Market Overview

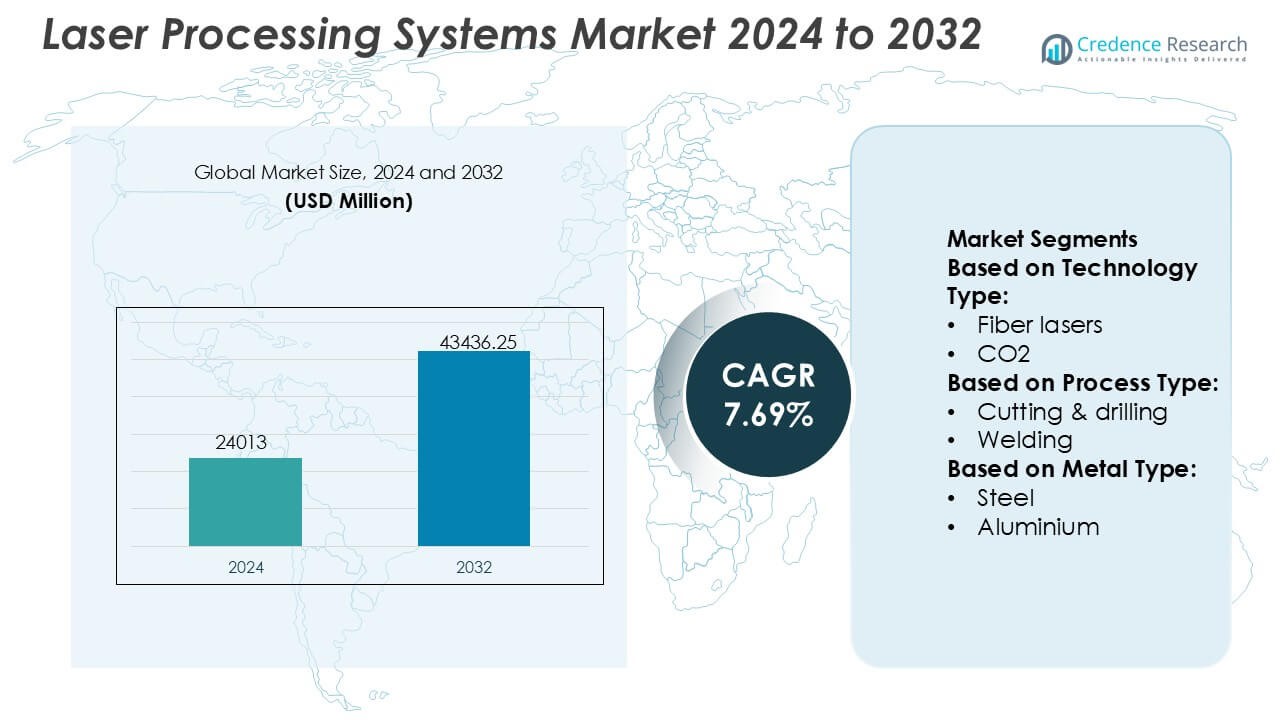

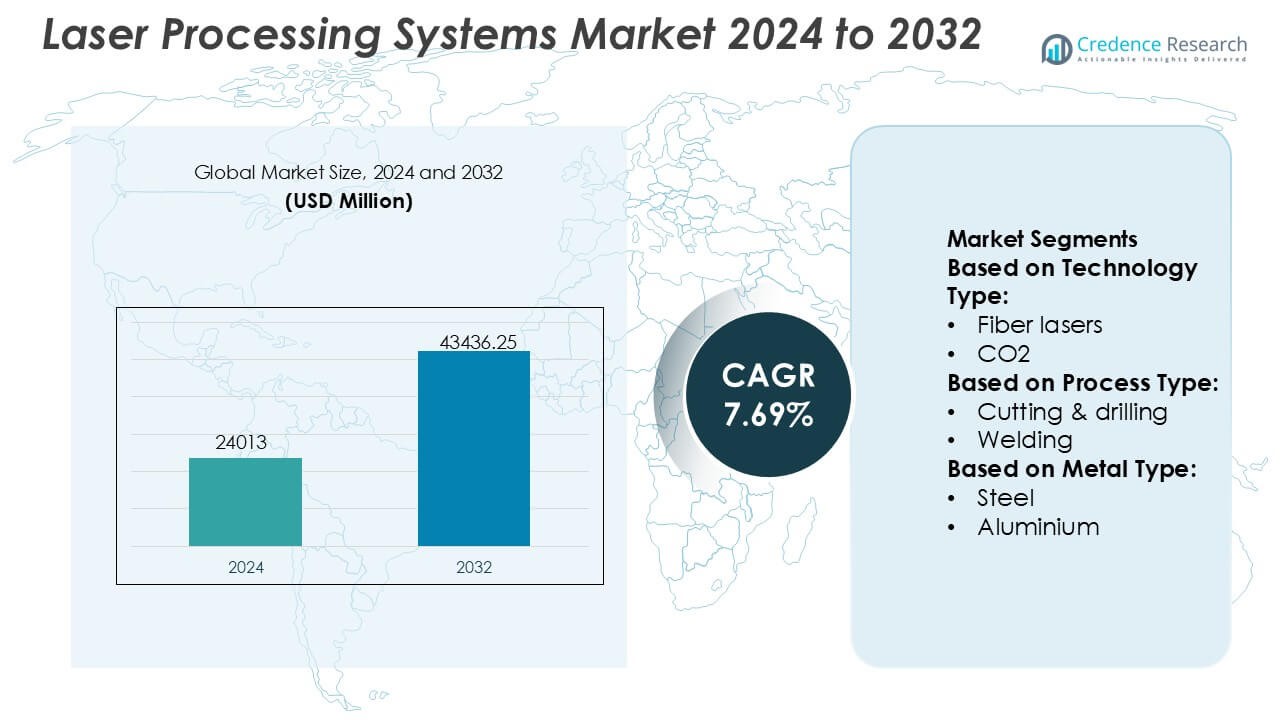

Laser Processing Systems Market size was valued USD 24013 million in 2024 and is anticipated to reach USD 43436.25 million by 2032, at a CAGR of 7.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Laser Processing Systems Market Size 2024 |

USD 24013 Million |

| Laser Processing Systems Market, CAGR |

7.69% |

| Laser Processing Systems Market Size 2032 |

USD 43436.25 Million |

The Laser Processing Systems Market is led by a group of technologically advanced manufacturers that compete on laser source innovation, system reliability, and application-specific performance. Top players focus on expanding high-power fiber and ultrafast laser portfolios while integrating automation, digital monitoring, and intelligent control features to support precision manufacturing. Competitive differentiation centers on processing speed, beam quality, lifecycle support, and the ability to address complex materials used in automotive, electronics, and industrial fabrication. Regionally, Asia-Pacific leads the market with an exact 34% share, supported by large-scale electronics, semiconductor, automotive, and battery manufacturing. Strong production volumes, rapid automation adoption, and continuous investment in advanced manufacturing infrastructure position the region as the primary growth engine for laser processing systems globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Laser Processing Systems Market size was valued at USD 24,013 million in 2024 and is projected to reach USD 43,436.25 million by 2032, growing at a CAGR of 7.69% during the forecast period.

- Market growth is driven by rising adoption of automation and precision manufacturing, with fiber lasers emerging as the dominant segment due to high efficiency, flexibility, and lower operating costs.

- Key trends include increased integration of laser systems with robotics, digital monitoring, and smart factory platforms, alongside growing demand for ultrafast lasers in micromachining and electronics processing.

- The competitive landscape remains intense, with leading players focusing on laser source innovation, high-power systems, application-specific solutions, and strong lifecycle service capabilities to differentiate offerings.

- Asia-Pacific leads the market with an exact 34% share, supported by large-scale electronics, semiconductor, automotive, and battery manufacturing, while capital-intensive system costs remain a key restraint for smaller manufacturers.

Market Segmentation Analysis:

By Technology Type

The Laser Processing Systems Market by technology type is led by fiber lasers, which hold the dominant share at around 46%. Fiber lasers maintain leadership due to high electrical efficiency, superior beam quality, and low maintenance requirements compared with CO₂ and solid-state systems. Their compact design and long operational lifetimes support continuous industrial use across automotive, electronics, and metal fabrication sectors. CO₂ lasers retain relevance in non-metal processing, while solid-state lasers serve precision applications. However, increasing adoption of automation and high-speed manufacturing continues to reinforce fiber lasers as the preferred industrial standard.

- For instance, Newport Corporation, under MKS Instruments, offers Spectra-Physics fiber laser platforms delivering output powers exceeding 2,000 watts with beam quality below 1.1 M² and designed operational lifetimes above 50,000 hours, supporting high-throughput cutting and welding applications in demanding production settings.

By Process Type

By process type, cutting and drilling represent the dominant sub-segment, accounting for approximately 41% of total demand. This dominance stems from widespread use in sheet metal fabrication, automotive body manufacturing, and heavy industrial components where precision and throughput are critical. Laser cutting enables high-speed processing, minimal material waste, and flexibility across thickness ranges. Welding and marking follow, supported by electronics and medical devices. Ongoing investments in smart factories and digitally controlled machining centers further strengthen cutting and drilling as the core revenue-generating process segment.

- For instance, Eurolaser GmbH develops large-format laser cutting systems with working areas up to 3,200 × 3,200 millimeters, achieving positioning accuracy of $\pm$0.1 millimeters and cutting speeds typically up to 85 meters per minute (1,414 mm/s), enabling high-volume, precision-driven industrial cutting operations.

By Metal Type

In terms of metal type, steel emerges as the leading sub-segment with an estimated 44% market share, driven by its extensive use in automotive structures, construction equipment, shipbuilding, and industrial machinery. Laser systems deliver high accuracy and repeatability when processing steel, supporting complex geometries and high-volume production. Aluminium and copper show rising adoption due to lightweighting and electrification trends, while plastics, ceramics, and composites serve specialized applications. Nevertheless, steel’s broad industrial footprint and compatibility with high-power laser systems sustain its dominant position.

Key Growth Drivers

Industrial Automation and Precision Manufacturing

Rising adoption of industrial automation drives sustained demand for laser processing systems across automotive, electronics, and general manufacturing. Manufacturers deploy fiber and solid-state lasers to achieve micron-level precision, consistent quality, and high repeatability in cutting, welding, and micromachining operations. Automated laser cells integrate seamlessly with robotics and CNC platforms, enabling lights-out manufacturing and reduced cycle times. These capabilities support mass customization, tighter tolerances, and improved yield, making laser systems a core technology for smart factories pursuing productivity gains and defect reduction.

- For instance, Han’s Laser Technology Industry Group Co., Ltd. supplies automated fiber laser cutting systems capable of positioning accuracy within ±0.03 millimeters, repeat positioning accuracy of ±0.02 millimeters, and continuous operation exceeding 20 hours per day, supporting high-throughput, fully automated manufacturing lines in automotive and electronics production.

Electrification and Lightweight Material Processing

The global shift toward electrification accelerates laser system adoption for processing advanced materials used in EVs, batteries, and power electronics. Laser cutting and welding deliver clean joints in aluminum, copper, and thin foils while minimizing heat-affected zones critical for battery safety and performance. As OEMs increase lightweighting initiatives, lasers replace mechanical tools to process high-strength alloys and composites with superior edge quality. This transition expands demand across battery module assembly, motor manufacturing, and thermal management components.

- For instance, IPG Photonics’ YLR series of ytterbium-doped fiber lasers delivers continuous output powers from 100 watts up to 4,000 watts with single-mode beam qualities suitable for precision cutting and welding, while its high-power fiber lasers can reach up to 125,000 watts output for thick metal processing, enabling manufacturers to achieve consistent, high-speed operations with reliable performance over extended duty cycles. 0search8.

Technological Advancements in Laser Sources

Continuous innovation in laser sources underpins market growth by improving efficiency, power density, and beam quality. High-power fiber lasers offer lower operating costs, longer lifetimes, and flexible beam delivery, broadening applicability across thick and thin materials. Advances in ultrafast and disk lasers enable precise micromachining with minimal thermal impact, supporting electronics and medical device manufacturing. Integrated monitoring, adaptive optics, and software control further enhance process stability, driving replacement cycles and new installations.

Key Trends & Opportunities

Adoption of Digital and Intelligent Laser Systems

Manufacturers increasingly adopt digitally enabled laser systems with real-time monitoring, closed-loop control, and data analytics. These capabilities optimize process parameters, predict maintenance needs, and reduce downtime. Integration with MES and Industry 4.0 platforms supports traceability and quality assurance across production lines. Intelligent lasers also enable rapid changeovers and remote diagnostics, creating opportunities for vendors to offer software, service contracts, and lifecycle solutions alongside hardware.

- For instance, Epilog Laser, Inc. offers Fusion Pro series laser systems equipped with Ethernet-based connectivity, onboard job memory exceeding 1,000 files, engraving speeds up to 165 inches per second, positioning resolutions of 5 microns, and CO₂ laser power options reaching 120 watts, enabling digitally controlled, high-throughput production with precise process repeatability.

Expansion into Micromachining and Electronics Manufacturing

Growing demand for miniaturized components fuels opportunities in micromachining, marking, and precision drilling. Ultrafast lasers address delicate substrates used in semiconductors, displays, and medical devices without compromising material integrity. As electronics manufacturing scales advanced packaging and flexible circuits, laser systems provide non-contact processing and high throughput. This trend opens avenues for specialized systems tailored to fine feature sizes and high-value applications.

- For instance, ALPhANOV develops ultrafast laser systems that are used in precision micromachining. The company’s product portfolio includes lasers operating with pulse durations below 10 picoseconds and repetition rates that can exceed 500 kilohertz.

Growth in Contract Manufacturing and Job Shops

Rising outsourcing of fabrication creates opportunities for laser system deployment in contract manufacturing and job shops. Flexible, multi-process laser platforms allow service providers to address diverse customer requirements efficiently. Shorter product lifecycles and variable batch sizes favor programmable laser solutions that reduce setup time and tooling costs. Vendors benefit through sales of versatile systems and aftermarket services to this expanding customer base.

Key Challenges

High Capital Investment and Cost Sensitivity

Laser processing systems require significant upfront investment, which can deter small and mid-sized manufacturers. Costs extend beyond equipment to include integration, safety infrastructure, and skilled operators. In price-sensitive markets, buyers may delay adoption or opt for lower-cost alternatives despite long-term efficiency benefits. Vendors must address this challenge through financing options, modular systems, and clear ROI justification to broaden market penetration.

Process Complexity and Skill Requirements

Advanced laser applications demand specialized process knowledge, parameter optimization, and maintenance expertise. Variability in materials and part geometries increases setup complexity and learning curves. Shortages of skilled technicians can limit effective utilization and slow adoption, particularly in emerging markets. Suppliers face pressure to simplify operation through automation, training programs, and user-friendly software while ensuring consistent performance across applications.

Regional Analysis

North America

North America holds an exact 31% market share in the Laser Processing Systems Market, driven by advanced manufacturing infrastructure and early adoption of automation technologies. The region benefits from strong demand across automotive, aerospace, electronics, and medical device manufacturing, where precision and repeatability are critical. High investment in smart factories, robotics integration, and digital manufacturing platforms supports sustained laser system adoption. The presence of leading laser technology suppliers, contract manufacturers, and system integrators further strengthens the market. Additionally, reshoring initiatives and focus on high-value manufacturing continue to stimulate demand for advanced laser processing solutions.

Europe

Europe accounts for an exact 26% market share, supported by its strong base in automotive, industrial machinery, and precision engineering. Countries such as Germany, Italy, and France emphasize high-quality manufacturing, where laser cutting, welding, and micromachining play a central role. Strict quality standards and energy-efficiency regulations encourage adoption of modern fiber and solid-state laser systems. The region also benefits from sustained investment in Industry 4.0, digitalization, and advanced materials processing. Strong collaboration between equipment manufacturers, research institutes, and end users accelerates innovation and technology upgrades across the region.

Asia-Pacific

Asia-Pacific dominates the Laser Processing Systems Market with an exact 34% market share, driven by large-scale manufacturing activity and rapid industrial expansion. China, Japan, South Korea, and Taiwan represent major demand centers due to strong electronics, semiconductor, automotive, and battery manufacturing bases. High-volume production environments favor laser systems for their speed, precision, and automation compatibility. Government initiatives supporting advanced manufacturing and domestic equipment development further strengthen regional adoption. The presence of extensive contract manufacturing and electronics assembly ecosystems positions Asia-Pacific as the fastest-growing and most competitive regional market.

Latin America

Latin America holds an exact 5% market share, reflecting gradual adoption of laser processing technologies across automotive, metal fabrication, and electronics assembly sectors. Brazil and Mexico serve as key markets due to their established automotive manufacturing bases and proximity to global supply chains. Increasing investment in industrial automation and modernization of fabrication facilities supports demand for laser cutting and welding systems. However, adoption remains selective due to capital constraints and uneven technological maturity. Growth opportunities emerge as regional manufacturers seek productivity improvements and quality enhancements to remain competitive in export-oriented industries.

Middle East & Africa

The Middle East & Africa region accounts for an exact 4% market share, supported by growing industrial diversification and infrastructure development. Demand concentrates in metal fabrication, energy equipment manufacturing, and emerging electronics assembly operations. Countries in the Gulf region invest in advanced manufacturing capabilities to reduce reliance on imports, driving adoption of laser cutting and marking systems. In Africa, gradual industrialization and foreign direct investment contribute to steady, though limited, uptake. While market penetration remains relatively low, long-term opportunities exist through industrial expansion and technology transfer initiatives.

Market Segmentations:

By Technology Type:

By Process Type:

- Cutting & drilling

- Welding

By Metal Type:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Laser Processing Systems Market features a Newport Corporation (MKS Instruments, Inc.), Eurolaser GmbH, Han’s Laser Technology Industry Group Co., Ltd., Altec GmbH, IPG Photonics Corporation, Epilog Laser, Inc., Alpha Nov Laser, Bystronic Laser AG, Coherent Inc., and Amada Co., Ltd. The Laser Processing Systems Market exhibits a highly competitive landscape characterized by continuous technological innovation, application-specific customization, and strong emphasis on performance reliability. Market participants compete on laser power scalability, beam quality, processing speed, and system integration capabilities to meet the evolving needs of automotive, electronics, aerospace, and precision manufacturing sectors. Vendors increasingly differentiate through advanced software, real-time monitoring, and automation-ready platforms that enhance productivity and process consistency. Strategic priorities include expanding solution portfolios for lightweight materials, batteries, and micromachining applications, while strengthening global service networks and lifecycle support. Competitive intensity remains high as companies invest in R&D, digitalization, and flexible manufacturing solutions to capture long-term contracts and maintain customer loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Newport Corporation (MKS Instruments, Inc.)

- Eurolaser GmbH

- Han’s Laser Technology Industry Group Co., Ltd.

- Altec GmbH

- IPG Photonics Corporation

- Epilog Laser, Inc.

- Alpha Nov Laser

- Bystronic Laser AG

- Coherent Inc.

- Amada Co., Ltd.

Recent Developments

- In April 2025, AkzoNobel bonds with IPG Photonics over laser curing for powder coatings. The partnership between AkzoNobel and IPG Photonics focused on applying laser technology for curing powder coatings.

- In January 2025, Laser Photonics Corp (LPC) (LASE) announced a significant development: a novel laser cleaning-enabled robotic crawler designed to revolutionize industrial maintenance, especially for naval corrosion, in partnership with Fonon Technologies and Boston Engineering, showcasing it at the Pearl Harbor Naval Shipyard.

- In January 2024, Coherent unveiled the OBIS 640 XT, a new red laser module that offers high output power, low noise, and excellent beam quality. This module complements their existing blue and green laser offerings, collectively enhancing the performance of high-performance SRM systems. The introduction of this product signifies Coherent’s commitment to advancing laser technology for various applications.

- In January 2024, Novanta Inc. acquired Motion Solutions, which is expected to facilitate the development of innovative intelligent subsystems by leveraging their combined technological capabilities. This acquisition aims to enhance their product offerings and create unique solutions tailored to customer needs.

Report Coverage

The research report offers an in-depth analysis based on Technology Type, Process Type, Metal Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Laser processing systems will see wider adoption as manufacturers prioritize precision, automation, and repeatable quality across high-volume production environments.

- Fiber and ultrafast laser technologies will continue to gain preference due to higher efficiency, longer service life, and lower operating complexity.

- Integration of laser systems with robotics, AI-driven monitoring, and digital manufacturing platforms will strengthen smart factory deployments.

- Demand for laser-based processing of lightweight and advanced materials will rise across electric vehicles, batteries, and power electronics.

- Micromachining and fine-feature processing will expand steadily with growth in electronics, medical devices, and semiconductor packaging.

- Software-enabled process optimization and predictive maintenance will become standard features in next-generation laser platforms.

- Modular and multi-process laser systems will gain traction by supporting flexible production and rapid changeovers.

- Adoption will increase among contract manufacturers and job shops seeking higher throughput and reduced tooling dependency.

- Vendors will place greater focus on service models, training, and lifecycle support to strengthen long-term customer relationships.

- Emerging economies will contribute incremental growth as industrial automation and advanced fabrication capabilities expand.