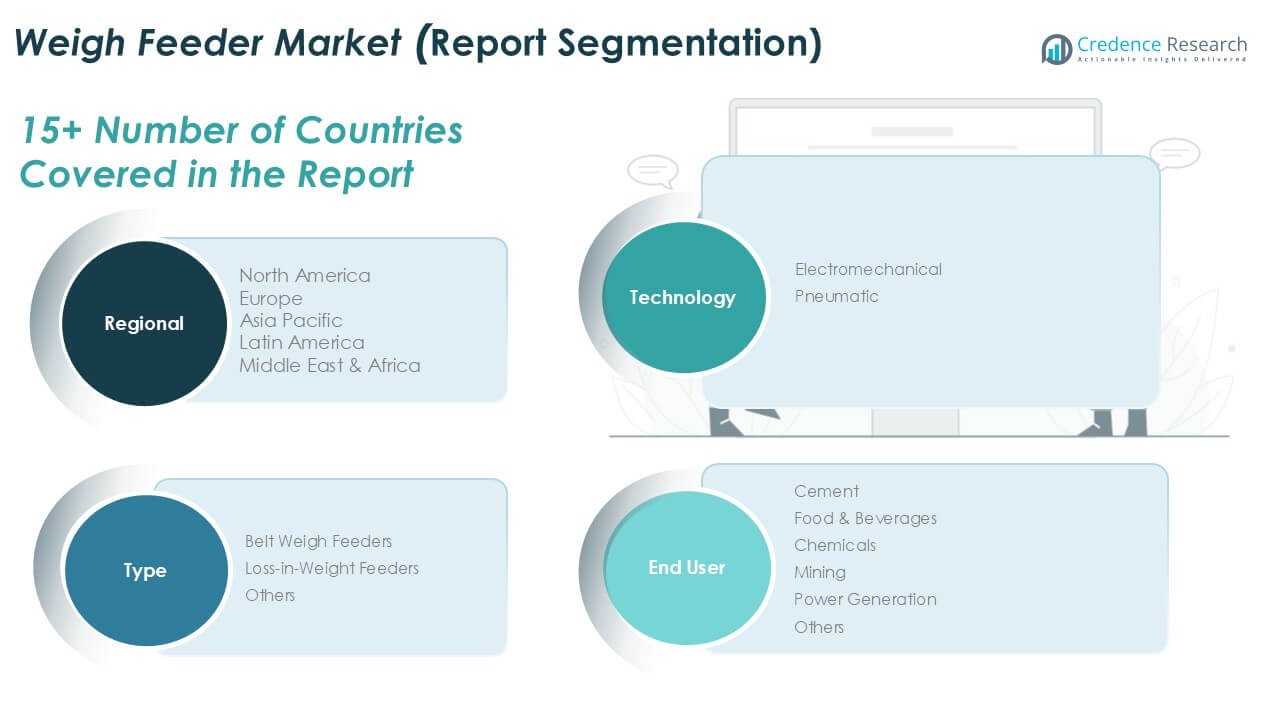

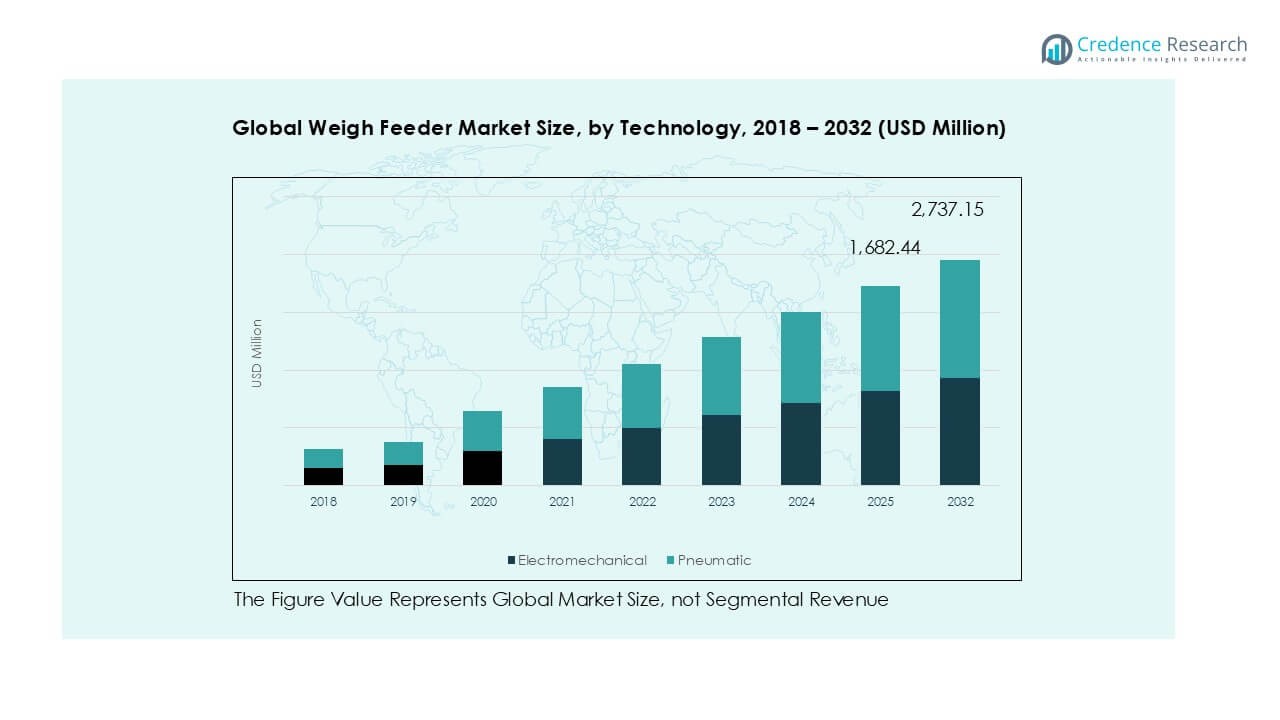

By Technology

The electromechanical segment dominated the weigh feeder market in 2024, accounting for over 65% of the total revenue share. Electromechanical feeders are widely adopted due to their high accuracy, durability, and compatibility with heavy-duty industrial operations. Industries such as cement and mining rely on these systems to ensure continuous and precise material handling. Pneumatic feeders, though holding a smaller share, are gaining traction in food and chemical applications where clean and controlled feeding is crucial. Rising automation and demand for efficiency continue to drive adoption of electromechanical feeders as the preferred technology.

- For instance, FLSmidth installed many electromechanical weigh feeders in 2023, primarily in cement plants across Europe and Asia, to ensure precision material handling in high-volume operations.

By Type

Belt weigh feeders held the leading position in the global market, capturing more than 55% share in 2024. Their dominance stems from extensive use in cement, mining, and power plants, where they provide reliable performance for bulk material handling. Belt feeders offer robust design and operational efficiency, making them ideal for large-scale installations. Loss-in-weight feeders, on the other hand, are increasingly used in food processing and chemical industries due to their precision in dosing applications. The “Others” category, including rotary and vibratory feeders, serves niche requirements across specialized industrial setups.

- For instance, Qlar Group, the company formerly known as Schenck Process, no longer has a mining business after selling that division to Sandvik AB in 2022. Today, the company, with its new branding since April 2024, provides industrial weighing and feeding solutions to industries like chemicals, energy, and infrastructure.

By End User

The cement industry emerged as the largest end-user segment in 2024, holding over 30% of the market share. High demand from large-scale cement production plants drives the use of weigh feeders to ensure accurate raw material blending and fuel feeding. The food and beverages sector is expanding rapidly with growing demand for hygienic and precise feeding systems, while the chemicals segment benefits from controlled dosing requirements. Mining and power generation industries also remain significant contributors, leveraging weigh feeders for bulk handling and continuous operations. Other end users add niche demand across varied industrial applications.

Key Growth Drivers

Rising Cement and Mining Demand

The cement and mining sectors are primary drivers of the global weigh feeder market, as both industries rely on accurate and continuous material feeding systems. In cement production, weigh feeders are critical for raw mix proportioning, kiln feeding, and fuel dosing, ensuring quality consistency and reduced material wastage. Mining applications also demand reliable feeders for transporting bulk ores and minerals with efficiency and safety. With global cement production projected to exceed 4.6 billion tons by 2032, the demand for precision equipment in large-scale plants continues to expand. Similarly, rapid growth in mining projects, driven by rising global demand for metals and minerals, is fueling adoption of high-capacity weigh feeders. Increasing investments in smart infrastructure and industrial expansion, particularly in emerging economies such as India and China, further support the integration of weigh feeders, making this segment a major growth engine for the market over the forecast period.

- For instance, FLSmidth supplies weigh feeders for cement plants, including in India and China, to improve raw mix proportioning and kiln operations.

Expansion of Food and Beverage Processing

The food and beverages industry represents another strong growth driver, as companies increasingly prioritize precision and compliance with safety standards in material handling. Weigh feeders are vital in processing lines for ingredients like flour, sugar, cereals, and additives, ensuring accurate dosing and consistent product quality. Growing demand for packaged foods, ready-to-eat meals, and processed beverages is creating large-scale opportunities for weigh feeder adoption across global markets. Rising regulatory emphasis on food safety and traceability standards is also pushing manufacturers to integrate advanced feeding solutions with automated monitoring systems. Emerging economies with expanding middle-class populations are witnessing a surge in demand for processed food, further accelerating market growth. With global food production expected to expand steadily, weigh feeders enable companies to improve efficiency, minimize waste, and maintain uniformity in production. The shift toward Industry 4.0-enabled solutions with digital monitoring in food processing facilities strengthens the role of weigh feeders as essential equipment.

- For instance, during 2023, following its acquisition of Schenck Process FPM, Coperion delivered numerous loss-in-weight feeders to global food processors, enabling the precision dosing of cereals and additives across Europe and North America.

Adoption of Automation and Industry 4.0 Solutions

Growing automation across industries is driving weigh feeder market expansion, particularly as companies embrace Industry 4.0 and digital transformation. Modern weigh feeders are now integrated with advanced control systems, IoT connectivity, and predictive maintenance features, allowing operators to monitor material flow in real time. These systems not only ensure higher accuracy but also reduce downtime and operating costs. Industries like chemicals, power generation, and food processing are deploying smart weigh feeders for precise dosing and continuous production efficiency. The rising focus on digital monitoring, energy efficiency, and predictive analytics is further pushing manufacturers to upgrade existing feeding systems. Additionally, government initiatives supporting industrial automation in developed and developing markets are fostering adoption. The trend aligns with increasing global demand for efficient and sustainable production processes, where weigh feeders serve as vital equipment to achieve consistent material handling, reduce losses, and optimize overall plant productivity in the long term.

Key Trends & Opportunities

Integration of Smart Sensors and IoT

One of the most prominent trends in the global weigh feeder market is the integration of smart sensors, IoT platforms, and advanced automation technologies. Smart weigh feeders now provide real-time data on material flow, system performance, and energy consumption, allowing operators to optimize production and reduce downtime. Predictive maintenance capabilities, enabled through sensor-based monitoring, also extend equipment lifespan and lower operational costs. Manufacturers are increasingly focusing on digital platforms to deliver integrated feeding solutions that align with smart factory requirements. This trend is opening opportunities for companies offering advanced IoT-enabled weigh feeder systems, particularly in industries with continuous and bulk material handling needs, such as cement, mining, and power generation. Rising investment in industrial IoT and digitalization, combined with the demand for operational efficiency, positions smart weigh feeders as key components of modern industrial infrastructure.

- For instance, in 2023, Schenck Process (now rebranded as Qlar) continued to integrate its weigh feeder systems with its CONiQ Cloud platform, which enables predictive maintenance and real-time optimization for operations in industries like cement and mining.

Growing Adoption in Emerging Markets

Emerging economies present a significant opportunity for weigh feeder manufacturers due to large-scale industrial expansion and infrastructure projects. Countries like India, China, and Brazil are witnessing rapid growth in cement, power, and food processing industries, driving substantial demand for accurate and efficient material handling systems. Government-backed investments in smart infrastructure, energy, and manufacturing are further fueling market penetration of weigh feeders. With industrial automation still in the growth stage in many developing regions, companies introducing cost-effective yet technologically advanced feeder solutions can gain significant market share. Additionally, rising awareness about energy-efficient equipment and stricter compliance with industrial quality standards are driving adoption. These markets provide opportunities for both global players and regional suppliers to expand their presence by offering customized solutions that meet local operational and economic requirements. The growing shift toward sustainable production and demand for automated systems strengthens the long-term potential in these regions.

Key Challenges

High Initial Investment and Maintenance Costs

One of the major challenges restraining the weigh feeder market is the high upfront investment and maintenance costs associated with advanced feeding systems. Small and medium-sized enterprises (SMEs), particularly in emerging markets, often find it difficult to justify the cost of modern weigh feeders compared to conventional alternatives. Installation of IoT-enabled and automated weigh feeders also requires skilled labor and additional infrastructure, adding to operational expenses. Regular calibration and maintenance are necessary to ensure accuracy, which can further increase costs over time. These financial constraints limit adoption in price-sensitive industries and regions. As a result, cost barriers slow down market penetration among smaller players and regional manufacturers, despite the long-term efficiency benefits weigh feeders provide. Addressing this challenge requires manufacturers to develop cost-effective feeder solutions, flexible financing options, and low-maintenance designs that encourage adoption in resource-constrained industries.

Technical Complexity and Operational Challenges

The growing complexity of advanced weigh feeder systems presents operational challenges for industries that lack skilled personnel and technical expertise. Modern feeders integrated with digital monitoring, IoT, and automation require specialized training for installation, operation, and troubleshooting. In regions where industrial workforce skills are limited, companies may face difficulties in ensuring accurate feeder operation and maintenance. In addition, issues such as improper calibration, inconsistent feeding rates, or breakdowns in critical applications can lead to production delays and quality inconsistencies. These operational risks make some industries hesitant to adopt technologically advanced feeders, preferring simpler, less precise alternatives. Addressing this challenge requires stronger after-sales support, technical training programs, and user-friendly system designs by manufacturers. Ensuring ease of integration and reliability in diverse industrial environments will be critical in overcoming adoption barriers and supporting broader market growth in the weigh feeder industry.

Regional Analysis

North America

North America accounted for 21% of the global weigh feeder market in 2024, reaching USD 332.17 million from USD 234.40 million in 2018. The region is projected to attain USD 547.43 million by 2032, registering a CAGR of 6.5%. Strong adoption in cement, mining, and food processing industries supports growth, alongside increasing automation investments in the U.S. and Canada. Demand for efficient material handling systems in energy and industrial applications reinforces regional dominance, with expanding smart manufacturing practices further driving long-term adoption.

Europe

Europe represented 27% of the market share in 2024, with revenues growing from USD 298.51 million in 2018 to USD 431.86 million in 2024. The market is projected to reach USD 733.01 million by 2032, expanding at a CAGR of 6.9%. Growth is supported by established cement, food, and chemical industries, coupled with strict EU regulatory standards promoting accurate and sustainable production. Germany, France, and Italy lead adoption, with advanced automation integration driving feeder upgrades. Demand for energy-efficient solutions is reinforcing Europe’s strong position in the global weigh feeder market.

Asia Pacific

Asia Pacific held the largest market share of 35% in 2024, growing from USD 372.26 million in 2018 to USD 561.40 million in 2024. The region is forecast to reach USD 1,006.72 million by 2032, recording the highest CAGR of 7.6%. Rapid industrialization, large-scale cement capacity additions, and expanding mining projects in China and India are primary growth drivers. The food and beverages industry also adds significant demand. Asia Pacific’s dominance stems from its large manufacturing base, infrastructure expansion, and rising adoption of Industry 4.0 technologies across processing and heavy industries.

Latin America

Latin America accounted for 9% of the global market in 2024, increasing from USD 90.44 million in 2018 to USD 141.35 million in 2024. The market is expected to grow to USD 264.68 million by 2032, at the fastest CAGR of 8.2% among all regions. Strong demand arises from cement and mining operations in Brazil, Chile, and Mexico, where bulk material handling is critical. Expansion in food processing industries also contributes to steady growth. Regional adoption is further supported by modernization of production facilities and ongoing industrial automation initiatives.

Middle East

The Middle East represented 5% of global market share in 2024, with revenues rising from USD 51.16 million in 2018 to USD 77.46 million in 2024. By 2032, the market is projected to reach USD 139.59 million, reflecting a CAGR of 7.7%. Industrial expansion in cement and power generation sectors underpins regional growth, particularly in Saudi Arabia and the UAE. Large-scale infrastructure development projects further drive demand for weigh feeders, ensuring consistent material handling. The region’s shift toward automation and energy-efficient solutions supports continued adoption in both heavy and process industries.

Africa

Africa accounted for 3% of the market in 2024, expanding from USD 23.55 million in 2018 to USD 31.08 million in 2024. The market is projected to reach USD 45.71 million by 2032, at a CAGR of 5.0%, the slowest globally. Cement production growth in Nigeria, Egypt, and South Africa drives demand, while mining projects add steady contributions. Limited industrial automation and high investment barriers constrain faster adoption. However, ongoing infrastructure projects and gradual industrial modernization provide opportunities, with weigh feeders increasingly seen as essential for consistent production and efficient material handling.

Market Segmentations:

By Technology

- Electromechanical

- Pneumatic

By Type

- Belt Weigh Feeders

- Loss-in-Weight Feeders

- Others

By End User

- Cement

- Food & Beverages

- Chemicals

- Mining

- Power Generation

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global weigh feeder market is characterized by strong competition among multinational corporations and specialized regional players. Leading companies such as Schenck Process Holding GmbH, Siemens AG, MTS Systems Corporation, Yamato Scale Co., Ltd., and Avery Weigh-Tronix LLC hold significant market positions through their broad product portfolios and strong global presence. These players focus on innovation in electromechanical and belt weigh feeder technologies, integrating automation, IoT connectivity, and predictive maintenance features to enhance performance and reliability. Firms like Metso Corporation, Eastern Instruments, Acrison, Inc., and Saimo Technology Co., Ltd. strengthen competition by offering cost-effective, application-specific solutions across industries such as cement, mining, and food processing. Strategic partnerships, capacity expansions, and investments in digital platforms are common growth strategies. Emerging players, including Jesma Vejeteknik A/S and Schenck Process India Pvt. Ltd., are capturing niche markets with tailored feeding systems. Overall, competition remains dynamic, with technological differentiation and regional expansion shaping long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schenck Process Holding GmbH

- Siemens AG

- MTS Systems Corporation

- Yamato Scale Co., Ltd.

- Avery Weigh-Tronix LLC

- Metso Corporation

- Eastern Instruments

- Acrison, Inc.

- Saimo Technology Co., Ltd.

- Schenck Process India Pvt. Ltd.

- Jesma Vejeteknik A/S

- Other Key Players

Recent Developments

- In 2025, Siemens released their WT 10 catalog featuring new weighing and batching products, further expanding their automation and weigh feeder offerings for diverse industries.

- In August 2025, Avery Weigh-Tronix launched the ZM223 Weight Indicator, which provides connectivity via RS232, USB, Bluetooth, Ethernet, and other protocols, as well as application-specific customizations for batching, inventory control, and remote monitoring. The IP69K-rated enclosure supports demanding environments, and the system facilitates cloud-based data collection across industries.

- In May 2023, Schenck Process launched the CS+ loss-in-weight feeding system, specifically designed for precise dosing in battery cell electrode production. This modular high-accuracy solution addresses safety, containment, and cleaning for hazardous material handling.

Report Coverage

The research report offers an in-depth analysis based on Technology, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily driven by automation and digital transformation across industries.

- Electromechanical feeders will remain the dominant technology due to accuracy and durability.

- IoT-enabled weigh feeders will gain wider adoption with predictive maintenance capabilities.

- Cement production growth will continue to fuel large-scale demand worldwide.

- Food and beverages will emerge as a fast-growing end-user sector.

- Asia Pacific will maintain leadership supported by industrialization in China and India.

- Europe will see strong adoption due to strict quality and sustainability standards.

- North America will benefit from modernization of mining and power generation facilities.

- Regional players will compete with global companies through cost-effective solutions.

- Advancements in energy-efficient designs will shape long-term competitiveness in the market.