Market Overview

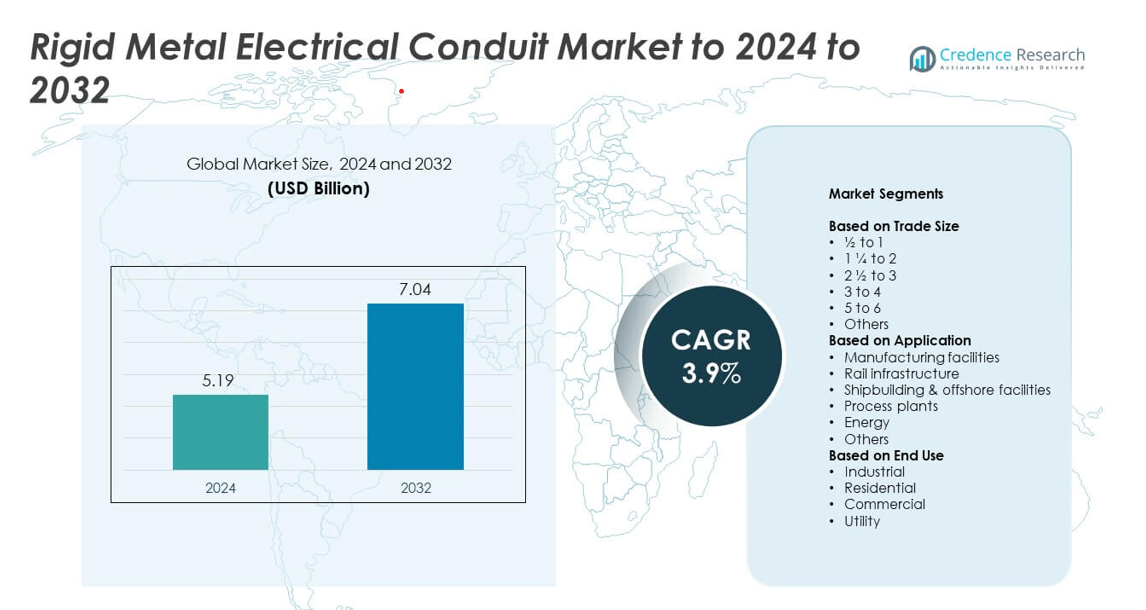

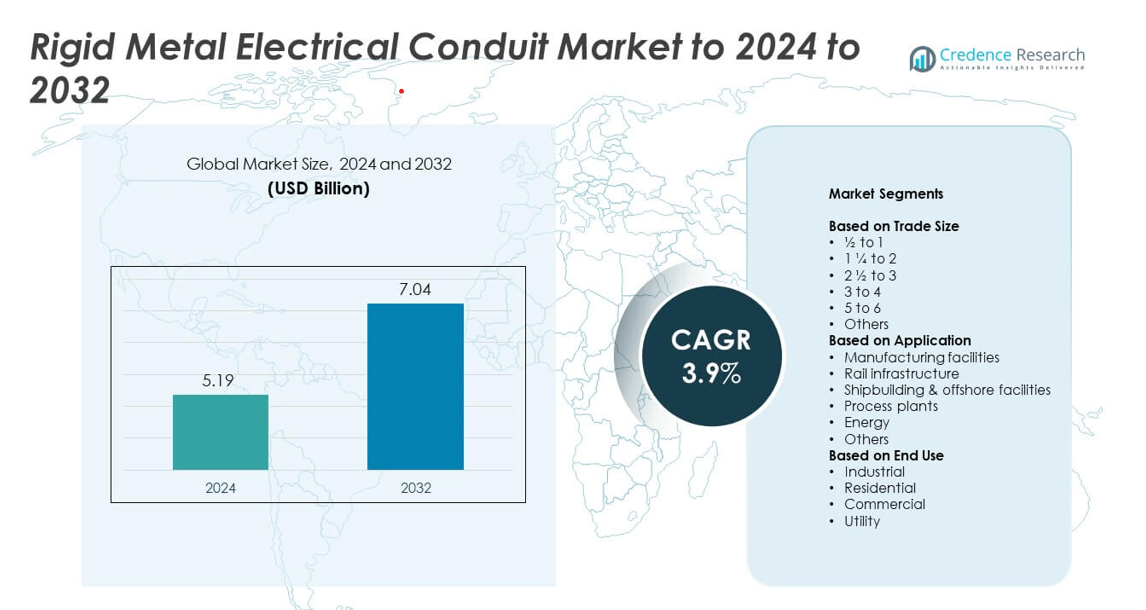

The Rigid Metal Electrical Conduit Market size was valued at USD 5.19 billion in 2024 and is anticipated to reach USD 7.04 billion by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rigid Metal Electrical Conduit Market Size 2024 |

USD 5.19 billion |

| Rigid Metal Electrical Conduit Market CAGR |

3.9% |

| Rigid Metal Electrical Conduit Market Size 2032 |

USD 7.04 billion |

The Rigid Metal Electrical Conduit Market is led by major players such as Atkore, American Conduit, Southwire Company, Zekelman Industries, and Nucor Tubular Products. These companies maintain a strong global presence through diversified product portfolios, continuous R&D, and efficient distribution networks. Market competition is centered on improving durability, corrosion resistance, and installation efficiency through advanced coating technologies and material innovations. Manufacturers are also prioritizing sustainability and compliance with international safety standards. Regionally, North America dominated the global market with a 36% share in 2024, supported by robust construction activity, industrial upgrades, and strong adoption in energy infrastructure modernization projects.

Market Insights

- The rigid metal electrical conduit market was valued at USD 5.19 billion in 2024 and is projected to reach USD 7.04 billion by 2032, growing at a CAGR of 3.9%.

• Market growth is driven by rising industrial electrification, renewable energy expansion, and increased construction in residential and commercial sectors.

• Key trends include the use of galvanized and coated conduits for better corrosion resistance and the integration of conduits with smart building and energy systems.

• Competition is strong, with companies investing in advanced materials, automation, and sustainable manufacturing to enhance product performance and meet safety standards.

• North America led with a 36% share in 2024, followed by Europe at 28% and Asia-Pacific at 25%, while the ½ to 1 trade size segment dominated with a 37% share due to its widespread use in small-scale and residential installations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Trade Size

The ½ to 1 trade size segment held the dominant share of 37% in 2024. Its popularity stems from widespread use in residential and small-scale commercial wiring applications. These conduits are favored for their easy installation, flexibility, and cost efficiency in low to medium voltage circuits. Growing renovation and smart home projects across North America and Europe are further driving adoption. Meanwhile, larger trade sizes like 3 to 4 inches are gaining traction in heavy industrial environments due to higher current-carrying capacity and mechanical strength.

- For instance, Atkore’s Calbond PVC-coated rigid steel conduit features a minimum exterior PVC coating of 0.040 inches and a minimum interior urethane coating of 0.002 inches.

By Application

Manufacturing facilities accounted for the largest share of 34% in 2024. Rising industrial automation and expansion of production plants are increasing conduit installations for power and control wiring. The demand for enhanced electrical safety and protection against mechanical damage supports steady use in this sector. Moreover, growth in renewable energy and smart manufacturing projects further boosts conduit deployment. Rail infrastructure and energy applications are also expanding rapidly as governments invest in transportation and grid modernization initiatives.

- For instance, Anamet’s SEALTITE Type SS-HTUA flexible conduit for industrial wiring is UL-listed for sizes 3/8–4 inches and features a stainless-steel core for superior corrosion resistance.

By End Use

The industrial segment dominated the market with a 42% share in 2024. This dominance is driven by continuous upgrades in electrical infrastructure across manufacturing, oil and gas, and process industries. Industries rely on rigid metal conduits for superior corrosion resistance, durability, and fire protection. Expansion in heavy manufacturing, power generation, and chemical processing further strengthens segment growth. The commercial sector is also witnessing steady gains, supported by increasing construction of data centers, shopping complexes, and institutional buildings requiring safe and long-lasting conduit systems.

Key Growth Drivers

Rising Industrial Electrification and Infrastructure Modernization

The growing modernization of industrial and energy infrastructure is a key driver of market growth. Industries are upgrading power distribution networks to meet higher efficiency and safety standards. Expanding automation and digital manufacturing demand durable conduits for reliable electrical protection. Governments across Asia-Pacific and North America are investing heavily in power, transport, and industrial facilities, supporting consistent installation of rigid metal conduits. Their strength, corrosion resistance, and long service life make them ideal for modern industrial environments.

- For instance, Zekelman’s Rochelle, Illinois complex spans 1,000,000 ft², with inline galvanizing capacity over 300,000 tons/year and a hot-dip line above 100,000 tons/year, supporting large electrification builds.

Expansion of Renewable and Utility Projects

The global shift toward renewable energy is fueling conduit demand across solar, wind, and grid networks. Rigid metal conduits ensure electrical safety in outdoor and high-temperature environments. Growing installation of power transmission lines and utility substations further strengthens usage. Countries are investing in grid resilience and energy transition initiatives, boosting demand for secure conduit infrastructure. The utility sector’s increasing adoption of high-performance metal conduits for durability and grounding efficiency supports steady market expansion.

- For instance, Atkore reported low 2-digit sequential growth in solar torque tube sales in Q4 2024, reflecting rising conduit hardware demand in utility solar.

Rising Construction in Commercial and Residential Sectors

Urbanization and housing expansion across emerging economies are driving conduit consumption in building projects. Rising demand for reliable electrical wiring systems in smart homes and high-rise buildings favors metal conduits for superior fire resistance and longevity. Government-backed infrastructure programs and energy-efficient construction norms are encouraging the use of high-quality electrical safety systems. Growth in commercial spaces, offices, and public facilities further reinforces market demand for rigid conduit systems in long-term installations.

Key Trends & Opportunities

Adoption of Galvanized and Coated Conduits

Manufacturers are introducing galvanized and polymer-coated conduits to improve corrosion resistance and extend product life. This trend is gaining attention in coastal, offshore, and high-humidity industrial environments. Advanced coating technologies are reducing maintenance costs and improving conductivity reliability. Increasing preference for durable and sustainable conduit materials creates new opportunities in infrastructure and marine applications. These innovations align with the growing focus on long-term operational efficiency and sustainability in construction and utilities.

- For instance, ABB’s Ocal PVC-coated rigid steel conduit lists a 40-mil external coating and 2-mil internal coating with a standard 10-ft length, tailored for corrosive, coastal installs.

Integration with Smart Building and Energy Systems

Smart buildings and industrial automation systems are creating new opportunities for conduit manufacturers. Integration with intelligent monitoring and sensor-based energy systems increases the importance of secure and organized electrical channels. Demand for conduit systems compatible with digital and power cable management is growing rapidly. This trend supports the shift toward connected infrastructure, where efficient cable routing and protection enhance performance reliability in advanced commercial and industrial facilities.

- For instance, ABB’s PMA connectors are rated IP66/IP68 (IP69) with temperature ranges published to +105 °C (variants to +200 °C and short-term +350 °C), aligning with sensor-rich smart facilities.

Key Challenges

High Material and Installation Costs

The relatively high cost of metal conduits compared to plastic alternatives poses a challenge to market expansion. Rigid steel and aluminum conduits involve higher material, labor, and installation expenses. Small contractors and residential builders often prefer cost-effective non-metallic conduits. Price volatility in raw materials such as steel and aluminum adds further uncertainty. These factors limit widespread adoption in cost-sensitive markets despite the superior performance and safety benefits of rigid metal conduits.

Competition from Flexible and Non-Metallic Alternatives

The rising use of flexible and non-metallic conduits in light-duty and indoor applications challenges market growth. These alternatives offer easier installation, lightweight design, and lower costs. Continuous innovation in non-metallic materials enhances their mechanical strength and flame resistance, narrowing the performance gap. Growing adoption in residential and commercial sectors reduces dependency on traditional metal conduits. To stay competitive, manufacturers are focusing on hybrid and coated metal designs that balance performance with installation convenience.

Regional Analysis

North America

North America held the largest share of 36% in 2024, driven by strong demand from industrial, commercial, and utility sectors. The U.S. leads the region with extensive adoption of rigid metal conduits in manufacturing and data center facilities. Rising investments in energy infrastructure upgrades and smart grid modernization support market growth. Stringent safety standards and the presence of major construction firms further enhance adoption. Canada and Mexico are witnessing steady gains due to growth in residential construction and renewable energy projects that require durable and corrosion-resistant conduit systems.

Europe

Europe accounted for a 28% market share in 2024, supported by the expansion of renewable energy and industrial automation projects. Countries like Germany, France, and the U.K. are emphasizing energy-efficient and sustainable electrical systems, boosting conduit installation. The region’s strict electrical safety regulations and focus on low-maintenance solutions drive the preference for galvanized steel conduits. Additionally, retrofitting of old industrial facilities across Western Europe and modernization of power distribution networks are expanding the market footprint. The European Union’s infrastructure investments continue to encourage long-term conduit demand.

Asia-Pacific

Asia-Pacific captured a 25% share in 2024 and is expected to register the fastest growth through 2032. Rising industrialization in China, India, Japan, and South Korea fuels demand for robust electrical infrastructure. Rapid urban development and large-scale construction projects in emerging economies are increasing conduit consumption. Government initiatives supporting renewable power and smart city expansion also promote usage. Manufacturers are expanding regional production facilities to meet growing local demand. Increasing investments in transportation, energy, and manufacturing sectors make Asia-Pacific a key contributor to future market growth.

Middle East & Africa

The Middle East & Africa region held a 7% share in 2024, driven by rising construction in energy, oil and gas, and infrastructure projects. Countries such as Saudi Arabia, the UAE, and South Africa are investing in industrial and urban development programs, increasing conduit installations. The region’s harsh climatic conditions favor the use of corrosion-resistant metallic conduits. Ongoing expansion of utility grids and renewable energy initiatives further support adoption. Infrastructure development under national transformation programs continues to generate significant demand for high-strength conduit systems.

Latin America

Latin America accounted for a 4% market share in 2024, primarily supported by growing industrial and utility infrastructure projects. Brazil, Mexico, and Chile are leading markets due to rising manufacturing activities and commercial construction. Government programs promoting energy distribution expansion and urban housing development drive conduit adoption. The market benefits from increasing foreign investments in industrial and energy sectors. However, fluctuating raw material prices and slower infrastructure development in smaller economies slightly limit growth, though long-term demand remains supported by modernization and grid enhancement projects.

Market Segmentations:

By Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

By Application

- Manufacturing facilities

- Rail infrastructure

- Shipbuilding & offshore facilities

- Process plants

- Energy

- Others

By End Use

- Industrial

- Residential

- Commercial

- Utility

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Rigid Metal Electrical Conduit Market features prominent players such as Atkore, American Conduit, Southwire Company, Zekelman Industries, Nucor Tubular Products, Legrand, Schneider Electric, Pittsburgh Pipe, Gibson Stainless & Specialty Inc., HellermannTyton, Flexa GmbH, Techno Flex, SMC Electric, Anamet Electrical, Weifang East Steel Pipe, and Yale Electrical Supply. The market is highly competitive, characterized by continuous innovation in conduit design, coating technologies, and corrosion-resistant materials. Leading manufacturers focus on expanding product portfolios to meet industrial, commercial, and utility requirements while improving performance and safety standards. Strategic mergers, facility expansions, and partnerships strengthen their global presence and distribution networks. Increasing adoption of automation and smart manufacturing supports cost efficiency and production scalability. Companies are also investing in sustainable materials and precision engineering to align with evolving environmental and safety regulations. This focus on innovation, durability, and compliance continues to define competition in the global rigid metal electrical conduit industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Atkore

- American Conduit

- Southwire Company, LLC

- Zekelman Industries

- Nucor Tubular Products

- Legrand

- Schneider Electric

- Pittsburgh Pipe

- Gibson Stainless & Specialty Inc.

- HellermannTyton

- Flexa GmbH

- Techno Flex

- SMC Electric

- Anamet Electrical, Inc.

- Weifang East Steel Pipe

- Yale Electrical Supply

Recent Developments

- In 2025, Atkore announced strategic actions that included an evaluation of divesting its HDPE pipe and conduit business, signaling a re-focus rather than a major expansion of its flexible conduit portfolio.

- In 2025, Zekelman Industries Launches “Steel Here” Campaign to Spotlight Vital Role of American-Made Steel

- In 2024, Southwire Company, LLC Partnered with Levidian to adopt technology for decarbonizing cable production, separating hydrogen and carbon from methane.

Report Coverage

The research report offers an in-depth analysis based on Trade Size, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily with rising industrial electrification worldwide.

- Increasing renewable energy and grid modernization projects will drive long-term conduit demand.

- Adoption of coated and galvanized conduits will expand for enhanced corrosion resistance.

- Urban infrastructure and smart city development will boost usage in residential and commercial buildings.

- Asia-Pacific will emerge as the fastest-growing regional market due to rapid industrialization.

- Integration of conduits with smart monitoring systems will enhance operational efficiency.

- Manufacturers will focus on lightweight and high-durability conduit materials to reduce installation costs.

- Government investments in transport and energy networks will strengthen regional market opportunities.

- Competition from non-metallic alternatives will push innovation in hybrid conduit designs.

- Sustainability initiatives and stricter safety standards will continue to shape product development strategies.