Market Overview

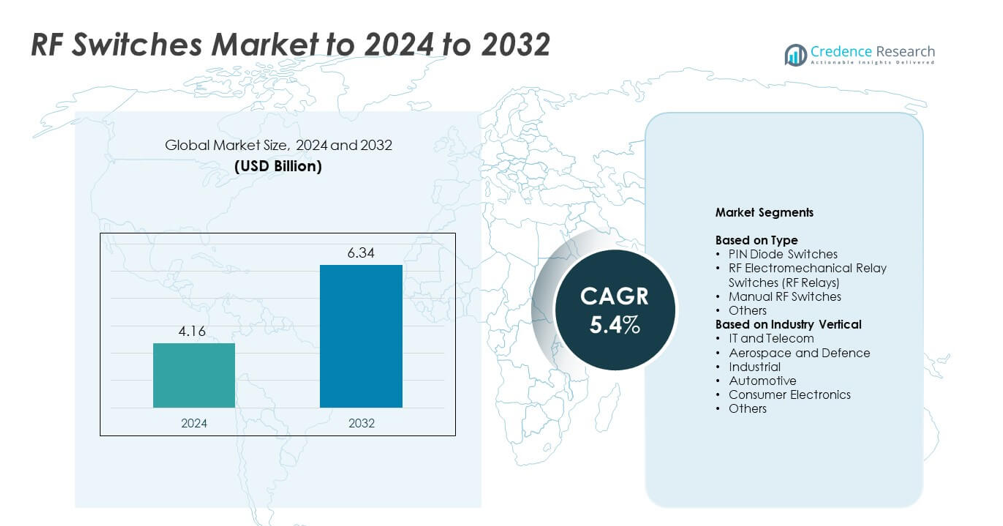

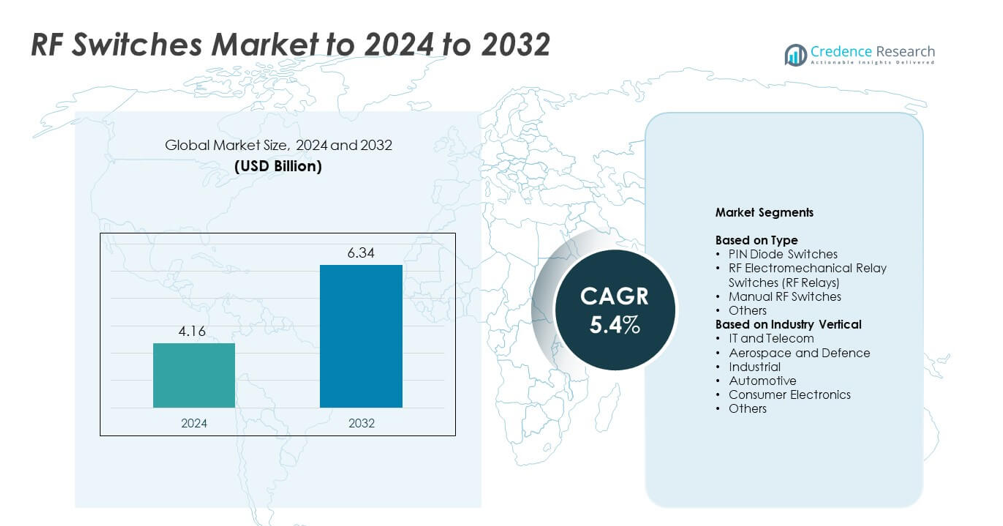

The RF Switches Market size was valued at USD 4.16 Billion in 2024 and is anticipated to reach USD 6.34 Billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RF Switches Market Size 2024 |

USD 4.16 Billion |

| RF Switches Market, CAGR |

5.4% |

| RF Switches Market Size 2032 |

USD 6.34 Billion |

The RF switches market is dominated by leading players such as Infineon Technologies AG, Analog Devices, Inc., Renesas Electronics Corporation, Qorvo, Inc., Skyworks Solutions, Inc., Honeywell International Inc., and Amphenol Corporation. These companies focus on developing high-frequency, low-loss, and energy-efficient switches to support applications in 5G infrastructure, defense systems, and automotive connectivity. Continuous investments in solid-state technology, miniaturization, and integrated RF modules enhance their market position globally. Regionally, North America led the market with a 35% share in 2024, driven by strong telecom and defense demand, followed by Asia-Pacific and Europe, both benefiting from robust semiconductor manufacturing and industrial automation growth.

Market Insights

- The RF switches market reached USD 4.16 billion in 2024 and is projected to attain USD 6.34 billion by 2032, expanding at a CAGR of 5.4%.

- Expanding 5G infrastructure, rising defense radar adoption, and increasing IoT and automotive connectivity continue to drive market growth.

- Advancements in MEMS and solid-state switch technologies are enhancing signal efficiency, reducing power loss, and enabling device miniaturization across industries.

- The market remains competitive as major companies focus on R&D investment, strategic collaborations, and high-frequency module innovation to expand global presence.

- North America led with a 35 percent share in 2024, followed by Asia-Pacific with 30 percent and Europe with 28 percent, while PIN diode switches dominated by type with a 41 percent share due to strong telecom and defense use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

PIN diode switches dominated the RF switches market with a 41% share in 2024. Their leadership stems from high-speed switching, compact design, and superior frequency performance in microwave and RF applications. These switches are extensively used in communication systems, radar modules, and signal routing devices due to low insertion loss and high isolation. RF electromechanical relays follow, supported by demand in test and measurement instruments requiring high linearity. Ongoing advancements in solid-state designs and miniaturized RF modules continue to drive growth for PIN diode switch adoption across commercial and defense applications.

- For instance, Skyworks’ SKY12211-478LF PIN-diode SPDT switch handles 40 W CW, covers 0.05–2.70 GHz, shows ~0.3 dB typical insertion loss, and 47 dB isolation at 1.2 GHz.

By Industry Vertical

The IT and telecom segment held the largest share of 37% in 2024, driven by rising deployment of 5G infrastructure and satellite communication systems. Increasing use of RF switches in base stations, signal routers, and antenna tuning units enhances connectivity and bandwidth efficiency. The aerospace and defense sector follows closely, benefiting from radar modernization and electronic warfare systems. Industrial and automotive sectors are gaining traction with IoT-enabled devices and vehicle-to-everything (V2X) communication. Expanding consumer electronics manufacturing further accelerates demand for compact, high-performance RF switching components.

- For instance, pSemi’s PE42524 SPDT switch spans 10 MHz–40 GHz, with 2.2 dB insertion loss and 47 dB isolation at 30 GHz.

Key Growth Drivers

Rising 5G Infrastructure Deployment

The rapid rollout of 5G networks worldwide is a major growth driver for the RF switches market. These switches are essential for managing high-frequency signal transmission and antenna routing in base stations and small cells. As telecom operators expand millimeter-wave coverage, demand for high-isolation and low-loss RF switches continues to rise. Increasing data traffic and the shift toward massive MIMO technology further boost adoption across network components, supporting enhanced connectivity and faster signal switching efficiency.

- For instance, Analog Devices’ HMC547 non-reflective SPDT achieves >40 dB isolation (to 28 GHz), ≤2 dB insertion loss midband, and 6 ns switching.

Growing Adoption in Aerospace and Defense Systems

The aerospace and defense sector is witnessing increased integration of RF switches in radar, communication, and electronic warfare systems. Their ability to handle high-frequency operations with minimal signal distortion makes them critical for mission-sensitive applications. Governments and defense agencies are investing in next-generation radar and satellite systems, which rely on RF switches for precise signal control. This surge in modernization programs across the U.S., Europe, and Asia-Pacific drives consistent demand for durable, high-performance RF components.

- For instance, Radiall’s RAMSES SP8T switch operates DC–40 GHz with eight positions and equal-length paths for consistent insertion loss.

Expansion of IoT and Automotive Connectivity

The proliferation of IoT devices and vehicle connectivity technologies is significantly fueling RF switch demand. Modern vehicles use RF switches in advanced driver assistance systems, infotainment modules, and telematics units. Similarly, IoT applications in smart cities, industrial automation, and remote monitoring depend on seamless wireless communication. The transition toward 5G-enabled IoT ecosystems enhances the role of RF switches in ensuring reliable signal routing and low-latency communication across diverse electronic platforms.

Key Trends & Opportunities

Advancement in Miniaturized and Solid-State Designs

Ongoing innovations in miniaturized and solid-state RF switch designs are creating new opportunities for manufacturers. Smaller and more energy-efficient components are now enabling integration into compact consumer electronics and wearable devices. Solid-state switches, replacing traditional mechanical relays, deliver superior reliability and switching speeds. This trend supports applications in medical diagnostics, aerospace instrumentation, and high-frequency 5G modules, driving design flexibility and reducing system costs for device makers.

- For instance, Menlo Micro’s MM3100 six-channel MEMS switch supports DC to over 3 GHz operation. It handles a maximum of 25 W CW power up to 300 MHz and 200 W of pulsed power at a 10% duty cycle.

Emergence of Reconfigurable RF Front-End Modules

The development of reconfigurable RF front-end modules is reshaping signal management in next-generation communication systems. These modules integrate RF switches with tunable filters and amplifiers, allowing dynamic control of frequency bands. The approach enhances device performance across multiple standards, such as 5G, Wi-Fi 7, and satellite links. Manufacturers focusing on such modular architectures can capitalize on increasing demand for adaptive, multi-band wireless systems in both commercial and defense networks.

- For instance, Qorvo’s QPB9850 switch-LNA module delivers ~33–34 dB gain at 3.6 GHz with 1.2 dB noise figure in a 3 × 3 mm LGA, supporting TDD base stations.

Key Challenges

Thermal Management and Power Efficiency Limitations

High-frequency operations in 5G and radar systems place substantial thermal and power stress on RF switches. Excessive heat can lead to signal distortion, component degradation, and reduced lifespan. Ensuring efficient heat dissipation while maintaining compactness remains a critical engineering challenge. Manufacturers are investing in advanced packaging and low-loss materials to balance power handling with performance, but managing thermal stability in dense electronic assemblies continues to be a key operational hurdle.

Complex Integration with Multi-Band Devices

The increasing number of wireless frequency bands in modern communication devices complicates RF switch integration. Designing switches that handle multiple frequency ranges without compromising isolation or insertion loss demands precise engineering and material optimization. As devices become more compact, integrating these switches alongside antennas and filters poses signal interference risks. Overcoming these design complexities is vital for ensuring consistent performance and maintaining compatibility across evolving communication standards.

Regional Analysis

North America

North America held the largest share of 35% in the RF switches market in 2024. The region’s dominance is supported by strong investments in 5G infrastructure, defense modernization, and satellite communication networks. The U.S. leads with extensive deployment of high-frequency components in base stations and radar systems. Increasing adoption of advanced telecommunication equipment and IoT connectivity further boosts demand. Key manufacturers focus on developing low-loss, high-isolation switches for aerospace and telecom applications, while strong R&D capabilities and government-backed innovation programs continue to sustain regional leadership in RF technology advancement.

Europe

Europe accounted for a 28% share of the RF switches market in 2024, driven by robust industrial automation and defense initiatives. Countries such as Germany, France, and the U.K. are investing heavily in 5G deployment and smart manufacturing technologies. The growing use of RF switches in radar systems, automotive electronics, and satellite communication enhances regional demand. European manufacturers emphasize energy-efficient designs and compliance with stringent reliability standards. Increasing focus on high-frequency component innovation and cross-border digital infrastructure projects further strengthens Europe’s role in global RF switch production and application development.

Asia-Pacific

Asia-Pacific captured a 30% share of the RF switches market in 2024, emerging as the fastest-growing region. Rapid expansion of telecom infrastructure in China, Japan, South Korea, and India supports high demand for RF components. The rise of 5G networks, consumer electronics production, and smart manufacturing accelerates market penetration. Local suppliers are expanding fabrication capacities to meet export and domestic requirements. Favorable government initiatives promoting digitalization and semiconductor self-reliance also boost growth. Increasing integration of RF switches in mobile devices and automotive systems solidifies Asia-Pacific’s position as a global production hub.

Middle East & Africa

The Middle East & Africa region held a 4% share of the RF switches market in 2024. Growth is driven by expanding telecom infrastructure, defense investments, and satellite communication programs. Countries like the UAE and Saudi Arabia are leading 5G deployment and smart city projects, increasing the use of RF switches in communication and monitoring systems. The defense sector’s modernization efforts further strengthen demand. Although adoption is still developing, ongoing regional digital transformation and government-led initiatives in advanced connectivity and industrial automation are expected to support steady market expansion.

Latin America

Latin America accounted for a 3% share of the RF switches market in 2024. The region is gradually adopting advanced telecommunication networks, with Brazil and Mexico leading 5G rollout initiatives. Expanding use of RF switches in consumer electronics, automotive telematics, and industrial monitoring applications is boosting demand. However, limited semiconductor manufacturing capabilities and higher import dependence restrain faster adoption. Continuous investment in digital connectivity and cross-border telecom projects is expected to improve market growth. Regional players are focusing on partnerships with global suppliers to strengthen technology access and local assembly capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- PIN Diode Switches

- RF Electromechanical Relay Switches (RF Relays)

- Manual RF Switches

- Others

By Industry Vertical

- IT and Telecom

- Aerospace and Defence

- Industrial

- Automotive

- Consumer Electronics

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The RF switches market features a competitive landscape led by Infineon Technologies AG, Analog Devices, Inc., Renesas Electronics Corporation, Qorvo, Inc., Skyworks Solutions, Inc., Honeywell International Inc., and Amphenol Corporation. The market is characterized by continuous innovation, strong R&D capabilities, and diversified product portfolios targeting telecom, aerospace, automotive, and industrial sectors. Leading manufacturers are focusing on developing high-frequency, low-loss, and miniaturized switches to support 5G infrastructure, IoT networks, and radar systems. Companies are also enhancing their supply chain efficiency through strategic partnerships with semiconductor foundries and component distributors. Advancements in solid-state switching and MEMS-based designs are enabling faster switching times and improved reliability. Additionally, players are investing in integrated RF modules combining amplifiers and tunable filters to address multi-band communication needs. Sustainable manufacturing practices and energy-efficient designs remain central to maintaining competitiveness in global markets, while regional production expansion continues to strengthen long-term growth and customer reach.

Key Player Analysis

Recent Developments

- In 2024, Skyworks Solutions Introduced new High Power SPDT RF Switches, emphasizing low insertion loss, high isolation, and high power handling for base station and wireless network applications.

- In 2024, Qorvo Released new high-power SPST reflective switches using its QGaN15 production process, targeting high-performance applications.

- In 2023, Analog Devices (ADI) Launched an integrated Open Radio Unit (O-RU) reference design, offering a comprehensive solution from fiber to RF for radio designers.

Report Coverage

The research report offers an in-depth analysis based on Type, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The RF switches market will witness steady growth driven by expanding 5G network deployments.

- Increased integration in satellite communication and radar systems will enhance long-term demand.

- Advancements in solid-state and MEMS-based switch technologies will improve performance and reliability.

- Growing adoption in electric and connected vehicles will boost usage in automotive electronics.

- Rising demand for miniaturized, low-power RF components will influence future design trends.

- Integration with IoT and smart devices will expand the application base across industries.

- Ongoing defense modernization programs will strengthen procurement of high-frequency RF components.

- Asia-Pacific will remain the key manufacturing hub supported by semiconductor advancements.

- The emergence of AI-enabled signal routing will enhance RF switch efficiency in communication systems.

- Increasing collaboration among telecom and semiconductor firms will drive product innovation and global competitiveness.