Market Overview

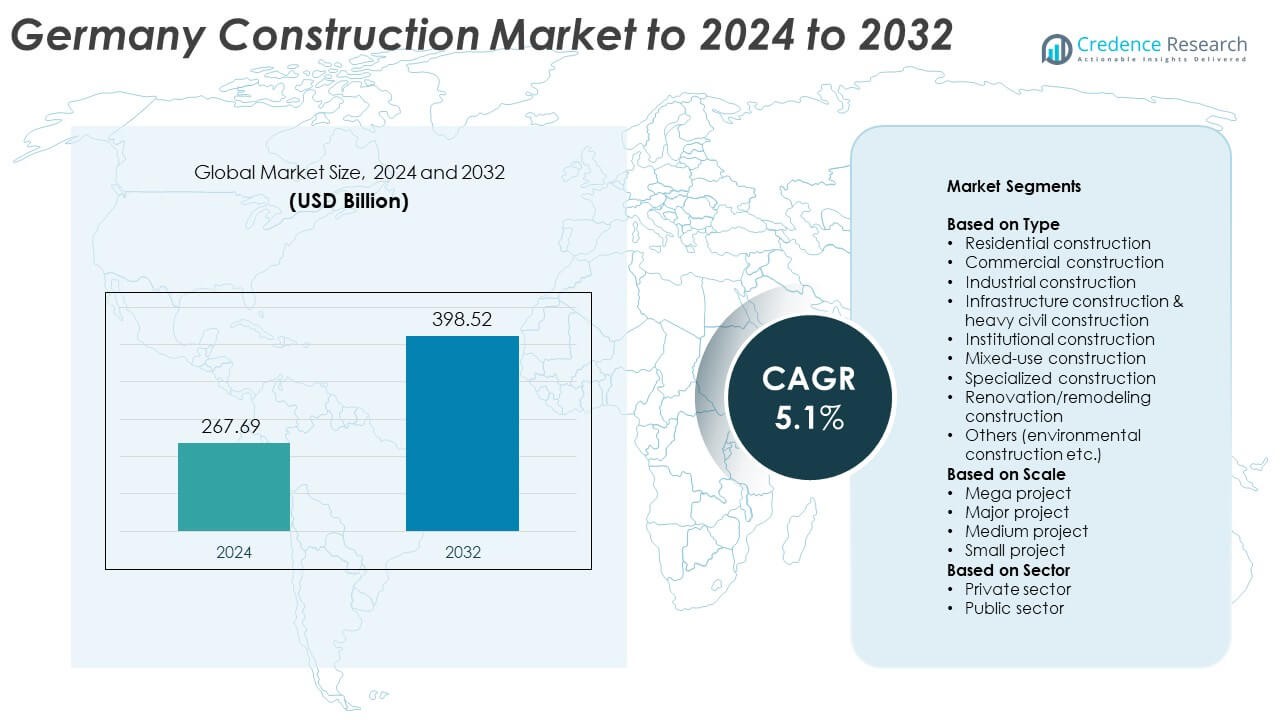

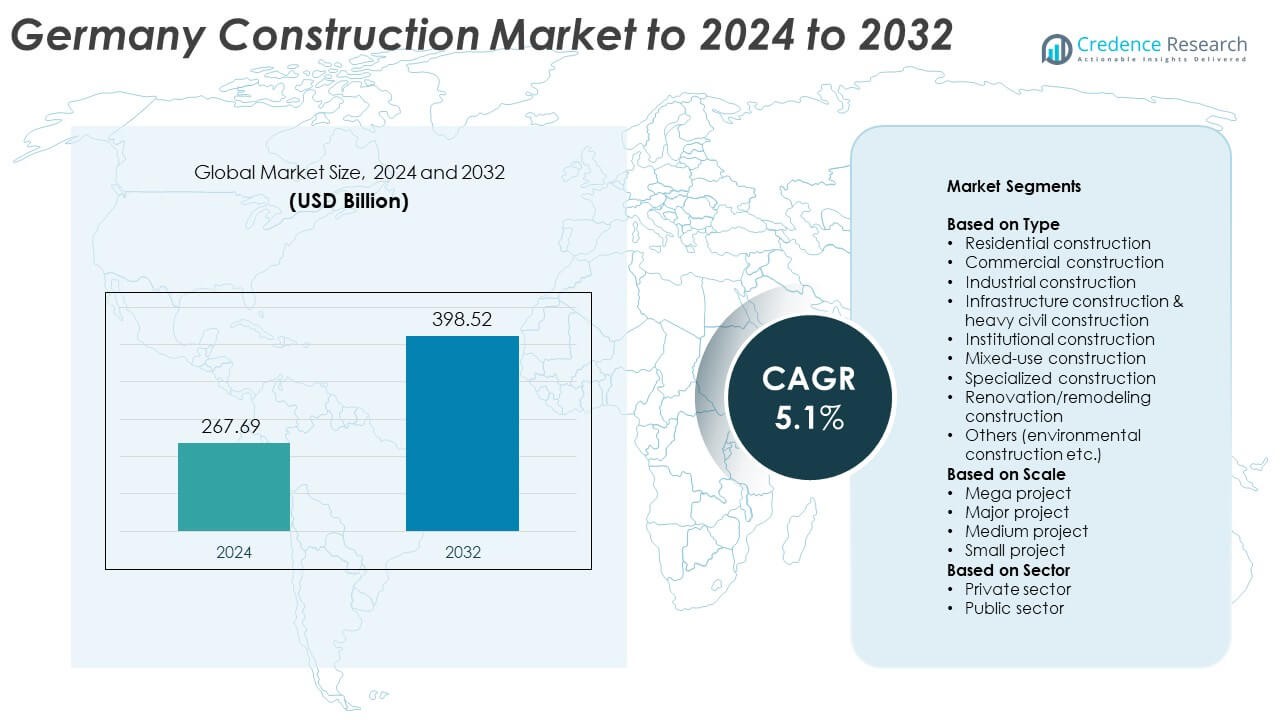

The Germany construction market size was valued at USD 267.69 billion in 2024 and is anticipated to reach USD 398.52 billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany construction Market Size 2024 |

USD 267.69 Billion |

| Germany construction Market, CAGR |

5.1% |

| Germany construction Market Size 2032 |

USD 398.52 Billion |

The Germany construction market is driven by major players such as Hochtief, Strabag, Goldbeck, Max Bögl, CRH, and Zeppelin Gruppe, which lead through extensive infrastructure, residential, and industrial development projects. These companies emphasize digital construction methods, sustainability, and modular building systems to enhance efficiency and meet carbon-neutral goals. Their strategic focus on renewable energy facilities, transportation networks, and green buildings reinforces market competitiveness. Regionally, Southern Germany dominated the market in 2024 with a 29% share, supported by strong activity in Bavaria and Baden-Württemberg, where rapid urbanization and industrial growth continue to fuel large-scale construction investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany construction market was valued at USD 267.69 billion in 2024 and is projected to reach USD 398.52 billion by 2032, growing at a CAGR of 5.1%.

- Market growth is driven by rising demand for sustainable and energy-efficient infrastructure, along with continuous investment in transport, housing, and renewable projects.

- Digitalization, modular construction, and prefabrication trends are reshaping project execution, improving cost efficiency, and accelerating completion timelines across sectors.

- The competitive landscape includes major players focusing on innovation, automation, and smart building technologies to strengthen market presence and enhance productivity.

- Southern Germany led with a 29% share in 2024, followed by Western Germany at 26%, Northern Germany at 24%, and Eastern Germany at 21%, while residential construction remained the largest segment with a 33% share across the national market.

Market Segmentation Analysis:

By Type

Residential construction dominated the Germany construction market in 2024 with a 33% share. The segment grew due to rising urban housing demand and government incentives promoting energy-efficient homes. Increased focus on sustainable building materials and prefabrication technologies has accelerated project completion. For instance, Vonovia SE completed over 4,000 residential units integrating heat pump systems to reduce emissions and operational costs, supporting the transition to climate-neutral housing. The push for affordable and smart homes continues to drive investment in this segment across urban centers.

- For instance, Vonovia operated 1,353 PV systems totaling 53.1 MWp in 2023.

By Scale

Mega projects led the market with a 38% share, driven by large-scale transport and infrastructure developments. These projects include high-speed rail networks, airports, and renewable energy parks aimed at enhancing national connectivity. For instance, the Stuttgart 21 railway redevelopment spans 100 kilometers of new track and involves over 60 bridges, boosting intercity travel efficiency. The German government’s emphasis on strategic public investment supports sustained growth of mega-scale initiatives.

- For instance, Deutsche Bahn’s Stuttgart 21 project includes approximately 57 km of new railway tracks, 59 km of tunnel tubes, and 44 bridges.

By Sector

The private sector accounted for a 57% share of Germany’s construction market in 2024, supported by strong investments in residential and commercial real estate. Developers are focusing on energy-efficient offices, logistics hubs, and mixed-use complexes to meet ESG goals. For instance, Deutsche Wohnen invested EUR 1.5 billion in modernizing building portfolios with smart meters and low-carbon heating systems. Continuous private participation, coupled with favorable financing conditions, ensures steady growth across Germany’s urban development landscape.

Key Growth Drivers

Rising Focus on Sustainable and Energy-Efficient Construction

Germany’s construction market is advancing through a strong focus on sustainability and energy efficiency. Builders are adopting eco-friendly materials, green roofing, and passive design systems to meet strict EU energy targets. Government incentives for carbon-neutral and low-emission buildings have further increased adoption of advanced insulation and renewable integration in new structures. Growing consumer awareness of environmental performance standards continues to strengthen demand for sustainable construction practices across both residential and commercial sectors.

- For instance, Heidelberg Materials’ Brevik CCS captures 400,000 t CO₂ per year.

Expansion of Infrastructure and Transportation Projects

Significant investments in infrastructure modernization remain a key driver of market growth. Major projects in rail, road, and airport development are enhancing national and regional connectivity. The government’s transport modernization plan underpins construction activity, particularly in high-speed rail and urban mobility networks. Rising public funding and private participation through PPP models continue to boost long-term project execution, ensuring a steady flow of contracts and investments across multiple construction categories.

- For instance, STRABAG is building a 38 km SuedOstLink section in Thuringia.

Increasing Urbanization and Housing Demand

Rapid urbanization and demographic changes are driving demand for new residential and mixed-use developments. Rising migration into metropolitan areas like Berlin, Munich, and Hamburg has intensified pressure on housing supply. Developers are responding with high-density, energy-efficient apartment complexes and affordable housing programs. This urban expansion also fuels related infrastructure development, including public utilities and transport networks, strengthening the construction market’s overall value chain.

Key Trends & Opportunities

Adoption of Digital Construction Technologies

Digitalization is transforming project planning and execution across Germany’s construction market. The integration of Building Information Modeling (BIM), AI-driven design tools, and digital twins enhances project efficiency, reduces costs, and minimizes design errors. Contractors and developers are increasingly using these platforms to monitor performance and optimize resource utilization. This shift toward technology-driven operations opens opportunities for innovation and productivity improvements across the construction lifecycle.

- For instance, HOCHTIEF, and its subsidiary HOCHTIEF ViCon, were involved in the Stuttgart 21 project and did use Building Information Modeling (BIM) methods.

Growth in Modular and Prefabricated Construction

The demand for modular and prefabricated construction is growing due to its cost-efficiency and speed. Prefabrication reduces on-site labor requirements and improves quality control, supporting the sector’s move toward sustainability. Developers are using prefabricated elements in housing, healthcare, and educational buildings to meet fast-track timelines. This trend aligns with Germany’s commitment to reducing construction waste and improving environmental performance, creating new business opportunities for suppliers and builders.

- For instance, ALHO lists production capacity of 12,000 building modules per year.

Key Challenges

Rising Material and Labor Costs

Germany’s construction industry faces pressure from increasing material and labor costs, which impact project profitability. The global shortage of raw materials like steel and concrete, combined with skilled labor gaps, has inflated overall project expenses. Contractors face delays and reduced margins as procurement costs rise. These challenges necessitate better supply chain management and automation adoption to maintain project efficiency and financial stability.

Regulatory Complexity and Project Delays

Complex approval procedures and stringent building regulations continue to hinder timely project execution. Long permitting timelines, environmental assessments, and zoning constraints often delay both public and private developments. Smaller firms struggle with compliance costs and administrative requirements, limiting competitiveness. Streamlined regulatory reforms and digital approval systems are increasingly needed to improve project delivery timelines and maintain steady construction growth.

Regional Analysis

Northern Germany

Northern Germany accounted for 24% of the market share in 2024, driven by large-scale infrastructure and port development projects across Hamburg, Bremen, and Kiel. The region’s focus on renewable energy infrastructure, particularly offshore wind installations, continues to fuel construction demand. Investments in logistics hubs, industrial zones, and residential complexes near major ports further strengthen growth. Rising urban redevelopment initiatives and smart city planning also contribute to expanding construction activity, particularly in sustainable commercial and mixed-use buildings across coastal metropolitan areas.

Southern Germany

Southern Germany held a 29% share of the market in 2024, supported by strong economic activity in Bavaria and Baden-Württemberg. The region benefits from continuous investments in residential housing, high-speed rail infrastructure, and industrial complexes. Cities like Munich and Stuttgart are seeing rapid urban expansion driven by tech and automotive sectors. Growth in green building adoption and renovation projects aligns with local sustainability goals. Southern Germany remains a hub for modern architecture and engineering excellence, attracting both domestic and international developers to ongoing large-scale projects.

Western Germany

Western Germany captured 26% of the total market share in 2024, led by strong construction activity across North Rhine-Westphalia and Hesse. The region’s focus on commercial infrastructure, transport networks, and energy-efficient buildings drives consistent growth. Urban centers such as Cologne, Frankfurt, and Düsseldorf are experiencing a surge in mixed-use developments and high-rise office spaces. Ongoing modernization of public transport and industrial zones further boosts demand. The combination of business investments and public infrastructure expansion keeps Western Germany among the most dynamic construction markets in the country.

Eastern Germany

Eastern Germany represented 21% of the market share in 2024, supported by regional redevelopment initiatives and infrastructure upgrades. The government’s focus on economic equalization between western and eastern states continues to attract construction investments. Cities such as Leipzig, Dresden, and Erfurt are witnessing increased residential and logistics construction due to growing industrial relocation and affordable land availability. Public housing schemes and smart energy projects add momentum, while EU-funded transport corridor enhancements strengthen connectivity and regional competitiveness within Germany’s overall construction landscape.

Market Segmentations:

By Type

- Residential construction

- Commercial construction

- Industrial construction

- Infrastructure construction & heavy civil construction

- Institutional construction

- Mixed-use construction

- Specialized construction

- Renovation/remodeling construction

- Others (environmental construction etc.)

By Scale

- Mega project

- Major project

- Medium project

- Small project

By Sector

- Private sector

- Public sector

By Geography

- Northern Germany

- Southern Germany

- Western Germany

- Eastern Germany

Competitive Landscape

The Germany construction market features intense competition among major players such as Hochtief, Strabag, Goldbeck, Max Bögl, CRH, Zeppelin Gruppe, Acciona, Bilfinger, Ed. Züblin, Ronesans, WOLFF, Alfred Kiessling, TRAPP Construction, ACS, and Muller. Companies are focusing on infrastructure modernization, energy-efficient buildings, and sustainable project execution. Strategic collaborations and public-private partnerships are expanding their portfolios across commercial, industrial, and residential sectors. Technological integration, including digital project management and automation tools, is improving productivity and cost control. Firms are investing in modular construction, renewable energy infrastructure, and green certifications to meet Germany’s carbon-neutral goals, reinforcing competitiveness across regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hochtief

- Strabag

- Goldbeck

- Max Bögl

- CRH

- Zeppelin Gruppe

- Acciona

- Bilfinger

- Züblin

- Ronesans

- WOLFF

- Alfred Kiessling

- TRAPP Construction

- ACS

- Muller

Recent Developments

- In 2025, Bilfinger SE Expanded its relationship with Dutch company Gasunie through a 10-year framework contract related to the energy transition, including projects for hydrogen and CO2 transport and storage.

- In 2025, Ed. Züblin AG Began construction on the “LOVT Vibe” timber hybrid office complex in Munich, showcasing expertise in complex site logistics and sustainable materials.

- In 2024, STRABAG SE signed a term sheet to acquire the Germany-based WTE Group, a water management specialist

Report Coverage

The research report offers an in-depth analysis based on Type, Scale, Sector and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of green building materials and energy-efficient systems will accelerate sustainable construction practices.

- Integration of digital tools like BIM and AI will enhance project planning and execution accuracy.

- Modular and prefabricated construction methods will gain traction for faster and cost-effective project delivery.

- Infrastructure modernization will expand, focusing on transport, renewable energy, and smart city projects.

- Demand for affordable and urban housing will increase due to population growth in metropolitan regions.

- Public-private partnerships will strengthen investment flow in large-scale infrastructure developments.

- Use of automation and robotics in construction processes will improve efficiency and safety.

- Renovation and retrofitting projects will rise as old buildings adapt to energy regulations.

- Construction waste reduction and recycling initiatives will become more prominent under EU sustainability goals.

- Digital permitting and regulatory reforms will streamline project approvals and boost overall sector productivity.