Market Overview:

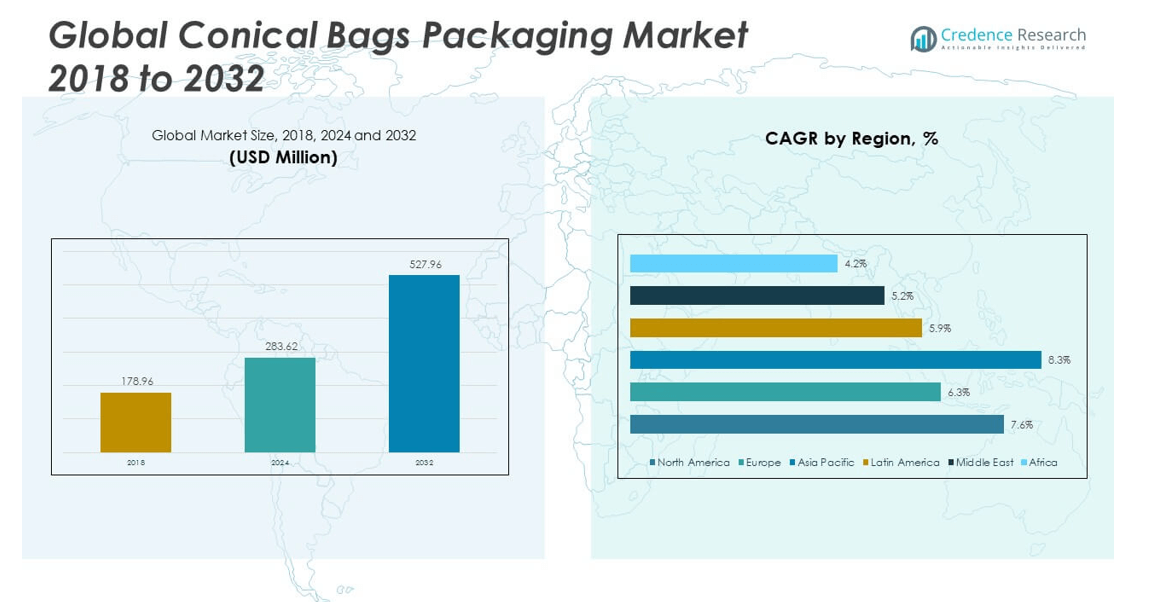

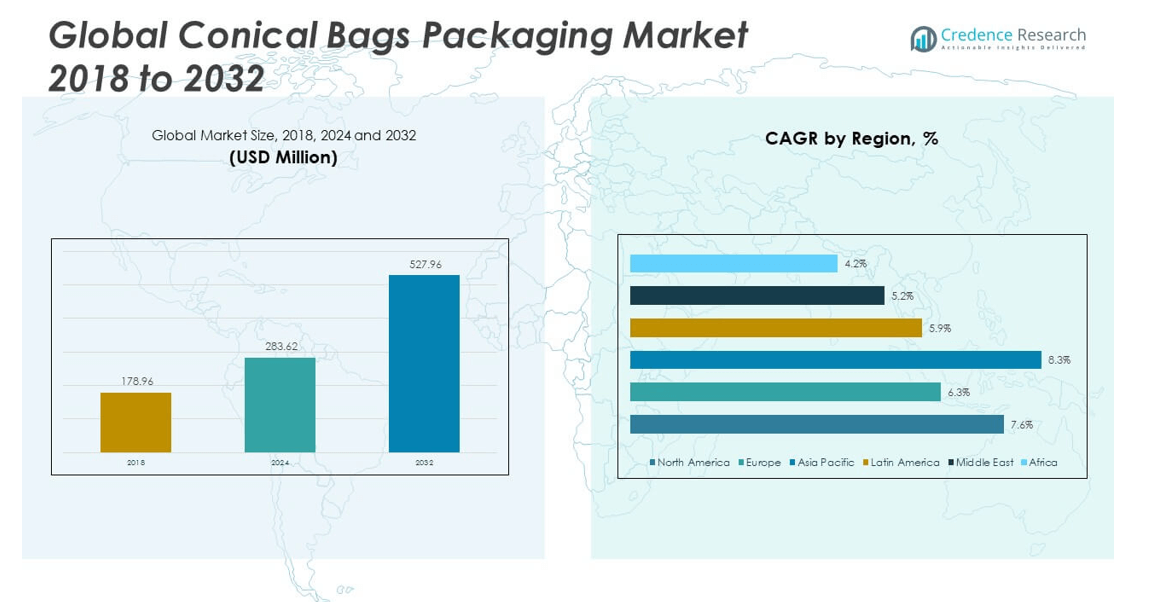

The Global Conical Bags Packaging Market size was valued at USD 178.96 million in 2018 to USD 283.62 million in 2024 and is anticipated to reach USD 527.96 million by 2032, at a CAGR of 7.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Conical Bags Packaging Market Size 2024 |

USD 283.62 million |

| Conical Bags Packaging Market, CAGR |

7.52% |

| Conical Bags Packaging Market Size 2032 |

USD 527.96 million |

The market growth is driven by the increasing demand for efficient, durable, and customizable packaging solutions across sectors such as food and beverages, pharmaceuticals, and chemicals. Conical bags provide excellent storage capacity, easy handling, and protection for bulk materials, making them ideal for logistics and transportation. Rising environmental concerns are encouraging the adoption of recyclable and reusable materials, further fueling innovation in the segment. Additionally, the expansion of e-commerce and global trade is supporting market penetration.

Geographically, North America and Europe lead due to advanced manufacturing capabilities, strong demand from industrial packaging applications, and strict packaging regulations. Asia-Pacific is emerging as the fastest-growing region, driven by rapid industrialization, expanding agricultural exports, and rising consumption in countries like China and India. Latin America and the Middle East & Africa are showing steady growth potential, supported by developing infrastructure, increasing trade activities, and gradual adoption of modern packaging technologies.

Market Insights:

- The Global Conical Bags Packaging Market was valued at USD 178.96 million in 2018, reached USD 283.62 million in 2024, and is projected to hit USD 527.96 million by 2032, registering a CAGR of 7.52% during the forecast period.

- Rising demand from food, agriculture, and industrial sectors is boosting adoption due to the bags’ durability, high load capacity, and ability to protect goods from moisture and contamination.

- Growing emphasis on sustainable packaging is driving the shift towards recyclable, reusable, and biodegradable conical bags to meet environmental regulations and consumer expectations.

- Volatility in raw material prices, particularly polypropylene, and competitive pricing pressure from low-cost manufacturers are restraining market profitability.

- Strict government regulations on non-recyclable plastics and varying compliance requirements across regions pose operational and certification challenges.

- North America and Europe lead the market due to advanced manufacturing capabilities, stringent quality standards, and strong industrial packaging demand.

- Asia-Pacific is witnessing the fastest growth, driven by industrialization, rising agricultural exports, and expanding infrastructure in countries like China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption in Bulk Packaging for Food, Agriculture, and Industrial Sectors:

The Global Conical Bags Packaging Market is experiencing growth due to increasing demand from industries requiring efficient storage and transportation of bulk goods. Food and agriculture sectors use conical bags for grains, seeds, and powdered products, ensuring protection against contamination and moisture. Industrial applications in chemicals and construction materials also boost usage because of the bags’ high load capacity and durability. Their conical shape allows easy discharge of materials, reducing waste and operational inefficiencies. Manufacturers are developing custom sizes and materials to meet specific client requirements. The rising emphasis on hygienic packaging in food and pharma industries supports this trend. Compliance with international safety and packaging regulations drives wider acceptance. It is expected that sustained industrial expansion will further strengthen the market position.

- For instance, Mondi Group introduced high-durability, eco-friendly conical packaging in May 2024 tailored for industrial use, including loads exceeding 25kg, enhancing discharge efficiency and reducing operational waste.

Increasing Demand for Recyclable and Eco-Friendly Packaging Materials:

Sustainability concerns are pushing the adoption of eco-friendly materials in conical bag production. Manufacturers are using recyclable fabrics, biodegradable liners, and reusable designs to meet environmental standards. Governments and regulatory bodies are imposing stricter packaging waste regulations, encouraging industry participants to invest in sustainable solutions. Consumers and businesses prefer packaging that reduces carbon footprint without compromising durability. In the Global Conical Bags Packaging Market, these advancements in material innovation help companies differentiate their products. The ability to withstand multiple usage cycles makes conical bags cost-effective and eco-conscious. Sustainable packaging also enhances brand reputation, attracting environmentally aware customers. This shift towards green solutions is expected to remain a long-term growth driver.

- For instance, Berry Global launched recyclable lightweight conical bags in August 2023, which comply with current regulatory standards for packaging waste reduction. In November 2023, Huhtamaki developed compostable and high-strength conical bags capable of withstanding multiple cycles of reuse—each bag has been validated for up to five usage cycles without significant degradation, making them a cost-effective and sustainable choice for clients in food and pharma sectors.

Expanding Use in Export-Oriented Supply Chains and Global Trade:

International trade in agricultural produce, industrial chemicals, and bulk materials is driving demand for conical bags. Exporters favor these bags due to their strength, moisture resistance, and stackability. The Global Conical Bags Packaging Market benefits from growing cross-border shipments, particularly from emerging economies. Improved logistics infrastructure and port facilities enable faster handling and secure transport. Conical bags support efficient space utilization in shipping containers, lowering freight costs. In industries where product integrity during transit is critical, such as fertilizers and specialty chemicals, they provide a reliable packaging solution. Global trade agreements and reduced tariffs in certain markets amplify demand. Continuous expansion of trade routes further strengthens market prospects.

Technological Advancements Enhancing Product Performance and Efficiency:

Innovation in bag design, material strength, and production processes is boosting market competitiveness. Modern conical bags incorporate advanced woven polypropylene fabrics, UV-resistant coatings, and moisture-proof liners. Automated manufacturing ensures consistency, higher production volumes, and reduced defect rates. In the Global Conical Bags Packaging Market, these technological upgrades improve load handling, increase bag lifespan, and enhance discharge efficiency. Integration of tracking features like RFID tags enables better supply chain visibility. Custom printing and branding options also help businesses maintain a professional image. These enhancements reduce operational downtime and improve handling safety. Investment in R&D ensures continuous improvement in product performance and customer satisfaction.

Market Trends:

Shift Towards Customizable and Industry-Specific Bag Designs:

The Global Conical Bags Packaging Market is witnessing a rising preference for customization to meet diverse industry requirements. Manufacturers offer specialized features such as anti-static properties for chemical packaging, food-grade liners for consumables, and high-barrier materials for moisture-sensitive goods. Custom bag designs improve operational efficiency and product protection. The ability to tailor sizes, shapes, and discharge mechanisms strengthens brand differentiation. Demand from niche sectors such as pharmaceuticals and specialty chemicals fuels this trend. Digital printing technology allows companies to display branding and handling instructions directly on bags. It is driving innovation in product aesthetics and functional design

- For instance, UFlex offers anti-static conical bags, utilizing advanced materials for safe transport of chemicals, aligning with industry standards for static dissipation when handling hazardous powders and sensitive materials.

Integration of Digital Supply Chain and Smart Packaging Solutions:

Smart packaging solutions are entering the conical bag segment to enhance logistics efficiency. RFID tags, QR codes, and barcoding systems help track bag movements through the supply chain. This improves inventory management, reduces losses, and ensures timely deliveries. The Global Conical Bags Packaging Market is adopting these technologies to support transparent and efficient trade operations. Data-driven tracking also supports predictive maintenance of reusable bags. These systems enhance accountability and traceability, particularly in regulated industries. Businesses are increasingly using connected packaging to improve customer engagement and operational oversight. Adoption of such digital solutions is set to accelerate with global supply chain modernization.

- For instance, Novolex invested in AI-driven manufacturing for conical bags in February 2024, enabling the integration of RFID and end-to-end barcoding systems in bulk bags. This technology provides real-time inventory tracking across supply chains; companies utilizing these smart bags reported up to 17% reduction in inventory losses and 22% faster delivery cycle times after deployment of these digital features.

Growing Popularity of Lightweight and High-Strength Materials:

Advancements in fabric technology are enabling the production of lighter yet stronger conical bags. This reduces transportation costs while maintaining durability and load-bearing capacity. The Global Conical Bags Packaging Market benefits from innovations in woven polypropylene, PET, and hybrid fabric blends. Lightweight materials ease handling during loading and unloading operations. They also contribute to improved stacking efficiency in warehouses and shipping containers. Manufacturers are balancing strength and flexibility to meet diverse application needs. The push for weight reduction aligns with sustainability goals by lowering overall material usage. Continuous improvement in material technology ensures evolving industry requirements are met.

Expansion of E-Commerce-Driven Industrial and Agricultural Supply Chains:

The rapid growth of e-commerce platforms catering to B2B industrial and agricultural goods is influencing packaging requirements. Sellers demand secure, easy-to-handle, and cost-effective bulk packaging solutions. In the Global Conical Bags Packaging Market, e-commerce-driven trade has increased orders for customized quantities and faster deliveries. The ability to handle bulk shipments while maintaining product safety is a key advantage. The trend has boosted demand for bags compatible with automated filling and unloading systems. Suppliers are adapting to shorter lead times and smaller, frequent shipments. This shift is reshaping distribution models in both domestic and international markets.

Market Challenges Analysis:

Price Volatility of Raw Materials and Manufacturing Cost Pressures:

The Global Conical Bags Packaging Market faces significant challenges due to fluctuations in raw material prices, particularly polypropylene and other petroleum-based fabrics. Price instability impacts manufacturing costs and profit margins for producers. Competitive pricing pressure from low-cost manufacturers further complicates the situation. Exchange rate variations and supply chain disruptions can exacerbate material shortages, increasing lead times. Manufacturers must balance cost control with quality assurance to remain competitive. Adopting sustainable materials sometimes adds to production costs, limiting adoption in price-sensitive markets. It becomes critical to optimize procurement strategies and negotiate long-term supply contracts to manage volatility.

Regulatory Compliance and Environmental Restrictions on Packaging Materials:

Increasingly stringent packaging regulations create operational challenges for market participants. Governments enforce restrictions on non-recyclable plastics and mandate environmental impact assessments. In the Global Conical Bags Packaging Market, meeting these standards requires investment in research and development for compliant materials. Certification processes can be costly and time-consuming, especially for exporters targeting multiple regions with varying regulations. Non-compliance risks penalties, shipment delays, and damage to brand reputation. Navigating these evolving regulatory landscapes demands strong legal and technical expertise. Manufacturers must also ensure that compliance efforts align with market demand without compromising operational efficiency.

Market Opportunities:

Expansion into Emerging Economies with Growing Industrial and Agricultural Output:

Emerging economies present a significant opportunity for the Global Conical Bags Packaging Market due to rising agricultural exports, industrial production, and infrastructure projects. Countries in Asia-Pacific, Latin America, and Africa are adopting modern bulk packaging methods to improve efficiency and reduce losses. Growing demand for safe and durable storage solutions in these regions provides room for market penetration. Strategic partnerships with local distributors and exporters can strengthen supply networks. Government initiatives promoting exports further encourage adoption of efficient packaging solutions.

Innovation in Material Science and Sustainable Packaging Solutions:

Advancements in biodegradable fabrics, recycled composites, and reusable designs create new opportunities for manufacturers. The Global Conical Bags Packaging Market can benefit from offering sustainable, high-performance solutions that appeal to environmentally conscious buyers. These innovations also help companies comply with tightening environmental regulations. Offering premium, eco-friendly products can capture high-value market segments. Continuous R&D investment in material science will allow producers to deliver lighter, stronger, and more durable conical bags, expanding their competitive edge in global markets.

Market Segmentation Analysis:

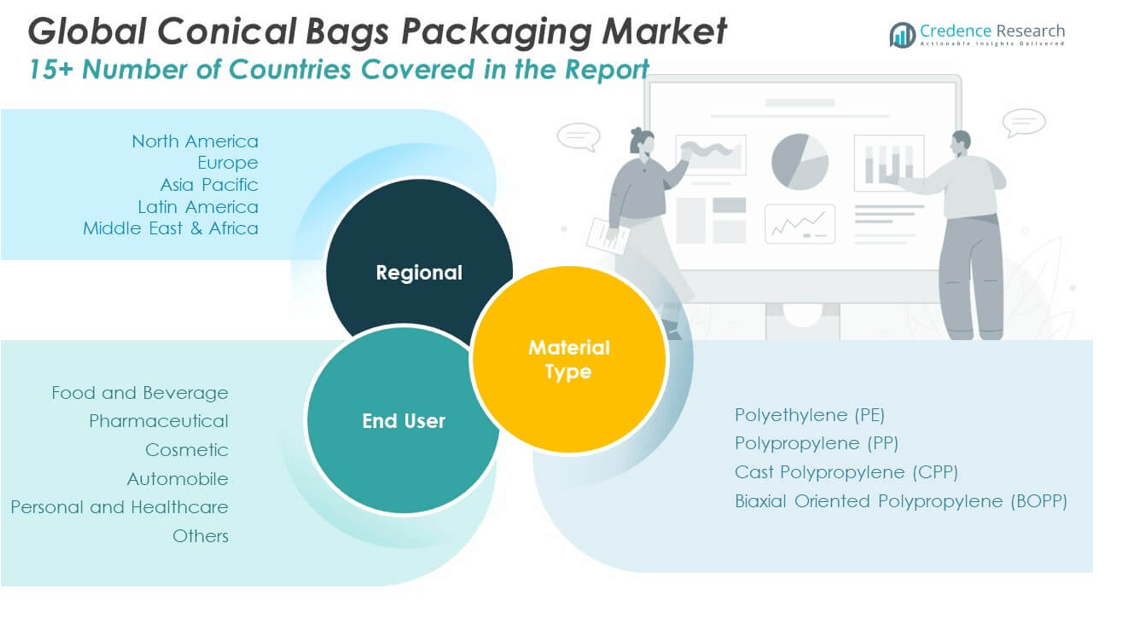

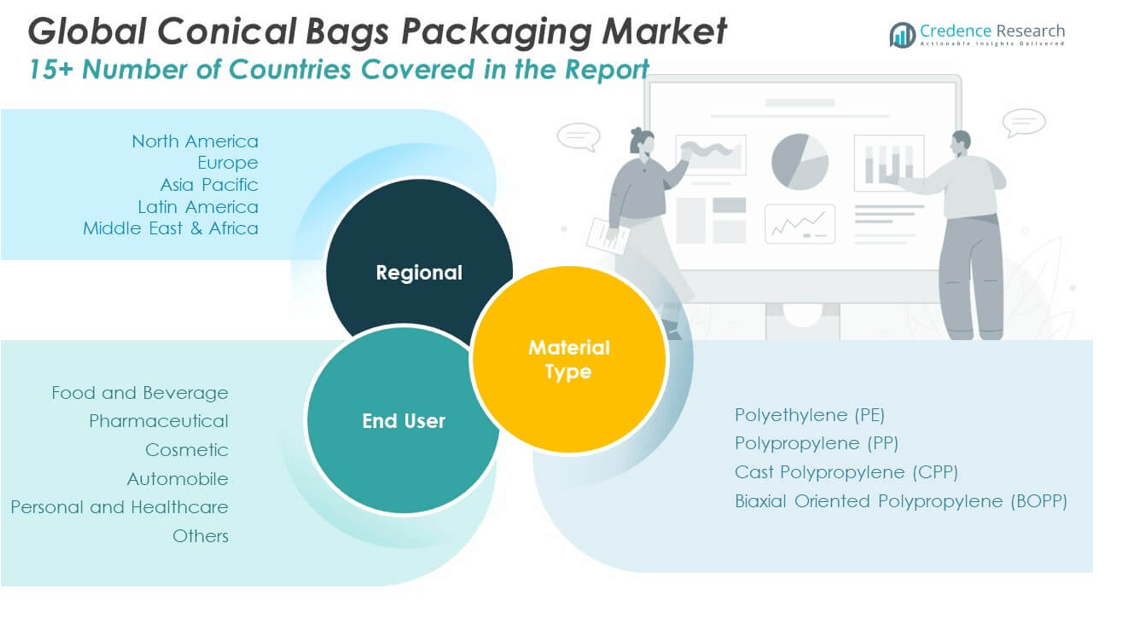

By Material Type

The Global Conical Bags Packaging Market is segmented into Polyethylene (PE), Polypropylene (PP), Cast Polypropylene (CPP), and Biaxial Oriented Polypropylene (BOPP). PE holds a significant share due to its flexibility, chemical resistance, and suitability for varied packaging applications. PP is preferred for its strength, durability, and cost-efficiency in bulk material handling. CPP offers superior clarity and sealing properties, making it ideal for specialized packaging requirements. BOPP is gaining traction for its excellent printability, moisture resistance, and lightweight structure, which supports branding and transportation efficiency.

- For instance, Polyethylene (PE) based conical bags by Berry Global are widely used for their chemical resistance and flexibility, matching the need for secure agricultural product transit and reducing rejection rates due to material failure. Polypropylene (PP) bags by Huhtamaki, thanks to their 30% greater tensile strength versus standard PE, have become standard in bulk powder and industrial material logistics. Mondi Group launched BOPP conical bags for clients in the processed food segment, offering bags with 15% lower weight and enhanced moisture resistance, streamlining food-grade branding and transportation efficiency.

By End User

The market is categorized into Food and Beverage, Pharmaceutical, Cosmetic, Automobile, Personal and Healthcare, and Others. The food and beverage segment dominates due to high demand for safe, hygienic, and moisture-resistant packaging for grains, powders, and processed foods. Pharmaceuticals adopt conical bags for secure bulk transport of active ingredients and medical powders, ensuring compliance with safety standards. Cosmetics utilize these bags for raw material storage and distribution. The automobile industry benefits from their capacity to handle bulk industrial materials such as rubber compounds and powdered chemicals. The personal and healthcare segment uses them for hygienic packaging of medical supplies and personal care products. It continues to expand in other industrial sectors seeking efficient and sustainable bulk packaging solutions.

- For instance, Sealed Air introduced protective conical bags for pharmaceutical shipping in April 2024, which meet rigorous contamination standards with less than 0.02% contamination incidents verified in third-party audits.

Segmentation:

By Material Type

- Polyethylene (PE)

- Polypropylene (PP)

- Cast Polypropylene (CPP)

- Biaxial Oriented Polypropylene (BOPP)

By End User

- Food and Beverage

- Pharmaceutical

- Cosmetic

- Automobile

- Personal and Healthcare

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global Conical Bags Packaging Market size was valued at USD 52.70 million in 2018 to USD 82.23 million in 2024 and is anticipated to reach USD 153.70 million by 2032, at a CAGR of 7.6% during the forecast period. North America holds a substantial share of the market due to advanced manufacturing infrastructure and strong adoption of high-quality bulk packaging solutions. Demand is driven by industrial sectors such as food processing, pharmaceuticals, and chemicals that require safe, moisture-resistant storage. Regulatory standards for packaging safety and environmental compliance encourage the use of durable and recyclable materials. The U.S. dominates regional demand, supported by large-scale production and export-oriented supply chains. Canada and Mexico contribute through agricultural exports and industrial packaging needs. Growing e-commerce distribution for industrial goods further boosts demand for conical bags. It benefits from established trade routes and efficient logistics networks. North America accounts for approximately 22.8% of the global market share.

Europe

The Europe Global Conical Bags Packaging Market size was valued at USD 34.64 million in 2018 to USD 52.00 million in 2024 and is anticipated to reach USD 88.34 million by 2032, at a CAGR of 6.3% during the forecast period. Europe benefits from a mature industrial base and strict packaging regulations that favor high-quality, eco-friendly solutions. Demand is strong in sectors such as chemicals, food, and specialty materials. Countries like Germany, France, and the UK lead due to advanced production capabilities and export-focused industries. Sustainability policies promote the use of recyclable polypropylene and polyethylene. The pharmaceutical industry’s bulk transport needs significantly contribute to growth. Eastern Europe is emerging as a cost-effective manufacturing hub. Rising agricultural exports from Southern Europe also support adoption. Europe accounts for roughly 14.4% of the global market share.

Asia Pacific

The Asia Pacific Global Conical Bags Packaging Market size was valued at USD 75.58 million in 2018 to USD 124.36 million in 2024 and is anticipated to reach USD 246.09 million by 2032, at a CAGR of 8.3% during the forecast period. Asia Pacific dominates the market due to rapid industrialization, high agricultural output, and expanding export activities. China leads in production and consumption, followed by India and Japan. The region benefits from low manufacturing costs and strong raw material availability. Growing infrastructure projects and industrial packaging demand fuel adoption. Agricultural exporters increasingly use conical bags for bulk handling of grains and fertilizers. Expanding e-commerce logistics networks drive industrial packaging needs. Southeast Asia is emerging as a competitive production hub. Asia Pacific holds the largest share, at approximately 34.4% of the global market.

Latin America

The Latin America Global Conical Bags Packaging Market size was valued at USD 8.61 million in 2018 to USD 13.48 million in 2024 and is anticipated to reach USD 22.27 million by 2032, at a CAGR of 5.9% during the forecast period. Latin America’s demand is driven by agricultural exports, mining, and industrial manufacturing. Brazil is the largest contributor, supported by its grain and coffee exports. Argentina and Chile also have growing adoption in agri-business and chemical sectors. The region faces logistical challenges, but modernization of port facilities is improving trade efficiency. Manufacturers are expanding local production to reduce import dependency. Demand for recyclable and cost-effective packaging is increasing with stricter environmental policies. The food processing industry uses conical bags for secure bulk storage and transportation. Latin America represents about 3.9% of the global market share.

Middle East

The Middle East Global Conical Bags Packaging Market size was valued at USD 4.87 million in 2018 to USD 7.04 million in 2024 and is anticipated to reach USD 11.00 million by 2032, at a CAGR of 5.2% during the forecast period. The region’s market growth is supported by demand from petrochemicals, fertilizers, and construction materials industries. GCC countries dominate due to large-scale industrial projects and export activities. Packaging requirements for bulk chemicals and raw materials drive steady demand. The shift toward sustainable packaging aligns with regional environmental initiatives. Infrastructure development projects increase consumption in the construction supply chain. Local manufacturing capabilities are expanding to cater to domestic and export markets. Strategic trade hubs such as the UAE facilitate regional distribution. The Middle East accounts for about 2.0% of the global market share.

Africa

The Africa Global Conical Bags Packaging Market size was valued at USD 2.56 million in 2018 to USD 4.51 million in 2024 and is anticipated to reach USD 6.56 million by 2032, at a CAGR of 4.2% during the forecast period. Africa’s growth is driven by agricultural exports, mining, and gradual industrialization. South Africa leads with established manufacturing and export channels, followed by Egypt and Nigeria. The region’s demand is increasing for secure bulk packaging in fertilizer, grain, and mineral transport. Infrastructure gaps limit large-scale adoption, but investment in trade facilities is improving accessibility. Environmental policies encourage the use of recyclable materials. Local production capacity remains limited, creating opportunities for imports. It is gradually becoming an attractive market for low-cost, durable conical bag solutions. Africa holds about 0.9% of the global market share.

Key Player Analysis:

- Bulkpack Exports Ltd.

- PP Global Limited

- Temkin International

- H. Emballage

- Brain Chamber Polymer Private Limited

- A and M Jumbo Bags Pvt. Ltd.

- Bison Bag Co., Ltd.

- ProAmpac

- Sealed Air

- Coveris

Competitive Analysis:

The Global Conical Bags Packaging Market features a moderately competitive landscape with a mix of global and regional players. Leading companies focus on expanding product portfolios, enhancing material quality, and integrating sustainable solutions to meet regulatory and consumer demands. Strategic initiatives include mergers, acquisitions, and partnerships to strengthen market presence and distribution networks. Innovation in eco-friendly and reusable bag designs is a key differentiator among competitors. The market benefits from established players leveraging economies of scale and advanced manufacturing capabilities. Smaller regional firms compete through cost efficiency and localized service. It continues to attract investment in automation, printing technology, and supply chain optimization to enhance operational efficiency and product appeal.

Recent Developments:

- In August 2025, Bulkpack Exports Ltd. emphasized the enhanced performance of its conical bulk bags for sticky and fine powders, highlighting features such as zero spillage and improved discharge efficiency in its latest communications.

- In 2025, Brain Chamber Polymer Private Limited maintained activities in bulk packaging solutions for various industries, but there is no record of a new launch or strategic partnership in the conical bags packaging sector.

- In January 2025, Bison Bag Co., Ltd., in partnership with Inteplast Engineered Films, introduced a new portfolio of store drop-off recyclable stand-up pouches. This collaboration resulted in flexible packaging solutions designed to meet sustainability objectives and offer enhanced recyclability options for clients in various end-use sectors.

Market Concentration & Characteristics:

The Global Conical Bags Packaging Market exhibits moderate concentration, with top players holding a significant but not dominant share, allowing space for emerging competitors. It is characterized by steady demand across food, agriculture, and industrial sectors, driven by durability, cost efficiency, and regulatory compliance needs. Competition is shaped by innovation in materials, sustainability initiatives, and customization capabilities. Regional manufacturing hubs contribute to supply chain resilience, while global brands maintain an advantage through scale and established client relationships.

Report Coverage:

The research report offers an in-depth analysis based on Material Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption in bulk handling for food, agriculture, and industrial sectors will drive consistent demand.

- Sustainability initiatives will accelerate the shift towards recyclable, reusable, and biodegradable materials.

- Technological innovations in material strength, moisture resistance, and discharge efficiency will enhance product performance.

- Expanding export-oriented supply chains will boost adoption across emerging and developed economies.

- E-commerce growth in industrial goods distribution will increase demand for secure, lightweight bulk packaging.

- Customization capabilities will become a competitive differentiator for niche industry applications.

- Regional manufacturing hubs will strengthen supply chain resilience and reduce dependency on imports.

- Strategic partnerships and acquisitions will expand market reach and product offerings.

- Regulatory compliance will push manufacturers to invest in eco-friendly and safety-certified designs.

- Demand growth in Asia-Pacific will continue to outpace other regions due to industrial and agricultural expansion.