Market Overview

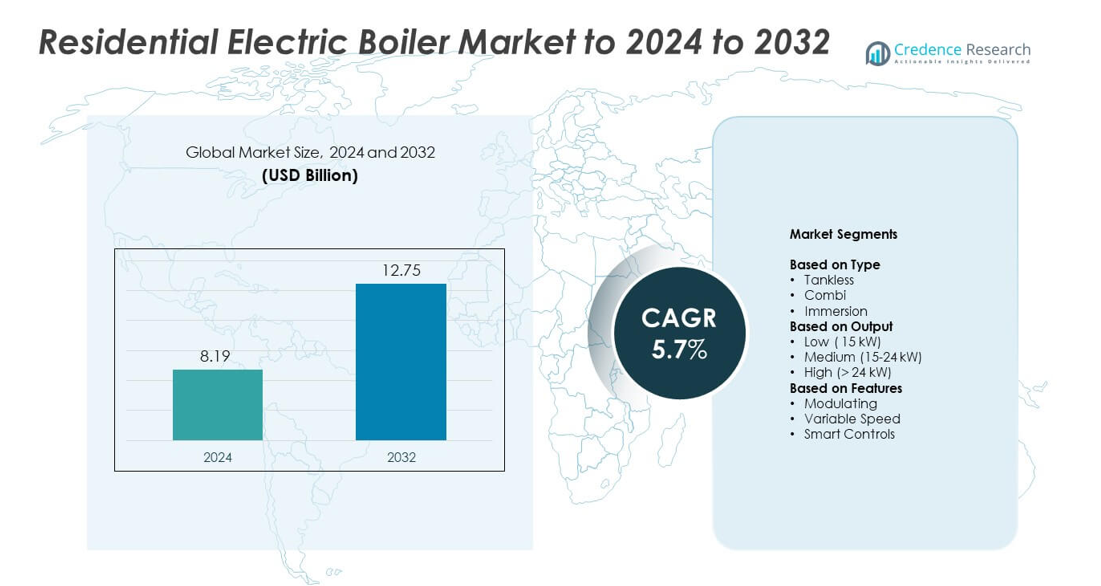

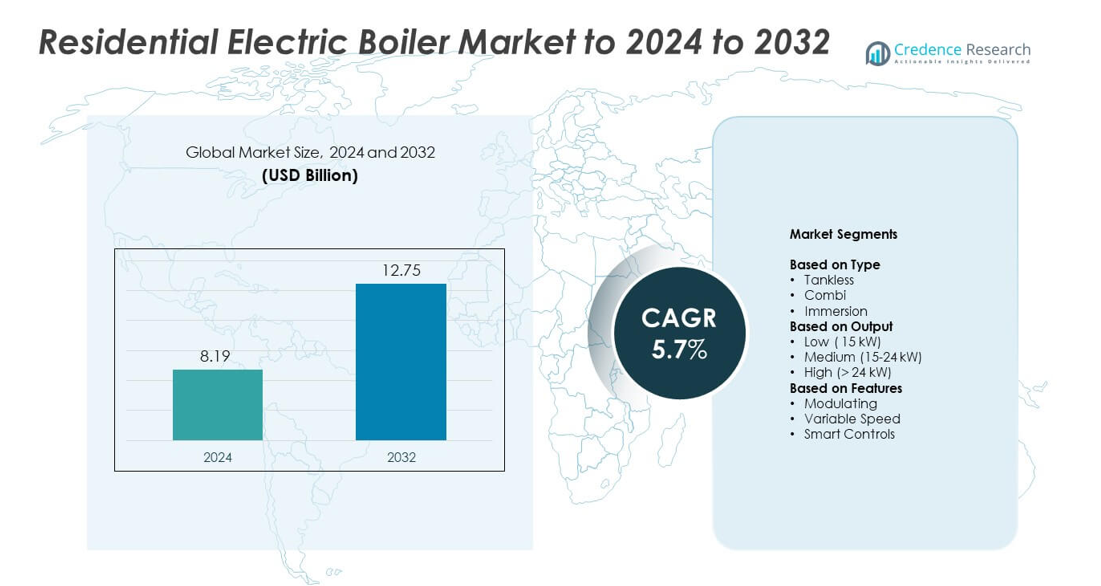

Residential Electric Boiler Market size was valued USD 8.19 Billion in 2024 and is anticipated to reach USD 12.75 Billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Electric Boiler Market Size 2024 |

USD 8.19 Billion |

| Residential Electric Boiler Market, CAGR |

5.7% |

| Residential Electric Boiler Market Size 2032 |

USD 12.75 Billion |

The residential electric boiler market is led by key players such as Bosch Thermotechnology, Rheem Manufacturing Company, LG, AO Smith Corporation, Viessmann, and Navien. These companies focus on energy-efficient designs, smart control integration, and eco-friendly heating technologies to strengthen their market presence. Strategic collaborations and regional expansions enhance their competitiveness across developed and emerging economies. Europe dominated the market in 2024, accounting for a 39% share, driven by strong regulatory support for decarbonization and widespread adoption of clean heating solutions. North America followed, supported by rising electrification programs and renewable integration.

Market Insights

- The residential electric boiler market was valued at USD 8.19 Billion in 2024 and is projected to reach USD 12.75 Billion by 2032, growing at a CAGR of 5.7%.

- Rising demand for clean energy heating solutions and government incentives promoting electrification are major growth drivers.

- Integration of smart controls, IoT connectivity, and renewable hybrid systems are key market trends improving energy efficiency.

- The market is moderately competitive, with global players focusing on advanced designs, sustainability, and expansion in emerging regions.

- Europe led the market with 39% share in 2024, followed by North America at 32%, while the combi boiler segment dominated by type with 46% share, driven by compact design and high efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The combi type segment dominated the residential electric boiler market in 2024, accounting for 46% share. Combi boilers gained traction due to their ability to provide both space heating and hot water without separate storage tanks. Their compact design and easy installation make them ideal for apartments and small homes. Increasing energy efficiency standards and demand for on-demand hot water systems further drive this segment. Tankless models are also expanding steadily as consumers seek continuous heating performance and lower energy losses compared to storage-based systems.

- For instance, Elnur Mattira Combi lists up to 12 L/min domestic hot-water flow and 3–15 kW outputs, with optimal 3 bar inlet pressure noted in its manual.

By Output

The medium output category, ranging from 15 to 24 kW, held the largest market share of 41% in 2024. This range offers the right balance between energy efficiency and heating capacity for modern homes. Medium-output boilers meet the heating requirements of average-sized residences while maintaining manageable power consumption. Growth is supported by expanding adoption in urban housing projects and retrofitting of traditional gas boilers. The demand for higher efficiency and compatibility with smart thermostats also strengthens the adoption of this output range.

- For instance, Vaillant eloBLOCK offers 21/24/28 kW models; the 28 kW unit specifies 1,204 L/h nominal flow at ΔT = 10 K and a 25–85 °C heating set range.

By Features

The smart controls segment led the market with 44% share in 2024. These systems allow remote operation, real-time energy monitoring, and automated temperature adjustments. Rising consumer preference for connected home technologies and energy optimization features has boosted smart control adoption. Integration with AI-based energy management platforms and IoT-enabled devices enhances efficiency and user convenience. The growing trend of home automation and sustainability-oriented heating systems continues to drive demand for feature-rich residential electric boilers.

Key Growth Drivers

Rising Shift Toward Clean and Efficient Heating Solutions

The growing focus on decarbonization and energy efficiency is driving the adoption of residential electric boilers. Governments across Europe and North America are phasing out fossil fuel-based heating systems to reduce emissions. Electric boilers produce zero on-site emissions and integrate easily with renewable power sources like solar and wind. The shift toward sustainable home heating, combined with stricter environmental regulations, is pushing homeowners to adopt electric alternatives, particularly in regions with robust clean energy infrastructure.

- For instance, Stiebel Eltron specifies 99% efficiency for its electric tankless heating line, highlighting near-total conversion of input power.

Government Incentives and Electrification Policies

Incentive programs promoting electrification in the residential sector are fueling market expansion. Subsidies, rebates, and tax credits encourage the installation of electric heating systems in both new and retrofit homes. European Union policies such as Fit for 55 and various national decarbonization strategies support heat electrification. In the U.S., federal and state programs under energy transition plans are accelerating adoption. These initiatives make electric boilers more affordable and attractive compared to gas or oil-based systems.

- For instance, tado° has publicly reported that its customers achieve an average heating saving of 22%. In a press release on September 23, 2025, tado° announced that its new AI Assist feature for tado° X customers could provide up to 55% more heating savings compared to using the free tado° app

Technological Advancements in Smart and Connected Boilers

Advances in smart technologies and IoT integration are reshaping the residential electric boiler market. Manufacturers are introducing systems with AI-driven temperature regulation, mobile connectivity, and predictive maintenance capabilities. Smart features optimize energy consumption and enhance user control. Integration with home automation platforms further strengthens their appeal. These innovations not only improve performance and efficiency but also align with rising consumer demand for intelligent and energy-saving home appliances.

Key Trends & Opportunities

Integration with Renewable and Hybrid Systems

The integration of electric boilers with renewable sources presents a major opportunity for sustainable heating. Pairing boilers with solar PV systems or heat pumps allows households to achieve near-zero carbon emissions. Hybrid configurations also provide flexibility and lower operating costs. Growing investments in distributed renewable generation are creating favorable conditions for such integrated setups, supporting long-term energy transition goals.

- For instance, myenergi’s eddi diverter supports a 3.68 kW max heater load, 100 W minimum, and 3 W standby, enabling PV-to-immersion routing for hot-water/heating.

Rising Adoption of Smart Home Ecosystems

The growing popularity of smart home systems is creating new opportunities for connected electric boilers. Integration with voice assistants, cloud-based control platforms, and smart thermostats enhances convenience and efficiency. Consumers increasingly favor automated energy management solutions that optimize power usage. This trend is driving innovation in digital controls and user-friendly interfaces, fostering stronger demand for intelligent heating systems across developed and emerging markets.

- For instance, During its February 2025 announcement of the new AI-powered Alexa+, Amazon indicated that Alexa-enabled devices enhance numerous heating-control integrations. At a later date, Amazon also disclosed that there were over 600 million Alexa-enabled devices globally.

Key Challenges

High Initial Installation and Conversion Costs

The initial cost of installing electric boilers remains a significant challenge, especially when replacing traditional systems. Electrical upgrades, such as enhanced circuit capacity and new wiring, can increase installation expenses. In older homes, retrofitting costs deter many homeowners despite long-term savings. Without adequate subsidies or financing options, these costs limit large-scale adoption in cost-sensitive regions.

Grid Dependency and Energy Supply Limitations

The heavy reliance on electricity poses challenges in areas with unstable grids or high energy prices. Electric boilers can strain local networks during peak demand, leading to energy management concerns. In regions with limited renewable capacity, reliance on fossil-fuel-generated electricity undermines sustainability goals. Addressing grid reliability and promoting renewable energy integration are essential to support consistent and efficient use of electric boilers.

Regional Analysis

North America

North America held a 32% share of the residential electric boiler market in 2024. The growth is driven by increasing adoption of clean heating technologies and government incentives supporting electrification. The U.S. and Canada are promoting low-emission home heating under national energy transition plans. Rising replacement of oil and gas systems with efficient electric models supports demand. Expanding smart home integration and strong renewable power generation further enhance adoption. Cold climate regions, particularly the northern U.S. and Canada, are witnessing strong demand for medium and high-output electric boilers.

Europe

Europe accounted for the largest market share of 39% in 2024. The region leads due to strict decarbonization targets and renewable energy adoption under the European Green Deal. Countries such as Germany, the UK, and France are rapidly phasing out fossil-fuel-based heating systems. Government-backed subsidies and zero-carbon home initiatives drive electric boiler installations in both residential and retrofit projects. High energy efficiency standards and integration with heat pumps further strengthen demand across Western and Northern Europe. Smart control technologies and hybrid systems are also becoming mainstream.

Asia-Pacific

Asia-Pacific held a 21% share in 2024, with strong growth led by China, Japan, and South Korea. Rapid urbanization, energy efficiency awareness, and adoption of smart home appliances are fueling regional demand. The shift toward electric-based heating in new residential constructions supports market expansion. China’s emphasis on reducing air pollution and promoting clean energy is driving large-scale electrification programs. Japan’s technological advancements in compact and efficient boiler designs also contribute to regional growth. Expanding renewable infrastructure and favorable government policies further enhance market potential.

Middle East and Africa

The Middle East and Africa region captured a 5% share of the residential electric boiler market in 2024. Market growth is supported by the rising construction of energy-efficient residential buildings and an increasing focus on sustainable energy solutions. Countries such as the UAE and Saudi Arabia are integrating electric boilers in high-end housing projects emphasizing energy efficiency. Expanding grid infrastructure and renewable capacity strengthen regional adoption. However, moderate heating requirements and higher electricity costs in some areas limit widespread penetration outside urban developments.

Latin America

Latin America accounted for a 3% share in 2024, driven mainly by growing awareness of clean energy technologies. Brazil, Chile, and Argentina are the leading adopters, supported by urban modernization and government energy transition programs. The availability of renewable energy sources such as hydropower and solar enhances the feasibility of electric heating. Market expansion is further supported by increasing investments in residential infrastructure and smart energy systems. However, limited grid coverage in rural regions and high upfront costs continue to restrict large-scale adoption in several parts of the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

By Output

- Low ( 15 kW)

- Medium (15-24 kW)

- High (> 24 kW)

By Features

- Modulating

- Variable Speed

- Smart Controls

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The residential electric boiler market is highly competitive, with major players such as Bosch Thermotechnology, Rheem Manufacturing Company, LG, AO Smith Corporation, Viessmann, Navien, Midea Group, Electrolux, Stiebel Eltron, Haier, Bradford White Corporation, COPELAND, CHINT Electric, FUJITSU GENERAL AMERICA, INC., Weil-McLain, Erie Electric, Sussman Electric Boilers, and ECR International leading the landscape. The competition centers on innovation, product efficiency, and digital connectivity. Companies are investing in advanced heating technologies that enhance performance and energy savings. Strategic partnerships and R&D initiatives are expanding their product portfolios. Manufacturers are focusing on integrating smart controls, IoT connectivity, and modular designs to cater to modern housing trends. Regional expansions and sustainability-focused offerings further strengthen competitiveness. Continuous innovation and eco-friendly technology adoption remain key strategies shaping the market’s future dynamics.

Key Player Analysis

- Bosch Thermotechnology

- Rheem Manufacturing Company

- LG

- AO Smith Corporation

- Viessmann

- Navien

- Midea Group

- Electrolux

- Stiebel Eltron

- Haier

- Bradford White Corporation

- COPELAND

- CHINT Electric

- FUJITSU GENERAL AMERICA, INC.

- Weil-McLain

- Erie Electric

- Sussman Electric Boilers

- ECR International

Recent Developments

- In 2025, Sussman Electric Boilers, a division of Diversified Heat Transfer, Inc. (DHT), introduces the EWx Series Electric Hot Water Boiler, a sustainable solution for commercial and industrial HVAC applications.

- In 2024, Bradford White Corporation has strategically acquired Heat-flow, one of the leading providers of stainless-steel indirect water heating and hydronic storage tanks for industrial, commercial and residential applications.

- In 2024, Weil-McLain introduces the Simplicity high-efficiency combination gas boiler, designed for residential use.

Report Coverage

The research report offers an in-depth analysis based on Type, Output, Features and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The residential electric boiler market will continue expanding with growing clean energy adoption.

- Electrification of home heating will accelerate under global decarbonization goals.

- Integration with renewable sources such as solar and wind will enhance system efficiency.

- Smart and connected boilers will become standard features in modern homes.

- Government subsidies and energy transition programs will strengthen market penetration.

- Compact and modular boiler designs will gain popularity in urban housing projects.

- Hybrid systems combining electric boilers with heat pumps will see wider use.

- Advancements in AI-based control and predictive maintenance will boost product performance.

- Energy storage integration will improve system stability and reduce operational costs.

- Expansion in Asia-Pacific and Europe will drive long-term global market growth.