Market Overview

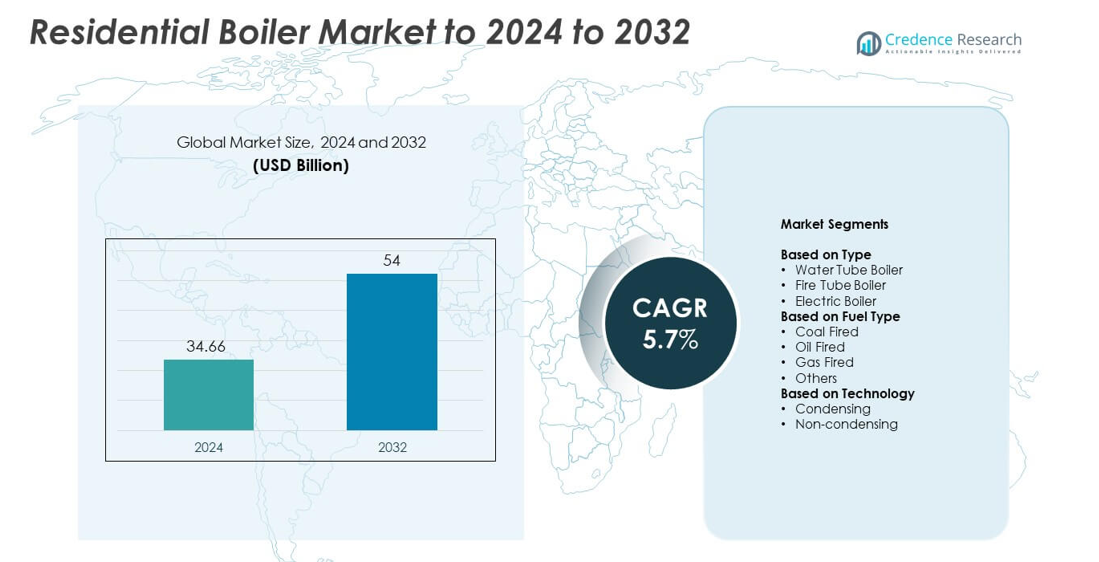

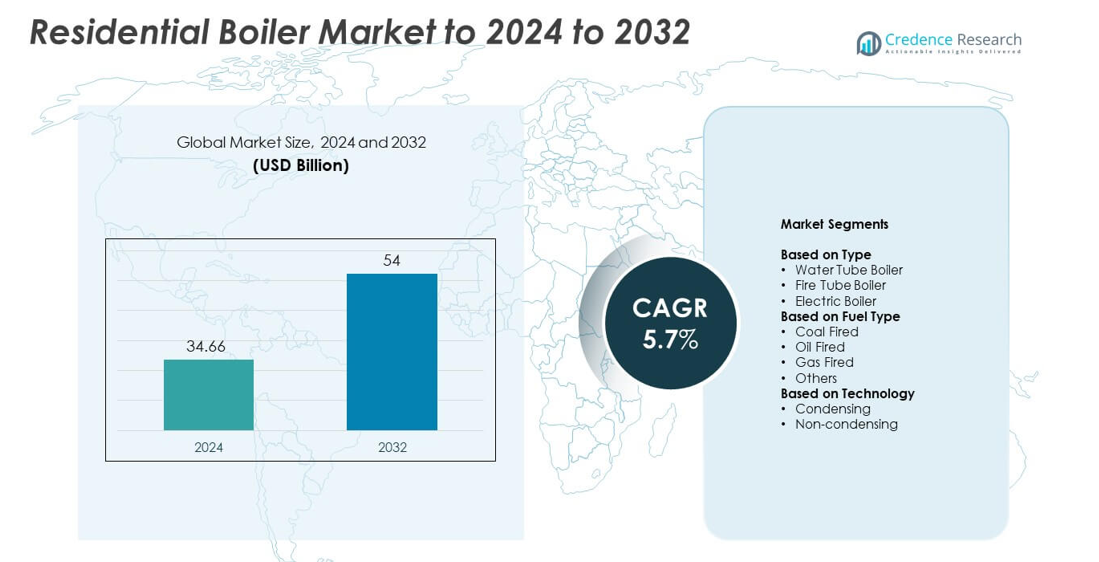

The Residential Boiler Market size was valued at USD 34.66 billion in 2024 and is anticipated to reach USD 54 billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Boiler Market Size 2024 |

USD 34.66 billion |

| Residential Boiler Market, CAGR |

5.7% |

| Residential Boiler Market Size 2032 |

USD 54 billion |

The residential boiler market is led by major players such as Robert Bosch GmbH, Viessmann, Daikin Industries Ltd., A. O. Smith Corporation, Ariston Holding N.V., and Lennox International Inc. These companies focus on energy-efficient, low-emission, and smart heating technologies to meet sustainability goals and regulatory standards. They emphasize R&D investment, product innovation, and expansion across high-demand regions through strategic partnerships and distribution networks. Europe dominated the global market in 2024 with a 38% share, driven by strict energy-efficiency regulations, replacement of aging systems, and the growing adoption of condensing and hydrogen-ready boilers in residential applications.

Market Insights

- The residential boiler market was valued at USD 34.66 billion in 2024 and is projected to reach USD 54 billion by 2032, growing at a CAGR of 5.7%.

- Market growth is driven by rising demand for energy-efficient and low-emission heating systems in residential buildings worldwide.

- The market is witnessing strong trends in condensing and hydrogen-ready boiler technologies, alongside smart connectivity and IoT-based control systems.

- Leading players are focusing on innovation, sustainable product designs, and expansion into high-growth regions, with the fire tube boiler segment holding a 46% share in 2024.

- Europe dominated the global market with a 38% share, followed by North America at 33% and Asia-Pacific at 22%, driven by modernization programs and clean heating adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The fire tube boiler segment dominated the residential boiler market in 2024, accounting for a 46% share. Its dominance is due to simple design, lower maintenance needs, and suitability for small to medium heating loads in residential buildings. Fire tube boilers provide consistent heat transfer and efficiency for central heating applications. Their compact size and cost-effectiveness make them a preferred choice for households, especially in Europe and North America. Rising replacement demand for aging heating systems and improved thermal efficiency further support this segment’s strong position.

- For instance, Lochinvar’s KNIGHT Fire Tube models list 95% AFUE and a stainless-steel fire-tube heat exchanger; the WHB110 lists 110,000 BTU/h and 10:1 turndown.

By Fuel Type

The gas-fired segment held the largest share of 58% in 2024, driven by high energy efficiency and lower emissions compared to oil or coal-based systems. The growing adoption of natural gas infrastructure in residential areas boosts the use of gas boilers. Governments promoting cleaner energy sources and carbon reduction targets have accelerated the transition to gas-fired units. Technological innovations in gas burner design and smart heating controls further enhance energy savings, supporting strong residential adoption across developed and emerging economies.

- For instance, the NCB-H series from Navien offers an AFUE of 95%, while the largest model, the NCB-250/150H, has a maximum DHW input of 210,000 BTU/h and can produce 5.4 GPM at a 70°F rise.

By Technology

The condensing segment led the market with a 64% share in 2024, owing to superior thermal efficiency and lower fuel consumption. Condensing boilers recover heat from exhaust gases, maximizing energy use and minimizing carbon emissions. Consumers prefer these models for their long-term cost savings and compliance with stringent energy-efficiency regulations. Growing government incentives for high-efficiency home heating solutions and modernization of residential infrastructure further boost adoption. The increasing replacement of traditional non-condensing systems also reinforces the leadership of the condensing technology segment.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating Systems

Growing consumer awareness of energy conservation is fueling the adoption of high-efficiency boilers. Condensing models, which recover heat from exhaust gases, help households cut fuel use and reduce carbon footprints. Government programs promoting eco-friendly heating solutions, such as efficiency rebates and emission regulations, further drive demand. The need for cost-effective and sustainable residential heating continues to accelerate product upgrades across Europe, North America, and Asia-Pacific.

- For instance, Rinnai’s I-Series Plus condensing boilers offer both heat-only and combination models, with the combi versions providing simultaneous heat-and-hot-water delivery and achieving up to 96% AFUE.

Urbanization and Increasing Residential Construction

Rapid urbanization and expansion of residential infrastructure are major factors boosting boiler demand. Rising housing developments and renovation projects in urban centers increase the installation of modern, compact, and efficient boiler systems. Developers prefer boilers that meet stricter energy standards and offer better temperature control for multi-unit buildings. The ongoing shift toward smart home heating solutions further amplifies market growth as consumers seek automated and reliable heating systems.

- For instance, Ideal Heating’s Logic2 Combi series includes 24 kW, 30 kW, and 35 kW models, with the 35 kW version offering the highest domestic hot water (DHW) flow rate of 14.5 l/min at a 35°C temperature rise

Shift Toward Cleaner and Renewable Energy Sources

Governments and consumers are shifting from coal and oil-based heating to cleaner options like natural gas and hybrid electric boilers. Environmental regulations and carbon reduction targets are pushing the replacement of older, inefficient systems. The growing availability of renewable fuels and biogas-compatible boilers also supports this transition. Manufacturers focusing on sustainable heating innovations are gaining traction as the market embraces low-emission, high-performance solutions for residential use.

Key Trends & Opportunities

Integration of Smart and Connected Boiler Systems

Smart boilers with Wi-Fi connectivity and IoT-based controls are transforming residential heating management. These systems allow remote operation, predictive maintenance, and real-time energy tracking through mobile apps. Homeowners benefit from improved energy efficiency and comfort customization. The trend toward smart homes is creating strong opportunities for manufacturers offering integrated, user-friendly control platforms. Partnerships between boiler makers and home automation companies are further accelerating this evolution.

- For instance, Bosch’s EasyControl documentation states the controller can improve a system’s ErP rating by 5% when paired with three Bosch Smart TRVs.

Expansion of Hybrid and Hydrogen-Ready Boiler Technologies

Hybrid and hydrogen-ready boilers are emerging as key opportunities in the shift toward sustainable heating. Hybrid models combine gas and electric systems, enabling flexible energy use and lower emissions. Hydrogen-ready boilers prepare homes for future low-carbon fuel adoption without major infrastructure changes. As countries expand hydrogen supply networks, manufacturers introducing compatible models gain an early competitive edge. This transition supports long-term decarbonization goals in residential heating markets.

- For instance, Vaillant’s hydrogen material notes confirm current gas boilers are tested for operation with up to 20% hydrogen blends

Key Challenges

High Installation and Maintenance Costs

The initial cost of purchasing and installing advanced residential boilers remains a major barrier. Condensing and smart boilers require specialized components and professional installation, increasing upfront expenses. Regular maintenance to ensure optimal efficiency also adds to operational costs. These financial factors can slow adoption, particularly in cost-sensitive markets. Incentive programs and financing options are essential to offset these challenges and encourage widespread modernization of heating systems.

Stringent Environmental and Regulatory Compliance

Compliance with evolving emission and energy-efficiency regulations creates challenges for manufacturers. Frequent changes in policy frameworks demand continuous product redesign and certification updates. Smaller manufacturers often face high costs associated with testing and approval processes. Meeting diverse regional standards across Europe, North America, and Asia adds further complexity. Despite these hurdles, regulatory pressure continues to push innovation toward cleaner, high-efficiency heating technologies.

Regional Analysis

North America

North America held a 33% share of the residential boiler market in 2024, driven by strong demand for efficient home heating systems. The United States and Canada are witnessing increased adoption of gas-fired and condensing boilers due to cold climates and energy efficiency standards. Government incentives for eco-friendly systems and rising home renovation projects further support growth. Major manufacturers focus on integrating smart controls and high-efficiency technologies to meet environmental regulations, enhancing the region’s dominance in modern residential heating systems.

Europe

Europe accounted for a 38% share in 2024, making it the largest regional market for residential boilers. The region’s leadership stems from stringent energy regulations and widespread replacement of outdated heating units with condensing models. Countries such as Germany, the United Kingdom, and Italy are key contributors due to extensive gas distribution networks and government subsidies for efficient boilers. The increasing shift toward hydrogen-ready and renewable-compatible systems aligns with Europe’s carbon neutrality targets, further strengthening its market position.

Asia-Pacific

Asia-Pacific captured a 22% share of the residential boiler market in 2024, fueled by rising urbanization and housing development in China, Japan, and South Korea. Rapid economic growth and cold-weather regions drive demand for advanced heating solutions. The growing preference for compact, energy-efficient boilers supports adoption in urban homes. Manufacturers are expanding regional production and focusing on hybrid and electric models to meet environmental goals. Government policies promoting clean heating technologies also enhance the region’s long-term growth outlook.

Middle East & Africa

The Middle East & Africa region held a 4% share in 2024, supported by increasing adoption of boilers in residential villas and premium housing projects. Cooler high-altitude and winter-prone regions in countries like Turkey and Iran contribute to steady demand. Rising construction investments and infrastructure development stimulate growth, while limited gas infrastructure restrains large-scale adoption. Manufacturers are introducing energy-efficient electric and hybrid boilers to suit local climatic and environmental conditions. Gradual modernization of building systems is expected to create moderate growth opportunities.

Latin America

Latin America accounted for a 3% share of the residential boiler market in 2024, led by Brazil, Argentina, and Chile. Expanding urban housing projects and growing middle-class income levels support adoption of modern residential heating systems. The region is gradually shifting from traditional heating sources to energy-efficient boilers due to sustainability concerns. Increasing awareness of energy conservation and government efforts to improve residential infrastructure further contribute to demand. However, limited heating requirements across tropical regions keep overall market penetration relatively low.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Water Tube Boiler

- Fire Tube Boiler

- Electric Boiler

By Fuel Type

- Coal Fired

- Oil Fired

- Gas Fired

- Others

By Technology

- Condensing

- Non-condensing

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

Robert Bosch GmbH, Viessmann, Daikin Industries Ltd., A. O. Smith Corporation, Ariston Holding N.V., Lennox International Inc., Bradford White Corporation, NORITZ Corporation, FERROLI S.p.A, Burnham Holdings Inc., SPX Corporation, and Slant/Fin Corporation are among the prominent participants in the residential boiler market. The competitive landscape is characterized by innovation-driven strategies, with companies focusing on energy-efficient and low-emission boiler technologies. Market players are expanding their portfolios with smart, connected, and hybrid heating systems to meet tightening regulatory standards and evolving consumer preferences. Strategic mergers, acquisitions, and collaborations strengthen their global reach and product integration capabilities. Manufacturers are emphasizing digital control systems, automation, and predictive maintenance to enhance performance and reliability. Strong after-sales service networks and localized manufacturing facilities also play a key role in maintaining competitiveness. Continuous R&D investment and alignment with sustainability goals remain central to securing long-term leadership in this evolving market.

Key Player Analysis

- Robert Bosch GmbH

- Viessmann

- Daikin Industries Ltd.

- O. Smith Corporation

- Ariston Holding N.V.

- Lennox International Inc.

- Bradford White Corporation

- NORITZ Corporation

- FERROLI S.p.A

- Burnham Holdings Inc.

- SPX Corporation

- Slant/Fin Corporation

Recent Developments

- In 2025, Viessmann introduced new developments, including hybrid heat pump systems and new boiler concepts, at the ISH 2025 trade show.

- In 2024, A. O. Smith’s subsidiary Lochinvar introduced the LECTRUS Light Commercial Electric Boiler, signaling a strategic shift towards electric heating solutions for residential and small commercial applications.

- In 2023, Bosch announced new training initiatives for installers focused on heat pump installations to accelerate the transition to electric heating.

Report Coverage

The research report offers an in-depth analysis based on Type, Fuel Type, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily with increasing demand for efficient home heating systems.

- Adoption of condensing boilers will rise as governments tighten energy-efficiency regulations.

- Smart and connected boiler systems will become standard in new residential installations.

- Manufacturers will invest more in hydrogen-ready and hybrid boiler technologies.

- Asia-Pacific will emerge as the fastest-growing region with rapid urban housing development.

- Replacement of outdated boilers in Europe and North America will sustain long-term demand.

- Environmental policies will encourage a stronger shift toward low-carbon and renewable heating solutions.

- Rising electricity prices may influence consumers toward gas and hybrid models.

- Technological innovation in digital controls and predictive maintenance will enhance operational reliability.

- Strategic partnerships between energy companies and boiler manufacturers will drive product integration and market expansion.