Market Overview:

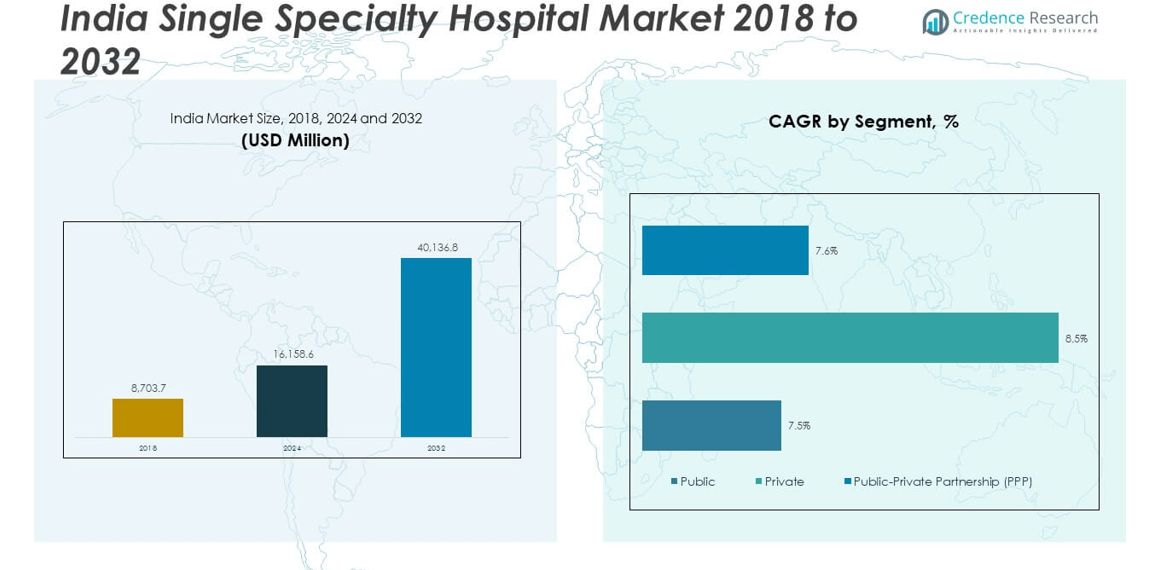

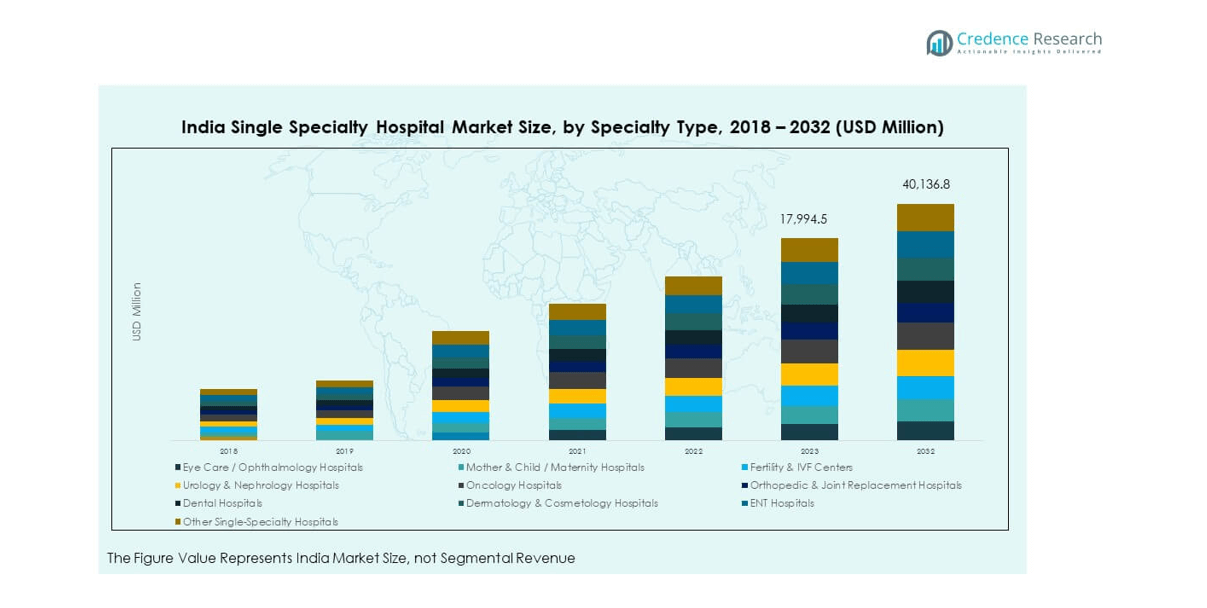

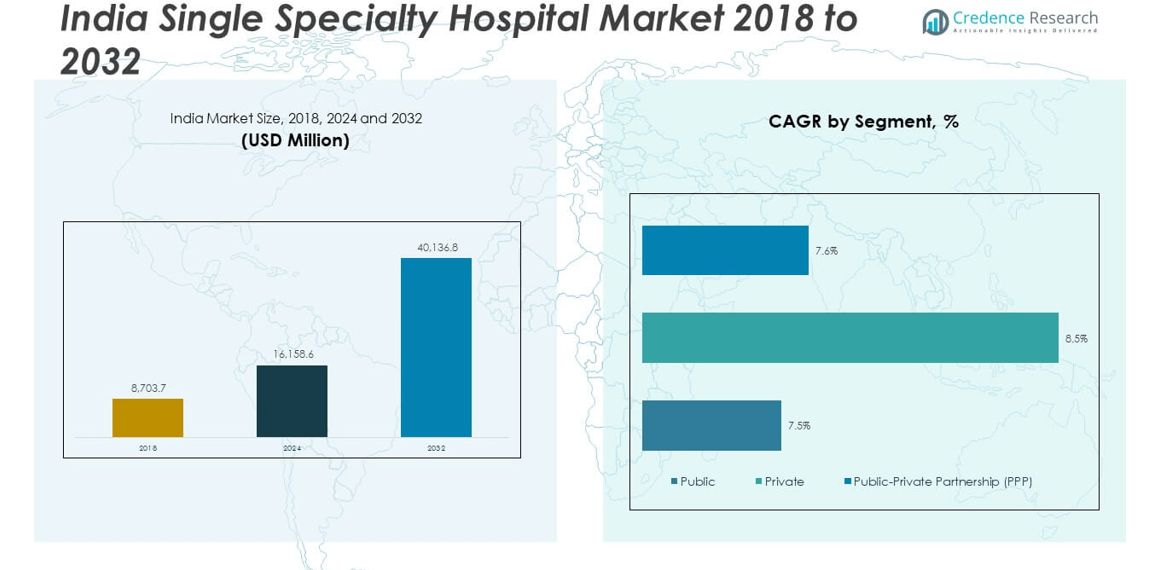

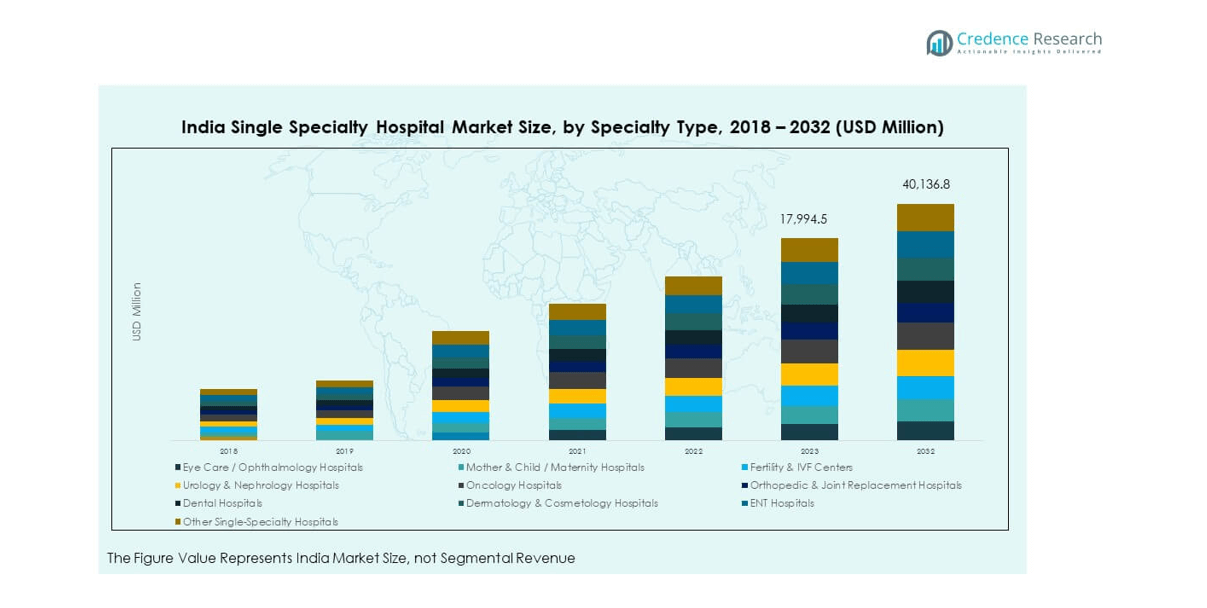

The India Single Specialty Hospital Market size was valued at USD 8,703.7 million in 2018 to USD 16,158.6 million in 2024 and is anticipated to reach USD 40,136.8 million by 2032, at a CAGR of 12.10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Single Specialty Hospital Market Size 2024 |

USD 16,158.6 million |

| India Single Specialty Hospital Market, CAGR |

12.10% |

| India Single Specialty Hospital Market Size 2032 |

USD 40,136.8 million |

The market is witnessing strong growth driven by rising healthcare awareness, increasing demand for specialized medical services, and a growing burden of chronic and lifestyle-related diseases. Patients are increasingly opting for facilities that offer focused expertise, advanced equipment, and personalized care in fields such as cardiology, oncology, orthopedics, and fertility. The expansion of medical tourism, driven by competitive treatment costs and high-quality care, further fuels growth. Technological advancements, coupled with rising private investments and supportive government policies, are enhancing the efficiency and reach of single specialty hospitals across India.

Regionally, Tier 1 cities such as Delhi, Mumbai, Bengaluru, and Chennai dominate the market due to better infrastructure, higher disposable incomes, and access to skilled medical professionals. However, Tier 2 and Tier 3 cities are emerging as high-growth areas, supported by expanding healthcare networks, government-led health schemes, and growing demand for quality specialized care. The rise of telemedicine and satellite centers is helping bridge the urban-rural gap, making advanced specialty services more accessible to underserved regions, and broadening the overall market reach.

Market Insights:

- The India Single Specialty Hospital Market was valued at USD 8,703.7 million in 2018, reached USD 16,158.6 million in 2024, and is projected to reach USD 40,136.8 million by 2032, growing at a CAGR of 12.10% during the forecast period.

- Rising prevalence of chronic and lifestyle-related diseases such as cardiovascular disorders, diabetes, and cancer is driving demand for focused, high-quality specialty care.

- Increasing healthcare awareness and preference for targeted treatment options are boosting patient inflow to single specialty hospitals.

- High capital investment requirements, uneven infrastructure distribution, and shortage of skilled specialists in rural areas act as significant restraints.

- Government healthcare initiatives, insurance penetration, and public-private partnerships are facilitating market growth and service expansion.

- Metropolitan cities dominate the market due to advanced infrastructure, higher disposable incomes, and access to specialized medical expertise.

- Tier 2 and Tier 3 cities are emerging growth hubs, supported by expanding healthcare networks, improving connectivity, and rising demand for affordable specialty care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Burden of Chronic and Lifestyle Diseases Creating Sustained Demand for Specialized Care:

The India Single Specialty Hospital Market is experiencing robust growth driven by the rising prevalence of chronic illnesses such as cardiovascular disorders, diabetes, cancer, and orthopedic conditions. Urbanization, sedentary lifestyles, and dietary changes have significantly increased the incidence of lifestyle-related diseases, leading patients to seek focused and advanced treatment. Single specialty hospitals provide targeted expertise and specialized diagnostic and therapeutic solutions that enhance patient outcomes. This focused care approach reduces treatment errors and improves recovery rates. Hospitals dedicated to one specialty can maintain advanced infrastructure tailored to specific patient needs. The increasing awareness about preventive care has encouraged patients to choose institutions with specialized screening programs. Enhanced clinical outcomes build patient trust and brand recognition for these hospitals. The growing middle-class population is willing to pay for specialized services, further accelerating market demand.

- For instance, Apollo Hospitals has established itself as a leader in cardiovascular care, having performed more than 130,000 cardiac surgeries with a 99.6% success rate. Their advanced heart transplant program and success in complex cardiac procedures demonstrate the impact of focused expertise in delivering superior patient outcomes and building considerable patient trust and brand recognition.

Government Healthcare Initiatives and Policies Supporting Specialty Infrastructure Expansion:

Government programs such as Ayushman Bharat and state-led health schemes are increasing access to specialty healthcare services across India. These initiatives encourage the development of infrastructure and improve affordability for patients requiring specialized care. The India Single Specialty Hospital Market benefits from policy measures aimed at upgrading medical equipment, training healthcare professionals, and offering incentives for private investments. Tax benefits and subsidies for hospital development in underserved areas drive expansion. Public-private partnerships are enabling the establishment of advanced facilities in semi-urban and rural regions. Regulatory support is streamlining hospital accreditation and operational approvals. Government-backed insurance programs expand patient access to high-quality specialty services. These initiatives also help reduce the patient load on multi-specialty hospitals, channeling demand toward focused care centers.

- For instance, the implementation of Ayushman Bharat (PM-JAY) has provided health coverage to 500 million Indians, resulting in a 36% increase in early cancer detection over six years and a 90% improvement in timely treatment access for beneficiaries. This initiative has required hospitals like Shravan Hospital and Private Limited (SHPL) to expand outpatient and emergency services and invest in advanced medical technology to meet the surge in patient inflow.

Growth of Medical Tourism Driving Demand for High-Quality Specialized Facilities:

India’s reputation as a hub for affordable yet high-quality medical treatment has positioned single specialty hospitals as key beneficiaries of medical tourism. Patients from abroad seek specialized care in areas such as cardiology, orthopedics, fertility, and oncology, where Indian hospitals offer world-class treatment at competitive costs. The India Single Specialty Hospital Market gains from shorter waiting times and personalized care packages designed for international patients. The presence of internationally trained specialists enhances credibility and attracts global patients. These hospitals invest in advanced medical technologies to meet global standards. Medical tourism clusters in cities like Delhi, Mumbai, and Chennai create a competitive advantage for specialized facilities. The economic benefits from this segment encourage further private investment in high-end specialty infrastructure. This trend is also supported by growing collaborations with international insurance providers.

Technological Advancements Enhancing Efficiency and Patient Outcomes in Specialty Care:

The integration of advanced diagnostic tools, robotic surgeries, AI-based patient monitoring, and telehealth platforms is transforming specialty healthcare delivery in India. The India Single Specialty Hospital Market leverages technology to offer precision treatment, reduce hospital stays, and improve recovery rates. Real-time patient data analysis enables timely interventions and personalized treatment plans. Minimally invasive surgical techniques are reducing complications and improving patient satisfaction. Telemedicine expands access to specialists for patients in remote regions. Electronic health records enhance coordination across care teams within the hospital. AI-based decision support systems help in early disease detection and risk assessment. Continuous investment in medical technology ensures these hospitals remain competitive in delivering superior patient care.

Market Trends:

Emergence of Chain-Based Single Specialty Hospitals Expanding Nationwide Presence:

A notable trend in the India Single Specialty Hospital Market is the rise of hospital chains dedicated to one specialty, such as eye care, cardiac care, or oncology. These chains leverage brand recognition, standardized protocols, and operational efficiency to expand across multiple regions. They focus on replicating successful models in both metropolitan and Tier 2 cities. Strategic mergers and acquisitions are strengthening their market footprint. This chain-based approach ensures uniform quality standards across locations. Investments in marketing and outreach build patient trust and increase referral rates. These networks benefit from economies of scale in procurement and technology adoption. The growing penetration of such chains is reshaping competition in the sector.

- For instance, Shalby Hospitals operates 11 multi-specialty and single-specialty hospitals with a total bed capacity of approximately 2,000 and holds a leading position in orthopedic care, managing roughly 15% of joint replacement surgeries conducted by private corporate hospitals in India. The network has also expanded via strategic acquisitions, such as acquiring Consensus Orthopedics’ implant assets to support scalable operations and uniform care quality across locations.

Integration of Wellness and Preventive Care into Specialty Hospital Services:

The market is witnessing a shift toward incorporating preventive care and wellness programs into the service portfolio of single specialty hospitals. The India Single Specialty Hospital Market is capitalizing on the rising demand for early detection and disease prevention. Hospitals are introducing specialized health check-up packages, lifestyle management programs, and diet counselling services. These offerings help retain patients and establish long-term relationships. Preventive care reduces the incidence of complications and lowers overall treatment costs for patients. Hospitals integrate diagnostic screenings with tailored preventive care plans. Wellness programs enhance the hospital’s image as a holistic healthcare provider. Corporate partnerships for employee health screening also contribute to demand.

- For instance, LV Prasad Eye Institute (LVPEI) pioneered integrated preventive and rehabilitative eye care, becoming the world’s first eye institute to combine rehabilitation services into standard care for irreversible vision loss. LVPEI has implemented large-scale community eye health and preventive screening programs impacting thousands of patients annually.

Adoption of Digital Health Platforms to Enhance Accessibility and Engagement:

Digital transformation is becoming a defining trend, with hospitals increasingly using telemedicine, mobile apps, and virtual consultations to reach patients. The India Single Specialty Hospital Market is leveraging digital tools to enhance accessibility for urban and rural populations. Hospitals are developing patient engagement platforms for appointment booking, test result access, and treatment follow-ups. AI-powered chatbots offer preliminary medical guidance and streamline patient flow. Digital health solutions improve operational efficiency and reduce administrative burdens. Online second opinions are becoming a key revenue stream for specialized facilities. Remote monitoring tools support post-surgical care and chronic disease management. This digital shift is strengthening patient loyalty and convenience.

Increasing Collaboration with Research Institutions and International Specialists:

Partnerships with academic institutions, research organizations, and global specialists are enabling single specialty hospitals to expand their capabilities. The India Single Specialty Hospital Market benefits from access to advanced treatment protocols, clinical trials, and innovative therapies. Collaborative initiatives enhance the credibility of hospitals in niche specialties. International tie-ups introduce new treatment techniques and medical technologies. Hospitals participate in joint research programs to address emerging healthcare needs. This collaborative model also supports physician training and skill development. Strategic alliances help hospitals differentiate themselves in a competitive market. Such partnerships strengthen their positioning in both domestic and international patient segments.

Market Challenges Analysis:

Infrastructure and Workforce Limitations Hindering Uniform Service Delivery Across Regions:

One of the primary challenges in the India Single Specialty Hospital Market is the uneven distribution of infrastructure and skilled workforce. While metropolitan areas host advanced facilities, smaller cities and rural areas face shortages of trained specialists, nurses, and technicians. High capital investment requirements limit the establishment of state-of-the-art specialty hospitals outside urban hubs. Recruitment and retention of qualified professionals remain difficult due to competitive offers from multi-specialty centers and overseas institutions. Inadequate local infrastructure increases operational costs and affects patient access. Variability in service quality across regions impacts patient trust and brand reputation. The lack of advanced diagnostic equipment in remote facilities further widens the accessibility gap. This disparity slows market penetration in emerging regions.

Regulatory Compliance, Rising Costs, and Competitive Pressures Affecting Profitability:

The sector faces stringent regulatory requirements for licensing, accreditation, and service quality compliance, adding complexity to operations. In the India Single Specialty Hospital Market, maintaining profitability is challenging due to rising costs of medical technology, consumables, and skilled labor. Smaller players struggle to match the marketing power and technological investments of larger chains. Competitive pricing pressures force hospitals to limit margins while maintaining service quality. Dependence on urban patient inflow exposes hospitals to economic fluctuations. Delays in insurance reimbursements strain cash flows, especially for facilities with high operational overheads. Constant technology upgrades demand significant capital outlay. The combined effect of these challenges impacts sustainable growth in the sector.

Market Opportunities:

Expanding Demand in Tier 2 and Tier 3 Cities Offering High Growth Potential:

The India Single Specialty Hospital Market has significant expansion opportunities in Tier 2 and Tier 3 cities, where demand for specialized care is rising due to increasing awareness and healthcare investments. These regions offer untapped patient bases with improving income levels. Government-backed infrastructure projects are improving connectivity, enabling easier patient access to specialty centers. Establishing facilities in these areas reduces competition intensity compared to metropolitan regions. Growing health insurance coverage encourages patients to seek specialized treatment. Hospitals can adopt hub-and-spoke models to connect urban expertise with rural demand. Targeted outreach programs can accelerate acceptance of advanced specialty services.

Leveraging Telemedicine and Mobile Health Solutions for Wider Reach:

Technology adoption opens new avenues for market growth by enabling remote consultations, diagnostics, and follow-ups. The India Single Specialty Hospital Market can use telemedicine to reach underserved populations without extensive physical infrastructure investment. Mobile health applications facilitate patient education and appointment scheduling. Remote monitoring devices enable continuous care for chronic patients. These tools improve convenience, reduce travel time, and strengthen patient loyalty. Expanding digital offerings creates opportunities for hospitals to establish nationwide presence. Strategic collaborations with telecom and technology providers can enhance these initiatives. The scalability of digital health solutions makes them a critical growth driver for the sector.

Market Segmentation Analysis:

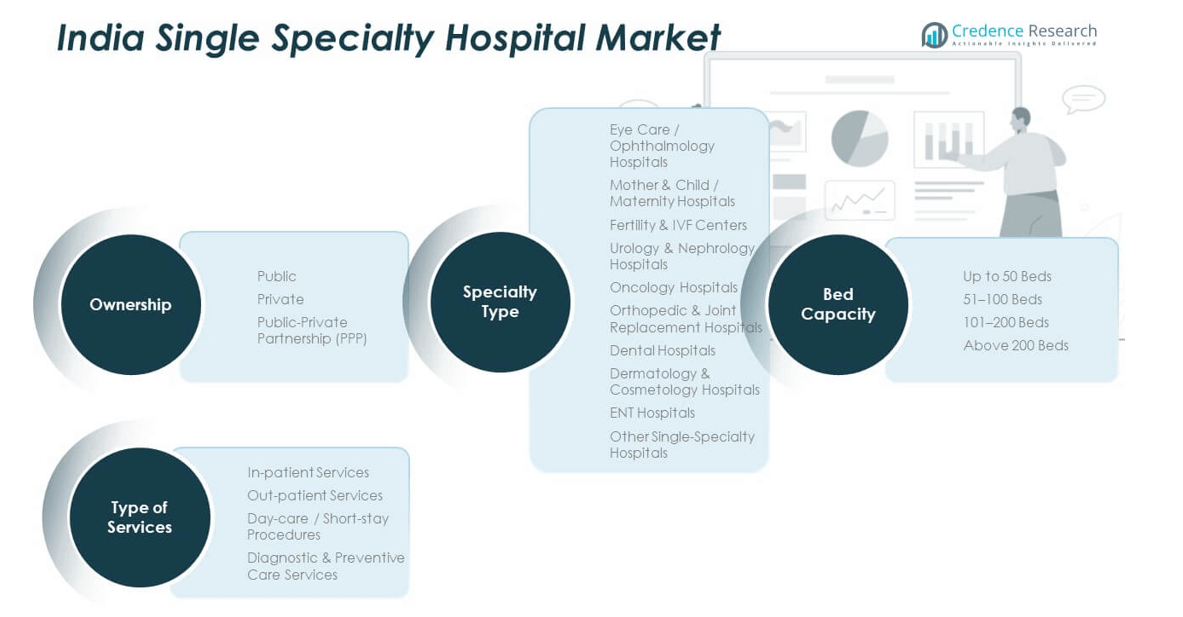

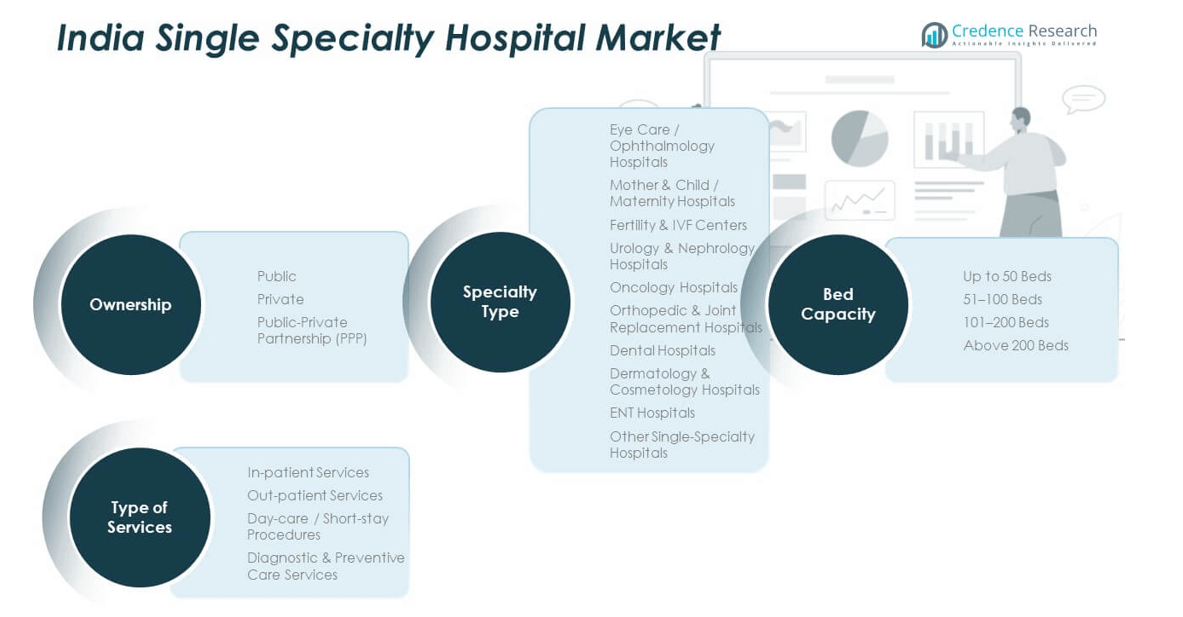

By Ownership Segment

The market is divided into public, private, and Public-Private Partnership (PPP) models. Public hospitals prioritize affordability and accessibility under government health schemes. Private hospitals focus on advanced infrastructure, specialized expertise, and premium patient experiences. PPP models integrate public sector outreach with private sector efficiency, enabling expansion of specialized care into semi-urban and rural regions.

By Specialty Type Segment

Key specialties include eye care and ophthalmology hospitals, mother & child hospitals, fertility and IVF centers, oncology hospitals, and orthopedic & joint replacement hospitals. Dental, dermatology, cosmetology, ENT, and urology facilities cater to niche but growing patient needs. These segments benefit from rising chronic diseases, lifestyle changes, and increasing demand for focused, high-quality care.

- For instance, in the eye care segment, LVPEI’s community programs deliver preventive screenings to hundreds of thousands of individuals and have been recognized by the World Health Organization for their excellence in blindness prevention. In orthopedics, Shalby Hospitals’ management of a substantial portion of all private joint replacement surgeries in India (15% market share) highlights the sector’s focus on technologically advanced and specialized care delivery.

By Bed Capacity Segment

Facilities range from small units with up to 50 beds to large centers exceeding 200 beds. Smaller facilities cater to localized demand with focused treatments, while larger centers handle high patient volumes and complex procedures. Bed capacity directly influences service scope, treatment complexity, and patient throughput.

By Type of Services Segment

Services include in-patient care for complex and surgical treatments, out-patient care for consultations and follow-ups, and day-care or short-stay procedures for minimally invasive interventions. Diagnostic and preventive care services are expanding due to the growing focus on early detection, health screening, and wellness programs. These service models allow providers to target diverse patient requirements effectively.

Segmentation:

By Ownership Segment

- Public

- Private

- Public-Private Partnership (PPP)

By Specialty Type Segment

- Eye Care / Ophthalmology Hospitals

- Mother & Child / Maternity Hospitals

- Fertility & IVF Centers

- Urology & Nephrology Hospitals

- Oncology Hospitals

- Orthopedic & Joint Replacement Hospitals

- Dental Hospitals

- Dermatology & Cosmetology Hospitals

- ENT Hospitals

- Other Single-Specialty Hospitals

By Bed Capacity Segment

- Up to 50 Beds

- 51–100 Beds

- 101–200 Beds

- Above 200 Beds

By Type of Services Segment

- In-patient Services

- Out-patient Services

- Day-care / Short-stay Procedures

- Diagnostic & Preventive Care Services

Regional Analysis:

North India

North India holds the largest share of the India Single Specialty Hospital Market, accounting for approximately 32% of the total revenue in 2024. The region’s dominance is supported by its high concentration of tier-1 and tier-2 cities, advanced healthcare infrastructure, and presence of leading hospital chains. States such as Delhi, Punjab, Haryana, and Uttar Pradesh attract significant patient inflows from neighboring states and countries due to their reputation for specialized treatments in cardiology, orthopedics, and oncology. Government-backed health insurance schemes and increasing private sector investments are strengthening accessibility to single specialty care. Medical tourism also plays a key role, with Delhi NCR emerging as a hub for international patients seeking affordable, high-quality treatment. The growing prevalence of lifestyle-related diseases in urban populations is further boosting demand for targeted healthcare facilities.

South India

South India represents around 29% of the India Single Specialty Hospital Market, driven by its reputation for advanced medical research, skilled healthcare professionals, and specialized surgical procedures. States such as Tamil Nadu, Karnataka, Telangana, and Kerala are known for their strong private healthcare networks and medical education institutions, which create a steady supply of trained specialists. The region has a high concentration of super-specialty centers in neurology, nephrology, and cardiac sciences, attracting patients from across the country and abroad. Affordable treatment costs compared to global standards, coupled with advanced technology adoption, strengthen its competitive position. Bengaluru, Chennai, and Hyderabad serve as prominent healthcare destinations for both domestic and international patients. Increasing awareness of preventive and elective specialty care is fostering steady market expansion.

West and East India

West India accounts for about 21% of the India Single Specialty Hospital Market, with Maharashtra, Gujarat, and Rajasthan leading the segment through a mix of large metropolitan facilities and expanding tier-2 city hospitals. Mumbai and Pune, in particular, have developed strong reputations for cancer treatment, fertility services, and ophthalmology. East India holds an estimated 18% market share, with growth led by states such as West Bengal, Odisha, and Assam. Kolkata serves as a regional hub for patients from the Northeast and neighboring countries like Bangladesh and Nepal. Although East India faces infrastructure gaps compared to other regions, increasing private investment and government healthcare programs are improving access to specialty care. Both regions are witnessing a gradual rise in demand for single specialty hospitals, supported by urbanization, better diagnostic capabilities, and targeted public health initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Asian Institute of Nephrology & Urology (AINU)

- Indira IVF

- Dr Agarwal’s Health Care

- Cloudnine Hospitals

- NephroPlus

- ASG Eye Hospital

- Shalby Hospitals

- Rainbow Children’s Hospitals

- HCG (Healthcare Global Enterprises)

- Motherhood Hospitals

- Eye Q Hospital

- Clove Dental

- RG Stone Urology & Laparoscopy Hospital

Competitive Analysis:

The India Single Specialty Hospital Market features a mix of established hospital chains, mid-sized regional players, and niche-focused healthcare providers. Competition is driven by service quality, brand reputation, and technological adoption. Leading players are expanding through new facility openings, strategic partnerships, and acquisitions to strengthen their regional and specialty-specific presence. It is increasingly shaped by the ability to attract and retain top medical talent, invest in advanced equipment, and deliver consistent patient outcomes. Marketing strategies focus on building trust, highlighting specialization, and promoting patient success stories. Large chains leverage economies of scale for cost efficiency and standardized protocols. Smaller facilities compete by offering personalized services and localized outreach. The market’s competitive intensity is rising as both domestic and international players target high-demand specialties.

Recent Developments:

- In August 2025, the Asian Institute of Nephrology & Urology (AINU) launched a new center in Hyderabad with a capacity of 150 beds, featuring advanced robotic surgical technology and eight centers of excellence covering sub-specialties like female urology, uro-oncology, and pediatric urology. This expansion is supported by a significant investment of Rs 400 crore by Asia Healthcare Holdings (AHH), aimed at doubling AINU’s hospital network over the next 4-5 years with a focus on Tier 2 cities.

- Indira IVF expanded its fertility services in June 2025 by acquiring a stake in Banker Healthcare, a well-established fertility center in Ahmedabad, strengthening its presence across Gujarat. This partnership combines over 30 years of clinical expertise and enhances accessibility to fertility care in the region.

- Agarwal’s Health Care, in early 2025, announced raising Rs 300 crore through an IPO to support expansion and acquisitions. The company is also merging its listed and parent entities to streamline operations. It operates a network of 193 facilities in India with a strong focus on ophthalmology services.

Market Concentration & Characteristics:

The India Single Specialty Hospital Market is moderately concentrated, with a few large chains holding significant market share while numerous regional players cater to local demand. It is characterized by a focus on high-demand specialties such as cardiology, oncology, orthopedics, and ophthalmology. Players differentiate through quality of care, technology integration, and specialization depth. The market is competitive yet fragmented, with opportunities for consolidation as demand for focused healthcare services rises. Chains benefit from standardized care models, while smaller players leverage community trust and patient relationships to remain competitive.

Report Coverage:

The research report offers an in-depth analysis based on Ownership, Specialty Type, Bed Capacity, and Type of Services. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion into Tier 2 and Tier 3 cities will accelerate service accessibility.

- Medical tourism will contribute significantly to specialty hospital revenues.

- Adoption of telemedicine will broaden patient reach beyond physical locations.

- Investment in AI and robotic surgery will improve treatment precision.

- Preventive healthcare integration will become a key revenue stream.

- Strategic mergers and acquisitions will drive market consolidation.

- Specialist training programs will address skilled workforce shortages.

- Government health schemes will expand patient affordability and coverage.

- International collaborations will enhance treatment protocols and technology adoption.

- Digital health platforms will strengthen patient engagement and retention.