Market Overview

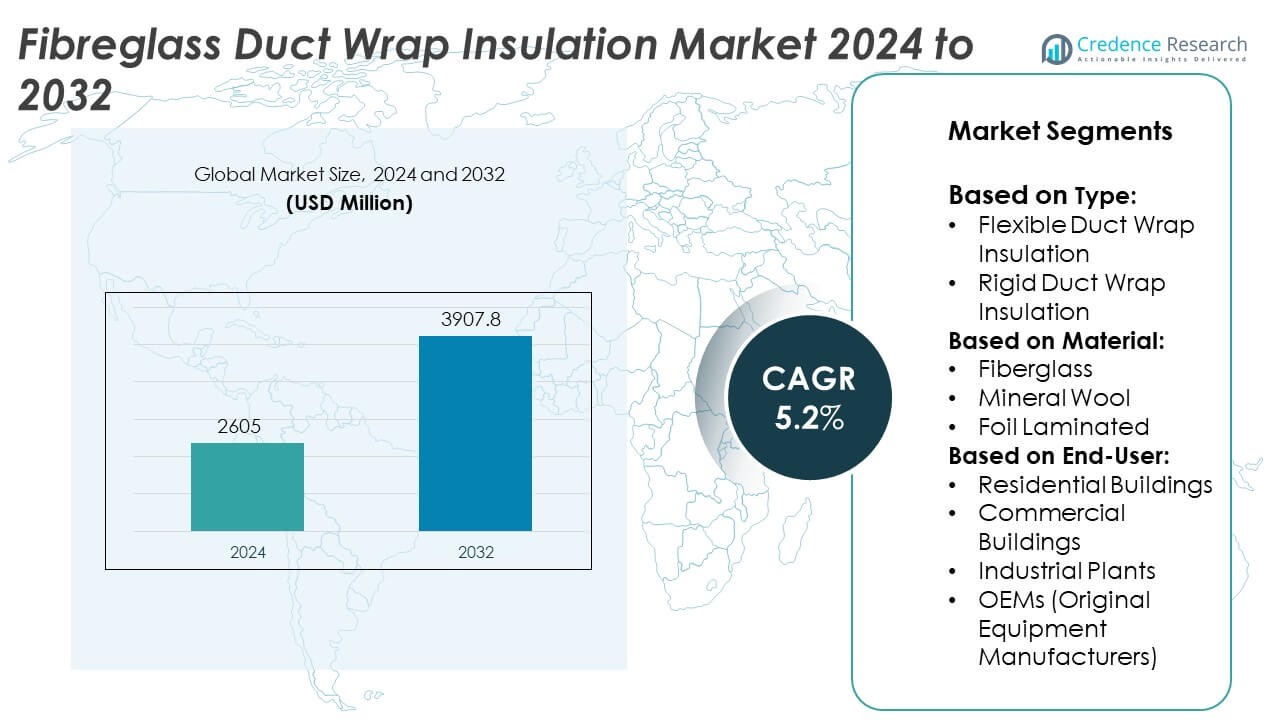

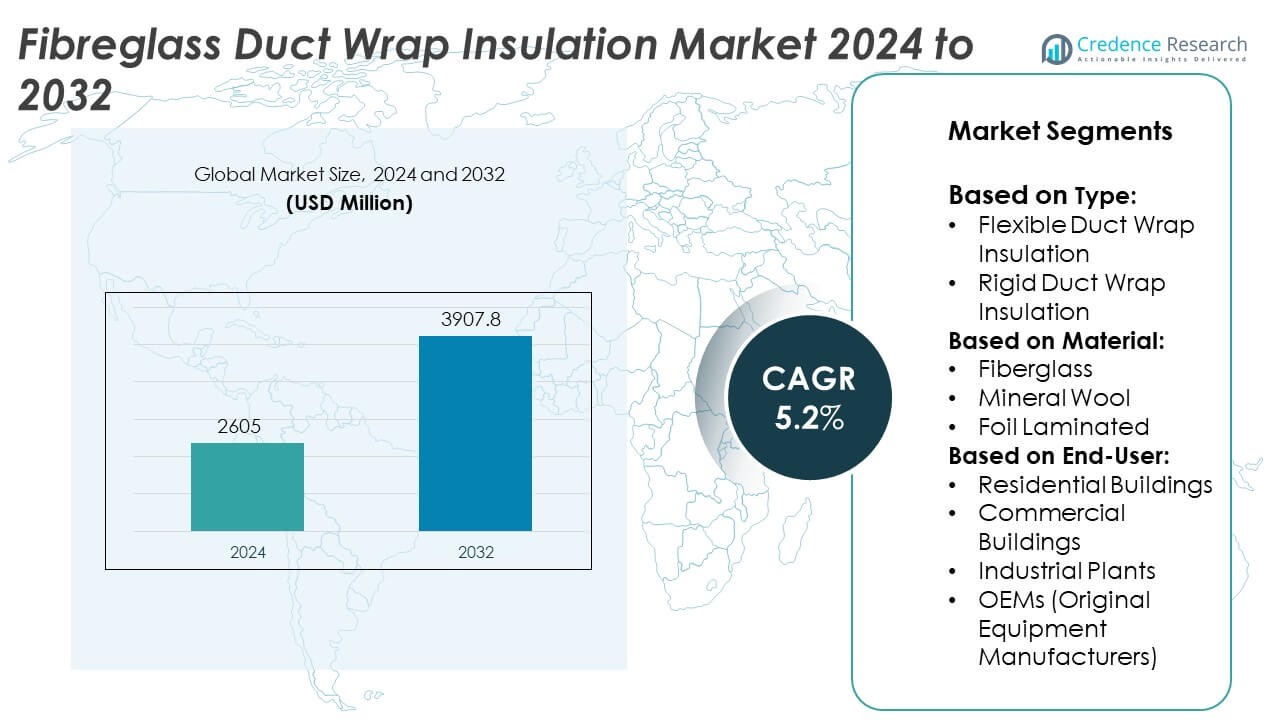

The Fibreglass Duct Wrap Insulation Market size was valued at USD 2605 million in 2024 and is anticipated to reach USD 3907.8 million by 2032, growing at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fibreglass Duct Wrap Insulation Market Size 2024 |

USD 2605 Million |

| Fibreglass Duct Wrap Insulation Market, CAGR |

5.2% |

| Fibreglass Duct Wrap Insulation Market Size 2032 |

USD 3907.8 Million |

The Fibreglass Duct Wrap Insulation market is driven by increasing demand for energy-efficient solutions in residential, commercial, and industrial buildings. Stringent energy regulations, rising construction activities, and a focus on sustainability are pushing the adoption of insulation materials that reduce energy consumption. Technological advancements in insulation performance, alongside growing awareness of environmental impact, support market growth. The trend towards green building certifications and eco-friendly construction practices further boosts demand.

The Fibreglass Duct Wrap Insulation market is experiencing growth across regions, driven by increased urbanization and rising energy efficiency demands. North America and Europe lead in adoption due to stringent regulations and high demand for sustainable construction materials. The Asia-Pacific region is witnessing rapid growth due to industrialization and infrastructure development. Key players in the market include Owens Corning, known for its innovative insulation products, CertainTeed, offering high-performance solutions, and Johns Manville, providing a wide range of energy-efficient insulation materials. These companies are continuously investing in product innovation and sustainability to maintain a competitive edge in the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fibreglass Duct Wrap Insulation market was valued at USD 2605 million in 2024 and is expected to reach USD 3907.8 million by 2032, growing at a CAGR of 5.2% during the forecast period.

- Increased demand for energy-efficient solutions and environmental sustainability is driving the market.

- Technological advancements in insulation materials, including improved fire resistance and thermal performance, are key market trends.

- The rise of green building certifications and eco-friendly construction practices is boosting the adoption of fibreglass duct wrap insulation.

- Key players like Owens Corning, CertainTeed, and Johns Manville are innovating to maintain market leadership and expand their product offerings.

- Fluctuating raw material prices, particularly for glass fibers and resins, act as a restraint, affecting production costs and market stability.

- North America and Europe lead the market, supported by strong energy regulations and high adoption of sustainable building materials, while Asia-Pacific is experiencing rapid growth due to urbanization and industrialization.

Market Drivers

Rising Demand for Energy-Efficient Solutions

The Fibreglass Duct Wrap Insulation market benefits from the increasing emphasis on energy efficiency in buildings. Governments across the globe are implementing stringent regulations to reduce energy consumption in both residential and commercial properties. Insulation materials such as fibreglass duct wraps contribute to maintaining desired temperatures while reducing energy losses in HVAC systems. This growing awareness about sustainability is driving the demand for energy-efficient insulation solutions, particularly in the construction and renovation sectors.

- For instance, Owens Corning’s insulation products, like their EcoTouch® PINK® Fiberglas™ Insulation, have helped save over 100 billion kWh of energy annually in residential buildings in North America alone, resulting in a significant reduction in overall energy consumption.

Technological Advancements in Insulation Materials

The continuous development of advanced fibreglass insulation materials is a major driver for the market. Manufacturers are focusing on enhancing the thermal performance, durability, and fire resistance of fibreglass duct wraps. Innovations in production techniques allow for higher efficiency in reducing energy loss while maintaining ease of installation. These advancements make fibreglass duct wrap insulation an attractive choice for both new builds and retrofitting projects.

- For instance, Knauf Insulation’s glass wool products have been used in the renovation of over 10 million square meters of commercial building space across Europe, significantly reducing energy consumption in the process.

Stringent Environmental and Safety Regulations

Governments worldwide are enforcing stricter regulations to ensure buildings meet energy standards and improve environmental impact. This includes requirements for high-performance insulation in HVAC systems to prevent energy waste. Fibreglass duct wrap insulation helps meet these mandates by offering superior thermal and soundproofing properties, contributing to regulatory compliance. Increased environmental awareness further reinforces the demand for high-quality, eco-friendly insulation products.

Growing Construction and Renovation Activities

The growth of the global construction sector is a significant factor driving the demand for fibreglass duct wrap insulation. Urbanization and infrastructure development, particularly in emerging markets, are increasing the need for energy-efficient building solutions. Additionally, the rise in retrofitting and renovation projects further boosts the market, as property owners seek to upgrade their HVAC systems to enhance energy efficiency.

Market Trends

Growing Adoption of Sustainable Building Practices

The Fibreglass Duct Wrap Insulation market is witnessing a shift toward more sustainable building practices. Increasing demand for green construction materials is driving the adoption of insulation products that offer both energy efficiency and environmental benefits. Builders and developers are prioritizing eco-friendly materials that contribute to reducing carbon footprints. This trend is fueled by both regulatory requirements and a heightened public awareness about sustainability. Fibreglass duct wrap insulation, with its superior thermal performance and recyclability, aligns with these growing demands.

- For instance, CertainTeed’s fiberglass duct insulation provides up to 25% better thermal performance compared to conventional fiberglass materials, reducing energy consumption by approximately 15% in HVAC systems.

Integration with Smart Building Technologies

The integration of smart technologies into building management systems is becoming a prominent trend within the Fibreglass Duct Wrap Insulation market. Smart thermostats and HVAC systems now work in conjunction with high-performance insulation products to optimize energy consumption. These technologies help track and manage energy usage, ensuring buildings remain energy-efficient and comfortable. As the market for smart buildings expands, fibreglass duct wrap insulation is increasingly being specified as part of the overall energy-saving strategy.

- For instance, Johns Manville’s fibreglass duct wrap insulation is certified by GREENGUARD Gold for low chemical emissions and has contributed to more than 1 million square feet of LEED-certified buildings.

Focus on Improved Acoustic Performance

An emerging trend in the Fibreglass Duct Wrap Insulation market is the growing demand for enhanced acoustic performance. Insulation materials, including fibreglass duct wraps, are being developed with improved soundproofing capabilities. This is particularly important in environments where noise control is critical, such as in commercial and residential buildings. The need for quieter, more comfortable spaces is influencing the preference for high-performance insulation that not only improves thermal efficiency but also contributes to noise reduction.

Shift Towards Customizable and Flexible Insulation Solutions

There is a noticeable shift toward more customizable and flexible insulation solutions in the Fibreglass Duct Wrap Insulation market. Contractors and architects increasingly seek insulation products that can be tailored to specific needs and building configurations. Fibreglass duct wrap insulation can be easily customized to fit various duct shapes and sizes, making it a versatile choice for diverse applications. This flexibility enhances its appeal in both new construction and renovation projects, meeting the demands of modern building designs.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Chain Disruptions

One of the significant challenges facing the Fibreglass Duct Wrap Insulation market is the volatility in raw material prices. The production of fibreglass insulation relies on various materials, including glass fibers and resins, which are subject to price fluctuations. These price changes often stem from shifts in global supply chains, trade policies, and raw material shortages. Manufacturers may face difficulties in maintaining consistent production costs, leading to price increases for end consumers. Disruptions in supply chains, such as those caused by geopolitical tensions or pandemics, further exacerbate these challenges, affecting both the availability and cost of materials.

Health and Safety Concerns Associated with Fibreglass Products

Health and safety concerns related to the handling and installation of fibreglass duct wrap insulation pose another challenge in the market. Fibreglass materials can release fine particles that irritate the skin, eyes, and respiratory system during installation. This raises concerns for workers’ safety and increases the need for proper protective gear and handling protocols. While manufacturers continue to improve the design of fibreglass products to minimize these risks, these safety issues can still deter potential customers from choosing fibreglass insulation over alternative materials. Addressing these concerns through education and enhanced safety standards is critical for market growth.

Market Opportunities

Growing Demand for Retrofitting and Renovation Projects

The Fibreglass Duct Wrap Insulation market stands to benefit from the increasing demand for retrofitting and renovation projects. Older buildings require energy-efficient upgrades to meet modern building codes and sustainability standards. Insulation solutions like fibreglass duct wraps provide an effective way to improve thermal performance in existing structures without significant alterations. This presents a significant opportunity for manufacturers to target the large, untapped market of building renovations, especially in regions with aging infrastructure. As more property owners focus on reducing energy consumption and improving indoor comfort, the market for fibreglass duct wrap insulation will expand.

Expansion in Emerging Markets and Green Building Initiatives

Emerging markets present a growing opportunity for the Fibreglass Duct Wrap Insulation market. As developing economies industrialize and urbanize, there is an increasing focus on energy-efficient buildings and infrastructure. Fibreglass duct wrap insulation plays a key role in reducing energy consumption, making it an attractive option for new developments in these regions. Furthermore, the global push for green building certifications and eco-friendly construction practices strengthens the demand for high-performance insulation materials. The adoption of sustainability practices in construction is expected to drive market growth, with fibreglass duct wrap insulation becoming a preferred choice for energy-efficient solutions.

Market Segmentation Analysis:

By Type:

The Fibreglass Duct Wrap Insulation market is primarily segmented into flexible and rigid duct wrap insulation. Flexible duct wrap insulation is the most commonly used type, favored for its ease of installation in complex or confined spaces. It offers superior flexibility, enabling it to conform to irregular duct shapes, making it ideal for residential and commercial buildings. Rigid duct wrap insulation, on the other hand, provides greater structural integrity and is more commonly used in industrial plants and larger-scale HVAC systems. Both types are critical for improving energy efficiency and reducing heat loss in air distribution systems.

- For instance, Owens Corning’s flexible duct wrap insulation products, such as the EcoTouch® PINK® Fiberglas™ Insulation, offer a thermal resistance of R-11 for a 3-inch thickness and R-38 for a 12-inch thickness, helping to minimize heat loss in HVAC systems.

By Material:

The material segment of the Fibreglass Duct Wrap Insulation market includes fiberglass, mineral wool, and foil laminated insulation. Fiberglass remains the dominant material due to its excellent thermal resistance and soundproofing properties. It is lightweight, cost-effective, and highly versatile, making it the preferred choice for most applications. Mineral wool insulation, while less common, is also gaining traction due to its superior fire-resistant properties, making it suitable for industrial and commercial buildings. Foil laminated insulation is mainly used in environments requiring enhanced moisture control and thermal reflection, providing a more specific, niche application.

- For instance, Johns Manville’s rigid duct wrap insulation, like its Thermafiber® Mineral Insulation, offers a thermal resistance of R-30 at a 6-inch thickness, ideal for larger industrial HVAC systems, and provides a 1-hour fire rating under ASTM E119 standards. Both types are critical for improving energy efficiency and reducing heat loss in air distribution systems.

By End-User:

The Fibreglass Duct Wrap Insulation market serves several key end-users, including residential buildings, commercial buildings, industrial plants, and OEMs. Residential buildings hold a significant share, driven by growing concerns about energy efficiency and rising utility costs. Insulation in HVAC systems helps reduce energy consumption and maintain temperature stability in homes. Commercial buildings follow closely, where insulation requirements are driven by energy regulations and the need for comfort in office spaces. Industrial plants also demand high-performance duct insulation to support energy savings and regulatory compliance. OEMs, particularly those in the HVAC industry, are increasingly using fibreglass duct wrap insulation in their manufacturing processes to offer energy-efficient solutions in their products.

Segments:

Based on Type:

- Flexible Duct Wrap Insulation

- Rigid Duct Wrap Insulation

Based on Material:

- Fiberglass

- Mineral Wool

- Foil Laminated

Based on End-User:

- Residential Buildings

- Commercial Buildings

- Industrial Plants

- OEMs (Original Equipment Manufacturers)

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Fibreglass Duct Wrap Insulation market, accounting for 35% of the global market. This region’s demand is driven by stringent energy efficiency regulations and the growing emphasis on sustainable building practices. The United States and Canada lead the adoption of energy-efficient insulation products, particularly in commercial and residential buildings. Both countries are making significant strides in retrofitting older buildings to comply with modern energy codes, boosting the demand for fibreglass duct wrap insulation. Furthermore, the presence of several leading manufacturers and advanced infrastructure projects contributes to North America’s dominant market position.

Europe

Europe holds the second-largest share of the Fibreglass Duct Wrap Insulation market, representing 30% of global demand. The region’s focus on reducing carbon emissions and improving energy efficiency is a key driver for the market. The European Union’s ambitious environmental policies, including the European Green Deal, are pushing the adoption of energy-efficient solutions in both new construction and renovation projects. Countries like Germany, the UK, and France are major contributors to the growth in this market. The growing trend of green building certifications and sustainable construction practices further fuels the demand for fibreglass duct wrap insulation in Europe.

Asia-Pacific

The Asia-Pacific region is experiencing rapid growth in the Fibreglass Duct Wrap Insulation market, capturing 25% of the global market share. Countries like China, India, and Japan are at the forefront of industrialization and urbanization, creating a significant demand for energy-efficient insulation in both residential and commercial buildings. With large-scale infrastructure projects and rising urban population densities, the region is witnessing increasing adoption of energy-saving products. Furthermore, the region’s growing focus on sustainability and reducing energy consumption in buildings has made fibreglass duct wrap insulation an attractive option for developers and building owners.

Latin America

Latin America represents 5% of the Fibreglass Duct Wrap Insulation market. The demand in this region is largely driven by urban growth, particularly in Brazil and Mexico, where infrastructure development is rapidly increasing. As the region focuses on improving energy efficiency in buildings, there is a growing need for insulation materials like fibreglass duct wraps. Although the market is smaller compared to North America and Europe, rising awareness of energy conservation and regulatory support for sustainable construction practices are expected to fuel steady growth in Latin America over the next few years.

Middle East & Africa

The Middle East and Africa (MEA) region accounts for 5% of the global market share for Fibreglass Duct Wrap Insulation. The demand for insulation products in this region is mainly driven by the construction boom in countries like the UAE, Saudi Arabia, and South Africa. As the region experiences rapid urbanization and new infrastructure projects, the need for energy-efficient building materials grows. Additionally, extreme temperatures in many parts of the region make effective insulation critical for maintaining energy efficiency in both residential and commercial buildings. However, market growth remains somewhat limited due to lower awareness and the high cost of advanced insulation materials in some areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The leading players in the Fibreglass Duct Wrap Insulation market include Owens Corning, CertainTeed, Johns Manville, Knauf, and GAF. These companies are major contributors to the growth and innovation within the market, consistently focusing on enhancing the performance of their insulation materials. Owens Corning and CertainTeed are known for their wide range of high-quality fibreglass insulation products that provide excellent thermal performance and energy efficiency. Both companies invest heavily in research and development to improve product characteristics, such as fire resistance and ease of installation. Johns Manville also maintains a strong position by offering versatile insulation solutions that cater to various applications in both residential and commercial markets, on the other hand, have successfully expanded their product portfolios to include eco-friendly options that align with growing demand for sustainability. Their focus on using recycled materials and minimizing environmental impact helps them cater to the increasing market demand for green building solutions. These companies compete by offering customized solutions to meet specific customer needs and by emphasizing product performance and compliance with industry regulations. As market demand for energy-efficient solutions grows, these key players are positioned to lead the market through continuous innovation and expansion in new regions.

Recent Developments

- In 2024, frost king offers fiberglass duct wrap products and insulation kits, but no new product or development was found.

- In 2023, Owens Corning, continued to focus on developing and improving their fiberglass duct wrap insulation products.

- In 2023, Knauf Insulation continued its focus on enhancing its fiberglass duct wrap insulation products. This included efforts to improve their performance, sustainability, and overall suitability for various applications.

Market Concentration & Characteristics

The Fibreglass Duct Wrap Insulation market is characterized by moderate concentration, with several key players dominating the space. Leading companies, such as Owens Corning, CertainTeed, and Johns Manville, maintain significant market shares due to their established product offerings, technological advancements, and strong distribution networks. These players continually invest in innovation to enhance the thermal efficiency, fire resistance, and sustainability of their products. The market also exhibits a high level of competition as new entrants and regional players strive to expand their presence. Despite this, the industry remains largely driven by the demand for energy-efficient solutions, regulatory compliance, and sustainability in construction materials. As more markets, particularly in emerging economies, adopt energy-efficient building practices, the market’s growth is propelled by the increasing adoption of high-performance insulation products. The market is moderately fragmented, with both large global players and regional manufacturers offering varied solutions tailored to specific regional needs.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Fibreglass Duct Wrap Insulation market is expected to grow steadily due to rising demand for energy-efficient solutions in buildings.

- Technological advancements in insulation materials will continue to improve thermal performance and fire resistance.

- Stringent regulations around energy efficiency in the construction industry will drive further adoption of high-performance insulation materials.

- The trend toward green building certifications and sustainable construction practices will support the growth of fibreglass duct wrap insulation.

- Increased awareness about reducing carbon footprints and improving building sustainability will accelerate market expansion.

- The market will see heightened demand in emerging economies as industrialization and urbanization continue to increase.

- The focus on reducing HVAC energy consumption in both residential and commercial buildings will continue to boost insulation demand.

- Product innovation will be key, with manufacturers focusing on improved ease of installation and higher durability.

- The adoption of eco-friendly and recyclable materials will shape the future of the fibreglass duct wrap insulation market.

- As the construction industry grows globally, the market will see expanded opportunities in both new construction and retrofitting projects.