Market Overview

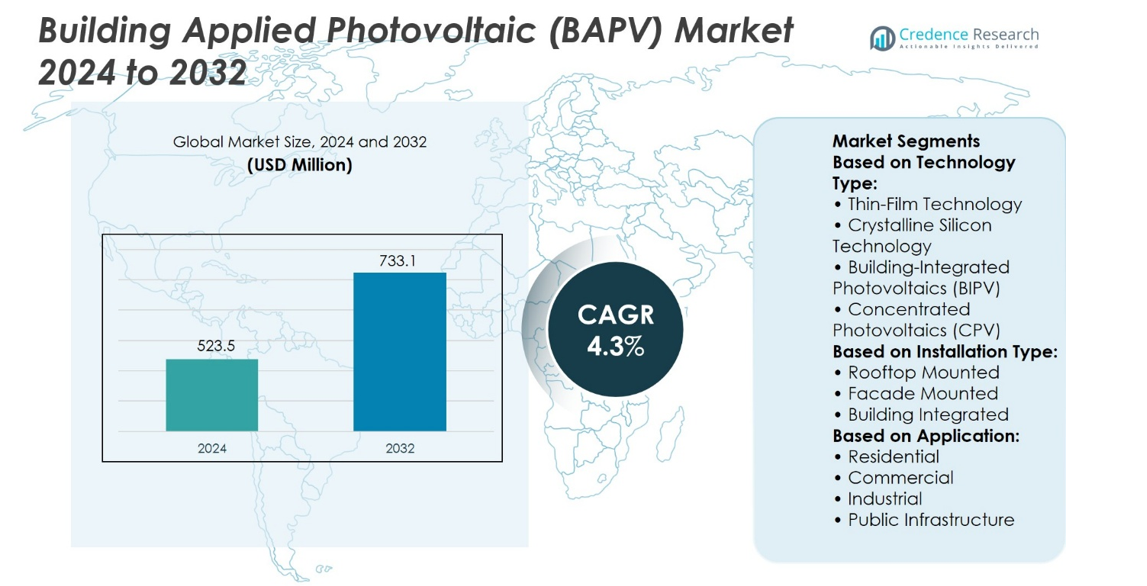

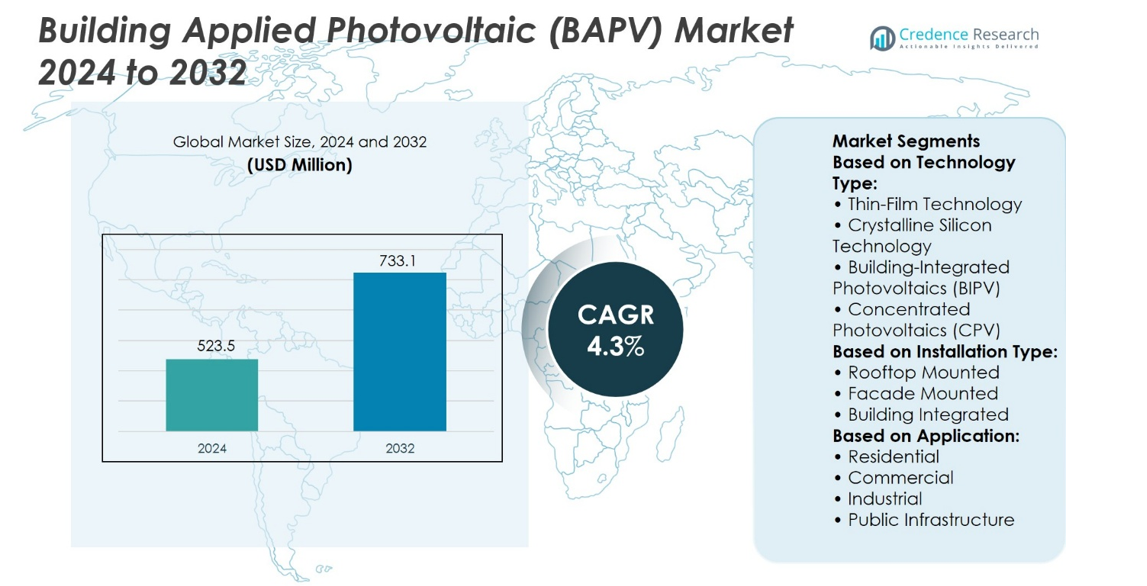

Building Applied Photovoltaic (BAPV) Market size was valued at USD 523.5 million in 2024 and is anticipated to reach USD 733.1 million by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Building Applied Photovoltaic (BAPV) Market Size 2024 |

USD 523.5 million |

| Building Applied Photovoltaic (BAPV) Market, CAGR |

4.3% |

| Building Applied Photovoltaic (BAPV) Market Size 2032 |

USD 733.1 million |

The Building Applied Photovoltaic (BAPV) Market grows through strong drivers such as rising demand for sustainable construction, stricter energy regulations, and advances in module efficiency that improve performance and cost-effectiveness. It benefits from government incentives, green building certifications, and increasing urban infrastructure projects that prioritize renewable integration. The market also reflects key trends including the adoption of lightweight thin-film and perovskite modules, integration with smart energy management systems, and growing demand for semi-transparent and aesthetically adaptable designs. Together, these factors position BAPV as a critical solution in achieving energy-efficient, visually appealing, and environmentally responsible building practices.

The Building Applied Photovoltaic (BAPV) Market shows strong geographical presence, with Europe leading adoption through strict sustainability mandates, Asia-Pacific expanding with rapid urbanization and government-backed solar initiatives, and North America advancing via technological innovation and green building codes. Latin America and the Middle East & Africa record gradual growth supported by solar potential and infrastructure investments. Key players such as Heliatek GmbH, Onyx Solar Energy S.L., Ascent Solar Technologies Inc., Centrosolar Group AG, and ENERGY GLASS drive innovation and competitive differentiation in the market.

Market Insights

- The Building Applied Photovoltaic (BAPV) Market was valued at USD 523.5 million in 2024 and is projected to reach USD 733.1 million by 2032, at a CAGR of 4.3%.

- Rising demand for sustainable construction and stricter energy regulations drive consistent adoption across residential, commercial, and public infrastructure projects.

- Advances in module efficiency, including thin-film and perovskite technologies, enhance performance and cost-effectiveness.

- Competitive intensity remains high with key players focusing on innovation, partnerships, and integration with smart building systems.

- High upfront costs, regulatory complexities, and integration challenges act as restraints limiting faster market penetration.

- Europe leads the market with strong sustainability mandates, while Asia-Pacific expands rapidly with urbanization and government-backed solar programs; North America grows through innovation and codes, with Latin America and Middle East & Africa recording gradual adoption.

- Industry trends emphasize lightweight, flexible, and semi-transparent modules that merge architectural design with renewable energy generation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Sustainable Building Solutions Driving Market Growth

The Building Applied Photovoltaic (BAPV) Market grows on the back of rising demand for sustainable and energy-efficient construction solutions. Governments implement stricter building energy codes, and developers align with sustainability certifications such as LEED and BREEAM. It benefits from strong integration potential in commercial and residential projects where energy self-sufficiency is prioritized. Urban expansion increases rooftop and façade deployment opportunities, providing a scalable path for clean electricity generation. Technological advancements in thin-film and lightweight modules enhance design flexibility. Together, these factors create a supportive environment for the wider adoption of BAPV systems.

- For instance, Onyx Solar Energy S.L. has installed over 2.7 million square feet of photovoltaic glass worldwide.

Cost Reductions and Efficiency Improvements in Photovoltaic Technology

The Building Applied Photovoltaic (BAPV) Market advances with consistent declines in solar module costs and higher conversion efficiencies. Research investments from manufacturers accelerate innovations in lightweight crystalline silicon and perovskite-based modules. It allows integration into glass, steel, and flexible substrates without compromising building aesthetics or safety. Economies of scale in solar manufacturing reinforce affordability, making BAPV systems viable for large-scale construction projects. Efficiency improvements extend energy yields across diverse climatic conditions, further enhancing value propositions. These developments significantly strengthen market competitiveness against conventional energy solutions.

- For instance, AGC Inc. partnered with Heliatek GmbH to produce more than 2.0 million m² of solar-integrated glass façades, enabling large commercial and infrastructure projects across Europe and Asia.

Strong Policy Support and Incentive Mechanisms Boosting Adoption

The Building Applied Photovoltaic (BAPV) Market gains momentum through policy-driven incentives, tax rebates, and net-metering frameworks across major economies. Governments emphasize solar integration in urban infrastructure to meet renewable energy targets and reduce reliance on fossil fuels. It benefits from regional programs promoting distributed generation, particularly in Asia-Pacific and Europe. Green financing initiatives provide easier access to capital, enabling wider adoption in both residential and commercial sectors. Public-private partnerships support large demonstration projects that showcase economic and technical feasibility. These regulatory and financial drivers remain central to accelerating market deployment.

Expanding Role of Digitalization and Smart Energy Management Platforms

The Building Applied Photovoltaic (BAPV) Market strengthens further with integration of digital tools that optimize energy output and reliability. Smart monitoring platforms enable real-time performance tracking and predictive maintenance. It aligns with smart city initiatives where connected infrastructure plays a vital role in energy planning. Building energy management systems combine BAPV output with storage and grid interaction for higher efficiency. Digital platforms enhance transparency and accountability, increasing investor and developer confidence. This convergence of renewable energy and digital innovation reinforces the long-term role of BAPV systems in sustainable construction.

Market Trends

Growing Integration of Photovoltaics into Building Materials and Structures

The Building Applied Photovoltaic (BAPV) Market reflects a trend toward embedding solar modules directly into construction materials such as façades, skylights, and roofing systems. Architects and developers adopt integrated modules that complement modern building aesthetics while delivering reliable power generation. It supports design flexibility, enabling customized solutions for commercial towers, industrial sites, and residential complexes. Lightweight thin-film technologies expand possibilities for curved and non-traditional surfaces. Manufacturers invest in product lines that merge energy functionality with architectural value. This integration trend redefines BAPV systems from energy devices into core building components.

- For instance, Onyx Solar Energy S.L. has delivered over 2.5 million m² of photovoltaic glass for integration into façades and skylights worldwide, enabling large-scale adoption of energy-generating building materials.

Rising Adoption of Lightweight and Flexible Module Technologies

The Building Applied Photovoltaic (BAPV) Market benefits from the increasing use of lightweight and flexible modules designed for retrofits and new constructions. It allows deployment on structures where traditional glass-based panels are impractical due to weight restrictions. Emerging thin-film and perovskite technologies demonstrate enhanced adaptability while maintaining efficiency. Flexible formats also reduce installation costs by lowering structural reinforcement requirements. Architects and engineers incorporate these solutions into both heritage buildings and advanced smart infrastructure. The growing preference for versatile modules reinforces BAPV’s position in urban development projects.

- For instance, Heliatek GmbH has deployed more than 1.2 million m² of its HeliaSol® flexible solar films across building rooftops and façades, supporting large-scale retrofit and lightweight construction projects in Europe and Asia.

Increasing Alignment with Smart Building and Energy Management Systems

The Building Applied Photovoltaic (BAPV) Market aligns closely with the expansion of smart building technologies that emphasize real-time energy management. It integrates with digital monitoring platforms and predictive maintenance tools to maximize efficiency and reliability. Developers link BAPV installations to advanced energy storage systems and grid interaction platforms. Smart energy ecosystems enable optimized demand-supply balancing in both commercial and residential spaces. Data-driven insights improve return on investment and support regulatory compliance. This trend strengthens the synergy between renewable energy generation and intelligent infrastructure.

Expanding Role of Aesthetic Design and Consumer-Centric Solutions

The Building Applied Photovoltaic (BAPV) Market experiences strong demand for products that prioritize aesthetics without compromising energy output. It evolves through innovations in colored modules, semi-transparent glass, and customizable designs. Building owners seek visually appealing systems that blend with modern architecture while meeting sustainability objectives. Manufacturers respond with modular formats that enhance creativity in design and support large-scale adoption. Consumer preference shifts toward solutions that merge functionality, efficiency, and visual harmony. This trend reinforces BAPV’s role as both an energy solution and a design-driven building technology.

Market Challenges Analysis

High Upfront Costs and Complex Integration with Building Structures

The Building Applied Photovoltaic (BAPV) Market faces a major challenge from high initial investment requirements and complex integration with existing building designs. It demands customized solutions that often involve specialized materials, advanced engineering, and skilled labor, which increase installation costs. Many developers hesitate to allocate capital for BAPV projects when conventional alternatives appear more cost-efficient. Retrofitting older buildings poses further difficulties because structural adjustments may be necessary to support photovoltaic modules. Regulatory compliance and adherence to strict building codes also extend project timelines and raise expenses. These financial and technical hurdles continue to limit faster adoption across diverse regions.

Variability in Performance, Durability, and Regulatory Frameworks

The Building Applied Photovoltaic (BAPV) Market also struggles with variability in performance and durability of photovoltaic modules under different climatic conditions. It remains sensitive to shading, dust accumulation, and thermal stress, which can reduce efficiency and reliability. Long-term durability of integrated systems often depends on consistent material quality and proper installation practices. Fragmented regulatory frameworks across countries create uncertainty for developers, slowing investment decisions. Lack of standardized testing procedures and certification protocols further complicates market expansion. These challenges highlight the need for stronger policy harmonization and technical innovation to build confidence among stakeholders.

Market Opportunities

Expansion in Green Building Initiatives and Urban Infrastructure Projects

The Building Applied Photovoltaic (BAPV) Market creates significant opportunities through rapid growth in green building initiatives and large-scale urban infrastructure development. Governments encourage adoption of renewable energy solutions in housing, commercial complexes, and industrial facilities through incentives and mandates. It aligns with smart city projects where distributed solar generation strengthens energy security and sustainability. Builders and architects integrate photovoltaic modules into façades, skylights, and rooftops to meet environmental certifications and consumer expectations. Rising urbanization in Asia-Pacific, the Middle East, and Latin America expands demand for scalable solutions. These factors position BAPV systems as a strategic choice for sustainable urban infrastructure.

Technological Innovations and Advancements in Energy Storage Integration

The Building Applied Photovoltaic (BAPV) Market also gains strong opportunities from technological advancements in module design, efficiency improvements, and integration with advanced energy storage. It benefits from breakthroughs in thin-film and perovskite technologies that enable lightweight, flexible, and aesthetically adaptable products. Energy storage innovations enhance system reliability by ensuring stable supply during variable solar conditions. Integration with smart energy management platforms provides real-time monitoring and improved performance optimization. Growing corporate and institutional investments in clean energy accelerate adoption of such advanced solutions. This convergence of technology and energy management creates long-term opportunities for market expansion.

Market Segmentation Analysis:

By Technology Type

The Building Applied Photovoltaic (BAPV) Market segments strongly by technology, with thin-film technology gaining traction due to its lightweight and flexible characteristics that suit modern architectural applications. Crystalline silicon technology retains dominance because of high efficiency rates and long-standing reliability. It continues to find extensive use in large commercial and industrial projects where space is not a constraint. Building-integrated photovoltaics (BIPV) represent a growing segment, merging energy generation directly into construction materials such as façades, skylights, and roofing systems. Concentrated photovoltaics (CPV) hold niche appeal, primarily in projects that seek higher efficiency under strong solar conditions. Each technology segment supports distinct performance and design needs across varying building profiles.

- For instance, First Solar, Inc. has shipped over 25 million thin-film photovoltaic modules globally, corresponding to more than 17 million m² of surface area, a significant share of which has been integrated into building-applied solar projects.

By Installation Type

The market shows clear division by installation type, with rooftop mounted systems forming the largest share due to widespread adoption across residential and commercial projects. It provides cost efficiency and straightforward integration into both new constructions and retrofits. Facade mounted systems rise steadily, driven by demand for modern building designs that combine aesthetics with energy production. Building-integrated systems deliver strong potential as developers seek seamless solutions that blend with construction materials. Such systems help reduce reliance on external solar arrays while enhancing architectural appeal. The installation choice often reflects both building design requirements and long-term energy goals.

- For instance, SunPower Corporation has installed more than 5.8 million rooftop solar modules across residential and commercial buildings in the United States, representing over 4.2 million m² of active BAPV surface area.

By Application

The Building Applied Photovoltaic (BAPV) Market demonstrates diverse applications across residential, commercial, industrial, and public infrastructure sectors. Residential demand grows steadily due to increasing awareness of energy self-sufficiency and the availability of rooftop space. Commercial adoption accelerates as businesses aim to reduce operating costs and improve sustainability credentials. It finds strong relevance in industrial facilities where high energy demand aligns with large structural surfaces for deployment. Public infrastructure projects also integrate BAPV solutions to support urban sustainability initiatives and meet government-mandated energy targets. Each sector creates unique opportunities, reinforcing BAPV as a critical component in modern construction and energy strategies.

Segments:

Based on Technology Type:

- Thin-Film Technology

- Crystalline Silicon Technology

- Building-Integrated Photovoltaics (BIPV)

- Concentrated Photovoltaics (CPV)

Based on Installation Type:

- Rooftop Mounted

- Facade Mounted

- Building Integrated

Based on Application:

- Residential

- Commercial

- Industrial

- Public Infrastructure

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of around 27% in the Building Applied Photovoltaic (BAPV) Market, supported by strong policy frameworks and widespread adoption of renewable energy across the United States and Canada. Federal and state-level incentives, such as investment tax credits, encourage builders and homeowners to integrate solar solutions into construction projects. It benefits from advanced technological development, strong manufacturing capacity, and high consumer awareness of sustainability. Commercial buildings, universities, and public infrastructure projects lead adoption, particularly in urban centers with stringent green building regulations. The market continues to expand with smart city initiatives that promote distributed energy systems and integration of solar technologies into modern architectural designs. Ongoing R&D investments strengthen module performance and support growth in retrofit projects across the region.

Europe

Europe commands the largest share at around 32%, making it a leader in the Building Applied Photovoltaic (BAPV) Market. The region demonstrates strong regulatory backing through policies such as the European Green Deal and national renewable energy targets. It benefits from high energy costs, which make BAPV systems more attractive for reducing long-term operational expenses. Architectural integration of solar technologies into façades, windows, and rooftops aligns with Europe’s strong emphasis on sustainable construction practices. Countries such as Germany, France, Italy, and the Netherlands lead adoption, with growing investments in commercial and public infrastructure projects. Supportive financing models and established building standards ensure consistent growth. Europe remains the benchmark region for innovation, efficiency, and large-scale deployment of integrated photovoltaic solutions.

Asia-Pacific

Asia-Pacific accounts for about 28% of the global market share, reflecting rapid urbanization, rising construction activities, and government-led clean energy initiatives. China, Japan, South Korea, and India form the primary hubs of demand, supported by large-scale infrastructure projects and strong renewable energy mandates. It benefits from cost-effective module manufacturing, which lowers installation costs and accelerates adoption in both residential and commercial sectors. Rooftop-mounted systems dominate in dense urban areas, while façade-mounted applications increase steadily in commercial towers. Japan and South Korea emphasize BAPV integration into smart city frameworks, while India expands deployment in government and public sector projects. Strong economic growth, urban development, and favorable policy incentives ensure Asia-Pacific remains a critical driver of global BAPV demand.

Latin America

Latin America secures a market share of approximately 7%, supported by growing interest in sustainable construction and solar integration across Brazil, Mexico, and Chile. It gains traction through favorable solar conditions that improve energy yields and strengthen project economics. Government programs that encourage renewable adoption and reduce dependency on fossil fuels create momentum for wider deployment. Commercial and industrial facilities show the highest adoption rates, while residential demand grows slowly due to financial barriers. It faces challenges in regulatory inconsistencies and limited availability of skilled labor, yet opportunities expand with new investments in urban infrastructure projects. Latin America remains a region with emerging but promising growth potential for BAPV systems.

Middle East & Africa

The Middle East & Africa region contributes around 6% to the global market share, driven by rising energy diversification strategies and ambitious renewable energy targets. Gulf countries invest heavily in solar infrastructure as part of long-term sustainability goals, integrating BAPV solutions into modern commercial complexes and public infrastructure. It benefits from high solar irradiation levels that maximize performance efficiency of integrated photovoltaic modules. South Africa and Morocco lead adoption in Africa, supported by government-backed solar programs and urban development initiatives. Market growth remains gradual due to limited financing structures and high upfront costs for building integration. However, the combination of favorable climate conditions and strategic renewable policies positions the region as an emerging growth hub for future BAPV deployment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Heliatek GmbH

- Skyco Skylights

- Power Film, Inc.

- Ascent Solar Technologies, Inc.

- Onyx Solar Energy S.L.

- Centrosolar Group Ag

- Greatcell Solar Limited

- ENERGY GLASS

- GIE SAS

- Dyesol

Competitive Analysis

The Building Applied Photovoltaic (BAPV) Market features such as Heliatek GmbH, Skyco Skylights, Power Film Inc., Ascent Solar Technologies Inc., Onyx Solar Energy S.L., Centrosolar Group AG, Greatcell Solar Limited, ENERGY GLASS, GIE SAS, and Dyesol. The Building Applied Photovoltaic (BAPV) Market remains highly competitive, driven by rapid advancements in solar module efficiency, material innovation, and architectural integration. Companies focus on delivering solutions that merge aesthetics with energy generation, enabling wider acceptance in residential, commercial, and public infrastructure projects. It demonstrates growing emphasis on lightweight thin-film technologies, semi-transparent glass modules, and flexible designs that fit seamlessly into modern construction. Strategic collaborations with architects, real estate developers, and governments enhance market penetration and support regulatory compliance. Continuous R&D investments accelerate breakthroughs in durability, efficiency, and cost-effectiveness, helping firms strengthen their market position. The competitive environment highlights a shift toward integrated energy solutions that prioritize sustainability, design flexibility, and long-term performance.

Recent Developments

- In May 2025, the Estonian company Roofit.Solar transitioned to TOPcon and announced intentions to introduce a new selection of colored metal roof panels featuring integrated monocrystalline solar cells.

- In March 2024, Fraunhofer ISE and partners announced development of standardized BIPV facade solution with motive to simplify use of facades for photovoltaics.

- In January 2024, Arctech announced expansion in Turkey with strategic partnership with Alpon Energy for BIPV solutions.

- In October 2023, Solar Frontier and LONGi announced strategic technical partnership to expand BIPV market in Japan.

Market Concentration & Characteristics

The Building Applied Photovoltaic (BAPV) Market demonstrates moderate concentration with a mix of established solar technology providers and specialized companies focused on integrated architectural solutions. It reflects characteristics of innovation-driven competition, where firms differentiate through advancements in thin-film, semi-transparent glass, and lightweight module technologies. The market benefits from steady government incentives, regulatory support, and growing sustainability mandates, which encourage adoption across residential, commercial, industrial, and public infrastructure sectors. It remains highly sensitive to cost structures, with efficiency gains and design flexibility serving as primary factors influencing customer preference. Regional variations in building codes, energy policies, and urbanization trends shape demand patterns, while partnerships between manufacturers, construction companies, and technology developers enhance market reach. The competitive landscape continues to evolve through digital integration, smart building compatibility, and increasing consumer interest in aesthetically aligned renewable energy solutions.

Report Coverage

The research report offers an in-depth analysis based on Technology Type, Installation Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Building Applied Photovoltaic (BAPV) Market will expand with stronger integration into smart building frameworks.

- Governments will continue to drive adoption through stricter energy codes and renewable mandates.

- It will benefit from ongoing efficiency improvements in thin-film and perovskite technologies.

- Architects will adopt more semi-transparent and colored modules for design-focused projects.

- Commercial and public infrastructure projects will dominate demand due to large-scale deployment potential.

- It will gain from advancements in energy storage systems that improve reliability and stability.

- Digital monitoring and predictive maintenance platforms will enhance performance optimization.

- Retrofitting opportunities in older buildings will create a significant growth avenue.

- Partnerships between solar manufacturers and construction firms will strengthen market reach.

- Sustainability certifications and green building initiatives will continue to boost market penetration.