Market Overview

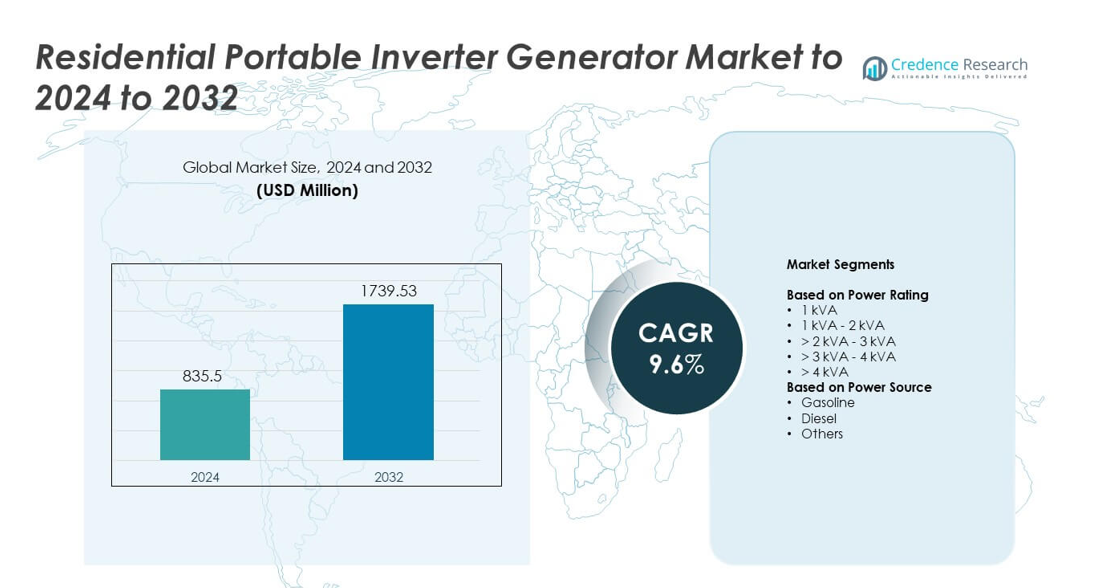

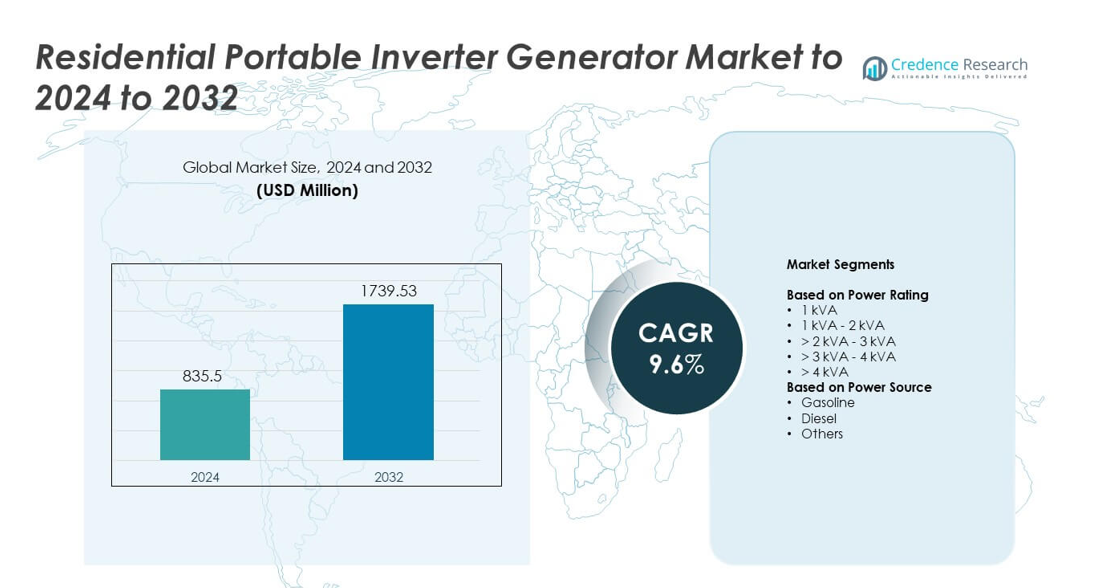

The Residential Portable Inverter Generator Market size was valued at USD 835.5 million in 2024 and is anticipated to reach USD 1,739.53 million by 2032, at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Portable Inverter Generator Market Size 2024 |

USD 835.5 million |

| Residential Portable Inverter Generator Market, CAGR |

9.6% |

| Residential Portable Inverter Generator Market Size 2032 |

USD 1,739.53 million |

The Residential Portable Inverter Generator Market is led by prominent players such as Honda India Power Products Ltd., Generac Power Systems Inc., Cummins, Inc., Yamaha Motor Co., Ltd., and Briggs & Stratton. These companies focus on technological innovation, energy efficiency, and eco-friendly designs to strengthen their global presence. Continuous advancements in low-noise, fuel-efficient, and smart inverter systems have enhanced product performance and consumer adoption. North America emerged as the leading region with a 38.6% market share in 2024, driven by high household power backup demand, expanding outdoor recreational use, and strong manufacturer distribution networks across the United States and Canada.

Market Insights

- The Residential Portable Inverter Generator Market was valued at USD 835.5 million in 2024 and is projected to reach USD 1,739.53 million by 2032, growing at a CAGR of 9.6%.

- Rising power outages, expanding outdoor activities, and increasing preference for clean, quiet, and fuel-efficient backup systems are driving market growth.

- Technological advancements such as smart monitoring, hybrid fuel options, and compact designs are shaping market trends and improving operational efficiency.

- The market is moderately competitive, with key players focusing on innovation, product reliability, and emission compliance to strengthen global presence.

- North America dominated with a 38.6% share in 2024, followed by Asia Pacific at 27.8% and Europe at 25.4%, while the 1 kVA–2 kVA power rating segment led the market with 38.2% share due to high household and recreational usage demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Rating

The 1 kVA – 2 kVA segment dominated the residential portable inverter generator market in 2024, accounting for 38.2% of the total share. This range is preferred for small households and recreational use due to compact size, quiet operation, and high portability. Rising adoption for outdoor activities, RV camping, and backup during short power outages supports demand. Manufacturers are improving fuel efficiency and runtime to cater to home users seeking reliable, lightweight, and easy-to-use solutions, strengthening this segment’s leadership across developed and emerging markets.

- For instance, Honda’s EU2200i outputs 2,200 W max and 1,800 W rated. It runs 8.1 hours at ¼-load on a 0.95-gal tank. Noise is 48–57 dB(A), weight 47.4 lb.

By Power Source

The gasoline segment held the dominant share of 64.5% in 2024, driven by wide availability and low maintenance cost. Gasoline-powered inverter generators offer faster start-up, reduced emissions, and lower noise levels compared to conventional models. Their ease of refueling and compact design make them ideal for residential backup and recreational applications. Increasing consumer shift toward cleaner and portable power alternatives continues to favor gasoline models, while hybrid and propane variants are gradually emerging in regions promoting eco-friendly energy sources.

- For instance, the international Yamaha EF2200iS uses a 4.7-liter gasoline tank, has a dry weight of 25 kg, and a runtime of up to 10.5 hours at a quarter-load with the economy mode on. The North American version, for comparison, has a 1.24-gallon fuel tank and a dry weight of 55.2 lbs (25 kg).

Key Growth Drivers

Rising Demand for Reliable Backup Power

Frequent power outages and unstable grid supply are increasing demand for portable inverter generators in residential settings. Homeowners prefer these systems for their ability to deliver consistent and clean power suitable for sensitive electronics. Their lightweight design, quiet operation, and improved fuel efficiency enhance user convenience. Growing urbanization and dependence on electronic devices further strengthen adoption, especially in areas facing frequent weather disruptions and grid instability.

- For instance, Westinghouse’s iGen2550c runs up to 12 hours at 25% load. Fuel tank capacity is 1.11 gal. Noise is as low as 52 dBA with ≤3% THD.

Expanding Recreational and Outdoor Activities

Growth in outdoor leisure activities such as camping, tailgating, and RV travel is boosting generator use. Consumers seek compact and efficient power solutions for remote locations without permanent power access. The portability and reduced noise levels of inverter generators make them ideal for recreational use. Rising disposable income and lifestyle changes supporting outdoor experiences continue to drive steady market expansion across developed and emerging economies.

- For instance, Champion’s 2500-W inverter operates at 53 dBA. Runtime reaches up to 11.5 hours on gasoline. Parallel kit doubles available output.

Technological Advancements and Eco-Friendly Designs

Advancements in inverter technology are improving energy efficiency and reducing emissions. Modern models now integrate digital control systems, parallel connectivity, and smart monitoring features. Manufacturers are adopting cleaner fuels and hybrid technologies to meet stricter environmental regulations. These improvements are attracting eco-conscious consumers while enabling compliance with evolving emission norms, reinforcing steady growth in the residential segment.

Key Trends & Opportunities

Integration of Smart Connectivity Features

Smart inverter generators equipped with IoT-based monitoring and remote-control systems are gaining traction. Consumers benefit from real-time status updates, fuel level tracking, and predictive maintenance alerts. Such features improve user experience and operational efficiency. The growing trend toward smart home integration supports adoption, creating opportunities for manufacturers to develop connected power solutions tailored to residential needs.

- For instance, Ryobi’s 2300-W inverter integrates Bluetooth GenControl. The app displays fuel level and remaining runtime. Runtime reaches up to 10.3 hours at 25% load.

Shift Toward Low-Noise and Compact Designs

Urban homeowners increasingly prefer low-noise generators suitable for confined spaces. Manufacturers are focusing on acoustic insulation, advanced muffler systems, and vibration control to enhance user comfort. Compact and lightweight models also appeal to consumers seeking easy transport and storage. This trend supports the rising adoption of inverter generators in apartments and residential communities with noise restrictions.

- For instance, Briggs & Stratton’s P2400 model specifications differ by market. The model sold in Europe and Australia (model 030800/030802) has a noise rating of 58 dB(A) at 7 meters at a 25% load, a 3.8 L fuel tank capacity, an 8-hour runtime at a 25% load, and weighs 22.7 kg.

Key Challenges

High Initial Cost and Maintenance Requirements

Portable inverter generators often involve higher upfront costs than traditional models. Advanced technologies and emission-compliant designs add to the overall price. Additionally, routine maintenance such as oil changes and filter replacements can deter price-sensitive consumers. These factors limit adoption in low-income households, especially in developing regions where cost-efficiency remains a primary purchase factor.

Environmental and Regulatory Compliance

Strict emission norms and noise regulations challenge manufacturers to balance performance with compliance. The transition to low-emission and fuel-efficient designs requires costly R&D investments. Companies face pressure to meet varying regional standards while maintaining affordability. These evolving regulatory demands slow product approvals and raise production costs, posing challenges for small and mid-sized players in the market.

Regional Analysis

North America

North America dominated the residential portable inverter generator market with a 38.6% share in 2024. The region’s leadership is driven by frequent power disruptions, rising adoption of recreational vehicles, and strong demand for home backup systems. The United States leads due to widespread use of inverter generators for residential and outdoor purposes. Increasing consumer preference for fuel-efficient and low-noise equipment supports steady market expansion. Technological innovation, combined with government emphasis on clean energy, further promotes advanced generator deployment across both urban and rural households.

Europe

Europe accounted for a 25.4% market share in 2024, supported by stringent emission norms and growing demand for eco-friendly backup power. Consumers in the United Kingdom, Germany, and France favor inverter generators for energy-efficient home power management. Expanding infrastructure modernization and renewable integration have boosted household generator usage. The shift toward compact, quiet, and low-emission models aligns with the region’s sustainability goals. Growing adoption for recreational activities such as caravanning and outdoor camping also supports market expansion across Northern and Western European countries.

Asia Pacific

Asia Pacific held a 27.8% share in 2024, driven by increasing residential electricity consumption and unreliable grid infrastructure in rural areas. Countries like China, Japan, and India lead demand due to rapid urbanization and a rising middle-class population. Manufacturers in the region are introducing cost-effective, compact, and fuel-efficient inverter generators to address household backup needs. Expanding outdoor leisure and recreational trends also support product demand. Government initiatives promoting cleaner power sources are further encouraging the transition from conventional generators to advanced inverter models across key Asian economies.

Latin America

Latin America captured a 4.6% share in 2024, fueled by increasing reliance on portable power solutions for residential and recreational use. Brazil and Mexico are the primary markets, with consumers opting for gasoline-powered inverter generators for their affordability and reliability. Frequent power fluctuations and limited grid coverage in remote areas further accelerate adoption. Growing interest in compact, easy-to-maintain systems is driving sales among households. However, limited consumer awareness and higher import costs continue to constrain large-scale adoption in certain developing parts of the region.

Middle East & Africa

The Middle East & Africa region held a 3.6% market share in 2024. Growth is driven by rising power outages, expanding residential infrastructure, and increasing investment in off-grid energy solutions. Countries such as Saudi Arabia, South Africa, and the UAE are witnessing rising adoption due to residential development and outdoor recreation trends. The preference for gasoline and hybrid inverter generators is strengthening, particularly in areas with unreliable grid networks. However, high equipment costs and limited product accessibility remain barriers to widespread adoption across rural and remote areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Power Rating

- 1 kVA

- 1 kVA – 2 kVA

- > 2 kVA – 3 kVA

- > 3 kVA – 4 kVA

- > 4 kVA

By Power Source

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Residential Portable Inverter Generator Market is characterized by strong competition among key players such as Honda India Power Products Ltd., Generac Power Systems Inc., Cummins, Inc., Briggs & Stratton, Yamaha Motor Co., Ltd., Kohler Co., Kirloskar, Caterpillar, Atlas Copco, Wacker Neuson SE, Champion Power Equipment, DuroMax Power Equipment, Westinghouse Electric Corporation, A-iPower Corp., WEN Products, EcoFlow, and Deere & Company. Companies are focusing on developing advanced inverter technologies offering higher fuel efficiency, reduced emissions, and quieter operation to meet consumer and regulatory expectations. Strategic initiatives include product innovation, regional expansion, and partnerships with distributors to strengthen brand visibility and customer reach. Manufacturers are also investing in hybrid and smart inverter systems to align with growing demand for sustainable and connected solutions. Continuous focus on lightweight, compact, and easy-to-maintain designs supports market competitiveness, while aftermarket service enhancement and digital engagement remain crucial for maintaining customer loyalty and long-term growth.

Key Player Analysis

- Honda India Power Products Ltd.

- Generac Power Systems Inc.

- Cummins, Inc.

- Briggs & Stratton

- Yamaha Motor Co., Ltd.

- Kohler Co.

- Kirloskar

- Caterpillar

- Atlas Copco

- Wacker Neuson SE

- Champion Power Equipment

- DuroMax Power Equipment

- Westinghouse Electric Corporation

- A-iPower Corp.

- WEN Products

- EcoFlow

- Deere & Company

Recent Developments

- In 2024, EcoFlow launched the EcoFlow DELTA Pro 3, an ultra-powerful and user-friendly portable power station.

- In 2023, Generac Power Systems released the GP15500EFI and GP18000EFI portable generators, which feature Electronic Fuel Injection (EFI)

- In 2023, Champion Power Equipment continued to offer budget-friendly inverter models, often featuring dual-fuel technology.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Power Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with growing residential demand for reliable backup power.

- Technological upgrades will enhance fuel efficiency and reduce operational noise levels.

- Integration of smart monitoring and IoT-based control will become standard in new models.

- Hybrid and cleaner fuel options will gain popularity due to environmental regulations.

- Manufacturers will focus on lightweight, compact designs to attract urban consumers.

- Rising outdoor and recreational activities will further boost portable generator adoption.

- Partnerships between energy and electronics firms will accelerate innovation and connectivity.

- Demand from emerging economies will grow with increasing household electrification.

- Expansion of e-commerce channels will strengthen product accessibility and aftersales services.

- Continuous regulatory focus on emission standards will drive sustainable product development.