Market overview

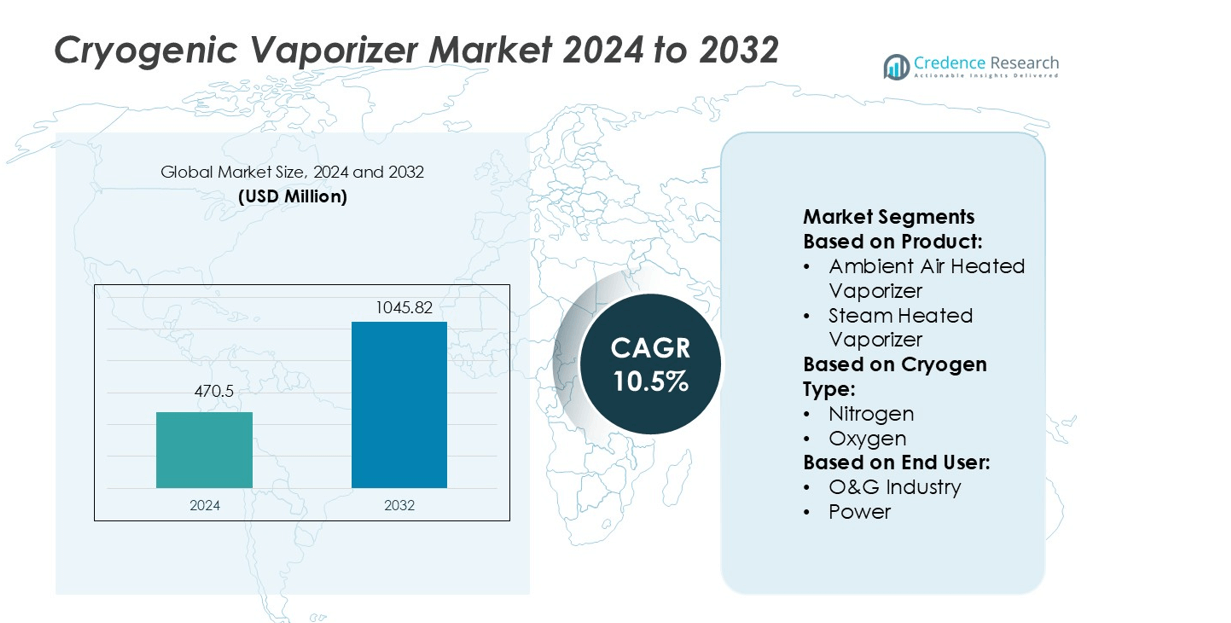

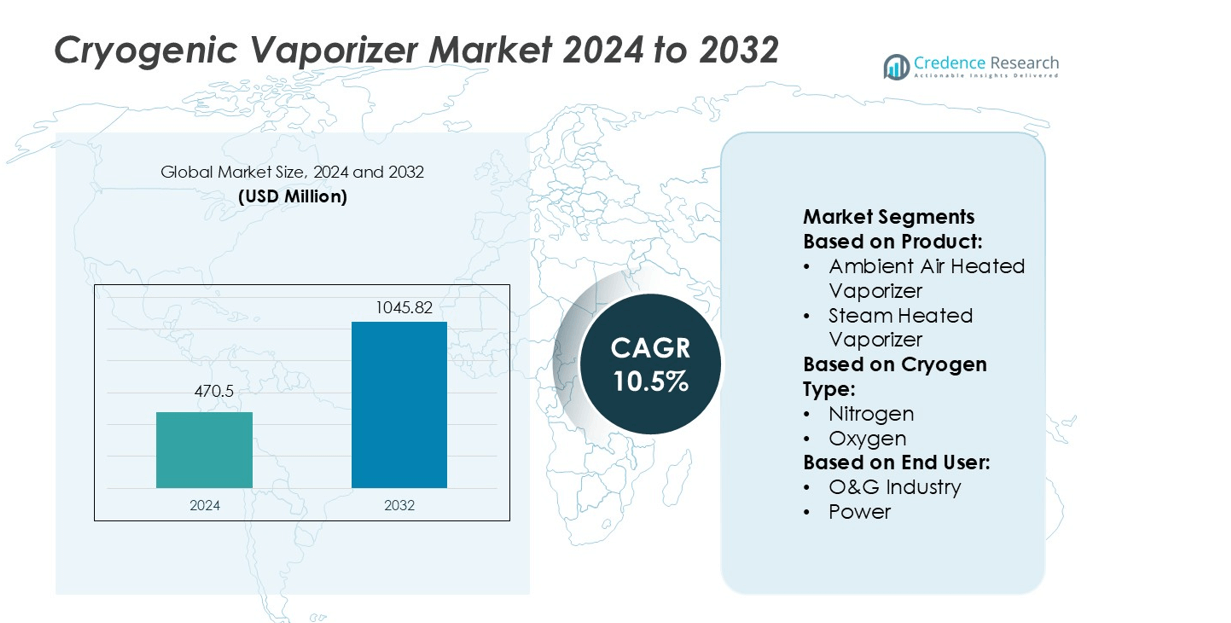

Cryogenic Vaporizer Market size was valued USD 470.5 million in 2024 and is anticipated to reach USD 1045.82 million by 2032, at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cryogenic Vaporizer Market Size 2024 |

USD 470.5 million |

| Cryogenic Vaporizer Market, CAGR |

10.5% |

| Cryogenic Vaporizer MarketSize 2032 |

USD 1045.82 million |

The cryogenic vaporizer market features prominent players such as Cryostar, Cryogas Equipment, FIBA Technologies, Cryonorm, Bronswerk, Cryotek, Chart Industries, Cryo-Tech Industrial, Cryolor, and Acme Cryo. These companies lead the market through technological innovation, energy-efficient designs, and strong distribution networks. They focus on integrating smart monitoring, modular configurations, and high-capacity systems to meet rising demand across LNG, chemical, and healthcare industries. North America emerges as the leading region in the global market, holding a 32% share, supported by extensive LNG infrastructure, advanced industrial gas usage, and strong regulatory support for clean energy. This regional dominance strengthens competitive positioning for top manufacturers.

Market Insights

- The cryogenic vaporizer market was valued at USD 470.5 million in 2024 and is projected to reach USD 1045.82 million by 2032, growing at a CAGR of 10.5% during the forecast period.

- Rising LNG infrastructure investments and growing industrial gas demand across power, chemical, and healthcare industries are key drivers fueling steady market expansion.

- Advancements in smart monitoring, modular configurations, and energy-efficient designs are shaping strong market trends and strengthening the position of top players.

- High initial investment costs and stringent safety regulations act as major restraints, particularly for small and medium enterprises in emerging economies.

- North America leads with a 32% regional share, while ambient air heated vaporizers hold the largest segment share due to low operating costs and energy efficiency, reinforcing strong global demand.Top of Form

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Ambient Air Heated Vaporizers hold the largest market share due to their low operational cost and energy efficiency. These systems rely on natural convection, making them ideal for continuous and large-scale gas vaporization. Their simple design reduces maintenance requirements and supports reliable performance in outdoor environments. The demand is driven by growing industrial gas consumption across multiple sectors. Steam Heated Vaporizers and other systems serve specialized applications but face higher operational costs, limiting adoption. The efficiency and low carbon footprint of ambient systems make them the dominant product type in this segment.

- For instance, FIBA Technologies’ FinnCo ambient series vaporizers are rated for a maximum allowable working pressure (MAWP) of up to 700 psig. Standard models offer capacities up to 140,000 SCFH, but custom units can be designed and manufactured to achieve capacities of up to 185,000 SCFH or more, depending on specific requirements.

By Cryogen Type

Nitrogen dominates the cryogen type segment, supported by its extensive use in manufacturing, food processing, and healthcare industries. Its inert nature ensures safe handling and storage, while applications in cooling, freezing, and purging drive steady demand. Nitrogen vaporizers support large flow rates, enabling cost-efficient supply chains for critical processes. Oxygen and natural gas vaporizers follow due to rising demand in energy and healthcare applications. Other cryogens such as argon support specialized uses in welding and metallurgy. The broad industrial utility of nitrogen ensures its leading position in the segment.

- For instance, Cryonorm manufactures a “CNLP 3x4x5000” Ambient Air Heated Vaporizer. The nominal capacity, which varies depending on specific design and environmental conditions such as flow rate, temperature, and pressure, is calculated to meet the requirements of particular applications, such as for nitrogen.

By End User

The oil and gas industry holds the dominant share of the end-user segment, driven by increasing LNG processing and distribution activities. Cryogenic vaporizers support gasification processes in terminals, refineries, and storage facilities. High flow rates, energy efficiency, and reliable operation make vaporizers essential for continuous O&G operations. The power sector and food & beverage industry also contribute significantly due to their rising reliance on industrial gases for cooling, preservation, and energy generation. The strong integration of cryogenic vaporization in O&G infrastructure underpins its leading role in this market segment.

Key Growth Drivers

Rising Demand for Industrial Gases

Expanding use of industrial gases in manufacturing, energy, and healthcare is a major growth driver. Industries rely on nitrogen, oxygen, and natural gas for critical operations like cooling, freezing, and energy generation. The need for consistent and large-scale gas supply boosts the adoption of high-efficiency vaporizers. Ambient air heated vaporizers, in particular, support low-cost operations with minimal energy input. Rapid expansion in steel, chemical, and LNG terminals further strengthens the demand base, supporting steady market growth across multiple end-use industries.

- For instance, Bronswerk’s patented High-Pressure Shell & Tube Heat Exchanger “Compact Header” design is rated to operate at pressures up to 1000 bar (14,500 psi).

Expansion of LNG Infrastructure

Growing investments in LNG terminals, pipelines, and regasification facilities fuel the cryogenic vaporizer market. Vaporizers play a vital role in converting LNG to gaseous form for power generation, transportation, and distribution. Global energy diversification strategies increase LNG imports and storage capacities, boosting vaporizer deployment. Operators favor ambient and steam-heated units for their reliability and performance in continuous operations. The rising number of LNG receiving stations in Asia-Pacific and North America reflects the critical role of vaporizers in ensuring supply security.

- For instance, Chart supplies its SuperGap™ Ambient Air Vaporizers, which for LNG service feature finned aluminum tubes and have a design temperature range down to –196 °C.

Focus on Energy-Efficient Systems

Industries are shifting to energy-efficient vaporization systems to reduce operational costs and carbon emissions. Ambient air heated vaporizers, which require no external power, align with sustainability goals and regulatory frameworks. Manufacturers are adopting advanced designs to optimize heat transfer and minimize gas loss. These improvements enhance reliability and lower lifetime costs for end users. Strong policy support for clean energy transition and emission reduction accelerates the replacement of older, energy-intensive systems with modern, efficient vaporizer technologies.

Key Trends & Opportunities

Integration of Smart Monitoring Systems

Digital monitoring and control systems are gaining traction in cryogenic vaporization. Real-time pressure, temperature, and flow tracking improve operational safety and efficiency. Automated adjustments help maintain stable gas supply, reduce downtime, and support predictive maintenance. IoT-enabled vaporizers also allow remote diagnostics, lowering operational risks. This integration of smart features offers new opportunities for manufacturers to deliver high-value solutions and support industries seeking better control over gas management systems.

- For instance, Cryo-Tech is a manufacturer of cryogenic vaporizers, and offers products for a range of pressure requirements and cryogenic fluids. The specific pressure ratings (150, 200, and 350 bar) and a minimum working temperature of –196 °C, often required for gases like liquid nitrogen, are representative of high-pressure industrial vaporizers.

Expansion of Healthcare and Food Sectors

The growing use of cryogenic gases in healthcare and food processing creates strong opportunities for vaporizer suppliers. Medical oxygen demand is increasing for hospitals, while liquid nitrogen use is expanding in food preservation and transportation. Compact, efficient vaporizers are well-suited for these sectors due to their low maintenance and steady output. As healthcare infrastructure expands globally and food export chains strengthen, these industries will remain key demand centers for vaporizer manufacturers.

- For instance, Acme Cryogenics’ ambient/forced-air vaporizer units incorporate proprietary extended-surface finned designs withworking pressures up to 15,000 PSIG for specialized high-pressure applications, and achieving total flow ratings of up to 200,000 SCFH or higher when multiple units are banked together for large-scale operations.

Development of Modular and Portable Systems

A clear trend is emerging toward modular and portable vaporizer units that can be deployed quickly in different environments. These systems offer flexibility in installation and are suited for smaller industries, remote energy projects, and temporary LNG facilities. Their ease of transport and lower upfront cost make them attractive for emerging markets. This trend creates new revenue streams for manufacturers and encourages technology innovation to meet varied operational needs.

Key Challenges

High Initial Investment Costs

The installation of cryogenic vaporizer systems involves significant upfront capital costs. Expenses include specialized equipment, storage infrastructure, and safety systems. Small and medium enterprises often face budget constraints, which limit large-scale adoption. While operational savings occur over time, the initial financial barrier can delay investment decisions. This challenge is especially relevant in developing regions, where budget priorities often focus on other critical infrastructure needs.

Stringent Safety and Regulatory Compliance

Cryogenic vaporizers operate under extreme temperature and pressure conditions, requiring strict adherence to safety standards. Meeting compliance involves complex engineering, continuous monitoring, and regular certification. Non-compliance can lead to operational shutdowns, legal penalties, and safety hazards. Adapting to evolving global and regional standards also increases operational complexity and costs for manufacturers. These factors create significant hurdles, especially for smaller operators with limited technical resources.

Regional Analysis

North America

North America holds the largest share of the cryogenic vaporizer market, accounting for 32% of the global revenue. The region’s dominance is driven by a strong LNG infrastructure, widespread industrial gas usage, and ongoing investments in clean energy projects. The U.S. leads with multiple LNG terminals, advanced pipeline networks, and established end-use industries such as power, chemicals, and healthcare. Canada supports this growth with energy exports and manufacturing expansion. The region’s regulatory focus on energy efficiency and emission control further accelerates adoption of ambient air heated vaporizers. High demand for reliable gas supply reinforces market leadership.

Europe

Europe represents 25% of the global market share, supported by advanced industrial infrastructure and strict environmental regulations. Key countries such as Germany, France, and the U.K. lead adoption through strong LNG imports and growing green energy initiatives. The region emphasizes energy-efficient systems, boosting demand for ambient air vaporizers. Investments in decarbonization, hydrogen infrastructure, and industrial automation drive steady expansion. Europe’s food, beverage, and healthcare sectors also rely heavily on cryogenic gases. Stringent safety standards and sustainability mandates encourage technology upgrades, creating consistent market growth across industrial and utility applications.

Asia-Pacific

Asia-Pacific accounts for 28% of the global cryogenic vaporizer market, making it one of the fastest-growing regions. China, India, Japan, and South Korea drive demand through large-scale LNG import facilities, expanding manufacturing sectors, and rising healthcare infrastructure. Rapid industrialization and energy diversification increase the need for high-capacity vaporizers. Governments are investing in LNG regasification terminals and power generation facilities, strengthening supply chains. Growing demand for industrial gases in electronics, chemicals, and steel production further supports growth. Favorable economic policies and infrastructure development programs enhance Asia-Pacific’s position as a key global demand center.

Latin America

Latin America holds 8% of the global market share, with growth concentrated in Brazil, Argentina, and Chile. LNG infrastructure development and increasing industrial gas applications are key drivers. The region is witnessing rising adoption of vaporizers in power generation, oil and gas, and food processing sectors. Ongoing investments in energy diversification and natural gas imports support market expansion. While infrastructure remains less developed compared to mature regions, growing partnerships with international suppliers are accelerating technology penetration. Brazil leads regional demand, benefiting from expanding industrial activity and strategic LNG import capacity.

Middle East & Africa

The Middle East & Africa account for 7% of the cryogenic vaporizer market. Strong investments in LNG export infrastructure and oil & gas projects drive demand in the Middle East, with the UAE, Qatar, and Saudi Arabia as key markets. Africa is emerging as a growth frontier with rising energy and healthcare investments. The region’s focus on increasing LNG capacity and improving energy security supports vaporizer deployment. Demand is also increasing in metallurgy and shipping. While regulatory frameworks are developing, large-scale infrastructure projects provide long-term growth potential for cryogenic vaporizer suppliers.

Market Segmentations:

By Product:

- Ambient Air Heated Vaporizer

- Steam Heated Vaporizer

By Cryogen Type:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cryogenic vaporizer market features key players such as Cryostar, Cryogas Equipment, FIBA Technologies, Cryonorm, Bronswerk, Cryotek, Chart Industries, Cryo-Tech Industrial, Cryolor, and Acme Cryo. The cryogenic vaporizer market is defined by strong technological innovation and expanding global infrastructure. Companies are prioritizing energy-efficient designs, modular systems, and advanced heat transfer technologies to meet the growing demand for industrial gases. Manufacturers are focusing on integrating digital monitoring and control systems to improve operational reliability and reduce maintenance costs. Strategic collaborations with LNG terminals, power producers, and healthcare facilities are helping expand product reach and strengthen market presence. Continuous investment in R&D and manufacturing capabilities drives product diversification, ensuring high performance and compliance with evolving environmental and safety standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cryostar

- Cryogas Equipment

- FIBA Technologies

- Cryonorm

- Bronswerk

- Cryotek

- Chart Industries

- Cryo-Tech Industrial

- Cryolor

- Acme Cryo

Recent Developments

- In May 2025, Linde signed an agreement to design and construct one of the biggest cryogenic cooling facilities in the world to support a utility-scale quantum computer run by PsiQuantum, a computing startup in Brisbane, Australia.

- In November 2024, AYR Wellness Inc. has expanded its Later Days brand to include a line of pocket-friendly vapes, available in New Jersey, Massachusetts, Nevada, and Ohio starting November 25th, with more markets to follow. The new vapes feature a compact disposable design, a 280mAh battery, USB-C charging, and an oil window.

- In August 2024, Nikkiso Clean Energy & Industrial Gases Group announced the commencement of construction on its expanded manufacturing facility in Wurzen, Germany. This expansion will significantly increase its manufacturing capacity in Europe, bolstering its capabilities in cryogenic equipment, heat exchangers, and hydrogen fueling skids.

- In June 2024, FIBA Technologies announced an upgrade of over to its Rayne, Louisiana re-test facility, which included the installation of a new Rotoblast machine. The addition was made to enhance efficiency and expand capacity for refurbishing and re-testing equipment.

Report Coverage

The research report offers an in-depth analysis based on Product, Cryogen Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient vaporizer systems will continue to rise across industries.

- LNG infrastructure expansion will drive strong adoption in power and energy sectors.

- Smart monitoring and automation will become standard features in vaporizer systems.

- Modular and portable units will gain traction in emerging and remote markets.

- Industrial gas consumption growth will strengthen vaporizer deployment in manufacturing.

- Healthcare and food industries will expand their use of cryogenic vaporizers for critical applications.

- Sustainability goals and emission regulations will push upgrades to advanced systems.

- Strategic collaborations and partnerships will enhance global market presence.

- Technological innovation will focus on performance optimization and operational safety.

- Rising investments in clean energy projects will create long-term growth opportunities.