Market Overview

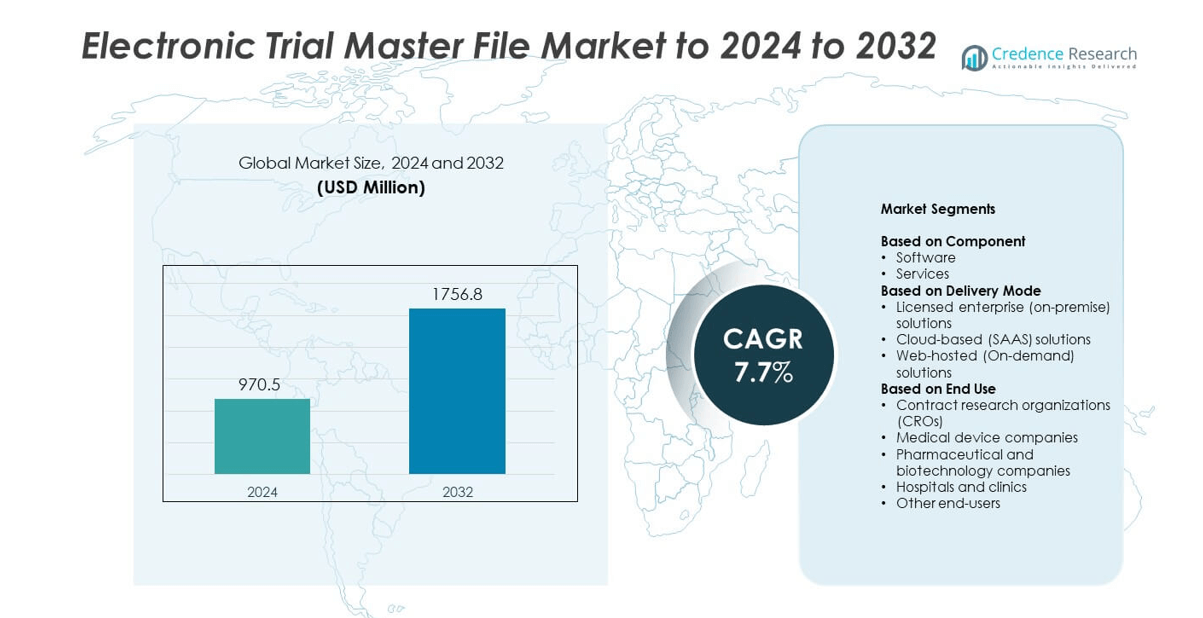

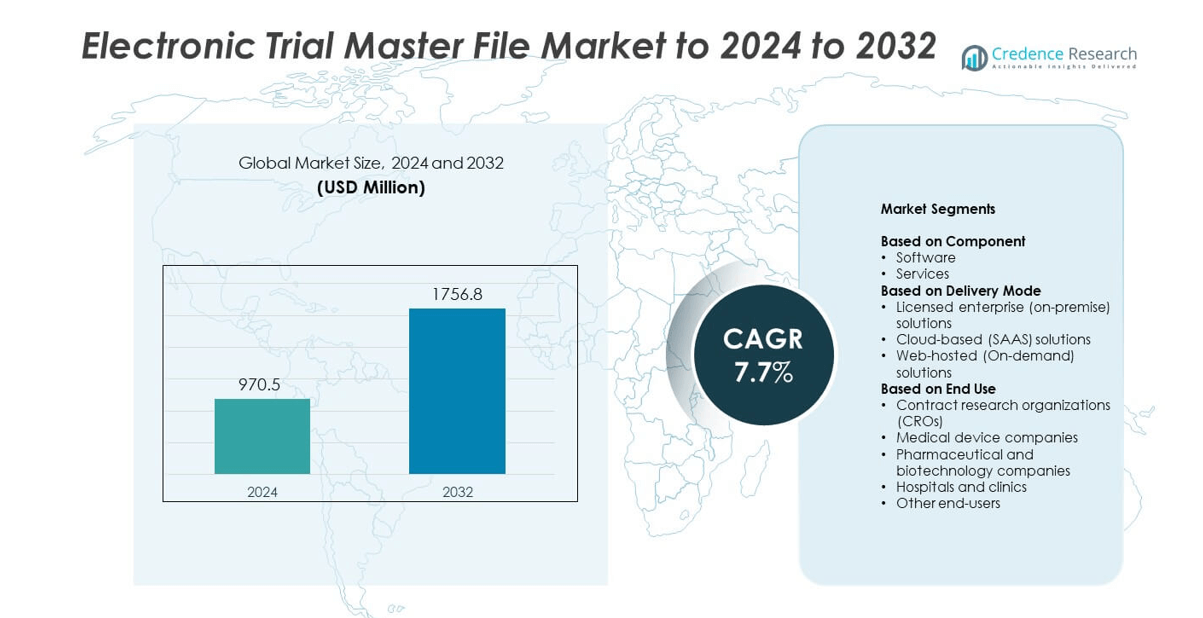

Electronic Trial Master File Market size was valued USD 970.5 million in 2024 and is anticipated to reach USD 1,756.8 million by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Trial Master File Market Size 2024 |

USD 970.5 million |

| Electronic Trial Master File Market , CAGR |

7.7% |

| Electronic Trial Master File Market Size 2032 |

USD 1,756.8 million |

The electronic trial master file market is led by key players such as Oracle, Veeva Systems, Egnyte, MasterControl Solutions, SureClinical, and Aris Global. These companies dominate through advanced eTMF software offerings that enhance regulatory compliance, streamline trial documentation, and support cloud-based collaboration. Strategic alliances with pharmaceutical firms and CROs strengthen their market presence globally. North America emerged as the leading region, accounting for 41.8% of the total share in 2024, driven by a high concentration of clinical research activities, strong regulatory infrastructure, and early adoption of digital trial management technologies.

Market Insights

- The electronic trial master file market was valued at USD 970.5 million in 2024 and is projected to reach USD 1,756.8 million by 2032, growing at a CAGR of 7.7%.

- Rising digitization of clinical research and growing regulatory compliance needs drive eTMF adoption across pharmaceutical, biotechnology, and medical device industries.

- The market is witnessing trends such as AI integration, automation, and the expansion of cloud-based platforms enabling decentralized and hybrid trial management.

- Competition remains strong among leading players offering advanced, compliant, and interoperable eTMF systems, with software dominating at 64.2% market share in 2024.

- North America led the market with 41.8% share in 2024, followed by Europe at 29.4% and Asia Pacific at 19.7%, supported by increasing R&D investments and digital transformation across clinical trial operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The software segment dominated the electronic trial master file market in 2024, accounting for 64.2% of the total share. Software platforms streamline clinical documentation, automate workflows, and enhance compliance with regulatory standards such as 21 CFR Part 11 and GCP. The growing shift toward digital trial management and centralized data control strengthens adoption among pharmaceutical and biotech firms. Integration of advanced analytics and AI-enabled document classification further boosts software demand. The services segment, including implementation and maintenance, continues to expand due to the increasing need for technical support and customized configuration.

- For instance, in 2024, Veeva Vault EDC—part of Veeva’s clinical technology—surpassed 1,000 study starts, with adoption from eight of the top 20 biopharma companies and two of the top six contract research organizations (CROs).

By Delivery Mode

The cloud-based (SAAS) solutions segment held the largest share of 58.6% in 2024, driven by scalability, lower upfront costs, and remote accessibility. The model supports real-time collaboration between sponsors, CROs, and clinical sites, ensuring data consistency across global studies. Rising adoption of decentralized trials and remote monitoring accelerates demand for cloud deployment. Vendors are enhancing platform security and compliance with international data protection laws such as GDPR and HIPAA. Licensed enterprise and web-hosted solutions remain relevant in organizations with strict data-control requirements or limited internet infrastructure.

- For instance, Dassault Systèmes’ Medidata supports the life sciences industry with its clinical technology platform, which serves over 2,300 customers, including biopharma, CROs, and MedTech companies, in more than 140 countries. The platform has supported over 36,000 clinical trials and served more than 11 million patient participants.

By End Use

Pharmaceutical and biotechnology companies accounted for the dominant share of 47.9% in 2024. These organizations lead clinical research activities and generate vast documentation, requiring efficient management solutions for regulatory submissions. Increasing adoption of digital platforms improves trial oversight, reduces audit time, and enhances data transparency. CROs are rapidly adopting eTMF systems to streamline multi-sponsor collaboration and ensure compliance during outsourced clinical trials. Medical device companies and hospitals also integrate eTMF platforms to manage study documentation, while other end-users adopt them to maintain compliance and accelerate approval timelines.

Key Growth Drivers

Rising Adoption of Digital Clinical Trial Platforms

The increasing digitization of clinical research drives the growth of the electronic trial master file market. Sponsors and CROs are shifting from paper-based systems to digital platforms for improved efficiency and compliance. eTMF systems enable centralized data storage, streamlined audit trails, and real-time document tracking, reducing regulatory delays. The growing use of remote and hybrid clinical trials further accelerates digital transformation, encouraging widespread adoption across pharmaceutical, biotechnology, and medical device companies seeking faster and more transparent trial operations.

- For instance, IQVIA is a global provider of advanced analytics, technology solutions, and clinical research services that operates in over 100 countries.

Regulatory Compliance and Data Integrity Requirements

Stringent regulations from agencies such as the FDA and EMA are boosting the adoption of eTMF systems. These platforms ensure adherence to Good Clinical Practice (GCP) and 21 CFR Part 11 by offering audit-ready documentation and traceability. The focus on maintaining complete, accurate, and secure records throughout trial lifecycles drives system upgrades. Organizations are increasingly investing in eTMF software to minimize compliance risks, enhance quality assurance, and support faster regulatory approvals through standardized digital documentation processes.

- For instance, ICON ran 1,700+ studies with 400+ active using integrated Medidata technology for streamlined operations.

Increased Outsourcing to Contract Research Organizations (CROs)

The growing trend of outsourcing clinical trials to CROs fuels eTMF adoption. CROs handle complex multi-sponsor studies, making efficient document management essential for meeting tight timelines and compliance standards. eTMF platforms allow CROs to share real-time updates with sponsors and regulators while maintaining data confidentiality. Rising partnerships between CROs and pharmaceutical firms drive demand for scalable, integrated solutions that enhance trial efficiency, reduce manual effort, and ensure synchronized global collaboration across study sites and stakeholders.

Key Trends & Opportunities

Integration of Artificial Intelligence and Automation

The integration of AI and automation in eTMF platforms is transforming trial document management. Machine learning tools classify, validate, and tag documents automatically, improving data accuracy and reducing manual workload. Predictive analytics enhance study progress monitoring and compliance tracking. Vendors are focusing on intelligent dashboards that identify missing or outdated records, ensuring continuous quality checks. This automation trend supports faster decision-making, lowers operational costs, and positions AI-enabled eTMF solutions as the next evolution in clinical trial management.

- For instance, Florence Healthcare connects 65,000 study sites and 600+ sponsors worldwide, supporting global digital trial operations.

Expansion of Cloud-Based and Decentralized Trials

The rising adoption of decentralized and hybrid clinical trial models is expanding opportunities for cloud-based eTMF solutions. Cloud deployment allows remote teams to collaborate in real time, access secure repositories, and maintain compliance across multiple geographies. The shift to patient-centric trial designs and virtual study models requires scalable, accessible platforms. This trend enhances interoperability with electronic data capture and clinical trial management systems, offering cost efficiency and operational agility to sponsors, CROs, and research institutions globally.

- For instance, WCG’s survey showed 94% of sites adopted at least one decentralized method and 88% hosted hybrid trials.

Key Challenges

Data Security and Compliance Risks

Data privacy remains a major concern in the eTMF market due to increasing cyber threats and regulatory scrutiny. Handling sensitive patient and trial information across multiple digital platforms raises risks of unauthorized access or data breaches. Organizations must implement strong encryption, access control, and compliance frameworks under HIPAA, GDPR, and local data laws. Maintaining real-time security monitoring and validating third-party cloud infrastructure adds cost and complexity, limiting adoption among smaller research organizations with restricted IT resources.

Integration Complexity with Existing Clinical Systems

Integrating eTMF platforms with existing clinical trial management systems, EDC, and ERP tools presents technical challenges. Legacy infrastructure and lack of standardized data formats often hinder seamless interoperability, delaying workflow automation. Companies face additional costs for customization, migration, and staff training during implementation. Inconsistent integration can lead to fragmented document repositories, manual redundancies, and data synchronization issues. Overcoming these integration barriers is essential for organizations aiming to achieve full digital transformation in trial documentation management.

Regional Analysis

North America

North America held the largest share of 41.8% in the electronic trial master file market in 2024. The region benefits from advanced clinical research infrastructure, strong regulatory frameworks, and early adoption of digital trial technologies. The United States dominates due to the high number of ongoing clinical trials and the presence of leading pharmaceutical and biotechnology firms. Increased demand for remote and hybrid trials following FDA guidance on digital compliance supports growth. Rising partnerships between CROs and tech providers further enhance adoption across the U.S. and Canada.

Europe

Europe accounted for a 29.4% share of the electronic trial master file market in 2024. The region’s growth is driven by strict data management regulations under EMA and GDPR compliance standards. Countries such as Germany, the U.K., and France lead adoption due to strong clinical trial activity and investments in cloud-based research systems. The rising focus on maintaining audit-ready digital documentation and improving transparency across multinational trials accelerates eTMF deployment. Increased collaborations between sponsors and CROs for decentralized clinical studies further support the regional market expansion.

Asia Pacific

Asia Pacific captured a 19.7% share of the electronic trial master file market in 2024. The region’s growth is fueled by expanding pharmaceutical research activity in China, India, Japan, and South Korea. Increasing investments in R&D infrastructure, favorable government support for clinical research, and cost-effective trial execution attract global sponsors. The rapid digitalization of trial operations and adoption of cloud-based platforms enhance efficiency and compliance. Growing participation of regional CROs in global studies strengthens the market outlook, with rising demand for automated and scalable eTMF solutions.

Latin America

Latin America held a 5.6% share of the electronic trial master file market in 2024. The region is witnessing steady growth due to increasing clinical trial activities in Brazil, Mexico, and Argentina. Favorable regulatory reforms and expanding pharmaceutical research pipelines encourage adoption of digital trial documentation systems. Cloud-based eTMF platforms are gaining traction among CROs and hospitals seeking cost-effective solutions. Challenges such as limited IT infrastructure persist, but improving internet accessibility and regional partnerships with global sponsors are expected to support continued digital transformation in trial management.

Middle East & Africa

The Middle East & Africa accounted for a 3.5% share of the electronic trial master file market in 2024. The region is gradually adopting eTMF solutions as healthcare institutions and research organizations digitize clinical processes. Countries like the UAE and South Africa lead adoption due to growing clinical research infrastructure and regulatory modernization. Rising collaboration between local CROs and global pharmaceutical firms is driving the use of compliant and secure documentation systems. Increasing investments in e-health and cloud-based technologies are expected to strengthen market penetration over the coming years.

Market Segmentations:

By Component

By Delivery Mode

- Licensed enterprise (on-premise) solutions

- Cloud-based (SAAS) solutions

- Web-hosted (On-demand) solutions

By End Use

- Contract research organizations (CROs)

- Medical device companies

- Pharmaceutical and biotechnology companies

- Hospitals and clinics

- Other end-users

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The electronic trial master file market is highly competitive, featuring key players such as Oracle, Veeva Systems, Egnyte, Inc., MasterControl Solutions, Inc., SureClinical Inc., Aris Global LLC, Cloudbyz, Clinevo Technologies, TransPerfect, Aurea, Inc., Octalsoft, Montrium Inc., and Anju Software, Inc. These companies focus on developing advanced eTMF platforms that enhance compliance, streamline workflows, and support decentralized clinical trials. The competition is driven by innovation in AI integration, automation, and real-time document tracking to ensure regulatory readiness. Vendors are expanding their product portfolios through cloud-based and SaaS models, catering to the rising demand for scalability and collaboration. Strategic partnerships with CROs and pharmaceutical firms are increasing to strengthen market presence. Additionally, ongoing investments in cybersecurity, interoperability, and data analytics are key differentiators among competitors. The market continues to evolve as providers emphasize user-friendly interfaces, integrated platforms, and global regulatory compliance to meet the growing complexity of clinical research management.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Oracle

- Veeva Systems

- Egnyte, Inc.

- MasterControl Solutions, Inc.

- SureClinical Inc.

- Aris Global LLC

- Cloudbyz

- Clinevo Technologies

- TransPerfect

- Aurea, Inc.

- Octalsoft

- Montrium Inc.

- Anju Software, Inc.

Recent Developments

- In 2025, Anju Software, Inc. launched clinexa, an AI-powered ecosystem designed to expedite clinical trial protocols by transforming them into trial-ready databases in days.

- In 2024, Oracle launched a multilingual eTMF platform, which was implemented in hundreds of trials across Europe and Asia within six months.

- In 2023, ArisGlobal unveiled LifeSphere NavaX, its next-generation cognitive computing engine. This engine leverages advanced technologies like Large Language Models and Generative AI, which are expected to enhance its entire LifeSphere suite, including its eTMF

Report Coverage

The research report offers an in-depth analysis based on Component, Delivery Mode, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with growing adoption of digital clinical trial solutions.

- Cloud-based eTMF platforms will gain dominance due to scalability and real-time collaboration benefits.

- Artificial intelligence will enhance document classification, quality control, and compliance tracking.

- Integration with electronic data capture and CTMS systems will streamline trial workflows.

- Rising decentralized and hybrid trials will increase demand for secure, remote-access eTMF systems.

- CRO partnerships will drive implementation across global multi-site studies.

- Data privacy and cybersecurity investments will strengthen as regulatory oversight intensifies.

- Vendors will focus on automation and analytics to reduce operational costs.

- Emerging markets in Asia Pacific will witness rapid adoption driven by expanding clinical research activity.

- Continuous innovation in interoperability and audit-readiness will define future market competitiveness.