Market Overview

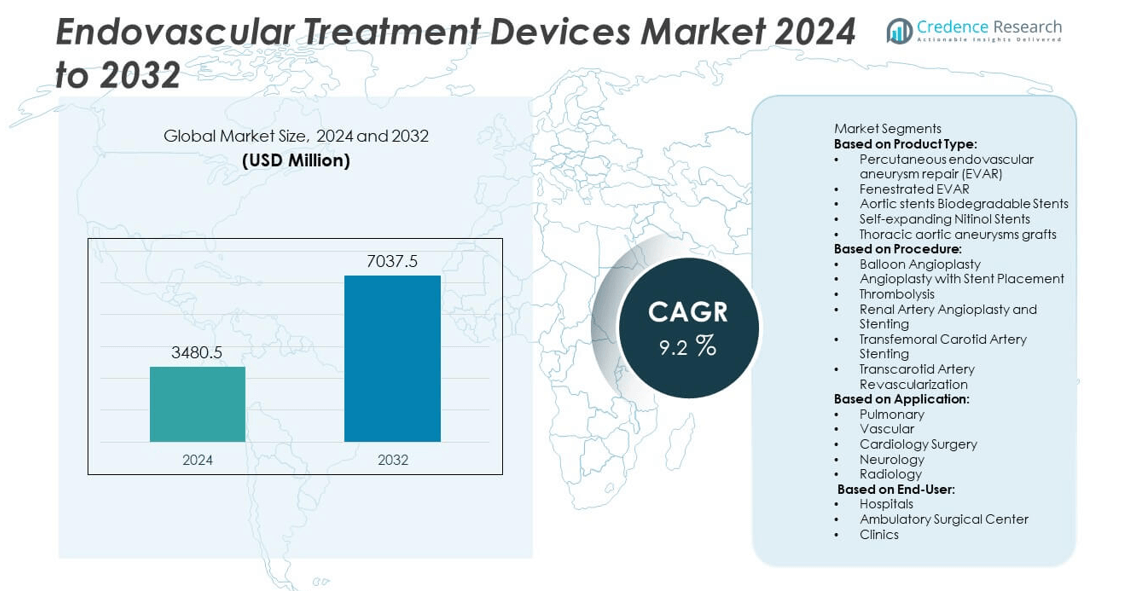

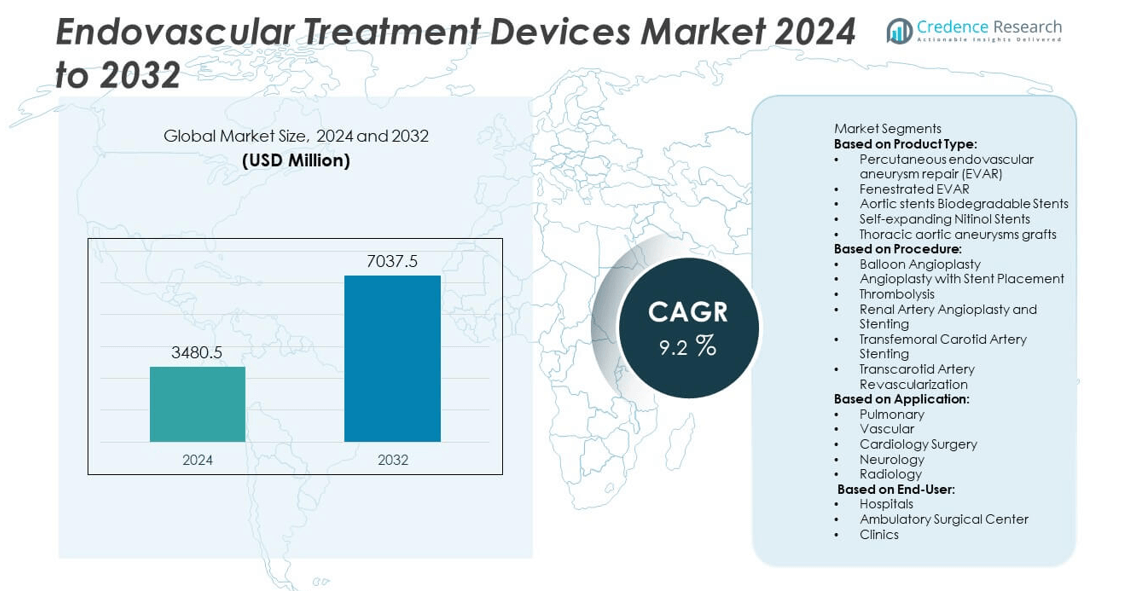

Endovascular Treatment Devices Market size was USD 3,480.5 million in 2024 and is projected to reach USD 7,037.5 million by 2032, registering a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Endovascular Treatment Devices Market Size 2024 |

USD 3,480.5 million |

| Endovascular Treatment Devices Market, CAGR |

9.2% |

| Endovascular Treatment Devices Market Size 2032 |

USD 7,037.5 million |

The Endovascular Treatment Devices Market is driven by the rising prevalence of cardiovascular and peripheral vascular diseases, growing adoption of minimally invasive procedures, and advancements in imaging-guided interventions that improve precision and patient outcomes. It benefits from an aging global population and increasing healthcare investments in advanced surgical technologies. Trends include the integration of drug-eluting technologies, bioresorbable materials, and next-generation stent designs to enhance long-term vessel patency.

The Endovascular Treatment Devices Market demonstrates strong geographical presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, driven by varying healthcare infrastructure, regulatory frameworks, and adoption rates of advanced vascular intervention technologies. North America leads in innovation due to high procedure volumes, advanced healthcare facilities, and strong reimbursement policies. Europe benefits from established cardiac care networks and growing adoption of minimally invasive interventions. Asia Pacific is emerging as a high-growth region with expanding access to advanced vascular treatments and rising investments in hospital infrastructure. Latin America and the Middle East & Africa are gradually increasing adoption through government-backed healthcare initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Endovascular Treatment Devices Market was valued at USD 3,480.5 million in 2024 and is projected to reach USD 7,037.5 million by 2032, growing at a CAGR of 9.2% during the forecast period.

- Rising demand for minimally invasive vascular interventions, coupled with an increasing prevalence of aortic aneurysms and peripheral artery disease, is driving market expansion across hospitals and specialty centers.

- Technological advancements such as drug-eluting stents, flow-diverting devices, and image-guided catheter systems are shaping product innovation and enhancing procedural outcomes.

- The market is competitive, with leading players including Medtronic plc, Boston Scientific Corporation, Terumo Corporation, and Penumbra focusing on R&D investment, global expansion, and portfolio diversification to strengthen market positioning.

- High procedural costs, complex regulatory approval processes, and limited availability of skilled interventionists in emerging economies act as restraints on faster adoption rates.

- North America leads due to high treatment volumes, strong reimbursement frameworks, and advanced healthcare infrastructure, followed by Europe with robust adoption of minimally invasive techniques.

- Asia Pacific is witnessing rapid growth driven by rising healthcare investments, expanding hospital networks, and increasing awareness of advanced endovascular procedures, while Latin America and the Middle East & Africa are progressing steadily through government-led healthcare modernization initiatives.

Market Drivers

Rising Prevalence of Cardiovascular and Peripheral Artery Diseases

The Endovascular Treatment Devices Market benefits from the increasing incidence of cardiovascular and peripheral artery diseases worldwide. Aging populations and lifestyle-related risk factors such as obesity, hypertension, and diabetes are contributing to higher patient volumes. It enables healthcare providers to adopt minimally invasive solutions for conditions like aneurysms, arterial blockages, and venous disorders. Growing awareness of early diagnosis and intervention is driving adoption in both developed and emerging economies. Technological advancements in stent grafts, angioplasty balloons, and thrombectomy systems are improving treatment precision and patient recovery times. The market responds to the urgent need for effective and less invasive treatment options in high-risk patient groups.

- For instance, Medtronic’s Endurant II bifurcated stent graft offers proximal diameters ranging from 23 mm to 36 mm with covered lengths between 124 mm and 166 mm, enabling tailored aneurysm repair in varied anatomical profiles.

Advancements in Minimally Invasive Surgical Techniques

Continuous innovation in minimally invasive surgical approaches strengthens the growth of the Endovascular Treatment Devices Market. It allows for smaller incisions, reduced hospital stays, and faster patient recovery compared to traditional open surgeries. Developments such as drug-eluting stents, bioresorbable scaffolds, and image-guided navigation systems enhance procedural success rates. Demand is rising in outpatient settings, where shorter recovery periods and lower complication risks are prioritized. Healthcare facilities are expanding their capabilities to accommodate these procedures, supported by advanced catheter-based delivery systems. These advancements are positioning endovascular therapies as the preferred choice for a growing range of vascular conditions.

- For instance, Boston Scientific’s Eluvia drug-eluting stent reaches lengths up to 150 mm, and incorporates a polymer delivering 0.167 µg/mm² of paclitaxel, aimed at sustained drug release and improved patency rates.

Supportive Government Policies and Reimbursement Frameworks

Government initiatives and favorable reimbursement policies are influencing the expansion of the Endovascular Treatment Devices Market. National health programs and insurance coverage for endovascular procedures are reducing the financial burden on patients. It improves accessibility to advanced treatment technologies across urban and rural healthcare settings. In regions with high disease prevalence, public health campaigns are promoting screening programs that lead to earlier interventions. Regulatory approvals for next-generation devices are accelerating market entry and adoption rates. Policy-driven investments in healthcare infrastructure are creating a conducive environment for market growth.

Increasing Adoption in Emerging Markets

The Endovascular Treatment Devices Market is gaining traction in emerging economies due to expanding healthcare infrastructure and rising disposable incomes. Hospitals and specialty clinics are adopting advanced devices to meet growing patient demand for effective vascular treatments. It is supported by training programs that enhance physician expertise in minimally invasive techniques. Growing collaborations between global device manufacturers and local distributors are improving supply chain efficiency. Public-private partnerships are facilitating the deployment of endovascular solutions in underserved regions. Rising investments in diagnostic and interventional cardiology centers further support adoption in these markets.

Market Trends

Advancement in Device Innovation and Materials Technology

The Endovascular Treatment Devices Market is witnessing significant trends driven by innovations in device design and materials. It incorporates bioresorbable scaffolds, drug-coated balloons, and next-generation stents that improve biocompatibility and reduce restenosis rates. Enhanced polymer coatings and nitinol alloys increase device flexibility and durability, allowing better navigation through complex vascular anatomies. These technological advancements optimize treatment outcomes and minimize complications. Manufacturers focus on developing smaller profile devices compatible with a broader range of vessel sizes. The trend toward personalized medicine also encourages the creation of customizable solutions tailored to patient-specific anatomy and pathology.

- For instance, Abbott’s Absorb bioresorbable vascular scaffold has a strut thickness of 157 µm and fully resorbs in approximately 36 months, offering vessel support while gradually restoring natural vessel function.

Integration of Image-Guided and Robotic-Assisted Systems

The growing adoption of image-guided navigation and robotic-assisted interventions shapes the Endovascular Treatment Devices Market. It enables precise device placement and improved visualization during complex vascular procedures. Real-time imaging modalities such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT) are increasingly incorporated to guide treatment. Robotic systems provide enhanced dexterity and stability, reducing operator fatigue and improving procedural accuracy. These technologies support minimally invasive approaches, lower complication rates, and shorten recovery times. Hospitals are investing in hybrid operating rooms to accommodate these advanced interventions, enhancing patient outcomes and operational efficiency.

- For instance, Corindus Vascular Robotics’ CorPath GRX system offers sub-millimeter measurement accuracy and allows operators to perform procedures from a shielded cockpit located up to 20 feet away from the radiation source.

Rising Preference for Minimally Invasive and Outpatient Procedures

The Endovascular Treatment Devices Market is trending toward minimally invasive techniques favored in outpatient and ambulatory care settings. It aligns with healthcare providers’ goals to reduce hospitalization time, lower infection risks, and optimize resource utilization. Device innovations support same-day discharge for certain vascular interventions, improving patient convenience and satisfaction. The shift is further supported by reimbursement models favoring outpatient treatments. Growing awareness among physicians and patients about the benefits of minimally invasive endovascular therapies contributes to this trend. Increasing procedural volume in ambulatory surgical centers is creating demand for compact, easy-to-use device platforms tailored for these environments.

Expansion of Applications Across Diverse Vascular Conditions

The Endovascular Treatment Devices Market is expanding its reach by addressing a broader range of vascular diseases beyond traditional indications. It now includes treatment of peripheral artery disease, cerebral aneurysms, deep vein thrombosis, and chronic venous insufficiency. The market benefits from increasing clinical evidence supporting endovascular therapies’ safety and efficacy for these varied conditions. Innovations in device flexibility, drug delivery, and clot retrieval are driving this application expansion. The trend encourages multidisciplinary collaborations among cardiologists, vascular surgeons, and interventional radiologists. Growing patient populations with complex comorbidities necessitate less invasive, tailored treatment options, fostering broader adoption of endovascular devices.

Market Challenges Analysis

High Procedural Costs and Reimbursement Limitations

The Endovascular Treatment Devices Market faces challenges related to the high costs associated with advanced devices and procedures. It often requires significant capital investment for equipment acquisition and specialized training for physicians. Limited reimbursement coverage in certain regions restricts patient access to cutting-edge therapies. Hospitals and clinics may hesitate to adopt expensive technologies without clear financial incentives or comprehensive insurance support. These economic barriers slow market penetration, particularly in emerging economies. Healthcare providers must balance cost constraints with the demand for minimally invasive, effective treatments. Efforts to streamline device manufacturing and improve reimbursement frameworks are critical to overcoming these challenges.

Complex Regulatory Environment and Clinical Adoption Barriers

Navigating diverse and stringent regulatory requirements presents another key challenge for the Endovascular Treatment Devices Market. It demands extensive clinical trials and compliance with evolving safety and efficacy standards across multiple jurisdictions. Prolonged approval processes delay product launches and increase development costs. Skepticism among some healthcare professionals regarding long-term outcomes of newer devices can hinder clinical adoption. Resistance to change from traditional open surgical techniques persists in certain regions, limiting market growth. The market relies on robust clinical evidence and physician education programs to build confidence in endovascular alternatives. Overcoming regulatory hurdles and enhancing awareness are essential to accelerating adoption rates worldwide.

Market Opportunities

Expanding Applications in Emerging and Complex Vascular Conditions

The Endovascular Treatment Devices Market holds significant opportunities by broadening its applications across a wide spectrum of vascular diseases. It addresses increasing clinical needs in treating complex conditions such as cerebral aneurysms, peripheral artery disease, and venous thromboembolism. Innovations in device design, including flexible stents and drug-coated balloons, allow safer interventions in previously challenging anatomies. Growing clinical evidence supporting the efficacy and safety of endovascular therapies encourages wider adoption by specialists across cardiology, neurology, and vascular surgery. This diversification expands the market reach beyond traditional coronary and carotid interventions, tapping into new patient populations with unmet medical needs.

Increasing Penetration in Emerging Markets and Healthcare Infrastructure Development

Emerging economies present promising growth avenues for the Endovascular Treatment Devices Market due to rising healthcare investments and expanding hospital networks. It benefits from increasing government initiatives aimed at improving cardiovascular health and expanding access to minimally invasive procedures. Training programs that enhance physician expertise and awareness campaigns further support market development. Collaborations between global device manufacturers and local distributors improve accessibility and after-sales service, facilitating smoother market entry. Rising urbanization and increasing prevalence of lifestyle-related diseases in these regions create sustained demand. This combination of factors offers strong potential for increased device adoption and revenue growth in underserved markets.

Market Segmentation Analysis:

By Product Type

The Endovascular Treatment Devices Market is segmented by product type into stents, catheters, guidewires, embolization coils, and vascular closure devices. Stents represent a substantial share due to their essential function in restoring and maintaining vessel patency during coronary and peripheral artery interventions. Catheters and guidewires facilitate precise navigation and access within complex vascular pathways, enabling minimally invasive procedures. Embolization coils find increasing usage in treating aneurysms and arteriovenous malformations, leveraging advancements in coil materials and design to enhance occlusion efficacy. Vascular closure devices support hemostasis post-procedure, reducing complications and improving patient recovery. Continuous innovation in materials and device miniaturization strengthens performance and procedural success across all product categories.

- For instance, Boston Scientific’s Synergy™ drug-eluting stent features a 74 µm strut thickness and a bioabsorbable polymer coating that fully degrades in approximately 4 months, reducing long-term inflammation risk.

By Procedure

Segmentation by procedure includes angioplasty, stenting, embolization, thrombectomy, and atherectomy. Angioplasty remains a dominant procedure type due to its broad application in treating arterial blockages with balloon catheters. Stenting procedures are growing, supported by drug-eluting stents and bioresorbable scaffolds that improve long-term vessel patency and reduce restenosis. Embolization procedures extend treatment options for vascular malformations and hemorrhages, driven by improvements in coil and plug technologies. Thrombectomy devices provide minimally invasive removal of blood clots, especially in stroke management, with enhanced aspiration catheters and mechanical retrieval systems gaining prominence. Atherectomy devices assist in plaque removal for calcified lesions, supporting complex lesion treatment and expanding patient eligibility for endovascular therapy.

- For instance, Penumbra’s Indigo® System CAT RX aspiration catheter has a 0.068-inch inner diameter and achieves peak aspiration flow rates of up to 250 mL/min, enabling rapid thrombus removal in acute coronary interventions.

By Application

The Endovascular Treatment Devices Market spans applications in coronary artery disease, peripheral artery disease, neurovascular conditions, and venous diseases. Coronary artery disease applications dominate due to high prevalence and established clinical guidelines promoting endovascular intervention. Peripheral artery disease treatment is expanding, driven by aging populations and increased screening for limb ischemia. Neurovascular applications include the management of cerebral aneurysms and stroke, where device innovations in flow diversion and mechanical thrombectomy are transforming outcomes. Venous disease interventions, such as deep vein thrombosis and varicose vein treatments, increasingly adopt embolization coils and sclerotherapy devices. Growing incidence of chronic vascular conditions fuels demand for versatile, minimally invasive treatment options across these diverse clinical areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Product Type:

- Percutaneous endovascular aneurysm repair (EVAR)

- Fenestrated EVAR

- Aortic stents Biodegradable Stents

- Self-expanding Nitinol Stents

- Thoracic aortic aneurysms grafts

Based on Procedure:

- Balloon Angioplasty

- Angioplasty with Stent Placement

- Thrombolysis

- Renal Artery Angioplasty and Stenting

- Transfemoral Carotid Artery Stenting

- Transcarotid Artery Revascularization

Based on Application:

- Pulmonary

- Vascular

- Cardiology Surgery

- Neurology

- Radiology

Based on End-User:

- Hospitals

- Ambulatory Surgical Center

- Clinics

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a dominant share of approximately 35% in the Endovascular Treatment Devices Market, driven by advanced healthcare infrastructure and high adoption of minimally invasive vascular procedures. The United States leads regional demand, supported by favorable reimbursement policies and extensive clinical research activities. Increasing prevalence of cardiovascular and peripheral artery diseases coupled with rising geriatric populations further accelerates market growth. The presence of key medical device manufacturers and well-established distribution networks facilitates timely access to advanced endovascular technologies. Investments in hospital upgrades, hybrid operating rooms, and physician training programs enhance procedural volumes. Government initiatives promoting cardiovascular health and preventive care also contribute to strong regional demand for innovative endovascular devices. Canada’s growing focus on expanding outpatient interventional centers complements this trend, supporting steady adoption across the region.

Europe

Europe accounts for about 28% of the global Endovascular Treatment Devices Market. It benefits from a mature healthcare system, strong regulatory frameworks, and widespread adoption of cutting-edge medical technologies. Countries such as Germany, France, and the UK exhibit significant procedural volumes, bolstered by rising cardiovascular disease burdens and growing awareness of minimally invasive therapies. Strict compliance with medical device regulations and safety standards ensures high-quality product offerings. Increasing investments in digital health technologies, including image-guided interventions and robotic assistance, are transforming procedural outcomes. Public health campaigns and government-backed screening programs accelerate early diagnosis and treatment, driving market expansion. The region’s focus on improving healthcare access in rural areas also opens opportunities for portable and easy-to-use endovascular devices.

Asia Pacific

Asia Pacific captures around 25% of the Endovascular Treatment Devices Market, with rapid growth supported by expanding healthcare infrastructure and increasing prevalence of lifestyle-related vascular diseases. Countries such as China, India, Japan, and Australia lead regional demand through rising healthcare expenditure and expanding insurance coverage. Urbanization and rising awareness about early diagnosis contribute to higher procedural rates. The region witnesses increasing adoption of advanced device technologies, including drug-eluting stents and neurovascular interventions. Training and skill development programs for physicians enhance procedural success and acceptance of minimally invasive options. Collaborations between global device manufacturers and local healthcare providers improve product availability. Government initiatives aimed at improving cardiovascular care and promoting medical tourism further propel market growth.

Latin America

Latin America represents roughly 7% of the Endovascular Treatment Devices Market. It shows steady expansion driven by increasing investments in healthcare infrastructure and rising incidence of vascular diseases, particularly in Brazil, Mexico, and Argentina. The region’s growing focus on cardiovascular health awareness and preventive screening encourages early intervention using endovascular therapies. However, limited reimbursement policies and economic disparities pose challenges to widespread adoption. Partnerships between multinational manufacturers and local distributors help overcome supply chain constraints. Initiatives to train healthcare professionals in advanced interventional techniques improve procedural capabilities. Growing urban healthcare facilities and government programs aimed at expanding access to specialized treatments create further opportunities for market penetration.

Middle East & Africa

The Middle East & Africa region holds approximately 5% market share in the Endovascular Treatment Devices Market. Growth is concentrated in countries such as the United Arab Emirates, Saudi Arabia, and South Africa, driven by increasing healthcare investments and rising prevalence of cardiovascular diseases. National health strategies focused on modernizing healthcare infrastructure and expanding specialist care are supporting endovascular treatment adoption. The availability of advanced imaging facilities and hybrid operating rooms in urban centers enhances procedural volumes. Ongoing efforts to improve physician training and patient awareness contribute to market expansion. Challenges such as limited healthcare access in rural areas and economic constraints persist but gradually improve through public-private partnerships and international collaborations. The region’s emphasis on adopting innovative medical technologies signals continued growth potential in the coming years.

Key Player Analysis

- InspireMD

- Cardinal Health

- Terumo Corporation

- Boston Scientific Corporation

- Endospan

- Getinge AB

- Medtronic plc

- Lombard Medical Technologies

- Japan Lifeline

- Penumbra

Competitive Analysis

The Endovascular Treatment Devices Market features strong competition among global leaders and innovative regional players. Leading companies include Medtronic plc, Boston Scientific Corporation, Terumo Corporation, Penumbra, Cardinal Health, Getinge AB, Japan Lifeline, Endospan, and InspireMD. Medtronic plc maintains a significant position with its broad portfolio of stent grafts, thrombectomy systems, and embolization devices, supported by extensive clinical research. Boston Scientific Corporation focuses on advanced catheter-based interventions, integrating imaging and navigation technologies to improve procedural precision. Terumo Corporation leverages its expertise in guidewires, microcatheters, and embolization solutions, strengthening its presence in both developed and emerging markets. Penumbra is recognized for its innovative aspiration thrombectomy systems and neurovascular treatment devices, expanding into peripheral interventions. Cardinal Health operates with a strong distribution network and procedural kits, ensuring product availability across healthcare facilities. Getinge AB emphasizes vascular graft technology and hybrid operating room solutions to enhance complex interventions. Competition centers on technological innovation, regulatory compliance, and strategic collaborations with hospitals and research institutions.

Recent Developments

- In July 2025, InspireMD Launched the U.S. commercial release of the CGuard® Prime carotid stent system, shortly after securing FDA approval for stroke prevention.

- In June 2025, Terumo Corporation’s neurovascular division, Terumo Neuro, launched the Sofia Flow 88 neurovascular aspiration catheter in the EMEA (Europe, Middle East, and Africa) region. This catheter is designed with a 0.088-inch inner diameter to improve trackability and procedural control during neurovascular interventions.

- In May 2025, Endospan announced positive 30-day outcomes from the TRIOMPHE IDE clinical study of the NEXUS Aortic Arch Stent-Graft System. The results, focusing on Zone 0 aortic repair, met the safety benchmarks for this critical area, suggesting the device could be a viable alternative to open surgery for high-risk patients.

Market Concentration & Characteristics

The Endovascular Treatment Devices Market is moderately consolidated, with a mix of global leaders and specialized regional manufacturers competing through innovation, clinical performance, and regulatory compliance. It is characterized by rapid technological advancements, particularly in stent graft designs, embolic protection systems, and drug-eluting technologies that enhance procedural outcomes and reduce recovery times. Leading manufacturers focus on expanding their product portfolios with minimally invasive solutions supported by strong clinical evidence, while investing in advanced delivery systems for greater precision and safety. The market benefits from high entry barriers due to stringent regulatory requirements, extensive R&D costs, and the need for proven long-term device performance. It demonstrates strong alignment with evolving treatment protocols for complex vascular diseases, emphasizing patient safety, reduced procedural risks, and faster rehabilitation. Collaboration with healthcare providers, clinical research institutions, and regulatory bodies strengthens product adoption and market presence, while customization for regional anatomical and procedural preferences supports global growth potential.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Procedure, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with the increasing prevalence of cardiovascular and peripheral vascular diseases.

- Advancements in minimally invasive device technology will improve procedural success rates.

- Drug-eluting and bioresorbable materials will gain wider adoption in treatment protocols.

- Integration of imaging and navigation systems will enhance precision in endovascular procedures.

- Growing geriatric population will drive higher demand for advanced vascular repair solutions.

- Regulatory approvals for novel devices will accelerate product launches across global markets.

- Hospitals and specialty clinics will expand adoption due to reduced recovery times and improved patient outcomes.

- Customizable stent grafts and patient-specific devices will address complex anatomical challenges.

- Emerging markets will witness stronger growth due to improving healthcare infrastructure and skilled workforce availability.

- Strategic collaborations between device manufacturers and research institutes will accelerate innovation pipelines.