Market Overview

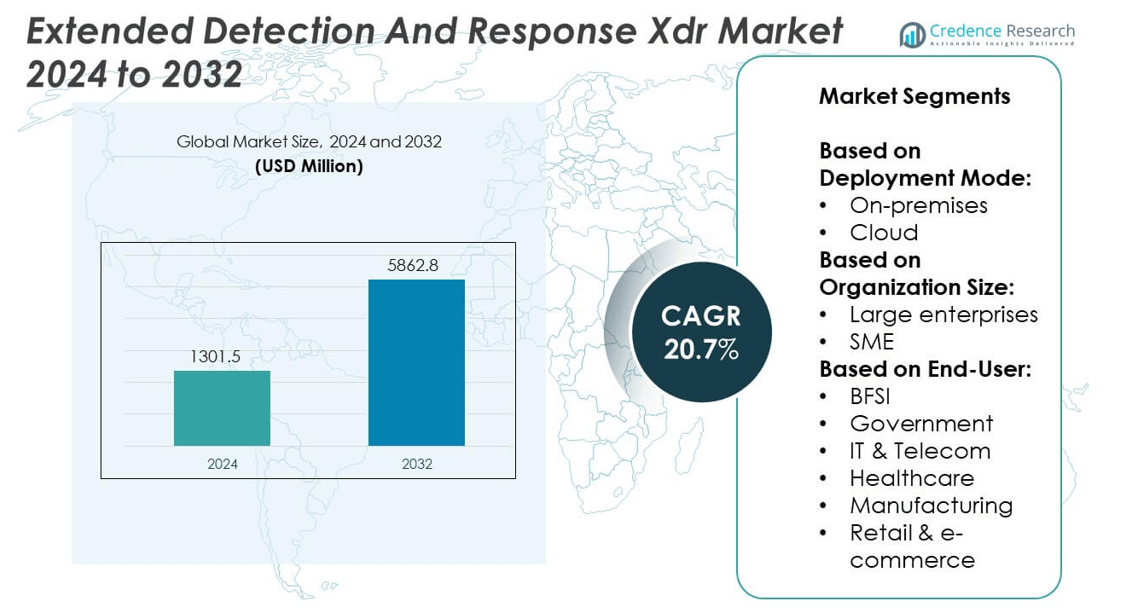

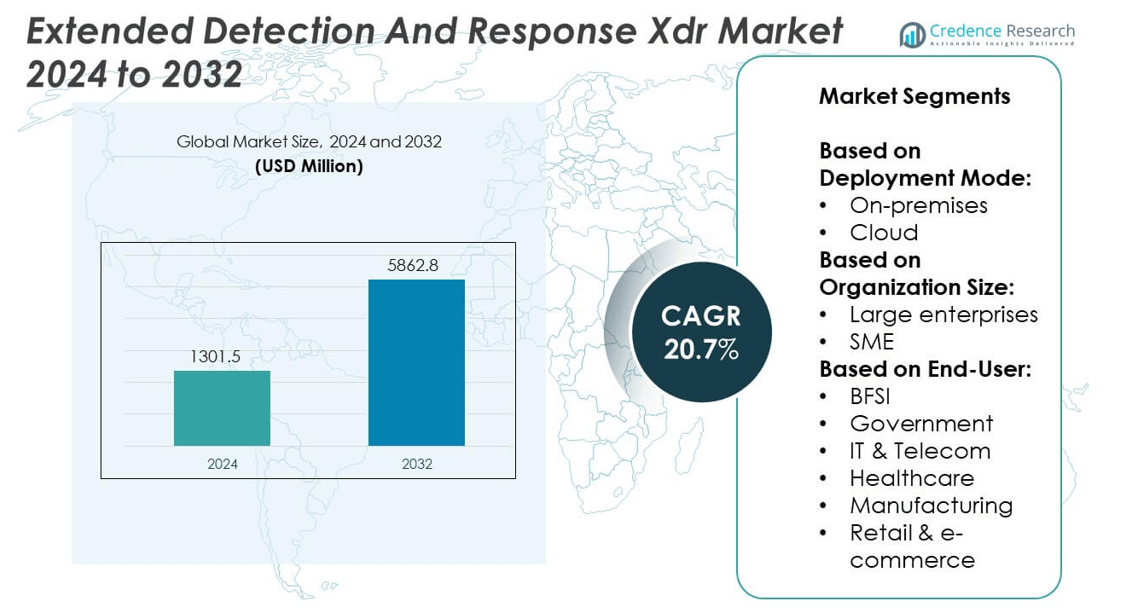

The Extended Detection and Response (XDR) market size was valued at USD 1,301.5 million in 2024 and is anticipated to reach USD 5,862.8 million by 2032, growing at a CAGR of 20.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Extended Detection and Response (XDR) Market Size 2024 |

USD 1,301.5 million |

| Extended Detection and Response (XDR) Market , CAGR |

20.7% |

| Extended Detection and Response (XDR) Market Size 2032 |

USD 5,862.8 million |

The Extended Detection and Response XDR market is driven by the rising complexity of cyber threats, increased cloud adoption, and the demand for integrated security operations. Organizations seek unified platforms to enhance threat visibility, reduce response time, and automate detection across endpoints, networks, and cloud environments. The shortage of skilled cybersecurity professionals further accelerates adoption. Key trends include the convergence of security tools, the integration of AI-driven analytics, and the alignment with zero trust frameworks.

North America leads the Extended Detection and Response XDR market due to advanced cybersecurity infrastructure and widespread adoption across critical industries. Europe follows with strong regulatory influence, while Asia-Pacific shows rapid growth driven by digital transformation and rising cyber threats. Latin America and the Middle East & Africa are emerging with increasing investment in threat detection and response technologies. Key players in the market include Palo Alto Networks, Microsoft, and CrowdStrike, each offering comprehensive XDR platforms. Vendors such as SentinelOne and Trellix are also expanding their global reach through partnerships and cloud-native innovations tailored to diverse enterprise environments.

Market Insights

- The Extended Detection and Response XDR market was valued at USD 1,301.5 million in 2024 and is projected to reach USD 5,862.8 million by 2032, growing at a CAGR of 20.7% during the forecast period.

- Rising cyber threats, including ransomware and advanced persistent attacks, are driving demand for unified threat detection and response platforms across enterprises.

- Integration of AI-driven analytics, behavioral detection, and identity-based threat analysis is reshaping how organizations manage security operations.

- Vendors such as Palo Alto Networks, CrowdStrike, Microsoft, and Trellix lead the competitive landscape with cloud-native platforms, advanced telemetry integration, and global partnerships.

- Integration complexity across legacy systems, concerns over vendor lock-in, and lack of standardization remain major restraints for broader XDR adoption.

- North America leads the market due to advanced infrastructure and vendor concentration, while Asia-Pacific shows the fastest growth with increasing adoption in telecom, BFSI, and manufacturing sectors.

- Enterprises are adopting XDR to consolidate security tools, improve response time, reduce alert fatigue, and enhance visibility across cloud, endpoint, and network environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Sophistication of Cyber Threats Is Driving the Adoption of Integrated Security Frameworks

The Extended Detection and Response XDR market is responding to a significant rise in advanced persistent threats, ransomware, and zero-day exploits. Organizations are seeking cohesive platforms that correlate data across endpoints, networks, cloud workloads, and applications to uncover complex attack vectors. Traditional siloed solutions lack the visibility and real-time analysis needed to address evolving threats. XDR platforms offer automated threat correlation and centralized detection capabilities, reducing incident dwell time. This shift toward unified threat detection improves response coordination across security layers. It enables enterprises to neutralize threats before significant damage occurs.

- For instance, Microsoft Defender XDR integrated over 50 distinct data sources into a unified view across Azure, AWS, and Google Cloud, supporting more than 280 million endpoints globally.

Growing Cloud Adoption and Digital Transformation Demands Broader Security Visibility

The rapid migration of business infrastructure to cloud environments has created complex, dynamic attack surfaces. The Extended Detection and Response XDR market is expanding as organizations require tools capable of monitoring across hybrid and multi-cloud architectures. Security teams demand consolidated telemetry and contextual analytics across assets to maintain control over dispersed workloads. XDR platforms offer centralized visibility, ensuring faster identification of misconfigurations and unauthorized access. It supports cloud-native integrations and automated detection across distributed environments. These capabilities are essential to maintaining security posture in modern digital ecosystems.

- For instance, SentinelOne Singularity XDR reduced alert volumes by 85% through autonomous correlation of events across endpoints, cloud, and identity sources, enabling customers to cut investigation time from hours to under 5 minutes.

Shortage of Cybersecurity Talent Is Accelerating the Shift Toward Automation-Driven Platforms

Enterprises face a growing cybersecurity workforce gap, making it difficult to manually manage threat detection and response across multiple tools. The Extended Detection and Response XDR market benefits from this challenge by providing intelligent automation, which reduces analyst workload and increases operational efficiency. XDR platforms use machine learning and behavioral analytics to identify suspicious activities without constant human intervention. It improves the signal-to-noise ratio, allowing teams to focus on verified threats. This automation reduces alert fatigue and improves overall incident response time. Organizations are choosing XDR to optimize limited security personnel resources.

Compliance Pressure and Regulatory Demands Are Influencing Security Investment Priorities

Evolving data protection laws and industry regulations are pressuring enterprises to demonstrate robust cybersecurity frameworks. The Extended Detection and Response XDR market is gaining traction among organizations aiming to meet audit and compliance requirements through unified monitoring and reporting. Regulatory bodies require visibility into detection mechanisms, incident response protocols, and breach reporting timelines. XDR provides integrated audit trails and real-time threat intelligence aligned with compliance objectives. It helps businesses maintain continuous monitoring and enforce security standards across critical assets. Regulatory-driven demand is shaping investment in scalable, policy-aligned XDR solutions.

Market Trends

Increased Convergence of Endpoint, Network, and Cloud Security Tools into Unified Platforms

The Extended Detection and Response XDR market is witnessing a growing shift toward platform unification. Enterprises are moving away from isolated tools and favoring XDR solutions that integrate endpoint, network, identity, and cloud telemetry into a single interface. This trend enhances visibility, accelerates response workflows, and minimizes the need for manual correlation. It enables security teams to detect lateral movement and hidden threats across diverse infrastructure. Vendors are redesigning their portfolios to provide all-in-one capabilities under one license. Consolidation supports operational efficiency and simplifies vendor management.

- For instance, Trellix integrated more than 650 telemetry connectors into its Helix and XDR platforms, allowing full-stack visibility across cloud, endpoint, and email layers within a single console.

Greater Emphasis on AI-Powered Threat Detection and Contextual Analytics

Artificial intelligence and machine learning are becoming foundational elements in next-generation XDR systems. The Extended Detection and Response XDR market is advancing toward behavior-based detection models that adapt to changing attack techniques. AI algorithms enable the system to distinguish anomalies from normal activity, reducing false positives and alert noise. It allows security teams to prioritize high-risk incidents with greater accuracy and context. Advanced analytics also provide early warning signals that static rules cannot identify. Vendors are increasingly embedding predictive analytics into their threat detection engines.

- For instance, SentinelOne expanded its Singularity XDR offering with new multi-tenant architecture for MSSPs, enabling partners to manage over 120,000 customer environments from a single pane of glass with real-time behavioral insights.

Expansion of XDR Use Cases Across Mid-Sized Enterprises and Managed Service Providers

Previously adopted primarily by large enterprises, XDR is now gaining traction among mid-sized organizations and MSSPs. The Extended Detection and Response XDR market is expanding as more vendors introduce scalable, cost-effective solutions tailored for resource-constrained environments. These offerings include simplified deployment, lower operational overhead, and pre-configured rule sets. It enables smaller security teams to access advanced detection capabilities without building in-house expertise. Managed security service providers are bundling XDR to offer turnkey threat monitoring and response. This democratization is widening the customer base for XDR vendors.

Integration with Identity Threat Detection and Zero Trust Architectures

Zero Trust adoption is accelerating the demand for identity-aware threat detection within XDR ecosystems. The Extended Detection and Response XDR market is evolving to support integration with IAM, MFA, and UEBA tools. It helps validate access patterns and detect credential misuse, insider threats, and privilege escalation. Security frameworks now emphasize continuous verification and behavior monitoring across all users and devices. XDR platforms are aligning with this shift by enriching detections with identity context. The move strengthens policy enforcement and limits attack propagation across trusted environments.

Market Challenges Analysis

High Complexity of Integration Across Diverse IT Environments Slows Adoption

Many organizations face significant challenges integrating XDR platforms into their existing infrastructure. The Extended Detection and Response XDR market is hindered by the complexity of unifying telemetry from legacy systems, third-party tools, and modern cloud environments. Custom APIs, data format inconsistencies, and varying vendor architectures complicate seamless data flow. It requires considerable effort to normalize and correlate information across disjointed security layers. This integration burden delays deployment timelines and increases operational risk. Enterprises must allocate skilled personnel and resources to manage platform alignment, which limits adoption in smaller organizations with constrained teams.

Lack of Standardization and Vendor Lock-In Concerns Impact Decision-Making

The absence of universal standards for data sharing and response orchestration across XDR solutions presents a major challenge. The Extended Detection and Response XDR market experiences buyer hesitation due to fears of vendor lock-in and limited interoperability. Proprietary frameworks often restrict customers from extending or customizing detection logic across heterogeneous environments. It constrains flexibility in adapting to evolving security needs or switching providers without major reengineering. Organizations demand open frameworks and transparent integration models to ensure long-term scalability. This lack of standardization influences procurement decisions and reduces trust in vendor-neutral deployments.

Market Opportunities

Rising Demand for Unified Security Operations in Hybrid Work Environments

The shift toward hybrid work models creates an opportunity for security platforms that deliver consistent threat visibility across office, remote, and cloud environments. The Extended Detection and Response XDR market can meet this demand by offering centralized control across dispersed assets and endpoints. It supports policy enforcement and real-time monitoring regardless of user location or device. Security teams seek integrated tools that close visibility gaps and reduce reliance on multiple point solutions. Vendors that offer seamless integration with collaboration platforms and mobile endpoints can strengthen their market position. This shift presents a growth path for XDR providers targeting enterprise security modernization.

Growing Adoption of Zero Trust Security Strategies Fuels Platform Expansion

Zero Trust frameworks are influencing how enterprises approach detection, access control, and identity verification. The Extended Detection and Response XDR market stands to benefit by aligning with identity-centric policies and micro-segmentation strategies. It enables context-rich threat detection that incorporates user behavior, access history, and device risk. Organizations seek XDR platforms that can enforce least-privilege access and adapt to real-time risk signals. Vendors who embed identity analytics and integrate with IAM tools can address these evolving needs. The trend opens new deployment opportunities in regulated industries and government networks requiring strict access governance.

Market Segmentation Analysis:

By Deployment Mode:

The Extended Detection and Response XDR market is segmented into on-premises and cloud-based deployments. On-premises solutions remain relevant for organizations with strict regulatory or data sovereignty requirements. These deployments offer greater control but involve higher infrastructure costs and resource demands. Cloud-based XDR dominates the segment due to scalability, faster updates, and remote accessibility. It allows security teams to monitor distributed assets without relying on local infrastructure. The increasing shift to hybrid and multi-cloud environments further supports cloud XDR adoption across enterprises seeking agile threat detection capabilities.

- For instance, Palo Alto Networks’ Cortex XDR handled over 25 million cloud-based detections per day across AWS, Azure, and Google Cloud environments, supporting real-time response across 140 countries via its global cloud infrastructure.

By Organization Size:

Large enterprises account for the major share of adoption due to their expansive IT environments and complex threat landscapes. The Extended Detection and Response XDR market benefits from this segment’s need for advanced threat correlation across endpoints, networks, and applications. These organizations prioritize customizable solutions that integrate with existing security stacks. Small and medium-sized enterprises (SMEs) represent an emerging growth area driven by increasing cyber risk awareness. Cloud-native and subscription-based XDR offerings appeal to SMEs with limited budgets and personnel. It enables them to access enterprise-grade security without managing fragmented tools.

- For instance, Cyberreason’s XDR capabilities powered by its MalOp (malicious operation) engine processed over 5 million MalOps detections per week, enabling customers to reduce investigation times from hours to under 20 minutes on average.

By End-User:

The BFSI sector leads XDR adoption due to its high exposure to fraud, data breaches, and compliance mandates. It relies on real-time threat analytics and integrated response capabilities to protect sensitive customer and financial data. Government agencies adopt XDR to safeguard national infrastructure and enforce zero trust principles across public networks. The IT & telecom industry uses XDR to manage distributed endpoints and monitor large-scale digital ecosystems. In healthcare, XDR supports continuous monitoring of medical devices and patient data systems, aligning with HIPAA and data protection laws. Manufacturing firms use it to protect operational technology from ransomware and industrial espionage. Retail and e-commerce players deploy XDR to detect credential theft, payment fraud, and API abuse across digital storefronts and supply chains.

Segments:

Based on Deployment Mode:

Based on Organization Size:

Based on End-User:

- BFSI

- Government

- IT & Telecom

- Healthcare

- Manufacturing

- Retail & e-commerce

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Extended Detection and Response XDR market, accounting for 41.8% of the global revenue in 2024. The region benefits from a mature cybersecurity ecosystem and the strong presence of leading vendors such as CrowdStrike, Palo Alto Networks, Microsoft, and IBM. Organizations across sectors, including BFSI, healthcare, and government, have aggressively adopted XDR platforms to enhance incident detection and automate response efforts. The U.S. leads in cloud adoption and compliance mandates such as CCPA and HIPAA, which drive the need for unified security frameworks. It continues to witness high investment in threat intelligence, behavior-based detection, and AI-powered analytics. Strong public-private collaboration on cybersecurity initiatives further accelerates platform implementation across industries.

Europe

Europe captures 25.3% of the Extended Detection and Response XDR market, driven by the region’s focus on data protection and digital sovereignty. The General Data Protection Regulation (GDPR) remains a central influence on enterprise security strategies. Countries like Germany, the U.K., and France are leading adopters due to growing concerns over ransomware, phishing, and nation-state cyberattacks. European enterprises are increasingly adopting cloud-native XDR solutions that support decentralized operations and secure remote access. Vendors such as Trend Micro, Fortinet, and SentinelOne are expanding their European footprint through strategic partnerships and tailored solutions for mid-sized organizations. Investments in cybersecurity by public agencies and critical infrastructure operators are expected to boost market demand.

Asia-Pacific

Asia-Pacific holds a market share of 18.7% and is the fastest-growing region in the Extended Detection and Response XDR market. Rapid digital transformation across manufacturing, telecom, and retail sectors in countries such as China, India, Japan, and Australia fuels demand for advanced threat detection tools. Governments across the region are enforcing cybersecurity frameworks and local data residency laws, which encourage the deployment of comprehensive platforms like XDR. Organizations in Asia-Pacific face growing risks from ransomware and supply chain attacks, prompting them to adopt solutions with cross-layer visibility and automated response capabilities. It is also seeing increased demand from SMEs investing in scalable cloud-based platforms. Vendors are enhancing regional offerings with multilingual support and compliance alignment for local regulations.

Latin America

Latin America contributes 8.1% to the global Extended Detection and Response XDR market. Adoption is rising steadily, driven by heightened awareness of cyber risks and the increasing frequency of targeted attacks. Countries such as Brazil and Mexico are leading the charge in digital security modernization across financial services, government, and telecommunications. Organizations in the region are beginning to favor unified platforms that minimize complexity and reduce reliance on disparate tools. Cloud-based XDR deployments are gaining traction due to cost-efficiency and ease of integration. Regional investment in cybersecurity training and partnerships with global vendors such as Trellix and VMware support market expansion.

Middle East & Africa

The Middle East & Africa region holds 6.1% of the Extended Detection and Response XDR market. Enterprises across the UAE, Saudi Arabia, and South Africa are investing in cybersecurity modernization to support digital infrastructure, financial systems, and critical services. The rise of smart city initiatives and national digital transformation programs increases the need for comprehensive threat detection platforms. It favors solutions that provide real-time visibility across hybrid environments, integrating endpoint, network, and identity analytics. Vendors are forming alliances with regional service providers to deliver tailored offerings with localized compliance support. The market is gradually transitioning from basic security controls to advanced, integrated defense strategies supported by XDR adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Trellix

- IBM

- SentinelOne

- Trend Micro

- Crowdstrike

- Fortinet

- VMware

- Palo Alto Networks

- Microsoft

- Cybereason

Competitive Analysis

The Extended Detection and Response XDR market features strong competition among leading vendors such as Palo Alto Networks, CrowdStrike, Microsoft, IBM, Trellix, SentinelOne, Trend Micro, VMware, Cybereason, and Fortinet. These players compete on platform integration, threat detection capabilities, and response automation. Each offers XDR solutions designed to correlate data across endpoints, networks, and cloud environments, with emphasis on reducing incident dwell time and improving threat visibility. Innovation in AI and machine learning is a key differentiator, enabling contextual analytics and behavioral detection. Vendors are investing in cloud-native architectures to meet the needs of hybrid and remote workforces. Strategic acquisitions, partnerships with managed security service providers, and API integrations with third-party tools are common approaches to expand capabilities and market presence.Pricing models, ease of deployment, and user interface design influence enterprise adoption, particularly among mid-sized organizations. Vendors also focus on compliance features to attract customers in regulated sectors such as BFSI, healthcare, and government. The market remains highly dynamic, with continuous product enhancements aimed at extending telemetry sources, improving threat intelligence feeds, and supporting zero trust architectures. Competitive pressure drives ongoing innovation, making XDR a critical component of modern security strategies across global enterprises.

Recent Developments

- In 2025, CrowdStrike published its Threat Hunting Report emphasizing AI weaponization by threat actors.

- In August 2024, Lumifi Cyber Inc. acquired Netsurion to enhance its managed detection and response (MDR) and extended detection and response (XDR) capabilities. The acquisition strengthens Lumifi’s security operations and integrates Netsurion’s expertise and 400 new clients.

- In June 2024, Kivu Consulting launched the new CyberCertainty Managed Extended Detection and Response (XDR). This advanced solution combines Kivu’s extensive threat expertise with cutting-edge technology to deliver agile protection and rapid detection across various attack vectors including endpoint, network, identity, and cloud.

Market Concentration & Characteristics

The Extended Detection and Response XDR market exhibits a moderate to high level of concentration, with a few dominant vendors holding significant influence due to their broad product portfolios and strong integration capabilities. Leading players control major shares by offering end-to-end solutions that combine endpoint, network, cloud, and identity telemetry into unified security operations platforms. The market favors vendors with advanced analytics, seamless third-party integration, and proven scalability across large enterprises. It is characterized by rapid innovation cycles, with vendors continuously enhancing AI-driven detection, automated response, and cross-domain visibility. The presence of both legacy cybersecurity firms and newer cloud-native providers creates a competitive yet specialized environment. Customer demand for centralized control, faster deployment, and lower operational complexity shapes the evolution of product offerings. The Extended Detection And Response XDR market continues to shift toward platform-based approaches, reducing reliance on multiple standalone tools. It supports growth across both large enterprises and mid-market organizations seeking streamlined threat detection without managing fragmented infrastructure. Demand for open architecture and interoperability also defines purchasing behavior, encouraging vendors to develop flexible, modular frameworks. The market remains dynamic, influenced by regulatory trends, increasing attack sophistication, and the need for integrated, real-time defense mechanisms.

Report Coverage

The research report offers an in-depth analysis based on Deployment Mode, Organization Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow rapidly due to increasing demand for unified threat detection and response solutions.

- Organizations will prioritize AI-driven analytics to enhance threat visibility and reduce manual investigation workloads.

- Cloud-based XDR platforms will see wider adoption across industries with hybrid and remote work environments.

- Integration with identity and access management tools will become a core feature to support zero trust security models.

- Mid-sized enterprises will increase investment in XDR due to the availability of scalable and cost-effective solutions.

- Vendors will expand open API capabilities to support broader interoperability across security ecosystems.

- Real-time threat intelligence and automated response will become critical differentiators in platform selection.

- Strategic partnerships between XDR providers and managed security service providers will expand customer reach.

- Compliance requirements and data protection regulations will drive adoption in regulated sectors.

- Continuous innovation in telemetry coverage and behavioral detection will shape future platform capabilities.