Market Overview:

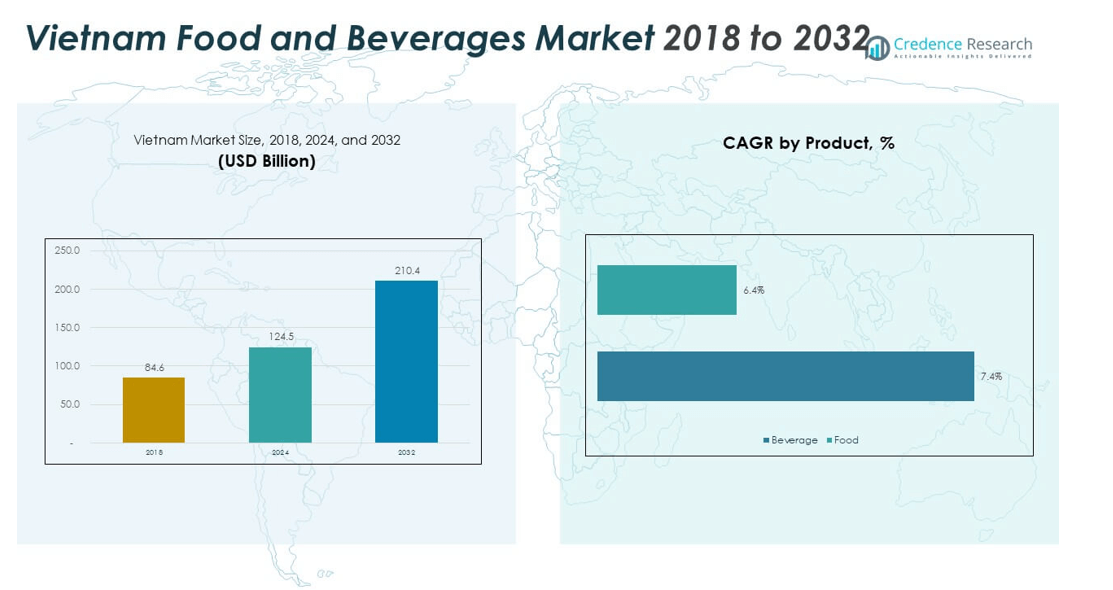

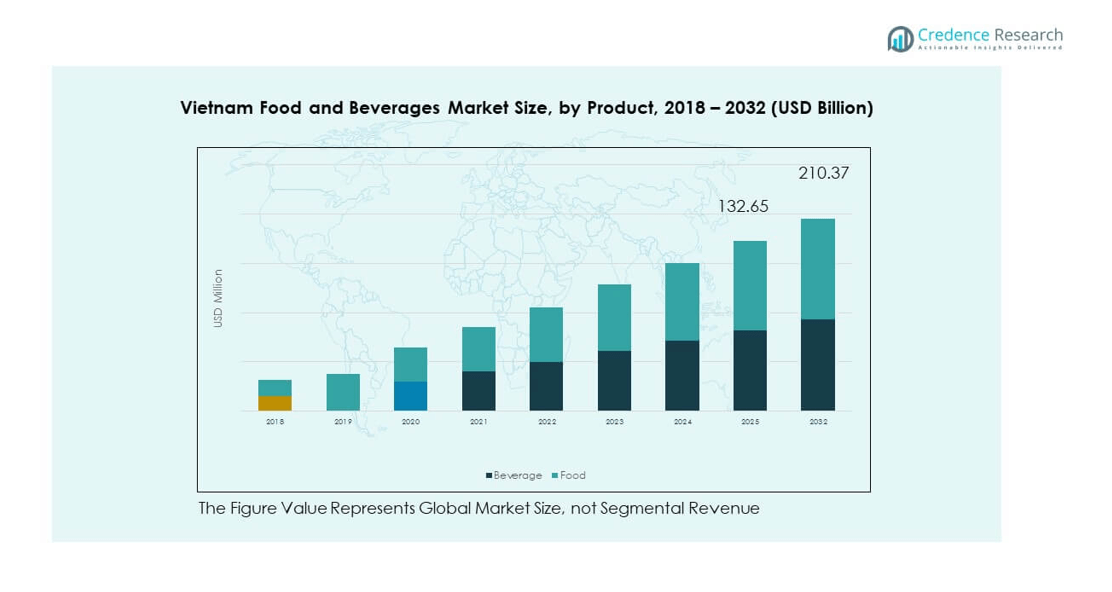

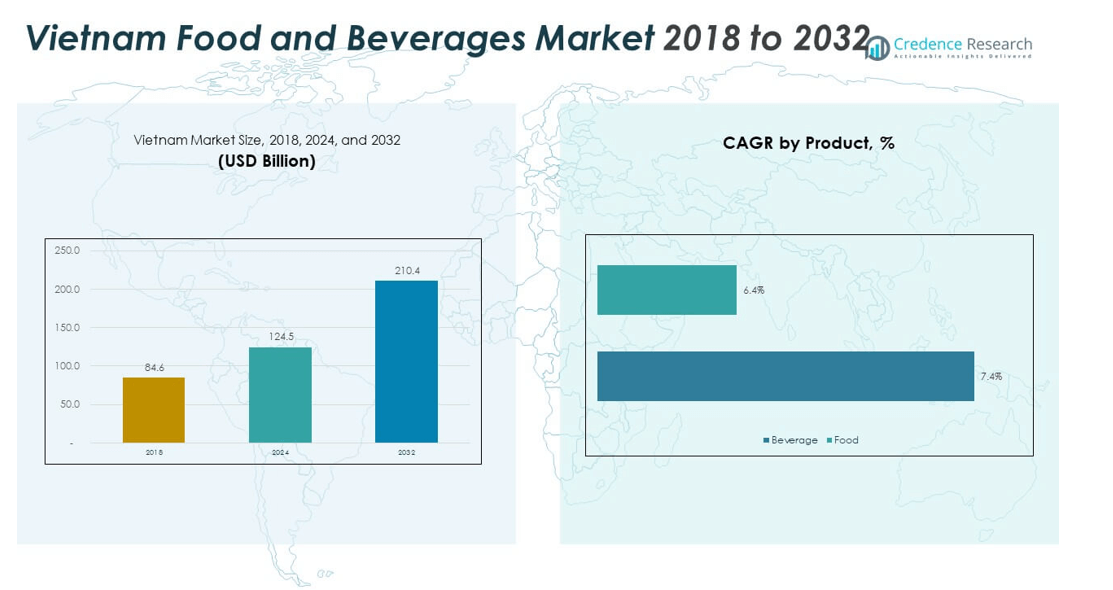

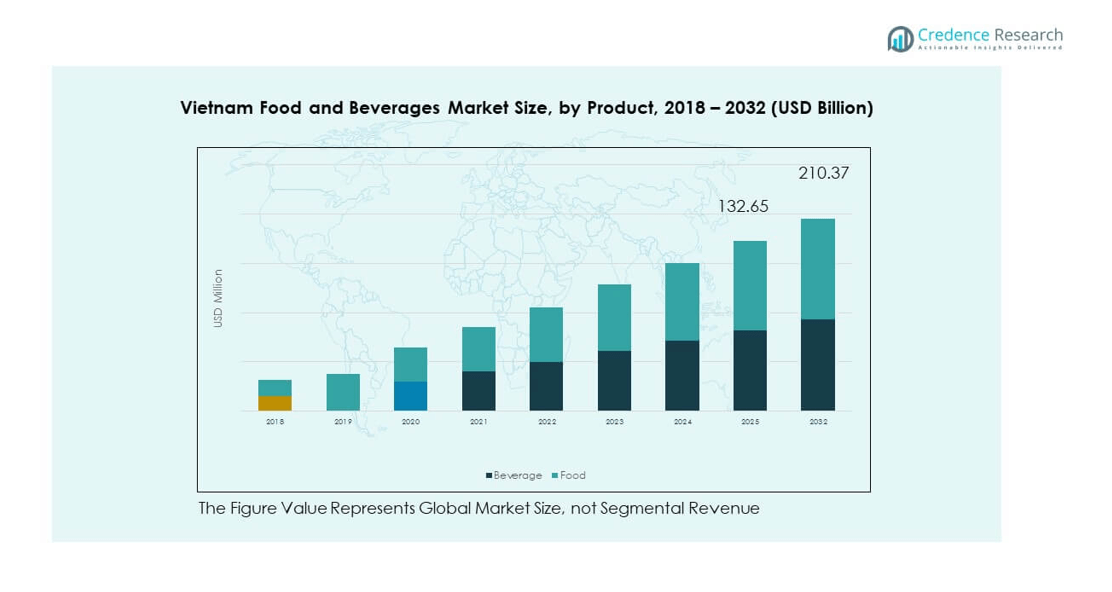

The Vietnam Food and Beverages Market. size was valued at USD 84.6 billion in 2018 to USD 124.5 billion in 2024 and is anticipated to reach USD 210.4 billion by 2032, at a CAGR of 6.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vietnam Food and Beverages Market Size 2024 |

USD 124.5 billion |

| Vietnam Food and Beverages Market, CAGR |

6.81% |

| Vietnam Food and Beverages Market Size 2032 |

USD 210.4 billion |

Strong income growth, rapid urbanization, and a youthful, digitally connected population expand demand across packaged foods, beverages, and quick-service formats. Modern retail and e-commerce scale distribution, while super apps and on-demand delivery deepen last-mile reach. Tourism recovery and rising out-of-home consumption lift premium, ready-to-drink, and convenience categories. Health, wellness, and clean-label preferences steer reformulation and functional launches. Cold-chain upgrades enhance product quality, and regulatory alignment on safety builds consumer trust. Brand investments, localized flavors, and omnichannel marketing intensify competition and accelerate category premiumization.

Southern Vietnam, anchored by Ho Chi Minh City and neighboring industrial corridors, leads on population density, higher disposable incomes, and superior logistics, supporting faster rollout of modern trade and foodservice networks. Northern Vietnam, centered on Hanoi, benefits from manufacturing clusters and proximity to cross-border supply routes, strengthening retail penetration and brand presence. Central coastal cities such as Da Nang and Nha Trang emerge on the back of tourism-led dining and hospitality demand. The Mekong Delta advances agri-processing and fresh supply integration, while the Central Highlands underpin coffee and tea value chains, with secondary cities like Hai Phong and Can Tho steadily formalizing retail.

Market Insights:

- The Vietnam Food and Beverages Market. was valued at USD 124.5 billion in 2024 and is projected to reach USD 210.4 billion by 2032, growing at a CAGR of 6.81%.

- Rising disposable incomes and urban lifestyles are boosting demand for packaged, premium, and convenience-oriented food and beverage products.

- Health-focused consumption trends are driving growth in functional, organic, and clean-label categories across major product lines.

- Price sensitivity and intense competition from both domestic and international players are pressuring margins in certain segments.

- Regulatory compliance and infrastructure gaps in rural areas continue to challenge nationwide market expansion.

- Southern Vietnam leads in market share due to higher purchasing power, dense retail networks, and advanced logistics.

- Central coastal cities and rural regions present untapped growth opportunities through tourism-driven demand and expanding modern retail access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Disposable Incomes and Shifting Consumer Lifestyles Fuel Demand Growth

The Vietnam Food and Beverages Market. benefits from consistent income growth, enabling consumers to spend more on quality and variety in their diets. Urban households are embracing premium packaged foods, imported beverages, and ready-to-eat options to match fast-paced routines. It adapts to changing tastes by incorporating both global flavors and modernized traditional dishes. Younger demographics with higher purchasing power are driving demand for healthy, functional, and convenience-oriented products. Expanding middle-class segments stimulate demand for dining out, specialty cafes, and branded quick-service restaurants. Food delivery apps and digital ordering platforms enhance accessibility and consumer choice. The growing preference for food safety and traceable supply chains pushes manufacturers to adopt higher standards.

Tourism, Hospitality, and Out-of-Home Consumption Accelerate Category Expansion

Tourism recovery and growth in the hospitality sector strengthen demand for diverse food and beverage offerings. The Vietnam Food and Beverages Market. gains from hotels, resorts, and restaurants upgrading menus to attract international travelers. Domestic tourism stimulates regional specialties, packaged souvenirs, and local beverage consumption. Foodservice operators expand in urban and coastal cities to cater to increased dining-out habits. It also benefits from global events and festivals, boosting sales of premium and seasonal products. Partnerships between local producers and international brands broaden product availability and quality. Cruise tourism and business travel add to high-value consumption in metropolitan centers. Growing exposure to global culinary experiences inspires local innovation in both flavor profiles and presentation styles.

- For example, Masan Consumer Holdings, through its partnership with Phúc Long Heritage, opened 33 new Phúc Long Coffee & Tea stores in 2024, bringing the total number of outlets to over 180 nationwide. The brand reported a 5.6% year-on-year growth in net revenue to VND 1.62 trillion, supported by store renovations that boosted dine-in average daily sales by 13.4% at upgraded locations compared to non-renovated ones.

Expanding Retail Infrastructure and Digital Platforms Boost Market Reach

The development of modern retail formats such as supermarkets, hypermarkets, and convenience stores strengthens the Vietnam Food and Beverages Market. reach. Online grocery platforms and e-commerce marketplaces open new sales channels for domestic and imported brands. It benefits from improved cold-chain logistics that maintain quality for perishable items. Direct-to-consumer models allow niche brands to reach targeted audiences efficiently. Retailers use loyalty programs and personalized promotions to build repeat purchases. The integration of cashless payments and app-based ordering drives convenience. Pop-up stores and experiential retail formats engage consumers and promote premium product launches. Strategic location of retail outlets in densely populated areas ensures steady footfall and high turnover.

- For example, Bach Hoa Xanh, an affiliate of Mobile World Group, operated 1,721 stores across Vietnam by August 2024, generating an average monthly revenue of VND 2.1 billion per store. By mid-2025, the chain expanded to approximately 2,180 stores, marking its highest store count to date.

Government Support, Food Safety Regulations, and Industry Investment Drive Growth

Policy initiatives promoting food safety, quality control, and agricultural modernization strengthen the Vietnam Food and Beverages Market. foundation. It benefits from trade agreements that lower tariffs on imported raw materials and finished products. Public health campaigns encourage balanced diets and healthier consumption habits, spurring product reformulation. Incentives for agribusiness and food processing attract domestic and foreign investment. The market gains from infrastructure development that facilitates smoother transportation of goods across regions. Quality certifications and labeling requirements improve consumer trust and brand credibility. Industry collaborations with research institutions foster innovation in product development. Investments in manufacturing automation enhance efficiency and reduce production costs.

Market Trends

Health, Wellness, and Functional Food Categories Experience Rapid Uptake

The Vietnam Food and Beverages Market. is witnessing a shift toward health-oriented products, including low-sugar, organic, plant-based, and fortified offerings. Consumers are becoming more aware of the link between nutrition and well-being, prompting demand for functional beverages, probiotics, and superfoods. It reflects a growing interest in clean-label and sustainably sourced products. Retailers allocate more shelf space to healthy alternatives, while brands promote transparency in sourcing and manufacturing. Celebrity endorsements and social media campaigns amplify wellness trends. Functional snacks and drinks are gaining popularity among urban youth and working professionals. Consumers actively seek products that combine convenience with nutritional benefits. This health-driven consumption pattern is influencing new product launches across multiple segments.

- For example, Phúc Long Coffee & Tea, under Masan Group, opened 33 new stores in 2024, contributing to 6% growth in full-year net revenue to VND 1.62 trillion (~$64.6 million). This performance came alongside a strategic focus on renovating existing outlets, which improved dine-in average daily sales by 13.4% at renovated locations compared to non-renovated ones

Premiumization and Experience-Driven Consumption Influence Purchase Behavior

The Vietnam Food and Beverages Market. is seeing consumers trade up to premium brands offering superior taste, packaging, and dining experiences. It benefits from rising aspirations and exposure to international food culture. Specialty coffee shops, artisanal bakeries, and gourmet restaurants are attracting urban middle-class customers. Food tourism within Vietnam promotes regional delicacies and fine-dining concepts. Branded outlets are experimenting with immersive store designs and thematic menus. Limited-edition launches and seasonal collections stimulate repeat visits. Premium alcoholic beverages, craft beers, and boutique wines are gaining attention from affluent consumers. Dining is increasingly viewed as a lifestyle experience rather than just a necessity.

Technology Integration and E-commerce Disruption Reshape Distribution Models

The Vietnam Food and Beverages Market. is transforming through rapid adoption of technology across the supply chain. E-commerce platforms and food delivery apps expand consumer access to diverse product ranges. It benefits from AI-driven recommendations, subscription models, and app-exclusive deals. Cloud kitchens reduce operational costs while meeting delivery demands efficiently. Brands use data analytics to track preferences and adjust product offerings. Augmented reality packaging and QR code-enabled product details enhance transparency. Social media marketplaces provide direct sales channels to niche communities. The integration of digital payments and loyalty apps strengthens customer retention in competitive urban markets.

- For example, Baemin Vietnam has achieved a five-fold increase in Day-30 customer retention by adopting marketing optimization tools, including attribution tracking, fraud prevention, and audience segmentation. Across Vietnam, e-commerce platforms and food delivery apps are increasingly using AI, big data, and customer behavior analysis to improve personalization, logistics, and service quality, thereby expanding consumer access to a wider range of products.

Sustainable Practices and Ethical Sourcing Shape Brand Perceptions

The Vietnam Food and Beverages Market. is increasingly influenced by sustainability commitments, with brands adopting eco-friendly packaging and reducing food waste. It responds to consumer demand for products with ethical sourcing credentials. Local producers highlight farm-to-table supply chains, while global brands adapt to green standards in Vietnam. Retailers encourage reusable containers and recycling programs. Sustainable seafood, certified coffee, and organic produce are gaining traction. Corporate social responsibility initiatives reinforce brand trust. Climate-conscious consumers are favoring companies with transparent environmental impact reports. Investment in renewable energy for production facilities further strengthens brand positioning.

Market Challenges Analysis

Intense Competition and Price Sensitivity Limit Profit Margins

The Vietnam Food and Beverages Market. faces a highly competitive environment with numerous local and international players vying for market share. It operates in a price-sensitive landscape where consumers often compare value before purchasing. Small and medium enterprises compete with multinational brands, creating pressure on pricing strategies. Promotional discounts, while boosting short-term sales, can erode profitability. Brand loyalty is fragmented, with consumers willing to switch for better deals or promotions. Counterfeit and low-quality products in certain segments pose risks to brand reputation. Maintaining quality while managing costs remains a persistent challenge. Market saturation in some urban areas intensifies the battle for visibility and shelf space.

Regulatory Compliance, Infrastructure Gaps, and Supply Chain Risks Hinder Growth

The Vietnam Food and Beverages Market. must navigate complex regulatory frameworks, including food safety standards, labeling requirements, and import-export procedures. It faces challenges from inconsistent enforcement and evolving compliance norms. Infrastructure gaps in rural areas slow the distribution of perishable goods. Seasonal weather disruptions affect agricultural yields, influencing raw material prices and availability. Global supply chain volatility, including freight costs and currency fluctuations, impacts profitability. Skilled labor shortages in specialized food processing limit production scalability. Rapid technological change requires continuous investment in equipment and processes. Coordinating between fragmented suppliers adds complexity to maintaining consistent quality standards.

Market Opportunities

Expanding Modern Retail and E-commerce Create New Sales Channels

The Vietnam Food and Beverages Market. can leverage the rapid growth of modern trade outlets, convenience stores, and e-commerce platforms. It benefits from increasing smartphone penetration, online shopping adoption, and digital payment usage. Cross-border e-commerce opens access to a wider range of imported goods. Retailers are investing in last-mile delivery to improve convenience. Opportunities exist for niche and premium brands to reach targeted consumer segments through direct-to-consumer models. Online promotions and personalized offers enhance engagement. Subscription services for staple food items and beverages provide recurring revenue streams.

Rising Demand for Specialty, Health-Oriented, and Premium Products

The Vietnam Food and Beverages Market. can capitalize on the growing appetite for premium, functional, and healthy food and beverage offerings. It benefits from consumers’ willingness to pay more for quality, authenticity, and wellness benefits. Expanding tourism offers opportunities to showcase local specialties and regional beverages to a global audience. Export potential increases for Vietnamese products meeting international quality standards. Collaboration with health and wellness influencers boosts product awareness. Developing innovative flavors and functional enhancements can capture emerging preferences. Sustainability-focused products create differentiation in a crowded marketplace.

Market Segmentation Analysis:

The Vietnam Food and Beverages Market. is segmented

By product into beverages and food. The beverage segment comprises alcoholic beverages and non-alcoholic beverages. Alcoholic beverages maintain steady demand, driven by domestic brands and expanding premium beer and wine categories, while non-alcoholic beverages see robust growth from bottled water, functional drinks, juices, and ready-to-drink teas and coffees. The food segment includes bakery and confectionery, frozen food, dairy products, breakfast cereals, and meat, poultry, and seafood. Bakery and confectionery benefit from urban snacking habits, while frozen food adoption rises due to convenience and improved cold-chain infrastructure. Dairy products remain a dietary staple, with value-added lines such as fortified milk and yogurt growing rapidly. Breakfast cereals gain traction among urban households seeking quick meal options. Meat, poultry, and seafood dominate the protein market, supported by both fresh and processed formats.

- For example, Sabeco (Saigon Beer Alcohol Beverage Corporation) achieved net revenue of approximately VND 31.8 trillion in 2024, marking a 5.6% increase in after-tax profit.

By distribution channel, the Vietnam Food and Beverages Market. is classified into supermarkets/hypermarkets, convenience stores, and online platforms. Supermarkets and hypermarkets lead in volume sales, offering broad assortments and competitive pricing. Convenience stores expand rapidly in urban centers, attracting younger consumers with ready-to-eat meals and beverage options. Online channels record significant growth, supported by e-commerce platforms, food delivery apps, and rising smartphone penetration. It benefits from the integration of digital payments, targeted promotions, and home delivery services, making product access more seamless and appealing to a broader customer base.

- For example, Circle K operated over 500 stores across Vietnam by mid-2024, with locations in major cities including Ho Chi Minh City, Hanoi, Vung Tau, and Nha Trang, strengthening its presence in the country’s convenience retail sector.

Segmentation:

By Product

- Beverage

- Alcoholic Beverages

- Non-alcoholic Beverages

- Food

- Bakery and Confectionery

- Frozen Food

- Dairy Product

- Breakfast Cereals

- Meat, Poultry, and Seafood

By Distribution Channel

- Supermarkets / Hypermarkets

- Convenience Stores

- Online

Regional Analysis:

The Vietnam Food and Beverages Market. shows clear regional distinctions shaped by income distribution, infrastructure, and consumer preferences. Southern Vietnam, led by Ho Chi Minh City and surrounding industrial areas, remains the largest consumption hub, supported by high purchasing power and dense urban populations. It benefits from modern retail dominance, extensive supermarket and convenience store networks, and a thriving foodservice industry. The south also attracts significant foreign investment in processing and distribution facilities, enabling faster product launches and greater market penetration.

Northern Vietnam, anchored by Hanoi, records steady expansion fueled by a growing middle class and increasing retail development in both metropolitan and semi-urban areas. Cross-border trade with China enhances product diversity and accessibility, while the region’s manufacturing capabilities strengthen supply chain efficiency. It is also experiencing rising demand for packaged and premium products as consumer lifestyles shift toward convenience and health-oriented options.

Central and rural regions contribute distinct strengths to the Vietnam Food and Beverages Market. Coastal cities like Da Nang, Hue, and Nha Trang are tourism-driven growth centers, boosting demand in hospitality and premium dining segments. The Mekong Delta serves as a major agricultural and seafood supply base, supporting both domestic needs and export markets. The Central Highlands play a key role in coffee and tea production, with opportunities for specialty branding. Rural markets, though slower in adopting modern retail, are expanding through mobile commerce, small-format convenience outlets, and improving logistics, creating new growth avenues for both local and international brands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Vinamilk

- Masan Consumer

- TH Group

- Nestlé

- PepsiCo

- Coca-Cola

- Kido Group

- Vietnam Beverage Co.

- Orion

- Acecook Vietnam

- Other Key Players

Competitive Analysis:

The Vietnam Food and Beverages Market. features a competitive mix of domestic leaders and multinational corporations, each leveraging brand strength, product innovation, and distribution networks to capture market share. Key players such as Vinamilk, Masan Consumer, TH Group, Nestlé, PepsiCo, Coca-Cola, Kido Group, Orion, and Acecook Vietnam operate across multiple categories, ensuring broad consumer reach. It is characterized by frequent product launches, localized flavors, and marketing strategies tailored to diverse demographics. Companies invest in modern trade, e-commerce, and digital engagement to strengthen market presence. Strategic mergers, acquisitions, and partnerships enhance product portfolios and supply chain efficiency. Competitive positioning is reinforced through sustainability initiatives and premium product lines that cater to evolving consumer preferences. Brands also focus on improving cold-chain capabilities and rural penetration to tap into untapped demand.

Recent Developments:

- In June 2025, the Saigon Beer Alcohol Beverage Corporation (SABECO) unveiled a new beer called 333 Pilsner. With an alcohol content of 4.3%, this beer is specially crafted to appeal to both connoisseurs and more casual drinkers.

- In August 2025, Vietnam and Indonesia strengthened regional partnerships targeting the food industry by setting a joint trade target of $18 billion by 2028. This partnership focuses on fostering co-development in the food industry between the two countries, supporting market expansion and greater trade connectivity in the Southeast Asian region.

- In March 2024, PepsiCo Inc. announced an investment of about $400 million for two new beverage manufacturing plants in Vietnam—one in Long An and another in Ha Nam. These facilities will be powered by renewable energy, reinforcing PepsiCo’s commitment to both market expansion and sustainability.

Market Concentration & Characteristics:

The Vietnam Food and Beverages Market. is moderately concentrated, with leading players controlling significant shares across dairy, beverages, packaged foods, and confectionery segments. It combines strong domestic brands with global entrants competing on quality, pricing, and innovation. High consumer loyalty in certain categories coexists with a willingness to try new offerings. The market values speed to market, nationwide distribution, and adaptability to evolving health, premiumization, and convenience trends. Competition is dynamic, with brands introducing differentiated formats to secure consumer attention. It also reflects a balance between traditional retail dominance and the rapid rise of online sales channels.

Report Coverage:

The research report offers an in-depth analysis based on Product and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of modern retail formats will improve product accessibility and enhance brand visibility across urban and semi-urban areas.

- Growth in health-conscious consumer segments will drive demand for functional, organic, and clean-label products.

- Rising adoption of e-commerce and food delivery platforms will strengthen direct-to-consumer sales channels.

- Innovation in product flavors, packaging, and formats will cater to evolving lifestyle and convenience needs.

- Development of cold-chain infrastructure will support wider distribution of perishable and premium categories.

- Increased collaboration between local producers and global brands will enhance product quality and variety.

- Tourism recovery will boost demand in hospitality-driven foodservice and premium beverage segments.

- Regulatory advancements in food safety and labeling will raise industry standards and consumer trust.

- Investment in sustainable sourcing and eco-friendly packaging will become a key competitive differentiator.

- Penetration into rural markets will open new growth opportunities through mobile commerce and localized distribution.